Free Adp Pay Stub PDF Form

In the world of payroll and employee management, understanding each document and form that crosses one's desk is crucial for both employers and employees. Among these documents, the ADP Pay Stub form stands out as a fundamental piece of paper that offers a detailed breakdown of an employee's earnings and deductions for a specific pay period. This form not only serves as proof of income, which is useful for various financial transactions such as applying for loans or renting apartments, but it also plays a critical role in personal financial management, allowing employees to keep track of their earnings, taxes paid, and any other deductions. The transparency provided by the ADP Pay Stub form helps in building trust between employers and employees, ensuring that all financial dealings are open and straightforward. Its significance extends beyond mere record-keeping, influencing day-to-day financial planning and long-term financial health for individuals.

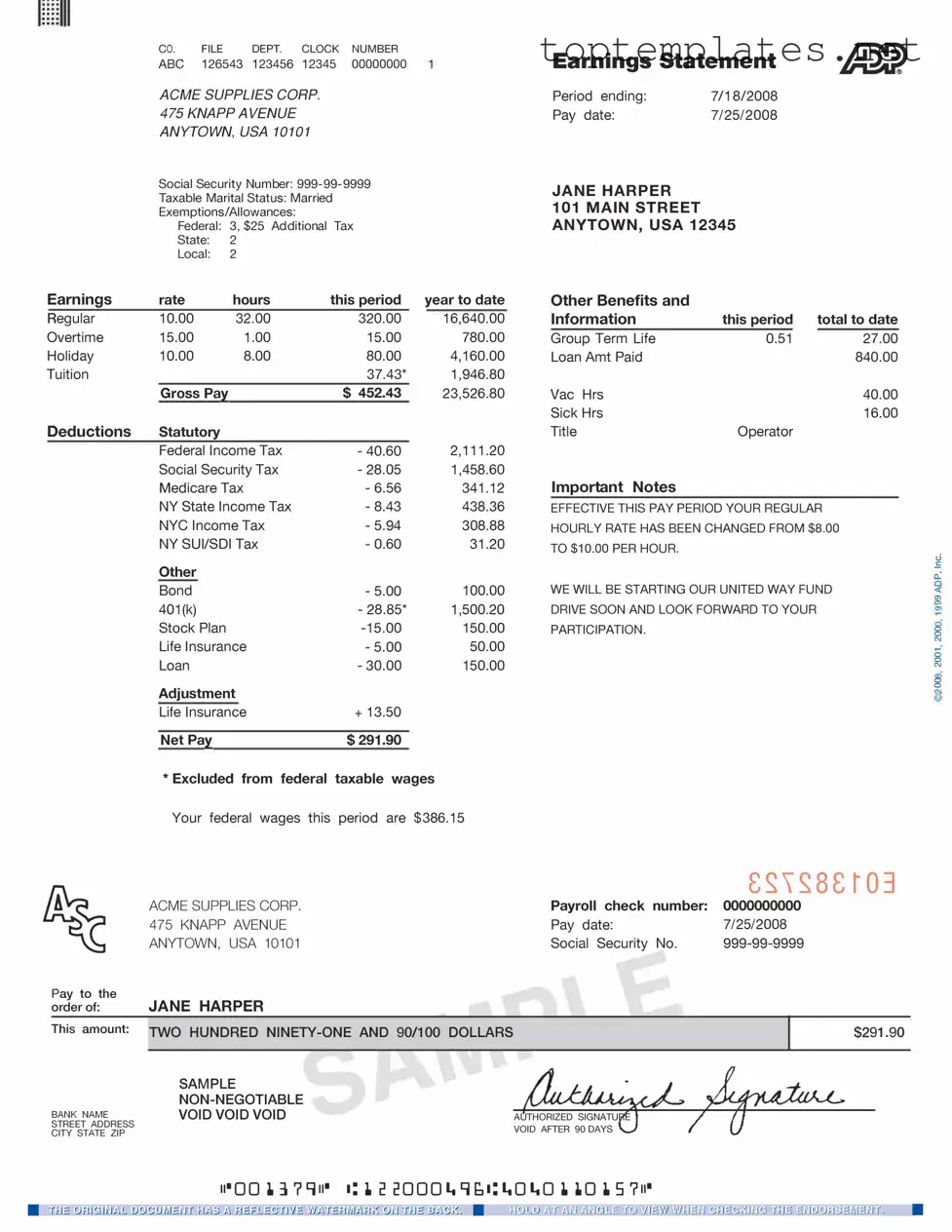

Sample - Adp Pay Stub Form

|

CO. |

FILE |

DEPT. |

CLOCK |

NUMBER |

|

|

ABC |

126543 123456 |

12345 |

00000000 |

|

|

|

ACME SUPPLIES CORP. |

|

|

|||

|

475 KNAPP AVENUE |

|

|

|

||

|

ANYTOWN, USA 10101 |

|

|

|||

|

Social Security Number: |

|

||||

|

Taxable Marital Status: Married |

|

|

|||

|

Exemptions/Allowances: |

|

|

|

||

|

Federal: 3, $25 Additional Tax |

|

||||

|

State: |

2 |

|

|

|

|

|

Local: |

2 |

|

|

|

|

Earnings |

rate |

|

hours |

this period |

year to date |

|

Regular |

10.00 |

|

32.00 |

|

320.00 |

16,640.00 |

Overtime |

15.00 |

|

1.00 |

|

15.00 |

780.00 |

Holiday |

10.00 |

|

8.00 |

|

80.00 |

4,160.00 |

Tuition |

|

|

|

|

37.43* |

1,946.80 |

|

Gross Pa� |

|

|

$ 452.43 |

23,526.80 |

|

Deductions |

Statutory |

|

|

|

2,111.20 |

|

|

Federal Income Tax |

|

- 40.60 |

|||

|

Social Security Tax |

|

- 28.05 |

1,458.60 |

||

|

Medicare Tax |

|

- 6.56 |

341.12 |

||

|

NY State Income Tax |

|

- 8.43 |

438.36 |

||

|

NYC Income Tax |

|

- 5.94 |

308.88 |

||

|

NY SUI/SDI Tax |

|

- 0.60 |

31.20 |

||

|

Other |

|

|

|

|

|

|

Bond |

|

|

|

- 5.00 |

100.00 |

|

401(k) |

|

|

|

- 28.85* |

1,500.20 |

|

Stock Plan |

|

|

150.00 |

||

|

Life Insurance |

|

- 5.00 |

50.00 |

||

|

Loan |

|

|

|

- 30.00 |

150.00 |

|

Adjustment |

|

|

|

||

|

Life Insurance |

|

+ 13.50 |

|

||

|

Net Pa� |

|

|

$291.90 |

|

|

*Excluded from federal taxable wages Your federal wages this period are $386.15

ACME SUPPLIES CORP. 475 KNAPP AVENUE ANYTOWN, USA 10101

Pay to the

order of: JANE HARPER

This amount: TWO HUNDRED

SAMPLE

BANK NAMEVOID VOID VOID

STREET ADDRESS

CITY STATE ZIP

Earnings Statement

Period ending: |

7/18/2008 |

Pay date: |

7/25/2008 |

JANE HARPER

101MAIN STREET

ANYTOWN, USA 12345

Other Benefits and

Information |

this period |

total to date |

|

|

Group Term Life |

0.51 |

27.00 |

|

|

Loan Amt Paid |

|

840.00 |

|

|

Vac Hrs |

|

40.00 |

|

|

Sick Hrs |

|

16.00 |

|

|

Title |

Operator |

|

|

|

Important Notes |

|

|

|

|

EFFECTIVE THIS PAY PERIOD YOUR REGULAR |

|

|||

HOURLY RATE HAS BEEN CHANGED FROM $8.00 |

|

|||

TO $10.00 PER HOUR. |

|

|

0 |

|

|

|

|

||

|

|

|

.!: |

|

WE WILL BE STARTING OUR UNITED WAY FUND |

0: |

|||

"' |

||||

DRIVE SOON AND LOOK FORWARD TO YOUR |

|

|||

|

|

|||

PARTICIPATION. |

|

|

0 |

|

|

|

|

0 |

|

C\J

0

0

C\J

0

0

|

£�,�8£�03 |

Payroll check number: |

0000000000 |

Pay date: |

7/25/2008 |

Social Security No. |

$291.90

File Specs

| Fact Name | Description |

|---|---|

| Purpose | The ADP Pay Stub form is used to provide employees with detailed information about their wages, including earnings, deductions, and net pay for a specific pay period. |

| Components | Typically includes employee and employer name and address, pay period, pay date, earnings, taxes withheld, deductions, and net pay. |

| Accessibility | Offered both in paper format and electronically, depending on the employer's process and the employee's preference. |

| Governing Law | Subject to federal regulations under the Fair Labor Standards Act (FLSA) as well as state-specific labor laws where applicable. |

| Usability | Used by employees to verify their pay, understand deductions, and manage their finances. It is also used for tax filing purposes. |

| State-Specific Variations | Some states require additional information on pay stubs, such as accrued sick leave or hours worked, affecting the form's content. |

Steps to Filling Out Adp Pay Stub

Filling out the ADP Pay Stub form is a straightforward process that ensures you have documentation of your earnings and withholdings. This document is crucial for various purposes, including loan applications, proving employment, and personal record keeping. The steps outlined below will guide you through completing the form accurately.

- Start by entering your full name and address in the designated fields at the top of the form. Ensure the information matches the details your employer has on file.

- Next, input your social security number (SSN) or employee identification number (EIN) in the appropriate box. This is critical for identification purposes.

- Fill in the pay period end date and the date of the pay stub to accurately reflect the specific time frame this document covers.

- Locate the section that details your earnings. Here, you will enter your gross pay for the current period as well as any additional earnings like overtime, bonuses, or commissions.

- In the deductions section, itemize any amounts withheld from your paycheck. This includes federal and state taxes, Social Security, Medicare, and any other applicable deductions like retirement plan contributions or health insurance premiums.

- Proceed to the net pay section and calculate your take-home pay after all deductions have been subtracted from your gross earnings. This represents the amount of money you actually receive.

- Review all entered information for accuracy. Mistakes can cause confusion or delay if you're using the pay stub for official purposes.

- Finally, if required, sign and date the bottom of the form to authenticate it. Some circumstances might necessitate your signature for validation.

After completing the ADP Pay Stub form, make sure to save a copy for your records before submitting it to the relevant party or institution. Accurate and timely management of such documents is beneficial for both immediate and future needs, ensuring a seamless process whenever proof of income is required.

Discover More on Adp Pay Stub

What is an ADP Pay Stub?

An ADP Pay Stub is a document provided by employers that outlines the details of an employee's pay for a specific pay period. It includes information such as gross wages, taxes withheld, deductions for benefits, and the net pay received by the employee. ADP, a leading provider of payroll and human resources management solutions, generates these documents to help employees understand their compensation and financial transactions in detail.

How can I obtain my ADP Pay Stub?

Employees can obtain their ADP Pay Stubs through the ADP online portal provided by their employer. After registering for an account with a unique identifier, usually an employee ID or email address, employees can log in to view, download, or print their pay stubs for each pay period. Some employers might also provide pay stubs directly to employees via email or hard copy.

What information is typically included on an ADP Pay Stub?

An ADP Pay Stub typically includes the employee's personal information, pay period dates, gross earnings, net earnings, federal and state taxes withheld, Social Security and Medicare deductions, any other deductions (such as retirement plans, health insurance, and other benefits), and the employer's information. Additionally, it may show year-to-date totals for earnings and deductions, providing a comprehensive overview of an employee's financial records.

Why is it important to review my ADP Pay Stub?

Reviewing your ADP Pay Stub is important for several reasons. It ensures that your earnings and deductions are accurate, gives you insight into your financial health, helps you budget effectively, and aids in the preparation of your tax returns. Moreover, it allows you to spot any discrepancies or errors in your pay or deductions, which can then be promptly addressed with your employer or HR department.

Can I use my ADP Pay Stub for loan applications or housing?

Yes, your ADP Pay Stub can be used as proof of income for various applications, such as loans, mortgages, or rental agreements. Lenders and landlords often require recent pay stubs to verify an applicant's income and employment status. Having an accurate and up-to-date ADP Pay Stub can aid in smoothing the application process for financial agreements and housing arrangements.

What should I do if I find a discrepancy in my ADP Pay Stub?

If you find a discrepancy in your ADP Pay Stub, you should promptly report it to your employer or the HR department. Provide specific details about the discrepancy, and, if possible, include documentation or evidence to support your claim. Your employer is responsible for addressing and correcting any payroll errors, and prompt reporting ensures that any issues are resolved quickly to maintain accurate financial records.

Common mistakes

When filling out an ADP Pay Stub form, individuals commonly encounter a range of mistakes. These errors can complicate their payroll process, creating unnecessary hurdles. Below is an expanded list detailing seven common mistakes to avoid for a smoother experience.

-

Not double-checking personal information:

One of the most frequent mistakes is the incorrect entry of personal information. This includes misspelling names, wrong addresses, or incorrect Social Security numbers. Such errors can lead to significant issues with tax documents and personal identification within the payroll system.

-

Incorrectly reporting hours worked:

Another common error is inaccurately reporting the number of hours worked. This mistake can either inflate or deflate an employee's earnings unnecessarily, affecting their overall compensation and tax calculations.

-

Overlooking overtime calculation:

Failure to correctly calculate or report overtime hours can also lead to payroll inconsistencies. Overtime is typically paid at a higher rate, and misunderstanding how to report it can affect an employee’s paycheck.

-

Ignoring deductions and withholdings:

Many individuals overlook the importance of accurately detailing deductions and withholdings, such as taxes, health insurance contributions, and retirement plan contributions. Errors here can lead to unexpected financial outcomes at the end of the fiscal year.

-

Misclassifying employment status:

Misclassifying an employee’s status, for example, as an independent contractor instead of an employee, can lead to incorrect payroll processing. This can significantly impact benefits, taxes, and legal rights.

-

Entering incorrect pay rates:

Inputting the wrong pay rate, whether it's an hourly wage or annual salary, can cause vast discrepancies in an employee's earnings. This mistake not only affects the employee's financial stability but can also lead to legal complications.

-

Not updating the form with changes:

Last but not least, a mistake often made is the failure to update the form when changes occur. Whether it’s a change in address, marital status, or number of dependents, keeping the pay stub form current is crucial for accurate record-keeping and payroll processing.

To avoid these mistakes, one should always review the ADP Pay Stub form carefully, ensure all information is accurate and current, and consult with a payroll professional if unsure about any details.

Documents used along the form

The ADP Pay Stub form is a critical document for both employers and employees, acting as a record of earnings and deductions for a specific pay period. This document often does not stand alone in the financial and employment documentation ecosystem. There are several other forms and documents that are commonly used in conjunction with an ADP Pay Stub to ensure a comprehensive approach to employment and financial documentation. Here are five such documents:

- W-2 Form: This essential tax document is provided by employers to employees at the end of each year. It reports an employee's annual wages and the amount of taxes withheld from their paycheck. It is indispensable for filing federal and state taxes.

- I-9 Employment Eligibility Verification: Employers use this form to verify the identity and legal authorization to work of their employees. The I-9 is critical for compliance with federal laws and must be completed for each individual employed.

- Employee Handbook Acknowledgement Form: This document is an acknowledgment by the employee that they have received, read, and understood the company's employee handbook. It often outlines company policies, procedures, and expectations.

- Direct Deposit Authorization Form: With this form, employees authorize their employers to deposit their pay directly into their bank accounts. It typically requires the employee's bank account information and signature.

- W-4 Form: This form is completed by the employee to indicate their tax situation to the employer. It determines how much federal income tax is withheld from the employee's paycheck. Employees may update their W-4 form anytime their personal or financial situation changes.

Each document serves a unique purpose, contributing to the seamless operation of employment and payroll processes. From ensuring compliance with government regulations to simplifying the way employees receive their pay, these documents, together with the ADP Pay Stub form, form a robust framework. This framework supports not just the financial aspects of employment, but also legal and operational necessities, making them indispensable tools for both employers and employees.

Similar forms

W-2 Form: Similar to the ADP Pay Stub, the W-2 form is a crucial document used by employees in the United States. It provides a detailed summary of an employee's annual wages and the amount of taxes withheld from their paycheck. Just as a pay stub gives insight into an employee's earnings and deductions for a specific pay period, the W-2 form offers an annual overview, making it easier to understand taxable income and prepare for tax season.

1099-MISC Form: This form shares commonality with the ADP Pay Stub in its role of reporting income. However, it's used for reporting payments made to independent contractors rather than traditional employees. Both documents detail the income received by an individual, though the ADP Pay Stub is more frequent and detailed, showing deductions and net pay for each pay period. In contrast, the 1099-MISC summarizes total payment without deductions, as contractors are responsible for their taxes.

Timesheet: A document used to record the number of hours worked by an employee during a specific period, typically for payroll purposes. It is similar to the ADP Pay Stub in that it serves as a foundational document for calculating pay and deductions. While the timesheet details the hours worked, the pay stub represents the financial outcome of those hours, including earnings for regular and overtime work, along with any deductions.

Leave and Earnings Statement (LES): Commonly used by military and other government employees, the LES functions similarly to a civilian ADP Pay Stub. It provides detailed information about an employee's pay and allowances, deductions, leave balances, and entitlements for a specific pay period. The LES is comprehensive, offering a clear picture of one's financial compensation and benefits, akin to how pay stubs function in the private sector.

Dos and Don'ts

When filling out the ADP Pay Stub form, accuracy and attention to detail are paramount. This document plays a crucial role in financial and employment matters. To guide you through the process, here is a list of dos and don'ts to ensure the form is completed correctly and effectively.

Dos:

- Double-check all personal information including your name, address, social security number, and any other identifying details to ensure they are accurate and match your identification documents.

- Review the numbers related to your wages, deductions, and net pay carefully to ensure they align with your records and expectations.

- Confirm your employment details, such as your job title, department, and employer's information, for consistency and accuracy.

- Use a clear and readable font if you need to fill out any part of the form manually to prevent misunderstandings or processing delays.

- Consult with HR or a payroll specialist if you have any doubts about the information required or how to fill in certain sections of the pay stub.

- Keep personal copies of the completed form and any related correspondence for your records and future reference.

- Submit the form within any given deadlines to ensure timely processing and avoid potential issues with your employment or financial status.

Don'ts:

- Don't rush through the form without verifying each section for accurateness. Mistakes can lead to delays or problems with your pay.

- Avoid using corrections fluid or making scribbles on the form. If an error is made, it is often best to start over with a new form to maintain clarity.

- Don't guess on any numbers or information. If unsure, it's crucial to confirm the correct information before filling it in.

- Don't leave blank spaces if a section pertains to you. Incomplete forms can cause processing delays or may be returned for corrections.

- Don't ignore instructions provided within the form or by your employer. These instructions are intended to guide you and help avoid common mistakes.

- Don't use unauthorized signatures—only sign the form yourself where required, and ensure any necessary approvals are obtained according to your company's policies.

- Don't forget to review the entire form before submission. A final check can catch any overlooked errors or omissions.

Misconceptions

When it comes to understanding the ADP Pay Stub form, several misconceptions frequently arise. This document is crucial for both employers and employees, as it includes detailed information about one's earnings, deductions, and net pay. However, confusion often surrounds its layout, purpose, and implications. Here, we aim to clarify some of these misunderstandings to ensure individuals have a clearer insight into what their pay stub entails.

It's only relevant for tax purposes: Many believe the ADP Pay Stub is only necessary during tax season. While it's vital for accurate tax filings, it also serves as proof of income, which is required for loans, mortgages, and renting applications.

It's too complicated to understand: The layout may seem daunting at first, but each section of the ADP Pay Stub has clear headings and is designed to be user-friendly. With a little guidance, anyone can learn to navigate their pay stub effectively.

Gross income equals take-home pay: A common misconception is that the gross income figure represents what you'll receive in your bank account. In reality, this figure is before tax and other deductions; your net pay is what you actually take home.

Deductions are optional: While some deductions are optional, such as contributions to a 401(k) plan, others, like federal and state taxes, are mandatory.

Only full-time employees receive ADP Pay Stubs: Both full-time and part-time employees get ADP Pay Stubs. Anyone earning a salary or hourly wages from an employer using ADP's services will receive a pay stub.

The pay stub doesn't affect credit scores: Directly, pay stubs don't influence your credit score. Indirectly, however, they play a critical role in loan or mortgage applications, which do affect your credit.

Year-to-date figures aren't important: On the contrary, the year-to-date (YTD) figures on your pay stub provide valuable insight into your earnings and deductions over the year, showing trends and potential discrepancies.

Employees don't need to keep their pay stubs: It's advisable to keep pay stubs for at least a year after receiving them. They're crucial for verifying income and understanding yearly earnings.

All employers use ADP Pay Stubs: Not all employers use ADP for payroll. There are various providers and systems in use, so pay stub formats can vary significantly.

There's no need to review pay stubs if direct deposit is used: Even if you receive your pay through direct deposit, it's essential to review each pay stub for accuracy. This ensures discrepancies are caught and corrected promptly.

Understanding your ADP Pay Stub is fundamental to managing your personal finances effectively. By debunking these misconceptions, individuals can take full advantage of the information provided in their pay stubs, leading to better financial health and awareness.

Key takeaways

Filling out and using the ADP Pay Stub form is essential for ensuring accurate and reliable payroll management. It is not just a document but a comprehensive tool that benefits both employers and employees. Understanding its components and effectively utilizing it ensure that everyone remains informed about their earnings and deductions. Here are nine key takeaways about the ADP Pay Stub form that everyone should keep in mind:

- Always double-check the personal information section for accuracy. This includes the employee’s name, address, social security number, and any other personal identifiers. Correct information is crucial for tax purposes and for the employee's records.

- Understand the difference between gross pay and net pay. Gross pay is the total amount earned before any deductions, while net pay is the amount the employee takes home after all deductions.

- Review the accuracy of the hours worked, especially if overtime or special holiday rates apply. Incorrect hours can significantly affect gross pay.

- Pay attention to all deductions, including federal and state taxes, insurance premiums, retirement contributions, and any other miscellaneous deductions. Knowing what deductions are taken out of the gross pay helps in understanding the net pay.

- Employers should ensure that the pay period covered by the stub is clearly indicated. This helps employees track their earnings over time and understand which days they are being paid for.

- For those enrolled in direct deposit, verify that the bank account details listed are current and accurate. Errors can delay access to funds.

- Year-to-date totals are an important aspect of the pay stub, providing insight into total earnings and deductions for the current year. This information is very helpful for personal financial planning and when applying for loans or credit.

- Look out for any discrepancies between the current pay stub and previous ones, especially in terms of deductions and contributions. Report any inconsistencies to the employer or HR department immediately.

- Finally, always save or print a copy of each pay stub for personal records. These documents are crucial for future reference, be it for tax filing, income verification, or resolving discrepancies.

By following these guidelines, both employers and employees can ensure the pay process is smooth, transparent, and free from errors. The ADP Pay Stub form, when filled out correctly and reviewed regularly, is a key component in managing financial well-being.

Common PDF Forms

How Long Asylum Process Take in Usa - Applicants may include details of any medical or psychological harm suffered due to persecution or torture in their I-589 application.

Dl 44 Form for Minors - Form filled with personal identification details necessary for processing by the California DMV for licensing or identification purposes.