Valid Articles of Incorporation Template

At the very heart of bringing a corporation to life lies a critical and foundational document known as the Articles of Incorporation. This form, while seemingly straightforward at a glance, serves as the official birth certificate for a corporation, embedding its existence into the legal framework. It outlines the primary aspects of the corporation, such as the corporation's name, its purpose, the type of corporation it intends to be, the address where it will operate, the number and type of shares it is authorized to issue, and information about the registered agent and incorporators. Beyond these basics, the document also sets the stage for the corporation's legal identity, offering it the ability to enter into contracts, own assets, hire employees, and much more, all under the protective umbrella of limited liability for its owners. Understanding the nuances of the Articles of Incorporation is crucial not just for compliance, but also for leveraging the document as a foundational stone upon which a successful enterprise can be built.

Sample - Articles of Incorporation Form

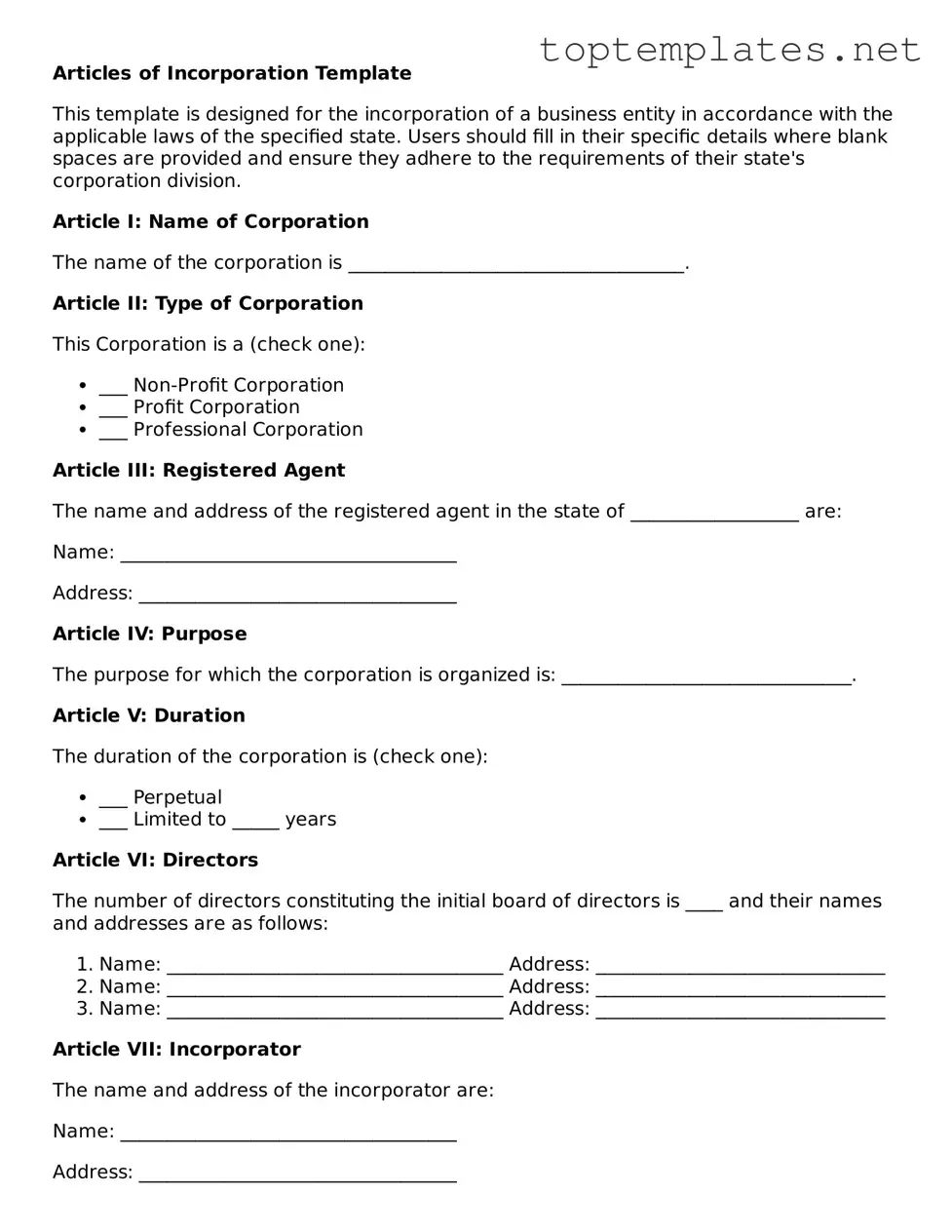

Articles of Incorporation Template

This template is designed for the incorporation of a business entity in accordance with the applicable laws of the specified state. Users should fill in their specific details where blank spaces are provided and ensure they adhere to the requirements of their state's corporation division.

Article I: Name of Corporation

The name of the corporation is ____________________________________.

Article II: Type of Corporation

This Corporation is a (check one):

- ___ Non-Profit Corporation

- ___ Profit Corporation

- ___ Professional Corporation

Article III: Registered Agent

The name and address of the registered agent in the state of __________________ are:

Name: ____________________________________

Address: __________________________________

Article IV: Purpose

The purpose for which the corporation is organized is: _______________________________.

Article V: Duration

The duration of the corporation is (check one):

- ___ Perpetual

- ___ Limited to _____ years

Article VI: Directors

The number of directors constituting the initial board of directors is ____ and their names and addresses are as follows:

- Name: ____________________________________ Address: _______________________________

- Name: ____________________________________ Address: _______________________________

- Name: ____________________________________ Address: _______________________________

Article VII: Incorporator

The name and address of the incorporator are:

Name: ____________________________________

Address: __________________________________

Article VIII: Stock

If the corporation is authorized to issue stock, the total number of shares of all classes of stock that the corporation shall have the authority to issue is: __________ shares.

The corporation is authorized to issue the following classes of stock:

- Class: ____________ Number of Shares: ________ Par Value: $______

- Class: ____________ Number of Shares: ________ Par Value: $______

Article IX: Incorporation State Specific Provisions

Any additional provisions specific to the state of _________________________ are attached herein.

Confirmation

By signing below, the incorporator certifies that the information provided in these Articles of Incorporation is true and correct:

Signature: _______________________________ Date: ________________

File Breakdown

| Fact Number | Detail |

|---|---|

| 1 | The Articles of Incorporation is a document that officially forms a corporation once it is filed with the respective state's secretary of state or similar government body. |

| 2 | It typically includes the corporation's name, type, purpose, total amount of stock to be issued, and information regarding the incorporator(s). |

| 3 | Requirements and specific details required in the form can vary significantly from state to state, based on local corporate laws. |

| 4 | Some states require the inclusion of the corporation's duration, although perpetual duration is common if not specified. |

| 5 | Designation of a registered agent and registered office within the filing state is a common requirement. This agent is responsible for receiving legal papers on behalf of the corporation. |

| 6 | Filing fees for the Articles of Incorporation vary widely among states, influencing the cost of forming a corporation in different jurisdictions. |

| 7 | Upon successful filing, the corporation obtains legal identity as an entity separate from its founders, capable of owning property, incurring liabilities, and entering contracts. |

| 8 | Articles of Incorporation are usually required to be accompanied by other organizational documents, such as bylaws, when submitted for filing. |

| 9 | The process and timeline to get the articles approved can vary, sometimes taking weeks or longer, depending on the state's processing speed and whether expedited services are used. |

| 10 | Governing laws for the Articles of Incorporation, including permissible corporation names, stock details, and director requirements, are primarily found in each state's corporate statutes. |

Steps to Filling Out Articles of Incorporation

Filling out the Articles of Incorporation is a pivotal step in the process of formalizing any new corporation. It establishes the corporation's legal existence under state law. Once this document is submitted and approved by the state, the entity can legally conduct business, enter into contracts, and ensure its rights as a corporate entity are protected. The following steps will guide you through accurately completing your Articles of Incorporation, ensuring a smooth submission process.

- Begin by gathering all necessary information about your corporation. This includes the corporation's name, principal address, purpose, total number of shares authorized to issue, and the names and addresses of the incorporators and the board of directors.

- Locate the correct Articles of Incorporation form for your state. This can usually be found on the official website of the state's Secretary of State or the Department of Commerce.

- Fill in the corporation's name, ensuring it complies with your state's naming conventions and is distinguishable from the names of other entities already on record.

- Enter the principal place of business address. This should include the full street address, city, state, and zip code.

- Specify the purpose of the corporation. Some states allow for a general purpose statement, while others may require a more detailed description of the corporation’s intended activities.

- State the number of shares the corporation is authorized to issue. If there are different classes of shares, make sure to specify the classes and the number of shares in each class.

- Provide the name and address of the registered agent. The registered agent is responsible for receiving legal documents on behalf of the corporation.

- List the names and addresses of the initial directors or incorporators of the corporation. Depending on the state, you may be required to list directors, incorporators, or both.

- If applicable, include any other articles mandated by your state's laws. This might include the corporation's duration, management structure, or any provisions for regulating the powers of the corporation, its directors, and shareholders.

- Review the form for accuracy and completeness. Make any necessary corrections.

- Sign and date the form as required. This usually involves the signature of at least one incorporator or director.

- Submit the form along with any required filing fees to the appropriate state office, typically the Secretary of State's office.

- Wait for confirmation that your Articles of Incorporation have been filed and approved. Keep a copy of the filed documents for your records.

Once the Articles of Incorporation are approved, the corporation will officially exist as a legal entity. However, there are still steps to be taken before the corporation can begin operating, such as obtaining necessary licenses and permits, creating bylaws, and holding the initial meeting of the board of directors. Preparing thoroughly for each part of this process ensures a solid foundation for the new corporation.

Discover More on Articles of Incorporation

What are Articles of Incorporation?

Articles of Incorporation are a set of formal documents filed with a government body to legally document the creation of a corporation. They outline the primary characteristics of the corporation, including its name, purpose, and structure. This process is required for a business to be recognized as a corporate entity under law, offering benefits like liability protection for its owners.

Who needs to file Articles of Incorporation?

Any group seeking to form a corporation needs to file Articles of Incorporation. This applies to both for-profit and non-profit organizations that wish to be recognized as separate legal entities from their owners or members. Filing these documents is a critical step in the formation of any corporation.

Where do I file the Articles of Incorporation?

The Articles of Incorporation are filed with a specific state agency in the state where the corporation chooses to establish its legal domicile. This is typically the Secretary of State’s office or a similar state agency tasked with business registrations. The exact requirements and filing procedures may vary by state.

What information is required in the Articles of Incorporation?

The required information in the Articles of Incorporation can vary from state to state, but generally includes the corporation's name, the purpose for which the corporation is formed, the number of shares the corporation is authorized to issue, the address of the corporation’s initial registered office, and the name of its initial registered agent. It may also require the names and addresses of the incorporators.

How much does it cost to file Articles of Incorporation?

The filing fee for Articles of Incorporation varies by state. Depending on the state, fees can range from as little as $50 to several hundred dollars. In addition to the base fee, some states may have additional charges for expedited processing or for filing additional documents that may be required.

What happens after the Articles of Incorporation are filed?

Once the Articles of Incorporation are filed and accepted by the state agency, the corporation becomes a legal entity separate from its founders. The corporation can then proceed with other necessary steps such as obtaining business licenses, opening a bank account, and starting its operations. The state may issue a certificate of incorporation or a similar document as official recognition of the corporation's legal status.

Common mistakes

Filling out the Articles of Incorporation is an essential step in forming a corporation. However, mistakes in this process can create delays and legal challenges. Here are five common mistakes people make:

-

Not checking the business name availability: Prior to filing, it's important to ensure your chosen business name isn't already taken by another entity. Failure to do so may result in the rejection of your application.

-

Incorrect information: Entering incorrect information, whether it's the business address, names of the incorporators, or registered agent details, can lead to processing delays and even the denial of the filing.

-

Omitting necessary signatures: All required parties must sign the Articles of Incorporation. Missing signatures can invalidate the entire filing process, necessitating a resubmission and leading to delays.

-

Failure to specify the type of corporation: The form may require you to specify whether your corporation is a standard C-corporation, an S-corporation, or a non-profit, among others. Neglecting to specify can lead to incorrect processing of your form.

-

Insufficient shares allocation: If your corporation plans to issue stock, the Articles of Incorporation must include the number of shares the corporation is authorized to issue. Underestimating the number of shares can hinder future funding opportunities and equity distribution among founders.

Being attentive and thorough when completing the Articles of Incorporation is crucial for a smooth start to your business journey. Avoiding these common mistakes will help streamline the process and set your corporation up for success.

Documents used along the form

When setting up a new business, filing the Articles of Incorporation is just the first step. This essential document is a formal declaration of a corporation's existence under the laws of a specific state. However, to fully establish your business’s legal and operational structure, you need additional forms and documents that complement the Articles of Incorporation. Here's a rundown of ten critical documents that are often used alongside the Articles of Incorporation, each playing a vital role in the incorporation process and the ongoing management of the company.

- Bylaws: These internal rules govern the operation of the corporation. They outline the procedures for holding meetings, electing directors and officers, and taking care of other corporate formalities.

- Operating Agreement: For LLCs (Limited Liability Companies), the operating agreement is crucial. It details the business's financial and functional decisions, including rules, regulations, and provisions for running the company.

- Board of Directors' Consent Forms: Initially, this document records the board members' acceptance of their positions and their agreement on the corporation's bylaws.

- Stock Certificates: Issued to represent ownership in the corporation, these certificates detail the number of shares owned by a shareholder.

- Shareholder Agreement: This agreement outlines the rights and obligations of the shareholders, including how shares can be bought and sold, and how decisions are made.

- Employer Identification Number (EIN) Application: Every corporation needs an EIN for tax purposes, obtained by filing an application with the IRS.

- Business Licenses and Permits: Depending on the type of business and its location, various local, state, and federal licenses and permits may be required to legally operate.

- Minutes of the First Board Meeting: This is a written record of the proceedings and decisions made during the first board meeting, including the ratification of the bylaws and election of officers.

- Bank Resolution: Necessary for opening a bank account in the name of the business, this document lists the individuals authorized to do banking on behalf of the corporation.

- Annual Reports: Most states require corporations to file an annual report, updating the state on the corporation’s activities, and confirming its continued existence.

Together, these documents form a comprehensive legal framework for your corporation, laying the foundation for its governance, operations, and compliance. While the Articles of Incorporation declare your business's legal existence, these additional documents equip you to organize, operate, and grow your business within the legal boundaries. Each document has its importance and requirements, ensuring that your corporation is well-prepared to meet its legal obligations and achieve its business goals. Setting up a corporation is a significant step, but with the right documents in hand, you’re well on your way to establishing a robust legal and operational framework for your business.

Similar forms

Bylaws: Both the Articles of Incorporation and bylaws are foundational documents for any corporation. While the Articles of Incorporation legally establish the corporation within the state, bylaws detail the internal managerial and operational rules of the company. Essentially, both documents serve to formalize aspects of the organization's structure and governance.

Operating Agreement: Similar to the Articles of Incorporation for corporations, the operating agreement serves limited liability companies (LLCs). This document outlines the ownership, duties, rights, and responsibilities of the members of an LLC, providing a legal framework for its operation, much like the Articles outline the structure for corporations.

Partnership Agreement: For partnerships, the partnership agreement plays a role similar to the Articles of Incorporation. It establishes the terms of the partnership, including the responsibilities and profit-sharing among partners, assisting in the legal and operational foundation of the partnership as the Articles do for corporations.

Business Plan: A business plan is a comprehensive document that outlines a company's goals, strategies for achieving them, and its organizational structure, products, or services. Though more detailed and expansive, it serves a foundational purpose similar to the Articles of Incorporation, defining the essence and direction of the business.

Shareholder Agreement: This document is crucial for detailing the rights and obligations of shareholders within a corporation. Though focusing specifically on shareholder relations rather than the broader corporate structure, like the Articles of Incorporation, it is fundamental to the functioning and governance of the corporate entity.

Certificate of Formation: Typically used by LLCs, a Certificate of Formation is similar to the Articles of Incorporation as it officially forms the company within the state. Both documents are essential for the legal establishment of the entity and vary primarily by the type of business structure they support (corporation vs. LLC).

Employment Agreement: Employment agreements outline the duties, responsibilities, and terms of employment for workers within a company. While these agreements focus on individual employment conditions rather than the corporate structure, they are similar to the Articles of Incorporation in ensuring clear, legally-binding understandings between parties.

Loan Agreement: A loan agreement specifies the terms of a loan between a borrower and lender, detailing repayment, interest rates, and other conditions. Similar to the Articles of Incorporation which establish a company's structural and operational beginnings, loan agreements legally document the financial foundations on which businesses may build or expand.

Dos and Don'ts

Filling out the Articles of Incorporation is a critical step in establishing a corporation. Ensuring accuracy and mindfulness during this process can save businesses from potential legal inconveniences and setbacks. Here are some essential dos and don'ts to consider.

Do:Review the requirements for Articles of Incorporation in your state, as they may vary.

Provide accurate and complete information for every section requested, including the corporation's name, purpose, registered agent, and incorporator details.

Ensure the corporation's name adheres to your state's naming conventions, including the use of a corporate designator like "Inc." or "Corporation".

Designate a registered agent with a physical address within the state, available during business hours, to receive legal and tax documents.

Keep the language clear and concise, avoiding any ambiguity that could lead to misinterpretation.

Double-check the document for any errors or omissions before submission.

Consult with legal counsel or a professional if you have questions or concerns about the proper way to fill out the form.

Skip sections or provide incomplete information, which can result in delays or rejection.

Use a post office box as the address for the registered agent; a physical address is necessary.

Forget to specify the number of shares the corporation is authorized to issue, if required.

Ignore the requirement to have signatures notarized, if applicable in your state.

Assume that filing these articles instantly grants you all protections and benefits of a corporation without further action.

File without double-checking your state's filing fees and methods for submission.

Overlook the need to draft bylaws or hold an initial meeting of the board of directors soon after filing.

Misconceptions

When it comes to the process of incorporating a business, the Articles of Incorporation play a foundational role. However, there are many misconceptions about this document that can cause confusion. Let's clarify some common misunderstandings:

Many people think that the Articles of Incorporation are the only document needed to start a business, but this is not true. Other documents, such as bylaws and initial shareholder agreements, are also usually necessary for the business to be fully operational.

It's a common misconception that the Articles of Incorporation will protect a business owner's personal assets from liability. While incorporating does offer some level of protection, it's crucial to understand that this protection is not absolute. Proper insurance and following corporate formalities are also important.

Some believe that once the Articles of Incorporation are filed, there's no more paperwork to do. In reality, many states require annual reports and other filings to keep the corporation in good standing.

Another misconception is that the Articles of Incorporation allow a business to sell stock to the public. However, selling stock to the public typically requires registration with the Securities and Exchange Commission (SEC) and adherence to both state and federal securities laws.

There's a belief that the Articles of Incorporation alone will enable a business to start hiring employees. But, obtaining an Employer Identification Number (EIN) from the IRS, registering with state labor departments, and adhering to employment laws are among the additional steps needed.

Some people think the process of filing the Articles of Incorporation is complicated and always requires a lawyer's help. While legal advice is beneficial, especially for complex structures, many states offer templates and online filing options that simplify the process for straightforward cases.

A myth persists that the Articles must detail every aspect of the business’s operations. Actually, this document usually asks only for basic information about the corporation, such as its name, registered agent, and the number of shares it is authorized to issue.

Many assume that the filing of the Articles of Incorporation marks the beginning of a corporation's existence. While generally true, some states allow for a delayed effective date, meaning a corporation can choose to start its existence at a later date.

Lastly, it's incorrectly believed that Articles of Incorporation are a one-time filing with no need for updates. Changes in the corporation, such as a change in the registered agent or the number of authorized shares, usually require filing an amendment to the Articles of Incorporation.

Key takeaways

The Articles of Incorporation form plays a crucial role in the establishment of a corporation in the United States. It is the document that formally marks the creation of a corporation, and its filing is required by the state. Understanding the key aspects of filling out and using this form is essential for ensuring the proper legal structuring and registration of your corporation. Here are eight key takeaways to consider:

- Know the requirements of your state: The specific requirements for the Articles of Incorporation can vary significantly from one state to another. It’s important to familiarize yourself with the regulations and requirements of the state where you intend to incorporate your business.

- Choose a unique name: Your corporation’s name must be unique and not easily confused with the names of other businesses already registered in your state. It often must include a corporate designator, such as "Inc.," "Incorporated," "Corporation," or an abbreviation.

- Identify your incorporators: In many states, one or more individuals or entities must sign and submit the Articles of Incorporation. These incorporators may or may not be part of the corporation once it is formed.

- Designate a registered agent: The Articles must include the name and address of a registered agent who will receive legal papers on behalf of the corporation. The registered agent must have a physical address in the state of incorporation and be available during normal business hours.

- Declare your corporate purpose: Some states require you to declare the purpose of your corporation. This may be as broad as “to engage in any lawful activity,” depending on the state’s regulations.

- Specify stock information: If your corporation will issue stock, the Articles must detail the types of stock and the number of shares the corporation is authorized to issue. This information is crucial for defining ownership in the corporation.

- Understand incorporator responsibilities: Once the Articles of Incorporation are filed, the incorporators or initial directors must usually call an organizational meeting to appoint officers, adopt bylaws, and conduct any other initial business activities.

- File with the correct state office: Articles of Incorporation are typically filed with the Secretary of State’s office or a similar state agency responsible for business registration. Be sure to file with the correct office to officially register your corporation.

Filling out and submitting the Articles of Incorporation is a foundational step in creating a corporation. It’s important to approach this process with careful attention to detail and a clear understanding of your state’s specific requirements. While the process may seem daunting at first, proper preparation and compliance with state laws will pave the way for your corporation’s successful establishment and operation.

Consider Other Documents

Accord Forms - Its acceptance across various jurisdictions underscores its importance as a unified standard for presenting and verifying auto insurance information.

Certificate of Membership - The go-to ledger for businesses to keep a continuous log of membership interest transfers and issuance, crucial for accuracy in ownership records.

Florida Family Law Financial Affidavit Short Form - The 12.902(b) form is a legal requirement in family law cases, ensuring that all parties have a transparent understanding of each other's financial situation.