Free Auto Insurance Card PDF Form

An Auto Insurance Card serves as a compact yet fundamental piece of documentation for vehicle owners, encapsulating key information about the insurance policy under which their vehicle is covered. This card, often required by law to be kept within the insured vehicle, is a tangible assurance of financial responsibility, designed to be presented upon demand, especially in the unsettling moments following an accident. It meticulously lists critical details such as the insurance company's name and contact number, the policy number, the effective and expiration dates of the policy, and specifics about the insured vehicle, including the year, make, model, and Vehicle Identification Number (VIN). Furthermore, the card outlines essential steps to be taken in the wake of an accident, including prompt notification of the incident to the insurance agent or company and gathering pertinent information from all parties involved. Notably, the card also features security elements, such as an artificial watermark, which can be verified by holding the card at a certain angle, underscoring the importance of authenticity in these documents.

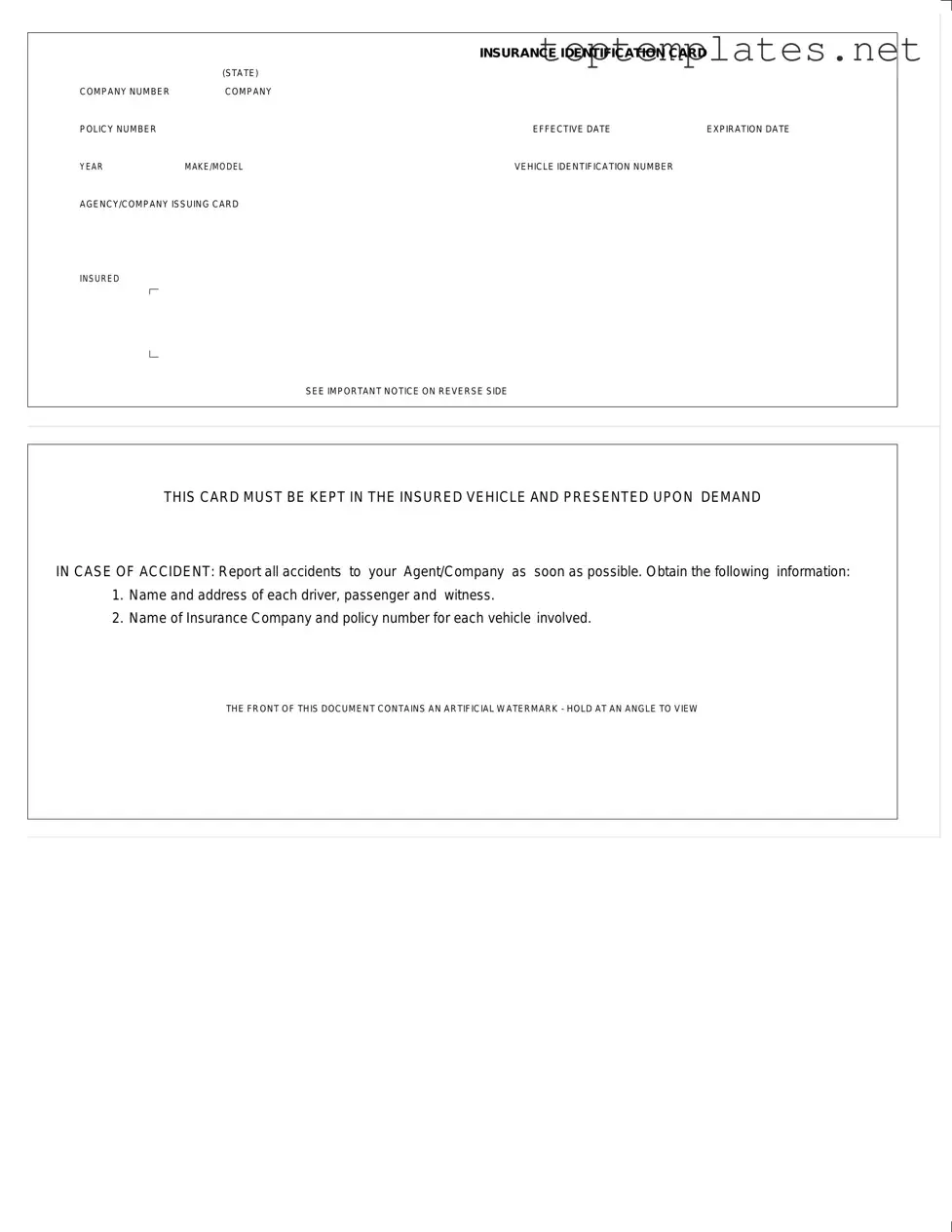

Sample - Auto Insurance Card Form

|

|

INSURANCE IDENTIFICATION CARD |

|

|

(STATE) |

|

|

COMPANY NUMBER |

COMPANY |

|

|

POLICY NUMBER |

|

EFFECTIVE DATE |

EXPIRATION DATE |

YEAR |

MAKE/MODEL |

VEHICLE IDENTIFICATION NUMBER |

|

AGENCY/COMPANY ISSUING CARD

INSURED

SEE IMPORTANT NOTICE ON REVERSE SIDE

THIS CARD MUST BE KEPT IN THE INSURED VEHICLE AND PRESENTED UPON DEMAND

IN CASE OF ACCIDENT: Report all accidents to your Agent/Company as soon as possible. Obtain the following information:

1.Name and address of each driver, passenger and witness.

2.Name of Insurance Company and policy number for each vehicle involved.

THE FRONT OF THIS DOCUMENT CONTAINS AN ARTIFICIAL WATERMARK - HOLD AT AN ANGLE TO VIEW

File Specs

| Fact Name | Description |

|---|---|

| Form Purpose | This form serves as proof of vehicle insurance and must be kept in the insured vehicle to be presented upon demand, especially in the event of an accident. |

| Key Information | The form includes details such as company number, policy number, effective and expiration dates, year, make/model of the vehicle, vehicle identification number (VIN), and the agency or company issuing the card. |

| Important Notice | The reverse side of the form contains an important notice that may include instructions on what to do in case of an accident and other relevant information for the insured. |

| Governing Laws | Requirements for an Auto Insurance Card vary by state, governed by each state's respective insurance laws and regulations. |

Steps to Filling Out Auto Insurance Card

Filling out your Auto Insurance Card is a straightforward process, ensuring that you have all the vital details of your coverage handy, especially if you're involved in an accident or if law enforcement requests it. This small document carries big importance as it serves as proof of your vehicle’s insurance. Here is a step-by-step guide to help you complete the form correctly. Remember, this card must be kept in your vehicle at all times and presented upon demand.

- Start with Insurance Identification Card at the top of the form and enter your State in the designated space to ensure that you are using the correct form applicable to your state's requirements.

- Enter the Company Number—this is a unique identifier for the insurance provider. You can find this number on your policy documents or by contacting your insurance company directly.

- Fill in the Company Policy Number. This is your personal policy number with the insurer and is crucial for identifying your account and coverage details.

- Add the Effective Date and Expiration Date of your coverage. These dates show the period during which your insurance is valid.

- Input the Year, Make, and Model of your insured vehicle to ensure clarity on what vehicle the insurance covers.

- The Vehicle Identification Number (VIN) must be entered next. This unique code is specific to your vehicle and can usually be found on the vehicle's registration documents, or displayed on the dashboard or driver’s side door frame.

- In the section labeled Agency/Company Issuing Card, write the name of the insurance agency or company that issued this card. This might be the same as where you got your policy, or it could be a specific agent or branch of the company.

- Finish by filling in the Insured section with your name as the policyholder to indicate whom this insurance card covers.

On the reverse side of the form, there is an Important Notice. Make sure to read this notice carefully, as it contains valuable information on what to do in case of an accident. This includes reporting accidents promptly and obtaining necessary details from other parties involved. Also, don’t forget to check the artificial watermark on the front to verify the document's authenticity. Once completed, place this card in a secure, easily accessible spot in your vehicle.

Discover More on Auto Insurance Card

What is an Auto Insurance Card, and why do I need to keep it in my vehicle?

An Auto Insurance Card serves as proof of your vehicle’s insurance policy. It contains vital details such as the insurance company's name and contact information, policy number, effective and expiration dates of the policy, as well as your vehicle’s year, make, model, and Vehicle Identification Number (VIN). You are required to keep this card in your vehicle because most states mandate that drivers have proof of insurance readily available to present to law enforcement or other parties in the event of a traffic stop or an accident.

How can I obtain my Auto Insurance Card?

You can obtain your Auto Insurance Card directly from your insurance agency or company. After purchasing or renewing an auto insurance policy, the company will typically mail you the card. Alternatively, many insurers offer digital access through their websites or mobile apps, where you can download and print your insurance card or keep a digital version on your smartphone.

What should I do if my Auto Insurance Card is lost or damaged?

If your Auto Insurance Card is lost or damaged, promptly contact your insurance agent or company to request a replacement. Many insurers can provide you with a temporary digital insurance card via email or their mobile app until your new card arrives by mail. Ensuring you have a valid insurance card in your vehicle at all times is crucial to comply with legal requirements and to facilitate information exchange in the event of an accident.

What is the “IMPORTANT NOTICE ON REVERSE SIDE” mentioned on the Auto Insurance Card?

The “IMPORTANT NOTICE ON REVERSE SIDE” refers to additional information or instructions provided by the insurance company, typically found on the back of your Auto Insurance Card. This notice often includes guidance on what to do in the event of an accident, such as how to report it to your insurance agency and what information to collect from other parties involved. It’s important to read and understand this notice to be prepared in case of an emergency.

Why does the card include an artificial watermark, and how do I view it?

The artificial watermark on the Auto Insurance Card is a security feature designed to deter fraud and confirm the document's authenticity. You can view this watermark by holding the card at an angle to the light. The visibility of the watermark when viewed from certain angles helps verify that the card is genuine and has been issued by a legitimate insurer, thereby offering protection against counterfeit documents.

Common mistakes

Filling out an Auto Insurance Card form is an important step for vehicle owners, ensuring they have proof of insurance easily accessible. However, mistakes can happen during this process. Here are ten common errors to watch out for:

Not updating the insurance identification card with new policy numbers or insurance company details after switching providers or renewing policies. This can lead to confusion or issues if you need to file a claim or provide proof of insurance.

Entering incorrect effective and expiration dates which can imply that your insurance is not active when in fact, it might be. Always double-check these dates for accuracy to avoid potential legal problems.

Miswriting the year, make, or model of the vehicle, which can lead to problems if you need to make a claim. The insurance company might delay the process if there are discrepancies between your vehicle's actual information and what's on the card.

Leaving the vehicle identification number (VIN) field blank or inaccurately filling it out. The VIN is crucial for identifying your vehicle and must match your vehicle's documentation exactly.

Omitting the agency/company issuing the card. This is vital information if you need to contact your insurer urgently or validate the card's legitimacy.

Failing to replace the card in the insured vehicle after updating or renewing it. The most current card should always be in your vehicle to provide valid proof of insurance during traffic stops or after an accident.

Ignoring the important notice on the reverse side. This notice often contains critical information and instructions that could be essential during an accident or when filing a claim.

Forgetting to check the card for an artificial watermark, a security feature. Holding the card at an angle to view the watermark is a way to verify its authenticity.

Neglecting to note the instructions for reporting an accident, such as obtaining information from other drivers. This can lead to incomplete claims or issues with insurance companies.

Not ensuring that the information matches across all documents. All details on your auto insurance card should align with those on your policy documents to ensure consistency and avoid issues.

By carefully avoiding these mistakes, you ensure that your auto insurance card remains a valid and useful form of proof for your vehicle's insurance coverage.

Documents used along the form

Carrying the right documents in your vehicle is just as important as having the keys when you plan to drive. An auto insurance card, which provides proof of insurance, is just one of the many essential documents drivers should have on hand. But apart from the insurance card, several other forms and documents are often used in conjunction with it to ensure full compliance with the law and to facilitate various processes related to vehicle ownership and operation. Here is a list of forms and documents that are commonly used alongside an auto insurance card.

- Vehicle Registration Certificate: This document proves that your vehicle is legally registered with the state. It includes information like the car's make, model, year, and the owner's name and address.

- Driver’s License: A valid driver's license is required to operate a vehicle. It serves as proof of your permission to drive and includes your photo, making it a useful form of photo ID.

- Vehicle Title: The vehicle title is a legal document that establishes the ownership of the vehicle. It is necessary for selling or buying a car and for certain insurance claims.

- Maintenance Records: Keeping a record of all maintenance and repairs performed on your vehicle can be helpful, especially when filing claims that involve mechanical failure or when selling the vehicle.

- Accident Report Form: In the event of an accident, an accident report form is used to capture all the details of the incident, which can be vital for insurance claims and legal matters.

- Emissions Testing Documentation: Some states require vehicles to undergo emissions testing and carry proof of passing. These documents are necessary to renew vehicle registration.

- Roadside Assistance Information: If your insurance policy includes roadside assistance, keeping this information handy can save time and stress in case of a breakdown.

- Loan Documents: If your vehicle is financed, carrying a copy of the loan agreement and contact information for the lender can be crucial, especially if you encounter issues related to payment or insurance claims.

- Emergency Contact Information: Though not a legal requirement, having a list of emergency contacts in your vehicle can be lifesaving in case of an accident or medical emergency.

Being prepared with the appropriate documents can significantly ease the process of dealing with vehicle-related legalities, insurance matters, and emergencies. Ensuring that these forms and documents are up-to-date and readily available in your vehicle, alongside the auto insurance card, promotes not only legal compliance but also peace of mind while on the road.

Similar forms

The Auto Insurance Card is a crucial document for drivers, serving as proof of insurance coverage. Interestingly, this form shares similarities with other essential documents that people frequently use. Here is a closer look at six such documents:

Driver's License: Much like the Auto Insurance Card, a driver's license contains vital identification information, including the holder's name, address, and a unique identification number. Both are indispensable for vehicular travel and must be presented upon demand by authorities.

Vehicle Registration: The vehicle registration document parallels the Auto Insurance Card in that it includes information about the vehicle, such as year, make/model, and the Vehicle Identification Number (VIN). Both documents are crucial for vehicle identification and must be kept in the vehicle to be shown when required.

Health Insurance Card: Similar to the Auto Insurance Card, a health insurance card contains policy numbers, effective and expiration dates, and the company's contact information. Both serve as proof of insurance coverage and are essential in emergencies.

Passport: A passport, while primarily used for international travel, shares common features with the Auto Insurance Card, such as personal identification and a unique number (passport number), much like the policy number on the insurance card. Both are official documents used for verification purposes.

Warranty Card: Warranty cards for products, like the Auto Insurance Card, often contain a unique identification number (in this case, for the product), effective and expiration dates for the warranty period, and contact information for the issuing company, mirroring the structure of insurance cards.

Credit Card: Though primarily a financial tool, a credit card shares characteristics with the Auto Insurance Card, including a unique identification number (account number), expiration date, and issuer information. Both are compact cards required for certain transactions.

Each of these documents serves specific, sometimes critical, roles in everyday life, ensuring that individuals can travel, verify their identity, or access services efficiently. The Auto Insurance Card is part of this family of essential documents, playing a key role in the realm of vehicular operation and safety.

Dos and Don'ts

When filling out the Auto Insurance Card form, it's crucial to approach the task with diligence and accuracy. This document verifies your coverage and is essential in the event of an accident. Below are critical dos and don'ts to consider:

Do:

- Ensure all information is accurate and matches the details on your official insurance policy documents. Accuracy is vital for the validity of your insurance card.

- Include the correct policy number as it appears on your insurance policy. This connects the card directly to your specific coverage plan.

- Write down the effective date and the expiration date exactly as they are stated on your insurance policy to prevent any disputes regarding the period of coverage.

- Fill in the vehicle identification number (VIN) carefully. Every character in the VIN is important for identifying the insured vehicle.

- Double-check the year, make, and model of your vehicle for accuracy. This ensures that the insurance coverage is correctly attributed to the specified vehicle.

- Keep the completed Auto Insurance Card in the insured vehicle at all times. This is required by law and must be presented upon demand.

Don't:

- Leave any fields blank. Incomplete forms may not comply with state regulations and could result in fines or legal issues.

- Guess or approximate information. Ensure that every detail on the card matches the official documents provided by your insurance company.

- Alter any pre-printed information on the form, such as the insurance company number or the policy terms. Tampering with official documents can lead to serious consequences.

- Overlook the important notice on the reverse side of the card. This section provides essential information about what to do in the event of an accident.

- Ignore the artificial watermark. This feature is a security measure to verify the authenticity of the document. Attempting to replicate or modify it could invalidate the card.

- Forget to report any discrepancies to your insurance agent or company immediately. Keeping your documentation accurate and up to date is key to maintaining your coverage.

Misconceptions

When it comes to Auto Insurance Cards, there's often a mix of understanding and misconceptions. Let's clarify a few common misunderstandings:

An Auto Insurance Card is the same as proof of insurance: While this card acts as a form of proof of insurance, it's crucial to note that different states may require additional information as proof. Therefore, relying solely on this card without understanding specific state requirements can lead to issues during traffic stops or after an accident.

The policy number is the only important detail: Every piece of information on the card, from the company number to the vehicle identification number (VIN), plays a crucial role. These details not only help in identifying the insurance policy but also assist in streamlining processes in case of an accident.

Digital copies of the Auto Insurance Card are always acceptable: The acceptance of digital proof varies by state. Some states may still require a physical copy to be carried in the vehicle. It's essential to be aware of your state's regulations to avoid any legal complications.

The front of the card contains all the necessary information: The statement, "See important notice on reverse side," indicates that valuable information is also presented on the back of the card. This often includes instructions on what to do in case of an accident and how to report it, which is equally important as the front details.

Understanding these nuances ensures individuals are better prepared and informed about their insurance coverage and responsibilities as a vehicle owner.

Key takeaways

Filling out and using an Auto Insurance Card form is crucial for every driver. Here’s what you need to know to ensure you're fully prepared and compliant on the road.

- Always ensure your information is current: Regularly check that your Auto Insurance Card contains up-to-date information, including the policy number, effective date, and expiration date, to avoid any issues during a traffic stop or after an accident.

- Keep the card in your vehicle at all times: The law requires that this card is kept within the insured vehicle and readily available to be presented upon demand. This can be crucial in the event of an accident or traffic stop.

- Know your policy details: Familiarize yourself with the company number, policy number, and the agency or company that issued your card. This information can save time and confusion in stressful situations.

- Remember the artificial watermark: The front of your insurance card has an artificial watermark. This feature is designed to authenticate the document and can be seen when held at an angle to the light.

- Prepare for accidents: In case of an accident, your insurance card provides a quick reference for what details to collect, including the names and addresses of all parties involved, and their insurance information.

- Report accidents promptly: The card reminds holders to report any accidents to their agent or insurance company as soon as possible. This prompt action is vital for the swift handling of your claim.

- Understand the ‘important notice’: Pay attention to the ‘important notice’ on the reverse side of the card. This section can offer crucial information and advice tailored to the policyholder’s specific state and insurance policy.

- Protect your privacy: While it's important to have your insurance card accessible in your vehicle, ensure that it's stored securely to protect your personal information from unnecessary exposure.

Having a well-prepared Auto Insurance Card isn't just about following the law; it's about ensuring your peace of mind while on the road. Keeping these key takeaways in mind will help you navigate the roads more confidently and securely.

Common PDF Forms

Western Union Receipt Generator - Lays out fees clearly so there are no surprises, ensuring transparency in how much you’re sending and spending.

Dl 44 Form for Minors - The base document required for engaging with the California DMV for any driver's license or ID card related services.

Prescription Slip - Ensures alignment between healthcare providers and pharmacists in the treatment process through clear prescription details.