Valid Business Bill of Sale Template

When a business changes hands, accurate documentation is crucial to ensure a smooth transition and safeguard the interests of both the buyer and the seller. At the heart of this process lies the Business Bill of Sale form, a vital legal document that officially records the sale and purchase of a business. This form not only confirms the transfer of the business's ownership but it also details the transaction's specifics, such as the purchase price, description of the assets being sold, and the terms of the agreement. Additional elements may include warranties, the allocation of liabilities, and any contingencies that must be met prior to the finalization of the sale. The form serves various purposes, offering legal protection, serving as a receipt for the transaction, and impacting tax considerations for both parties involved. Given the complexity and significance of the form, understanding its components and ensuring its correct completion are essential steps in the business sale process.

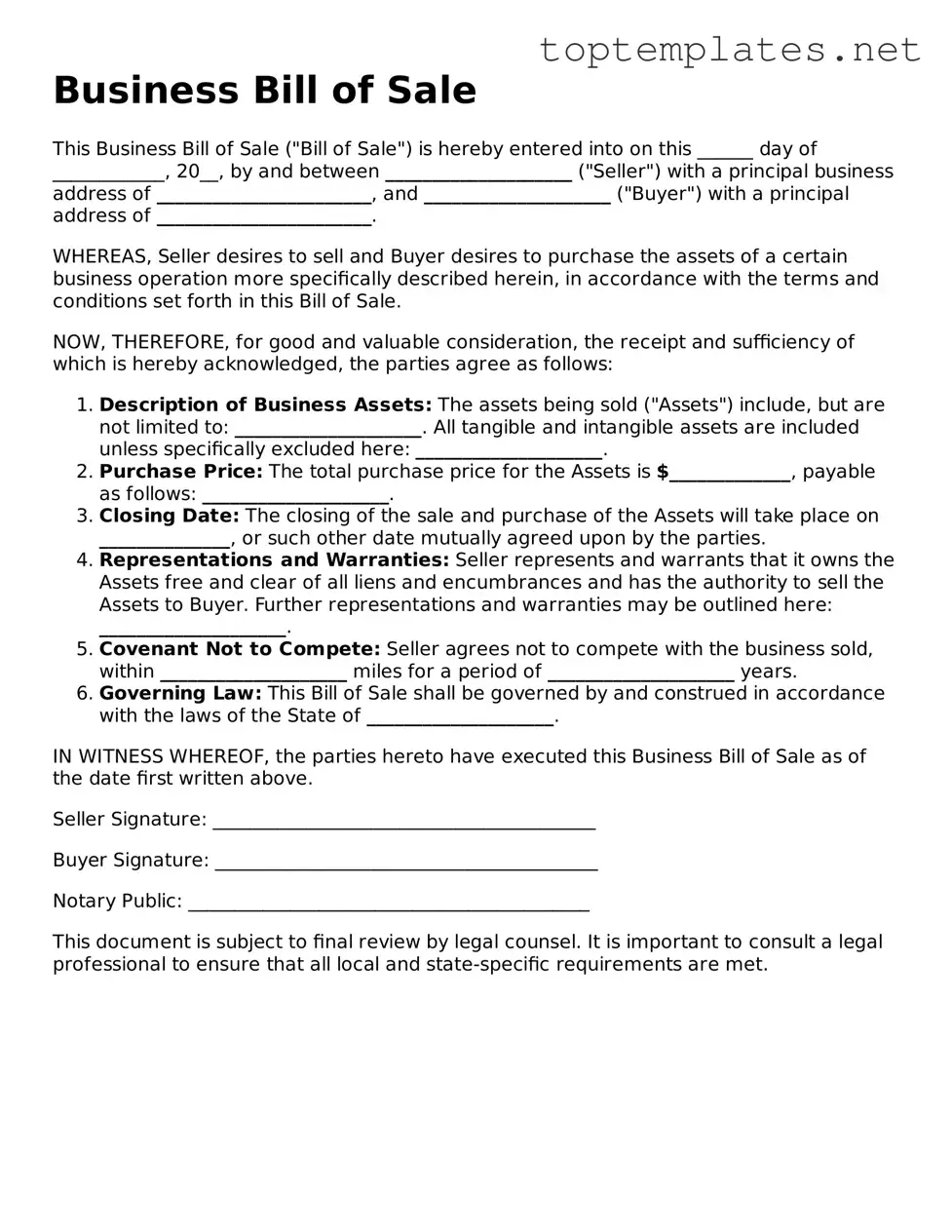

Sample - Business Bill of Sale Form

Business Bill of Sale

This Business Bill of Sale ("Bill of Sale") is hereby entered into on this ______ day of ____________, 20__, by and between ____________________ ("Seller") with a principal business address of _______________________, and ____________________ ("Buyer") with a principal address of _______________________.

WHEREAS, Seller desires to sell and Buyer desires to purchase the assets of a certain business operation more specifically described herein, in accordance with the terms and conditions set forth in this Bill of Sale.

NOW, THEREFORE, for good and valuable consideration, the receipt and sufficiency of which is hereby acknowledged, the parties agree as follows:

- Description of Business Assets: The assets being sold ("Assets") include, but are not limited to: ____________________. All tangible and intangible assets are included unless specifically excluded here: ____________________.

- Purchase Price: The total purchase price for the Assets is $_____________, payable as follows: ____________________.

- Closing Date: The closing of the sale and purchase of the Assets will take place on ______________, or such other date mutually agreed upon by the parties.

- Representations and Warranties: Seller represents and warrants that it owns the Assets free and clear of all liens and encumbrances and has the authority to sell the Assets to Buyer. Further representations and warranties may be outlined here: ____________________.

- Covenant Not to Compete: Seller agrees not to compete with the business sold, within ____________________ miles for a period of ____________________ years.

- Governing Law: This Bill of Sale shall be governed by and construed in accordance with the laws of the State of ____________________.

IN WITNESS WHEREOF, the parties hereto have executed this Business Bill of Sale as of the date first written above.

Seller Signature: _________________________________________

Buyer Signature: _________________________________________

Notary Public: ___________________________________________

This document is subject to final review by legal counsel. It is important to consult a legal professional to ensure that all local and state-specific requirements are met.

File Breakdown

| Fact | Description |

|---|---|

| Definition | A Business Bill of Sale form is a document that evidences the transfer of ownership of business assets from the seller to the buyer. |

| Primary Purpose | It serves as legal proof that the sale and purchase of business assets occurred and outlines the terms and conditions of the sale. |

| Contents | Typically includes details of the seller and buyer, description of assets, sale price, and date of sale. |

| Importance | Ensures the buyer gains legal ownership of the business assets, and protects both parties’ interests in the transaction. |

| Governing Law | Governed by the laws of the state in which the transaction occurs, and requirements can vary from one state to another. |

| Witness Requirements | Some states may require the form to be witnessed or notarized for the document to be legally binding. |

| Post-Sale Obligations | May include provisions for the seller’s assistance during the transition period and non-compete clauses. |

Steps to Filling Out Business Bill of Sale

After deciding to purchase or sell a business, the next big step involves properly documenting the transaction. A Business Bill of Sale serves as an official record of the sale and transfer of ownership of business assets. It provides legal protection for both the buyer and seller. The form should be filled out accurately to reflect the details of the transaction. Following these steps will help ensure the document is completed correctly and efficiently.

- Begin by entering the date of the sale at the top of the form. This marks the official date when the transaction takes place.

- Next, fill in the full legal names and addresses of both the seller and the buyer. Make sure these are accurate, as they identify the parties involved in the transaction.

- Describe the business being sold. This should include the name of the business and a detailed description of the business assets included in the sale. Be as specific as possible, listing all physical and intangible assets.

- Indicate the total purchase price of the business assets. This should reflect the agreed amount between the buyer and seller.

- If there are any terms and conditions related to the sale, such as payment plans or warranties, make sure to detail these in the provided section. Clear terms help prevent misunderstandings.

- Both the buyer and the seller should sign and date the form. These signatures officially seal the agreement and are necessary for the document to be legally binding.

- Finally, it is advisable to have the form notarized. Although not always required, a notarized document adds a level of verification and trust to the transaction.

Once the Business Bill of Sale is fully completed and signed by both parties, it acts as a formal receipt of the transaction. It’s important to keep a copy for your records. This document can be crucial for tax purposes, future legal questions, or if any disputes arise about the sale. Taking the time to accurately complete the Business Bill of Sale sets a solid foundation for the new ownership and provides peace of mind to everyone involved.

Discover More on Business Bill of Sale

What is a Business Bill of Sale?

A Business Bill of Sale is a legally binding document that records the sale and transfer of a business from one owner to another. It confirms that the buyer has agreed to purchase the business and its assets for a certain price, and that the seller has agreed to sell the business under those terms.

Why do I need a Business Bill of Sale?

Having a Business Bill of Sale is crucial for a number of reasons. It provides proof of the transaction, clarifies the terms and conditions of the sale, helps to prevent misunderstandings or disputes, and is often required for tax purposes. Additionally, it can be necessary for the buyer to obtain financing or for the seller to remove their name from business liabilities.

What information is included in a Business Bill of Sale?

A comprehensive Business Bill of Sale will include details such as the names and addresses of the buyer and seller, a description of the business being sold, the sale price, payment terms, a list of included assets, any liabilities or responsibilities being assumed by the buyer, and the date of the sale. It often also outlines any warranties or representations made by the seller.

How does a Business Bill of Sale differ from a Purchase Agreement?

While both documents are used in the sale of a business, a Business Bill of Sale is more of a receipt confirming that ownership has been transferred and the agreed-upon payment has been made. A Purchase Agreement, on the other hand, is a more comprehensive contract that outlines the terms of the sale, including obligations and warranties, before the sale is finalized.

Is a Business Bill of Sale legally required?

While not always legally required, having a Business Bill of Sale is highly recommended as it serves as legal evidence of the sale and transfer of ownership. Without it, there could be disputes over the legitimacy of the sale or the terms agreed upon.

Can a Business Bill of Sale be used for service-based businesses?

Yes, a Business Bill of Sale can be used for both product-based and service-based businesses. The key aspect is that it documents the sale and transfer of ownership of a business entity, regardless of its nature. For service-based businesses, the sale might include customer lists, ongoing contracts, and intellectual property among other assets.

What happens if I don't have a Business Bill of Sale?

Without a Business Bill of Sale, proving ownership transfer or the details of the agreement between buyer and seller can become challenging. This can lead to legal complications, disputes over assets, or issues with tax authorities. To ensure a smooth transition and safeguard against possible disputes, securing a Business Bill of Sale is pivotal.

Common mistakes

Filling out a Business Bill of Sale form seems straightforward, but it's a bit like walking through a minefield blindfolded if you don't know what you're doing. Mistakes here can not only delay the sale but can also result in financial losses or legal troubles down the line. Let’s go through some common errors to avoid.

Not getting it in writing: Sometimes, in the whirl of transactions, there's a temptation to rely on oral agreements. However, the absence of a written Business Bill of Sale can lead to significant legal and financial repercussions. This document is crucial for recording the sale's specifics, ensuring all parties are on the same page.

Omitting important details: Leaving out key information can be just as damaging as not creating the document in the first place. Essential details include the business name, a clear description of the assets being sold (including quantity, model, make, etc.), the sale date, and parties' information. This oversight can lead to disputes over what was agreed upon.

Ignoring legal advice: Legal documents can be complex, and the Business Bill of Sale is no exception. It's not uncommon for people to complete the form without seeking legal advice. This decision can lead to overlooked clauses that don't protect one's interests or, worse, create legal vulnerabilities.

Incorrect or missing financial details: A crucial aspect of the Business Bill of Sale is the financial transaction it represents. Mistakes in stating the purchase price, payment method, or terms can result in disputes or financial discrepancies. Ensuring these details are accurate and agreed upon by all parties is essential.

Lack of signatures or incomplete documentation: The absence of a signature turns a potentially binding document into a piece of paper without legal standing. Additionally, failing to have the document notarized, if required by law, or neglecting to compile supplementary documents that may be needed for the transaction's completeness, overlooks the form’s legal efficacy.

To navigate the complexities of a business sale smoothly, avoiding these common pitfalls when filling out a Business Bill of Sale form is critical. Whether you're the buyer or the seller, you want the peace of mind that comes from knowing your interests are protected and that the transaction complies with the law. Always consider consulting with a legal expert to ensure your documents are in order.

Documents used along the form

In the process of selling or buying a business, a Business Bill of Sale form plays a central role by officially documenting the sale and transfer of ownership of business assets. However, this form does not exist in isolation. To ensure a comprehensive and legally sound transaction, several other documents are often used alongside it. These documents help in clarifying the terms of the sale, the condition of the business, and the responsibilities of each party.

- Purchase Agreement: This document outlines the overall terms of the sale, including the purchase price and the terms and conditions of the sale. Unlike the Business Bill of Sale, which finalizes the transaction, the Purchase Agreement is often negotiated and signed prior to the final sale to outline the agreement's specifics.

- Warranty Document: A Warranty Document provides assurances from the seller to the buyer regarding the condition of the assets being sold and the business itself. This document can offer guarantees that there are no undisclosed liabilities or other potential issues that could affect the value of the business.

- Promissory Note: In instances where the buyer does not pay the full purchase price upfront and opts for installment payments, a Promissory Note is used. It details the repayment schedule, interest rates, and what happens in case of a default.

- Non-compete Agreement: To protect the buyer from the seller starting a competing business immediately after the sale, a Non-compete Agreement may be included. This document outlines restrictions on the seller to engage in similar business activities for a certain period and within certain geographical areas.

- Asset Inventory: An essential document for both the buyer and seller, an Asset Inventory lists all the assets included in the sale. This can range from physical goods to intellectual property and ensures that both parties have a clear understanding of what is being transferred.

These documents, when used alongside a Business Bill of Sale, create a robust framework for business sale transactions. They ensure clarity, legality, and fairness for all parties involved. It’s essential for buyers and sellers to understand not just the purpose of each document, but also how they interconnect to protect their interests and facilitate a smooth transition of ownership.

Similar forms

Asset Purchase Agreement: This document is similar to the Business Bill of Sale in that it details the sale and transfer of business assets from the seller to the buyer. However, it is more comprehensive, often including terms for the transfer of liabilities, non-compete clauses, and the conditions precedent to the closing of the sale.

Warranty Bill of Sale: Similar to the Business Bill of Sale, a Warranty Bill of Sale provides proof that an item has been sold. It goes further by guaranteeing that the seller holds the title to the item and it is free from any liens and encumbrances. This added layer offers more protection to the buyer.

Quitclaim Bill of Sale: Like the Business Bill of Sale, this document is used to transfer ownership of property (often personal property) without any guarantees about the seller's title. The emphasis is on the act of selling rather than the quality of what is being sold, making it less secure for the buyer compared to a Warranty Bill of Sale.

Vehicle Bill of Sale: This is used specifically for the sale of vehicles. While it serves a similar purpose to the Business Bill of Sale by documenting the transaction between buyer and seller, it is tailored for vehicular transactions, often requiring specific information like the make, model, year, and VIN of the vehicle.

General Bill of Sale: It is akin to the Business Bill of Sale as it is used to document the sale and transfer of ownership of items between two parties. The main difference is its broader application, not limited to business assets; it can cover any type of personal property from furniture to equipment.

Promissory Note: While primarily a financial instrument implying a promise to pay rather than a sales document, it shares similarities with the Business Bill of Sale when it is used as evidence of debt incurred through the purchase of a business, aligning the agreement of sale with a commitment to pay.

Commercial Invoice: This document is primarily used in international trade to declare the value of goods being shipped for customs, taxation, and accounting purposes. Much like the Business Bill of Sale, it serves as a record of the transaction, but it focuses more on the contents of the shipment rather than the transfer of ownership.

Dos and Don'ts

When engaging in the transfer of a business, a Business Bill of Sale serves as a critical document. It not only evidences the sale but ensures a smooth ownership transition. To assist in this significant process, we offer a curated list of do's and don'ts tailored to help you accurately complete the Business Bill of Sale form.

Do's:

- Ensure all parties' names and contact information are accurately entered. This includes the legal names of both the buyer and the seller.

- Clearly describe the business being sold, including its name, type, and location, to avoid any ambiguity.

- Include a detailed list of all assets being transferred. This should cover tangible and intangible assets to provide a clear scope of the sale.

- State the sale price and payment terms. This should detail the total amount, down payment, and schedule of payments, if applicable.

- Specify any liabilities or responsibilities the buyer will assume. Being upfront about this can prevent disputes later on.

- Get the document notarized. Although not always legally required, having the document notarized adds a level of authenticity and can be crucial in some jurisdictions.

- Keep a copy of the signed document for your records. Having this document readily available can be beneficial for legal or tax purposes in the future.

- Consult with a legal professional if you have any doubts. This ensures that all legal requirements are met and that the document is valid.

- Ensure both parties fully understand and agree to the terms before signing. This mutual understanding is foundational for a successful transfer.

Don'ts:

- Do not leave any sections blank. If a section does not apply, mark it as “N/A” (not applicable) instead of leaving it empty.

- Do not rush through the process. Take the necessary time to review all information and ensure it's correct and complete.

- Avoid using vague language or terms that could be misinterpreted. Be as specific and clear as possible in your descriptions.

- Do not rely on verbal agreements. Ensure everything is documented in writing within the Bill of Sale.

- Do not forget to date the document. The date of the sale is crucial for both legal and tax purposes.

- Do not underestimate the importance of disclosing all relevant information about the business. Full disclosure is key to a transparent transaction.

- Avoid signing the document without fully understanding every term and condition. If something is unclear, seek clarification.

- Do not neglect state-specific requirements. Some states may have additional mandates that need to be adhered to.

- Do not hesitate to seek professional advice. Professionals offer valuable insights that can prevent common pitfalls.

By following these guidelines, you can help ensure the Business Bill of Sale form is filled out thoroughly and accurately, paving the way for a successful business transaction.

Misconceptions

Understanding the Business Bill of Sale is crucial for anyone involved in buying or selling a business. However, there are several misconceptions that can confuse or mislead individuals during this process. Clearing up these misunderstandings is essential to ensure a smooth transaction.

It's just a simple form. Many believe that a Business Bill of Sale is just a basic document requiring only names and a price. However, it should accurately detail the assets being transferred, any liabilities, and specifics regarding payment terms to protect both parties legally.

One size fits all. Another misconception is that there's a universal template that works for every sale. In reality, the form should be tailored to match the specifics of the transaction, including the type of business and state laws.

Legal advice isn't necessary. Often, parties think they can skip legal advice when drafting or signing this document. It's crucial, however, to consult with legal professionals to ensure that the agreement is valid, enforceable, and in your best interest.

It's only about selling physical assets. People commonly mistake the Business Bill of Sale as a document for transferring physical assets like equipment. But it also covers intellectual property, customer lists, and even goodwill associated with the business.

Signing finalizes the sale. Some believe that once the Business Bill of Sale is signed, the sale is complete. Physical possession of assets and full payment often need to occur post-signing for the transaction to be fully concluded.

The price is the only important figure. While the sale price is undoubtedly important, ensuring that the document clearly states payment terms, such as deposits, installments, and dates, is equally critical. This clarity can prevent misunderstandings and disputes later on.

By addressing these misconceptions, parties involved in selling or buying a business can navigate the transaction more effectively and securely, ensuring a legal transfer of ownership and assets.

Key takeaways

When it comes to buying or selling a business, the Business Bill of Sale form serves as crucial documentation, representing the transfer of ownership from the seller to the buyer. Below are five key points to keep in mind while filling out and using this form:

Ensure Accuracy: The information provided on the Business Bill of Sale form must be precise and accurate. This includes the full legal names of the buyer and seller, the business name, and a detailed description of what is being transferred. This could range from physical assets to intellectual property.

Include Payment Details: It’s vital to clearly outline the payment terms agreed upon between the buyer and seller. This section should detail the total purchase price, payment method (such as cash, check, or transfer), and any payment schedule or financing arrangements.

Legal Descriptions Are Key: If the sale includes real estate or specific assets that can be distinctly identified, including legal descriptions can prevent future disputes. Precision here ensures both parties recognize exactly what is being transferred.

Signatures Matter: The form must be signed by both the buyer and seller to be legally binding. Depending on state laws, you may also need witnesses or a notary public to validate the signatures. Checking local requirements can save you from legal headaches down the road.

Keep Copies for Records: Lastly, both the buyer and seller should keep signed copies of the Business Bill of Sale. This document serves as proof of ownership transfer and can be crucial for tax purposes, resolving disputes, or during any future sale of the business.

By keeping these points in mind, parties involved in the transaction can ensure the process is conducted smoothly and all legal bases are covered. Whether you’re new to business transactions or an experienced entrepreneur, attention to detail with the Business Bill of Sale can facilitate a clear transfer of ownership and protect your interests.

Find Other Types of Business Bill of Sale Documents

Quick Bill of Sale - This form can also serve as a negotiation tool, providing a basis for discussions about the trailer's condition and value.

Printable Livestock Bill of Sale - By detailing the transaction, it also aids in tracking the movement of livestock, which can be important for disease control and prevention efforts.