Free Broker Price Opinion PDF Form

In the intricate world of real estate transactions, the Broker Price Opinion (BPO) form holds a key position, especially when evaluating a property's market value. Originating as a comprehensive document, the BPO form is often utilized in scenarios ranging from loan originations to foreclosures, providing an alternative to the traditional, more costly appraisal. This form gathers detailed information about the subject property, including its type, the conditions of the current market, marketability, necessary repairs to bring the property up to market standards, and a comparative market analysis with similar properties in the vicinity. Brokers, using their expertise, complete this form to suggest an estimated selling price by factoring in various attributes like the general market conditions, subject marketability, competitive closed sales, and suggested marketing strategies. Information about the property’s occupancy status, the types of financing available, and any association fees also feature prominently, giving a well-rounded view of the property’s position in its local real estate market. This document's dual-purpose nature assists lenders in making informed decisions regarding property loans while providing owners with valuable insights on preparing their property for the market. The Broker Price Opinion form, in essence, serves as a pivotal tool, bridging gaps between buyers, sellers, and financial institutions by forecasting the potential selling price of a property with a nuanced understanding of its unique characteristics and the current market trends.

Sample - Broker Price Opinion Form

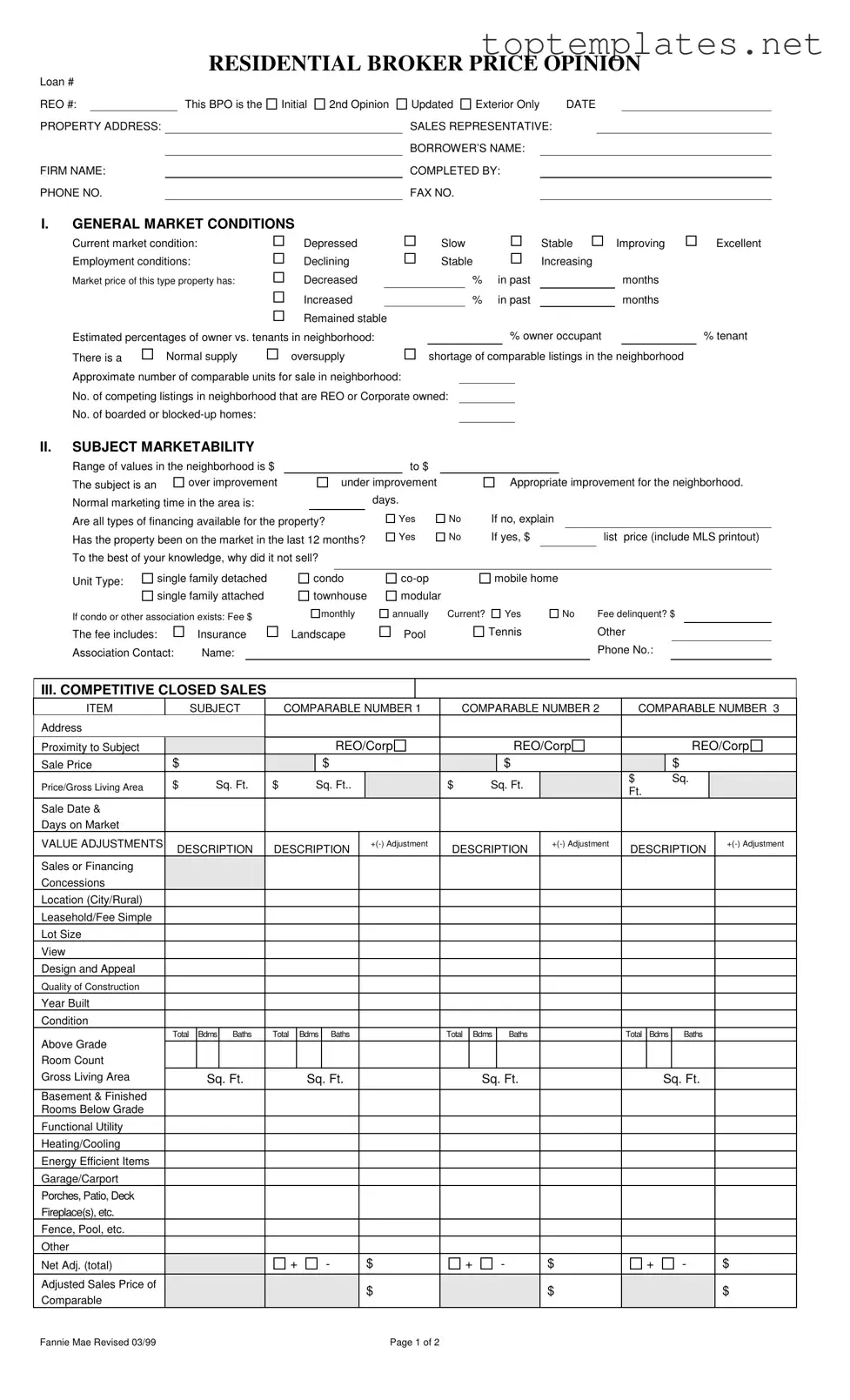

RESIDENTIAL BROKER PRICE OPINION

Loan #

REO #:This BPO is the

PROPERTY ADDRESS:

FIRM NAME:

PHONE NO.

Initial

2nd Opinion

Updated Exterior Only |

DATE |

|||

SALES REPRESENTATIVE: |

|

|

|

|

BORROWER’S NAME: |

|

|

|

|

COMPLETED BY: |

|

|

|

|

FAX NO. |

|

|

|

|

I.GENERAL MARKET CONDITIONS

Current market condition: |

Depressed |

Slow |

|

Stable |

Improving |

||

Employment conditions: |

Declining |

Stable |

|

Increasing |

|

||

Market price of this type property has: |

Decreased |

|

|

% |

in past |

|

months |

|

Increased |

|

|

% |

in past |

|

months |

|

Remained stable |

|

|

|

|

|

|

Estimated percentages of owner vs. tenants in neighborhood: |

|

|

% owner occupant |

|

|||

There is a |

Normal supply |

oversupply |

shortage of comparable listings in the neighborhood |

||||

Approximate number of comparable units for sale in neighborhood: |

|

|

|

|

|

||

No. of competing listings in neighborhood that are REO or Corporate owned:

No. of boarded or

Excellent

% tenant

II.SUBJECT MARKETABILITY

Range of values in the neighborhood is $ |

|

|

|

|

|

to $ |

|

|

|

|

|

|

|

|

The subject is an |

over improvement |

|

|

under improvement |

|

Appropriate improvement for the neighborhood. |

||||||||

Normal marketing time in the area is: |

|

|

|

|

days. |

|

|

|

|

|

|

|||

Are all types of financing available for the property? |

Yes |

No |

If no, explain |

|

|

|

||||||||

Has the property been on the market in the last 12 months? |

Yes |

No |

If yes, $ |

|

|

list price (include MLS printout) |

||||||||

To the best of your knowledge, why did it not sell? |

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

||||

Unit Type: |

single family detached |

|

condo |

|

mobile home |

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

single family attached |

|

townhouse |

modular |

|

|

|

|

|

|

||||

If condo or other association exists: Fee $

monthly

annually Current?

Yes

No |

Fee delinquent? $ |

The fee includes:

Association Contact:

Insurance

Name:

Landscape

Pool

Tennis |

Other |

|

Phone No.: |

III. COMPETITIVE CLOSED SALES

ITEM |

|

|

SUBJECT |

|

COMPARABLE NUMBER 1 |

|

COMPARABLE NUMBER 2 |

|

COMPARABLE NUMBER 3 |

|||||||||||||||||||||||

Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Proximity to Subject |

|

|

|

|

|

|

|

|

|

|

REO/Corp |

|

|

|

|

|

|

REO/Corp |

|

|

|

|

|

REO/Corp |

||||||||

Sale Price |

$ |

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

$ |

|

|

|

|||

Price/Gross Living Area |

$ |

|

Sq. Ft. |

$ |

|

Sq. Ft.. |

|

|

$ |

|

|

Sq. Ft. |

|

|

$ |

|

|

|

Sq. |

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

Ft. |

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Sale Date & |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Days on Market |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

VALUE ADJUSTMENTS |

|

DESCRIPTION |

|

DESCRIPTION |

|

|

DESCRIPTION |

|

DESCRIPTION |

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

Sales or Financing |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Concessions |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Location (City/Rural) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Leasehold/Fee Simple |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Lot Size |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

View |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Design and Appeal |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Quality of Construction |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year Built |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Condition |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total |

|

Bdms |

Baths |

|

Total |

Bdms |

|

Baths |

|

|

|

Total |

|

Bdms |

|

Baths |

|

|

Total |

Bdms |

Baths |

|

|

|

||||||

Above Grade |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Room Count |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross Living Area |

|

|

|

Sq. Ft. |

|

|

Sq. Ft. |

|

|

|

|

|

|

Sq. Ft. |

|

|

|

|

|

Sq. Ft. |

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basement & Finished |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Rooms Below Grade |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Functional Utility |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Heating/Cooling |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Energy Efficient Items |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Garage/Carport |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Porches, Patio, Deck |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fireplace(s), etc. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fence, Pool, etc. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Adj. (total) |

|

|

|

|

|

+ |

- |

|

|

$ |

|

+ |

- |

|

$ |

|

+ |

|

|

- |

|

$ |

|

|||||||||

Adjusted Sales Price of |

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

$ |

|

Comparable |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fannie Mae Revised 03/99 |

|

|

|

|

|

|

|

|

|

|

|

|

Page 1 of 2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

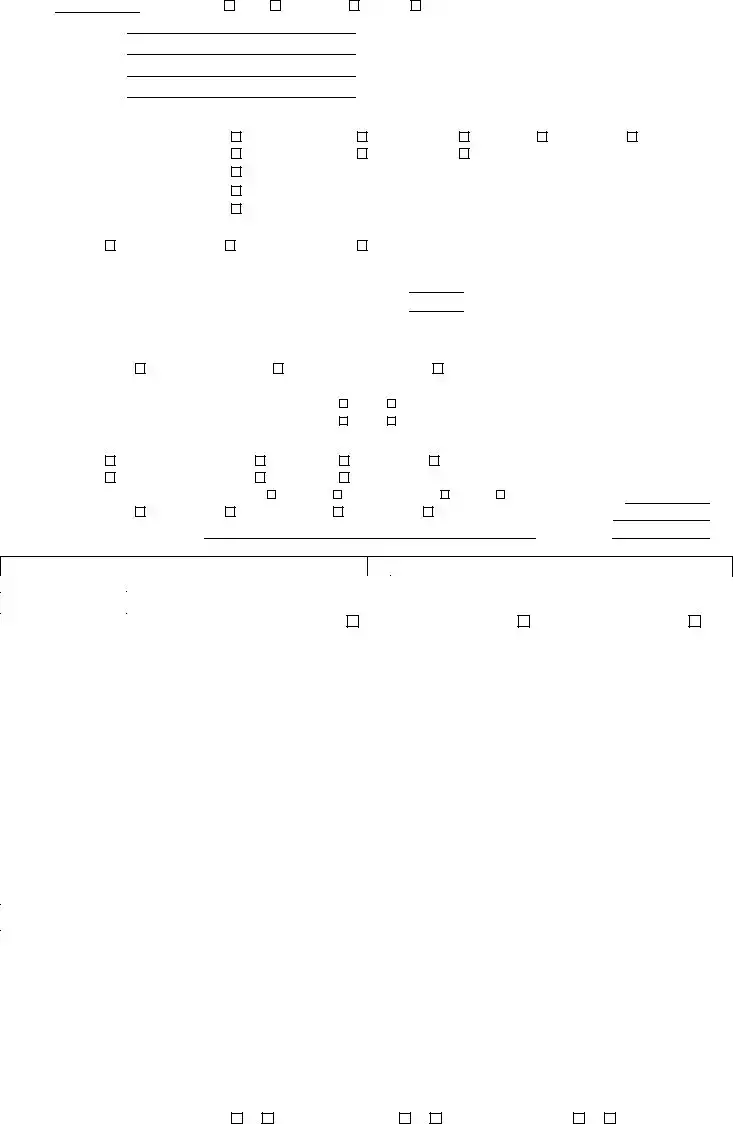

REO# |

Loan # |

IV. MARKETING STRATEGY

Minimal Lender Required Repairs |

V. REPAIRS

Occupancy Status: Occupied

Repaired Most Likely Buyer:

Vacant

Unknown

Unknown

Owner occupant

Investor

Investor

Itemize ALL repairs needed to bring property from its present “as is” condition to average marketable condition for the neighborhood. Check those repairs you recommend that we perform for most successful marketing of the property.

$

$

$

$

$

$

$

$

$

$

|

|

|

|

GRAND TOTAL FOR ALL REPAIRS $ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

VI. COMPETITIVE LISTINGS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

ITEM |

|

|

SUBJECT |

COMPARABLE NUMBER 1 |

COMPARABLE NUMBER. 2 |

COMPARABLE NUMBER. 3 |

|||||||||||||||||||||

Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Proximity to Subject |

|

|

|

|

|

REO/Corp |

|

|

|

|

|

REO/Corp |

|

|

REO/Corp |

||||||||||||

List Price |

$ |

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

$ |

|

|

||

Price/Gross Living Area |

$ |

|

Sq.Ft. |

$ |

Sq.Ft. |

|

|

|

$ |

Sq.Ft. |

|

|

|

$ |

Sq.Ft. |

|

|

||||||||||

Data and/or |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Verification Sources |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

VALUE ADJUSTMENTS |

|

DESCRIPTION |

DESCRIPTION |

|

+ |

DESCRIPTION |

|

DESCRIPTION |

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sales or Financing |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Concessions |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Days on Market and |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date on Market |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Location (City/Rural) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Leasehold/Fee |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Simple |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Lot Size |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

View |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Design and Appeal |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Quality of Construction |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year Built |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Condition |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Above Grade |

Total |

Bdms |

Baths |

Total |

Bdms |

Baths |

|

|

|

Total |

Bdms |

|

Baths |

|

Total |

Bdms |

|

Baths |

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Room Count |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross Living Area |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

Sq. Ft. |

|

Sq. Ft. |

|

|

|

Sq. Ft. |

|

|

|

Sq. Ft. |

|

|

|||||||||||||

Basement & Finished |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Rooms Below Grade |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Functional Utility |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Heating/Cooling |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Energy Efficient Items |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Garage/Carport |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Porches, Patio, Deck |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fireplace(s), etc. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fence, Pool, etc. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Net Adj. (total) |

|

|

|

|

+ |

- |

|

|

|

$ |

|

|

+ |

- |

- |

|

$ |

|

|

+ |

- |

|

$ |

|

|

||

Adjusted Sales Price |

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

$ |

|

|

of Comparable |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

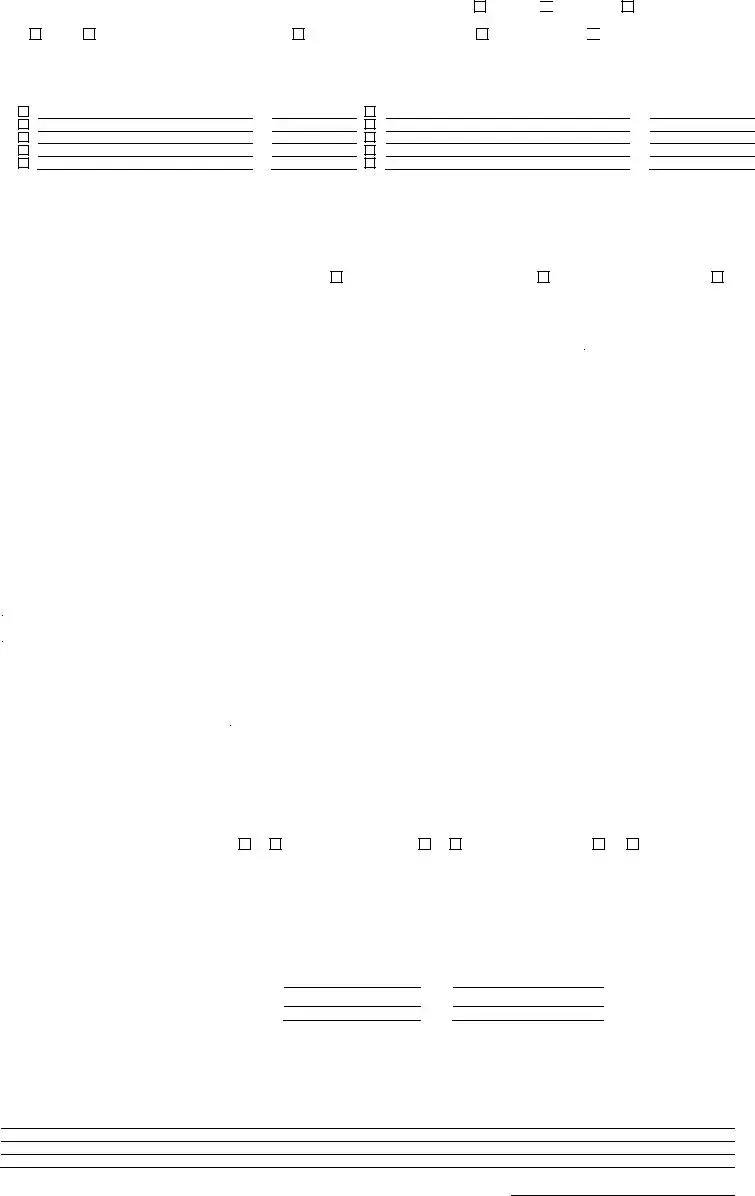

VI. THE MARKET VALUE (The value must fall within the indicated value of the Competitive Closed Sales).

Market Value |

Suggested List Price |

AS IS REPAIRED

30 Quick Sale Value

Last Sale of Subject, Price |

Date |

COMMENTS (Include specific positives/negatives, special concerns, encroachments, easements, water rights, environmental concerns, flood zones, etc. Attach addendum if additional space is needed.)

Signature: |

|

Date: |

Fannie Mae Revised 03/99 |

Page 2 of 2 |

CMS Publishing Company 1 800 |

File Specs

| Fact Name | Description |

|---|---|

| Purpose of the Form | The Broker Price Opinion form is used to provide an estimated market value of a residential property, taking into account current market conditions, property characteristics, and comparable sales. It serves as an alternative to a more detailed and expensive appraisal. |

| Key Sections | It includes sections on general market conditions, subject marketability, competitive closed sales, marketing strategy, necessary repairs, competitive listings, and the estimated market value. |

| Governing Law | Fannie Mae guidelines influence the structure and content of this form. Additionally, real estate valuation and brokerage activities are subject to state-specific laws where the property is located. |

| Usage Considerations | This form is often used by financial institutions, investment companies, and others considering the purchase, sale, or financing of a property. It provides a cost-effective tool for assessing market value but does not replace a formal appraisal for mortgage lending purposes. |

Steps to Filling Out Broker Price Opinion

Filling out a Broker Price Opinion (BPO) form is a critical process for assessing property value, informing sale strategies, and understanding market conditions. The BPO form collects detailed information about the property in question, market health, and comparable sales, which aids in making informed decisions. Whether you're conducting an initial, second opinion, or updated exterior-only BPO, completing the form accurately is essential. Here are the steps to fill out a BPO form.

- Start by entering the loan number and REO number, if applicable, at the top of the form.

- Specify the type of BPO being conducted (Initial, 2nd Opinion, Updated, Exterior Only) and input the date.

- Fill in the property address, your firm's name, and contact information including phone and fax numbers.

- In the section labeled "SALES REPRESENTATIVE," enter the name of the individual completing the form. Also, include the borrower's name if relevant.

- Under "GENERAL MARKET CONDITIONS," select the current market condition, employment conditions, and note the market price change percentage over the specified period. Also, fill in the estimated owner vs. tenant percentages and the listing supply condition in the neighborhood.

- Provide the number of competing listings, including those that are REO (Real Estate Owned) or corporate-owned, and the count of boarded or blocked-up homes in the area.

- For "SUBJECT MARKETABILITY," specify the value range in the neighborhood, the subject’s comparison to neighborhood improvements, and typical marketing times. Indicate if all financing types are available and if the property has been marketed in the last 12 months, including listing price and reasons for any selling failures.

- Detail the unit type and, if applicable, association fees, indicating if current or delinquent, and what the fees cover.

- In the "COMPETITIVE CLOSED SALES" section, list the subject property and three comparables, including addresses, proximity, REO status, sale prices, and sale dates. Fill in adjustments for various attributes to align them with the subject property.

- Under "MARKETING STRATEGY," circle the condition of the property and the repairs required or recommended. Also, specify the most likely buyer.

- List all necessary repairs and their costs to bring the property to marketable condition.

- In "COMPETITIVE LISTINGS," enter details for the subject property and up to three comparable listings, including addresses, list prices, and price per square foot. Adjust the values based on specific features and market data.

- Finally, provide the estimated market value, as-is and repaired value, and a quick sale value. Add any comments related to the property's positives/negatives, and special concerns. If more space is needed, attach an addendum.

- Sign and date the form at the bottom.

Completing the Broker Price Opinion form with attention to detail ensures that all relevant information about the property and market conditions is accurately represented. This careful documentation aids in making well-informed decisions regarding property sales strategies.

Discover More on Broker Price Opinion

What is a Broker Price Opinion (BPO)?

A Broker Price Opinion (BPO) is an estimate of a property's value, commonly conducted by a real estate broker or agent. It provides an analysis of local market conditions, comparable sales, and listings to estimate the potential selling price of a residential property. BPOs are used by lenders, investors, and mortgage companies, typically in situations such as loan modifications, foreclosures, and short sales.

When is a BPO used instead of a full appraisal?

BPOs are often used in situations where a faster, more cost-effective evaluation is needed, such as in the case of foreclosures, loan modifications, and short sales. They are not as comprehensive as full appraisals but provide a valuable assessment of a property’s market value for financial institutions and investors to make informed decisions.

What information is included in a BPO form?

A BPO form includes detailed information about the property and the local real estate market. This includes general market conditions (such as current market trend and employment conditions), subject property marketability, competitive closed sales and listings comparisons, value adjustments, marketing strategy, necessary repairs, and suggested listing prices. It provides a thorough analysis to support the broker's estimated value of the property.

How do brokers determine the value in a BPO?

Brokers determine the value in a BPO by analyzing several factors, including local market conditions, comparisons with similar recently sold properties, current competition in the market, and the physical condition of the property. Adjustments are made for differences in size, location, condition, and amenities to estimate a property’s market value accurately.

Are there different types of BPOs?

Yes, there are typically two types of BPOs: an exterior drive-by BPO and an interior BPO. The drive-by BPO involves an external examination of the property and neighborhood, whereas the interior BPO includes a detailed inspection of both the interior and exterior of the property. Each type serves different purposes based on the required level of detail and the circumstances under which the BPO is ordered.

Can BPOs be used for purposes other than foreclosures or loan modifications?

While commonly associated with foreclosures and loan modifications, BPOs are also used for a variety of other purposes including, but not limited to, investment analysis, pre-listing pricing for real estate agents, internal decision-making by financial institutions, and supporting legal processes such as divorce settlements and estate evaluations.

How accurate are BPOs, and can they replace an appraisal?

BPOs are considered to be accurate estimates of a property’s value, particularly when conducted by an experienced broker familiar with the local market. However, they are not as thorough as a full appraisal and are not typically used in situations where an appraisal is required by law, such as during the origination of a mortgage loan. BPOs serve as a cost-effective alternative in situations where a full appraisal is not necessary or feasible.

Common mistakes

Filling out a Broker Price Opinion (BPO) form is an intricate process that demands attention to detail. Common mistakes can significantly affect the form's accuracy and usefulness. Understanding these errors can help ensure a more reliable and precise completion of the BPO form.

- Incorrect Market Analysis:

Failure to accurately assess the current market conditions, including overlooking trends in employment and misjudging the market performance of similar properties, can lead to a flawed valuation.

- Misestimation of the Property's Appeal:

Improper evaluation of the property as an over or under improvement in the neighborhood affects the perceived value and marketability.

- Overlooking Financing Availability:

Not correctly noting whether all types of financing are available for the property can mislead potential buyers about their purchasing capabilities.

- Previous Market Presence Ignored:

Failure to indicate whether the property has been on the market in the last 12 months, and if so, why it did not sell, overlooks critical factors affecting saleability.

- Inaccurate Competitive Market Analysis:

Errors in comparing the subject property to similar, recently sold properties, such as incorrect addresses or sale prices, can lead to a skewed value assessment.

- Skewed Repair Assessments:

Underestimating or overestimating the cost and extent of repairs needed can significantly affect the property’s “as is” and repaired value estimations.

- Error in Listing Comparables:

Mistakes in listing comparable active properties, including inaccuracies in listing prices or overlooking relevant available properties, can distort the competitive landscape.

- Value Adjustment Discrepancies:

Incorrectly adjusting values for differences in location, condition, size, etc., between the subject property and comparables can lead to an inaccurate final valuation.

Each of these mistakes has the potential to significantly impact the outcome of the Broker Price Opinion. Accuracy, thoroughness, and an objective viewpoint are critical when completing the BPO form to ensure it reflects a true and fair valuation of the property in question.

Documents used along the form

When working with a Residential Broker Price Opinion (BPO) form, professionals in the real estate and banking industries often find themselves needing additional documentation to complete a thorough property analysis. The BPO provides a valuation of a property by real estate brokers, which is crucial for decisions on sales, purchases, or mortgage operations. However, this form is just a part of the puzzle. Several other key documents usually accompany the BPO to provide a clearer picture of the property's condition, market status, and legal standing.

- Comparative Market Analysis (CMA): This document compares the subject property with similar properties that have recently sold in the area. It helps in understanding how the property stands in the current market.

- Property Condition Report: Details the physical condition of the property, including any damage or repairs needed. This report is crucial for assessing the true value of a property.

- Appraisal Report: Conducted by a licensed appraiser, this report gives an in-depth analysis of the property’s fair market value, which supports or contests the valuation given by the BPO.

- Title Report: Provides the legal status of the property, including ownership, liens, and any encumbrances that might affect the property’s value or marketability.

- Listing Agreement: If the property is being sold, this document between the seller and the real estate agent details the terms under which the property is listed.

- Repair Estimates: Itemized estimates of any repairs needed on the property, often derived from the Property Condition Report, can significantly impact the valuation.

Together, these documents play crucial roles in painting a comprehensive picture of a property's value, condition, and marketability. They support the Broker Price Opinion by providing necessary context, legal clarity, and the detailed condition and history of the property. Professionals using these documents can make well-informed decisions regarding property sales, purchases, or financing.

Similar forms

Comparative Market Analysis (CMA) - Similar to a Broker Price Opinion (BPO), a CMA evaluates the prices of homes recently sold, currently listed, or those that were listed but removed from the market within a specific area. Both documents help in determining a property's market value.

Appraisal Report - Both an appraisal report and a BPO offer estimates of a property's value. However, an appraisal is typically more detailed and is performed by a licensed appraiser, whereas a BPO can be conducted by real estate agents or brokers.

Property Condition Report - This report shares similarities with the BPO's section on necessary repairs and the property's condition. It assesses the physical state of a property but does not estimate its market value.

Listing Agreement - A BPO can influence the setting of a listing price in a listing agreement, in which a homeowner authorizes a real estate agent to sell the property. Both documents are integral to the home-selling process.

Real Estate Owned (REO) Property Report - Like a BPO, an REO property report includes assessments of a property's conditions and marketability. REO reports focus on properties owned by a lender following an unsuccessful foreclosure auction.

Investor Analysis Reports - Investors use these reports to assess the potential return on investment in real estate properties, considering market conditions and property values similar to a BPO.

Home Inspection Report - While a home inspection report provides a detailed examination of a property's condition, it does not offer a market value estimate. However, it complements the BPO by highlighting repair needs and property status.

Market Absorption Analysis - This analysis predicts how long it will take for properties to sell in a specific market based on current listings and sales pace, similar to market condition assessments in a BPO.

Lease Comparative Analysis - Similar to a BPO, this analysis examines comparable lease properties to determine appropriate rental rates, focusing on the rental market instead of sales.

Insurance Inspection Report - While focused on assessing a property to determine insurance risks and premiums, this report also evaluates property conditions like a BPO but with an emphasis on insurability rather than sale value.

Dos and Don'ts

When completing the Broker Price Opinion (BPO) form, there are important dos and don'ts to ensure that the information provided is accurate and useful. Below are four key points each for what you should and shouldn't do.

What You Should Do:

- Review all sections of the form carefully to understand what information is required, including general market conditions, subject marketability, competitive closed sales, marketing strategy, repairs, and competitive listings.

- Provide accurate and current data for each section to reflect the property's value and the state of the market accurately. This includes correct figures for sales, listings, and adjustments.

- Consider the unique features and conditions of the property when making value adjustments. Ensure adjustments are justified and align with market expectations.

- Verify that all financial figures, such as estimated repair costs and association fees, are accurate and realistic. This helps in creating a credible and reliable BPO.

What You Shouldn't Do:

- Do not leave sections incomplete. Each part of the BPO form contributes to the final opinion of value, and missing information can lead to inaccuracies.

- Avoid using outdated or irrelevant comparable sales and listings. The data used should reflect the current market to ensure the accuracy of the BPO.

- Resist the urge to overestimate the property's value. It is important to remain objective and unbiased, considering both the property's strengths and weaknesses.

- Do not ignore market conditions and trends that could affect the property's value. These include general market conditions, employment conditions, and the balance of supply and demand in the neighborhood.

Misconceptions

Several misconceptions surround the Broker Price Opinion (BPO) form that can lead to confusion regarding its use and purpose in the real estate market. Below are four common misunderstandings and clarifications to demystify the BPO form.

- BPOs are the same as appraisals: A common misconception is that Broker Price Opinions and appraisals serve the same purpose and can be used interchangeably. However, BPOs are performed by real estate brokers and are primarily used by banks and mortgage companies for a quick property value assessment, often in foreclosure situations. In contrast, appraisals are more detailed evaluations conducted by licensed appraisers and are required by lenders before approving a mortgage.

- BPOs can always replace appraisals for mortgage approval: Another mistaken belief is that BPOs can always replace appraisals for mortgage approvals. While BPOs provide a cost-effective and quicker property valuation, most lenders require a formal appraisal performed by a licensed appraiser for mortgage underwriting purposes, especially for home purchases.

- Any real estate agent can perform a BPO: While many real estate agents are capable of performing BPOs, not all agents have the experience or qualifications to do so. Banks or other institutions often require agents who have received specific training or have a particular level of experience in performing BPOs to ensure accuracy.

- BPOs are only about determining the value of a property: While a primary function of the BPO is to estimate the value of a property, it also provides crucial information on local market conditions, the property's exterior and interior condition, and comparable sales data. This information can be valuable for various purposes beyond just determining property value, such as understanding market trends and identifying potential issues with the property.

By understanding what the Broker Price Opinion form accurately represents and its intended use, professionals and consumers alike can better navigate the nuances of real estate transactions and valuations.

Key takeaways

When dealing with a Broker Price Opinion (BPO) form, understanding its components and how to accurately complete it is essential for real estate professionals. Below are key takeaways to assist in filling out and utilizing the form efficiently:

- Accuracy is Crucial: Ensure all information provided on the BPO is accurate, especially regarding current market conditions, property details, and comparative market analysis.

- Assess Market Conditions: Complete the section on market conditions carefully, analyzing if the market is depressed, slow, stable, or improving, as this affects the property's value.

- Detail Property Characteristics: Clearly specify the property type, be it a single-family detached home, condo, townhouse, etc., and indicate any association fees if applicable.

- Analyze Comparable Sales: When listing competitive closed sales, proximity to the subject property and adjustments for differences in features or conditions should be carefully considered to ensure an accurate market value estimation.

- Consider Marketability: Evaluate and document elements that affect the property's marketability, including financing availability, the property's condition, and whether it has been on the market previously.

- Marketing Strategy and Repairs: A clear plan should be outlined in the BPO form for marketing the property, including acknowledging any necessary repairs to bring the property to a marketable condition.

- Competitive Listings Analysis: Similar to analyzing closed sales, listing current competitive listings requires understanding of the market and adjustments for significant differences to accurately position the subject property.

- Value Adjustments: Thoroughly document adjustments made for differences between the subject property and comparables to justify the final value opinion.

- Objective Opinion: Provide an objective valuation by considering all factors fairly and without bias towards a desired valuation outcome.

- Complete and Professional Submission: Ensure that the BPO form is filled out completely and presented professionally, adhering to all guidelines and standards expected by the requesting party.

Understanding these aspects of the BPO form can significantly enhance the accuracy and reliability of the property valuation process, benefiting both the real estate professional and their clients. By adhering to these key takeaways, one can ensure a comprehensive and fair assessment of a property's worth in the current market.

Common PDF Forms

Roof Certification Form Florida - A roofing certification document indicating that the roof has been deemed satisfactory and moisture-proof for at minimum of two years post-inspection and/or repair.

Form 6059B Customs Declaration - The information provided helps CBP officers make informed decisions regarding the admissibility of goods into the U.S.

Change of Rater Ncoer - The DA 2166-9-1 form's design reflects the Army's core values, promoting integrity, accountability, and excellence among non-comissioned officers.