Free Business Credit Application PDF Form

In the realm of business finance, understanding the intricacies of obtaining credit is crucial for companies aiming to expand their operations or sustain their workflow. Central to this process is the Business Credit Application form, a document that serves as the gateway for businesses seeking to establish a credit line with lenders or vendors. This form is meticulously designed to collect comprehensive information about a business, including its financial stability, credit history, and other details that are pivotal in determining the creditworthiness of a business. As such, careful completion of this form can significantly influence a lender's decision to extend credit. Moreover, the form often includes terms and conditions related to the credit agreement, thereby laying the groundwork for the financial relationship between the business and the creditor. On the flip side, this document also poses challenges, as inaccuracies or incomplete information can hinder a business’s ability to secure the needed credit. Thus, a thorough understanding of the Business Credit Application form and its major components is indispensable for businesses navigating the complexities of credit acquisition.

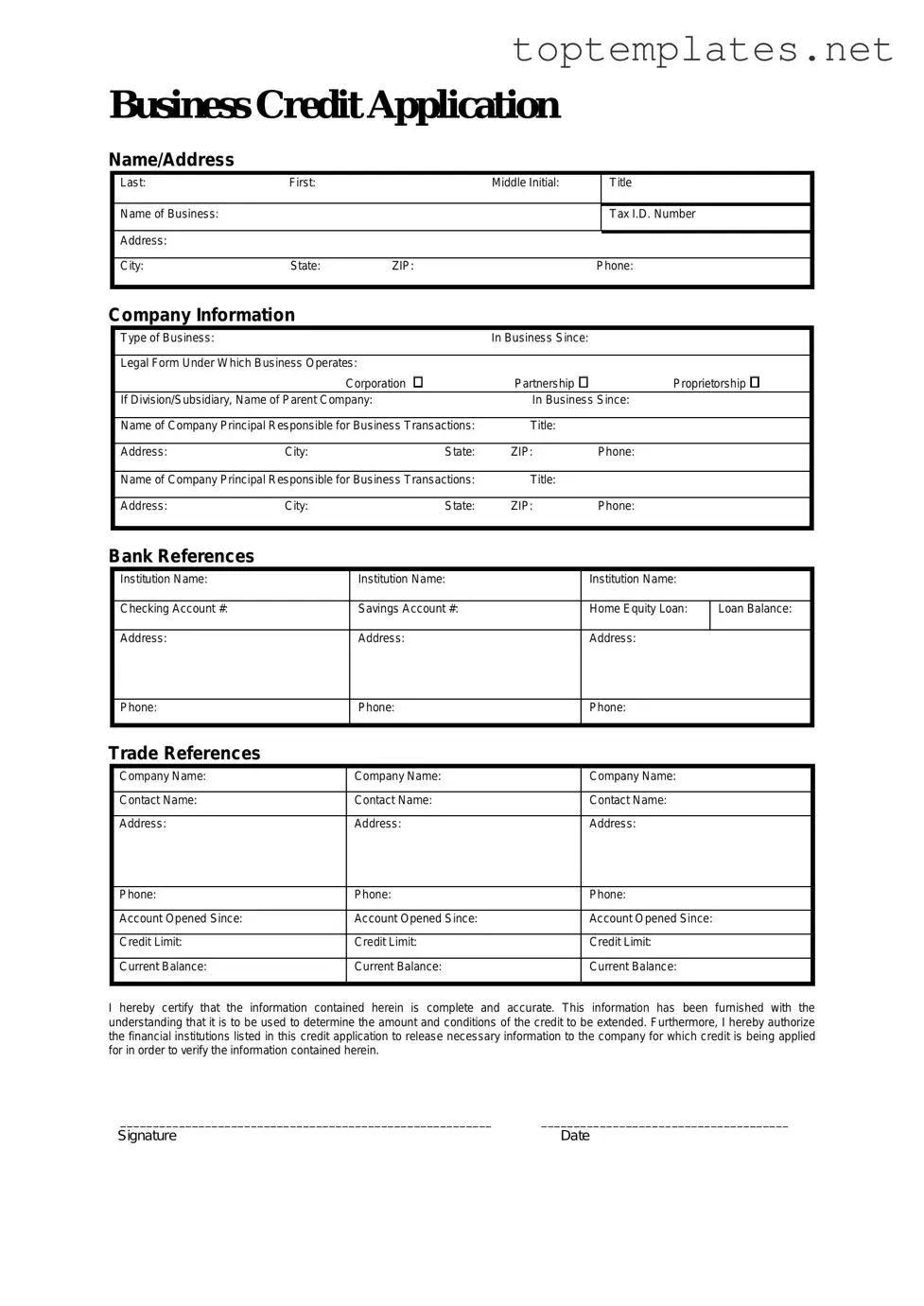

Sample - Business Credit Application Form

Business Credit Application

Name/Address

Last: |

First: |

|

Middle Initial: |

|

Title |

|

|

|

|

|

|

Name of Business: |

|

|

|

|

Tax I.D. Number |

|

|

|

|

|

|

Address: |

|

|

|

|

|

|

|

|

|

|

|

City: |

State: |

ZIP: |

|

Phone: |

|

|

|

|

|

|

|

Company Information

|

Type of Business: |

|

|

|

In Business Since: |

|

|

|

|

|

|

|

|

|

|

||

|

Legal Form Under Which Business Operates: |

|

|

|

|

|||

|

|

|

Corporation |

Partnership |

Proprietorship |

|

||

|

If Division/Subsidiary, Name of Parent Company: |

In Business Since: |

|

|||||

|

|

|

|

|

|

|

||

|

Name of Company Principal Responsible for Business Transactions: |

Title: |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

Address: |

City: |

|

State: |

ZIP: |

Phone: |

|

|

|

|

|

|

|

|

|

||

|

Name of Company Principal Responsible for Business Transactions: |

Title: |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

Address: |

City: |

|

State: |

ZIP: |

Phone: |

|

|

|

|

|

|

|

|

|

|

|

Bank References |

|

|

|

|

|

|

|

|

|

Institution Name: |

|

|

Institution Name: |

|

Institution Name: |

||

|

|

|

|

|

|

|

|

|

|

Checking Account #: |

|

|

Savings Account #: |

|

Home Equity Loan: |

ILoan Balance: |

|

|

Address: |

|

|

Address: |

|

Address: |

|

|

Phone:

Phone:

Phone:

Trade References

Company Name: |

Company Name: |

Company Name: |

|

|

|

Contact Name: |

Contact Name: |

Contact Name: |

|

|

|

Address: |

Address: |

Address: |

|

|

|

Phone: |

Phone: |

Phone: |

|

|

|

Account Opened Since: |

Account Opened Since: |

Account Opened Since: |

|

|

|

Credit Limit: |

Credit Limit: |

Credit Limit: |

|

|

|

Current Balance: |

Current Balance: |

Current Balance: |

|

|

|

I hereby certify that the information contained herein is complete and accurate. This information has been furnished with the understanding that it is to be used to determine the amount and conditions of the credit to be extended. Furthermore, I hereby authorize the financial institutions listed in this credit application to release necessary information to the company for which credit is being applied for in order to verify the information contained herein.

_________________________________________________________ ______________________________________

Signature |

Date |

File Specs

| Fact | Description |

|---|---|

| Definition | A Business Credit Application form is a document used by businesses to request credit from suppliers or lenders, detailing the terms of the credit request. |

| Purpose | It streamlines the process of obtaining credit, helping suppliers or lenders to assess the creditworthiness of a business. |

| Components | Typically includes business information, bank references, trade references, and a request for the credit terms desired. |

| Governing Law | Varies by state; however, it generally adheres to federal regulations surrounding credit and lending practices. |

Steps to Filling Out Business Credit Application

Applying for business credit is a critical step for any company looking to expand its operations or manage its cash flow more effectively. This process begins with the completion of a Business Credit Application form. It's an opportunity to present your business in the best light to prospective creditors and lay the groundwork for a successful financial partnership. Remember, the information you provide will help them to assess your creditworthiness, so it's important to be accurate and thorough. Let's walk through the steps you'll need to take to fill out this form correctly.

- Start by gathering all necessary documents that will help you provide accurate information. This may include your business license, financial statements, tax ID number, and any other relevant financial documents.

- Fill in the basic information section. This typically includes your business name, address, phone number, email, and type of business entity (such as LLC, corporation, partnership).

- Provide your Tax ID number and DUNS number if available. These are crucial for establishing your business's credit identity.

- Detail the nature of your business, including the products or services offered. Be clear and concise to give creditors a good understanding of your operations.

- List the names and contact information of any principals or owners. Depending on the structure of your business, this might include partners, directors, or major shareholders.

- Enter banking information, including the name of your bank, the branch, account number(s), and contact information for your bank representative. This information is used to verify your financial stability and cash flow.

- Include trade references, if applicable. These are companies with which you have existing credit relationships and can attest to your payment history and reliability.

- State the amount of credit being requested. Ensure this amount aligns with your business needs and financial capacity to repay.

- Agree to the terms and conditions specified by the creditor. This usually involves a checkbox or signature field at the end of the form. It's essential to read these terms carefully before agreeing to them.

- Double-check all the information provided for accuracy and completeness. Missing or incorrect information can delay the approval process.

- Sign and date the application. If it's a digital form, ensure your electronic signature is used where required.

Once you've completed these steps, submit the form according to the creditor's instructions. This may involve mailing a physical copy, submitting it through an online portal, or sending it via email. After submission, the waiting game begins. The creditor will review your application, possibly reach out for additional information, and then make a decision on your credit application. It's a good practice to follow up after a week or two if you haven't heard back, just to check on the status of your application and demonstrate your interest. Good luck!

Discover More on Business Credit Application

What is a Business Credit Application form?

A Business Credit Application form is a document used by businesses to request credit terms from a supplier or lender. It typically includes information about the business seeking credit, such as company details, financial statements, and references. This form is the first step in obtaining credit, which can be crucial for business operations and growth.

Why do businesses need to fill out a Business Credit Application form?

Filling out a Business Credit Application form is essential for businesses that wish to establish a credit line with a supplier or obtain financing. It allows the supplier or lender to assess the creditworthiness of the business, determining whether they can reliably meet payment terms. This process helps manage risk and ensures that the business can access the goods or funds it needs on credit.

What information is typically required on a Business Credit Application form?

The form usually requests detailed information about the business, including legal name, type of business entity, federal tax ID, business address, phone number, and contact information of the owners or principals. Financial information, such as annual revenue, bank references, and other credit references, may also be required. Some forms may ask for details about the company's history and the purpose of the credit request.

How can a business improve its chances of approval through the Business Credit Application form?

To improve its chances of approval, a business should ensure all information provided on the form is accurate and complete. Providing solid financial statements, a history of on-time payments, and strong credit references can also help. It may be beneficial to include a cover letter explaining the reason for the credit request and how it will be used to grow the business.

Is it safe to provide sensitive information on a Business Credit Application form?

While there is always a degree of risk when submitting sensitive information, reputable suppliers and lenders have measures in place to protect this data. Ensure you are submitting the form through a secure method, such as an encrypted online platform or directly to a verified contact at the company. If in doubt, ask the recipient about their data protection policies.

Can a new business without a credit history apply for business credit?

Yes, new businesses without a credit history can apply for business credit, but the process may be more challenging. These businesses may need to provide more detailed financial projections, a business plan, or personal guarantees from the owners. Some lenders and suppliers are more open to working with new businesses, especially if there are clear growth potential and a solid business model.

What happens after submitting a Business Credit Application form?

After submission, the supplier or lender will review the information and perform a credit check to evaluate the business's creditworthiness. This review can take from a few days to several weeks, depending on the complexity of the application and the volume of applications the creditor is processing. The applicant may be asked for additional information or clarification. Once the review is complete, the business will be notified of the decision.

Is there a difference between personal and business credit applications?

Yes, there is a significant difference. Personal credit applications are based on an individual's credit history and financial stability, while business credit applications focus on the business's financial health and creditworthiness. Although business and personal credit may be linked, especially for small businesses, they are assessed using different criteria and for different purposes.

Can a denial of a Business Credit Application affect a business's credit score?

Simply applying for business credit does not affect a business's credit score. However, if the credit application leads to a credit check, that inquiry may be recorded on the business's credit report. Multiple inquiries in a short period can negatively impact the score. A denial itself does not affect the credit score, but the reasons behind the denial, such as high debt levels or payment delinquencies, may.

How often should a business update or resubmit a Business Credit Application?

A business should update or resubmit a Business Credit Application whenever significant changes occur in its financial situation, or if requested by the supplier or lender. Regular updates can also be beneficial if the business's financial health has improved, potentially leading to better credit terms. It's good practice to review financial relationships and terms annually to ensure they meet the business's current needs.

Common mistakes

When businesses apply for credit, the process can be detailed and requires careful attention to ensure accuracy and completeness. A Business Credit Application form is a critical step in seeking financial assistance or establishing trade terms with suppliers. However, individuals often make several key mistakes during this process, which can lead to delays or the denial of credit. Below are ten common errors to be aware of:

Not Checking Creditworthiness First: Before applying, businesses should review their credit reports to correct any errors. Failure to do so can lead to surprises and potential rejections.

Omitting Necessary Details: All required fields should be accurately filled in. Incomplete applications can be seen as a lack of attention to detail or unwillingness to disclose important information.

Providing Inaccurate Information: Whether intentional or accidental, submitting false information can lead to legal consequences and damage credibility.

Ignoring the Terms and Conditions: Not reading or understanding the terms can lead to agreeing to unfavorable conditions, such as high-interest rates or stringent repayment schedules.

Not Personalizing the Application: When applicable, customizing the application to suit the specific credit requested or to highlight the business strengths can help in securing approval.

Failing to Provide Adequate Financial Documentation: Lenders require proof of financial stability. Neglecting to attach financial statements or tax documents can result in an incomplete application.

Applying for Too Much Credit: Requesting more credit than what seems justifiable based on the business size and earnings can signal red flags to creditors.

Overlooking the Importance of a Cover Letter: A well-crafted cover letter explaining the credit need and how it fits into business plans can strengthen an application.

Ignoring Credit Scores: Both business and personal credit scores may be evaluated in the credit approval process. Overlooking poor credit ratings without offering explanations or mitigating factors can hurt.

Submitting the Application Too Hastily: Rushing to submit without double-checking details for accuracy can lead to errors or omissions that could have been easily corrected.

Being mindful of these mistakes and taking steps to avoid them when filling out a Business Credit Application form can increase the chances of approval and foster a stronger financial future for the business.

Documents used along the form

When businesses seek to establish a credit line or credit terms with another company, the Business Credit Application form plays a pivotal role in the process. However, to thoroughly evaluate the creditworthiness of the business applying for credit, additional forms and documents are often required. These ancillary documents provide a more comprehensive view of the applicant's financial health and operational capacity, ensuring informed decision-making by the credit provider.

- Personal Guarantee: A Personal Guarantee is a commitment by the business owner or an individual to accept personal responsibility for the debt if the business fails to meet its credit obligations. This document is prevalent among small businesses where the business's financial health is closely tied to the owner's personal finances.

- Financial Statements: These documents, including balance sheets, income statements, and cash flow statements from the previous years, offer a detailed insight into the financial status and performance of the business. They serve as a critical tool for assessors to gauge the business's ability to repay its debts.

- Trade References: Often comprised of a list of suppliers or partners with whom the applicant has had previous credit arrangements. Trade References provide real-world insight into the business's payment habits and creditworthiness.

- Bank Reference: A Bank Reference, sometimes called a Banker's Reference, is a report from the business's bank that provides a brief overview of the business's financial stability and reliability in managing its accounts. This document helps credit providers understand the level of risk associated with extending credit to the applicant.

Together, the Business Credit Application and these supplementary documents paint a comprehensive picture of a business's financial standing and reliability. This process not only aids suppliers in managing risk but also empowers businesses by facilitating access to the credit they need to grow and thrive. By requiring this set of documents, credit providers strike a balance between due diligence and efficiency, making informed decisions that benefit both parties.

Similar forms

A Personal Credit Application closely mirrors the structure and purpose of a Business Credit Application. While the Business version focuses on obtaining credit based on a company's financial health and creditworthiness, a Personal Credit Application does the same but for an individual. Both require detailed financial information and history to assess credit risk.

A Loan Application Form shares similarities with the Business Credit Application in that it gathers financial data and information on the applicant's ability to repay the borrowed amount. While the former is tailored towards extending credit lines or trade credit to businesses based on their financial stability, loan application forms can be used by both individuals and businesses to secure various types of loans.

The Vendor Application Form is another document with similarities to a Business Credit Application. It is used by companies looking to become suppliers or partners of other businesses. This form collects information about the business's capacity, reliability, and financial status—much like a credit application—to determine if they can meet the contractual obligations and financial terms.

A Membership Application Form for business organizations or clubs might also share characteristics with the Business Credit Application. Though its primary purpose is to gather information pertinent to becoming a member of an organization or club, it often requires business information, references, and sometimes financial details to ensure the applying entity meets the organization's criteria for membership, similar to how credit applications assess creditworthiness.

Dos and Don'ts

Filling out a Business Credit Application form correctly is key to establishing a beneficial credit line for your business. Here are several dos and don'ts to ensure your application process is smooth and successful.

- Do:

- Review the entire form before you start to understand all the required information.

- Provide accurate and current details about your business, including legal business name, type, and tax identification number.

- Ensure financial statements are up-to-date and prepared in accordance with generally accepted accounting principles (GAAP).

- Include complete contact information for the references, making it easier for the credit issuer to perform checks.

- Read the terms and conditions carefully to understand the credit terms and your obligations.

- Don't:

- Leave any sections blank. If a section doesn't apply, mark it with "N/A" to indicate that you didn't overlook it.

- Guess on figures or details. Providing incorrect information can lead to delays or rejection of your application.

- Forget to sign and date the application. An unsigned application is usually considered incomplete and will not be processed.

Misconceptions

Many entrepreneurs and business owners face misconceptions about the Business Credit Application form, which can complicate or even stall the process of acquiring necessary credit. Understanding these inaccuracies is crucial for navigating financial opportunities and requirements more effectively.

It's Only About Your Business's Current Financial State: A widespread misunderstanding involves the belief that the credit application process solely scrutinizes a business's present financial condition. However, lenders are also deeply interested in past financial performance and future financial projections to assess the business's capacity to repay the loan.

Personal Credit Scores Don't Matter: Some applicants mistakenly assume their personal credit scores are irrelevant when applying for business credit. This isn't the case, especially for small businesses and startups without a long credit history. In such cases, the personal credit score of the owner can significantly influence the lending decision.

It's a Quick Process: There's a misconception that the business credit application process is swift. The reality is that it can be time-consuming, requiring the collection of detailed financial information, business plans, and projections. The time frame can also extend based on the lender's review process and the need for additional documentation.

The Same Information Fits All Applications: Many applicants believe that once they've completed one business credit application, they can use the same information for other applications. Each lender, however, may have different requirements, emphasizing various aspects of the business's financial health. Tailoring the application to each lender's criteria is often necessary.

Approval Is Guaranteed with Collateral: Offering collateral does improve the chances of obtaining credit, but it doesn't guarantee approval. Lenders consider a range of factors including business performance, credit history, and cash flow forecasts. High-value collateral does not compensate for significant deficiencies in these areas.

Dispelling these misconceptions can guide businesses through the application process with a more accurate understanding of what lenders are looking for, potentially increasing their chances of securing the credit they need to grow and thrive.

Key takeaways

When embarking on the process of filling out a Business Credit Application form, there are several critical points that businesses must pay attention to. This document plays a vital role in establishing credit terms between businesses. Here are nine key takeaways:

- Ensure all information is accurate and up to date. Mistakes or outdated information can lead to delays or rejections of the credit application.

- Be thorough in providing business details, including legal business name, type of business entity (e.g., LLC, corporation), tax ID numbers, and contact information. These details are crucial for credit verification purposes.

- Include comprehensive financial information, such as bank accounts, trade references, and financial statements. This information helps lenders assess your business's creditworthiness.

- Specify the credit terms you are seeking. Clearly outline desired credit limit and terms of payment. This aids in setting clear expectations from the beginning.

- Consider including a personal guarantee in the application, especially for startups or businesses with limited credit history. This can sometimes improve the chances of approval.

- Ensure the application is signed and dated by an authorized representative of the company. This legally binds your business to the information provided.

- Review privacy policies and understand how your information will be used. Knowing who has access to your sensitive information is critical.

- Keep a copy of the completed application for your records. This will be invaluable for future reference and in case any disputes arise.

- Follow up with the credit grantor after submitting your application. A proactive approach can help expedite the review process.

Proper completion and handling of a Business Credit Application are fundamental to establishing and maintaining strong business credit relationships. These steps not only aid in securing credit but also in fostering trust between businesses and creditors. It's about positioning your business for success by ensuring financial flexibility and stability.

Common PDF Forms

How Long Asylum Process Take in Usa - The I-589 form's instructions offer detailed guidance on how to complete the application, which should be read carefully to ensure compliance.

How Many Cells in 96 Well Plate - Can undergo gamma sterilization to ensure sterility without compromising structural integrity or chemical resistance.

Change of Rater Ncoer - Through its detailed assessment criteria, the form contributes to the cultivation of a professional, capable, and motivated NCO corps, central to the Army's mission effectiveness.