Valid Business Purchase and Sale Agreement Template

When individuals or entities decide to buy or sell a business, a critical document guiding the process is the Business Purchase and Sale Agreement. This form encapsulates the terms and conditions agreed upon by both parties, outlining the specifics of what is being bought and sold, which could include assets, shares, or both. Key elements typically covered in such an agreement include the purchase price, payment terms, liabilities, assets, and any conditions that must be met before the deal can finalize. Ensuring that every detail is meticulously documented in this contract protects the interests of both the buyer and the seller, aiding in the prevention of future disputes. It often includes warranties and representations made by both parties, along with covenants about the operation of the business until the sale is completed. A well-crafted Business Purchase and Sale Agreement is indispensable, as it not only officiates the agreement but also serves as a roadmap for a smooth transition of ownership, setting the foundation for the future success of the business under its new ownership.

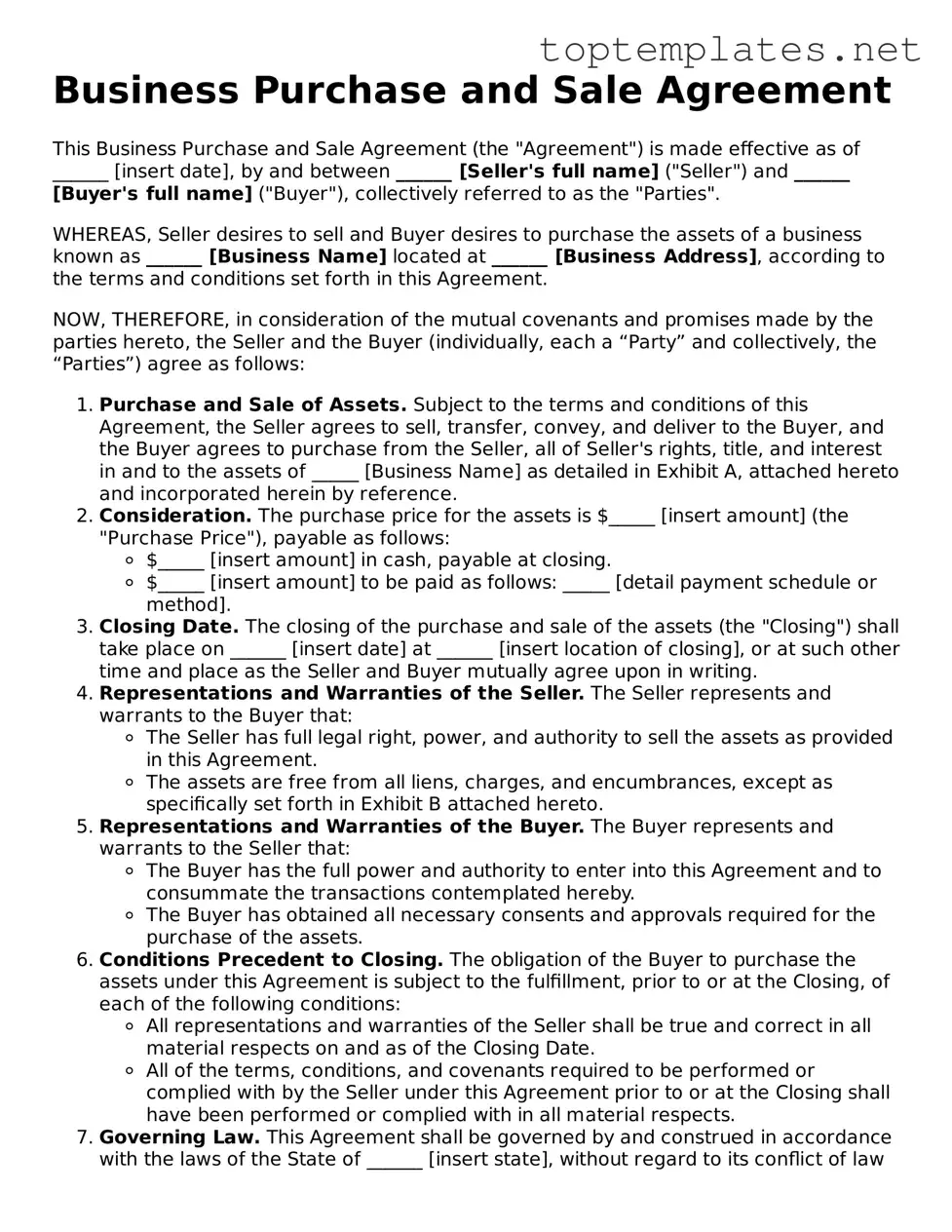

Sample - Business Purchase and Sale Agreement Form

Business Purchase and Sale Agreement

This Business Purchase and Sale Agreement (the "Agreement") is made effective as of ______ [insert date], by and between ______ [Seller's full name] ("Seller") and ______ [Buyer's full name] ("Buyer"), collectively referred to as the "Parties".

WHEREAS, Seller desires to sell and Buyer desires to purchase the assets of a business known as ______ [Business Name] located at ______ [Business Address], according to the terms and conditions set forth in this Agreement.

NOW, THEREFORE, in consideration of the mutual covenants and promises made by the parties hereto, the Seller and the Buyer (individually, each a “Party” and collectively, the “Parties”) agree as follows:

- Purchase and Sale of Assets. Subject to the terms and conditions of this Agreement, the Seller agrees to sell, transfer, convey, and deliver to the Buyer, and the Buyer agrees to purchase from the Seller, all of Seller's rights, title, and interest in and to the assets of _____ [Business Name] as detailed in Exhibit A, attached hereto and incorporated herein by reference.

- Consideration. The purchase price for the assets is $_____ [insert amount] (the "Purchase Price"), payable as follows:

- $_____ [insert amount] in cash, payable at closing.

- $_____ [insert amount] to be paid as follows: _____ [detail payment schedule or method].

- Closing Date. The closing of the purchase and sale of the assets (the "Closing") shall take place on ______ [insert date] at ______ [insert location of closing], or at such other time and place as the Seller and Buyer mutually agree upon in writing.

- Representations and Warranties of the Seller. The Seller represents and warrants to the Buyer that:

- The Seller has full legal right, power, and authority to sell the assets as provided in this Agreement.

- The assets are free from all liens, charges, and encumbrances, except as specifically set forth in Exhibit B attached hereto.

- Representations and Warranties of the Buyer. The Buyer represents and warrants to the Seller that:

- The Buyer has the full power and authority to enter into this Agreement and to consummate the transactions contemplated hereby.

- The Buyer has obtained all necessary consents and approvals required for the purchase of the assets.

- Conditions Precedent to Closing. The obligation of the Buyer to purchase the assets under this Agreement is subject to the fulfillment, prior to or at the Closing, of each of the following conditions:

- All representations and warranties of the Seller shall be true and correct in all material respects on and as of the Closing Date.

- All of the terms, conditions, and covenants required to be performed or complied with by the Seller under this Agreement prior to or at the Closing shall have been performed or complied with in all material respects.

- Governing Law. This Agreement shall be governed by and construed in accordance with the laws of the State of ______ [insert state], without regard to its conflict of law provisions.

- Entire Agreement. This Agreement constitutes the entire agreement between the Parties pertaining to its subject matter and supersedes all prior and contemporaneous agreements, representations, and understandings of the Parties.

IN WITNESS WHEREOF, the Parties have executed this Agreement as of the date first above written.

Seller's Signature: ___________________________ Date: ______

Buyer's Signature: ___________________________ Date: ______

File Breakdown

| Fact Name | Description |

|---|---|

| Definition | A Business Purchase and Sale Agreement is a legally binding document that outlines the terms and conditions under which a business is bought and sold. |

| Components | The form typically includes details such as the purchase price, assets being sold, liabilities being assumed, conditions precedent to closing, and representations and warranties of the parties. |

| Governing Law | The agreement is governed by the laws of the state in which the transaction occurs or the state specified in the agreement. |

| Significance | It serves as a roadmap for the transaction, providing clarity and reducing the risk of disputes between buyer and seller. |

| Customization | While there are standard forms, the agreement can be customized to address the specific needs and agreements of the parties involved. |

Steps to Filling Out Business Purchase and Sale Agreement

Filling out a Business Purchase and Sale Agreement is a crucial step in the process of buying or selling a business. This document formalizes the terms and conditions of the sale, ensuring both parties are clear on their obligations and the specifics of the transaction. Completing this form accurately is essential for a smooth transfer of ownership and to avoid any potential disputes. Here are the step-by-step instructions to guide you through this process.

- Start by entering the full legal names of both the buyer and seller in the designated spaces. This identifies the parties involved in the transaction.

- Specify the business being sold, including its legal name, type of business, and its location. This ensures there's no confusion about what is being transferred.

- List the assets included in the sale. This can range from physical assets, like inventory and equipment, to intangible assets, such as trademarks and customer lists. Be as detailed as possible to avoid any misunderstandings.

- Enter the purchase price and the terms of payment. This section should detail how much the buyer will pay and the schedule or method of payment, including any deposits or financing arrangements.

- Outline any liabilities or obligations that will be assumed by the buyer. This is crucial for understanding the full scope of what is being purchased.

- Include any contingencies that must be met before the sale can be finalized. Common contingencies include the buyer securing financing or passing due diligence checks.

- Detail the closing date and location, specifying when and where the final transfer of ownership will take place.

- State the warranties and representations being made by both the buyer and seller. These are assurances about the condition of the business and the authority to sell it.

- Provide for any agreements on confidentiality, non-compete clauses, and any other terms relevant to the sale. These protect both parties post-transaction.

- Sign and date the agreement. Both the buyer and seller should sign the document to make it legally binding. Witnesses or a notary public may also need to sign, depending on local laws.

Once completed, this agreement lays the groundwork for a successful transfer of business ownership. Both parties should keep a copy of the document for their records. It’s advisable to review the filled-out form with a legal professional to ensure that all information is accurate and that the agreement complies with relevant laws. Moving forward, the next steps will typically involve fulfilling any remaining contingencies, preparing for the closing date, and executing the change of ownership in accordance with the agreed terms. Keeping open communication between the buyer and seller during this phase can help resolve any issues that arise, leading to a smooth transition for both parties.

Discover More on Business Purchase and Sale Agreement

What is a Business Purchase and Sale Agreement?

A Business Purchase and Sale Agreement is a legally binding document that outlines the terms and conditions under which a business is being sold and bought. This agreement details the sale's specifics, such as the purchase price, the assets and liabilities being transferred, any conditions precedent to the sale, and the responsibilities of each party involved. Its primary purpose is to ensure that both the seller and the buyer have a clear understanding of their rights and obligations, thereby facilitating a smoother transaction.

Why is it important to have a Business Purchase and Sale Agreement?

Having a Business Purchase and Sale Agreement is crucial because it provides a formal record of the transaction's terms, reducing the risk of misunderstandings or disputes between the buyer and the seller. It ensures that each party knows exactly what they are agreeing to, which can protect both parties’ interests. Additionally, this agreement serves as a comprehensive guide for the transfer process, detailing each step to ensure legal compliance and a successful transfer of ownership.

What information is typically included in a Business Purchase and Sale Agreement?

Though the contents can vary based on the nature of the business and the specifics of the transaction, a Business Purchase and Sale Agreement generally includes details such as the names and addresses of the buyer and seller, a description of the business being sold, the purchase price, payment terms, a list of assets and liabilities included in the sale, any representations and warranties made by the seller, conditions precedent to the sale, and the anticipated closing date. It may also outline any post-sale obligations, such as non-compete clauses and confidentiality agreements.

How does a Business Purchase and Sale Agreement protect the buyer?

The agreement protects the buyer by specifying the conditions under which the sale will proceed, including ensuring that the buyer receives all assets free and clear of undisclosed liens or encumbrances. It also typically includes warranties from the seller regarding the condition of the business and its compliance with laws. These provisions help the buyer to avoid any unpleasant surprises post-purchase and provide a legal basis for recourse should the seller fail to meet their obligations as outlined in the agreement.

Can modifications be made to a Business Purchase and Sale Agreement after it has been signed?

Yes, modifications can be made to a Business Purchase and Sale Agreement even after it has been signed, but any changes must be agreed upon by both the buyer and the seller. These amendments should be made in writing and signed by both parties to ensure they are legally binding. It is essential to approach modifications with caution and ideally with the guidance of legal counsel to ensure that they do not unintentionally affect other parts of the agreement or void any of its terms.

Common mistakes

When individuals embark on the journey of buying or selling a business, they often encounter the Business Purchase and Sale Agreement form. This document is pivotal in delineating the terms of the sale, safeguarding both parties' interests. However, due to its complexity, people frequently make mistakes. These errors can cause delays, incur additional costs, or even compromise the agreement's integrity.

Failing to thoroughly review every section of the agreement often leads individuals to miss critical details that could impact the transaction's terms.

Not clearly defining the assets and liabilities included in the sale. This lack of clarity can lead to disputes and misunderstandings between the buyer and seller.

Omitting contingencies that protect the involved parties' interests, such as financing conditions or the outcome of due diligence, is a common oversight.

Incorrectly stating the purchase price or the terms of payment can lead to significant financial discrepancies, affecting the feasibility of the deal.

Neglecting to specify the agreement's completion date or timelines can create ambiguity about the transaction's expected conclusion.

Underestimating the importance of warranties and representations made by the seller leads to a lack of accountability if issues arise post-purchase.

Overlooking the need to comply with local, state, and federal regulations can result in legal complications and penalties.

Not involving legal or financial advisors to review the agreement may lead to the parties not fully understanding their rights and obligations.

Assuming all Business Purchase and Sale Agreements are standardized, people forget that each business transaction is unique and may require a tailored agreement.

Remember, attention to detail, rigorous review, and professional consultation are key to navigating the complexities of a Business Purchase and Sale Agreement successfully. Avoiding these common mistakes can save time, money, and ensure a smoother transaction for both buyers and sellers.

Documents used along the form

When engaging in the sale or purchase of a business, parties rely on more than just the Business Purchase and Sale Agreement to comprehensively cover all aspects of the transaction. These additional documents ensure that every detail, from financial assessments to the transfer of licenses, is clearly defined and legally binding. Below is a list of commonly used forms and documents that accompany the main agreement, touching upon various critical areas involved in the sale and acquisition process.

- Bill of Sale: This document acts as a receipt for the business sale, transferring ownership of the business's tangible assets from the seller to the buyer.

- Assignment of Lease: When a business operates out of leased premises, this document is necessary to transfer the lease agreement to the new owner, with the landlord's consent.

- Non-Compete Agreement: Often, the seller agrees not to start a new, competing business within a certain geographical area for a specified period, protecting the buyer’s investment.

- Due Diligence Documents: These are records provided by the seller for the buyer's review before finalizing the purchase, covering financial statements, contracts, and employee records.

- Asset Purchase Agreement: Used in transactions where not all assets or liabilities of a business are acquired, specifying which assets are being bought and which liabilities are being assumed.

- Consulting Agreement: This is sometimes established if the seller will remain involved in the business for a transition period, providing expertise as a consultant.

- Indemnity Agreement: It protects either party from potential losses resulting from specified conditions, ensuring compensation for any future liabilities that arise from past business operations.

- Escrow Agreement: To secure the transaction, an escrow agreement involves a third party holding funds until predefined conditions are met, safeguarding both buyer’s and seller’s interests.

- Employee Transfer Agreement: This outlines the terms under which the business’s employees will be transferred to the new owner, including their rights and the conditions of their employment post-sale.

These documents serve vital roles in ensuring a business sale is executed smoothly and legally. They address various contingencies and provide a structured path for the transfer of ownership, assets, and responsibilities. Each document must be carefully reviewed and understood by all parties involved to ensure a clear and effective transfer of the business.

Similar forms

Asset Purchase Agreement: This document closely mirrors the Business Purchase and Sale Agreement, as both are used in transactions involving the sale of a company's assets. However, an Asset Purchase Agreement specifically focuses on transferring assets and does not necessarily include the entire business, making it more suitable for buyers interested in acquiring specific pieces of the company rather than the enterprise as a whole.

Stock Purchase Agreement: Similar to a Business Purchase and Sale Agreement, a Stock Purchase Agreement is another fundamental document in the acquisition process, but it differs in scope. Rather than acquiring the company's assets directly, the buyer purchases shares of the company's stock, effectively obtaining ownership of the corporation. This method transfers both assets and liabilities to the buyer, contrasting with the more selective nature of asset acquisitions.

Merger Agreement: This agreement facilitates the process where two companies combine to form a single new entity. While the Business Purchase and Sale Agreement generally involves a clear buyer and seller, a Merger Agreement can often represent a more collaborative approach to combining businesses, assets, and liabilities, aiming towards mutual growth or strategic advantages.

Partnership Agreement: Although primarily used for establishing the roles, responsibilities, and profit-sharing among business partners at the commencement of their collaboration, a Partnership Agreement shares similarities with the Business Purchase and Sale Agreement in terms of defining stakeholder rights and interests. When a business is sold or a new partner is introduced, adjustments or new Partnership Agreements may be necessary to reflect the changed ownership structure.

Dos and Don'ts

When entering into a Business Purchase and Sale Agreement, it's important to approach the process with care to ensure both parties understand the agreement's terms. Here are essential dos and don'ts:

Do:Read the entire agreement carefully before filling it out. Understanding every part will help prevent misunderstandings and ensure that the terms are in your favor.

Include detailed descriptions of the business assets and liabilities being transferred. The clearer the descriptions, the fewer the chances for disputes.

Verify the accuracy of all financial information. This includes the purchase price, payment terms, and any adjustments to be made.

Consider consulting with a legal professional. A lawyer can provide valuable insights and identify potential issues with the agreement.

Clarify the responsibilities of each party. Clearly stating who is responsible for what after the sale can prevent future conflicts.

Keep a copy of the signed agreement for your records. Having a copy can be crucial for resolving any future disputes.

Skip reading clauses that seem unimportant. Every clause can have significant implications for the agreement.

Ignore the fine print. Details regarding dispute resolution, for example, are often found in smaller print but have big impacts.

Rely solely on verbal agreements. Ensure that every agreement between parties is documented in writing within the form.

Forget to specify the effective date of the transaction. The exact dates can affect various aspects of the agreement, including financial calculations.

Leave blanks in the agreement. If a section does not apply, indicate it with a "N/A" or "Not Applicable" to prevent unauthorized alterations.

Sign without a witness or notary. Depending on your jurisdiction, having the agreement witnessed or notarized can add a layer of legal validity.

Misconceptions

When considering the purchase or sale of a business, the Business Purchase and Sale Agreement form plays a pivotal role in outlining the terms and conditions of the deal. However, there are several misconceptions surrounding this document that can lead to confusion. Let's clarify some of these misunderstandings:

One common misconception is that the Business Purchase and Sale Agreement is a standard form that cannot be altered. In reality, while there are common clauses, this agreement is highly adaptable to fit the specific needs and agreements between the buyer and seller.

Another misunderstanding is that only the financial aspects of the sale are covered in the agreement. This is not true. In addition to the sale price, the agreement typically addresses a wide range of issues, including inventory, assets, liabilities, and employee transition.

Some believe that verbal agreements between the buyer and seller are enough and that the written agreement is a formality. However, verbal agreements are difficult to enforce, and the written contract is crucial in legally binding the parties to their agreement.

There's also a misconception that once the agreement is signed, there is no turning back. While it's true that the agreement signals a commitment, there are usually conditions that must be met before the sale is finalized, allowing for the possibility of renegotiation or termination under certain circumstances.

Lastly, many people think that legal representation is not necessary when drafting or signing the Business Purchase and Sale Agreement. This belief can lead to significant oversights. Professional advice ensures that the agreement accurately reflects the deal and protects the rights of all involved.

Understanding these misconceptions can help parties involved in a business sale better prepare for the process and ensure a smoother transition for both parties.

Key takeaways

When embarking on the journey of buying or selling a business, the Business Purchase and Sale Agreement form is a crucial document. This agreement outlines the terms and conditions of the sale, ensuring that both parties are aware of their rights and obligations. Understanding the key points of this agreement can facilitate a smoother transaction process. Below are ten key takeaways to guide you in filling out and using this form:

- Comprehensive Details: Ensure that the agreement includes detailed information about the buyer, seller, business being sold, and the terms of sale. Accurate and thorough details are key to prevent misunderstandings.

- Assets Included: Clearly specify which assets are included in the sale. This can encompass physical items, intellectual property, and even client lists, among others.

- Excluded Assets: Just as important as stating what is included, is specifying what assets are not part of the sale. These exclusions must be clearly outlined.

- Purchase Price and Payment Terms: The agreement should clearly state the purchase price and the terms of payment. This includes down payment amounts, financing arrangements, and any conditions that might affect the final sale price.

- Liabilities: Clarify which, if any, liabilities the buyer will assume. Understanding the financial obligations that come with the business is crucial for the buyer.

- Non-compete Clause: Often, sellers are required to agree not to start a competing business within a certain geographic area for a specified period. This clause protects the buyer's investment.

- Transition Assistance: The agreement can include terms requiring the seller to assist in the business transition post-sale, specifying the duration and nature of the assistance.

- Contingencies: Include any conditions that must be met before the transaction is finalized. This might involve financing approvals, successful inspections, or obtaining necessary licenses.

- Closing Date and Possession: The agreement should state when the official transfer of ownership will occur and when the buyer will take possession of the business.

- Legal and Tax Advice: It is highly recommended that both parties seek legal and tax advice before finalizing the Business Purchase and Sale Agreement. Professional advice can help in understanding the implications of the agreement fully.

This agreement serves as the backbone of the transaction, setting the stage for a successful transfer of ownership. Paying careful attention to each of these points when filling out and using the Business Purchase and Sale Agreement form can help in mitigating risks and ensuring both parties are satisfied with the transaction.

Consider Other Documents

Sample Loi - A Letter of Intent is a document that outlines the preliminary commitments between two or more parties before a formal agreement is made.

Closing Date Extension Addendum Form - This form is essential for keeping real estate transactions on track when the original timeline is no longer feasible.