Free California Death of a Joint Tenant Affidavit PDF Form

In California, when a property owner who held title as a joint tenant passes away, the surviving owner(s) must take specific steps to formally remove the deceased owner from the property's title. One critical piece of this process involves the California Death of a Joint Tenant Affidavit form. This document serves as official notice of the death and facilitates the legal transfer of the deceased joint tenant's interest in the property to the surviving joint tenant(s), without the need for probate proceedings. Essentially, it streamlines the transition of property ownership, ensuring that the title reflects the current ownership accurately. To complete this form correctly, the surviving joint tenant(s) must provide detailed information about the deceased, including a certified copy of the death certificate, and must adhere to all filing requirements set forth by California law. This affidavit, once properly executed and recorded with the county recorder's office, updates the public records, thus protecting the rights of the surviving tenant(s) and providing clarity regarding the property's rightful ownership. It is a pivotal document in the context of real estate and estate planning within the state, highlighting the importance of understanding both its function and the procedure for its use.

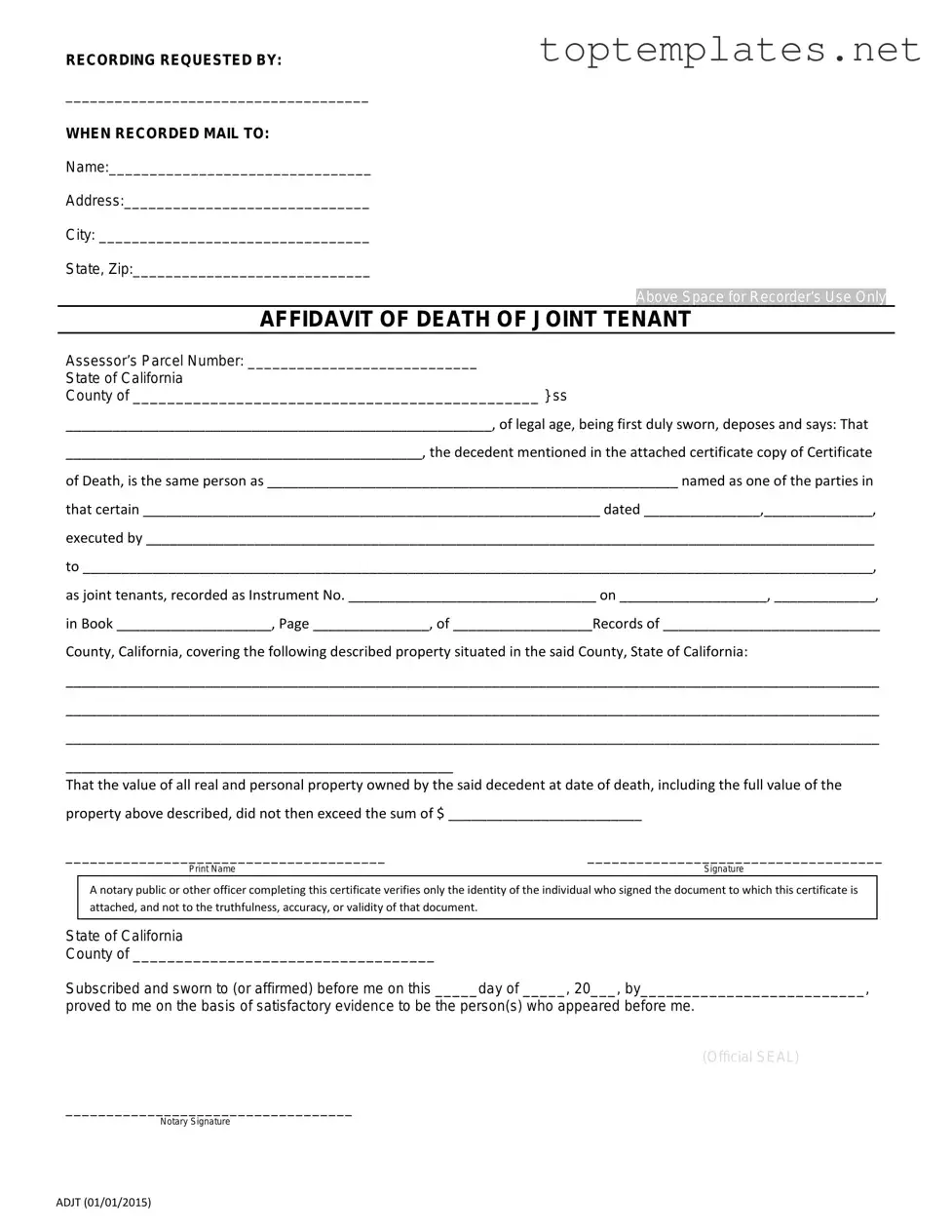

Sample - California Death of a Joint Tenant Affidavit Form

RECORDING REQUESTED BY:

_____________________________________

WHEN RECORDED MAIL TO:

Name:________________________________

Address:______________________________

City: _________________________________

State, Zip:_____________________________

Above Space for Recorder’s Use Only

AFFIDAVIT OF DEATH OF JOINT TENANT

Assessor’s Parcel Number: ____________________________

State of California

County of _______________________________________________ } ss

_______________________________________________________, of legal age, being first duly sworn, deposes and says: That

______________________________________________, the decedent mentioned in the attached certificate copy of Certificate

of Death, is the same person as _____________________________________________________ named as one of the parties in

that certain ___________________________________________________________ dated _______________,______________,

executed by ______________________________________________________________________________________________

to ______________________________________________________________________________________________________,

as joint tenants, recorded as Instrument No. ________________________________ on ___________________, _____________,

in Book ____________________, Page _______________, of __________________Records of ____________________________

County, California, covering the following described property situated in the said County, State of California:

_________________________________________________________________________________________________________

_________________________________________________________________________________________________________

_________________________________________________________________________________________________________

__________________________________________________

That the value of all real and personal property owned by the said decedent at date of death, including the full value of the property above described, did not then exceed the sum of $ _________________________

_______________________________________ |

____________________________________ |

Print Name |

Signature |

A notary public or other officer completing this certificate verifies only the identity of the individual who signed the document to which this certificate is attached, and not to the truthfulness, accuracy, or validity of that document.

State of California

County of ___________________________________

Subscribed and sworn to (or affirmed) before me on this _____day of _____, 20___, by__________________________,

proved to me on the basis of satisfactory evidence to be the person(s) who appeared before me.

(Official SEAL)

___________________________________

Notary Signature

ADJT (01/01/2015)

File Specs

| Fact Number | Details |

|---|---|

| 1 | The California Death of a Joint Tenant Affidavit form is used to transfer property after the death of a joint tenant. |

| 2 | It requires a certified copy of the death certificate of the deceased joint tenant. |

| 3 | This form must be filed with the county recorder's office where the property is located. |

| 4 | The form serves to remove the deceased person's name from the property title. |

| 5 | Completion of this form does not require a probate process. |

| 6 | It only applies to property owned in joint tenancy, not other forms of ownership such as tenancy in common. |

| 7 | Governing laws for this form include the California Probate Code and the California Civil Code. |

| 8 | The person filing the affidavit must ensure accuracy, as false statements can lead to legal consequences. |

Steps to Filling Out California Death of a Joint Tenant Affidavit

Filling out the California Death of a Joint Tenant Affidavit form is a necessary step in the process when you're dealing with the passing of one party in a joint tenancy situation. This document allows for the real estate owned jointly to be transferred to the surviving tenant(s) without the need for a probate process. The procedure can seem daunting at first, but by following these clear, step-by-step instructions, you can ensure that the process is handled correctly and efficiently.

- Locate the correct version of the form. It's crucial to use the most current form provided by a reliable source, usually a county recorder's office or their website.

- Gather the necessary documents beforehand, including the deceased tenant's death certificate and the property deed, to reference as you fill out the affidavit.

- Start by filling in the date at the top of the form.

- Enter the full legal name(s) of the surviving tenant(s) in the section provided.

- Fill in the deceased tenant's full legal name exactly as it appears on the property deed.

- Include the date of death of the deceased tenant, making sure it matches the date listed on the death certificate.

- Provide a legal description of the property. This can typically be found on the property deed and must be included exactly as it appears there.

- Attach a certified copy of the death certificate of the deceased tenant. Make sure it is legible and all pertinent details are clearly visible.

- Review the affidavit carefully, ensuring all information is accurate and matches the supporting documentation.

- Sign the affidavit in the presence of a notary public. The notary will verify your identity and witness your signature, applying their seal to the document.

- File the completed affidavit, along with any required filing fee, with the county recorder's office where the property is located. Each county may have different requirements, so be sure to follow their specific instructions for submission.

After completing these steps, the process for transferring the property title due to the death of a joint tenant is well underway. The county recorder's office will review the affidavit and supporting documents. Once everything is verified and processed, the property will be officially transferred to the surviving tenant(s), updating the public record. Remember, each case can vary slightly, so if there are any uncertainties, consulting with a professional familiar with California property and inheritance laws can provide clarity and guidance.

Discover More on California Death of a Joint Tenant Affidavit

What is a California Death of a Joint Tenant Affidavit?

A California Death of a Joint Tenant Affidavit is a legal document used to remove the name of a deceased joint tenant from the title of property they owned together with another individual. This affidavit allows the surviving joint tenant(s) to assume full ownership of the property without going through probate court.

Who needs to file a California Death of a Joint Tenant Affidavit?

Surviving joint tenants need to file this affidavit to legally remove the deceased tenant's name from the property title. It's necessary for those who held property in joint tenancy with someone who has passed away, and wish to have clear title in their name or sell the property.

What documents are required to file a California Death of a Joint Tenant Affidavit?

Along with the affidavit, you will need a certified copy of the death certificate of the deceased joint tenant. Some counties may also require additional documentation, such as a preliminary change of ownership report. It is advisable to check with the local county recorder's office for specific requirements.

How do I file a California Death of a Joint Tenant Affidavit?

The affidavit needs to be completed, signed, and notarized. Then, it must be filed with the county recorder’s office in the county where the property is located. It's important to include all required documents and fees with your filing to ensure it is processed without delay.

Is there a filing fee for the California Death of a Joint Tenant Affidavit?

Yes, most county recorder’s offices charge a filing fee for recording the affidavit. The amount varies by county, so it's best to contact the local recorder's office directly for the current fee schedule. Additional fees may apply for extra services or documents.

How long does it take for the affidavit to be processed?

The processing time can vary significantly from one county to another. Typically, it may take anywhere from a few days to several weeks. For the most accurate information, contact the county recorder's office where the document is being filed. Expedited services may be available for an additional fee.

Common mistakes

Filling out the California Death of a Joint Tenant Affidavit form is a process that needs attention to detail. When dealing with the passing of a property ownership from a deceased joint tenant to the surviving joint tenant(s), accuracy is crucial. Yet, mistakes are common and can significantly delay the process. Here are seven common errors made:

-

Not attaching a certified copy of the death certificate. This document is essential as it serves as legal proof of the joint tenant's death and must accompany the affidavit.

-

Incorrect or incomplete property description. The legal description of the property must match the description on the original deed. Failing to do so could lead to confusion or disputes about the property in question.

-

Missing signatures. All surviving joint tenants must sign the affidavit. A missing signature can invalidate the document or delay the transfer of ownership.

-

Notarization errors. The affidavit requires notarization to verify the identity of the signers and the authenticity of their signatures. Any mistake in this process can lead to the rejection of the form.

-

Using outdated forms. Laws and regulations change, and so do forms. Using an outdated version might mean missing crucial updates or instructions, resulting in the form being rejected.

-

Failure to file with the county recorder. Simply completing the form is not enough. It must be filed with the appropriate county recorder's office to be legally effective.

-

Lack of attention to detail. Small mistakes such as typos, incorrect dates, or missing information can delay the process. Each detail on the form is important and must be carefully reviewed.

To avoid these common mistakes, individuals are encouraged to thoroughly review their forms, ensure all required documents are attached, and seek professional advice if uncertain. The goal should be to ensure that the transfer of property ownership is smooth and without delay.

Documents used along the form

When managing the estate of a deceased joint tenant in California, the process often requires more than just the submission of a Death of a Joint Tenant Affidavit. This document is crucial for transferring property solely into the name of the surviving joint tenant(s) without probate. However, to ensure a smooth transition and to fulfill legal obligations, other forms and documents are typically needed to complement this affidavit. Understanding these additional documents can help individuals navigate the complexities of estate administration more effectively.

- Certified Copy of the Death Certificate: This document is essential for many post-death transactions and legal processes. It serves as an official government-issued record that confirms the death. Banks, real estate offices, and courts often require a certified copy to proceed with any changes or transfers related to the deceased's assets.

- Preliminary Change of Ownership Report (PCOR): When real estate property changes hands, even due to the death of a joint tenant, this document is required by the California county assessor's office. It provides the assessor with information on the property transfer, helps determine reassessment exemptions, and ensures that property tax records are updated accordingly.

- Property Tax Affidavit: This affidavit is needed to inform the county tax collector of a death that impacts property tax responsibilities. It may help in applying for certain exclusions from reassessment, keeping the tax liability lower for the surviving joint tenant under specific conditions.

- Trust Certification: If the property was held in a trust, this document verifies the trust's existence and the trustees' authority to act. It outlines the successor trustees and their powers regarding the trust property, crucial for transactions or transfers involving trust assets.

These documents work together with the Death of a Joint Tenant Affidavit to ensure the deceased's assets are properly managed and transferred. Handling estate matters can be a complex process, often during a time of grief. It's important for surviving joint tenants or executors to gather the necessary documents early on and seek professional advice to navigate the legal steps required in California. Ensuring accuracy and completeness in filing these documents can provide peace of mind and uphold the decedent's wishes regarding their property and assets.

Similar forms

Transfer on Death Deed: Just like the California Death of a Joint Tenant Affidavit, a Transfer on Death Deed allows property to be passed on without going through probate. However, it is used to designate a beneficiary for when the property owner dies, while the affidavit is used after death to show that ownership has transferred.

Affidavit of Surviving Spouse for Termination of Joint Tenancy: This document, similar to the Death of a Joint Tenant Affidavit, is used by the surviving spouse to remove the deceased spouse from the property title. Both clarify the transfer of property interest to the surviving owner(s) without probate.

Affidavit of Death of Trustee: This affidavit parallels the Death of a Joint Tenant Affidavit in purpose. It is employed to notify entities and courts that a trustee has died, transferring duties to the successor. The key similarity is their role in the non-probate transfer of property or responsibility.

Executor’s/Personal Representative’s Deed: Used in the context of estate resolution, this deed facilitates the transfer of property ownership from an estate to a new owner, just as the Death of a Joint Tenant Affidavit transfers ownership between co-owners. Both play a pivotal role in property distribution following death.

Beneficiary Form for Financial Accounts: Comparable to the affidavit in that it designates who will receive assets upon the account holder's death, bypassing the probate process. Although it pertains to financial accounts rather than real property, the principle of direct transfer to a named beneficiary upon death is shared.

Small Estate Affidavit: This document facilitates the transfer of assets without a formal probate proceeding for estates below a certain value. Like the Death of a Joint Tenant Affidavit, it serves to simplify the transfer process after death, albeit in a broader context that may include personal property, bank accounts, and sometimes real estate.

Joint Tenancy Grant Deed: It establishes joint tenancy ownership of property, implying that upon death, the deceased owner’s interest automatically passes to the surviving joint tenant(s). It is the framework upon which the Death of a Joint Tenant Affidavit acts, providing the legal basis for the transfer of interest upon death.

Life Estate Deed: This deed allows property owners to transfer their property while retaining the right to use and benefit from it for their lifetime. Upon death, the property passes to the remainderman, or beneficiary, much like the Death of a Joint Tenant Affidavit bypasses probate court in the transfer of property interest.

Dos and Don'ts

Filling out the California Death of a Joint Tenant Affidavit form is a significant step in managing the legal and property affairs after a loved one's passing. Below are 10 essential dos and don'ts to consider when preparing and submitting this important document. Following these guidelines can help ensure the process is completed accurately and respectfully.

- Do carefully read all the instructions on the form before filling it out. This ensures you understand each section and its requirements.

- Do gather all necessary documents beforehand, such as the death certificate and property deed, to make sure the information you provide is accurate.

- Do use black ink when filling out the form, as it is required for clarity and official recording purposes.

- Do double-check the legal description of the property to avoid any mistakes that could complicate the transfer of ownership.

- Do sign the form in front of a notary public to validate its authenticity. This is a critical step for the document to be legally recognized.

- Do file the completed form with the county recorder's office where the property is located, as this officially records the change in ownership.

- Don't rush through filling out the form—taking your time can help prevent errors that might delay the process.

- Don't guess on any information. If you're unsure, it's better to seek clarification from a legal professional or the county recorder's office.

- Don't neglect to check whether a new property deed needs to be drafted. In some cases, this might be necessary to complete the ownership transfer process.

- Don't forget to make a copy of the filed form and any related documents for your records. Having these documents easily accessible can be important for future reference.

Misconceptions

Many people have misconceptions about the California Death of a Joint Tenant Affidavit form. It is essential to dispel these myths to ensure that individuals can navigate the process of handling property after a joint tenant's death accurately and efficiently.

It automatically transfers property: A common misconception is that the affidavit itself transfers property to the surviving joint tenant(s). In reality, it serves as legal documentation to update the property's title reflecting the demise of one of the joint tenants.

It avoids probate for all assets: While the affidavit helps in bypassing probate for the property held in joint tenancy, it does not apply to other assets owned by the deceased outside this arrangement. Each asset type may require different documentation for transfer or succession.

It's valid without a death certificate: An authentic death certificate of the deceased joint tenant is required to accompany the affidavit for it to be considered valid and for the title change to be effected legally.

It's only for married couples: This form can be used by any joint tenants with the right of survivorship, not just married couples. Friends or relatives owning property together can also utilize this affidavit, provided they meet the joint tenancy criteria.

It leads to reassessment of property taxes: The transfer of property interest under this affidavit, due to the death of a joint tenant, generally does not cause a reassessment of property taxes, which is a significant relief to the survivors.

No need for a notary: Contrary to some beliefs, the affidavit must be notarized to validate the identity of the surviving joint tenant(s) signing the document, which is a critical step in the process.

It's a complicated process: While it involves legal documentation, the process of completing and filing the affidavit is relatively straightforward, especially with proper guidance or legal advice.

It can be filed anytime: There's a common belief that there's no time limit to file this affidavit. However, handling this promptly is advisable as delays may complicate future transactions involving the property.

It's the only document needed: Sometimes more documentation, such as a clear statement of the property, an appraisal, or other legal forms, might be necessary along with the affidavit to update the property records fully.

Any joint tenant can complete it: Only the surviving joint tenant(s) can execute this document. It's a declaration by the survivor(s) regarding the death of one of the joint tenants, and it cannot be filled out or submitted by the deceased's family members or representatives who are not joint tenants.

Key takeaways

The California Death of a Joint Tenant Affidavit form serves an important function in the transfer of property following the death of a co-owner. Understanding its purpose, requirements, and implications can streamline the process, ensuring that property is transferred smoothly and efficiently. Here are five key takeaways to keep in mind when filling out and using the form:

Understanding its Purpose: The California Death of a Joint Tenant Affidavit is utilized to remove the deceased individual’s name from the property title, effectively transferring full ownership to the surviving joint tenant(s). This document is crucial for ensuring that the property does not go through probate, a lengthy and often costly legal process.

Accuracy is Key: When filling out the affidavit, it’s vital to provide accurate and complete information. This includes the deceased individual’s full name, date of death, and a legal description of the property in question. Mistakes or omissions can result in delays or the rejection of the affidavit by the county recorder’s office.

Attachment of Death Certificate: Along with the affidavit, a certified copy of the death certificate of the deceased joint tenant must be attached. This serves as the official proof of death and is required to legally validate the transfer of property ownership.

Notarization is Required: Before submitting the affidavit, it must be notarized. This means a notary public must witness the signing of the document. Notarization adds a layer of verification, confirming the identity of the person filling out the affidavit and their authority to do so.

Submission to the County Recorder’s Office: After completion and notarization, the affidavit, along with the attached death certificate, should be submitted to the county recorder’s office where the property is located. This official recording is the final step in ensuring that the property title reflects the change of ownership.

Navigating the process of transferring property after the passing of a joint tenant can be complex, but with a careful approach to completing the California Death of a Joint Tenant Affidavit, the task can be managed with clarity and assurance. This form plays an essential role in simplifying what could otherwise be a cumbersome and emotionally taxing process.

Common PDF Forms

Panel Schedule - Its role in emergency preparedness plans is undeniable, ensuring that critical systems can be quickly addressed and restored in crisis situations.

Blank Pdf Invoice - By offering a free and comprehensive invoicing solution, this form levels the playing field for startups competing against established enterprises.