Free Cash Drawer Count Sheet PDF Form

In the bustling world of retail and small businesses, efficient and accurate financial management is a cornerstone of success. Among the various tools and documents employed to ensure this efficiency, the Cash Drawer Count Sheet form plays a crucial role. This practical form serves as a blueprint for tracking daily transactions, providing a clear and concise overview of cash flow within a business. It's integral for reconciling the day's beginning and ending cash amounts, thereby pinpointing discrepancies, if any, between the actual cash present and the expected figures based on sales data. This process not only aids in preventing potential financial losses due to errors or theft but also fortifies the accountability of staff members handling cash. Furthermore, the form's structured format allows for an easier audit trail, ensuring that businesses can uphold transparency and comply with regulatory requirements. Simultaneously, it simplifies the process of preparing for tax obligations and financial reporting, making the Cash Drawer Count Sheet form an indispensable tool in the arsenal of small business operations. Its design, though straightforward, encapsulates the complex interplay of accuracy, accountability, and auditing, making its daily utilization a pivotal practice for businesses aiming to maintain financial integrity.

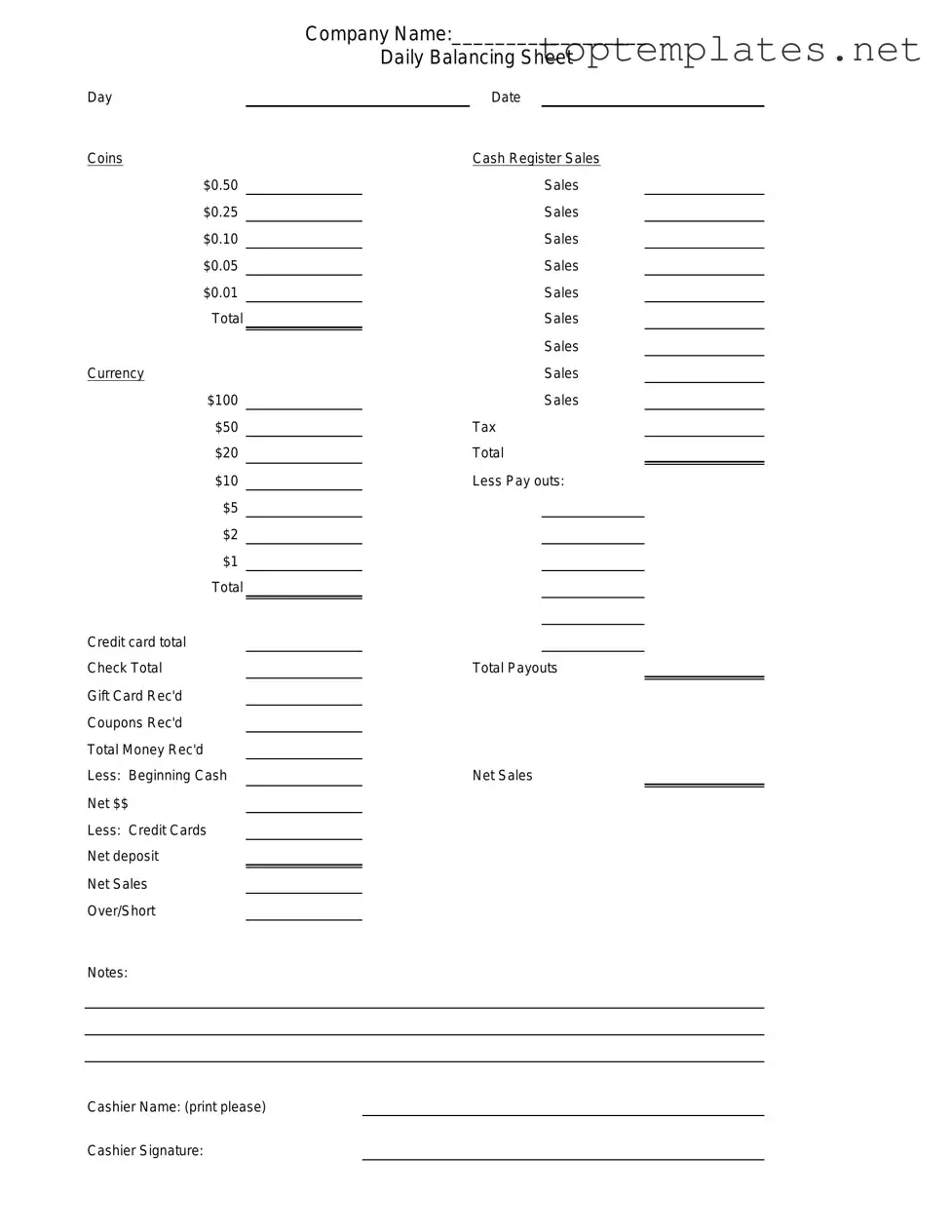

Sample - Cash Drawer Count Sheet Form

|

Company Name:__________________ |

|||||

|

|

Daily Balancing Sheet |

||||

Day |

|

|

Date |

|

||

Coins |

|

|

Cash Register Sales |

|||

$0.50 |

|

|

|

Sales |

|

|

$0.25 |

|

|

|

Sales |

|

|

$0.10 |

|

|

|

Sales |

|

|

$0.05 |

|

|

|

Sales |

|

|

$0.01 |

|

|

|

Sales |

|

|

Total |

|

|

|

Sales |

|

|

|

|

|

|

Sales |

|

|

Currency |

|

|

|

Sales |

|

|

$100 |

|

|

|

Sales |

|

|

$50 |

|

|

Tax |

|

||

$20 |

|

|

Total |

|

||

$10 |

|

|

Less Pay outs: |

|||

$5 |

|

|

|

|

|

|

$2 |

|

|

|

|

|

|

$1 |

|

|

|

|

|

|

Total |

|

|

|

|

|

|

Credit card total |

|

|

|

|

|

|

|

|

|

|

|

|

|

Check Total |

|

|

Total Payouts |

|||

Gift Card Rec'd |

|

|

|

|

|

|

Coupons Rec'd |

|

|

|

|

|

|

Total Money Rec'd |

|

|

|

|

|

|

Less: Beginning Cash |

|

|

Net Sales |

|||

Net $$ |

|

|

|

|

|

|

Less: Credit Cards |

|

|

|

|

|

|

Net deposit |

|

|

|

|

|

|

Net Sales |

|

|

|

|

|

|

|

|

|

|

|

|

|

Over/Short |

|

|

|

|

|

|

Notes: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cashier Name: (print please)

Cashier Signature:

File Specs

| Fact Name | Description |

|---|---|

| Purpose | The Cash Drawer Count Sheet is used to track the cash amounts that are added or removed from a cash drawer during a business day or shift. |

| Users | This form is mainly utilized by retail businesses, restaurants, and any other cash-handling operations to ensure accountability and to minimize discrepancies. |

| Components | It typically includes fields for the date, initial cash amount, cash in (additions), cash out (subtractions), expected final amount, actual cash counted, and a section for discrepancies or notes. |

| Governing Law(s) | While this form is generally not governed by specific laws, it must comply with state and federal tax laws, as well as standards for financial reporting and internal control procedures. |

Steps to Filling Out Cash Drawer Count Sheet

Filling out a Cash Drawer Count Sheet is an important step in managing daily transactions. It helps track the cash amount available at the beginning and end of a business day, ensuring financial accuracy and accountability. The form can reduce errors and provide a clear record of cash flow, which is essential for any business. With proper completion, this document aids in reconciling cash on hand with point-of-sale records or receipts, making it easier to identify discrepancies.

To correctly fill out the Cash Drawer Count Sheet, follow these steps:

- Enter the date and the name of the person counting the cash at the top of the form. This ensures accountability and tracks who performed the count.

- Begin with recording the starting cash amount in the drawer before the business day begins. This is your starting point for the cash flow of the day.

- List all denominations of currency and coins in the respective columns, starting from highest to lowest. Fill in the quantity of each denomination on hand.

- Calculate the total amount for each denomination. Multiply the quantity of each denomination by its value, and write this in the designated space.

- Sum up the totals of all denominations to find the total amount of cash in the drawer. This includes currency, coins, checks, and other forms of payment, if applicable.

- Record any payouts or expenses paid out from the drawer during the day. Deduct these from the total to adjust for correct cash on hand.

- After the business day, count the ending cash in the drawer and record it in the appropriate section. This is the amount of cash present in the drawer at the close of business.

- Finally, compare the expected total (starting cash plus daily sales minus payouts) with the actual ending cash on hand. Note any discrepancies in the designated area for further investigation and action.

- Sign and date the bottom of the form to certify the accuracy of the cash count. This step is crucial for accountability and may require a witness or manager’s signature as well.

Once the Cash Drawer Count Sheet is filled out, review the information for accuracy. Resolve any discrepancies immediately to ensure your business's financial integrity. Proper management and tracking of cash transactions are fundamental to the health and success of any business.

Discover More on Cash Drawer Count Sheet

What is a Cash Drawer Count Sheet?

A Cash Drawer Count Sheet is a document used by businesses to track the amount of cash that is added or removed from a cash drawer. It helps in ensuring that the drawer starts with a specified amount of cash each day and helps in reconciling cash sales with the physical cash present at the end of the business day. This sheet is an essential tool for cashiers, managers, and business owners to maintain accuracy and accountability in cash transactions.

How do I fill out a Cash Drawer Count Sheet?

To fill out a Cash Drawer Count Sheet, start by entering the initial cash balance at the beginning of the day. As the day progresses, record every cash transaction, including sales, refunds, and payouts. At the end of the business day, count the cash in the drawer and enter this total on the sheet. Subtract the initial balance and note the difference. This final step helps identify any discrepancies between the recorded transactions and the actual cash amount, enabling corrective actions if necessary.

Why is it important to use a Cash Drawer Count Sheet?

Using a Cash Drawer Count Sheet is crucial for several reasons. It provides a clear and organized method to monitor cash flow, helping to detect errors or theft quickly. The practice of counting cash regularly promotes accountability among staff, reducing the likelihood of financial discrepancies. Additionally, maintaining accurate daily records of cash transactions is beneficial for financial reporting and analysis, contributing to the overall financial health of the business.

Can I customize a Cash Drawer Count Sheet for my business?

Yes, customizing a Cash Drawer Count Sheet to suit the specific needs of your business is not only possible but recommended. While the basic elements such as starting cash, cash sales, and ending cash balance are common, you may need to add sections for other types of transactions specific to your business, such as gift card redemptions or loyalty program deductions. Customizing the sheet ensures that it covers all aspects of your business's cash handling processes, making it a more effective tool for managing your finances.

Common mistakes

When managing a business, accurately completing the Cash Drawer Count Sheet is vital for tracking daily transactions and maintaining financial integrity. Unfortunately, people often make mistakes while filling out this form, which can lead to discrepancies and accounting errors. Here are nine common errors to look out for:

- Not double-checking for accuracy. Individuals may rush through the process, leading to mistakes in arithmetic or entry. It's crucial to review all figures and calculations to ensure they're correct.

- Failing to record the date and time. The Cash Drawer Count Sheet should always have the date and time noted for accurate record-keeping and to help reconcile the count with specific business hours.

- Omitting the cashier's name. If the cashier's name who is responsible for the drawer is not included, it can make accountability and follow-up difficult should any discrepancies arise.

- Mixing currencies. In businesses that accept more than one type of currency, recording them separately is crucial. Mixing currencies can complicate the reconciliation process.

- Inaccurate record of denominations. Failing to correctly note the quantity of each currency denomination leads to an inaccurate total count, affecting the day's financial reports.

- Skipping over transactions. It's important to record all transactions, including sales, refunds, and payouts. Overlooking any can result in a mismatch between the cash drawer and sales records.

- Not noting discrepancies. When differences between the expected and actual cash amounts are found, they should be noted and explained. Ignoring these can mask issues like theft or procedural errors.

- Forgetting to sign the form. The form typically requires a signature from both the cashier responsible for the drawer and a manager. This step verifies that the count has been checked and is agreed upon by both parties.

- Improperly storing the form. Once completed, the Cash Drawer Count Sheet should be stored securely. Mishandling or losing the form can lead to lack of documentation for financial audits.

By being aware of these common errors and taking steps to avoid them, businesses can ensure more accurate financial tracking and smoother operational processes.

Documents used along the form

When managing daily financial transactions in retail or hospitality businesses, several documents complement the Cash Drawer Count Sheet to ensure accuracy and accountability. This form is crucial for tracking cash amounts at the start and end of a business day, but it works best when used alongside other documents designed for financial oversight and operational efficiency.

- Daily Sales Report: This document summarizes all transactions that occur within a day, providing a detailed account of sales, including cash, credit/debit card transactions, and any other forms of payment received. It helps in reconciling the cash drawer count with total sales.

- Deposit Record Form: After counting the cash drawer and reconciling it with the Daily Sales Report, the surplus cash is prepared for deposit. The Deposit Record Form documents the amount of cash, checks, or other payment forms being deposited to a bank, ensuring that financial records match bank statements.

- Employee Shift Change Report: In businesses where employees work in shifts, this report records the cash drawer's condition at the start and end of each shift. It is crucial for identifying discrepancies and holding individuals accountable for their cash handling responsibilities.

- Receipt Log: This register keeps a record of all receipts issued during the day. It is an essential audit tool for cross-referencing transactions and payments reported on the Cash Drawer Count Sheet and the Daily Sales Report, ensuring all sales are accounted for and discrepancies are easily traced.

Together, these documents form a comprehensive system for tracking daily financial transactions, providing checks and balances that help prevent errors and fraud. Proper use and management of these forms strengthen a business's financial integrity, supporting overall operational success.

Similar forms

A Bank Reconciliation Statement is similar to a Cash Drawer Count Sheet as both are used to verify the accuracy of cash transactions. A Bank Reconciliation Statement aligns the bank's records with a company's ledger, whereas a Cash Drawer Count Sheet ensures the cash in a drawer matches sales records.

A Daily Sales Report shares similarities with a Cash Drawer Count Sheet because both track the daily financial transactions of a business. The Daily Sales Report summarizes total sales, payment methods, and any discrepancies, similar to how the Cash Drawer Count Sheet tallies cash amounts to confirm they reflect sales accurately.

An Inventory Control Sheet resembles a Cash Drawer Count Sheet in its function of recording and tracking assets. While an Inventory Control Sheet monitors physical stock quantities against sales or shipments, the Cash Drawer Count Sheet tracks cash on hand against sales to prevent discrepancies.

The Petty Cash Reconciliation Form is akin to a Cash Drawer Count Sheet as both are used for managing small amounts of cash. The Petty Cash Reconciliation Form tracks expenditures from a petty cash fund, requiring receipts and justifications for disbursements, similar to how the Cash Drawer Count Sheet logs cash transactions to ensure accuracy and accountability.

Dos and Don'ts

When managing a Cash Drawer Count Sheet, accuracy and attention to detail are paramount. Here are some guidelines to ensure the process is carried out correctly and efficiently.

Do:Always count the cash in a quiet and secure environment to prevent any distractions or interruptions that could lead to mistakes or discrepancies.

Use a calculator or a cash counting machine to ensure accuracy. Double-check your calculations to avoid errors.

Record the amounts neatly and legibly. Clear handwriting prevents misunderstandings and ensures others can easily review the records.

Sign and date the form upon completion. This establishes accountability and provides a clear record of the cash handling process.

Rush through the process. Taking your time to count carefully prevents mistakes that could lead to cash drawer shortages or overages.

Mix denominations while counting. Keep bills and coins separated by their values to maintain organization and simplify the counting process.

Leave the cash drawer unattended or open while counting is in progress. This prevents theft and ensures the integrity of the cash count.

Forget to check for counterfeit bills. Using a counterfeit detector pen or machine during the counting process protects against accepting fake currency.

Misconceptions

When it comes to managing finances in a business, the Cash Drawer Count Sheet plays a crucial role. However, there are some common misconceptions about how it's used and its importance. Let's debunk these myths and understand the reality behind the Cash Drawer Count Sheet form.

- It's just for retailers. Many assume that only retail businesses need to use a Cash Drawer Count Sheet. However, any business that handles cash transactions can benefit from using it to track cash flow accurately.

- It's complicated and time-consuming. Some might think that filling out a Cash Drawer Count Sheet is a complex and lengthy process. In truth, once you understand the format and what's required, it becomes a quick and straightforward task that ensures financial accountability.

- Digital transactions have made it obsolete. With the rise of digital payments, there's a perception that cash handling practices, such as using a Cash Drawer Count Sheet, are outdated. Yet, many businesses still handle significant amounts of cash daily, making the form relevant.

- Any employee can fill it out. While it's true that most employees can be trained to fill out the form, it's crucial for businesses to have designated, trustworthy individuals responsible for this task to reduce errors and prevent fraud.

- It's only necessary at the end of the day. Conducting cash counts solely at the day's end overlooks the benefits of mid-day counts, especially in high-volume businesses, for identifying discrepancies early and taking corrective action promptly.

- It doesn't affect the bottom line. This misconception underestimates the impact of accurate cash handling on a business's financial health. Regular and accurate use of the form helps identify leaks in cash handling processes, directly affecting profitability.

- The form is the same for every business. While the basic elements of a Cash Drawer Count Sheet may be similar, businesses should customize the form to their specific needs and cash handling processes for maximum effectiveness.

- Manual counting is better than using a form. Trusting the process entirely to manual counts without documentation is risky and opens the door to mistakes and intentional miscounts. The form provides a structured and verifiable method for counting cash.

- It's only about counting cash. Beyond merely counting cash, the form plays a vital role in auditing, tracking discrepancies, and providing a clear record for financial management and accountability within the business.

Understanding the Cash Drawer Count Sheet form and its proper use is essential for any business that handles cash transactions. Dispelling these misconceptions can lead to better financial practices, improved accountability, and ultimately, contribute to the business’s overall success.

Key takeaways

Tracking and managing the cash flow in any business is crucial for its smooth operation. A Cash Drawer Count Sheet is a helpful tool in ensuring that all transactions are accurately recorded. Here are seven key takeaways to consider when filling out and using this form:

- Accuracy is key: Ensure all amounts are recorded with precision. A small mistake can lead to significant discrepancies, making it difficult to track the origin of the error.

- Count cash regularly: To maintain accurate records and prevent theft or error, it's essential to count the cash in the drawer at the start and end of each shift or business day.

- Keep records up to date: Update the Cash Drawer Count Sheet in real-time or as close to real-time as possible. This proactive approach helps in identifying discrepancies sooner rather than later.

- Use a standard form: Consistency in the form used across the business ensures that all necessary information is captured uniformly, making it easier to train staff and conduct audits.

- Review for accountability: Regular reviews of the count sheets by a supervisor or manager add an extra layer of accountability, deterring potential mishandling of funds.

- Include all forms of payment: While it's called a Cash Drawer Count Sheet, it's important to record all forms of payment received, including checks and electronic transactions, to ensure comprehensive financial tracking.

- Securely store completed forms: Once filled out, these forms contain sensitive information and should be stored securely, with access limited to authorized personnel only. This protects the business from potential fraud or breaches of privacy.

Utilizing a Cash Drawer Count Sheet effectively requires diligence, attention to detail, and consistent practices across the board. By adhering to these key takeaways, businesses can safeguard their assets, ensure accuracy in their financial reports, and identify potential issues before they become significant problems.

Common PDF Forms

California Disability Benefits - Designed to help employees in California, the DE 2501 facilitates the application process for those unable to work due to health issues.

Joint Tenancy in California - Provides a legal workaround to typical probate requirements, facilitating quicker property transfer.

Florida Dh 680 Form Printable - The form also covers requirements for middle school students, including additional immunizations necessary for this age group as part of the ongoing vaccination schedule.