Free Cash Receipt PDF Form

In every transaction involving money exchange, documenting the details is crucial for both parties involved. This is where the Cash Receipt form comes into play, serving as an essential tool for recording financial transactions with precision and clarity. By providing a solid proof of payment, it safeguards the interests of both the payer and the payee, ensuring there’s a clear acknowledgment of the money exchanged. The form typically includes critical details such as the amount of cash received, the date of the transaction, the names of the involved parties, and the reason for the payment. Its usage spans across various settings, from retail establishments and service providers to private sales between individuals. Not only does it help in maintaining accurate financial records, which is invaluable for accounting and tax purposes, but it also plays a pivotal role in resolving any discrepancies that may arise regarding payments. In recognising the importance of the Cash Receipt form, one gains insight into its foundational role in establishing transparency and accountability in financial dealings.

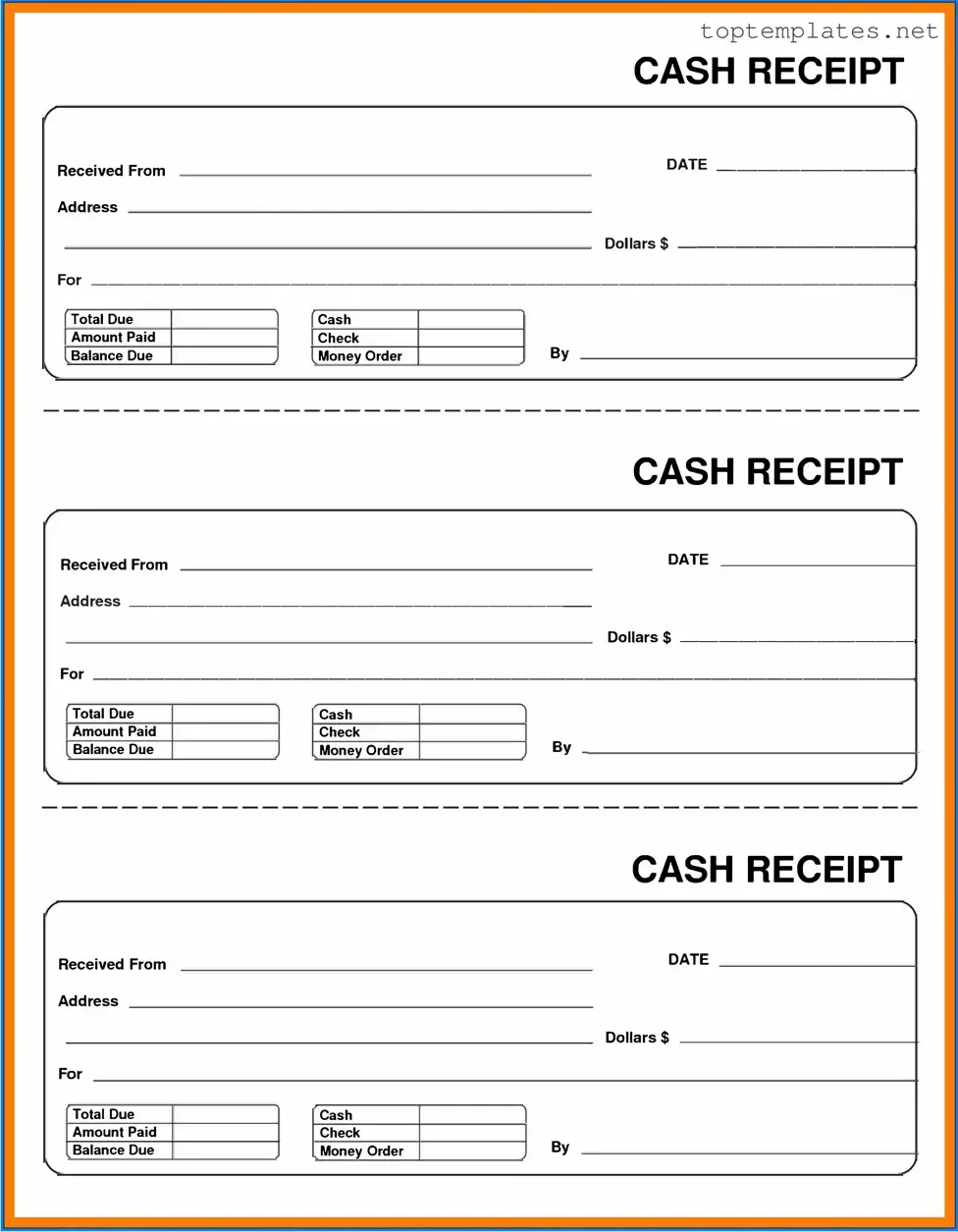

Sample - Cash Receipt Form

CASH RECEIPT

Received From |

|

� |

|||

Address |

|

|

Dollars$ |

||

|

|

|

|

||

|

� |

||||

Total Due

Amount Paid

Balance Due

Cash

Check

Money Order

By

CASH RECEIPT

Received From |

|

|

|

|

|

|

|

|

|

DATE |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

||||||

Address ________________________ |

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

Dollars$ |

+ |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Due |

|

|

|

|

|

Cash |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

Amount Paid |

|

|

|

|

|

Check |

|

|

By |

|

|

|

|

|

|

Balance Due |

|

|

|

|

|

Money Order |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CASH RECEIPT

Received From |

|

DATE |

|||

Address |

|

|

|

||

|

|

|

|

Dollars$ |

|

For |

|

|

|

||

Total Due

Amount Paid

Balance Due

Cash

Check

Money Order

By

File Specs

| Fact Name | Description |

|---|---|

| Definition | A Cash Receipt form is a document used to acknowledge the receipt of payment in cash for goods or services provided. |

| Key Components | Typically includes the date of transaction, amount received, payment method, payer and payee details, and a description of the transaction. |

| Usage | Widely used in various transactions, ranging from small businesses to personal sales, to maintain a record of cash payments. |

| Importance of Accuracy | Ensuring the accuracy of the information on the form is crucial for financial tracking and auditing purposes. |

| State-Specific Variations | Some states may have specific requirements or formats for a Cash Receipt form, often influenced by local commerce regulations. |

| Governing Laws | While the specific use of a Cash Receipt form isn't usually governed by a single law, it must comply with federal and state tax and business regulations. |

Steps to Filling Out Cash Receipt

Completing a Cash Receipt form correctly is crucial for documenting transactions accurately. Whether you're receiving funds for goods, services, or even a donation, this form acts as a proof of payment received in cash. The process is straightforward but requires attention to detail to ensure every section is filled out accurately, which helps in maintaining accurate financial records. Below are the steps to guide you through filling out this form efficiently.

- Start by entering the Date of the transaction in the top right corner of the form. Ensure the date is correct and formatted properly.

- In the Received From section, write the name of the individual or business from whom the cash was received. It's important to spell names correctly to avoid any confusion.

- Next, fill in the Amount section with the total cash amount received. Write this both in numerals and words to verify the total amount is correct and clear.

- Under the For Payment Of section, describe the reason for the payment. Be specific; for example, if the payment is for a product, include the product name or, if for a service, describe the service provided.

- The Form of Payment section should already be marked as cash. However, if it's not, ensure to check or mark the box next to Cash to indicate the form of payment correctly.

- In the section marked Received By, the individual collecting the cash should print their name. This acts as a confirmation that the money was collected by someone authorized to do so.

- Finally, the Signature area must be signed by the person who received the cash. The signature is a vital part of this form as it validates the transaction.

Once you have completed all the steps, review the form to ensure all information is accurate and legible. This document should then be filed accordingly, with copies provided to both the payer and the recipient for their records. Keeping a well-documented record of cash transactions is beneficial for bookkeeping and can be critical evidence for financial audits.

Discover More on Cash Receipt

What is a Cash Receipt form?

A Cash Receipt form is a document used to acknowledge the receipt of money. It typically details the amount received, the date of the transaction, the source of the payment, and the reason for the payment. This form serves as proof that money has been transferred from one party to another and is essential for managing financial records accurately.

When should I use a Cash Receipt form?

You should use a Cash Receipt form any time you receive cash payments. Whether it's for a sale of goods, provision of services, or any other transaction involving cash, documenting it properly with a Cash Receipt form helps keep your financial records up to date and accurate. It's especially useful for tracking cash flow in small businesses or personal transactions.

What information do I need to include in a Cash Receipt form?

In a Cash Receipt form, you should include the date of the transaction, the amount of money received, the name of the person or entity making the payment, the reason for the payment, and any additional notes related to the transaction. It's also advisable to have a space for the signature of the person acknowledging the receipt of cash.

Who should keep a copy of the Cash Receipt?

Both the giver and the receiver of the cash should keep a copy of the Cash Receipt. This ensures that both parties have a record of the transaction, which can be useful for accounting purposes, resolving disputes, or as evidence in legal matters.

Is it necessary to sign a Cash Receipt form?

Yes, it is highly recommended that the Cash Receipt form be signed by the person receiving the money. This signature acts as verification that the stated amount has indeed been received and is acknowledged by the recipient, adding an extra layer of security to the transaction.

Can I create a Cash Receipt form digitally?

Absolutely. Digital Cash Receipt forms are becoming increasingly popular and offer a convenient and secure way to acknowledge receipt of money. They can be created using various software or online platforms, and they also offer the benefit of being easily stored and retrieved electronically for future reference.

What if I lose a Cash Receipt?

If you lose a Cash Receipt, it's important to try to obtain a duplicate from the other party involved in the transaction. For businesses, maintaining digital copies of all receipts can mitigate the risk of losing physical copies. If a duplicate cannot be obtained, keeping a detailed record of all cash transactions in your accounting software or ledger can provide an alternative reference point.

Are Cash Receipts only for cash transactions?

While Cash Receipt forms are primarily designed for cash transactions, they can be adapted for use with other types of payments, such as checks or electronic transfers, especially in small businesses or informal transactions. The key is to ensure that the form reflects the actual method of payment accurately.

Common mistakes

When dealing with a Cash Receipt form, accuracy and attention to detail are paramount. Unfortunately, mistakes are all too common, undermining the credibility of the transactions they represent. Here are eight mistakes people frequently make:

Failing to record the date of the transaction accurately. The date is crucial for financial tracking and reporting.

Incorrectly identifying the payer or payee. This mistake can lead to confusion and inaccuracies in financial records.

Omitting the transaction amount or recording it incorrectly. Precision is key when it comes to financial transactions.

Not specifying the form of payment, such as cash, check, or electronic transfer. This detail is necessary for proper cash flow management.

Skipping the purpose of the payment. Knowing why a payment was made is essential for accurate bookkeeping and auditing.

Forgetting to obtain a signature from the involved parties. A signature verifies that the transaction has been acknowledged by both the payer and the payee.

Using unclear or vague descriptions for the transaction. Clear descriptions prevent misunderstandings and ensure that the records are useful for future reference.

Ignoring to provide a receipt copy to the payer. It's imperative for maintaining transparency and trust between the parties involved.

Avoiding these mistakes not only enhances the accuracy of financial records but also ensures compliance with accounting standards and practices. Attention to detail can save significant time and resources in managing finances effectively.

Documents used along the form

When managing financial transactions, especially in receiving cash, the Cash Receipt form is a crucial document. However, it usually works in conjunction with other documents and forms to ensure a seamless and comprehensive financial management process. These documents help in tracking, recording, and reconciling financial transactions accurately.

- Invoice: This document itemizes the products or services provided, including quantities and prices, and it is sent to the customer before payment as a request for payment.

- Payment Agreement Form: Outlines the terms and conditions agreed upon by the parties involved in a transaction, including payment amounts, deadlines, and penalties for late payments.

- Receipt Book: Often used alongside individual cash receipt forms, a receipt book offers a physical record of cash transactions, serving as a backup for the digital or paper form.

- Bank Deposit Slip: Used when depositing one or more cash receipts into a bank account, it details the amount of cash, checks, and the total deposit amount, ensuring that the bank correctly processes the deposit.

- Sales Ledger: This document records all sales transactions, including cash, credit, and debit transactions. It is critical for tracking outstanding payments and reconciling sales revenue with cash receipts.

The use of these forms and documents, along with the Cash Receipt form, provides an integrated approach to manage financial transactions properly. Not only does each document play a vital role in ensuring accuracy in financial reporting, but they also contribute to effective cash management and accountability. Organizations should ensure that these documents are used consistently and are accurately filled out and maintained for optimal financial management.

Similar forms

Invoices: Much like a cash receipt, an invoice acts as a request for payment, detailing goods or services rendered. However, it is issued before the payment is made, whereas a cash receipt confirms that a payment has been received.

Payment Acknowledgment Letters: These letters serve a similar purpose to cash receipts by acknowledging the receipt of payment. While cash receipts are more transactional and often used in retail or immediate service scenarios, payment acknowledgment letters are more formal and commonly used in professional or contractual agreements.

Bank Deposit Slips: When money is deposited into a bank account, a deposit slip provides a breakdown of the deposit, including cash and checks. Similar to cash receipts, they provide proof of a transaction, in this case, the deposit transaction.

Sales Receipts: Sales receipts are essentially the retail counterpart to cash receipts, provided to customers as proof of purchase. They record the transaction details such as the date, items purchased, and amount paid, comparable to the information found on a cash receipt.

Credit Card Slips: After making a payment with a credit card, customers receive credit card slips, which include the transaction amount, date, and merchant's details. Like cash receipts, they act as proof of payment, although through electronic means rather than cash.

Shipping Receipts: Upon receiving a shipment, a shipping receipt is often issued, detailing the goods delivered. While their primary focus is on the details of the items shipped rather than the payment itself, they still confirm the transaction has occurred, akin to how a cash receipt confirms a payment.

Dos and Don'ts

Completing a Cash Receipt form accurately is crucial for effective financial management and accounting. The following guidelines can help ensure that these forms are filled out correctly and efficiently:

What You Should Do

Verify the accuracy of all figures entered on the form. Double-check the amounts received against the actual cash, checks, or credit card transactions to prevent discrepancies.

Use clear, legible handwriting or type the information if the form is available in a digital format. This ensures that all details can be easily read and understood by anyone who handles or reviews the form.

Include a detailed description of the transaction. Specify the nature of the payment (e.g., sale of goods, service charges) to provide clear context for the cash receipt, which is helpful for accounting purposes.

Ensure that the form is signed by an authorized individual. The signature acts as a verification of the receipt and the details it contains, adding an extra layer of validation.

What You Shouldn't Do

Avoid leaving any fields blank. If a section does not apply, mark it as "N/A" (Not Applicable) to indicate that the information was considered but deemed not relevant to the current transaction.

Do not estimate figures. Use exact amounts to ensure financial records are precise, which is critical for budgeting and reporting accuracy.

Refrain from using correction fluid or heavily crossing out mistakes. If an error is made, it is best to start over on a new form to keep the document clean and easy to read.

Never sign the form without verifying all the information it contains. This includes checking that the amounts, dates, and other details accurately reflect the transaction in question.

Misconceptions

Many misunderstandings surround the Cash Receipt form. Clearing up these misconceptions is crucial to ensuring accurate financial transactions and record keeping. Below are seven common misconceptions and the truths behind them:

All cash transactions are identical: This is false. Each cash transaction varies depending on its nature, source, and purpose. Recording details accurately on the Cash Receipt form is essential for accurate financial management.

Only large transactions require a Cash Receipt form: In reality, all cash transactions, regardless of size, should be documented using a Cash Receipt form. This practice ensures accountability and provides a clear financial record.

The Cash Receipt form is only for internal use: This is incorrect. While it is a crucial internal document, it also serves as proof of transaction for clients and customers, reinforcing transparency and trust.

Digital receipts cannot replace the Cash Receipt form: This is a misunderstanding. Digital receipts, if properly formatted and securely stored, are just as valid as paper forms and offer efficiency and environmental benefits.

Any employee can complete the Cash Receipt form: This is not advisable. Designating specific, trained employees to handle cash transactions and complete the form reduces errors and the risk of mismanagement.

Cash Receipt forms are unnecessary for recurring payments: This is false. Even for regular transactions, documenting each payment on a Cash Receipt form maintains accurate and up-to-date financial records.

Handwritten Cash Receipt forms are less valid than typed forms: This is a myth. The validity of a Cash Receipt form depends on its accuracy and the presence of all required information, not on whether it is handwritten or typed.

Key takeaways

When managing financial transactions, the Cash Receipt form plays a crucial role in documenting the receipt of funds. It is vital for both the entity receiving the funds and the paying party, ensuring a clear record of the transaction. Here are key takeaways to consider when filling out and using the Cash Receipt form:

- Date of Transaction: Always ensure that the date the cash is received is accurately recorded. This is essential for maintaining proper financial records and for future referencing.

- Amount Received: The exact amount of cash received must be clearly stated. To avoid discrepancies, write the amount in both words and figures.

- Form of Payment: Indicate whether the payment was made in cash, check, money order, or any other form. This helps in tracking how funds are being received.

- Information of the Payer: Accurately document the payer's details, including their name and contact information. This is crucial for any necessary follow-ups or clarifications.

- Purpose of Payment: Clearly describe the reason for the payment. This detail supports the allocation of funds to the correct account or budget line and aids in financial analysis.

- Signature of Recipient: The form should be signed by the person receiving the funds. This acts as an acknowledgment of the transaction and enhances the form’s validity.

- Issuing Receipts: Provide the payer with a copy of the Cash Receipt. This serves as proof of payment and is important for both parties' records.

- Secure Storage: Once completed, store the Cash Receipt form securely. These forms are vital financial documents and should be treated with the same care as cash.

Using the Cash Receipt form correctly ensures that transactions are recorded systematically and transparently. This meticulous approach benefits organizational accountability, auditability, and financial integrity.

Common PDF Forms

Doctors Note Template - Contributes to a culture that values health and wellbeing in professional and academic environments, through formal recognition of medical advice.

Panel Schedule - The schedule is essential for safety, allowing for easy identification of circuits during repairs and ensuring correct load distribution to prevent overloading.