Free Cg 20 10 07 04 Liability Endorsement PDF Form

In the realm of insurance, the CG 20 10 07 04 Liability Endorsement form serves as a pivotal document for businesses, extending commercial general liability coverages to additional insured entities. This form is specifically designed to benefit parties such as owners, lessees, or contractors, naming them as additional insureds under a policy, thereby providing a layer of protection against liabilities arising from bodily injury, property damage, or personal and advertising injury. The coverage is intricately linked to the actions or omissions of the named insured, extending to those under its direction, within the scope of ongoing operations for the additional insured at specified locations. However, it distinctly outlines that coverage is only applied to the extent permitted by law and mandates adherence to the coverage breadth dictated by contractual agreements. Furthermore, the form introduces specific exclusions, particularly emphasizing that no coverage exists for damages post the completion of work or once the work is utilized, unless such use involves other contractors or subcontractors working on the same project. It also addresses limits of insurance, specifying that coverage for additional insureds is capped according to contractual requirements or the policy's limits, whichever is lower, without increasing the policy's overall limits. This nuanced endorsement highlights the insurance industry's response to complex liability exposures faced by various stakeholders in commercial operations, underlining the need for meticulous attention to the terms and conditions stated within insurance documents.

Sample - Cg 20 10 07 04 Liability Endorsement Form

POLICY NUMBER: |

COMMERCIAL GENERAL LIABILITY |

|

CG 20 10 12 19 |

THIS ENDORSEMENT CHANGES THE POLICY. PLEASE READ IT CAREFULLY.

ADDITIONAL INSURED – OWNERS, LESSEES OR

CONTRACTORS – SCHEDULED PERSON OR

ORGANIZATION

This endorsement modifies insurance provided under the following:

COMMERCIAL GENERAL LIABILITY COVERAGE PART

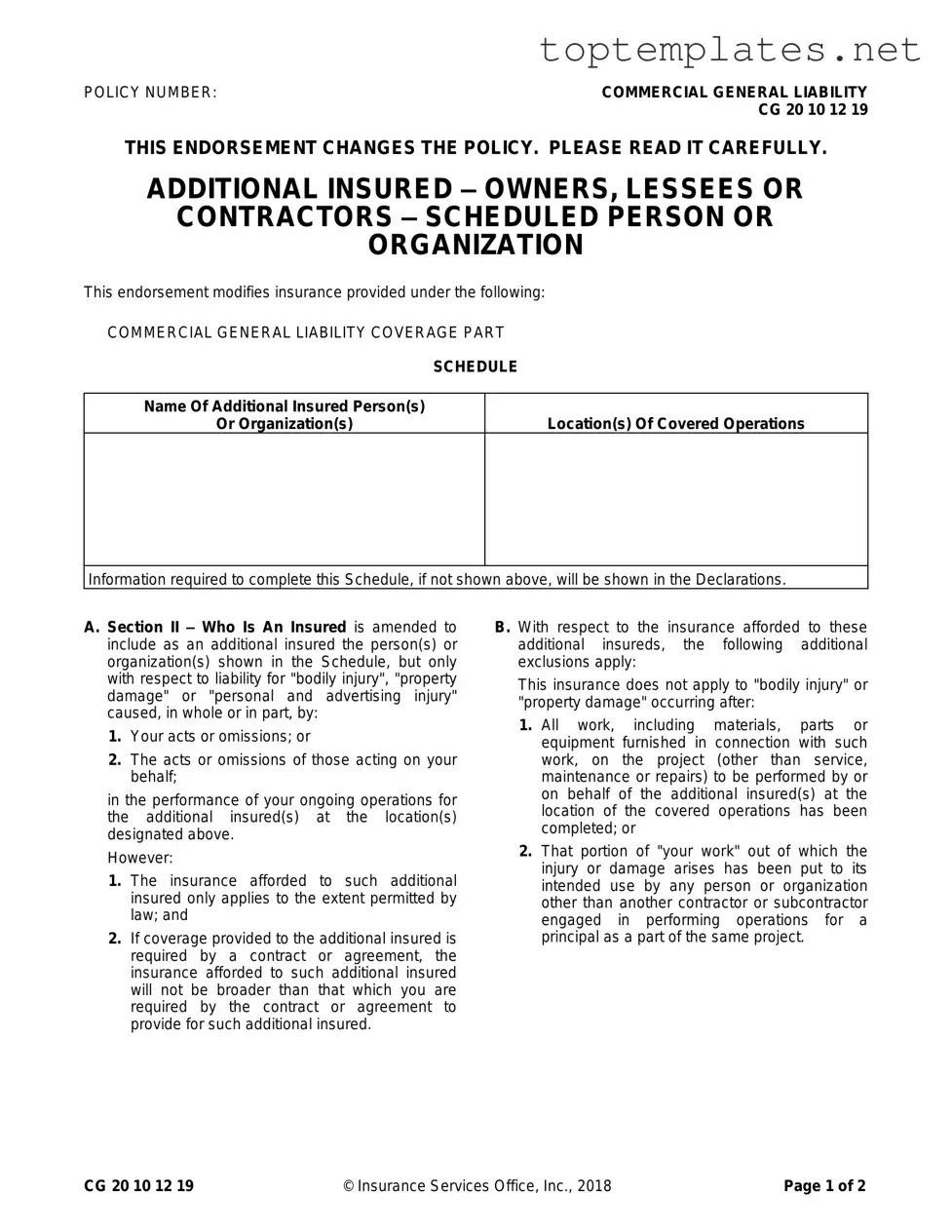

SCHEDULE

Name Of Additional Insured Person(s)

Or Organization(s)

Location(s) Of Covered Operations

Information required to complete this Schedule, if not shown above, will be shown in the Declarations.

A. Section II – Who Is An Insured is amended to include as an additional insured the person(s) or organization(s) shown in the Schedule, but only with respect to liability for "bodily injury", "property damage" or "personal and advertising injury" caused, in whole or in part, by:

1.Your acts or omissions; or

2.The acts or omissions of those acting on your behalf;

in the performance of your ongoing operations for the additional insured(s) at the location(s) designated above.

However:

1.The insurance afforded to such additional insured only applies to the extent permitted by law; and

2.If coverage provided to the additional insured is required by a contract or agreement, the insurance afforded to such additional insured will not be broader than that which you are required by the contract or agreement to provide for such additional insured.

B. With respect to the insurance afforded to these additional insureds, the following additional exclusions apply:

This insurance does not apply to "bodily injury" or "property damage" occurring after:

1.All work, including materials, parts or equipment furnished in connection with such work, on the project (other than service, maintenance or repairs) to be performed by or on behalf of the additional insured(s) at the location of the covered operations has been completed; or

2.That portion of "your work" out of which the injury or damage arises has been put to its intended use by any person or organization other than another contractor or subcontractor engaged in performing operations for a principal as a part of the same project.

CG 20 10 12 19 |

© Insurance Services Office, Inc., 2018 |

Page 1 of 2 |

C. With respect to the insurance afforded to these additional insureds, the following is added to

Section III – Limits Of Insurance:

If coverage provided to the additional insured is required by a contract or agreement, the most we will pay on behalf of the additional insured is the amount of insurance:

1.Required by the contract or agreement; or

2.Available under the applicable limits of insurance;

whichever is less.

This endorsement shall not increase the applicable limits of insurance.

Page 2 of 2 |

© Insurance Services Office, Inc., 2018 |

CG 20 10 12 19 |

File Specs

| Fact Name | Detail |

|---|---|

| Endorsement Title | Additional Insured – Owners, Lessees or Contractors – Scheduled Person or Organization |

| Form Number | CG 20 10 12 19 |

| Policy Modification | This endorsement changes the policy. |

| Coverage Part Affected | Commercial General Liability Coverage Part |

| Eligibility | Person(s) or organization(s) shown in the Schedule as additional insured. |

| Coverage Basis | Liability for "bodily injury", "property damage" or "personal and advertising injury" caused, in whole or in part, by specified acts or omissions. |

| Legal Restrictions | Coverage applies only to the extent permitted by law. |

| Contract or Agreement Requirement | If coverage is required by a contract or agreement, it will not exceed that which is necessary under the contract or agreement. |

| Additional Exclusions | Coverage does not apply to injuries or damage occurring after specified work completion stages. |

| Limits of Insurance | Most paid on behalf of the additional insured is the lesser of the amount required by contract or agreement or the applicable limits of insurance. |

| Applicable Limits | This endorsement does not increase the applicable limits of insurance. |

Steps to Filling Out Cg 20 10 07 04 Liability Endorsement

Filling out the CG 20 10 07 04 Liability Endorsement form is a critical step in amending your commercial general liability policy to include additional insured entities. This process entails specifying the persons or organizations to be added as additional insureds under your policy, indicating the scope and location of covered operations, and understanding the limits and exclusions related to this endorsement. Careful and accurate completion of the form ensures that the intended additional insureds are properly covered according to the terms of your policy and applicable laws. Below are the steps to fill out this form.

- Locate the "POLICY NUMBER" section at the top of the form and enter your current commercial general liability policy number.

- Under the SCHEDULE section, provide the full legal name(s) of the individual(s) or organization(s) that you wish to add as additional insured(s).

- Next to the name(s), specify the "Location(s) Of Covered Operations" by listing the physical address(es) or a descriptive location of where the covered operations pertinent to the additional insured(s) will take place.

- If there is any information that could not be included in the provided lines of the SCHEDULE section, ensure that this information is detailed in the Declarations page of your policy. This may include additional names, locations, or specifics about the coverage extended to the additional insured(s).

- Review section A to understand the extent to which the additional insured(s) are covered. This includes liabilities arising from your acts or omissions, or those acting on your behalf, in the performance of your ongoing operations at the specified location(s).

- Note the limitations of coverage for additional insured(s) as outlined in section B. Understand that coverage does not extend to injuries or damages occurring after the completion of work or after the part of your work has been put to its intended use, except by another contractor or subcontractor on the same project.

- Pay close attention to section C, which details the Limits Of Insurance. It is crucial to understand that if coverage is mandated by a contract or agreement, the maximum payable amount on behalf of the additional insured will be the lesser of the amount required by the contract/agreement or the amount available under the applicable limits of insurance.

- Ensure that all information provided is accurate and complete before submitting the form to your insurance provider for processing.

Completing the CG 20 10 07 04 Liability Endorsement form accurately is essential for modifying your insurance policy to include additional insureds properly. This process not only provides them with certain protections under your policy but also ensures compliance with any contractual obligations requiring such coverage. Always consult with your insurance provider or agent if you encounter any difficulties or have questions about specific entries on the form.

Discover More on Cg 20 10 07 04 Liability Endorsement

What is the CG 20 10 07 04 Liability Endorsement form?

The CG 20 10 07 04 form is an endorsement that can be added to a commercial general liability (CGL) insurance policy. This form serves to extend the insurance coverage to include additional insureds, specifically naming owners, lessees, or contractors as protected under the policy. The coverage applies only to liability for bodily injury, property damage, or personal and advertising injury caused, in whole or in part, by the named insured’s acts or omissions, or those acting on their behalf, during the performance of ongoing operations at a designated location.

Who can be added as an additional insured on this endorsement?

Owners, lessees, or contractors specified in the schedule of the endorsement can be added as additional insureds. The inclusion is subject to the completion of the schedule which should specify the names of the additional insured persons or organizations along with the locations of the covered operations.

Does this endorsement provide coverage for all types of liability?

No, the coverage is specifically limited to liability arising from bodily injury, property damage, or personal and advertising injury caused by the named insured’s operations for the additional insured at the designated locations. It does not provide blanket coverage for all types of liability.

Are there any restrictions or exclusions to the coverage provided?

Yes, there are notable restrictions. The insurance does not apply to injuries or damages that occur after all work at the project location has been completed or after the part of the work out of which the injury or damage arises has been put to its intended use. In addition, the coverage for additional insureds will not exceed the limits required by any contract or agreement, nor the policy's applicable limits of insurance.

What determines the extent of coverage for an additional insured?

The extent of coverage for an additional insured is determined by the terms of the contract or agreement that requires the named insured to provide insurance coverage to the additional insured. The insurance afforded will not be broader than what is required by the contract or agreement and is subject to the policy’s terms and exclusions.

How does this endorsement affect the policy’s limits of insurance?

This endorsement does not increase the overall limits of insurance under the policy. For additional insureds, the most that will be paid is the amount of insurance required by the contract or agreement or the available limits under the policy, whichever is less.

Is there a specific time period during which the coverage applies?

Yes, the coverage applies only to liability for injuries or damages occurring during the performance of the named insured’s ongoing operations for the additional insured at the designated locations. It does not extend to injuries or damages occurring after the project has been completed or the work has been put to its intended use.

Can the CG 20 10 07 04 endorsement be modified to suit specific needs?

The details that can be modified in the CG 20 10 07 04 endorsement typically relate to the naming of additional insureds and designating the locations of covered operations. However, the fundamental terms of the coverage, including exclusions and limits, are standardized and cannot be individually altered. Specific needs or variations in coverage may require additional endorsements or alterations to the policy.

How is this endorsement obtained and added to a commercial general liability policy?

This endorsement is obtained through an insurance provider that offers commercial general liability insurance. It must be explicitly requested and added to the policy, often at the inception of the policy or at renewal. The schedule part of the endorsement must be properly completed to identify the additional insureds and the locations of the covered operations. Insurance providers may require additional documentation or agreements to process and add this endorsement.

Common mistakes

Filling out the CG 20 10 07 04 Liability Endorsement form might seem straightforward, but there are common mistakes that people often make. Understanding these errors can help ensure that the process goes smoothly and the intended coverage is accurately provided.

Not accurately identifying the additional insured person(s) or organization(s) in the schedule. It's crucial to input the correct names and details to ensure proper coverage.

Overlooking the location(s) of covered operations. Each location where the additional insured operates must be listed to guarantee that the coverage is applicable.

Assuming the coverage is broader than it is. The endorsement specifies that if coverage is required by a contract, it won't extend beyond what that contract stipulates.

Missing the additional exclusions section, which clearly outlines when the insurance does not apply. Especially, missed are the points regarding the completion of work and the usage of the completed work.

Misunderstanding the limits of insurance provided to the additional insured. Some fail to realize that the most that will be paid on behalf of the additional insured is either what's required by contract or what's under the current limits, whichever is less.

Not considering the legal jurisdiction that could affect the applicability of the insurance. The insurance afforded only applies to the extent permitted by law, which can vary significantly depending on the location.

Failing to update the endorsement as required. If any changes in the covered operations or additional insureds occur, the form should be updated accordingly to ensure continuous and accurate coverage.

Avoiding these mistakes requires a careful review of the form and, if necessary, the consultation with a professional to ensure that all details are correctly captured and the insurance coverage meets the required needs.

Documents used along the form

The Commercial General Liability (CG 20 10 07 04) Liability Endorsement form is a crucial document in the suite of insurance and legal documents designed to provide comprehensive coverage and contractual assurances within the sphere of commercial operations. This endorsement specifically extends the insurance coverage to include additional insured entities, typically required in contracts involving owners, lessees, or contractors. Accompanying this form, a variety of other essential documents and forms often play supportive and complementary roles in ensuring that the contractual and insurance needs of a business are fully addressed.

- Commercial General Liability (CGL) Policy: This foundational document outlines the core coverage offered to a business, including protection against liability claims for bodily injury, property damage, and personal and advertising injury.

- Certificate of Insurance (COI): Serves as proof of insurance coverage, detailing the types and limits of coverage currently in force. It is often requested by third parties to verify insurance before contracts are signed or services are rendered.

- Additional Insured Endorsement Form: Beyond the CG 20 10, several other endorsement forms exist to extend coverage to additional insureds under specific circumstances or for different relationship types.

- Waiver of Subrogation Endorsement: This form modifies a policy to prevent the insurance company from seeking reimbursement from a third party that may have caused an insurance loss.

- Indemnity Agreement: A contract that outlines the obligations of one party to compensate for losses incurred by another, often used in conjunction with liability insurance to manage risk.

- Performance Bond: Assures the completion of a project or contract in accordance with its terms. It is particularly relevant in construction and contracting industries.

- Property Lease Agreement: For entities leasing property, this document outlines the terms and conditions of the lease, often requiring specific insurance coverage endorsements like the CG 20 10.

- Contractor Service Agreement: Details the scope of work, responsibilities, and insurance requirements for contractors, often necessitating additional insured endorsements for liability protection.

- Incident Report Forms: Utilized to document any occurrences that may lead to a liability claim, providing essential details that will be necessary for insurance claims processing.

Together, these documents create a robust legal and insurance framework that supports and protects the interests of all parties involved in commercial activities. Each document serves a specific purpose, whether it is to define the scope of coverage, provide proof of insurance, outline contractual obligations, or document incidents for potential claims. Their collective use ensures that businesses are well-positioned to manage risk and uphold their contractual commitments.

Similar forms

CG 20 37 (Additional Insured – Owners, Lessees or Contractors – Completed Operations): This endorsement is similar to CG 20 10 because it extends additional insured status to owners, lessees, or contractors after the completion of the project. However, it specifically covers completed operations, unlike CG 20 10, which primarily addresses ongoing operations.

CG 20 33 (Additional Insured – Owners, Lessees or Contractors – Automatic Status when Required in Construction Agreement with You): Like CG 20 10, CG 20 33 automatically provides additional insured status under certain conditions outlined in a construction agreement. The key difference lies in the automatic provision of status based on contractual requirements, emphasizing the contract's role in defining coverage.

CG 20 26 (Additional Insured – Designated Person or Organization): This form is akin to CG 20 10 in that it designates an additional insured by naming them on the endorsement. The coverage is similar in nature, focusing on liability arising out of the named insured's actions. The distinction typically revolves around the broader eligibility criteria for who can be named as an additional insured.

CG 20 32 (Additional Insured – Engineers, Architects or Surveyors Not Engaged by the Named Insured): Similar to CG 20 10, this endorsement extends additional insured status to certain professionals. The main similarity is in the liability coverage stemming from the named insured's operations. CG 20 32 specifically targets professionals in engineering, architecture, or surveying, highlighting the professional services aspect.

CG 20 18 (Additional Insured – Owners or Other Interests from whom Land Has Been Leased): CG 20 18 shares similarities with CG 20 10 by extending additional insured status to landowners or leaseholders. This endorsement focuses on property-related liabilities. Both endorsements aim to protect additional insured parties against certain liabilities associated with the named insured's operations.

CG 20 38 (Additional Insured – Mortgagee, Assignee, or Receiver): Like CG 20 10, CG 20 38 provides additional insured status, but specifically for financial interests such as mortgagees, assignees, or receivers. The coverage under both endorsements is related to the liability arising from the named insured's actions. The difference largely lies in the targeted additional insured party being financially rather than operationally involved.

CG 24 26 (Waiver of Transfer of Rights of Recovery Against Others to Us – Per Schedule): Although not providing additional insured status, this form is akin to CG 20 10 in its augmentation of the policy's terms to benefit certain parties. CG 24 26 allows the named insured to waive subrogation rights against others. This similarity lies in the contractual modification to address specific needs of the involved parties, affecting liability and recovery rights.

Dos and Don'ts

Filling out the CG 20 10 07 04 Liability Endorsement form requires careful attention to detail and an understanding of certain dos and don'ts to ensure accuracy and compliance. Keeping these guidelines in mind can significantly impact the successful processing of your form.

Do's:

- Read the Instructions Carefully: Before you begin filling out the form, make sure to read through all the instructions and guidelines provided. This knowledge equips you with the information needed to fill out the form correctly.

- Verify Information for Accuracy: Double-check all information, including policy numbers, names of insured persons or organizations, and locations of covered operations. Accurate information is crucial for the validity of the endorsement.

- Consult Legal or Insurance Advisors: If there are sections of the form that seem unclear, consulting with a legal or insurance advisor is wise. They can provide clarity and guidance, ensuring that you’re completing the form correctly.

- Keep a Copy for Your Records: After submitting the form, ensure you keep a copy for your own records. This copy is essential for future reference or if any disputes arise regarding the endorsement.

Don'ts:

- Omit Required Information: Do not leave any required fields empty. Incomplete forms may lead to delays or outright rejection of the endorsement request. If a section does not apply, make sure to mark it accordingly as instructed in the form guidelines.

- Make Unapproved Alterations: Avoid making any changes or alterations to the form that are not explicitly allowed. Unauthorized modifications could invalidate the form, leading to complications with the endorsement.

- Guess Information: If you are unsure about specific details required in the form, do not guess or fill in uncertain information. It’s better to verify the correct information to ensure the form’s accuracy.

- Use Ineligible Signatures: Ensure that the individual signing the form is authorized to do so under your policy. Using a signature from an unapproved individual can cause delays or rejection of the document.

By following these guidelines, you’re well on your way to successfully completing the CG 20 10 07 04 Liability Endorsement form. Remember, attention to detail and understanding the requirements will facilitate a smoother process for this and any future endorsements.

Misconceptions

Understanding the CG 20 10 07 04 Liability Endorsement form, commonly referred to in the insurance world, is crucial for many businesses, especially those involved in construction, leasing, or contracting work. However, there are numerous misconceptions about what this document entails and its implications. Let's clarify some of the most common misunderstandings:

It automatically covers all activities and operations: Many believe this endorsement provides blanket coverage for all operations of the additional insured. In truth, it only covers liability arising from the named insured’s acts or omissions or those acting on their behalf in the performance of ongoing operations for the additional insured at the designated locations.

It provides unlimited coverage: The endorsement does not extend the policy's limits of insurance. When coverage is provided to an additional insured, it is subject to the policy's existing limits or as required by contract, whichever is less. This clause ensures that the endorsement does not inadvertently increase the insurer's liability beyond what was originally underwritten.

Covers all types of liability: A common misconception is that this form covers all liabilities. However, it specifically addresses liability for "bodily injury", "property damage", or "personal and advertising injury" caused, in part or in full, by the named insured's actions. Other liabilities are not covered under this endorsement.

Coverage extends indefinitely: The endorsement has clear limitations on the coverage period. Specifically, it does not apply to injuries or damages occurring after all work on the project has been completed or after the performed work has been put to its intended use, other than by another contractor or subcontractor on the project.

All additional insureds receive the same coverage level: Coverage for additional insureds is often thought to be uniform. In reality, the scope of coverage is determined by the underlying contract or agreement and may vary significantly among additional insureds based on the specified requirements.

It negates the need for direct insurance: Some might think that being named as an additional insured on someone else’s policy is a substitute for having their own policy. This endorsement is designed to complement, not replace, the direct insurance policies held by the additional insureds, offering specific protection related to the named insured's operations.

Claims against additional insureds are prioritized: The belief that claims against additional insureds take precedence over those against the named insured is incorrect. Claims are handled based on the terms of the policy and the nature of the claim, without inherent preference for additional insureds.

No action is required by the additional insured: Additional insureds may wrongly assume that once they are named on the endorsement, no further action is required on their part. However, maintaining communication with the named insured and the insurance provider, understanding the scope of the coverage, and promptly reporting potential claims are critical steps in ensuring the intended protection is in place.

Coverage applies to all locations: Another misconception is that the coverage granted by this endorsement automatically extends to all locations associated with the additional insured. Coverage is specifically tied to the location(s) of covered operations as described in the schedule or declarations of the policy.

Understanding the distinct elements and limitations of the CG 20 10 07 04 Liability Endorsement form can prevent false expectations and ensure that all parties involved have adequate and appropriate coverage for their needs. Vetting all aspects of this endorsement with a knowledgeable insurance professional is advisable to mitigate risks effectively.

Key takeaways

Filling out and using the CG 20 10 07 04 Liability Endorsement form is a critical step for many businesses. It plays a paramount role in defining how liability coverage is extended to additional insureds, typically in a commercial context. Here are key takeaways to ensure that stakeholders navigate this process with a clear understanding.

- Identification of Additional Insureds: It's essential that the form accurately identifies the person(s) or organization(s) to be added as additional insureds. This section directly impacts who is covered under the policy, specifically relating to liability for bodily injury, property damage, or personal and advertising injury caused by the named insured or those acting on their behalf.

- Limitations of Coverage: The coverage extended to additional insureds is not limitless. It corresponds directly to the scope of the named insured's acts or omissions and is further constrained by any applicable laws and the specifics of the contract or agreement necessitating the additional insured status. This nuanced limitation necessitates a thorough understanding of the underlying contract or agreement and its relation to the insurance coverage provided.

- Exclusions: The CG 20 10 07 04 outlines specific exclusions to the coverage extended to additional insureds. Most notably, coverage does not apply to bodily injury or property damage occurring after the completion of the project or after the insured's work has been put to its intended use, except when performed by another contractor or subcontractor as part of the same project. This exclusion emphasizes the temporal and operational boundaries within which the coverage is applicable.

- Limits of Insurance: The endorsement clarifies that the most that will be paid on behalf of an additional insured is the lesser of the amount required by the contract or agreement or the available limits of insurance. This provision ensures that the extension of coverage to additional insureds does not increase the policy's overall limits of insurance. It is a crucial consideration for parties relying on being added as additional insureds for specific projects or operations.

Understanding these key aspects of the CG 20 10 07 04 Liability Endorsement form is fundamental for businesses and individuals navigating the complexities of commercial general liability insurance. It ensures that additional insureds are appropriately covered while also acknowledging the limitations and exclusions that define the scope of that coverage. Being thoroughly familiar with these details can significantly impact the management of liability risks in commercial operations.

Common PDF Forms

Da 638 - Employs a standardized approach to the nomination process, promoting fairness and consistency in award recommendations.

Work Incident Report Template - An effective communication tool that bridges the gap between employees and management regarding workplace safety concerns.

Form I 134 - By sponsoring someone with this form, individuals contribute to the richness and diversity of the U.S. cultural landscape.