Free Childcare Receipt PDF Form

Managing childcare expenses is critical for families, making the Childcare Receipt Form an invaluable document. This essential form captures all the necessary details related to childcare services, including the date, amount paid, recipient's detailed information, the child or children's names, the duration of services provided, and the provider's signature. Its primary use is not only to confirm payments made by parents or guardians for childcare services but also serves as a vital record for tax purposes and for parents to manage their budgets more effectively. The form's structure ensures clear communication between the service provider and the recipient, making it a straightforward tool for documenting transactions related to childcare. Accurate completion and preservation of this form can facilitate smooth financial tracking and provide essential support during tax season, ensuring that families can claim relevant deductions and credits. Additionally, its standardized format helps in maintaining professionalism and trust in the childcare service industry, reinforcing the importance of accountability and record-keeping in financial transactions.

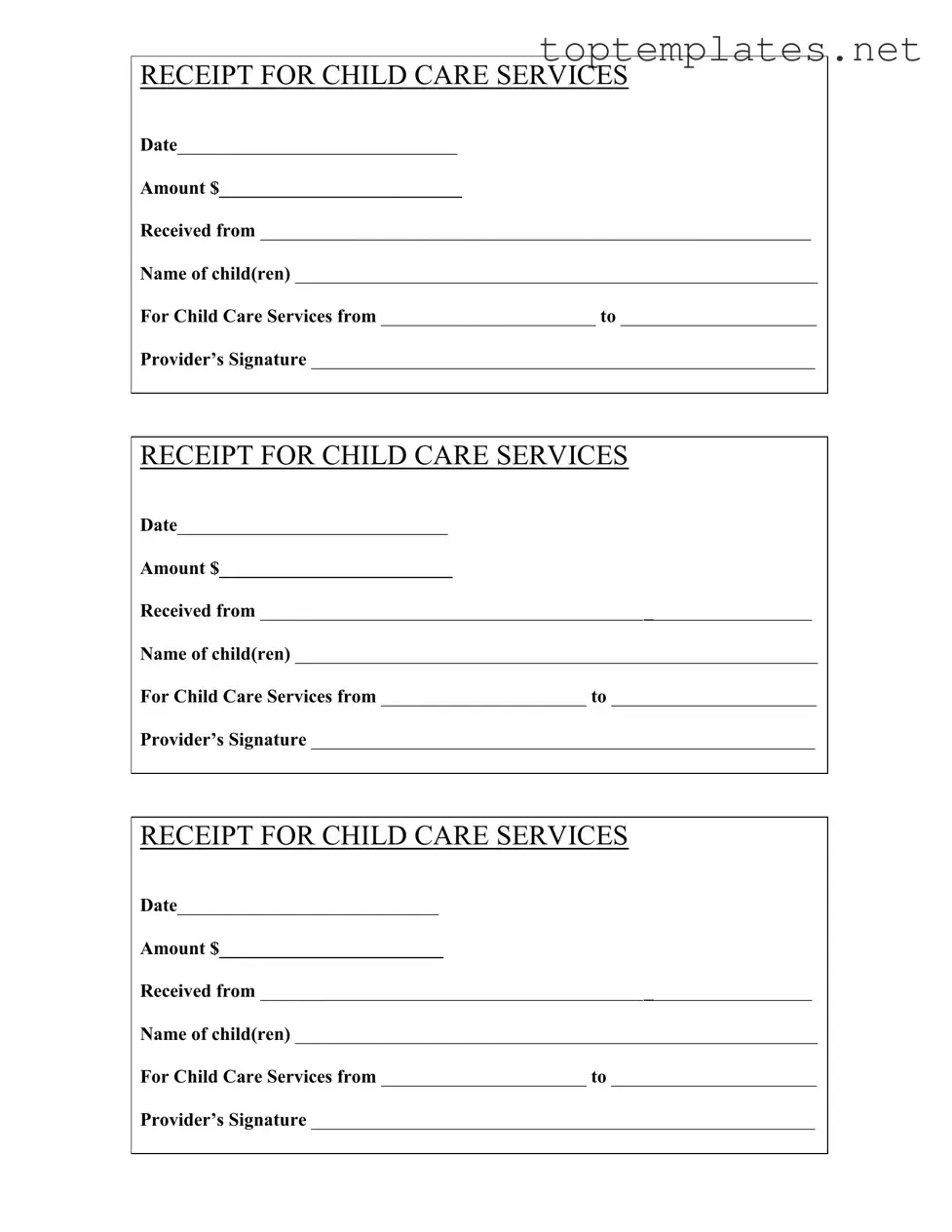

Sample - Childcare Receipt Form

RECEIPT FOR CHILD CARE SERVICES

Date______________________________

Amount $__________________________

Received from ___________________________________________________________

Name of child(ren) ________________________________________________________

For Child Care Services from _______________________ to _____________________

Provider’s Signature ______________________________________________________

RECEIPT FOR CHILD CARE SERVICES

Date_____________________________

Amount $_________________________

Received from ___________________________________________________________

Name of child(ren) ________________________________________________________

For Child Care Services from ______________________ to ______________________

Provider’s Signature ______________________________________________________

RECEIPT FOR CHILD CARE SERVICES

Date____________________________

Amount $________________________

Received from ___________________________________________________________

Name of child(ren) ________________________________________________________

For Child Care Services from ______________________ to ______________________

Provider’s Signature ______________________________________________________

File Specs

| Fact Number | Fact Detail |

|---|---|

| 1 | The Childcare Receipt must include the date of the transaction. |

| 2 | The amount of payment received for childcare services is required on the form. |

| 3 | Identification of the payer is necessary, specified as "Received from." |

| 4 | The name(s) of the child(ren) receiving care must be listed. |

| 5 | The form must outline the period of childcare services provided, indicating the start and end dates. |

| 6 | It requires the provider's signature to validate the receipt. |

| 7 | The form is designed for multiple uses, evident from the repeated template. |

| 8 | Governing laws vary by state; it's crucial to reference local regulations regarding childcare service documentation. |

| 9 | This form serves as a formal acknowledgment of payment received for childcare services. |

Steps to Filling Out Childcare Receipt

Completing a Childcare Receipt form is a straightforward process, but it's crucial to ensure accuracy. Whether you're providing or receiving child care services, this form acts as a formal acknowledgment of the payment made for services rendered. It includes essential details such as the date, amount, names of the child or children, service duration, and the provider's signature. Here's a step-by-step guide on how to fill it out correctly.

- Date: Enter the current date when the payment is made.

- Amount: Write the total amount of money received for the childcare services.

- Received from: Fill in the name of the parent or guardian who made the payment.

- Name of child(ren): List the name(s) of the child or children who received the childcare services.

- For Child Care Services from: Specify the start and end dates of the service period.

- Provider’s Signature: The childcare provider must sign the receipt to validate it.

After filling out the form, it's important for both parties to retain a copy for their records. This ensures that there's a clear and accessible record of the transaction, which can be helpful for future reference, tax purposes, or in the event any disputes arise regarding the payment.

Discover More on Childcare Receipt

What is the purpose of a Childcare Receipt?

A Childcare Receipt serves as a formal acknowledgment that payment has been made for childcare services. It details the amount paid, the date, information about the child or children for whom the services were provided, and spans the service period. This document is crucial for record-keeping purposes and may be required for tax deductions or reimbursement through certain family or employment benefits.

Who needs to provide a Childcare Receipt?

The provider of childcare services is responsible for issuing a receipt. This includes daycare centers, private caregivers, nannies, and anyone else who offers childcare in exchange for payment. The receipt acts as proof of the transaction between the caregiver and the parent or guardian.

What should be included in a Childcare Receipt?

Every Childcare Receipt must include the date the receipt was issued, the amount of money received, the name of the parent or guardian who made the payment, the names of the child or children cared for, the period for which services were provided, and the provider’s signature. These details ensure the receipt is comprehensive and substantiates the provided care and payment.

Is there a specific format required for Childcare Receipts?

No specific format is mandated; however, the receipt must contain all essential information to be considered valid. Some organizations or tax entities may provide templates to facilitate consistency and ensure all necessary details are captured. Regardless of the format, clarity and completeness are paramount.

How does a Childcare Receipt affect taxes?

Childcare Receipts are vital for tax purposes. Parents or guardians may use them to claim childcare expenses on their income tax returns, potentially reducing their taxable income. The IRS requires such receipts to include detailed information as proof of these expenses. Without a proper receipt, claiming these expenses would be challenging.

Can digital Childcare Receipts be used, or do they have to be paper?

Digital receipts are acceptable as long as they contain all the required information. In today's digital age, electronic record-keeping is becoming more common, and as such, digital receipts are considered just as valid as paper ones. However, it's important to ensure that digital receipts are stored securely and are easily accessible when needed.

Do Childcare Receipts need to be signed?

Yes, the provider's signature is crucial as it verifies the authenticity of the receipt. Whether the receipt is digital or paper, a signature is necessary to confirm that the provider acknowledges the payment and the details of the services provided. This can include a written signature on paper receipts or an electronic signature on digital ones.

Common mistakes

Not clearly filling in the dates of service can be a common mistake. This includes both the date on which the services were paid for and the range of dates for which the child care services were provided. Clear dates ensure both parties can accurately keep track of the services rendered and payments made. A vague or inaccurate date might result in discrepancies and misunderstandings about the period the payment covers.

Omitting the correct amount paid is another error often found on these forms. It is crucial to accurately write the full amount in figures to avoid any confusion about the payment received. The amount should reflect the agreed-upon rate for the period specified and include any additional agreed-upon charges, if applicable.

Leaving out the name(s) of the child(ren) receiving the care is a mistake that might seem minor but can lead to issues, especially when the caregiver provides services to multiple children in a family or if there's a need to differentiate between clients. Including the child's name clarifies for whom the services were provided, which is especially important for record-keeping and in case of disputes.

Miswriting or not including the provider's signature can invalidate the receipt. The provider's signature is a critical component of the receipt as it serves as proof of the transaction between the service provider and the client. An unsigned receipt might not be recognized as an official document in case there is a need for legal proof of payment.

Failing to fill out the "Received from" section accurately is also a common pitfall. This section should clearly state the name of the parent, guardian, or organization making the payment. Vague or incorrect information in this field can create confusion about who is responsible for the payment, which can be problematic, especially in situations involving custody arrangements or when third-party entities, like employers or governmental assistance programs, make payments on behalf of parents or guardians.

Documents used along the form

When managing childcare services, various documents are utilized alongside the Childcare Receipt form to ensure comprehensive record-keeping and compliance with regulations. These documents support the administrative tasks involved in running a childcare facility, provide clarity for both the provider and the parents, and ensure that essential information related to the child's care is accurately documented and easily accessible.

- Child Enrollment Form: This essential document is filled out upon a child's first entry into a childcare program. It collects vital information such as the child's full name, date of birth, residential address, medical history, dietary restrictions, and emergency contact information. It ensures that the childcare provider has all necessary details to offer personalized and safe care to each child.

- Attendance Record: Keeping track of the child’s daily attendance is crucial for operational and safety reasons. This document records the dates and times when a child is dropped off and picked up from the childcare facility. It can also note who is authorized to pick up the child, adding an extra layer of security and peace of mind for both parents and providers.

- Incident Report Form: In the event of an accident or unusual occurrence, an Incident Report Form is filled out. This document details the incident, including what happened, when and where it occurred, who was involved, and the response taken by the childcare staff. It’s a vital tool for communication between childcare providers and parents, and for documenting any necessary follow-up actions.

- Medication Administration Form: If a child requires medication while at the childcare center, this form ensures that the child receives the correct dosage at the right times. It includes information on the medication's name, dosage, administration times, and potential side effects. Parents sign this form to authorize the childcare staff to administer the medication, ensuring the child's well-being is maintained throughout the day.

Together, these documents create a framework that supports the effective management of childcare services. They ensure that every child's health, safety, and educational needs are met while under the care of the facility. Moreover, they provide a structured way for childcare providers to communicate with parents, share vital information, and maintain transparency in the services offered. Incorporating these documents alongside the Childcare Receipt form offers a comprehensive approach to childcare management, emphasizing care quality, safety, and communication.

Similar forms

A Rent Receipt: Similar to a childcare receipt, a rent receipt outlines payments made by a tenant to a landlord. This document itemizes specific details of the transaction, such as the date, amount paid, and period of rent covered, closely mirroring the structure found in a childcare receipt which notes the amount paid, service dates, and parties involved.

Invoice for Freelance Services: Freelancers typically use invoices to bill their clients, and these documents share several similarities with childcare receipts. Both identify the service provider and recipient, describe the service provided (be it childcare or a professional service), list the service period, and include the amount charged.

Service Agreement Contract: A service agreement contract outlines the terms under which services are provided and contains details on the service provider, recipient, services provided, and compensation, similar to information found in a childcare receipt. The key difference is the inclusion of more detailed terms and conditions in a service agreement.

Tuition Receipt: Issued by educational institutions, tuition receipts record payments made towards a student's education costs. These receipts detail the payment amount, recipient's name (or the student's name), and payment period, reflecting the structure of a childcare receipt, which also documents service fees, client details, and the service timeframe.

Medical Bill: Medical bills issued by healthcare providers to patients for services rendered share similarities with childcare receipts. Both detail the service provider's name, the recipient (or patient), the service period, and the amount charged. However, medical bills often include a more detailed breakdown of services.

Pet Sitting Invoice: Pet sitters may issue invoices for their services that resemble childcare receipts. These documents typically include the period of service, the pet owner's name (similar to the parent's or guardian's name on a childcare receipt), the pets cared for, and the amount charged for the service.

Gym Membership Receipt: A receipt for gym membership payments includes the member's name, the payment date, the membership period (similar to the service period in childcare receipts), and the amount paid. Both serve as proof of payment for services expected to be rendered over a specified timeframe.

Donation Receipt: Charities and nonprofit organizations issue donation receipts to acknowledge contributions. These receipts often list the donor's name, the donation date, and the amount given, akin to the structure of a childcare receipt documenting a transaction between service provider and client.

Event Ticket Purchase Receipt: When purchasing tickets for an event, buyers receive receipts listing the event date (comparable to the service period on a childcare receipt), the purchaser's name, the number of tickets bought, and the total cost, paralleled by the structure of a childcare receipt noting the service period, payer, and amount.

Auto Repair Bill: Auto repair shops issue bills detailing the services performed on a vehicle, the service dates, the vehicle owner's name, and the total charges. This format closely aligns with childcare receipts, which document the service period, client information, and service fees in a similar manner.

Dos and Don'ts

When filling out a Childcare Receipt form, it's important to approach the task with attention to detail and accuracy. Below are guidelines that can help ensure the process is done correctly and efficiently. Following these do's and don'ts will not only make the receipt valid and professional but also could safeguard against potential disputes or misunderstandings in the future.

Things You Should Do

- Double-check that all the dates are correct, including the date of the receipt, and the start and end dates for the childcare services provided. Accurate dates are crucial for maintaining clear records.

- Ensure the amount paid is written clearly and includes any relevant details like the period it covers or if it's partial or full payment. This transparency helps avoid any confusion.

- Print or write legibly when filling out the name of the child(ren) and the person from whom the payment was received. Clear information helps confirm who the services were provided for and who has made the payment.

- Provide detailed contact information of the provider, if space allows or on an attached document, including the phone number or email. This is critical for maintaining a line of communication.

- Sign the receipt to validate it. A provider's signature is a necessary component of the receipt, serving as proof of the transaction.

- Make copies of the completed receipt. Keeping a copy for yourself and giving one to the paying party ensures both have a record of the transaction.

Things You Shouldn't Do

- Don’t leave any sections blank. If a section doesn’t apply, write “N/A” (not applicable) instead of leaving it empty. Blank sections can lead to questions or concerns about the completeness of the receipt.

- Avoid guessing on dates or amounts. If uncertain, verify the details before entering them to prevent inaccuracies in your records.

- Do not use pencil or any erasable writing tool. This can lead to alterations or make the document appear less formal or official.

- Never lose your copy of the receipt. Keeping a well-organized file of all childcare receipt forms is essential for financial tracking and future reference.

- Refrain from writing in a rushed or careless manner. Errors or legibility issues can create misunderstandings or disputes down the line.

- Avoid omitting the provider's signature, as this acts as a personal verification of the transaction's authenticity and agreement to the terms.

Misconceptions

Many people have misconceptions about childcare receipts, which can lead to confusion or misunderstandings. Let's clarify some of these misconceptions.

Only formal childcare providers need to issue receipts. This is a common misconception. In reality, anyone who provides childcare services and receives payment for those services should provide a receipt, regardless of whether they are a licensed daycare center or a local teenager making some extra money by babysitting on weekends.

A childcare receipt only benefits the person paying for the service. While it's true that parents or guardians use these receipts to claim childcare expenses on their taxes, providers also benefit from issuing receipts. Maintaining accurate records can help providers track their income and expenses, simplifying their tax filings and financial management.

Any piece of paper can serve as a childcare receipt. Technically, while a childcare receipt can be written on any piece of paper, it must include specific information to be considered valid. This includes the date, amount paid, names of the child(ren), duration of services provided, and provider’s signature. A note scribbled on a napkin likely won't meet the necessary criteria for tax purposes or legal proof of payment.

Childcare receipts are only necessary for long-term care arrangements. Regardless of the duration, whether it's a single day or an entire year, a receipt should be issued for any payment for childcare services. This documentation is essential for both parties for tax reasons and to resolve any potential disputes about payments.

Digital receipts are not valid. In our increasingly digital world, digital receipts are just as valid as paper ones, provided they contain all required information. Many providers and recipients prefer digital receipts for their ease of storage and ability to be easily shared and reproduced if lost.

If payment was made in cash, a receipt isn't necessary. This is perhaps one of the most dangerous misconceptions. Regardless of the payment method, a receipt should be issued. Cash payments, without a paper trail, can lead to disputes or confusion about whether and when payment was made. A receipt provides clear evidence of the transaction for both provider and client.

Understanding the significance and requirements of childcare receipts ensures a smoother and more transparent relationship between providers and clients, reinforcing trust and accountability in childcare services.

Key takeaways

When filling out and using the Childcare Receipt form, several crucial points need careful attention to ensure accuracy and compliance. These key takeaways can help guide individuals through this process smoothly.

- Detail is paramount: Each field on the Childcare Receipt form must be completed with precise information. This includes filling out the date accurately, the exact amount paid (in dollars), the full name of the person making the payment, the child or children's names receiving care, the specific period the payment covers, and finally, securing the provider's signature. This detailed approach ensures clarity and accountability for both the provider and the service recipient.

- Legibility is essential: To maintain the document's validity and ensure it serves its purpose effectively, all information provided on the form must be legible. Whether the form is filled out by hand or electronically, the printed text should be clear enough to prevent any misunderstandings or disputes that could arise from illegible handwriting or print errors.

- Keep records: Both the childcare provider and the parent or guardian should keep a copy of each filled-out receipt. Maintaining these records is crucial for several reasons, including tax preparations, resolving any future disputes, and tracking the financial expenses associated with childcare over time.

- Tax implications: Childcare receipts play a significant role during tax season. They can provide essential proof of childcare expenses, which may be eligible for tax deductions or credits in many jurisdictions. Therefore, ensuring that each receipt is accurately filled out and securely stored is not just a matter of personal record-keeping but could also have notable financial implications during tax filing.

By following these guidelines, individuals can make sure they are using the Childcare Receipt form correctly and efficiently. This not only fosters a transparent financial relationship between childcare providers and families but also supports good financial and legal practices related to child care expenses.

Common PDF Forms

Printing Payroll Checks - Aids in explaining the complex process of salary computation, from gross earnings to net pay, including all deductions.

Prescription Bottle Label Requirements - Lists possible signs of an adverse reaction to the medication and instructs patients on immediate steps to take if they occur.