Free Citibank Direct Deposit PDF Form

In today’s fast-paced world, where convenience and efficiency reign supreme, the Citibank Direct Deposit form emerges as an essential tool for managing personal finances with ease. This form, designed for Citibank account holders, streamlines the process of depositing funds directly into a bank account, thereby eliminating the need for physical checks. It not only accelerates access to funds but also enhances security by minimizing the risk associated with lost or stolen checks. Ideal for a myriad of transactions, including salary, tax refunds, or government benefits, the Citibank Direct Deposit form requires accurate filling out to ensure successful processing. Understanding its components, from routing numbers to account information, becomes crucial. Moreover, its utilization cuts across a broad spectrum of individuals, from employees eager to receive their wages swiftly to retirees dependent on timely pension disbursements. Employers also find it beneficial, as it streamlines payroll management and reduces administrative burdens. Thus, navigating the intricacies of the Citibank Direct Deposit form holds the key to maximizing financial management and operational efficiency.

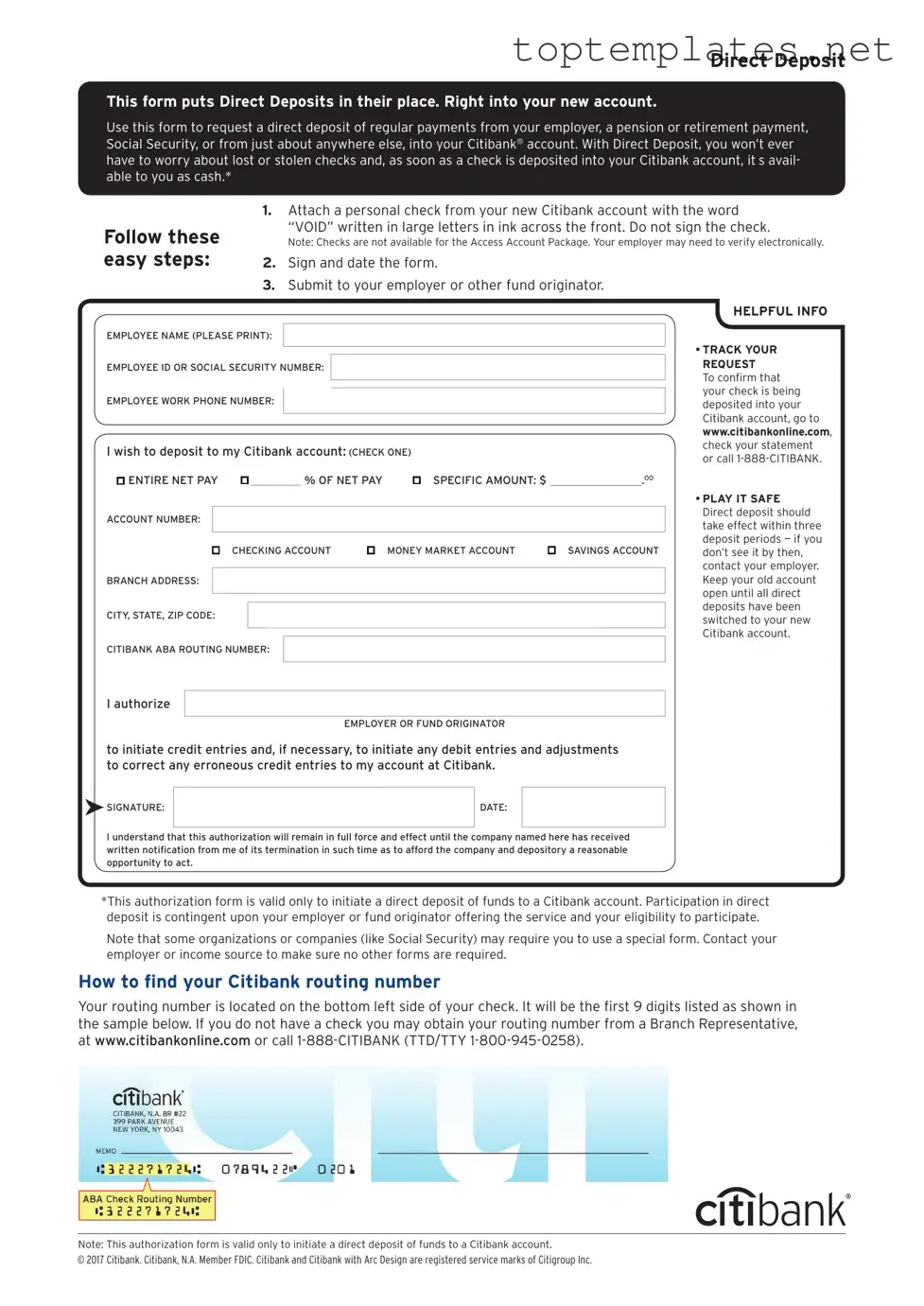

Sample - Citibank Direct Deposit Form

Direct Deposit

This form puts Direct Deposits in their place. Right into your new account.

Use this form to request a direct deposit of regular payments from your employer, a pension or retirement payment, Social Security, or from just about anywhere else, into your Citibank® account. With Direct Deposit, you won’t ever have to worry about lost or stolen checks and, as soon as a check is deposited into your Citibank account, it’s avail- able to you as cash.*

Follow these easy steps:

1.Attach a personal check from your new Citibank account with the word

“VOID” written in large letters in ink across the front. Do not sign the check.

Note: Checks are not available for the Access Account Package. Your employer may need to verify electronically.

2.Sign and date the form.

3.Submit to your employer or other fund originator.

HELPFUL INFO

EMPLOYEE NAME (PLEASE PRINT):

• TRACK YOUR

EMPLOYEE ID OR SOCIAL SECURITY NUMBER:

EMPLOYEE WORK PHONE NUMBER:

I wish to deposit to my Citibank account: (CHECK ONE)

ENTIRE NET PAY ı__________ % OF NET PAY |

ı SPECIFIC AMOUNT: $ ________________.OO |

ACCOUNT NUMBER:

ı CHECKING ACCOUNT |

ı MONEY MARKET ACCOUNT |

ı SAVINGS ACCOUNT |

BRANCH ADDRESS:

CITY, STATE, ZIP CODE:

CITIBANK ABA ROUTING NUMBER:

REQUEST

To confirm that your check is being deposited into your Citibank account, go to www.citibankonline.com, check your statement or call

•PLAY IT SAFE Direct deposit should take effect within three deposit periods — if you don’t see it by then, contact your employer. Keep your old account open until all direct deposits have been switched to your new Citibank account.

I authorize

EMPLOYER OR FUND ORIGINATOR

to initiate credit entries and, if necessary, to initiate any debit entries and adjustments to correct any erroneous credit entries to my account at Citibank.

SIGNATURE:

SIGNATURE:

DATE:

I understand that this authorization will remain in full force and effect until the company named here has received written notification from me of its termination in such time as to afford the company and depository a reasonable opportunity to act.

*This authorization form is valid only to initiate a direct deposit of funds to a Citibank account. Participation in direct deposit is contingent upon your employer or fund originator offering the service and your eligibility to participate.

Note that some organizations or companies (like Social Security) may require you to use a special form. Contact your employer or income source to make sure no other forms are required.

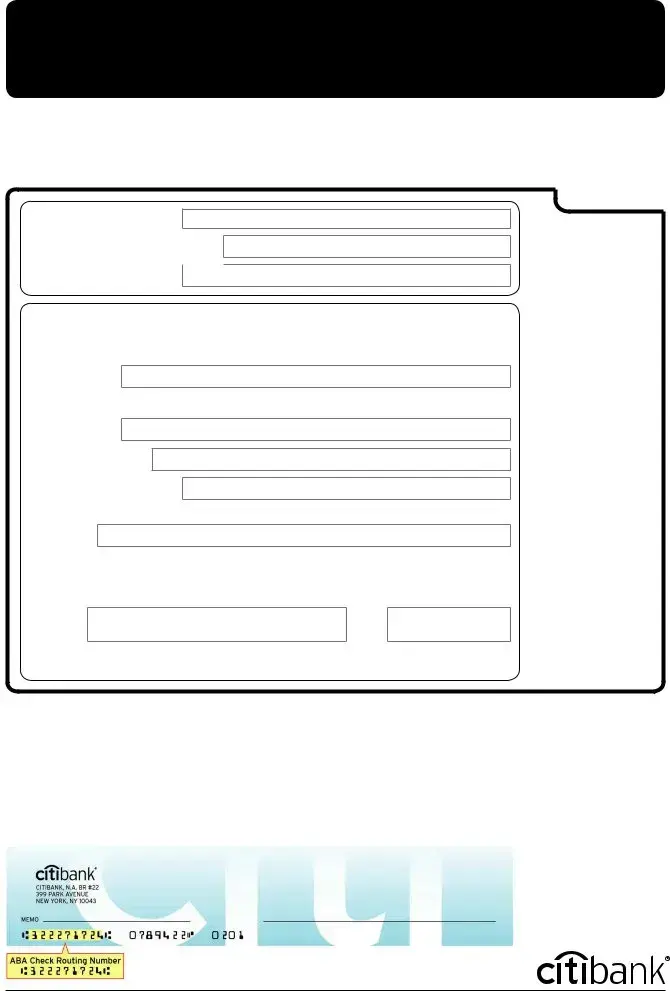

How to find your Citibank routing number

Your routing number is located on the bottom left side of your check. It will be the first 9 digits listed as shown in the sample below. If you do not have a check you may obtain your routing number from a Branch Representative, at www.citibankonline.com or call

Note: This authorization form is valid only to initiate a direct deposit of funds to a Citibank account.

© 2017 Citibank. Citibank, N.A. Member FDIC. Citibank and Citibank with Arc Design are registered service marks of Citigroup Inc.

File Specs

| Fact Name | Description |

|---|---|

| Form Purpose | The Citibank Direct Deposit form is used to set up automatic deposits of regular payments to a customer's account, such as salaries, dividends, and pensions. |

| Required Information | Customers must provide their account number, bank routing number, type of account (checking or savings), and employer or depositor information. |

| Processing Time | Once submitted, the setup for direct deposit may take up to two payroll cycles to become effective. |

| Governing Law | Direct deposit procedures are governed by federal laws and regulations, with state-specific rules applying in certain situations. |

Steps to Filling Out Citibank Direct Deposit

Filling out the Citibank Direct Deposit form is a straightforward process that enables employees to receive their paychecks directly in their bank accounts, eliminating the need for physical checks. This safe and efficient method ensures that your funds are available faster than traditional deposit methods. Before you begin, ensure you have your Citibank account number and routing number, along with your employer's name and address, readily available.

- Locate the section of the form titled 'Employee Information'. Enter your full name, address, and contact details in the specified fields.

- Under 'Account Information', provide your Citibank account number where you wish your paycheck to be deposited.

- Next, fill in Citibank's routing number. This nine-digit code identifies your bank location and is necessary for setting up direct deposit.

- In the 'Type of Account' section, indicate whether your account is a checking or savings account by checking the appropriate box.

- Some forms may request your employment information. If required, enter your employer’s name and address in the designated area.

- Review the form to ensure all the information provided is correct and complete.

- Sign and date the form in the designated area at the bottom to authorize the direct deposit request.

- Finally, submit the completed form to your employer's payroll or human resources department. They will process the form and initiate the direct deposit setup with Citibank.

After submitting the form, your employer and Citibank will take care of the rest. It may take one or two payroll cycles for the direct deposit to begin. Once it's set up, you will receive your paycheck automatically in your designated Citibank account, typically on your employer's regular pay date. You will also receive a notification from Citibank confirming the direct deposit setup. This modern banking convenience allows you to access your funds promptly and securely.

Discover More on Citibank Direct Deposit

What is the purpose of the Citibank Direct Deposit form?

The Citibank Direct Deposit form is used to set up an automatic deposit of regular payments from your employer, government agencies, or other sources directly into your Citibank account. This service ensures that your funds are available more quickly than with traditional deposit methods.

How can I get a Citibank Direct Deposit form?

You can obtain a Citibank Direct Deposit form by either downloading it from the Citibank website, requesting one from a Citibank branch, or contacting customer service to have the form mailed to you.

What information do I need to fill out the Citibank Direct Deposit form?

To complete the form, you’ll need your Citibank account number, the bank’s routing number, the type of account (checking or savings), and your personal information (name, address, and sometimes your Social Security Number). Additionally, you may need to provide employment information if the deposit is from your job.

Is there a fee to set up Direct Deposit into my Citibank account?

No, Citibank does not typically charge a fee for setting up or maintaining Direct Deposit into a Citibank account. It’s a free service provided to account holders.

How long does it take for Direct Deposit to start after submitting the form?

After submitting your Direct Deposit form, it can take one to two payroll cycles for your Direct Deposit to become active. The exact time frame can vary based on the entity making the deposits and their processing times.

Can I set up Direct Deposit into a savings account, or does it have to be a checking account?

Direct Deposit can typically be set up into either a checking or savings account. When completing your Citibank Direct Deposit form, just indicate which type of account you're using.

Is my information secure when setting up Direct Deposit?

Yes, Citibank takes the security of your personal and financial information very seriously. When you submit your Direct Deposit form, your information is processed securely to protect your privacy and financial assets.

What should I do if my Direct Deposit is not showing up in my account?

If your Direct Deposit does not appear in your account as expected, first verify with the issuing entity that the payment was processed. If it was, contact Citibank Customer Service for assistance in tracing the deposit. It’s helpful to have your deposit information and the date it was supposed to occur available when you call.

Can I split my Direct Deposit between multiple Citibank accounts?

Yes, in most cases, you can split your Direct Deposit between multiple Citibank accounts. You will need to specify the accounts and the amounts to be deposited into each on the Direct Deposit form, or set this up directly with your employer if they offer that option.

Common mistakes

-

Not verifying account numbers. One of the most prevalent errors is entering incorrect account numbers. Double-checking these numbers against your bank records can prevent funds from being misdirected.

-

Entering the wrong routing number. The routing number differentiates your bank from others. A mistake here could send your deposit to a different bank entirely.

-

Failing to choose between ‘Checking’ and ‘Savings.’ Selection of the account type is critical, as this directs where the money should go. It’s a simple yet frequently overlooked detail.

-

Omitting signatures when required. Some Direct Deposit forms require a signature for verification purposes. An unsigned form can delay processing.

-

Not updating personal information. If you’ve recently changed your address or phone number, ensure your Direct Deposit form reflects this. Updated information helps maintain clear communication.

-

Ignoring the account holder's name field. This should match the name on your bank account precisely. Variations or nicknames can create confusion and processing delays.

-

Misplacing the form. Once filled, the form needs to reach your employer or the party making the deposit. Delaying or forgetting to submit the form can postpone your Direct Deposit setup.

-

Forgetting to attach a voided check when necessary. Some organizations require a voided check to process Direct Deposits, as it provides verified banking information. Not attaching one can stall your application.

Below are additional pointers to consider:

- Review everything twice. A second look can catch mistakes you initially missed.

- Stay in communication with your HR department or payer. They can offer guidance and clarify requirements.

- Keep a copy of your submitted form. Having a record can be invaluable if there are disputes or delays.

By steering clear of these common errors and following the added advice, you can enhance the accuracy of your Citibank Direct Deposit setup, ensuring a smooth and efficient process.

Documents used along the form

When setting up direct deposit with Citibank, several other forms and documents may be needed to ensure a smooth and efficient process. These materials are designed to complement the Direct Deposit form, providing additional information or authorization that Citibank requires for successful account transactions. From verifying your identity to setting up proper tax withholdings, each document plays a critical role in managing your finances with Citibank.

- W-9 Form: This IRS form is used to provide your correct taxpayer identification number to Citibank, certifying that you are not subject to backup withholding taxes.

- Authorization Agreement for Preauthorized Payments (ACH Debit): This document allows for the automatic deduction of payments from your Citibank account, often used for bills or loan payments.

- Payroll Authorization Form: Given to your employer, this form notifies them of your intent to deposit your paycheck directly into your Citibank account.

- Personal Identification Verification (PIV): This could be a state-issued ID or passport required to confirm your identity when opening a new account or setting up direct deposit.

- Citibank Account Opening Form: Necessary for individuals who do not already have a Citibank account, this form gathers information to establish a new account.

- Voided Check: Often required to provide the bank routing and account number for setting up the direct deposit correctly.

- Employment Verification Letter: Some banks may require a letter from your employer verifying your employment as part of the direct deposit setup process.

- Deposit Slip: If the direct deposit is not for a paycheck, a deposit slip might be necessary to provide specific details about the deposit transaction.

- IRS Form 1040: For individuals who are self-employed, this tax return form may be required to verify income when setting up a direct deposit account.

Together, these forms and documents support the direct deposit process, from initiation to completion, ensuring that both Citibank and the account holder have all necessary information for accurate and prompt transactions. It's important for individuals to check with Citibank directly, as requirements can vary based on the account type and specific customer needs.

Similar forms

Bank Account Authorization Form: This form authorizes the setup of automatic payments from or deposits into a bank account, similar to how the Direct Deposit form authorizes automatic deposits of one's paycheck into their account.

ACH Credit Authorization Form: Used for authorizing automatic deposits into an account through the Automated Clearing House network, it closely resembles the Direct Deposit form in its purpose of facilitating electronic payments.

Payroll Direct Deposit Enrollment Form: Specific to setting up payroll deposits, this document also collects employee banking information to direct their earnings into their bank account, akin to the process specified in a Citibank Direct Deposit form.

Employer Direct Deposit Form: Often provided by an employer to initiate direct deposits of paychecks, this form shares the goal with a Citibank Direct Deposit form of transferring funds electronically to an employee’s account.

Government Benefits Direct Deposit Enrollment Form: Used to sign up for direct deposit of government benefits like Social Security, it serves a similar role in ensuring recipients receive their benefits in their bank accounts efficiently.

Electronic Funds Transfer (EFT) Authorization Form: This document authorizes the transfer of funds between accounts electronically, embodying the principle of direct deposits by facilitating these transactions without physical checks.

Vendor Direct Deposit Authorization Form: Designed for businesses opting to receive payments from customers or clients directly into their bank accounts, it parallels the Citibank Direct Deposit form in easing the flow of funds electronically.

Tax Refund Direct Deposit Form: Filed to receive tax refunds directly into a bank account, it mirrors the convenience and efficiency touted by direct deposit forms for receiving different types of payments or income.

Automatic Bill Payment Authorization Form: While focused on outgoing payments from an account for bills, it shares with the Citibank Direct Deposit form the essence of using bank account details to automate financial transactions.

Rental Direct Deposit Authorization Form: Utilized by tenants to have rent payments automatically withdrawn from their account, though it involves outgoing payments, the mechanism of setting up the transaction is akin to that for receiving funds via direct deposit.

Dos and Don'ts

When managing your finances, ensuring that all forms, including the Citibank Direct Deposit form, are filled out correctly is crucial. To assist with this, here is a list of things you should and should not do:

Do:Verify your account number and routing number. These are essential for accurate processing.

Use a pen with black or blue ink for clear legibility.

Write neatly and within the designated spaces to prevent any confusion.

Double-check the form for any mistakes before submitting it.

Keep a copy of the completed form for your records.

Use a pencil or any erasable ink, as these can be altered, leading to possible fraud or processing errors.

Sign without reading and understanding the terms and conditions associated with direct deposit.

Leave any fields blank. If a section does not apply, mark it with "N/A" to indicate it has been reviewed.

Forget to notify your employer or the issuing party of the direct deposit setup. They need this information to initiate the deposit.

Ignore the importance of updating your information if your banking details change.

Misconceptions

When it comes to managing your finances, direct deposit is a convenient option. However, there are several misconceptions about the Citibank Direct Deposit form that might cause some confusion. Let’s clear up some of these misunderstandings:

- Anyone Can Set It Up Instantly: It's commonly thought that setting up direct deposit with Citibank – or any bank, for that matter – is an instant process. In reality, it may take a few days for the setup to be completed. This delay allows for the verification of the account details entered on the form.

- Direct Deposit Is Only for Paychecks: Many believe that direct deposits are limited to paychecks. This isn’t true. Direct deposit can be used for various payments including tax refunds, social security benefits, and more.

- A New Form Is Needed for Each Deposit: Some users think they need to fill out a new form for every deposit. However, once you set up direct deposit, subsequent deposits from the same source require no additional paperwork.

- You Can’t Split Your Deposit: There’s a myth that your entire paycheck must go into one account. Citibank allows you to split your deposit among different accounts, making it easier to manage your finances.

- It’s Unsafe: Concerns about safety are common. It's important to note that direct deposit is actually safer than receiving physical checks, as it reduces the risk of lost or stolen checks.

- Only U.S. Citizens Can Use Direct Deposit: This is inaccurate. While certain restrictions may apply, non-U.S. citizens who have a Citibank account can also set up direct deposit.

- Employers Have Access to Your Account: A common worry is that setting up direct deposit gives your employer access to your bank account. In fact, employers only have the ability to deposit money, not withdraw it.

- There’s a Fee to Set Up Direct Deposit: Many people erroneously believe there’s a fee involved in setting up direct deposit. Citibank does not charge a fee for initiating a direct deposit.

- Direct Deposit Works with Any Bank Account: Some think that you can set up direct deposit into any account worldwide. However, certain restrictions apply, and not all international bank accounts may be eligible for direct deposits from Citibank.

Understanding these misconceptions helps ensure a smoother, more informed approach to managing direct deposits with Citibank. It’s all about making your financial life a bit easier and more secure.

Key takeaways

When filling out and using the Citibank Direct Deposit form, individuals and employers can ensure the accurate and efficient processing of payroll, government benefits, or other direct deposit payments. Below are key takeaways to assist in successfully completing and submitting the form:

- It is important to provide accurate account information, including the account holder's name, Citibank account number, and the bank's routing number to prevent any delays or errors in deposit transactions.

- Employers or payers need the authorization of the account holder, usually provided through a signed Direct Deposit form, to initiate the deposit of funds into the specified Citibank account.

- For a smooth process, individuals should verify their Citibank account type (checking or savings) to ensure the direct deposit is routed to the correct account type.

- Attaching a voided check or deposit slip, if requested on the form, can help verify the account details provided and facilitate the accurate setup of direct deposits.

- Changes in account details or the desire to redirect deposits to a different account require submitting a new Direct Deposit form to avoid transaction errors.

- Reviewing the form for completeness and accuracy before submission is crucial, as missing or incorrect information can lead to processing delays or the misrouting of funds.

By paying attention to these details, individuals and employers can utilize the Citibank Direct Deposit service effectively, ensuring timely and correct deposit transactions.

Common PDF Forms

Credit Application Template - Ensures that credit applications are evaluated based on standardized criteria, promoting fairness in the lending process.

Aaa Repair Cost Estimator - Designed to help car owners understand the scope of repair work, including estimated time and associated costs.

Esa Papers - A legally recognized letter that highlights the significance of an animal's emotional support for its owner.