Valid Closing Date Extension Addendum Form Template

When parties involved in a real estate transaction agree to extend the closing date, the Closing Date Extension Addendum Form becomes an essential document. This form acts as an amendment to the original purchase agreement, clearly documenting the mutual decision to revise the timeline for the closing. The primary purpose of this document is to provide a formal mechanism for extending the closing date, which can be necessary for a variety of reasons, including financing delays, title issues, or unexpected circumstances that impede the ability to close on the originally agreed-upon date. The form not only helps to avoid misunderstandings by ensuring both buyer and seller are on the same page but also serves to protect the interests of both parties by legally documenting the agreement to extend the timeline. Using the Closing Date Extension Addendum Form, therefore, ensures that the transaction remains on track, albeit on a revised schedule, allowing both parties more time to fulfill their respective obligations under the purchase agreement.

Sample - Closing Date Extension Addendum Form Form

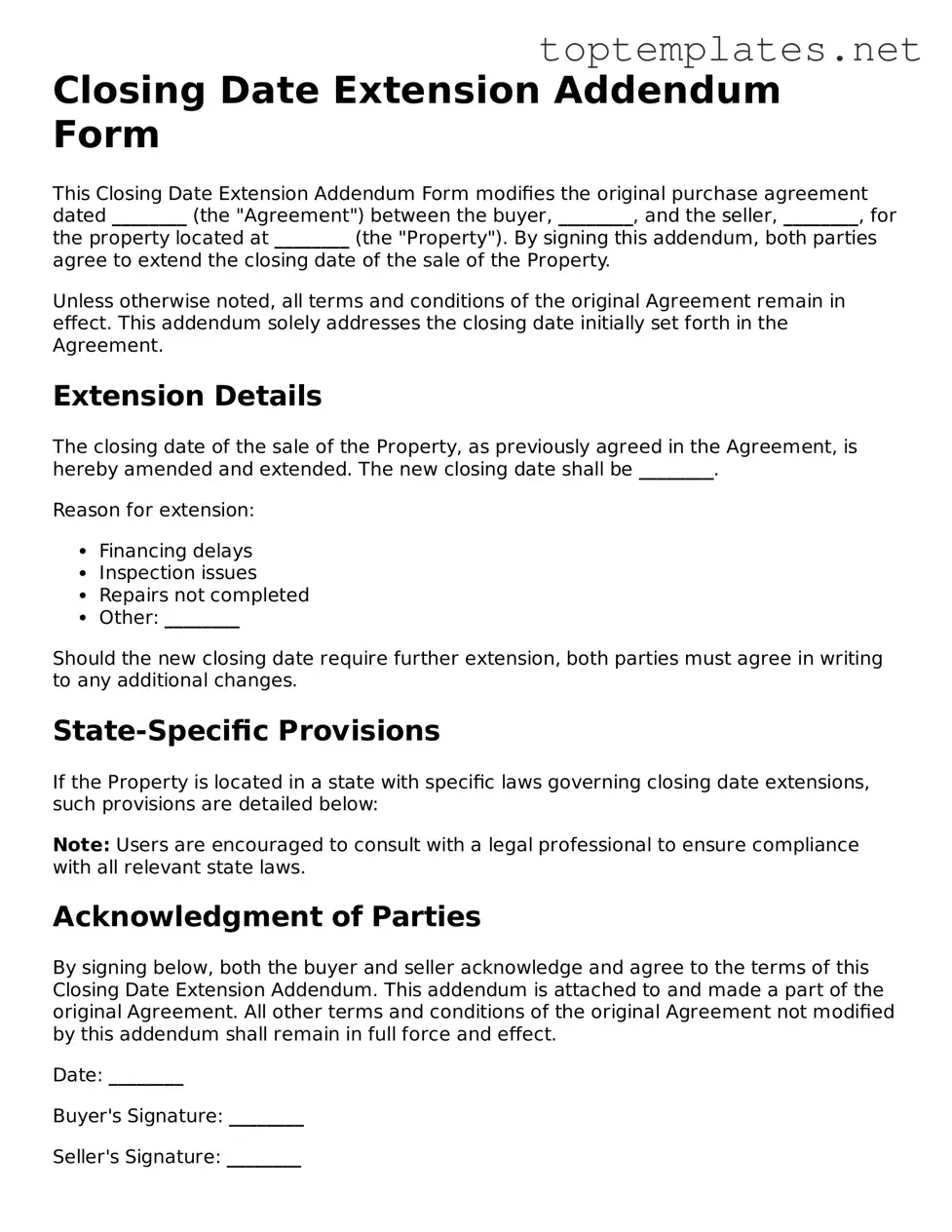

Closing Date Extension Addendum Form

This Closing Date Extension Addendum Form modifies the original purchase agreement dated ________ (the "Agreement") between the buyer, ________, and the seller, ________, for the property located at ________ (the "Property"). By signing this addendum, both parties agree to extend the closing date of the sale of the Property.

Unless otherwise noted, all terms and conditions of the original Agreement remain in effect. This addendum solely addresses the closing date initially set forth in the Agreement.

Extension Details

The closing date of the sale of the Property, as previously agreed in the Agreement, is hereby amended and extended. The new closing date shall be ________.

Reason for extension:

- Financing delays

- Inspection issues

- Repairs not completed

- Other: ________

Should the new closing date require further extension, both parties must agree in writing to any additional changes.

State-Specific Provisions

If the Property is located in a state with specific laws governing closing date extensions, such provisions are detailed below:

Note: Users are encouraged to consult with a legal professional to ensure compliance with all relevant state laws.

Acknowledgment of Parties

By signing below, both the buyer and seller acknowledge and agree to the terms of this Closing Date Extension Addendum. This addendum is attached to and made a part of the original Agreement. All other terms and conditions of the original Agreement not modified by this addendum shall remain in full force and effect.

Date: ________

Buyer's Signature: ________

Seller's Signature: ________

State of ________

This form is not a legal document. For legal advice regarding your situation, please consult a licensed attorney.

File Breakdown

| Fact Number | Description |

|---|---|

| 1 | The Closing Date Extension Addendum Form is used when both parties involved in a property transaction agree to extend the closing date beyond the one originally agreed upon in the sales contract. |

| 2 | This form must be signed by both the buyer and the seller to be considered valid and enforceable. |

| 3 | It outlines the new agreed-upon closing date and any conditions that must be met prior to this new date. |

| 4 | Using the form helps to avoid misunderstanding and provides a written record of the agreement to extend the closing date, which can be beneficial for both parties. |

| 5 | State-specific laws may govern the execution and enforceability of the Closing Date Extension Addendum Form, so it is crucial to consult with a real estate professional or legal advisor. |

| 6 | In some states, real estate laws require that any changes to a purchase agreement, including extending the closing date, must be done in writing, making this form a necessity for compliance. |

| 7 | Failure to properly execute a Closing Date Extension Addendum could result in a breach of contract and potential legal repercussions for the party that fails to adhere to the agreed-upon terms. |

Steps to Filling Out Closing Date Extension Addendum Form

Once both parties involved in a real estate transaction agree to extend the closing date, the Closing Date Extension Addendum Form becomes a necessary document. This addendum allows for a new closing date to be officially recognized, ensuring that all parties are on the same page regarding the extended timeline. The process of filling out this form is crucial for maintaining the legality and validity of the agreement. The following steps guide you through the correct completion of the form, ensuring accuracy and compliance with relevant laws and regulations.

- Start by entering the date at the top of the form. This is the current date when you are filling out the addendum.

- Write the full names of both the buyer and the seller as they appear in the original real estate purchase agreement.

- Include the address of the property in question. This should match the address as listed in the original agreement.

- Specify the original closing date as agreed upon in the initial contract.

- Enter the new agreed-upon closing date. This date must be agreed upon by both parties before filling out the form.

- Both the buyer and the seller should read the agreement carefully. It includes terms and conditions related to the extension of the closing date.

- Have both parties sign and date the form. These signatures legally bind the addendum to the original purchase agreement.

- If applicable, have your real estate agent and/or lawyer review the completed form to ensure it meets all legal requirements and accurately reflects the agreement between the buyer and seller.

Once the form is fully completed and signed, it should be attached to the original purchase agreement. Both parties should keep a copy for their records. The process of extending the closing date is then considered legally documented, allowing for the new timeline to be officially recognized. This addendum not only provides clarity and prevents misunderstandings but also ensures that the agreement remains enforceable under law.

Discover More on Closing Date Extension Addendum Form

What is a Closing Date Extension Addendum Form?

A Closing Date Extension Addendum Form is a legal document used when the parties involved in a property transaction agree to extend the closing date originally set in their purchase agreement. This form serves as an official amendment to the original contract, noting the new agreed-upon closing date. It's important to have this agreement in writing to avoid any misunderstandings or legal complications.

Why would I need to extend the closing date?

Several reasons might necessitate the extension of the closing date, such as delays in mortgage approval, the need for additional time to clear title issues, unexpected repairs identified during the final walk-through, or other unforeseen circumstances. Extending the closing date allows both the buyer and the seller to address these issues properly without breaching the original contract.

How do you officially extend the closing date?

To officially extend the closing date, both the buyer and the seller must agree to the new date and signify this agreement by signing the Closing Date Extension Addendum Form. This form should detail the original closing date, the new closing date, and any other relevant modifications to the original agreement. Once signed, it becomes a part of the original contract, legally binding both parties to the new timeline.

What happens if we don't sign a Closing Date Extension Addendum?

If a Closing Date Extension Addendum is not signed but both parties wish to proceed with the extension, the transaction may enter a legal gray area where the original closing date is still in effect. Without a formal extension, the seller might have the right to cancel the contract or keep the buyer's deposit if the closing does not occur by the originally specified date. Official documentation prevents such complications and provides a clear, agreed-upon path forward.

Can the closing date be shortened with an addendum?

Yes, an addendum can also be used to shorten the closing date if both the buyer and the seller agree. Similar to extending the closing date, this adjustment would require the preparation of a new addendum specifying the new, earlier closing date. Both parties must sign this document for the change to be officially recognized and legally binding.

Common mistakes

When dealing with the intricate process of real estate transactions, the Closing Date Extension Addendum Form plays a critical role. This document, crucial for extending the original closing date agreed upon in the real estate contract, requires meticulous attention. Often, individuals encounter mistakes that can hinder the process, complicating what should be a straightforward step towards finalizing the property transfer. Recognizing these errors is the first step toward ensuring a smoother transaction.

Not clearly stating the new closing date: One common mistake is failing to specify the new closing date clearly. This ambiguity can lead to misunderstandings between the parties involved, potentially leading to further delays or complications in the transaction process.

Omitting original closing date: Another error includes not mentioning the original closing date. For clarity and legal integrity, it's crucial to reference the initial agreed-upon date before introducing any amendments, ensuring all parties are aligned with the timeline adjustments.

Incorrectly identifying the parties: Incorrect or incomplete identification of the property buyer and seller in the document can invalidate the addendum. Correct and full legal names should be used to avoid doubts about the document's legitimacy and applicability.

Failing to obtain necessary signatures: An often overlooked yet critical mistake is not securing signatures from all necessary parties involved in the transaction. The addendum requires the consent of all parties to be legally binding and enforceable.

Lack of specificity regarding changes: Being vague about the terms of the extension can lead to disputes. It’s crucial to specify whether other conditions of the sale remain unchanged or if additional adjustments accompany the closing date extension.

Overlooking state-specific requirements: Each state may have unique requirements or forms for extending the closing date on a real estate transaction. Neglecting these details can result in the addendum being non-compliant with state real estate laws, potentially invalidating the extension.

To maximize the efficacy of the Closing Date Extension Addendum, one should approach this document with the same level of attention and precision as the original real estate contract. A well-prepared addendum avoids these common pitfalls, streamlining the path to a successful closing. Attention to detail ensures that all parties move forward with a clear understanding of the new timelines and expectations, preventing avoidable delays and fostering a smooth transition to property ownership.

Documents used along the form

In real estate transactions, the Closing Date Extension Addendum form is commonly utilized to modify the original closing date stipulated in the purchase agreement. This adjustment may be necessary due to various reasons such as financing delays, inspection issues, or other unforeseen circumstances. Accompanying this form, there are several other documents and forms that parties might need to use to ensure a smooth transaction process. Below is a list of documents often used alongside the Closing Date Extension Addendum form, each described briefly for better understanding.

- Amendment to the Purchase Agreement: This document is used when parties need to make changes to the original purchase agreement besides the closing date. These changes could include modifications to the sales price, repairs, or other terms of the agreement.

- Contingency Removal Form: This form officially documents the removal of contingencies outlined in the purchase agreement, such as financing or inspection contingencies, indicating that these conditions have been met to proceed with the sale.

- Title Insurance Commitment: This outlines the terms under which the title insurance company agrees to insure the title. It is an essential document for identifying any potential issues with the title that need resolution before closing.

- Final Closing Disclosure: This form provides the final details of the mortgage loan, if applicable. It outlines the loan terms, projected monthly payments, and closing costs. Buyers must receive this form at least three days before closing.

- Home Inspection Report: A comprehensive report detailing the condition of the property, including any defects or issues that need attention. This document is crucial for negotiations following the inspection period.

- Appraisal Report: This assessed the property's value to ensure it meets or exceeds the agreed purchasing price. Lenders typically require this document before finalizing the mortgage loan.

- Loan Approval Letter: A letter from the lender confirming the buyer's approval for the loan. It includes the amount of the loan, the approved interest rate, and other terms of the loan.

- Property Insurance Proof: Document that proves the buyer has secured property insurance, which is a requirement before closing to protect against losses from unforeseen events.

- Escrow Instructions: Detailed instructions for the escrow agent or company, outlining the requirements and processes for holding and distributing funds in the transaction.

- HOA Documents: For properties in a homeowners' association (HOA), these documents provide the rules, regulations, and financial health of the HOA. They are crucial for the buyer to review before closing.

These documents play critical roles in supporting the real estate transaction, addressing various aspects from financing to property condition, and ensuring all parties meet their obligations. They help provide a smooth path to adjusting the closing date when needed, as well as facilitate a successful, legally compliant property transfer. When any of these documents are employed in conjunction with the Closing Date Extension Addendum form, they contribute to a well-organized and thorough approach to real estate transactions.

Similar forms

Amendment to Sales Contract: This document, like the Closing Date Extension Addendum, modifies the terms of an existing agreement. Specifically, it can adjust various conditions or clauses within the sales contract, not limited to just the closing date.

Lease Extension Agreement: Similar to the Closing Date Extension Addendum in purpose, this document extends the term of a lease beyond its original end date. It shows how parties can mutually agree to continue their relationship under previously determined conditions, with modifications pertaining to the time frame.

Loan Modification Agreement: While focusing on loans, this document parallels the Closing Date Extension Addendum because it revises the terms of an existing loan agreement. It might extend the loan's maturity date, which is somewhat akin to extending the closing date in a real estate transaction.

Contingency Removal Form: This form is used in real estate transactions to remove contingencies that were previously agreed upon in the purchase agreement. It's similar to the Closing Date Extension Addendum in that both can be pivotal in moving a transaction forward to closing.

Inspection Objection Notice: Although primarily used for highlighting issues uncovered during a property inspection that buyers want addressed, it's similar in its function of negotiating terms after the initial agreement. This process can sometimes lead to a need for extending the closing date.

Property Disclosure Statement: While this document primarily informs the buyer of known defects or issues with the property, its similarity lies in the timing of its use. Discoveries within this statement can lead to renegotiations of terms, including the closing date, requiring an addendum or extension form.

Final Walk-Through Checklist: This checklist is used shortly before closing to ensure all conditions of the sale are met. Though its purpose is different, the outcomes can affect the closing date, potentially necessitating an extension if issues are found that need to be resolved.

Mortgage Commitment Letter: It is a lender’s promise to grant a loan under specific terms. Similarities to the Closing Date Extension Addendum include circumstances where financial arrangements might delay the closing process, requiring adjustments to the original closing date.

Escrow Agreement: This agreement outlines the holding and distribution of funds by a third party during the transaction. Related to the Closing Date Extension Addendum, both involve procedural arrangements essential for the completion of a real estate transaction, and adjustments in one can necessitate modifications in the other.

Dos and Don'ts

When navigating the process of completing the Closing Date Extension Addendum, certain practices can make the process smoother and more effective, while others can introduce complications or misunderstandings. To ensure that you fill out this form accurately and with due diligence, here are essential dos and don'ts to consider:

Do:- Review the original agreement: Before filling out the addendum, thoroughly review the original purchase agreement to understand the previously agreed-upon closing date and terms. This ensures consistency and accuracy when proposing a new closing date.

- Be specific about dates: Clearly specify the new requested closing date. Ambiguity can lead to misunderstandings or further delays, so it’s important to state the exact date clearly.

- Provide a valid reason: Include a valid and understandable reason for the extension request. This helps all parties involved to assess the situation fairly and make informed decisions.

- Ensure all parties sign the addendum: An addendum is only legally binding if it is signed by all parties involved in the original agreement. Make sure that everyone agrees to the new terms and signs the document accordingly.

- Consult with a professional: Whenever possible, consult with a real estate attorney or a knowledgeable professional to ensure that the addendum meets all legal requirements and is in your best interest.

- Alter the original agreement: The addendum should only extend the closing date and not modify any other terms of the original agreement unless explicitly agreed upon by all parties.

- Submit without proofreading: Simple mistakes or typos can cause significant issues. Always proofread the addendum carefully before submitting it to ensure all information is accurate and complete.

- Forget to include necessary documentation: If the extension request is due to specific reasons like financing delays or inspection issues, attach relevant documentation to support the request.

- Leave any blank spaces: Ensure that no parts of the form are left blank. If a section does not apply, mark it as "N/A" (not applicable) to indicate that it was not overlooked.

- Ignore local and state laws: Real estate laws can vary significantly by location. Always ensure that the addendum complies with local and state regulations to avoid legal complications.

Misconceptions

In real estate transactions, the Closing Date Extension Addendum Form plays a crucial role when parties agree to amend the original closing date specified in their purchase agreement. However, several misconceptions surround its purpose and implications. Understanding these common fallacies can prevent misunderstandings and ensure smoother transaction processes.

- Misconception #1: Automatic Approval

Many believe that the submission of a Closing Date Extension Addendum automatically extends the closing date. In reality, both parties—the buyer and the seller—must mutually agree to the new date, and their signatures are required to make the amendment official.

- Misconception #2: Unlimited Extensions

Another misunderstanding is the belief that parties can extend the closing date indefinitely. However, extensions are subject to the willingness of both parties to agree to new terms, and in some cases, lenders may have policies limiting the duration of extensions.

- Misconception #3: No Impact on Financing

It's often assumed that extending the closing date has no effect on financing. Contrary to this belief, changes in the closing date can impact loan commitments. Lenders’ offers are time-sensitive, and a prolonged extension could lead to the need for re-approval, potentially under different terms.

- Misconception #4: Extension Requests Require No Justification

Many parties think that they don't need to provide a reason for requesting an extension. While the form itself may not require a detailed justification, providing a reason can facilitate negotiations and demonstrate good faith, especially if unforeseen circumstances arise.

- Misconception #5: The Same Form Works for All Transactions

There's a common belief that one standard Closing Date Extension Addendum can be used for all real estate transactions. In reality, different states may have variations of the form or require specific addenda, emphasizing the importance of consulting legal or real estate professionals familiar with local requirements.

- Misconception #6: No Legal Consequences

Failing to understand the legal implications of the Closing Date Extension Addendum is a significant oversight. This document legally amends the purchase agreement; thus, not adhering to its terms can lead to breaches of contract with potential legal and financial consequences.

It's essential for buyers, sellers, and their agents to approach the amendment process with careful consideration and a clear understanding of these misconceptions. Doing so can help ensure a successful and smooth transition to closing.

Key takeaways

When it comes to managing real estate transactions, flexibility is often required as unexpected circumstances can arise. One document that provides such flexibility is the Closing Date Extension Addendum Form. Used to amend an existing agreement, this form extends the closing date initially set between the buyer and seller. Below are key takeaways important for anyone considering or needing to fill out and use this form:

- Understanding the purpose: The Closing Date Extension Addendum is specifically designed to provide a new closing date for a real estate transaction, replacing the original date agreed upon in the purchase agreement.

- Consent is required: Both parties involved in the transaction, the buyer and the seller, must agree to the new closing date and signify their agreement by signing the addendum.

- Legal binding: Like the original purchase agreement, once signed by both parties, the Closing Date Extension Addendum becomes a legally binding document, and both parties are obligated to adhere to the terms.

- Clarification of terms: The addendum should clearly outline the new closing date and reaffirm that all other terms of the original purchase agreement remain unchanged, unless otherwise specified.

- Reasons for extension: While the form itself may not require parties to state the reason for the extension, it’s essential for both parties to discuss and understand the cause—be it financial issues, title problems, necessary repairs, or other due diligence matters.

- Impact on financing: Buyers should be aware that extending the closing date might affect their mortgage commitment. It’s crucial to communicate with lenders to ensure financing will not be jeopardized.

- Recording specifics: The addendum should document specific details, such as the parties involved, the property in question, and the original purchase agreement date, for clarity and legal accuracy.

- Modification limits: It’s important to recognize that this addendum specifically addresses the closing date. Any other modifications to the purchase agreement require a separate addendum or legal document.

- Additional costs: The extension of the closing date may involve additional costs, such as extended rate locks for mortgages or additional legal fees. These should be considered and discussed by the parties.

- Professional advice: Given the legal implications of modifying a real estate transaction, seeking advice from real estate professionals or legal counsel before finalizing an extension is advised.

Accurately completing and effectively using the Closing Date Extension Addendum Form can alleviate potential stress and misunderstanding in real estate transactions. By paying careful attention to these key takeaways, parties can navigate the extension process more smoothly and ensure the continued legality and efficacy of their agreement.

Consider Other Documents

Shared Well Agreement Example - A contract to manage a shared well's operation and maintenance, solidifying how costs and responsibilities are divided.

Printing Payroll Checks - Formalizes the income details of an employee, setting out the gross pay, applicable deductions, and net salary.