Valid Deed Template

When individuals or entities look to transfer property ownership, a critical document known as the "Deed" plays a central role in this process. This specific form, vital for the conveyance of real estate, comes in various types, each tailored to suit different circumstances and requirements. Its primary function is to legally formalize the transfer of property rights from one party to another, ensuring clarity and protection for all involved. Beyond its fundamental role, the contents of a deed form include essential information such as the identities of both the grantor and grantee, a clear description of the property, and any conditions or warranties associated with the transaction. Understandably, this document is meticulously crafted to ensure compliance with state laws, as these regulations can vary significantly across jurisdictions, affecting how property transactions are conducted. Given its legal importance, the drafting, execution, and recording of a deed must be approached with careful consideration, often necessitating professional guidance to navigate the intricacies of real estate law effectively.

Sample - Deed Form

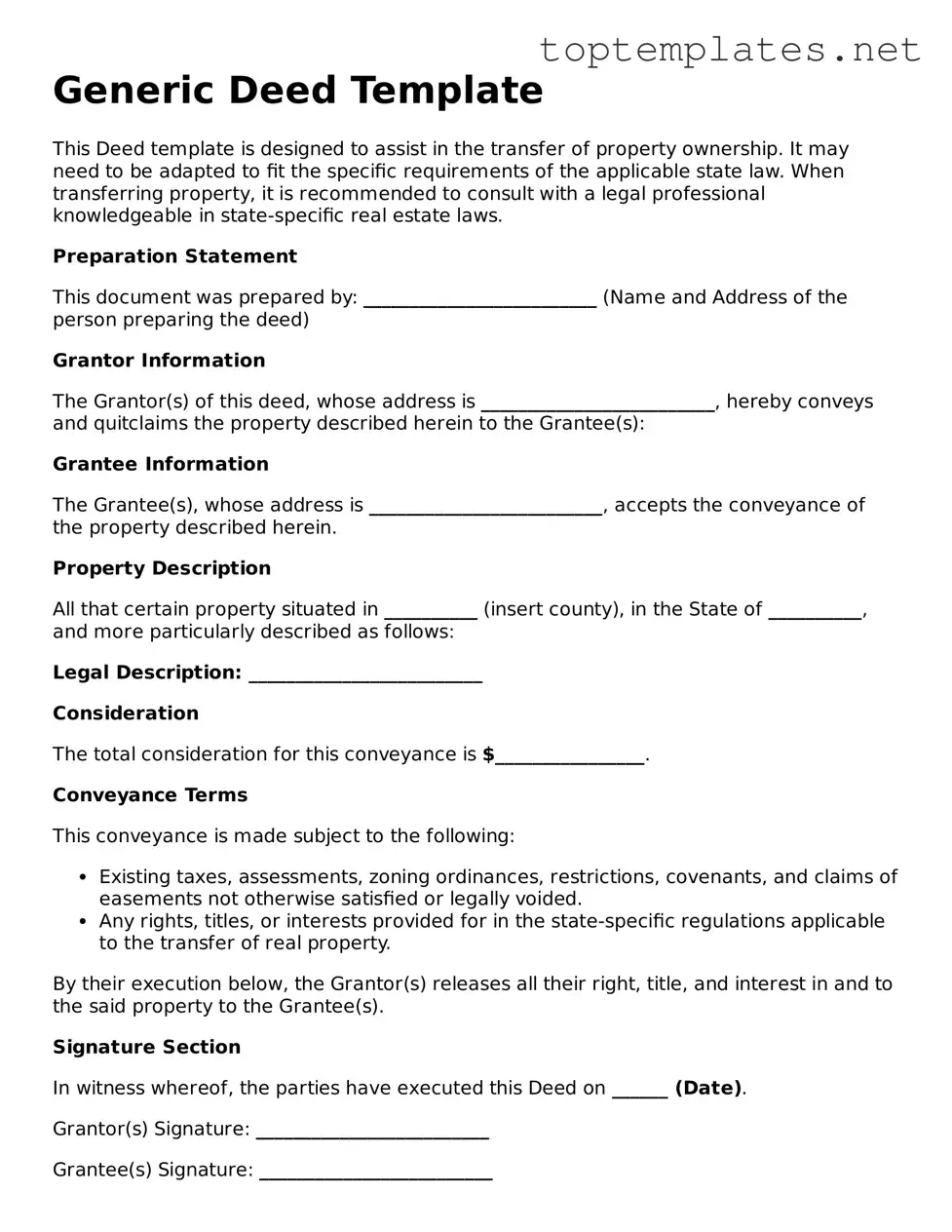

Generic Deed Template

This Deed template is designed to assist in the transfer of property ownership. It may need to be adapted to fit the specific requirements of the applicable state law. When transferring property, it is recommended to consult with a legal professional knowledgeable in state-specific real estate laws.

Preparation Statement

This document was prepared by: _________________________ (Name and Address of the person preparing the deed)

Grantor Information

The Grantor(s) of this deed, whose address is _________________________, hereby conveys and quitclaims the property described herein to the Grantee(s):

Grantee Information

The Grantee(s), whose address is _________________________, accepts the conveyance of the property described herein.

Property Description

All that certain property situated in __________ (insert county), in the State of __________, and more particularly described as follows:

Legal Description: _________________________

Consideration

The total consideration for this conveyance is $________________.

Conveyance Terms

This conveyance is made subject to the following:

- Existing taxes, assessments, zoning ordinances, restrictions, covenants, and claims of easements not otherwise satisfied or legally voided.

- Any rights, titles, or interests provided for in the state-specific regulations applicable to the transfer of real property.

By their execution below, the Grantor(s) releases all their right, title, and interest in and to the said property to the Grantee(s).

Signature Section

In witness whereof, the parties have executed this Deed on ______ (Date).

Grantor(s) Signature: _________________________

Grantee(s) Signature: _________________________

Acknowledgment by Notary Public

State of ________________

County of ________________

On ____ before me, _______________________ (Notary Public Name), personally appeared _______________________, who proved to me on the basis of satisfactory evidence to be the person(s) whose name(s) is/are subscribed to the within instrument, and acknowledged to me that he/she/they executed the same in his/her/their authorized capacity(ies), and that by his/her/their signature(s) on the instrument, the person(s), or the entity upon behalf of which the person(s) acted, executed the instrument.

Witness my hand and official seal.

Signature of Notary Public: _________________________

Seal of Notary:

File Breakdown

| Fact Name | Description |

|---|---|

| Purpose of a Deed | A legal document that transfers property ownership from one person to another. |

| Types of Deeds | Common types include Warranty, Special Warranty, and Quitclaim Deeds. |

| Key Components | Includes grantor and grantee details, legal description of the property, and the signature of the grantor. |

| Recording | Must be filed with the local government, typically the county recorder, to be legally enforceable. |

| Governing Law | Varies by state but generally governed by state statutes concerning property transfers. |

| State-Specific Forms | Different states may require specific forms or clauses to be included in a deed. |

| Necessity for Legal Description | A precise, legal description of the property is necessary for accurate identification and transfer. |

| Importance of Accuracy | Errors in a deed can lead to disputes or a cloud on the title, making future transactions difficult. |

Steps to Filling Out Deed

Filling out a deed form is a critical step in the process of transferring property ownership. This document, once completed and recorded, legally transfers the title of a property from the seller to the buyer. The following steps have been outlined to ensure the deed form is filled accurately and completely, ensuring a smooth transition of ownership.

- Start by entering the date of the deed at the top of the form. This should be the date when the deed is being executed.

- Write the full legal name of the grantor(s) (the current owner or seller) and their mailing address in the designated section.

- Enter the full legal name of the grantee(s) (the new owner or buyer) and their mailing address in the specified area.

- Provide a complete legal description of the property being transferred. This information can be found on the current deed, a property tax bill, or by contacting the local assessor's office.

- Include the consideration being given for the property. This is usually the purchase price but can also be other forms of compensation.

- If required, insert any specific clauses or conditions under which the property is being transferred. These could relate to rights of way, easements, or restrictions.

- Have the grantor(s) sign and date the deed in the presence of a notary public. The notary must then acknowledge the deed with their official seal and signature.

- Check if witness signatures are required in your jurisdiction, and if so, ensure the deed is also signed by the appropriate number of witnesses.

- File the completed deed with the local county recorder's or land registry office to make the transfer public record. There may be a filing fee associated with this step.

Completing the deed form carefully and accurately is essential to the property transfer process. Once these steps are fulfilled and the document is officially recorded, the transfer of ownership is legally recognized. Taking the time to verify each step can prevent potential legal issues and ensure a clear transfer of property rights.

Discover More on Deed

What is a Deed form?

A Deed form is a legal document that signifies the transfer of ownership of property from one party to another. It includes details such as the identities of the buyer and seller, a description of the property, and the signature of the party transferring the property. The form must be filed with the local government to be considered valid.

How do I know if I need a Warranty Deed or a Quitclaim Deed?

The type of Deed you need depends on the level of protection you desire. A Warranty Deed provides the buyer with warranties that the seller owns the property free and clear of any liens or encumbrances. On the other hand, a Quitclaim Deed transfers ownership without making any guarantees about the property's lien status, typically used between family members or to clear up title issues.

Is it necessary to have a Deed notarized?

Yes, for a Deed to be legally binding, it generally must be notarized. Notarization ensures that the signatory has indeed signed the document. This step is crucial for the Deed to be recorded properly with the local county recorder's or land registry office, making the transfer of property public record.

Can I prepare a Deed form by myself?

While it is possible to prepare a Deed form by yourself, it is highly recommended to seek legal advice or assistance. This ensures that the document complies with local laws and regulations, accurately reflects the property's description, and includes all necessary legal elements. Mistakes in a Deed can lead to potential legal issues or challenges to the property transfer.

What happens after a Deed is signed and notarized?

After a Deed is signed and notarized, it must be filed with the appropriate local government office, such as the county recorder's office. This filing makes the property transfer a matter of public record, provides legal notice of the ownership change, and ensures the new deed is recognized for legal and taxation purposes. The buyer typically receives the original document after recording.

Common mistakes

When filling out a Deed form, individuals often encounter complexities that can lead to a variety of common mistakes. It is of utmost importance to approach this task with thoroughness and precision. Below are eight mistakes that are frequently made during this process:

Not verifying the exact legal description of the property. The property's legal description is a detailed way of describing the land in legal documents, different from the street address. Errors here can lead to serious complications.

Overlooking the necessity to check for any restrictions or easements on the property. These legal constraints can affect use, improvements, and transferability.

Failing to use the correct Deed form. Different types of deeds are used based on the circumstances of the property transfer, such as Warranty Deeds or Quitclaim Deeds.

Not obtaining signatures from all parties holding an interest in the property. This oversight can render the document legally invalid.

Omitting necessary witness and/or notary signatures where required. Many jurisdictions mandate these additional verifications for a deed to be considered valid.

Forgetting to include a complete conveyance clause, which specifies the intentions of the transfer and the rights being transferred. An incomplete clause can lead to disputes or a lack of legal clarity.

Inaccurately recording the names and details of grantor(s) and grantee(s). Precision in these details is critical for the legality of the document.

Ignoring the requirement to file the deed with the appropriate county or local government office. Until the deed is recorded, the transfer of ownership is not complete and may not be legally recognized.

Ensuring that all information is correctly provided and adhering to the specific procedures of the jurisdiction can prevent these and other potential errors. Taking extra care during this process can mitigate complications and solidify the legality of the transaction.

Documents used along the form

When transferring property ownership, the deed form plays a crucial role. However, this document rarely stands alone in the process. Several other forms and documents frequently accompany the deed to ensure a smooth, legally compliant transfer. Understanding these documents can simplify the transfer process, providing clarity and security for all parties involved.

- Title Search Report: This document is essential for verifying the seller's right to transfer the property and for identifying any existing liens or encumbrances that may affect the sale. It provides a detailed history of the property, including previous ownerships.

- Property Tax Receipts: Buyers need to verify that property taxes are up to date. These receipts are critical since outstanding taxes can create liens on the property, complicating the transfer process.

- Home Inspection Reports: While not directly related to the legal side of the transfer, a home inspection report is crucial for the buyer. It reveals the physical condition of the property, identifying any problems that might need to be addressed either before or after the sale.

- Mortgage Pre-approval Letter: If the buyer is financing the purchase, a mortgage pre-approval letter is often required during the negotiation phase. This letter indicates the buyer's financial capability to follow through on the purchase, providing reassurance to the seller.

In conclusion, while the deed is a fundamental document in property transactions, the additional forms and documents listed above are equally important. They work together to ensure the transfer is conducted fairly and legally, protecting the interests of both buyer and seller. Understanding the role and requirement of each can significantly streamline the transaction process.

Similar forms

Mortgage Agreement: A deed and a mortgage agreement share similarities as they both involve real estate transactions. A mortgage agreement is a contract where a borrower (typically the property buyer) agrees to pledge the property to the lender as security for the loan used to purchase the property. Like a deed, a mortgage clearly outlines the parties involved and the property in question, but focuses on the lending aspects rather than the transfer of ownership.

Bill of Sale: Similar to a deed, a bill of sale is a legal document that transfers ownership of personal property, such as vehicles or equipment, from one person to another. Both documents serve as proof of transfer and contain detailed information about the seller, buyer, and the property involved. This similarity lies in their function to formally document the change in ownership, albeit for different types of assets.

Lease Agreement: Lease agreements, like deeds, are contracts concerning real property. A lease agreement outlines the terms under which one party agrees to rent property owned by another party. It guarantees the lessee, or tenant, use of an asset and guarantees the lessor, the property owner or landlord, regular payments for a specified period in exchange. While a deed transfers ownership, a lease transfers the right to use the property without transferring ownership.

Title Certificate: A title certificate and a deed both deal with the ownership aspect of a property. The title certificate is a document that shows the legal owner of the property and any liens against it, while a deed is used to transfer the ownership from one party to another. Both are crucial in establishing and proving ownership, but the deed plays a pivotal role in the actual transfer process whereas the title is more about asserting who owns the property at any given time.

Warranty of Title: This is a guarantee provided by a seller to a buyer that they hold the clear title to a piece of property (typically real estate) and have the right to sell it. It is similar to a deed in that it pertains to the transfer of property ownership. The main difference is that it serves as an assurance of the seller's legal right to transfer ownership, whereas a deed is the instrument that accomplishes this transfer.

Dos and Don'ts

Filling out a deed form is a crucial step in the process of transferring property ownership. To ensure this process goes smoothly and legally, there are certain practices one should follow and others to avoid. Below is a compiled list of dos and don’ts when completing a deed form.

- Do verify the type of deed required: Different transactions require different types of deeds. Ensure you are using the correct form to match the legal requirements of your transaction.

- Do provide accurate information: It’s essential to double-check all details, including the legal description of the property, the names of the grantor and grantee, and any other pertinent information. Mistakes can lead to significant legal complications.

- Do consult a professional: Seeking advice from a legal professional or a real estate expert can prevent costly errors. They can provide insight into the nuances of property laws in your state.

- Do review state and local regulations: Property transfer laws vary by location. Familiarize yourself with the regulations in your area to ensure compliance.

- Do keep the language clear and concise: Avoid using unnecessary legal jargon or complex language that could obscure the deed's intentions.

- Don’t omit crucial details: Failing to include necessary information can invalidate the deed or delay the transfer process.

- Don’t sign without witnesses or notarization, if required: Many jurisdictions require deed forms to be signed in the presence of witnesses or a notary public for the document to be legally binding.

- Don’t use generic forms without customization: While generic deed forms can be a starting point, it is important to tailor the document to the specific transaction and to comply with local laws.

- Don’t forget to file the deed with the appropriate county office: After signing, the deed must be filed or recorded with the county recorder's office or similar local government entity to make the transfer public record.

Misconceptions

When it comes to transferring property, the deed is a crucial document. However, there are many misconceptions about the deed form. Understanding these misconceptions is vital to ensuring a smooth transaction. Here are eight common misunderstandings:

All deeds are the same: This is not true. There are different types of deeds (such as warranty, quitclaim, and special warranty deeds), each serving different purposes and offering varying levels of protection to the grantee.

A deed guarantees the condition of the property: In reality, a deed does not provide any assurance about the property's condition. It merely transfers whatever interest the grantor has in the property.

Filing a deed with the local government is not necessary: This misconception can cause significant problems. For the transfer to be effective against third parties, the deed must be filed (or recorded) with the appropriate local government office.

A deed is only valid if witnessed and notarized: The necessity for witnesses and notarization varies by state. While many states require notarization for the deed to be recorded, not all require witnesses.

Deeds must be drafted by lawyers: While it's highly recommended to have a legal professional draft or review the deed for compliance and to ensure your rights are protected, it's not a legal requirement. However, using standardized forms without legal advice can lead to mistakes.

The deed and the title are the same: These terms are often used interchangeably, but they differ significantly. The deed is the physical document transferring the property, while the title is a concept that signifies ownership.

Once executed, a deed cannot be changed: If both parties agree, a deed can be altered or rescinded. However, any modifications must be made following state laws, which often requires executing a new deed.

A quitclaim deed transfers property free and clear: Quitclaim deeds transfer the grantor's interest in the property without any warranties. This means it transfers the ownership without guaranteeing that the property is free of claims or liens.

Understanding the realities behind these misconceptions can help property buyers and sellers navigate the complexities of real estate transactions more confidently and efficiently. Always consider consulting a real estate lawyer to guide you through the specific nuances of your transaction.

Key takeaways

When it comes to transferring property ownership, a Deed form plays a crucial role. Understanding the intricacies of filling out and using this document effectively can ensure a smooth and legally sound transaction. Here are key takeaways to consider:

- Accuracy Is Key: Every detail on the Deed form, from the names of the parties involved to the description of the property, needs to be accurate. Mistakes can lead to disputes or complications in the ownership transfer.

- Type of Deed Matters: There are various types of Deeds such as Warranty, Quitclaim, and Special Warranty. Each serves different purposes and levels of protection for the buyer and seller. Choosing the correct type is essential based on the situation.

- Legal Description of Property: A property’s legal description is more detailed than its street address. This includes boundaries, lot number, and other specifics that uniquely identify the property. Include this information precisely to avoid any ambiguity.

- Signatures Are Crucial: A Deed is not valid unless signed by all necessary parties, often requiring the seller's signature to be notarized. Depending on state laws, additional witnesses' signatures might be required.

- Understand State Laws: Property laws can vary significantly from state to state. It’s important to understand and comply with the specific requirements for Deeds in the state where the property is located.

- Recording the Deed: After signing, the Deed must be filed with the local county office to make the property transfer official. This process, known as recording, provides a public record of property ownership.

- Consider Professional Help: Given the legal complexity and the significant impact of errors, consulting with a real estate attorney or legal expert when filling out and executing a Deed can provide valuable peace of mind.

In conclusion, the Deed form is a vital document in the real estate world, acting as the official record of the transfer of property. Its importance cannot be overstated, and careful attention must be paid to its accurate completion and understanding the legal obligations it entails. Ensuring all legal requirements are met not only secures the validity of the property transfer but also protects the rights of all parties involved.

Consider Other Documents

Faa Aircraft Bill of Sale - The Aircraft Bill of Sale is a key document in the chain of custody for an aircraft, essential for clear title transfer.

Dd 2870 Army Pubs - The authorization is valid until the specified expiration date, giving individuals time-bound control over their information.

Interest Letter Sample - Offers a framework that can significantly reduce the time and expense involved in reaching a final investment agreement.