Valid Corrective Deed Template

When navigating the complex realm of real estate transactions, precision and accuracy in documentation are paramount. Errors, no matter how minor they might seem, can lead to significant complications, potentially impacting the validity of a property transfer. This is where the Corrective Deed form plays an essential role. Designed as a tool to amend previously recorded deeds that contain mistakes, it serves to rectify issues such as misspellings, incorrect property descriptions, or any other inaccuracies that were made in the original document. The importance of this form lies not only in its ability to correct these errors but also in its role in ensuring the smooth continuation of the property transfer process. It acts as a safeguard, protecting the interests of all parties involved by ensuring that property records reflect the true intention of the transaction. Utilizing a Corrective Deed is a testament to the commitment to detail and legal integrity within the realm of property law, highlighting the intricate balance between the letter of law and the realities of real estate transactions.

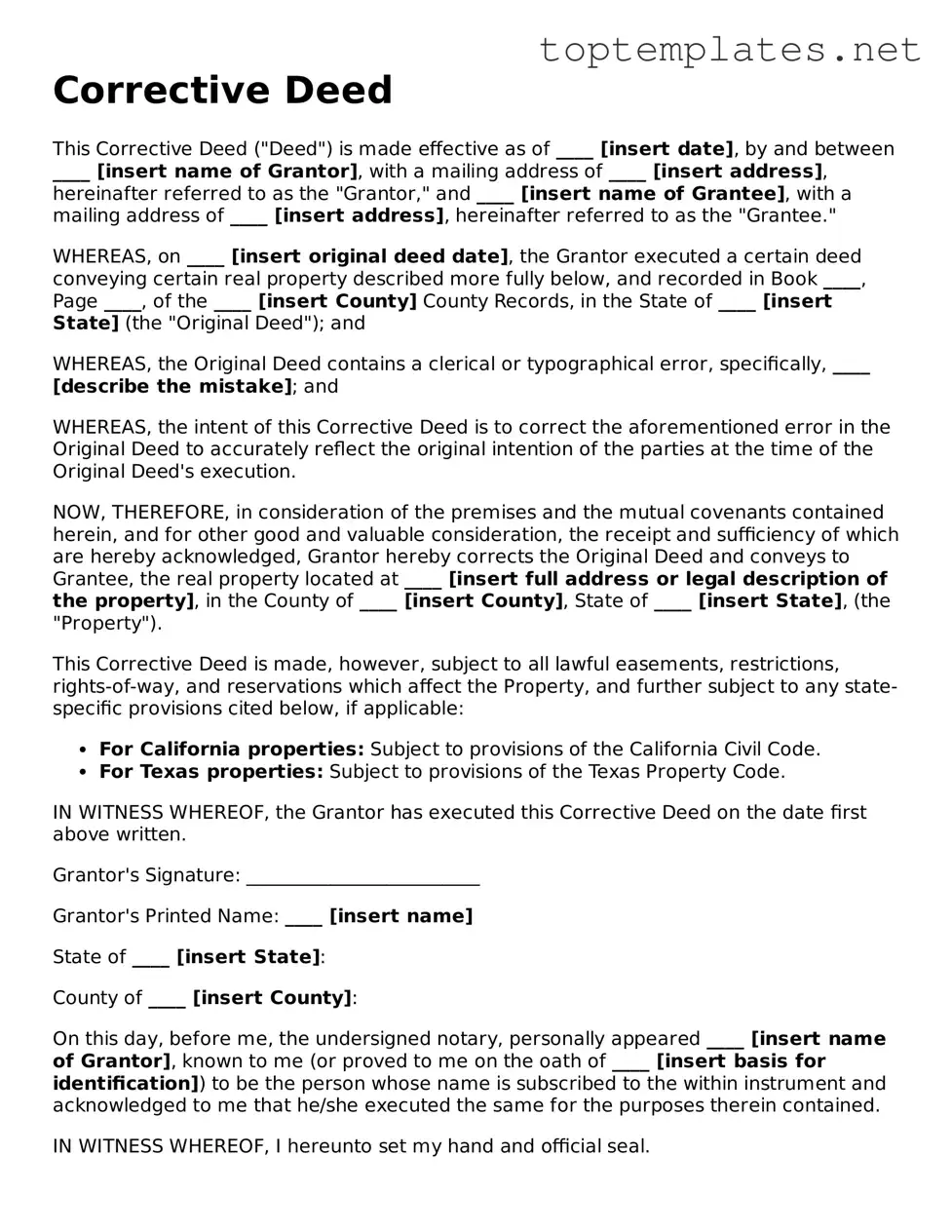

Sample - Corrective Deed Form

Corrective Deed

This Corrective Deed ("Deed") is made effective as of ____ [insert date], by and between ____ [insert name of Grantor], with a mailing address of ____ [insert address], hereinafter referred to as the "Grantor," and ____ [insert name of Grantee], with a mailing address of ____ [insert address], hereinafter referred to as the "Grantee."

WHEREAS, on ____ [insert original deed date], the Grantor executed a certain deed conveying certain real property described more fully below, and recorded in Book ____, Page ____, of the ____ [insert County] County Records, in the State of ____ [insert State] (the "Original Deed"); and

WHEREAS, the Original Deed contains a clerical or typographical error, specifically, ____ [describe the mistake]; and

WHEREAS, the intent of this Corrective Deed is to correct the aforementioned error in the Original Deed to accurately reflect the original intention of the parties at the time of the Original Deed's execution.

NOW, THEREFORE, in consideration of the premises and the mutual covenants contained herein, and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, Grantor hereby corrects the Original Deed and conveys to Grantee, the real property located at ____ [insert full address or legal description of the property], in the County of ____ [insert County], State of ____ [insert State], (the "Property").

This Corrective Deed is made, however, subject to all lawful easements, restrictions, rights-of-way, and reservations which affect the Property, and further subject to any state-specific provisions cited below, if applicable:

- For California properties: Subject to provisions of the California Civil Code.

- For Texas properties: Subject to provisions of the Texas Property Code.

IN WITNESS WHEREOF, the Grantor has executed this Corrective Deed on the date first above written.

Grantor's Signature: _________________________

Grantor's Printed Name: ____ [insert name]

State of ____ [insert State]:

County of ____ [insert County]:

On this day, before me, the undersigned notary, personally appeared ____ [insert name of Grantor], known to me (or proved to me on the oath of ____ [insert basis for identification]) to be the person whose name is subscribed to the within instrument and acknowledged to me that he/she executed the same for the purposes therein contained.

IN WITNESS WHEREOF, I hereunto set my hand and official seal.

Notary's Signature: _________________________

Notary's Printed Name: ____ [insert name]

Seal:

File Breakdown

| Fact Name | Description |

|---|---|

| Purpose | Corrective Deeds are used to amend errors in previously recorded deeds. |

| Common Errors Addressed | Typographical errors, misspellings, incorrect legal descriptions, and omission of vital information. |

| Does Not Change | The original conveyance intention or validity of the original deed. |

| Necessity for New Parties | No new parties are required to execute a Corrective Deed; only the parties involved in the original deed. |

| Recording Requirement | Like the original deed, a Corrective Deed must be recorded with the county to be effective. |

| State-Specific Forms and Laws | Some states have specific forms and governing laws for Corrective Deeds, which must be adhered to for the correction to be valid. |

| Consideration Statement | A Corrective Deed should state that it is correcting a previously recorded deed and often repeats the original consideration. |

| Legal Description | The corrected legal description of the property must be accurately provided in the Corrective Deed. |

| Impact on Title | When properly executed and recorded, a Corrective Deed clarifies and confirms the title, making future transactions smoother. |

Steps to Filling Out Corrective Deed

When you're dealing with property ownership, accuracy is crucial. Sometimes, after a deed is recorded, mistakes are discovered. These could be as simple as a misspelled name or as complex as an incorrect property description. A Corrective Deed is used to fix these mistakes. This is not about changing the terms of the original transaction but about ensuring the document reflects what was intended accurately. The process might feel daunting, but with clear steps, it can be straightforward.

- First, secure a copy of the original deed that needs correction. You'll need the exact details as they were listed to reference what is being corrected.

- Identify the mistake that needs to be corrected. This could be an incorrect name, legal description, or any other error present in the original deed.

- Obtain the Corrective Deed form. This form may be available through local government offices or online resources specific to your state or county.

- Fill in the preparer's information. This includes the name and address of the person completing the Corrective Deed form.

- Enter the date the Corrective Deed is being prepared.

- Provide the grantor's information exactly as it appeared in the original deed, including any incorrect details that are being corrected.

- Include the grantee's information, again as it was listed in the original deed, making note of any errors that need correction.

- Write the corrected information clearly, specifying what is being amended from the original deed. This should be done in a manner that leaves no room for confusion.

- Reference the original deed by including its recording date and any identifying number or book and page number it was recorded on. This information is crucial for the corrective deed to be properly indexed.

- Ensure the grantor signs the Corrective Deed in the presence of a notary public. Some jurisdictions may require additional witnesses.

- Submit the Corrective Deed to the appropriate local office for recording. This is usually the county recorder or register of deeds where the property is located. There may be a filing fee involved.

Once you've completed these steps, the Corrective Deed will be reviewed and recorded, officially correcting the mistake. Remember, the goal is to make the deed accurately reflect the original intentions of the parties involved. This correction not only clarifies any confusion but also ensures that records are accurate for future transactions. If you're unsure about any part of the process, consider consulting with a real estate attorney to guide you.

Discover More on Corrective Deed

What is a Corrective Deed?

A Corrective Deed is a document used to correct errors in a previously recorded deed. This includes misspellings, incorrect names, inaccurate legal descriptions of the property, or any other mistakes that were made when the original deed was recorded.

When should a Corrective Deed be used?

A Corrective Deed should be used as soon as an error is discovered in the recorded deed. Prompt correction ensures that the property records accurately reflect the true intentions of the parties involved and maintains a clear chain of title.

Who can prepare a Corrective Deed?

While there's no legal requirement specifying who must prepare a Corrective Deed, it's often prepared by the person who has interest in making sure the property records are correct, such as the property owner or their legal representative.

Does a Corrective Deed change property ownership?

No, a Corrective Deed does not change property ownership. It only corrects errors in a previously recorded deed to ensure that the records accurately reflect the original intentions regarding ownership and the property description.

What are common mistakes corrected by a Corrective Deed?

Common mistakes corrected by a Corrective Deed include typographical errors in names or addresses, incorrect or incomplete legal descriptions of the property, and missing or incorrect notary acknowledgments.

How is a Corrective Deed filed?

After preparation, a Corrective Deed must be signed by the parties involved in the original deed, notarized, and then filed with the county recorder's office or other appropriate local government entity where the property is located, along with any required filing fees.

Does filing a Corrective Deed incur any fees?

Yes, filing a Corrective Deed typically requires payment of a filing fee to the county recorder's office. These fees vary by location, so it's important to check with the local office for the specific amount.

Can a Corrective Deed resolve all issues with a deed?

While a Corrective Deed is effective for rectifying many common errors in a deed, some issues might require more complex legal actions, such as a court order. It’s advisable to consult with a legal professional to understand the best course of action for your specific situation.

Common mistakes

When filling out a Corrective Deed form, people often encounter several common pitfalls. Attention to detail can prevent these mistakes, ensuring the process goes smoothly. Below are nine mistakes frequently made on these forms.

Not checking the legal description of the property. This is crucial, as any discrepancy can invalidate the deed.

Forgetting to obtain the original deed. Having the original deed at hand is essential for referential and verification purposes when filling out a Corrective Deed.

Failing to correctly identify the mistake from the original deed. A Corrective Deed is used to amend errors, and precisely identifying the error is key.

Omitting key details, such as the date when the original deed was executed or recorded. Every detail from the original deed needs to be accurately reflected and corrected as necessary.

Not obtaining all necessary signatures. Just like the original deed, a Corrective Deed requires signatures from all parties involved in the original transaction.

Incorrectly stating the reason for the correction. Specifying whether it's a typographical error, incorrect legal description, or another mistake is required.

Using unclear or imprecise language. The language used should be as clear and specific as the original deed, if not more so, to prevent further complications.

Forgetting to notarize the document. This formal step is often a legal requirement for the document to be recognized as valid.

Not checking with local jurisdiction requirements. Some areas may have specific requirements for filing a Corrective Deed, including additional forms or fees.

Avoiding these mistakes requires diligence and a keen eye for detail. It's often helpful to consult with a professional to ensure that the Corrective Deed is correctly executed and will effectively amend the errors of the original document.

Documents used along the form

When dealing with property transactions, a Corrective Deed form is often not the only document required to ensure the legality and completeness of the process. This form, primarily used to correct errors in a previously recorded deed, such as misspellings or incorrect property descriptions, is typically accompanied by other forms and documents to bolster the correction's validity and comply with legal standards. The following list provides an overview of additional forms and documents commonly used alongside the Corrective Deed form, each playing a crucial role in property transactions.

- Title Search Report: Before processing a corrective deed, it's essential to conduct a title search to uncover any issues with the property's title that need addressing. This report provides a history of ownership, liens, and any encumbrances on the property.

- Warranty Deed: This document is used to transfer property from the seller to the buyer and guarantees that the seller holds clear title to the property. It often complements a corrective deed if substantial errors in the original deed affect the clear transfer of title.

- Quitclaim Deed: Similar to a warranty deed, a quitclaim deed transfers ownership of property without any guarantees about the title's clarity. It's frequently used alongside corrective deeds for minor corrections that don't affect title guarantees.

- Affidavit of Property Value: This form, required in some jurisdictions, discloses the sale price of the property and other pertinent details. It may need to be refiled or amended in light of corrections made by a corrective deed.

- Grant Deed: A grant deed transfers ownership with a promise that the property hasn't been sold to someone else. Like a warranty deed, it might be used in conjunction with a corrective deed to affirm the property's status post-correction.

- Deed of Trust: In states where this is applicable, a deed of trust acts as a security for a loan on the property. If discrepancies in the property description are corrected, a new or amended deed of trust might be necessary.

- Property Tax Forms: Correcting a deed may affect property taxes if the correction involves changes in property description or boundaries. Updated tax forms may need to be submitted to reflect these corrections accurately.

- Mortgage Documents: If there's an existing mortgage on the property, amended mortgage documents may be necessary to reflect any changes made by the corrective deed, especially if the corrections pertain to legal descriptions or ownership details.

- Escrow Instructions: In real estate transactions, escrow instructions outline the conditions and terms of the property transfer. If a corrective deed is issued, these instructions may need to be revised to accommodate the deed's changes.

- Closing Statement: A closing statement details the financial transactions involved in the property's sale. If a corrective deed alters the terms or details of the sale, this document should be updated to reflect the current state of affairs.

In conclusion, while a Corrective Deed form is pivotal in rectifying mistakes on a previously recorded deed, it is merely a part of a larger ecosystem of documents required for a legally sound property transaction. These documents work together to ensure that all aspects of the transaction are accurate, transparent, and comply with the legal framework governing property transfers. Understanding the role and necessity of each can significantly streamline the process of correcting property deed errors.

Similar forms

Quitclaim Deed - This document transfers ownership of property without guaranteeing the title is clear. Like a Corrective Deed, it's often used to correct or update titles, but it specifically relinquishes the grantor's rights to the property.

Warranty Deed - Offers a guarantee that the grantor holds clear title to a piece of real estate and has the right to sell it, somewhat similar to a Corrective Deed in its function of ensuring correct ownership details, although a Corrective Deed does not guarantee a clear title.

Grant Deed - Transfers property ownership with certain promises from the seller, including that the property hasn’t been sold to someone else. Similar to the Corrective Deed, it is used in property transactions but includes warranties which are not found in a Corrective Deed.

Deed of Trust - Involves a third party, the trustee, holding the title for a property until a loan is paid off. While its purpose differs, it's similar to a Corrective Deed by involving property title handling.

Special Warranty Deed - Provides a warranty that the seller hasn’t encumbered the property during their ownership but doesn’t cover issues from previous owners. Like a Corrective Deed, it deals with the title but offers limited protection.

Transfer on Death Deed - Allows property to be passed to a beneficiary without going through probate upon the owner's death. It's similar to a Corrective Deed by handling property titles, but for the specific event of the owner's passing.

Interspousal Transfer Deed - A document used between spouses to transfer property. While it specifically deals with the transfer between spouses, similar to a Corrective Deed, it corrects or changes property ownership details.

Fiduciary Deed - Issued by a trustee, executor, or other fiduciary, transferring property from an estate. It resembles a Corrective Deed in that it deals with the transfer of property titles under specific circumstances.

Dos and Don'ts

When dealing with a Corrective Deed form, accuracy and attention to detail are vital. This document is typically used to amend a previously recorded deed that contains mistakes. To ensure the process goes smoothly, here are nine key dos and don'ts:

- Do thoroughly review the original deed for errors. Understanding exactly what needs correction is critical before you start filling out a Corrective Deed form.

- Do use the exact names and legal descriptions from the original deed. Any discrepancy in these details can lead to further complications.

- Do provide a clear statement within the deed that it is a correction of a previously recorded deed, including the date of the original recording and the recorder’s document number if available.

- Do consult with a legal professional or someone with experience in real estate transactions. Their insight can be invaluable, even for seemingly minor corrections.

- Do ensure that all parties who signed the original deed are available to sign the Corrective Deed, as their consent may be necessary for the correction to be legally effective.

- Don't rush through filling out the form. Mistakes made on a Corrective Deed can lead to further errors and complicate the property's title more than the original mistake.

- Don't use a Corrective Deed to change fundamental aspects of the original deed such as transferring property to a new owner who wasn’t part of the original deed without proper legal guidance.

- Don't neglect to record the Corrective Deed with the appropriate county office. Failing to record the document properly can render the correction invalid.

- Don't assume a Corrective Deed is the right tool for all types of deed corrections. Sometimes, other forms or legal actions may be necessary.

Correcting a deed requires a careful approach. Following these guidelines can help streamline the process, correct the public record accurately, and safeguard against future title issues. Always consider seeking legal advice to ensure the Corrective Deed is completed and recorded correctly.

Misconceptions

Understanding the Corrective Deed form is crucial for anyone involved in rectifying errors on previously recorded deeds. However, numerous misconceptions can lead to confusion. Below is a list of common misunderstandings and clarifications to help guide you through the process of using a Corrective Deed form effectively.

- It can change ownership. - A Corrective Deed is intended to correct errors in a previously recorded deed, not to change the ownership of the property. Its purpose is to amend mistakes like typographical errors, missing information, or incorrect property descriptions.

- It’s only for major errors. - Both significant and minor errors can be rectified using a Corrective Deed. Whether it's a misspelled name or an incorrect property description, correcting any mistake is vital for ensuring clear title to the property.

- Signing a Corrective Deed is all you need to do. - While signing the Corrective Deed is crucial, it's just one step in the process. The document must also be notarized and then recorded with the county recorder’s office where the property is located.

- No need for the original parties to sign. - Typically, the original parties involved in the transaction must sign the Corrective Deed. This ensures that all parties agree to the corrections being made.

- A Corrective Deed can correct any type of mistake after any amount of time. - While many errors can be corrected with a Corrective Deed, there are exceptions, and the ability to correct a mistake might depend on state laws and the nature of the error. Furthermore, addressing errors promptly is always recommended to avoid complications.

- Corrective Deeds are complicated and require a lawyer. - While legal guidance can be helpful, especially in complex cases, preparing a Corrective Deed can be straightforward. Many resources are available to help individuals understand and complete the process.

- There’s a standard Corrective Deed form for all states. - Corrective Deed forms can vary by state due to differing state laws and requirements. It’s important to use the form that complies with the state where the property is situated.

- Filing a Corrective Deed is expensive. - The cost associated with filing a Corrective Deed can vary, but it is generally not expensive. The primary cost is the recording fee charged by the county, which is typically modest.

- Using a Corrective Deed can adversely affect property values. - Correcting a deed to accurately reflect the proper information does not negatively impact the property's value. In fact, it clarifies ownership and can prevent future legal issues.

- A Corrective Deed is an admission of a legal mistake. - Errors in deeds are not uncommon and rectifying them through a Corrective Deed is a responsible action to ensure the deed accurately reflects the intended legal transaction. It is not necessarily an admission of a legal mistake, but rather an effort to correct clerical or informational errors.

By understanding what a Corrective Deed is and what it is not, property owners and involved parties can navigate the correction process more smoothly and with confidence.

Key takeaways

When handling real estate transactions, accuracy and precision in documentation cannot be overstated. Occasionally, errors in deeds related to property transfers are discovered after filing with the county recorder. To address these errors, a Corrective Deed form is used. Here are five key takeaways to consider when filling out and utilizing a Corrective Deed form:

- Identify and clearly state the error being corrected. The primary purpose of a Corrective Deed is to amend a previously recorded deed that contains inaccuracies. These mistakes can range from typographical errors in names or addresses to incorrect legal descriptions of the property. Being explicit about the nature of the error ensures the corrective action is understood and properly recorded.

- Reference the original deed information. To accurately correct the prior mistake, the Corrective Deed must reference the original deed's recording information. This includes the date of the original deed, the parties involved, and the book and page number where the deed was recorded. This information is crucial for the recorder's office to locate the original document and record the correction appropriately.

- Ensure all parties involved in the original deed participate. For a Corrective Deed to be valid, all parties who signed the original deed must also sign the corrective one, unless the error is of a nature that affects only the grantor’s representations (e.g., an incorrect legal description). This is essential to maintain the legal integrity of the property transfer and ensure all parties agree to the correction.

- Include appropriate acknowledgment and notarization. Similar to the original deed, the Corrective Deed must be properly acknowledged before a notary public. This formal acknowledgment confirms the identities of the parties signing the document and validates the signature as voluntary and genuine.

- File the Corrective Deed with the appropriate county recorder’s office. After all parties have signed and notarized the Corrective Deed, it should be filed with the county recorder or land registry office where the original deed was filed. This step is imperative for the correction to be officially recorded and considered part of the public record.

Utilizing a Corrective Deed to amend errors in property transfer documents is a straightforward process, but it requires careful attention to detail and adherence to legal formalities. By following these key takeaways, parties can ensure their real estate transactions are accurately reflected in the public record.

Find Other Types of Corrective Deed Documents

Quit Claim Deed Form Iowa - Simplifies the process of property transfer without the complexity of warranty deeds.