Valid Deed in Lieu of Foreclosure Template

In the realm of real estate and mortgage resolution, homeowners and lenders often seek alternatives to the lengthy and costly process of foreclosure. One such alternative is the Deed in Lieu of Foreclosure, a document that allows a borrower to transfer the ownership of their property back to the lender voluntarily. This process not only helps in avoiding the negative impacts of a foreclosure on the borrower's credit history but also benefits the lender by reducing the time and expenses associated with foreclosure proceedings. The form itself embodies a legal agreement between the two parties, detailing the relinquishment of the property by the borrower, thereby nullifying the mortgage obligation. It represents a mutual concession, with the lender typically agreeing not to pursue any deficiency judgment against the borrower, contingent on certain conditions being met. As a critical document, the Deed in Lieu of Foreclosure must be crafted with attention to legal requirements and the specifics of the agreement between the homeowner and the lender, ensuring clarity and mutual understanding of the terms.

Sample - Deed in Lieu of Foreclosure Form

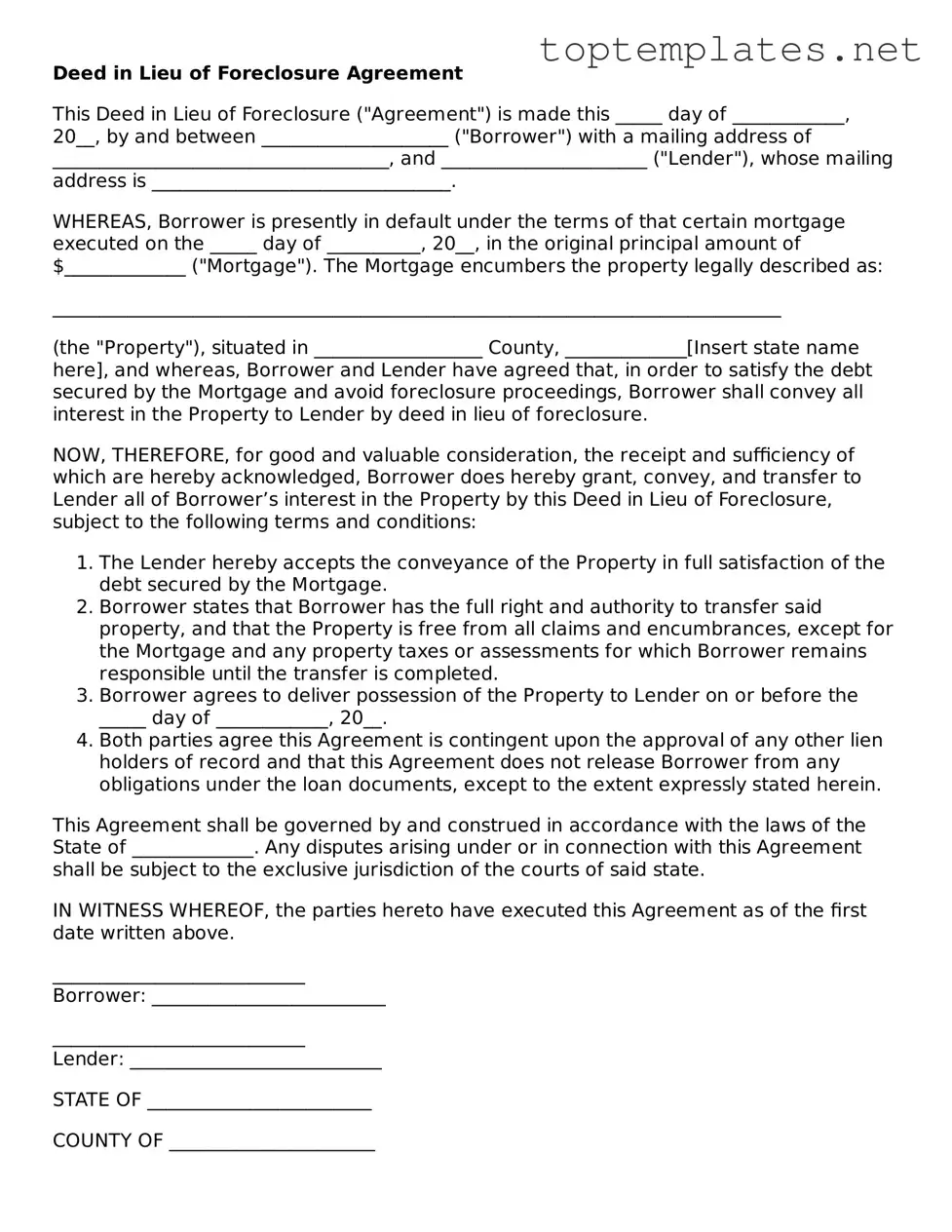

Deed in Lieu of Foreclosure Agreement

This Deed in Lieu of Foreclosure ("Agreement") is made this _____ day of ____________, 20__, by and between ____________________ ("Borrower") with a mailing address of ____________________________________, and ______________________ ("Lender"), whose mailing address is ________________________________.

WHEREAS, Borrower is presently in default under the terms of that certain mortgage executed on the _____ day of __________, 20__, in the original principal amount of $_____________ ("Mortgage"). The Mortgage encumbers the property legally described as:

______________________________________________________________________________

(the "Property"), situated in __________________ County, _____________[Insert state name here], and whereas, Borrower and Lender have agreed that, in order to satisfy the debt secured by the Mortgage and avoid foreclosure proceedings, Borrower shall convey all interest in the Property to Lender by deed in lieu of foreclosure.

NOW, THEREFORE, for good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, Borrower does hereby grant, convey, and transfer to Lender all of Borrower’s interest in the Property by this Deed in Lieu of Foreclosure, subject to the following terms and conditions:

- The Lender hereby accepts the conveyance of the Property in full satisfaction of the debt secured by the Mortgage.

- Borrower states that Borrower has the full right and authority to transfer said property, and that the Property is free from all claims and encumbrances, except for the Mortgage and any property taxes or assessments for which Borrower remains responsible until the transfer is completed.

- Borrower agrees to deliver possession of the Property to Lender on or before the _____ day of ____________, 20__.

- Both parties agree this Agreement is contingent upon the approval of any other lien holders of record and that this Agreement does not release Borrower from any obligations under the loan documents, except to the extent expressly stated herein.

This Agreement shall be governed by and construed in accordance with the laws of the State of _____________. Any disputes arising under or in connection with this Agreement shall be subject to the exclusive jurisdiction of the courts of said state.

IN WITNESS WHEREOF, the parties hereto have executed this Agreement as of the first date written above.

___________________________

Borrower: _________________________

___________________________

Lender: ___________________________

STATE OF ________________________

COUNTY OF ______________________

On this _____ day of ____________, 20__, before me, ______________________________, a Notary Public in and for said state, personally appeared ________________________________, known to me (or satisfactorily proven) to be the person(s) whose name(s) is/are subscribed to the within instrument and acknowledged that he/she/they executed the same for the purposes therein contained.

IN WITNESS WHEREOF, I hereunto set my hand and official seal.

___________________________

Notary Public

My commission expires: ____________

File Breakdown

| Fact Name | Detail |

|---|---|

| Purpose | It is used to transfer property ownership from the borrower to the lender to avoid foreclosure. |

| Key Element | The borrower voluntarily transfers the deed of the property to the lender. |

| Benefit for Borrower | Helps avoid the negative impact of foreclosure on credit history. |

| Benefit for Lender | Reduces the time and cost associated with the foreclosure process. |

| State-Specific Forms | Forms and regulations can vary by state, requiring specific language and adherence to local laws. |

| Governing Laws | Governed by state laws where the property is located, affecting the use and validity of the form. |

| Common Requirements | Typically requires notarization and may require witness signatures, depending on the state. |

Steps to Filling Out Deed in Lieu of Foreclosure

Filling out a Deed in Lieu of Foreclosure form is a critical step towards resolving a situation where you might be unable to continue making payments on your mortgage. This legal document transfers the ownership of your property back to the lender, thus avoiding the foreclosure process. Before you begin, gather all necessary information including your mortgage account details, property information, and any other documents that might be required by your lender. This will streamline the process, making it as smooth as possible. Following the steps below will guide you through filling out the form accurately.

- Gather all required information: Before filling out the form, make sure you have all the necessary details including your mortgage account number, lender information, and detailed information about the property.

- Identify the parties involved: Clearly write the legal names of the borrower(s) and the lender. If there are co-borrowers, include their information as well.

- Describe the property: Provide a complete legal description of the property. This information can usually be found on your original mortgage documents or property deed.

- State the consideration: This refers to the agreement that the transfer of property is in lieu of foreclosure. It’s important to mention any specific conditions agreed upon with the lender.

- Review, sign, and date the form: After thoroughly reviewing the information for accuracy, sign and date the form. If there are co-borrowers, they must sign as well.

- Notarization: The document must be notarized to validate the signatures. Visit a notary public to complete this step.

- Submit the document: The final step is to submit the completed, signed, and notarized form to your lender. Follow their specific instructions for submission, which may include mailing or hand-delivering the document.

Once you have submitted the Deed in Lieu of Foreclosure form, your lender will review the document. You should keep in communication with your lender for updates and to confirm receipt of the document. It’s also wise to retain copies of all correspondence and the submitted form for your records. This can be a challenging time, but taking informed, methodical steps will help you navigate the process with clarity and confidence.

Discover More on Deed in Lieu of Foreclosure

What is a Deed in Lieu of Foreclosure?

A Deed in Lieu of Foreclosure is a document where a homeowner voluntarily gives up the ownership of their property to the lender. This is done to avoid the foreclosure process when the homeowner cannot make their mortgage payments. The lender then cancels the mortgage to prevent the property from going into foreclosure.

Who can use a Deed in Lieu of Foreclosure?

This option is available to homeowners who are struggling with their mortgage payments and are facing foreclosure. It is important to note that the lender must agree to this arrangement. Not every lender will accept a Deed in Lieu of Foreclosure, as this decision depends on numerous factors including the current real estate market and the amount owed on the mortgage.

How does a Deed in Lieu of Foreclosure affect my credit score?

While a Deed in Lieu of Foreclosure can negatively impact your credit score, the effect is generally less severe than a foreclosure. However, the impact varies based on individual credit history and the scoring model used. It is important to consult with a financial advisor or credit counselor to understand how this might affect your specific situation.

What are the financial implications of a Deed in Lieu of Foreclosure?

By avoiding the foreclosure process, homeowners may be relieved from the remaining mortgage debt. However, this is conditioned upon the lender agreeing to forgive the debt, which is not guaranteed. Tax implications may also arise if the forgiven debt is considered taxable income. It is recommended to speak with a tax advisor to understand how this may affect your taxes.

Can I remain in my home after submitting a Deed in Lieu of Foreclosure?

Typically, once a Deed in Lieu of Foreclosure is completed, the homeowner must vacate the property. Sometimes, lenders may allow a short period for homeowners to find alternative housing. This is often negotiated as part of the agreement. However, each situation is unique, so it's important to discuss this with the lender beforehand.

How do I begin the process of a Deed in Lieu of Foreclosure?

The first step is to contact your lender to discuss if a Deed in Lieu of Foreclosure is an option for you. If the lender is agreeable, they will usually provide specific instructions and forms that need to be completed. It is recommended to work with a lawyer to ensure that the paperwork accurately reflects the agreement and protects your interests. Remember, clear and open communication with your lender throughout this process is crucial.

Common mistakes

When it comes to the process of navigating through the complexities of a Deed in Lieu of Foreclosure, individuals often encounter various pitfalls. This method of resolving debt issues can provide a pathway to avoid foreclosure, but filling out the required form inaccurately or incompletely can result in unintended consequences. Understanding and avoiding these common mistakes are crucial:

Not Reviewing the Entire Document: Many people simply do not read through the entire form before beginning to fill it out. Every detail matters in legal documents, and missing a single aspect can lead to significant issues down the line.

Omitting Essential Information: It is critical to complete every required field with the correct information. Leaving sections blank or omitting necessary details can invalidate the entire document or delay the process significantly.

Providing Inaccurate Financial Details: The form requires accurate financial information. Errors in this area, whether unintentional or not, can be viewed as fraudulent and might jeopardize the agreement.

Failing to Attach Required Documents: Often, individuals overlook the necessity to attach supporting documents. Proper documentation, such as proof of income and hardship, is essential for processing the deed in lieu.

Ignoring Tax Implications: Not considering the tax implications of a deed in lieu agreement is a common oversight. It’s important to understand the potential tax consequences and to seek financial advice if needed.

Not Verifying Lender Information: It's crucial to verify and accurately record the lender's information. Any discrepancy in this can lead to miscommunications or the document being sent to the wrong party.

Skipping Legal Review: Attempting to complete the process without consulting with a legal professional can lead to misunderstandings of the paperwork or overlook potential legal protections available for the homeowner.

Avoiding these mistakes requires careful attention to detail and a comprehensive understanding of the process. While filling out the Deed in Lieu of Foreclosure form, it's advisable to seek the guidance of professionals to ensure accuracy and completeness. Taking these steps can help homeowners navigate through this difficult process with greater ease and certainty.

Documents used along the form

When homeowners are unable to continue with their mortgage payments, they often seek alternatives to foreclosure to minimize financial damage and protect their credit scores. One such alternative is a Deed in Lieu of Foreclosure. This arrangement allows the borrower to transfer the ownership of their property to the lender, effectively avoiding the foreclosure process. To complete this process effectively, several additional forms and documents are often used in conjunction with the Deed in Lieu of Foreclosure form. These documents ensure that the transaction is conducted legally and that both parties' interests are protected.

- Hardship Letter: This document is a personal letter provided by the borrower, explaining the financial difficulties they are facing and why they are unable to continue making payments on their loan. It provides context to the lender regarding the borrower's situation and sets the stage for considering a Deed in Lieu of Foreclosure.

- Financial Statement: This detailed statement lists the borrower's income, expenses, assets, and liabilities. It serves to give the lender a clear understanding of the borrower’s financial situation, demonstrating why the borrower cannot meet their mortgage obligations.

- Agreement in Principle: Before finalizing a Deed in Lieu of Foreclosure, this document outlines the preliminary terms agreed upon by both parties. It includes conditions such as the timeline for vacating the property and how any remaining debt will be handled.

- Estoppel Affidavit: An Estoppel Affidavit is signed by the borrower to declare that they are entering into the agreement voluntarily and that they fully understand the terms. This document may also include declarations regarding the absence of junior liens or other encumbrances on the property.

- Quitclaim Deed or Warranty Deed: Alongside the Deed in Lieu of Foreclosure, a Quitclaim Deed or a Warranty Deed may be used to transfer the property's title from the borrower to the lender. The choice between these deeds depends on the agreement regarding the guarantees being made about the title's clearness and the property's liens.

Together, these documents play a crucial role in facilitating a Deed in Lieu of Foreclosure. By thoroughly understanding and properly executing each form, both lenders and borrowers can ensure that the transition of property ownership happens smoothly and legally. This ultimately allows both parties to mitigate losses and move forward more positively, despite the challenging circumstances that led to the arrangement.

Similar forms

A Mortgage Agreement shares similarities with a Deed in Lieu of Foreclosure form, as both documents deal with the rights and obligations related to a property under a loan. However, while the Mortgage Agreement outlines the borrower's responsibility to repay the loan, the Deed in Lieu of Foreclosure serves as a mechanism for borrower to avoid foreclosure by voluntarily transferring property ownership to the lender.

The Loan Modification Agreement is similar in that it also offers an alternative to foreclosure. This agreement modifies the terms of the original loan to make it more manageable for the borrower, contrasting with the Deed in Lieu of Foreclosure which involves transferring property back to the lender.

A Short Sale Approval Letter from a lender, like a Deed in Lieu of Foreclosure, is used to prevent foreclosure. The letter approves the sale of the property for less than the amount owed on the mortgage, whereas the Deed in Lieu transfers the property directly to the lender without a sale.

The Quitclaim Deed is related as it is another form of property transfer document. While the Quitclaim Deed is often used to transfer property rights without selling the property and without any warranties, a Deed in Lieu of Foreclosure specifically transfers property from the borrower to the lender to satisfy a debt.

A Foreclosure Notice is the formal notification a borrower receives before the foreclosure process begins, making it a document that precedes the need for a Deed in Lieu of Foreclosure. The latter may serve as an alternative resolution after such a notice is issued.

The Bankruptcy Discharge Papers signify the conclusion of a bankruptcy proceeding, potentially eliminating certain debts. While bankruptcy can affect all outstanding debts of the borrower, a Deed in Lieu of Foreclosure specifically relates to resolving mortgage debt without foreclosure.

A Loan Agreement sets the terms and conditions under which money is lent, potentially leading to situations where a Deed in Lieu of Foreclosure might be considered if the borrower becomes unable to meet the repayment terms.

Eviction Notices are significant as they represent a step in the foreclosure process where the resident is being formally asked to vacate the property, an outcome that the Deed in Lieu of Foreclosure aims to avoid by transferring property ownership before such actions are necessary.

The Property Settlement Agreement in the context of divorce proceedings divides property, including real estate, between parties. It's similar as it involves the transfer of property rights, but a Deed in Lieu of Foreclosure specifically deals with a financial arrangement tied to a mortgage.

A Warranty Deed transfers property ownership with guarantees about the title's status, contrasting with a Deed in Lieu of Foreclosure which does not necessarily include such guarantees and is used under distressed financial conditions.

Dos and Don'ts

Filling out a Deed in Lieu of Foreclosure form involves careful attention to detail. When done correctly, it offers a way to avoid foreclosure and its negative impact on your credit score. Below are essential do's and don'ts to keep in mind:

Do:- Review your loan documents: Ensure you fully understand the terms and conditions of your loan agreement, as well as your rights and obligations under it.

- Get a legal professional's advice: Consult with a lawyer or a legal advisor who specializes in real estate matters to understand the implications and to ensure this process is in your best interest.

- Gather all required information: Make sure you have all the necessary documents and financial information ready. This includes your mortgage statements, property details, and any correspondence with your lender regarding your financial hardship.

- Communicate with your lender: Maintaining open lines of communication with your lender can help facilitate the process and ensure that all parties are on the same page.

- Ensure the accuracy of all information: Double-check all entered information for accuracy. Mistakes can delay the process or even invalidate the deed.

- Keep copies: Always keep a copy of the completed form and any documentation you provide to your lender for your records.

- Rush through the process: Take your time to fill out the form carefully and thoroughly. Overlooking details can cause unnecessary complications.

- Ignore the consequences: Understand that a Deed in Lieu of Foreclosure may still affect your credit score, though potentially less severely than a foreclosure. Consider how this will impact your future borrowing abilities.

- Overlook tax implications: Be aware of any potential tax consequences of accepting a Deed in Lieu of Foreclosure. Sometimes, forgiven debt may be considered taxable income.

- Skip consulting with a financial advisor: In addition to legal advice, getting input from a financial advisor can provide a clear picture of how this action fits into your overall financial plan.

- Assume it's your only option: Explore all available options for managing your financial difficulty with your lender before deciding. Other options may be more suitable for your situation.

- Forget to follow up: After submitting the form, stay in touch with your lender to ensure that the process is moving forward and to address any issues promptly.

Misconceptions

When it comes to managing real estate challenges, particularly foreclosure, many homeowners and borrowers encounter the term "Deed in Lieu of Foreclosure." This option might sound straightforward at first glance, but there are several misunderstandings surrounding its concept and consequences. Below, we'll explore four common misconceptions about the Deed in Lieu of Foreclosure to provide clarity and aid in better decision-making.

- It Will Significantly Damage Your Credit Score: Many people believe that a Deed in Lieu of Foreclosure will drastically affect their credit score, similar to or worse than a foreclosure. While it's true that it will impact your credit, the effect may be less severe compared to a foreclosure. Credit bureaus often view a deed in lieu as a more responsible way of dealing with inability to pay your mortgage, potentially leading to a quicker recovery period for your credit score.

- It Will Release You From All Financial Obligations: Another common misconception is that once a homeowner completes a Deed in Lieu of Foreclosure, they are free from all financial liabilities associated with the property. This isn’t always the case. Depending on the agreement with the lender, there might be conditions where a borrower could still be responsible for any deficiency, the difference between the sale price and the mortgage amount owed if the sale price is less.

- It's An Easy Process: Some homeowners might think that opting for a Deed in Lieu of Foreclosure is a straightforward solution to avoid foreclosure. However, this process involves negotiation with the lender and potentially complex legal documentation. It's not guaranteed that the lender will agree to a deed in lieu, and homeowners usually have to prove that they’ve exhausted all other options before a lender will consider this route.

- It’s Only Available to Homeowners Facing Immediate Foreclosure: While it's often pursued as a last resort to avoid foreclosure, a Deed in Lieu of Foreclosure is not exclusively available to those who are on the brink of losing their home to the bank. In reality, lenders may agree to this arrangement if continuing the mortgage payments becomes challenging for the homeowner, enabling an early and proactive approach to address the situation.

Key takeaways

Filling out and using the Deed in Lieu of Foreclosure form is a significant step for homeowners facing foreclosure. It allows the property owner to voluntarily transfer the deed of the property back to the lender, thus avoiding the lengthy and credit-damaging process of foreclosure. Understanding the key takeaways of this form can make a notable difference in navigating the process effectively:

- Voluntary Process: A deed in lieu of foreclosure is a voluntary agreement between the borrower and the lender. It is not initiated by the lender but proposed by the borrower, offering an alternative to foreclosure.

- Impact on Credit Score: While it still affects the borrower's credit score, a deed in lieu of foreclosure can have a less severe impact compared to a traditional foreclosure. However, the precise impact varies depending on individual credit history and the lender's reporting practices.

- Negotiation is Key: Terms of a deed in lieu agreement can often be negotiated. This may include asking the lender to not report the action to credit agencies or negotiating a waiver for the deficiency balance – the difference between the sale amount and what is owed.

- Comprehensive Documentation: The process requires detailed financial documentation from the borrower to prove financial distress and the impossibility of continuing with mortgage payments. This includes financial statements, tax returns, and a hardship letter.

- Legal and Tax Implications: It's crucial to understand the legal and tax consequences of a deed in lieu. The cancellation of debt may be considered taxable income, and there might be specific state laws that affect the agreement. Consulting with a legal or tax advisor is advisable.

- Not Always an Option: Not all lenders accept a deed in lieu of foreclosure, especially if there are second mortgages, home equity lines of credit (HELOCs), or other liens on the property. Each lienholder must agree to the deed in lieu, which can complicate the process.

Successfully navigating a deed in lieu of foreclosure requires a clear understanding of these key points. It’s a structured but flexible alternative that avoids the extensive repercussions of foreclosure, but it’s vital to approach this option with thorough preparation and, when possible, professional guidance.

Find Other Types of Deed in Lieu of Foreclosure Documents

Corrective Deed California - Acts as a safeguard for property owners against future title challenges.