Valid Gift Deed Template

When an individual decides to transfer property to another person without expecting anything in return, navigating the process can feel overwhelming. However, a crucial document, known as the Gift Deed form, streamlines this procedure with a legal framework that ensures the gift is transferred properly and responsibly. This form not only spells out the donor's intent clearly but also meticulously records all relevant details of the transaction, ensuring that there's no room for misunderstandings in the future. The Gift Deed is comprehensive, covering major aspects such as the identification of the donor and recipient, a detailed description of the property being given, and any conditions attached to the gift. Additionally, it plays a pivotal role in documenting the transfer for legal and tax purposes, providing a clear paper trail. With the Gift Deed in place, both parties are afforded peace of mind knowing that the transaction is not only heartfelt but also legally bound and recognized.

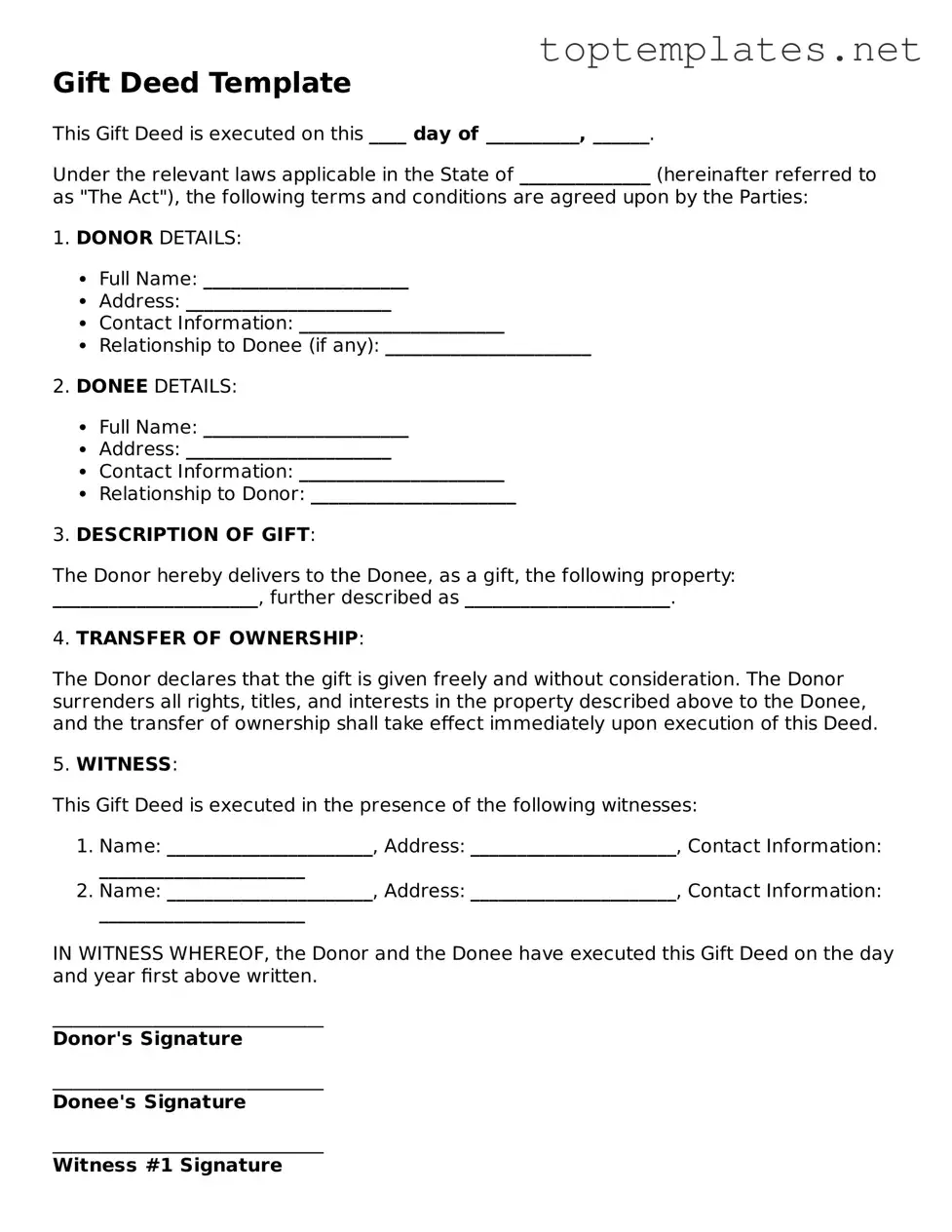

Sample - Gift Deed Form

Gift Deed Template

This Gift Deed is executed on this ____ day of __________, ______.

Under the relevant laws applicable in the State of ______________ (hereinafter referred to as "The Act"), the following terms and conditions are agreed upon by the Parties:

1. DONOR DETAILS:

- Full Name: ______________________

- Address: ______________________

- Contact Information: ______________________

- Relationship to Donee (if any): ______________________

2. DONEE DETAILS:

- Full Name: ______________________

- Address: ______________________

- Contact Information: ______________________

- Relationship to Donor: ______________________

3. DESCRIPTION OF GIFT:

The Donor hereby delivers to the Donee, as a gift, the following property: ______________________, further described as ______________________.

4. TRANSFER OF OWNERSHIP:

The Donor declares that the gift is given freely and without consideration. The Donor surrenders all rights, titles, and interests in the property described above to the Donee, and the transfer of ownership shall take effect immediately upon execution of this Deed.

5. WITNESS:

This Gift Deed is executed in the presence of the following witnesses:

- Name: ______________________, Address: ______________________, Contact Information: ______________________

- Name: ______________________, Address: ______________________, Contact Information: ______________________

IN WITNESS WHEREOF, the Donor and the Donee have executed this Gift Deed on the day and year first above written.

_____________________________

Donor's Signature

_____________________________

Donee's Signature

_____________________________

Witness #1 Signature

_____________________________

Witness #2 Signature

File Breakdown

| Fact Name | Description |

|---|---|

| Definition of Gift Deed | A legal document used to give a gift of property or money to another person without expecting anything in return. |

| Revocability | A Gift Deed, once executed and delivered, is irrevocable except under specific conditions as permitted by law. |

| Delivery Requirement | The gift must be physically or constructively delivered to the recipient for the Gift Deed to be valid. |

| Consideration | No consideration, meaning no payment or compensation, is required for a gift to be legally effective. |

| State-Specific Laws | Requirements and procedures for Gift Deeds can vary significantly from one state to another, affecting how they're drafted and executed. |

| Tax Implications | Gifts may be subject to federal gift tax, though many qualify for exclusions or exemptions depending on their value and the circumstances. |

Steps to Filling Out Gift Deed

Filling out a Gift Deed form is a crucial step in the process of legally transferring ownership of property from one person to another without any exchange of money. It's a generous act that requires careful documentation to ensure the transfer is recognized and binding. Below, you'll find a step-by-step guide detailing how to complete this form properly. By following these instructions, you'll help secure the transfer of your gift to the recipient.

- Begin by entering the date at the top of the form. This should be the current date when you are filling out the Gift Deed.

- Write the full legal name of the person giving the gift (the donor) in the space provided. Ensure accuracy to avoid any potential legal issues.

- Insert the full legal name of the person receiving the gift (the recipient) in the designated area. Like the donor's information, this must be accurate.

- Describe the property being gifted in detail. Include any identifying information such as address, serial numbers, or legal descriptions that can clarify what is being transferred.

- Have the donor sign the form in the presence of a notary public. This authentication is a crucial step for validating the document.

- The notary public should then fill out their section, which includes verifying the identity of the donor, the date of signing, and affixing their notarial seal to the form. This step officially notarizes the document.

- Check if your state requires witnesses for Gift Deeds. If so, have two impartial witnesses sign the form, providing their full names and addresses. This step might not be necessary in all locations but is crucial if your state mandates it.

- Lastly, file the completed Gift Deed with the local county recorder's office if required by your state laws. This final step ensures the gift is officially recorded and recognized.

After completing these steps, the Gift Deed process will be finalized, transferring ownership of the property to the recipient. It is advisable to keep copies of the notarized document for personal records and future reference. This careful documentation will help both parties avoid any confusion or disputes about the gift in the future.

Discover More on Gift Deed

What is a Gift Deed?

A Gift Deed is a legal document used to transfer property from one person to another without any exchange of money. The person giving the gift is called the donor, and the person receiving it is called the donee. This deed signifies that the transfer is voluntary and made out of affection, without any consideration.

Is a Gift Deed legally binding?

Yes, a Gift Deed, once properly executed and delivered, is legally binding. It must be signed by the donor, witnessed, and in some jurisdictions, notarized to be valid. Some states also require this deed to be recorded in local land records to complete the transfer of real property.

What should be included in a Gift Deed?

A Gift Deed should clearly identify the donor and the donee, describe the gifted property with precision, and state that the gift is being given freely without any coercion or consideration. It should also be witnessed as required by law to ensure its validity.

Can a Gift Deed be revoked?

Once a gift has been made through a Gift Deed and it has been accepted by the donee, it is irrevocable, meaning it cannot be revoked unless it was made under duress, fraud, or undue influence. If any of these conditions are proven, a court may nullify the deed.

Are there tax implications for creating a Gift Deed?

Yes, there can be tax implications for both the donor and the donee. The donor may be subject to federal gift tax if the value of the property exceeds the annual exclusion limit set by the IRS. The donee may be liable for taxes if the property generates income or if they sell the property and realize a gain.

Do I need a lawyer to create a Gift Deed?

While it is possible to create a Gift Deed without a lawyer, consulting with one is highly recommended to ensure that the deed complies with state laws and is properly executed. A lawyer can also advise on potential tax implications and ways to minimize them.

How is a Gift Deed different from a Will?

A Gift Deed transfers property immediately and irrevocably from the donor to the donee, whereas a Will is a document that specifies how a person's property is to be distributed upon their death. Unlike with a Will, property transferred by a Gift Deed does not go through probate, allowing for a quicker and simpler transfer process.

Common mistakes

When transferring ownership of property through a Gift Deed, ensuring the form is filled out correctly is paramount. Mistakes can lead to legal complications, potentially voiding the deed or resulting in unforeseen tax liabilities. Here are four common errors people make during this process:

-

Not Providing Complete Details of Both Parties

It's crucial to include full legal names, addresses, and, if applicable, the relationship between the giver and the receiver. Omitting or providing incomplete information can make the deed unenforceable and complicate property records.

-

Failing to Describe the Property Accurately

The gift deed must contain a precise and thorough description of the property being transferred. This includes, where applicable, the address, legal description from the property's current deed, and any identifying numbers such as parcel or registration numbers. Errors or vagueness in this section can invalidate the deed or cause disputes later on.

-

Omitting Key Clauses or Statements

Every state has specific requirements for what a gift deed must include, such as clauses stating that the gift is being given freely without any consideration or specifying the rights being transferred. Leaving out these critical components can void the document or create loopholes.

-

Failing to Follow State-Specific Requirements

The laws governing the execution of gift deeds vary significantly from one state to another. This can include the need for witness signatures, notarization, or specific filing procedures with local authorities. Ignoring these requirements can result in the gift deed being legally ineffective.

It's worth noting that these mistakes are not only common but also easily avoidable. By paying close attention to the details and understanding the legal requirements of the jurisdiction where the property is located, one can ensure a smooth and legally sound gift deed transfer.

Documents used along the form

When transferring ownership or gifting property, individuals often utilize a Gift Deed form. This formal document is instrumental in legally documenting the transfer of any item of value from one person to another without any payment or consideration in return. To ensure the transaction is recognized legally, and to safeguard all parties involved, a few other forms and documents may frequently accompany a Gift Deed. The use and importance of these documents vary based on the nature of the gift, the relationship between the donor and the recipient, and state laws.

- Affidavit of No Consideration: This document serves as a declaration by the donor that the transfer of property was made without receiving any form of payment or consideration. It helps to clarify the intent behind the transaction as a gift.

- Title Search Report: Before the transfer of property, a title search is often conducted to ensure that the property is free from any liens, disputes, or encumbrances. This report provides a comprehensive history of the property's title, confirming the donor's legal right to gift the property.

- Real Property Transfer Tax Declarations: Depending on the jurisdiction, this form might be required to report the property transfer to local or state tax authorities. It helps in the calculation of any potential transfer tax liability, although gifts are often exempt from such taxes.

- Settlement Statement: In some cases, especially if the property has a mortgage or any associated settlement costs, this document outlines all financial transactions and costs involved in the transfer of property. It provides a clear financial summary of the transaction for both parties.

- Revocable Living Trust: When property is being gifted through a trust, this document allows the donor to retain control over their assets during their lifetime. Upon the donor's death, the property is transferred to the designated recipient as outlined in the terms of the trust.

Ensuring that these documents accompany a Gift Deed can significantly smooth the process of gifting property. They not only add a layer of security to the transaction but also provide a clear record of the gift for legal and taxation purposes. Individuals considering gifting property should consult with legal professionals to understand which accompanying documents are necessary in their specific circumstances. This careful preparation helps in avoiding future legal hurdles, making the generous act of gifting a more fulfilling experience.

Similar forms

Will: Like a Gift Deed, a Will also facilitates the transfer of personal property upon the death of the owner. However, a Will becomes effective only after the owner's death, whereas a Gift Deed is effective immediately.

Trust Agreement: Similar to a Gift Deed, a Trust Agreement can transfer property or assets. The main difference is the appointment of a trustee to manage the assets for the benefit of third parties, known as beneficiaries.

Quitclaim Deed: This document is used to transfer any ownership interest in property the grantor might have, without any warranty. It's similar to a Gift Deed but usually used between family members or close friends where trust is implied.

Warranty Deed: This is used for real estate transactions, offering a guarantee that the property is free from any claims or encumbrances. It's like a Gift Deed but involves a sale and guarantees about the property's title.

Grant Deed: Similar to a Gift Deed, a Grant Deed transfers property ownership. The main difference is that it provides limited warranties against prior encumbrances or impediments to the title, which is not a concern with most Gift Deeds.

Life Estate Deed: This document allows a property owner to transfer real estate while retaining the right to use the property for life. It shares the immediate transfer feature with a Gift Deed but differs in the lifespan usage rights.

Power of Attorney: Though not strictly a transfer document, a Power of Attorney can authorize someone else to manage one's property, including the signing of Gift Deeds. It's a preparatory step that can precede or accompany the gifting process.

Beneficiary Designation Form: Common in retirement accounts and life insurance policies, this form names who will receive assets upon the account holder's death. It's like a Gift Deed in its intention to transfer assets, albeit operative upon death.

Promissory Note: While primarily a debt instrument, it's akin to a Gift Deed in that it can transfer value (in this case, a promise to pay) from one party to another. Unlike a Gift Deed, it involves a repayment obligation.

Dos and Don'ts

Filling out a Gift Deed form is an important process that should be handled with care and attention to detail. Here are some essential do's and don'ts to guide you through accurately completing the form:

Do's- Verify the correct form: Ensure you are using the most current version of the Gift Deed form applicable in your jurisdiction.

- Provide complete information: Fill out all required fields with accurate information to avoid delays or legal issues.

- Use black ink: If filling out the form by hand, write neatly in black ink to ensure legibility and prevent any misunderstanding.

- Review for errors: Before finalizing, double-check all entries for spelling, dates, and other potential errors.

- Consult a professional: If you are unsure about any aspects of the Gift Deed, seeking advice from a legal professional can provide clarity and confidence.

- Secure witnesses or notarization: Depending on state law, ensure the document is either witnessed as required or notarized to validate its authenticity.

- Keep copies: After the deed is complete, keep a copy for your records and provide another to the recipient of the gift for their records.

- Avoid assumptions: Do not assume any part of the form is irrelevant; if a section does not apply, mark it as such according to the form's instructions.

- Don't use pencil: Pencil can fade or be altered easily, which could lead to legal complications or disputes in the future.

- Refrain from guessing: If you are unsure about how to answer a specific question, it's better to seek clarification than to make an incorrect guess.

- Avoid leaving blanks: If a field is not applicable, fill it with "N/A" or "None" as per the form's instructions, rather than leaving it empty.

- Don't rush: Take your time to fill out the form carefully to ensure all information is correct and complete.

- Do not disregard local laws: Be aware of any state or local laws that might affect the gift deed, as requirements can vary.

- Do not forget to sign: A Gift Deed is not legally binding until it is signed by the donor in the presence of the required witnesses or notary.

Misconceptions

When it comes to transferring property or assets from one person to another without any payment, a Gift Deed is often used. However, misunderstandings about this legal document are common. Addressing some of these misconceptions can help clarify its purpose and process.

A Gift Deed is not necessary if trust exists between the parties. This is a common misconception. Despite the level of trust between the giver and the receiver, a Gift Deed provides a legal record of the gift, ensuring that it's recognized by law. This can prevent potential disputes in the future about the ownership of the property.

Gifting property means immediate tax benefits. Many believe that transferring property through a Gift Deed automatically results in tax benefits. However, tax implications for the giver or the receiver can vary. In some instances, the person receiving the gift may be liable for taxes depending on the value of the gift and the laws applicable in their jurisdiction.

A Gift Deed cannot be revoked. Once a Gift Deed is executed, some think it's irreversible. However, there are circumstances under which a Gift Deed can be revoked, such as if it was made under coercion or with undue influence. The ability to revoke a Gift Deed depends on the conditions under which it was made.

Any type of property can be transferred through a Gift Deed. While many types of property can be gifted through a Gift Deed, there are exceptions. For example, certain types of property that carry legal restrictions or require a different form of transfer document cannot be gifted using a Gift Deed. It's important to check the legal requirements for the specific type of property being gifted.

Creating a Gift Deed is a complex and costly process. Some hesitate to use a Gift Deed, believing the process to be complicated and expensive. While it's true that legal advice should be sought to ensure the document is properly prepared, the process does not have to be daunting or prohibitively expensive. Many resources are available to help individuals understand and create a Gift Deed that meets legal requirements.

Key takeaways

When it comes to transferring property as a gift, the Gift Deed form is a legal document that ensures the process is done correctly and according to the law. Here are some key takeaways to keep in mind when filling out and using the Gift Deed form:

- Clarity is key: Make sure all information on the Gift Deed is clear and accurate. This includes the full names of both the giver (donor) and receiver (donee), as well as a detailed description of the property being gifted.

- State-specific requirements: The rules and requirements for a Gift Deed can vary from one state to another. It’s important to ensure that the form complies with the legal requirements of the state where the property is located.

- No consideration: A Gift Deed is used when property is given without expecting anything in return. The document should state that the gift is made voluntarily and without consideration.

- Signing and witnessing: Most states require that a Gift Deed be signed by the donor in the presence of a certain number of witnesses. Some states might also require the document to be notarized to be legally valid.

- Acceptance by the donee: The donee must accept the gift for the transfer to be effective. This acceptance can often be implied, but some states might require explicit acceptance to be documented.

- Revocability: Unless specifically stated as irrevocable in the Gift Deed, most gifts are considered revocable. This means the donor can cancel the gift before it is transferred. However, once the donee has accepted the gift, it cannot usually be revoked.

- Transfer and recording: After the Gift Deed is completed and properly executed, it’s advised to record the deed with the local county recorder’s office. This step is crucial for real estate gifts as it puts the public on notice of the new ownership.

Understanding these key points can help ensure that the process of gifting property is conducted smoothly and legally. It’s always advisable to consult with a legal professional to ensure that all aspects of the gift are properly addressed and that the deed complies with current laws and regulations.

Find Other Types of Gift Deed Documents

Quit Claim Deed Form Iowa - Allows for the immediate transfer of property interest from one individual to another.

Corrective Deed California - Maintains consistency and accuracy within public land records and registries.