Valid Lady Bird Deed Template

When planning for the future, particularly in terms of estate planning and the transfer of property, the Lady Bird Deed form presents a unique and efficient tool. This particular form of deed, also known as an enhanced life estate deed, allows property owners significant flexibility and benefits. Notably, it permits the transfer of real estate to beneficiaries upon the owner's death without the need for probate, a process that can be time-consuming and costly. The owner retains the right to use and control the property during their lifetime, including the ability to sell or mortgage the property without the beneficiary's consent. This aspect sets it apart from traditional life estate deeds. Furthermore, the Lady Bird Deed can offer tax advantages and can be a strategic part of Medicaid planning, potentially protecting the property from certain recovery claims. By considering the Lady Bird Deed, individuals have a powerful tool at their disposal for estate planning, one that safeguards their interests and those of their beneficiaries, ensuring a smoother transition of assets.

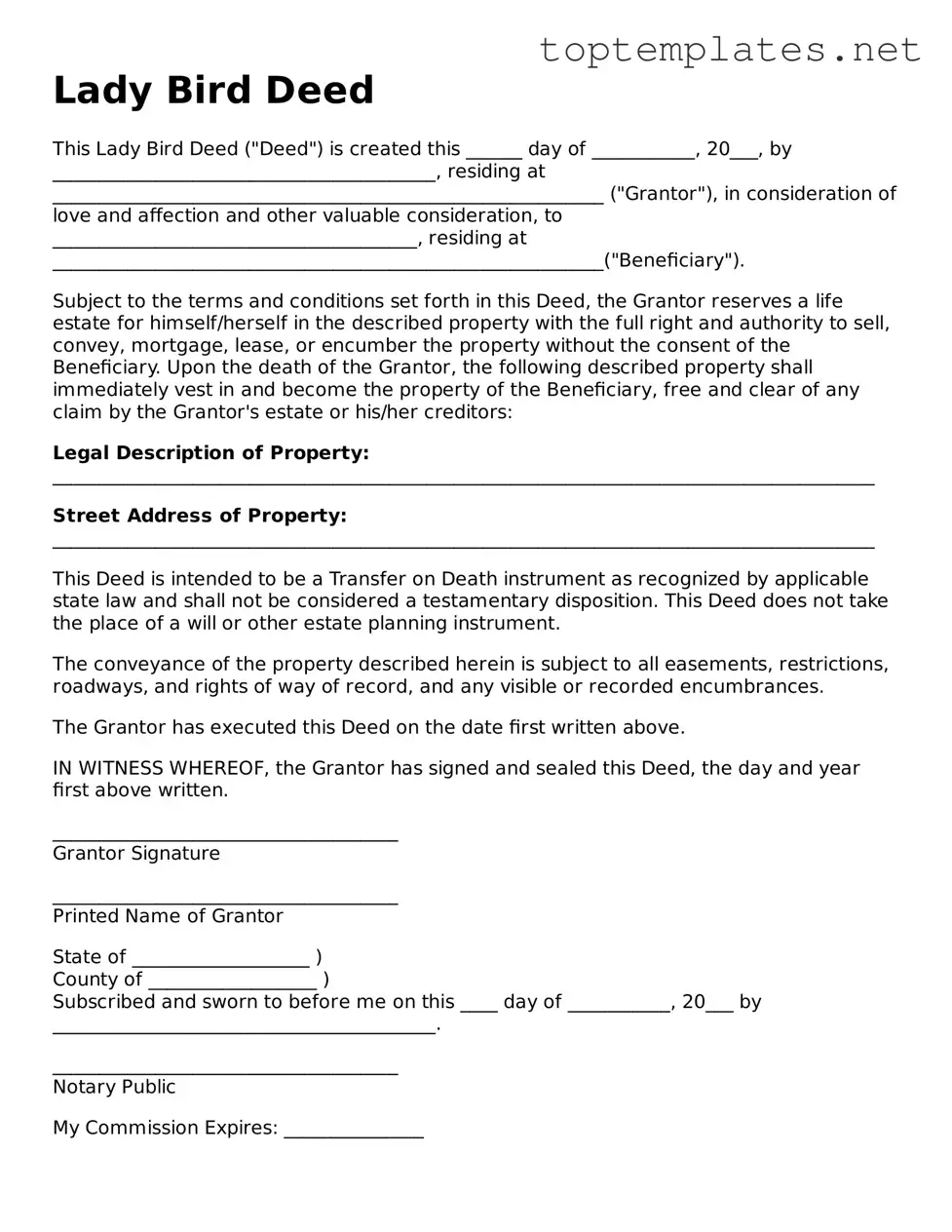

Sample - Lady Bird Deed Form

Lady Bird Deed

This Lady Bird Deed ("Deed") is created this ______ day of ___________, 20___, by _________________________________________, residing at ___________________________________________________________ ("Grantor"), in consideration of love and affection and other valuable consideration, to _______________________________________, residing at ___________________________________________________________("Beneficiary").

Subject to the terms and conditions set forth in this Deed, the Grantor reserves a life estate for himself/herself in the described property with the full right and authority to sell, convey, mortgage, lease, or encumber the property without the consent of the Beneficiary. Upon the death of the Grantor, the following described property shall immediately vest in and become the property of the Beneficiary, free and clear of any claim by the Grantor's estate or his/her creditors:

Legal Description of Property: ________________________________________________________________________________________

Street Address of Property: ________________________________________________________________________________________

This Deed is intended to be a Transfer on Death instrument as recognized by applicable state law and shall not be considered a testamentary disposition. This Deed does not take the place of a will or other estate planning instrument.

The conveyance of the property described herein is subject to all easements, restrictions, roadways, and rights of way of record, and any visible or recorded encumbrances.

The Grantor has executed this Deed on the date first written above.

IN WITNESS WHEREOF, the Grantor has signed and sealed this Deed, the day and year first above written.

_____________________________________

Grantor Signature

_____________________________________

Printed Name of Grantor

State of ___________________ )

County of __________________ )

Subscribed and sworn to before me on this ____ day of ___________, 20___ by _________________________________________.

_____________________________________

Notary Public

My Commission Expires: _______________

File Breakdown

| Fact Name | Detail |

|---|---|

| Definition of Lady Bird Deed | A Lady Bird Deed is a legal document that allows property owners to transfer their real estate upon their death without going through probate. |

| Alternate Name | It is also known as an Enhanced Life Estate Deed. |

| Control During Lifetime | The owner retains complete control over the property, including the right to sell or mortgage, until their death. |

| Probate Avoidance | This deed helps avoid the costly and time-consuming probate process. |

| Impact on Medicaid Eligibility | It can help in planning for Medicaid eligibility without affecting the property owner's qualifications. |

| State-Specific | Lady Bird Deeds are not recognized in all states. They are mainly used in Florida, Texas, Michigan, and a few others. |

| Governing Law | Since this deed form is state-specific, the governing laws are the property laws of the state where the property is located. |

| Benefits | Benefits include avoiding probate, potential protection against creditors, and no need for a trust or life insurance to transfer real estate assets. |

Steps to Filling Out Lady Bird Deed

When estate planning, ensuring that your property smoothly transitions to your beneficiaries without the need for probate is a concern for many. The Lady Bird Deed, utilized in certain states, offers a mechanism to accomplish this goal by allowing property owners to retain control over their property during their lifetime, including the ability to sell or mortgage, and then automatically transfer it to a designated beneficiary upon their death. The following steps guide you through the process of filling out a Lady Bird Deed form, ensuring clarity and precision in this crucial document.

- Identify the current property owner(s) as the "Grantor(s)." Full legal names must be used to avoid any confusion or misidentification.

- Specify the designated beneficiary(ies) who will receive the property upon the grantor's death. As with the grantor, include full legal names and clarify the relationship to the grantor, if applicable.

- Provide a complete and accurate description of the property being transferred. This should include the physical address, legal description, and any identifying numbers such as parcel or tax identification numbers. Details must be precise to ensure correct property identification.

- State clearly that the grantor retains a life estate in the property, which includes the right to use, profit from, and sell the property during their lifetime. This clause is crucial as it distinguishes the Lady Bird Deed from a traditional life estate deed by allowing retained control by the grantor.

- If the grantor reserves the right to revoke the deed or change the beneficiary, this should be explicitly mentioned in the document. This flexibility is a key feature of the Lady Bird Deed, differentiating it from other estate planning tools.

- The grantor must sign and date the deed in the presence of a notary public. The notarization of the deed is a mandatory step to ensure its validity and enforceability.

- The completed deed must then be filed with the appropriate county recorder's office or similar local government body where the property is located. Filing the deed is the final step in making it effective and must be done according to local guidelines, which may vary.

Completing the Lady Bird Deed with accuracy is paramount as it directly impacts the future ownership of your property. This deed, allowing for a seamless transition while avoiding the pitfalls of probate, requires attention to detail in its execution. Following the outlined steps diligently ensures that the property is conveyed according to the grantor's wishes, safeguarding the intended beneficiary's interest.

Discover More on Lady Bird Deed

What is a Lady Bird Deed?

A Lady Bird Deed, also known as an enhanced life estate deed, is a legal document that allows property owners to transfer their property to someone else upon their death without the need for probate. It gives the current owner retained control over the property during their lifetime, including the right to sell or use the property, while designating a beneficiary to automatically receive the property upon the owner's death.

How does a Lady Bird Deed differ from a traditional life estate deed?

Unlike a traditional life estate deed, which significantly limits the original owner's rights to sell or borrow against the property, a Lady Bird Deed provides the owner with greater flexibility. The owner retains the right to sell, lease, or mortgage the property without needing consent from the beneficiary. Upon the owner’s death, the property passes directly to the beneficiary, thereby avoiding probate.

Is a Lady Bird Deed recognized in all states?

No, Lady Bird Deeds are not recognized in all states. They are currently valid in a limited number of states. It is critical for property owners to consult with a legal professional familiar with their state’s laws to determine if a Lady Bird Deed is a viable estate planning tool in their situation.

Can a Lady Bird Deed be revoked or changed?

Yes, one of the key benefits of a Lady Bird Deed is that it remains revocable until the owner's death. The property owner has the flexibility to cancel or change the beneficiary designation at any time without needing the beneficiary's consent.

What are the benefits of using a Lady Bird Deed?

Lady Bird Deeds offer several advantages, including avoiding probate, which can be time-consuming and costly. They also provide the owner with continued control over the property during their lifetime, offer potential tax benefits, and can help in eligibility considerations for Medicaid long-term care planning.

Are there any disadvantages to using a Lady Bird Deed?

While Lady Bird Deeds offer considerable benefits, there are potential disadvantages such as lack of awareness and recognition in some states, possible misunderstandings or disputes among future beneficiaries, and variations in how these deeds are treated by local tax authorities or in Medicaid eligibility considerations. Consulting with a legal expert is advisable to understand any possible implications fully.

What information is required to create a Lady Bird Deed?

To create a Lady Bird Deed, the following information is typically required: the legal description of the property, the name and address of the current owner, the name and address of the beneficiary, and specific language that grants the life estate while retaining rights and specifying the remainder beneficiary. It must also be signed, witnessed, and notarized according to state law requirements.

How does one terminate a Lady Bird Deed?

To terminate a Lady Bird Deed, the current owner can revoke the deed by preparing a new document that expressly revokes the deed or creates a new deed that transfers the property either back to the owner or to a different beneficiary. This action should be executed with the same formalities as the original deed, including being filed with the local county recorder’s office.

Common mistakes

-

Not correctly identifying the property is a common mistake made when filling out the Lady Bird Deed form. The legal description of the property must be accurate and complete to ensure the deed is valid and binding. Just using the address may not be sufficient as it does not provide the detailed information typically required for real estate transactions.

-

Failing to properly name and designate beneficiaries can lead to potential disputes and confusion after the grantor's passing. Beneficiaries must be clearly identified by their full names to avoid any ambiguity regarding the grantor's intentions. It's crucial to specify the relationships and distribution shares if there are multiple beneficiaries to ensure the property is transferred according to the grantor's wishes.

-

Overlooking the need for notarization is another mistake. For a Lady Bird Deed to be legally effective, it must be signed by the grantor in the presence of a notary public. The omission of this step can result in the deed being considered invalid, which means the property may not transfer as intended upon the grantor's death.

-

Incorrectly assuming the deed overrides other legal documents is a mistake that can complicate estate planning. People often fail to realize that the Lady Bird Deed is part of a broader estate plan and must be coordinated with other documents like wills and trusts. It's necessary to ensure all documents are aligned to avoid conflicting instructions regarding asset distribution.

Documents used along the form

When managing estates and property matters, a variety of forms and documents often accompany the Lady Bird Deed form. These documents play pivotal roles in ensuring the seamless transfer of property rights, avoiding probate, and clarifying the intentions of the property owner. The Lady Bird Deed, known for allowing property owners to retain control over their property while alive and automatically transfer it to a designated beneficiary upon death, is frequently accompanied by several key documents.

- Warranty Deed: This document guarantees that the property title is clear and free of liens, providing assurance to the beneficiary that no legal claims or encumbrances from previous owners will affect their ownership.

- Quit Claim Deed: Used to transfer any ownership interest in property the grantor may have, without any guarantee of clear title, often utilized within families or between close individuals to clear up title issues.

- Revocable Living Trust: A document that holds property or assets for the benefit of a beneficiary, which can be altered or revoked as long as the grantor is alive. This trust allows for the avoidance of probate upon the grantor's death.

- Power of Attorney: Grants a chosen individual the authority to handle legal and financial matters on behalf of the property owner, including real estate transactions, if the owner becomes incapacitated.

- Last Will and Testament: A legal document specifying how a person's assets and estate will be distributed upon their death. It clarifies the property owner's intentions and may work in conjunction with the Lady Bird Deed to provide a comprehensive estate plan.

- Death Certificate: While not a document directly involved in property transfer, it is often required to prove the death of the property owner to finalize the property transfer under a Lady Bird Deed.

These documents, when used in conjunction with a Lady Bird Deed, form a robust framework for handling estate planning and property transfer. Each serves a unique purpose in ensuring that property transfer is smooth, legally sound, and in accordance with the property owner's wishes. Proper utilization and understanding of these forms are essential in navigating the complexities of estate planning and real estate management.

Similar forms

Transfer on Death Deed (TODD): Like the Lady Bird Deed, a Transfer on Death Deed allows property owners to name beneficiaries who will inherit the property upon the owner's death without the need for probate. Both deeds enable the owner to retain control over the property during their lifetime, including the right to sell or mortgage.

Joint Tenancy with Right of Survivorship: This arrangement mirrors the Lady Bird Deed’s mechanism for avoiding probate by automatically transferring property to the surviving owner(s) upon one’s death. However, it differs in that all owners hold an equal interest in the property while alive, unlike the sole control retained with a Lady Bird Deed.

Life Estate Deed: Similar to the Lady Bird Deed, a Life Estate Deed splits property ownership between the life tenant and the remainderman. The life tenant has the right to use the property until death, after which the remainderman gains full ownership. The distinction lies in the life tenant's limited ability to sell or mortgage the property without the remainderman's consent, a restriction not present with Lady Bird Deeds.

Revocable Living Trust: Like the Lady Bird Deed, a Revocable Living Trust can help avoid probate by transferring ownership of property to beneficiaries upon the trustor’s death. Both allow for amendments or revocation as long as the grantor is alive and mentally competent, providing a flexible approach to managing assets.

Payable on Death (POD) Account: While not a deed or directly related to real property, a POD account shares the Lady Bird Deed's principle of bypassing probate. By naming a beneficiary, the contents of the account transfer to that person upon the owner’s death without going through probate, similar to how a Lady Bird Deed operates for real estate assets.

Community Property with Right of Survivorship: In states that recognize community property, this form of ownership allows married couples to hold property together with the surviving spouse automatically inheriting the deceased spouse’s share upon their death, akin to the swift transfer of property without probate seen with the Lady Bird Deed. However, it applies only to spouses and directly to assets acquired during the marriage.

Dos and Don'ts

Filling out a Lady Bird Deed form is an important process that allows property owners to transfer property upon their death without the need for probate. Here are some essential do's and don'ts to help guide you through this process:

Do's:

- Ensure all information is accurate: Double-check the legal description of the property, your name, and the names of the beneficiaries to prevent any issues.

- Use precise legal language: It's crucial to use the exact legal terms required by the Lady Bird Deed to ensure it's valid and enforceable.

- Sign the deed in the presence of a notary: To make the deed legally binding, signing it in front of a notary public is a necessity.

- Record the deed with the county clerk: After the deed is signed, it must be filed with the office of the county clerk in the county where the property is located to make it official.

Don'ts:

- Leave any sections blank: Incomplete forms can lead to misunderstandings or legal challenges, so be sure to fill out every section.

- Attempt to use the deed to avoid creditors: A Lady Bird Deed is not a tool for dodging lawful debts or creditors, which can lead to legal repercussions.

- Forget to consider other estate planning documents: While a Lady Bird Deed is helpful, it should be part of a broader estate planning strategy that includes other documents like a will or trust.

- Overlook consulting with an estate attorney: Because laws vary by state and can be complex, consulting with a professional can ensure the deed achieves your intentions and complies with local laws.

Misconceptions

When discussing estate planning, the Lady Bird Deed (LBD) often comes up, surrounded by a mix of facts, misunderstandings, and half-truths. This deed, available in a few states, offers a way for property owners to pass on real estate to beneficiaries upon their death without the need to go through probate. Let's clear up some common misconceptions about the Lady Bird Deed.

- It allows the grantor complete control until death: A common misconception is that the grantor loses some control over the property after signing a Lady Bird Deed. In reality, this special deed lets the original property owner keep full control. They can sell, mortgage, or gift the property without needing permission from the future beneficiaries.

- It's recognized in every state: Another misunderstanding is that Lady Bird Deeds are valid everywhere in the United States. However, only a few states recognize this type of deed, including Florida and Michigan. It's important to check if it's an option in the state where the property is located.

- It protects the property from all creditors: Some believe that a Lady Bird Deed protects the property from all the grantor's creditors. While it does offer some level of protection, especially in regards to Medicaid estate recovery in some states, it may not shield the property from all types of creditors or liens.

- It's a substitute for a will or living trust: It's a misconception that a Lady Bird Deed can replace a will or living trust. Although it can be part of a comprehensive estate plan, a Lady Bird Deed only covers real estate. Other assets, including personal property and bank accounts, require a will or trust to be distributed according to the grantor's wishes.

- It complicates taxes for the beneficiary: Many people incorrectly believe that inheriting property through a Lady Bird Deed will lead to complicated tax issues for the beneficiary. In truth, the property is stepped up to its market value at the time of the grantor's death, potentially minimizing capital gains taxes if the property is sold.

Key takeaways

When considering a Lady Bird Deed for estate planning, understanding its features and proper application is key. This deed, also known as an enhanced life estate deed, allows property owners to maintain control over their property during their lifetime, while also naming beneficiaries to inherit the property upon their death, bypassing the probate process. Here are five essential takeaways about filling out and using the Lady Bird Deed form:

- Accuracy is critical when completing a Lady Bird Deed form. Ensure all information, especially names and addresses of the property owner and beneficiaries, is accurate and matches official documents.

- Not all states recognize the Lady Bird Deed. Before proceeding, check if your state allows for this type of deed. If it does, familiarize yourself with any state-specific requirements or limitations.

- A key benefit of the Lady Bird Deed is that it allows the property owner to retain full control over the property during their lifetime, including the ability to sell or mortgage the property without needing approval from the beneficiaries.

- Consulting with a legal professional is highly recommended. While the form may seem straightforward, a lawyer specializing in estate planning can provide valuable advice on whether this deed suits your specific situation and ensure it's properly executed.

- Recording the deed with the appropriate government office is a necessary final step after filling it out. This process makes the deed legally effective and ensures that it is recognized upon the property owner's death.

Understanding these key points can help individuals make informed decisions about whether a Lady Bird Deed aligns with their estate planning goals and can assist in the smooth transfer of property to their intended beneficiaries.

Find Other Types of Lady Bird Deed Documents

What Is a Deed in Lieu of Foreclosure - A tool for settling mortgage debt without going through the foreclosure process, this form transfers the deed of the property to the lender.

Does California Have a Transfer on Death Deed - This legal document is a proactive step in estate planning that can alleviate the emotional and financial toll on loved ones after the property owner's passing.