Valid Quitclaim Deed Template

In the realm of property transactions, the Quitclaim Deed form emerges as a vital instrument, facilitating the conveyance of a property's title without the assurances typically provided by a general warranty deed. This document, pivotal for its utility in specific circumstances, enables an individual (referred to as the grantor) to transfer any interest they possess in a property to another party (known as the grantee), with the clear understanding that no warranties regarding the quality of the title are being made. Often utilized among family members, in divorce settlements, or to clear title disputes, its simplicity and effectiveness in transferring ownership interest without the implications of guaranteeing a clear title make it a preferred option in situations where speed and efficiency are prioritized. However, the very features that make the Quitclaim Deed advantageous also call for a careful consideration of its limitations and the specific contexts in which its use is most appropriate.

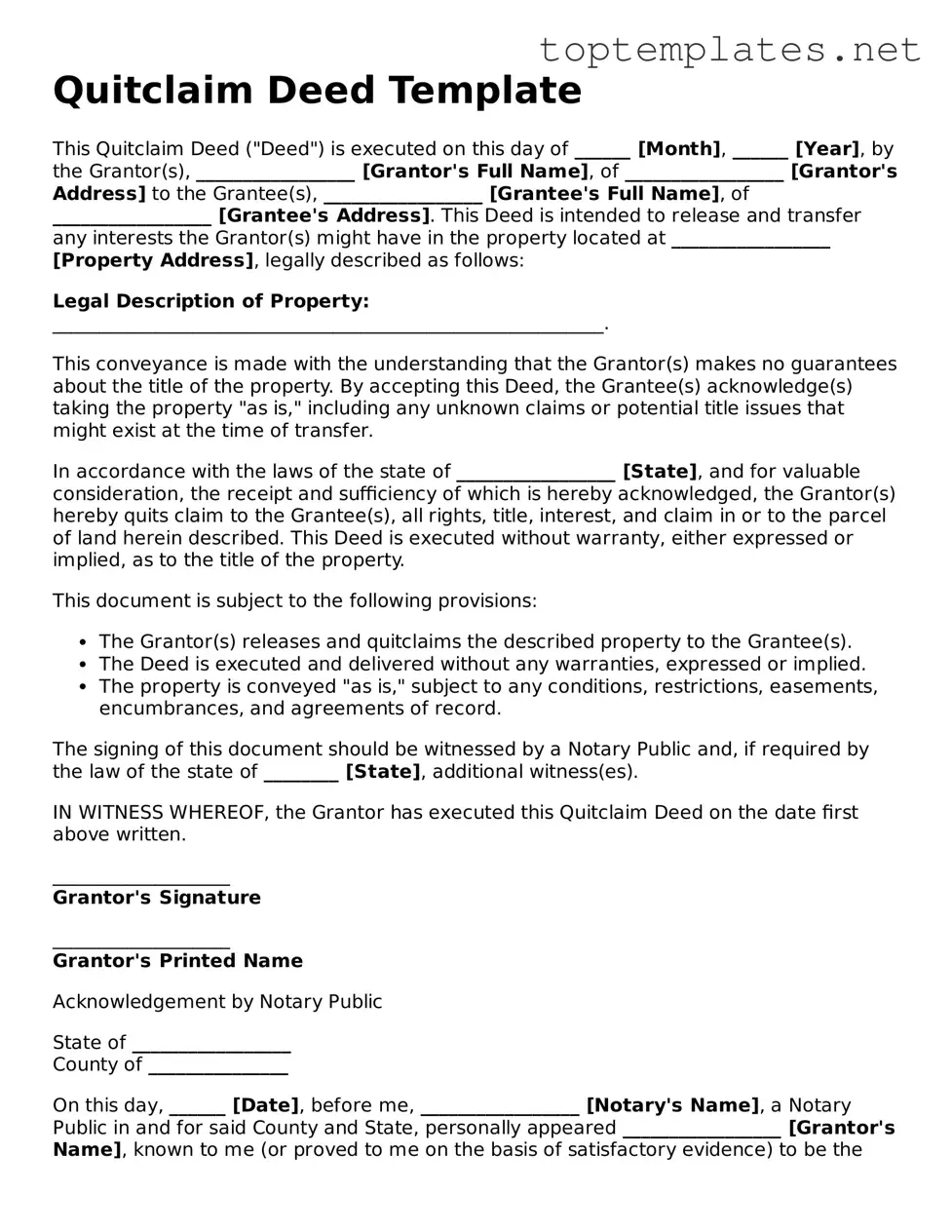

Sample - Quitclaim Deed Form

Quitclaim Deed Template

This Quitclaim Deed ("Deed") is executed on this day of ______ [Month], ______ [Year], by the Grantor(s), _________________ [Grantor's Full Name], of _________________ [Grantor's Address] to the Grantee(s), _________________ [Grantee's Full Name], of _________________ [Grantee's Address]. This Deed is intended to release and transfer any interests the Grantor(s) might have in the property located at _________________ [Property Address], legally described as follows:

Legal Description of Property: ___________________________________________________________.

This conveyance is made with the understanding that the Grantor(s) makes no guarantees about the title of the property. By accepting this Deed, the Grantee(s) acknowledge(s) taking the property "as is," including any unknown claims or potential title issues that might exist at the time of transfer.

In accordance with the laws of the state of _________________ [State], and for valuable consideration, the receipt and sufficiency of which is hereby acknowledged, the Grantor(s) hereby quits claim to the Grantee(s), all rights, title, interest, and claim in or to the parcel of land herein described. This Deed is executed without warranty, either expressed or implied, as to the title of the property.

This document is subject to the following provisions:

- The Grantor(s) releases and quitclaims the described property to the Grantee(s).

- The Deed is executed and delivered without any warranties, expressed or implied.

- The property is conveyed "as is," subject to any conditions, restrictions, easements, encumbrances, and agreements of record.

The signing of this document should be witnessed by a Notary Public and, if required by the law of the state of ________ [State], additional witness(es).

IN WITNESS WHEREOF, the Grantor has executed this Quitclaim Deed on the date first above written.

___________________

Grantor's Signature

___________________

Grantor's Printed Name

Acknowledgement by Notary Public

State of _________________

County of _______________

On this day, ______ [Date], before me, _________________ [Notary's Name], a Notary Public in and for said County and State, personally appeared _________________ [Grantor's Name], known to me (or proved to me on the basis of satisfactory evidence) to be the person(s) whose name(s) is/are subscribed to the within instrument, and acknowledged that he/she/they executed the same for the purposes therein contained.

Witness my hand and official seal.

___________________

Notary's Signature

___________________

Notary's Printed Name

My Commission Expires: ______

File Breakdown

| Fact Number | Description |

|---|---|

| 1 | A Quitclaim Deed is used to transfer ownership of property without making any warranties about the title. |

| 2 | It is often used among family members, such as transferring property between parents and children or between siblings. |

| 3 | This deed is typically used for property transfers that do not involve an exchange of money. |

| 4 | Quitclaim Deeds do not guarantee that the grantor holds clear title to the property. |

| 5 | Recording a Quitclaim Deed with the local county office is necessary to make the transfer official. |

| 6 | Each state has specific laws that govern how a Quitclaim Deed must be executed and recorded. |

| 7 | In some states, the deed must be signed in the presence of a notary public. |

| 8 | Some states require witnesses in addition to notarization for the deed to be legally valid. |

| 9 | Tax implications may arise from transferring property using a Quitclaim Deed, depending on the circumstances of the transfer. |

| 10 | Even though it is a simple form, consulting with a real estate attorney to ensure it is the right document for your situation is advisable. |

Steps to Filling Out Quitclaim Deed

A Quitclaim Deed is a legal document used to transfer interest in real property from one person or entity to another. It is commonly used among family members or to clear up title issues. This document does not warrant or guarantee that the title is clear. It simply transfers whatever interest the grantor has in the property, if any, to the grantee. After the form is filled out, it may need to be notarized and filed with the local county recorder's office to be effective. Here are the steps to fill out a Quitclaim Deed form properly.

- Identify the preparer of the document. This is typically the name and address of the person filling out the form.

- Include the return address. Specify where the recorded deed should be sent after it is filed with the county recorder's office.

- State the consideration. This is the amount of money, if any, being exchanged for the transfer of the property. Even if no money is involved, a nominal amount like $10 should be mentioned as a legal formality.

- List the grantor's information. Write down the name and address of the current owner(s) of the property who is/are transferring the interest.

- List the grantee's information. Provide the name and address of the person(s) or entity receiving the interest in the property.

- Describe the property. Include a legal description of the property being transferred. This can often be found on the current deed or by contacting the county recorder's office.

- Execution by the grantor(s). The grantor(s) must sign the Quitclaim Deed in the presence of a notary public.

- Notarization. The document must be officially notarized by a notary public, who will fill out this section.

- Record the deed. The last step is to take or send the notarized deed to the county recorder’s office where the property is located to have it officially recorded.

After the document is filed with the county recorder’s office, the Quitclaim Deed transfer is complete. It is important to keep a copy of the recorded deed for personal records and future reference. The process of filing and recording times may vary based on local regulations. One should inquire with the local county recorder for any specific requirements or fees associated with recording the deed.

Discover More on Quitclaim Deed

What is a Quitclaim Deed?

A Quitclaim Deed is a legal document used to transfer interest in real property from one person or entity (the grantor) to another (the grantee). Unlike other types of property deeds, it conveys only the interest the grantor has in the property, if any, without any warranty of clear title. This means the grantee receives no guarantee about the extent of the property interest transferred or the property's debt-free status.

When should one use a Quitclaim Deed?

Quitclaim Deeds are commonly used when transferring property between family members, such as adding or removing a spouse's name from a property title during a marriage or divorce. They are also used to clear up title issues, transfer property into a trust, or in other situations where a quick, uncomplicated transfer of property takes place without the need for extensive guarantees.

What are the main differences between a Quitclaim Deed and a Warranty Deed?

The major difference lies in the level of protection offered to the buyer. A Quitclaim Deed offers no warranties on the title, meaning the buyer accepts the property "as-is", including any unknown liens or claims. On the other hand, a Warranty Deed assures the buyer of a clear title, free from liens and encumbrances, providing greater protection against future disputes over the property’s title.

Is a Quitclaim Deed the right choice for selling property?

Generally, a Quitclaim Deed is not the preferred method for selling property, especially in transactions where the buyer seeks assurance of a clear title. Since Quitclaim Deeds make no guarantee about the property's title status, buyers often prefer the security that comes with a Warranty Deed in sales transactions. However, in transactions between family members or to clear title defects, a Quitclaim Deed may be a simple and effective choice.

Common mistakes

-

Not Checking Local Requirements: Each state and sometimes counties have unique requirements for a Quitclaim Deed. Failing to comply with these local regulations can render the deed invalid. This oversight includes ignoring specific formatting rules or additional documentation that may be necessary.

-

Incorrect Names and Identifying Information: It's essential to use the full legal names of both the grantor (the person transferring the property) and the grantee (the person receiving the property). Mistakes or omissions in names, including misspellings or excluding middle names, can lead to disputes or complications in establishing clear ownership.

-

Leaving Blank Spaces: Every field in the Quitclaim Deed should be completed to prevent ambiguity. Unfilled spaces or sections might lead to misinterpretation or manipulation of the document's intent after the fact.

-

Not Specifying Ownership Share: When property is transferred to multiple grantees, the deed should specify how ownership is divided. Without this clarity, the law defaults to equal shares regardless of the parties' intentions, potentially leading to conflict among co-owners.

-

Failure to File with the Correct Office: After execution, the Quitclaim Deed must be filed with the appropriate local office, often the county clerk or land records office. Neglecting to file, or filing with the wrong office, means the transfer is not officially recorded, affecting future transactions and potentially the legal ownership status.

-

Not Obtaining Necessary Signatures: Depending on jurisdiction and specific circumstances, additional signatures beyond those of the grantor and grantee may be required. This can include witnesses, notaries, or the spouses of the parties involved. Many individuals overlook this requirement, risking the validity of the document.

Documents used along the form

When managing property transactions, leveraging the correct documents is crucial to ensure everything proceeds smoothly and legally. Alongside a Quitclaim Deed, a range of other forms and documents are typically employed to guarantee that all aspects of the property transfer are comprehensively covered. These include agreements clarifying the terms of the transfer, official records ensuring the legality of the transaction, and practical documents assisting both the grantor and grantee throughout the process.

- Title Search Report: Essential for verifying the property’s legal status, this document outlines any existing liens, encumbrances, or claims against the property that could complicate the transfer.

- Warranty Deed: In contrast to a Quitclaim Deed, this form offers the grantee a guarantee regarding the clear title of the property, ensuring it's free from liens and encumbrances.

- Property Disclosure Statement: This document requires the seller to disclose any known issues with the property, ranging from structural problems to past repairs and renovations.

- Mortgage Payoff Statement: For properties under a mortgage, this statement provides the exact amount required to pay off the current mortgage, crucial for the closing process.

- Homeowners' Association (HOA) Documents: If the property is part of an HOA, these documents detail any covenants, conditions, and restrictions (CC&Rs), fees, and assessments pertinent to the property.

- Final Closing Statement: An itemized list of all the financial transactions and fees associated with the transfer, which is reviewed and signed at closing.

- Insurance Documents: Proof of insurance is often required before closing to protect both parties from potential future liabilities or damage to the property.

Each of these documents plays a pivotal role in facilitating a smooth transfer of property rights. By ensuring completeness and accuracy in these accompanying forms and documents, all parties can navigate the transaction with a higher degree of confidence and security, significantly reducing potential legal complications down the line. Emphasizing thoroughness and adherence to legal requirements underscores the critical nature of understanding and utilizing these documents appropriately in any property transaction.

Similar forms

Warranty Deed: Like a Quitclaim Deed, a Warranty Deed is used in real estate transactions but offers more protection to the buyer. While a Quitclaim Deed offers no guarantees about the property's title, a Warranty Deed guarantees that the seller holds a clear title and has the legal right to sell the property.

Grant Deed: Similar to Quitclaim Deeds, Grant Deeds are used to transfer property ownership. However, Grant Deeds provide the buyer with two guarantees: that the property has not been sold to someone else, and that there are no undisclosed liens or encumbrances against the property.

Special Warranty Deed: This document is akin to the Quitclaim Deed in the sense that it is used in the transfer of property ownership. However, it differs by providing a warranty that only covers the period during which the seller owned the property, unlike a Quitclaim Deed, which offers no warranties at all.

Trustee’s Deed: A Trustee's Deed is somewhat similar to a Quitclaim Deed as it is used in the conveyance of real property. The primary difference is that a Trustee’s Deed is executed by the trustee of a trust, not the property owner, often as part of administering a trust or the foreclosure process.

Deed of Trust: Similar in its purpose to a Quitclaim Deed, a Deed of Trust is involved in real estate transactions. It differs as it involves three parties - the borrower, the lender, and the trustee - and secures a loan on real property, ultimately serving as a collateral for the debt.

Fiduciary Deed: Like the Quitclaim Deed, a Fiduciary Deed is used to transfer property rights. It is executed by an individual acting in a fiduciary capacity, such as an executor of an estate or a trustee, and offers no guarantees about the property title.

Transfer-on-Death (TOD) Deed: Although distinct, the TOD Deed shares the Quitclaim Deed's feature of transferring property. The critical difference is that a TOD Deed allows property owners to name beneficiaries to whom the property will transfer upon their death, bypassing probate.

Dos and Don'ts

When filling out a Quitclaim Deed form, it is crucial to ensure accuracy and completeness in the process. This legal document is used to transfer interest in real property from one party to another without any guarantee that the title is clear and free of claims. Here are five things you should do and five things you shouldn't do to navigate this process effectively:

Do:

- Verify the legal description of the property. Ensure that the description on the Quitclaim Deed matches exactly with the description on the existing deed.

- Include all necessary parties. All individuals who have an interest in the property should sign the deed, ensuring that the transfer of interest is agreed upon by all parties.

- Use clear and precise language. Avoid ambiguous terms to ensure that the intent of the deed is clearly understood by all parties and any future readers.

- Check for recording requirements. Different jurisdictions have varying requirements for document formatting, fees, and necessary attachments. Confirm these with your local recording office.

- Seek legal advice if uncertain. If there are any doubts or complexities, consulting with a legal professional can provide clarification and ensure that the deed is properly executed.

Don't:

- Overlook the importance of a notary. Many jurisdictions require that the deed be notarized to be considered valid for recording. Skipping this step can invalidate the document.

- Misspell names or details. Errors in personal information or the legal description can lead to disputes or a cloud on the title, complicating future transactions.

- Assume it clears all claims or liens on the property. A Quitclaim Deed transfers only the interest the grantor has at the time of the transfer and does not guarantee a clear title.

- Ignore tax implications. Transferring property can have tax consequences for both the grantor and the grantee. It's essential to understand these implications beforehand.

- Forget to file the deed with the county recorder's office. After execution, the deed must be filed to put the public on notice of the transfer and to make it effective.

Misconceptions

When it comes to transferring property, the Quitclaim Deed form is often misunderstood. Here, we'll clear up some common misconceptions to help ensure you're well-informed.

A Quitclaim Deed guarantees a clear title. One of the biggest misconceptions is that a Quitclaim Deed guarantees the buyer (grantee) that the seller (grantor) has a clear title to the property. In fact, this type of deed makes no assurances about the title's status, transferring only the interest the grantor has at the time of the deed's execution, if any.

Quitclaim Deeds are only for property sales. Contrary to popular belief, Quitclaim Deeds are not exclusively used for selling property. They are often utilized in non-sale transactions, such as adding or removing someone’s name from the property title in cases of marriage, divorce, or inheritance.

Quitclaim Deeds can fully protect the buyer. Given that these deeds do not guarantee the seller's interest in the property or the state of the title, they offer less protection to the buyer compared to warranty deeds. Buyers should proceed with caution and conduct thorough due diligence.

Using Quitclaim Deeds is always the best option for transferring to a family member. While Quitclaim Deeds are commonly used between family members, they may not always be the best option. Based on the specific circumstances, especially concerning tax implications and future sales, consulting with a professional is advisable.

Quitclaim Deeds eliminate your financial responsibilities. Transferring your interest in a property through a Quitclaim Deed does not absolve you of any mortgage or financial obligations tied to the property. Those remain your responsibility unless specifically transferred or settled otherwise.

You can easily reverse a Quitclaim Deed. Once executed, reversing a Quitclaim Deed is not straightforward. It typically requires the agreement and cooperation of all involved parties, and, in some cases, legal intervention may be necessary.

Quitclaim Deeds transfer property rights immediately. Although a Quitclaim Deed can transfer legal interest upon execution and delivery, the actual process may involve other steps, such as recording the deed with the local county office, which can affect the timing of the transfer’s recognition.

Understanding these misconceptions about the Quitclaim Deed can help individuals make more informed decisions when handling property transfers. When in doubt, consulting a legal or real estate professional is recommended to navigate the specifics of your situation effectively.

Key takeaways

A Quitclaim Deed is a legal document used to transfer ownership of real estate from one person (the grantor) to another (the grantee) without warranties of title. Here are seven key takeaways to remember when filling out and using the Quitclaim Deed form:

- The correct names of both the grantor and grantee must be clearly stated. Ensure these are the legal names to avoid any disputes or challenges regarding the property's ownership.

- Property description is crucial. The deed should include a detailed legal description of the property being transferred. This might include lot numbers, boundary descriptions, or parcel numbers as found in public records.

- Understand that a Quitclaim Deed transfers only what ownership the grantor has, if any. It does not guarantee that the grantor owns the property free and clear of other claims.

- The document must be signed by the grantor in the presence of a notary public to be valid. Some jurisdictions also require the grantee to sign the deed.

- After signing, the Quitclaim Deed must be filed with the county recorder's office or land registry to make the transfer part of the public record. Filing fees will apply.

- Consideration must be clearly mentioned, even if it is a nominal amount like $1 or an alternative like "love and affection," depending on the relationship between the grantor and grantee and state law requirements.

- Before completing the form, it's advised to review state laws related to property transfers. Some locales may have specific requirements or restrictions on the use of Quitclaim Deeds.

Following these guidelines will help ensure that the property transfer is legally effective and reduces the risk of future complications.

Find Other Types of Quitclaim Deed Documents

What Is a Deed in Lieu of Foreclosure - Emphasizes the voluntary nature of the property transfer, distinguishing it from the forceful process of foreclosure.