Valid Transfer-on-Death Deed Template

Many people look for ways to ensure their property is smoothly passed on to their loved ones after they pass away, without the hassle and expense of going through probate court. One effective tool for achieving this is the Transfer-on-Death (TOD) Deed. This legal document allows property owners to name one or more beneficiaries who will receive their property immediately upon the owner's death, without the property having to go through probate. It's a method that has gained popularity for its simplicity and efficiency in bypassing the time-consuming and often costly probate process. The TOD Deed requires the property owner to clearly specify the recipient(s) of the property, but it's important to note that the deed does not take effect until the owner's death, and the owner retains full control over the property during their lifetime. They can sell it, change beneficiaries, or revoke the deed without needing consent from the named beneficiaries. However, it's crucial for property owners to understand the specific rules and requirements of their state since the availability and regulations surrounding TOD Deeds can vary significantly across different jurisdictions.

Sample - Transfer-on-Death Deed Form

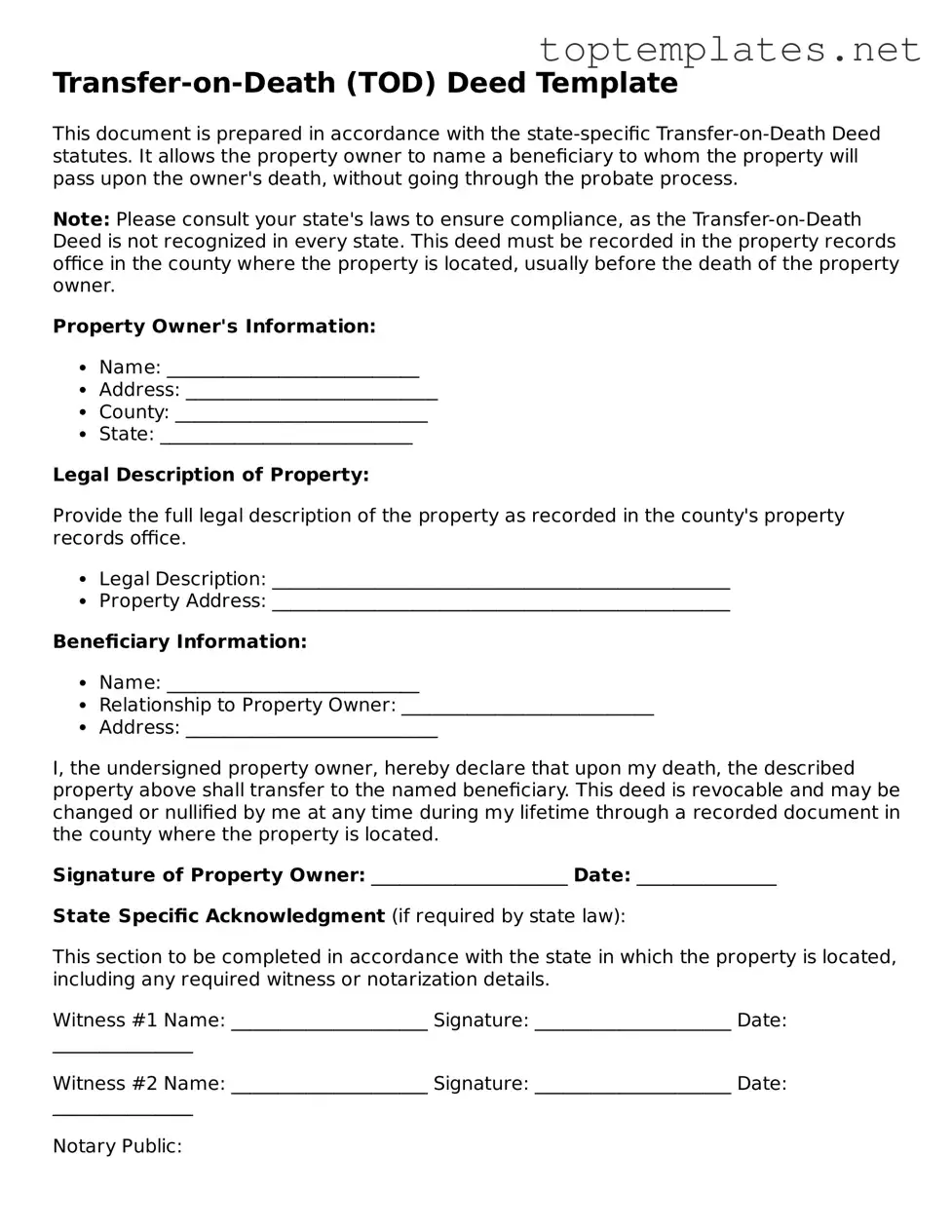

Transfer-on-Death (TOD) Deed Template

This document is prepared in accordance with the state-specific Transfer-on-Death Deed statutes. It allows the property owner to name a beneficiary to whom the property will pass upon the owner's death, without going through the probate process.

Note: Please consult your state's laws to ensure compliance, as the Transfer-on-Death Deed is not recognized in every state. This deed must be recorded in the property records office in the county where the property is located, usually before the death of the property owner.

Property Owner's Information:

- Name: ___________________________

- Address: ___________________________

- County: ___________________________

- State: ___________________________

Legal Description of Property:

Provide the full legal description of the property as recorded in the county's property records office.

- Legal Description: _________________________________________________

- Property Address: _________________________________________________

Beneficiary Information:

- Name: ___________________________

- Relationship to Property Owner: ___________________________

- Address: ___________________________

I, the undersigned property owner, hereby declare that upon my death, the described property above shall transfer to the named beneficiary. This deed is revocable and may be changed or nullified by me at any time during my lifetime through a recorded document in the county where the property is located.

Signature of Property Owner: _____________________ Date: _______________

State Specific Acknowledgment (if required by state law):

This section to be completed in accordance with the state in which the property is located, including any required witness or notarization details.

Witness #1 Name: _____________________ Signature: _____________________ Date: _______________

Witness #2 Name: _____________________ Signature: _____________________ Date: _______________

Notary Public:

State of: ___________________

County of: __________________

On this, the _____ day of ___________, 20__, before me, a Notary Public, personally appeared _____________________________, known to me (or satisfactorily proven) to be the person whose name is subscribed to the within instrument and acknowledged that he/she executed the same for the purposes therein contained.

In witness whereof, I hereunto set my hand and official seal.

Notary Signature: _____________________ Notary Seal:

File Breakdown

| Fact | Detail |

|---|---|

| Definition | A Transfer-on-Death (TOD) deed allows property owners to pass their real estate to a beneficiary upon their death without the need for probate court proceedings. |

| Variability by State | TOD deeds are allowed in many states, but the specific rules and requirements can vary. It's important to consult state-specific laws to ensure compliance. |

| Governing Laws | State-specific statutes govern the use of TOD deeds. For example, in California, the California Probate Code sections 5600-5696 detail TOD deed regulations. |

| Revocability | The property owner can revoke a TOD deed at any time before their death, allowing for flexibility in estate planning. |

| Beneficiary Designation | The beneficiary(ies) designated in a TOD deed must survive the property owner to inherit the property. If the beneficiary predeceases the owner, the deed typically becomes ineffective unless alternate beneficiaries are named. |

Steps to Filling Out Transfer-on-Death Deed

Preparing a Transfer-on-Death (TOD) Deed is a significant step in estate planning, allowing property owners to designate beneficiaries to receive their property upon death, bypassing the often lengthy and costly probate process. It's crucial for property owners to understand the correct way to fill out this form to ensure that their real estate is seamlessly transferred to their chosen beneficiaries without any legal complications. The process is straightforward but requires attention to detail.

To complete the Transfer-on-Death Deed form, follow these steps:

- Locate the legal description of the property. This information can usually be found on your current deed or by contacting your local property records office.

- Clearly write the full name and mailing address of the property owner(s) in the designated section.

- Enter the full name(s) of the designated beneficiary(ies) along with their mailing addresses. If designating more than one beneficiary, specify the percentage of interest each beneficiary is to receive.

- If the property is located in a state that permits the naming of alternate beneficiaries, and you wish to do so, include the full name(s) and mailing address(es) of alternate beneficiary(ies).

- Review the TOD deed form to ensure all required sections are completed accurately. Misinformation or omissions can lead to the deed being invalid.

- Sign the form in the presence of a notary public. Most states require notarization for the document to be legally binding.

- Record the signed form with the county recorder's office or equivalent in the county where the property is located. A recording fee may apply.

Once the Transfer-on-Death Deed is correctly filled out, signed, notarized, and recorded, the document is considered valid. It's important for the property owner to inform the beneficiaries about the TOD deed to prepare them for future responsibilities. Additionally, keeping a copy of the recorded deed among personal records is advisable. The transition of property ownership occurs automatically upon the death of the property owner, provided the deed met all legal requirements at the time of creation. It's also recommended to periodically review and update the deed if circumstances change, such as the death of a beneficiary or a change in the property owner's intentions.

Discover More on Transfer-on-Death Deed

What is a Transfer-on-Death (TOD) Deed?

A Transfer-on-Death Deed is a legal document that allows individuals to pass on their real property to a beneficiary upon their death without the need for a will or going through probate. It becomes effective only upon the death of the property owner.

How does a TOD Deed differ from a will?

Unlike a will, a TOD Deed is specifically designed for the direct transfer of real estate and does not cover other personal property. It allows the property to bypass the probate process, facilitating a quicker and less costly transfer to the designated beneficiary.

Are TOD Deeds available in all states?

No, TOD Deeds are not available in all states. It's important to check the specific laws in your state to determine if this option is available and under what conditions it can be utilized.

Who can be named as a beneficiary in a TOD Deed?

Almost anyone can be named as a beneficiary in a TOD Deed, including family members, friends, or organizations. However, the beneficiary must be clearly identified to avoid any potential disputes or confusion upon the owner's death.

Can a TOD Deed be revoked or changed?

Yes, a TOD Deed can be revoked or changed at any time before the death of the property owner, provided they are mentally competent. This is typically done by filing a new TOD Deed or a revocation deed.

What happens to the property if the beneficiary predeceases the owner?

If the beneficiary predeceases the owner, the TOD Deed typically becomes void. The property owner should update the deed to name a new beneficiary, otherwise the property may have to go through probate.

Is a TOD Deed subject to the debts of the deceased?

Yes, property transferred using a TOD Deed may still be subject to the debts of the deceased, including state taxes and federal estate taxes, where applicable. Creditors may have claims against the property, impacting the beneficiary's inheritance.

Do beneficiaries have any rights to the property before the owner's death?

No, beneficiaries have no legal rights to the property or its use before the death of the owner. The owner retains full control and can sell, lease, or otherwise use the property at their discretion without the beneficiary's consent.

Are there any special requirements for executing a TOD Deed?

Yes, the specific requirements for executing a TOD Deed vary by state but typically include the necessity for the deed to be in writing, contain a legal description of the property, be signed by the property owner, and be notarized. Some states also require the deed to be filed with the local county recorder's office.

What happens when the property owner dies?

Upon the death of the property owner, the beneficiary must typically file a death certificate and a form of affidavit with the local county recorder's office to formally transfer the property title. This process and any additional requirements may vary by state.

Common mistakes

When filling out the Transfer-on-Death (TOD) Deed form, many individuals tend to overlook or improperly complete certain sections. These errors can result in delays or even failure in transferring property as intended upon the owner's death. Here are some of the common mistakes:

Not verifying ownership details accurately. This includes failing to match the legal description of the property with public records, which can cause confusion regarding which property is being transferred.

Omitting to name a beneficiary clearly. Beneficiaries must be identified by their full legal names to avoid ambiguity about who will inherit the property.

Listing a minor as a direct beneficiary without appointing a guardian or setting up a trust. This can complicate the transfer process since minors cannot directly inherit property.

Failure to acknowledge spousal rights, if applicable, can lead to legal challenges, especially in community property states where a spouse may have a claim to the property regardless of what the TOD deed specifies.

Forgetting to sign and date the document in front of the required witnesses or notary public. The TOD deed is legally binding only if it's properly executed according to state law.

Not specifying what happens if a beneficiary predeceases the owner. Without clear instructions, the property may not transfer as intended.

Failing to file the TOD deed with the county recorder’s office. Unrecorded TOD deeds might not be recognized, making the intended transfer ineffective.

Overlooking the need to update the TOD deed after major life events, such as marriage, divorce, or the birth of a child, which can lead to unintended beneficiaries.

It is crucial for property owners to approach the TOD deed with attention and precision, ideally with guidance from a legal professional, to ensure their property is passed on according to their wishes.

Documents used along the form

When managing estate planning, a Transfer-on-Death (TOD) Deed is an important document that allows property owners to name beneficiaries to their property, ensuring it passes to the desired individuals without the need for probate. However, to fully prepare an estate for the smooth transfer of assets, several other forms and documents may need to be used in conjunction with a TOD Deed. These additional documents help to clarify intentions, protect assets, and ensure all legal bases are covered.

- Will: A legal document that specifies how a person's assets should be distributed upon their death. It can also appoint guardians for minor children and specify funeral arrangements.

- Durable Power of Attorney: Designates someone to make financial and legal decisions on behalf of the person, should they become incapacitated.

- Health Care Proxy (or Medical Power of Attorney): Appoints a trusted person to make medical decisions for the individual if they are unable to make such decisions themselves.

- Living Will: Specifies what kind of medical treatment the person does or does not want if they become incapacitated and cannot express their wishes.

- Beneficiary Designations: Forms that specify who will receive assets from accounts like life insurance policies, retirement accounts, and bank accounts that have payable-on-death (POD) or transfer-on-death (TOD) provisions.

- Revocable Living Trust: Allows the individual to use their assets during their lifetime and specifies how these assets are distributed upon their death, often bypassing probate.

- Letter of Intent: A document that provides additional details and instructions regarding the person's assets, funeral arrangements, and other personal wishes that are not legally binding but can guide those handling the estate.

Combining a TOD Deed with these documents creates a comprehensive estate plan that addresses many potential legal and personal concerns. It is essential for individuals to consider their unique situations and possibly consult with a legal professional to ensure that their assets are distributed according to their wishes and in a manner that minimizes the burden on their loved ones.

Similar forms

Living Trust: Much like a Transfer-on-Death (TOD) Deed, a Living Trust allows individuals to designate beneficiaries for their property that will inherit it upon their death. Both bypass the probate process, making the transfer of assets quicker and less costly.

Last Will and Testament: While serving different functions, both a TOD Deed and a Last Will provide mechanisms to distribute assets after death. However, unlike a TOD Deed, a will goes through probate, which can be time-consuming and expensive.

Joint Tenancy Agreement: Similar to a TOD Deed, a Joint Tenancy Agreement allows property to pass to the surviving owner(s) upon the death of one owner, bypassing probate. However, it involves shared ownership while the original owner is still alive.

Beneficiary Designations on Financial Accounts: Similar to TOD Deeds for real estate, beneficiary designations on accounts like IRAs, 401(k)s, and life insurance policies allow these assets to pass directly to named beneficiaries upon the account holder's death, avoiding probate.

Payable on Death (POD) Account: This designation, used on bank accounts, functions similarly to a TOD Deed by naming a beneficiary to inherit the account's contents upon the account holder’s death, bypassing the probate process.

Life Estate Deed: This allows property owners to use and control the property during their lifetime but passes it to a named remainderman upon their death. Like a TOD Deed, it avoids probate but limits the owner’s power to change the beneficiary once established.

Revocable Transfer on Death Deed: A specific type of TOD deed that, like its name suggests, can be revoked or changed at any time before the death of the owner, allowing flexibility in estate planning similar to a traditional TOD deed but with added revocability.

Gift Deed: While a Gift Deed transfers property ownership while the giver is still alive, unlike a TOD Deed which takes effect after death, both allow for the transfer of property outside of probate.

Lady Bird Deed: Similar to a TOD Deed, a Lady Bird Deed allows property owners in some states to retain control over their property during their lifetime, including the ability to sell, while designating a beneficiary to automatically receive the property upon their death, bypassing probate.

Retirement Account Beneficiary Designations: Again, while specific to financial accounts rather than real property, these designations serve a similar purpose to a TOD Deed by allowing assets to pass directly to beneficiaries without going through probate.

Dos and Don'ts

Filling out a Transfer-on-Death (TOD) Deed form requires attention to detail and a thorough understanding of what is required. Below are guidelines on what to do and what not to do when completing this vital document.

What to Do:

- Verify the form’s validity in your state as TOD Deeds are not recognized everywhere.

- Clearly identify the property by including its legal description as found in your property deed.

- Name beneficiaries using their full legal names to avoid ambiguity.

- Sign the document in the presence of a notary to ensure its legality and validity.

- File the completed form with the county recorder’s office where the property is located, as failure to do so renders the deed ineffective.

What Not to Do:

- Do not leave any sections incomplete as this could void the document.

- Avoid using vague language when describing the property or naming beneficiaries.

- Do not sign the document without a notary present, as the authenticity of your signature must be verified.

- Refrain from assuming TOD Deeds supersede all other legal documents; always consider existing wills or trusts.

- Never delay in recording the document; this process is crucial for the TOD Deed to be effective.

Misconceptions

Understanding the Transfer-on-Death (TOD) deed is crucial for effective estate planning. Many people, however, hold misconceptions about how this document operates. Clarifying these misconceptions can empower individuals, ensuring they make informed decisions regarding their property and legacy. Here are ten common misconceptions about the TOD deed:

TOD Deeds Avoid Probate for All Assets: Many believe that a TOD deed will help avoid probate proceedings for all their assets. However, this form only applies to the specific property listed in the deed. Other assets not included in a TOD deed may still go through probate.

TOD Deeds Are Only for Real Estate: While mainly used for real estate, some states allow TOD designations for vehicles and other types of personal property. It's essential to consult local laws to understand what assets can be transferred using a TOD deed.

A Will Overrides a TOD Deed: A common misconception is that a will can supersede a TOD deed. In reality, the TOD deed takes precedence over a will for the property it covers, ensuring the asset transfers directly to the named beneficiary upon death.

TOD Deeds Are Irrevocable: Some believe that once a TOD deed is signed, it cannot be changed. On the contrary, the property owner can revoke or modify a TOD deed at any time before their death, as long as they follow the legal process.

TOD Beneficiaries Automatically Take Over the Mortgage: If the property has a mortgage, the beneficiary does not automatically take responsibility for it upon the owner's death. Instead, the mortgage terms will dictate how it is to be handled.

Using a TOD Deed Means You Lose Control Over Your Property: Property owners retain full control and use of their property after executing a TOD deed. The transfer of ownership does not occur until after the owner's death.

All States Recognize TOD Deeds: Not every state recognizes TOD deeds as a valid way to transfer property. Checking with a local estate planning attorney to determine if TOD deeds are permissible and effective in your state is crucial.

There Are No Limits to What Can Be Included in a TOD Deed: Certain assets, such as proceeds from life insurance or retirement accounts, cannot be included in a TOD deed. This form is specifically for tangible property like real estate.

Married Individuals Do Not Need Spousal Approval to Execute a TOD Deed: Depending on the state's community property laws, a spouse may need to give consent for a TOD deed to be valid. This is particularly true if the property is owned jointly.

A TOD Deed Protects the Property from Creditors: Many think that a TOD deed can protect the property from the original owner's creditors after their death. However, creditors may have claims against the estate, potentially affecting the property transferred via a TOD deed.

Addressing these misconceptions about Transfer-on-Death deeds ensures better preparedness when considering estate planning tools. Always consult with a legal professional to understand how a TOD deed can fit into your specific estate planning strategy.

Key takeaways

When it comes to managing your estate and ensuring your property is transferred according to your wishes after you pass away, the Transfer-on-Death (TOD) Deed can be a valuable tool. Here are key takeaways about filling out and using the Transfer-on-Death Deed form:

- Accuracy is paramount. Make sure all information entered on the TOD Deed form is accurate, including the legal description of the property and the names of the beneficiaries. Errors can create confusion and potentially lead to disputes among heirs or even invalidate the deed.

- Witnesses or Notarization may be required. Depending on your state's laws, your TOD Deed may need to be either witnessed or notarized to be valid. It's important to understand your state's requirements to ensure the deed is legally binding.

- Keep the form updated. Life changes, such as marriage, divorce, the birth of children, or the death of a named beneficiary, can affect your estate plans. Regularly review and, if necessary, update your TOD Deed to reflect your current wishes.

- Consult with a professional. While filling out a TOD Deed can seem straightforward, it's a legal document that plays a critical role in estate planning. It's wise to consult with a legal or estate planning professional to ensure it's completed correctly and aligns with the rest of your estate plan.

- Record the deed promptly. After completing the TOD Deed, it must be recorded with the appropriate government office, usually the county recorder's office where the property is located. This step is crucial to make the deed effective and to avoid complications after your passing.

Utilizing a Transfer-on-Death Deed provides a straightforward way to pass real estate to your beneficiaries without the need for probate, but it's important to follow your state's specific requirements and consider how it fits into your overall estate plan.

Find Other Types of Transfer-on-Death Deed Documents

Deed of Gift Form - It is crucial for the Gift Deed to be crafted with clear language to avoid ambiguities that could challenge the donee's rightful ownership in the future.

Free Lady Bird Deed Form - Maintains the confidentiality of the property transfer, a preference for many during the estate planning process.