Free EDD DE 2501 PDF Form

When individuals find themselves unable to work due to a medically verified disability, navigating the financial implications becomes a paramount concern. In such situations, the EDD DE 2501 form emerges as a critical document, serving as the gateway to Disability Insurance benefits in the state. This form allows eligible employees to formally request temporary financial assistance, providing a lifeline during periods when earning a regular income isn't feasible. Completing and submitting this form correctly is not just about initiating a claim; it represents a crucial step in ensuring continuity of income for those facing medical challenges that impede their ability to work. The nuances of filling out the form, understanding eligibility criteria, and knowing the deadlines and required documentation can significantly impact the effectiveness and speed of receiving benefits. As daunting as the process may seem, especially during a period of health-related stress, the form is designed to systematically gather all necessary information, simplifying the transition into a state-supported safety net.

Sample - EDD DE 2501 Form

Claim for Disability Insurance (DI) Benefits

The State Disability Insurance (SDI) program provides

Please read instruction and information pages (A through D) before completing the enclosed forms.

For faster processing, file your claim using SDI Online at edd.ca.gov. If you file online, do NOT mail this form to the Employment Development Department (EDD).

DO NOT COMPLETE THIS FORM IF YOU ARE:

•Insured by a Voluntary Plan. Ask your employer for the proper forms.

•Filing for

If you cannot complete this form due to your disability, or if you are an authorized representative filing for benefits on behalf of an incapacitated or deceased claimant, call

HOW TO COMPLETE THIS FORM

•Use black ink only.

•Type or write clearly within the boxes provided.

•Enter your Social Security number on all pages of the claim form including attachments.

•Do not fax the form.

•Mail the completed form to the EDD in the envelope provided. Submit your claim no earlier than nine days after the first day your disability begins, but no later than 49 days after your disability begins. You may lose benefits if your claim is late.

1.Complete ALL items in “PART A – CLAIMANT’S STATEMENT” and sign box A40. Errors or missing information may cause your claim to be returned and delay payment. For box A13, the United States Postal Service will not deliver mail to a private mail box unless it is preceded by the initials “PMB.”

2.Have your physician/practitioner complete and sign “Part B – PHYSICIAN/PRACTITIONER’S CERTIFICATE.” Certification may be made by a licensed physician or practitioner authorized to certify to a patient’s disability or serious health condition pursuant to CUIC, section 2708. If you are under the care of an accredited religious practitioner, obtain a Claim for Disability Insurance Benefits - Religious Practitioner’s Certificate (DE 2502) by calling

3.You should carefully decide the date you want your claim to begin because it may affect your benefit amount. See “YOUR BENEFIT AMOUNTS” on page B for information.

4.If you have a

5.Place the completed, signed form(s) in the envelope provided. A claim is complete when “PART A – CLAIMANT’S STATEMENT” and “PART B – PHYSICIAN/PRACTITIONER’S CERTIFICATE” are received. Claims are generally processed within 14 days.

6.Keep these instructions and information pages (A through D) for future reference.

The EDD is an equal opportunity employer/program. Auxiliary aids and services are available upon request to individuals with disabilities. Requests for services, aids, and/or alternate formats need to be made by calling

DE 2501 Rev. 81 |

Page 1 of 13 |

Instruction & Information A |

BASIC ELIGIBILITY. DI benefits can be paid only after you meet all of the following requirements:

•You must be unable to do your regular or customary work for at least eight consecutive days.

•You must be employed or actively looking for work at the time you become disabled.

•You must have lost wages because of your disability or, if unemployed, have been actively looking for work.

•You must have earned at least $300 in wages from which SDI deductions were withheld during your established base period (see “YOUR BENEFIT AMOUNTS” in the next column).

•You must be under the care and treatment of a licensed physician/ practitioner or accredited religious practitioner during the first eight days of your disability. (The beginning date of a claim can be adjusted to meet this requirement.) You must remain under care and treatment to continue receiving benefits.

•You must complete and submit a claim form within 49 days of the date you became disabled or you may lose benefits.

•Your physician/practitioner must complete the medical certification of your disability. A licensed midwife or nurse- midwife may complete the medical certification for disabilities related to normal pregnancy or childbirth. If you are under the care of a religious practitioner, request a DE 2502 from the SDI office. Certification by a religious practitioner is acceptable only if the practitioner has been accredited by the EDD.

We may require an independent medical examination to determine your initial or continuing eligibility.

INELIGIBILITY. You may apply for benefits even if you are not sure you are eligible. If you are found to be ineligible for all or part of a period claimed, you will be notified of the ineligible period and the reason. You may not be eligible for DI benefits if you:

•are claiming or receiving Unemployment Insurance or Paid Family Leave benefits.

•became disabled while committing a crime resulting in a felony conviction.

•are receiving Workers’ Compensation benefits at a weekly rate equal to or greater than the SDI rate.

•are in jail or prison because you were convicted of a crime.

•are a resident in an alcoholic recovery home or

•fail to submit to an independent medical examination when requested to do so.

FRAUD. Under sections 2101, 2116, and 2122 of the California Unemployment Insurance Code, it is a violation to willfully make a false statement or knowingly conceal a material fact in order to obtain the payment of any benefits, such violation being punishable by imprisonment and/or by a fine not exceeding $20,000 or both. To detect and discourage fraud, SDI continually monitors claim payments, vigorously investigates suspicious activity, and will seek restitution and conviction through prosecution.

YOUR RESPONSIBILITIES.

•File your claim and other forms completely, accurately, and in a timely manner. If a form is late, attach a written explanation of the reason(s) to the form.

•Thoroughly read the instructions on this and all other forms your receive from SDI. If you are not sure what is required, contact the SDI office.

•Report to SDI in writing, electronically, or by telephone any:

-change of address or telephone number.

-return to

-recovery from your disability.

-income you receive.

Keep an appointment for an independent medical examination, if requested.

•Include your name and Social Security number or Claim ID number on all correspondence.

YOUR RIGHTS. Information about your claim will be kept confidential, except for the purposes allowed by law. California Civil Code, section 1798.34, gives you the right to inspect any personal records maintained about you by the EDD. Section 1798.35 permits you to request that the record be corrected if you believe

it is not accurate, relevant, timely, or complete. Certain types of information that would generally be considered personal are exempt from disclosure to you: medical or psychological records where knowledge of the contents might be harmful to the subject (Civil Code, section 1798.40); records of active criminal, civil, or administrative investigations (Civil Code, section 1798.40). If you are denied access to records which you believe you have a right to inspect or if your request to amend your records is refused, you may file an appeal with the SDI office. You may request a copy of your file by calling SDI at

You also have the right to appeal any disqualification, overpayment, or penalty. Specific instructions on how to appeal will be provided on any appealable document you receive. If you file an appeal and you remain disabled, you must continue to complete and return continued claim certifications.

YOUR BENEFIT AMOUNTS. Your claim begins on the date your disability began. SDI calculates your weekly benefit amount using your base period. The date your disability began determines your base period, unless the claim effective date is adjusted by SDI. If you want your claim to begin later so that you will have a different base period, please call SDI at

This base period covers 12 months and is divided into four consecutive quarters. Your base period includes wages subject to SDI tax which you were paid approximately 5 to 17 months before your disability claim begins. Your base period does not include wages being paid at the time the disability begins. For a disability claim to be valid, you must have at least $300 in wages in the base period. Using the following, you may determine the base period for your claim.

•If your claim begins in January, February, or March, your base period is the 12 months ending last September 30.

•If your claim begins in April, May, or June, your base period is the 12 months ending last December 31.

•If your claim begins in July, August, or September, your base period is the 12 months ending last March 31.

•If your claim begins in October, November, or December, your base period is the 12 months ending last June 30.

The quarter of your base period in which you were paid the highest wages determines your weekly benefit amount. You may not change the beginning date of your claim or adjust your base period after you have established a valid claim.

Your daily benefit amount is your weekly benefit amount divided by seven. Your maximum benefit amount is 52 times your weekly benefit amount or the total wages subject to SDI tax paid in your base period, whichever is less. Exceptions are as follows:

•For employers and

•For residents in a state licensed and certified alcoholic recovery home or

Contact the SDI office to inquire and provide additional information if your situation fits any of these circumstances: If you do not have sufficient base period wages and you remain disabled, you may be able to establish a valid claim by using a later beginning date. If you do not have enough base period wages and you were actively seeking work for 60 days or more in any quarter of the base period, you may be able to substitute wages paid in prior quarters. Additionally, you may be entitled to substitute wages paid in prior quarters either to make your claim valid or to increase your benefit amount if during your base period you were in the U.S. military service, received Workers’ Compensation benefits, or did not work because of a labor dispute.

DE 2501 Rev. 81 |

Page 2 of 13 |

Instruction & Information B |

HOW BENEFITS ARE PAID. When your completed “PART A – CLAIMANT’S STATEMENT” and “PART B – PHYSICIAN/ PRACTIONER’S CERTIFICATE” are received, the SDI office will notify you by mail of your weekly and maximum benefit amounts and may request additional information if needed to determine your eligibility. If you are eligible to receive benefits, you have an option in how you receive your benefit payments. The EDD issues benefit payments by the EDD Debit CardSM or by check. The EDD Debit Card is the fastest and most secure way to receive your benefits. You do not have to accept the EDD Debit Card, to receive your benefits by check mailed from the EDD allow

The first seven days of your claim is a

If you are eligible for further benefits, additional payments will be sent automatically or a continued claim certification form for the next period will be enclosed. Usually, the certification periods are for two weeks; however, the period will vary under certain circumstances. You will be paid 1/7 of your weekly benefit amount for each calendar day you are eligible unless benefits are reduced for some reason. (See “BENEFIT REDUCTIONS” below.) If you receive DI benefits in place of Unemployment Insurance or Paid Family Leave benefits, the amounts paid will be reported to the Internal Revenue Service. Contact the Internal Revenue Service for more specific tax information.

BENEFIT REDUCTIONS. Under certain circumstances, you may not be eligible for a period of your claim or you may be entitled only to partial benefits. SDI will determine whether or not benefits must be reduced. The types of income shown in the following list should be reported to SDI even though they may not always affect your benefits. Failure to report your income could result in an overpayment, penalties, and a false statement disqualification.

•Sick leave pay

•

•Military pay

•Commissions

•Wages, including modified duty wages

•Residuals

•

•Bonuses

•Workers’ Compensation benefits

•Insurance settlements

•Holiday pay

In addition, your benefits may be reduced because of a prior Unemployment Insurance, Paid Family Leave, or DI overpayment or for delinquent

BENEFIT INTERRUPTION and TERMINATION. A Notice of Final Payment will be issued when records show you have:

•been paid to your physician/practitioner’s estimated date of recovery. If you are still disabled, ask your physician/ practitioner to complete and return the Physician/Practitioner’s Supplementary Certificate (DE 2525XX) (enclosed with the Notice of Final Payment).

•recovered or returned to your work. If you return to work and become disabled again, immediately submit a new claim form and report the date(s) you worked.

OVERPAYMENT. An overpayment results when you receive DI benefits you were not entitled to receive. Once SDI determines that you were overpaid, the SDI office will contact you to explain the reason for your overpayment. It is important that you complete and return all information requests, as there are some instances when an overpayment can be waived. If it is determined that you were overpaid and the overpayment cannot be waived, you must repay this money. Benefits issued after an overpayment is established may be reduced by 25 to 100 percent to collect your overpayment. You will receive a Notice of Overpayment Offset (DE 826) if a reduction is taken for either a DI, Paid Family Leave, or Unemployment Insurance overpayment.

DISQUALIFICATION. All available information will be considered before paying or disqualifying your claim. Benefits will be paid only for the days to which you are entitled. If payment of benefits is denied or reduced, you will be issued a Notice of Determination (DE 2517) stating the reason for the disqualification and the time period.

If you deliberately report incorrect information or if you willfully omit or withhold information, false statement disqualifications of up to 92 days are assessed. This may apply if you accept disability benefit payments you know include days for which you should not be paid, such as days after you returned to work. In addition, any resulting overpayment will be increased by a 30 percent penalty assessment.

SPECIAL CIRCUMSTANCES.

in the State government pages of your telephone book under California, State of; Industrial Relations Department; Workers’ Compensation Appeals Board.

Pregnancy. As with any medical condition, the disability period begins with the first day you are unable to do your regular

or customary work. DI benefits will be paid for the period of time supported by your physician/practitioner’s certification.

Bonding with a New Child. Contact the EDD’s Paid Family Leave program at

Child Support Questions. Contact the Department of Child Support Services at

Spousal or Parental Support Questions. Contact the District Attorney’s office administering the court order.

Family Care. If a family member must stop work to care for you, or if you stop work to care for a seriously ill family member, please visit edd.ca.gov or contact the EDD’s Paid Family Leave program at

Rehabilitation. If you have a disability which prevents you from getting or keeping a job, the Department of Rehabilitation may be able to assist you with vocational training, education, career opportunities, independent living, and use of assistive technology.

Job Training. Contact a

Seeking Work. Contact the EDD for information and assistance concerning employment opportunities and Unemployment Insurance benefits.

Death of Claimant. If a person receiving DI benefits dies, an heir or legal representative should report the death to SDI. Benefits are payable through date of death.

DE 2501 Rev. 81 |

Page 3 of 13 |

Instruction & Information C |

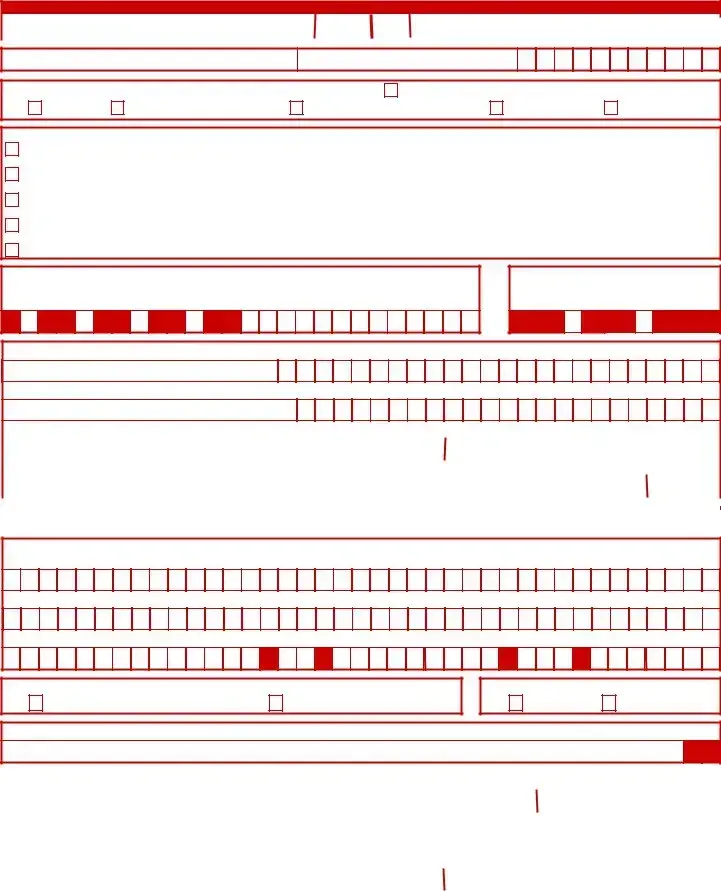

EDD Debit Card Fee Disclosures

Monthly Fee |

Per purchase |

ATM withdrawal |

Cash reload |

$0 |

$0 |

$0 |

N/A |

|

|

$1.00** |

|

|

|

|

|

ATM balance inquiry |

|

|

$0 |

|

|

|

|

Customer service |

|

|

$0 per call |

|

|

|

|

Inactivity |

|

|

$0 |

We charge 5 other types of fees. Here are some of them: |

|

||

|

|

|

|

Replacement card, express delivery |

|

$10.00 |

|

|

|

|

|

Each international transaction |

|

2% |

|

*This document entitled ‘Fee Disclosure and Other Important Disclosures’ is included with, and incorporated in, the California Employment Development Department Debit Card Account Agreement.

**Fees can be lower depending on how and where this card is used.

See the materials you received with your card for free ways to access your funds and balance information.

No overdraft/credit features.

Your funds are eligible for FDIC insurance.

For more information about prepaid cards, visit cfpb.gov/prepaid.

Find details and conditions for all fees and services in the cardholder agreement.

DE 2501 Rev. 81 |

Page 4 of 13 |

Instruction & Information D |

All Fees

Amount

Details

Spend Money

Per purchase with PIN |

$0 |

|

|

|

|

Per purchase with signature |

$0 |

|

|

|

|

Get Cash in the U.S. |

|

|

|

|

|

ATM withdrawal, |

$0 |

“In Network” refers to Bank of America ATMs. Locations can |

|

|

be found at www.bankofamerica.com/eddcard. You will not be |

|

|

charged a fee by Bank of America. |

ATM withdrawal, |

$1.00 |

You will be charged this fee after 2 free for each deposit. “Out of |

|

Network” refers to all the ATMs outside of Bank of America ATMs. |

|

|

|

You may also be charged a fee by the ATM operator even if you do |

|

|

not complete a transaction.* |

Bank teller cash withdrawal |

$0 |

Available at financial institutions that accept Visa cards. Limited to |

|

|

available balance only. |

Emergency cash transfer, |

$15.00 |

All emergency cash transfers must be initiated through the Prepaid |

domestic |

|

Debit Card Customer Service Center. |

Information |

|

|

|

|

|

Customer service |

$0 |

|

|

|

|

Online account information |

$0 |

|

|

|

|

Account alert service |

$0 |

|

|

|

|

ATM balance inquiry |

$0 |

|

|

|

|

Using your card outside the U.S. |

|

|

|

|

|

Each international |

2% |

Of total U.S. Dollar amount of transaction |

transaction |

|

|

International ATM |

$1.00 |

This is the Bank of America fee. You may also be charged a fee by |

withdrawal |

|

the ATM operator, even if you do not complete a transaction. |

Other |

|

|

|

|

|

Online funds transfer |

$0 |

|

|

|

|

Replacement card, domestic |

$0 |

|

|

|

|

Replacement card, express |

$10.00 |

Additional charge |

delivery |

|

|

Replacement card, |

$10.00 |

Additional charge |

international |

|

|

Inactive account |

$0 |

|

|

|

|

*ATM owners may impose an additional “convenience fee” or “surcharge fee” for certain ATM transactions (a sign should be posted at the ATM to indicate additional fees); however you will not be charged any additional convenience fee or surcharge fee at a Bank of America ATM. A Bank of America ATM means an ATM that prominently displays the Bank of America name and logo.

Your funds are eligible for FDIC insurance. Your funds are insured up to $250,000 by the FDIC in the event Bank of America, N.A. fails, if specific deposit insurance requirements are met. See fdic.gov/deposit/deposits/prepaid.html for details.

No overdraft/credit feature.

Contact Bank of America by calling 1.866.692.9374, 1.866.656.5913 (TTY), or 1.423.262.1650 (Collect, when calling outside the U.S.), by mail at Bank of America, PO Box 8488, Gray, TN

For general information about prepaid accounts, visit cfpb.gov/prepaid.

If you have a complaint about a prepaid account, call the Consumer Financial Protection Bureau at

DE 2501 Rev. 81 |

Page 5 of 13 |

Instruction & Information E |

FEDERAL PRIVACY ACT. The EDD requires disclosure of Social Security numbers to comply with California Unemployment Insurance Code, sections 1253 and 2627; with California Code of Regulations, Title 22, sections 1085, 1088, and 1326; with Code of Federal Regulations, Title 20, Part 604; and with U.S. Code, Title 8, sections 1621, 1641, and 1642.

INFORMATION COLLECTION AND ACCESS. State law requires the following information to be provided when collecting information from individuals:

Agency Name:

Employment Development Department (EDD)

Title of Official Responsible for Information Maintenance:

Manager, EDD State Disability Insurance Office

Local Contact Person: |

Contact Information: |

Manager, EDD State Disability Insurance Office |

You may contact State Disability Insurance by calling |

|

State Disability Insurance local office locations can be found on the Internet at |

|

edd.ca.gov/disability/Contact_DI.htm. The address and phone number of State |

|

Disability Insurance will also appear on the “Notice of Computation,” DE 429D, |

|

issued at the time your benefit determination is made. |

|

|

Maintenance of the information is authorized by:

California Unemployment Insurance Code, sections 2601 through 3272.

California Code of Regulations, Title 22, sections

Consequences of not providing all or any part of the requested information:

•Failure to supply any or all information may cause delay in issuing benefit payments or may cause you to be denied benefits to which you are entitled.

•If you willfully make a false statement or representation or knowingly withhold a material fact to obtain or increase any benefit or payment, the EDD will disqualify you from receiving benefits and/or services and may initiate criminal prosecution against you.

Principal purpose(s) for which the information is to be used:

•To determine eligibility for Disability Insurance benefits.

•To be summarized and published in statistical form for the use and information of government agencies and the public (your name and identification will not appear in publications).

•To be used to locate persons who are being sought for failure to provide child, spousal, or other

•To be used by other governmental agencies to determine eligibility for public social services under the provisions of California Welfare and Institutions Code, Division 9.

•To be used by the EDD to carry out its responsibilities under the California Unemployment Insurance Code.

•To be exchanged pursuant to California Unemployment Insurance Code, section 322, and California Civil Code, section 1798.24, with other governmental departments and agencies, both federal and state, which are concerned with any of the following:

(1)Administration of an Unemployment Insurance program.

(2)Collection of taxes which may be used to finance Unemployment Insurance or State Disability Insurance.

(3)Relief of unemployed or destitute individuals.

(4)Investigation of labor law violations or allegations of unlawful employment discrimination.

(5)The hearing of workers’ compensation appeals.

(6)Whenever necessary to permit a state agency to carry out its mandated responsibilities where the use to which the information will be put is compatible with the purpose for which it was gathered.

(7)When mandated by state or federal law. Disclosures under California Unemployment Insurance Code, section 322, will be made only in those instances in which it furthers the administration of the programs mandated by that Code.

•Pursuant to California Unemployment Insurance Code, sections 1095 and 2714: (1) Information may be revealed to the extent necessary for the administration of public social services, to the Director of Social Services or his/her representatives, or to the Director of Child Support Services or his/her representatives; (2) Claimant identity may be released to the Department of Rehabilitation.

•Information shall be disclosed to authorized agencies in accordance with California Unemployment Insurance Code, sections 1095 and 2714.

DE 2501 Rev. 81 |

Page 6 of 13 |

Instruction & Information F |

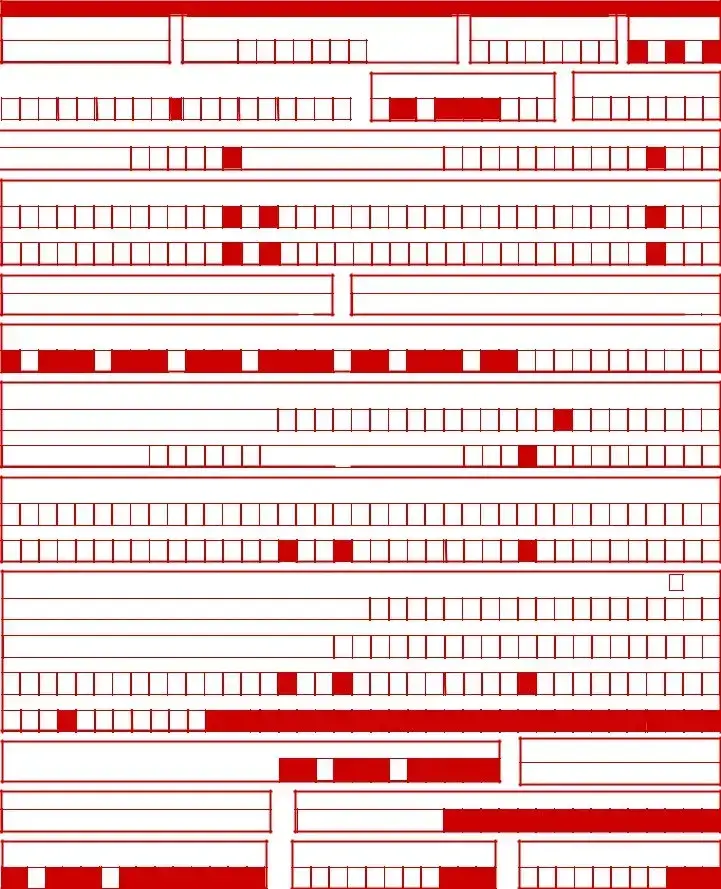

SAMPLE, this page for reference only

Claim for Disability Insurance (DI) Benefits

Health Insurance Portability and Accountability Act (HIPAA) Authorization

Claimant Social Security Number 0 0

0 0

0

0

0 0

0

0

0  0

0  0

0  0

0

Claimant Name (First) |

(MI) (Last) |

S

S  a

a  m

m  p

p  l

l  e

e

C

C  l

l  a

a  i

i  m

m  a

a n

n t

t

I authorize

G  e

e  o

o  f

f  f

f

B

B o

o o

o k

k e

e r

r

(Person/Organization providing the information) to furnish and disclose all my health information and to allow inspection of and provide copies of any medical, vocational rehabilitation, and billing records concerning my disability for which this claim is filed that are within their knowledge to the following employees of the California Employment Development Department (EDD): Disability Insurance Branch examiners, their direct supervisors/managers and any other EDD employee who may have a need to access this information in order to process my claim and/or determine eligibility for State Disability Insurance benefits.

I understand that EDD is not a health plan or health care provider, so the information released to EDD may no longer be protected by federal privacy regulations.

(45 CFR Section 164.508(c)(2)(iii)). EDD may disclose information as authorized by the California Unemployment Insurance Code.

I agree that photocopies of this authorization shall be as valid as the original.

I understand I have the right to revoke this authorization by sending written notification stopping this authorization to EDD, DI Branch MIC 29, PO Box 826880, Sacramento, CA 94280. The authorization will stop on the date my request is received. I understand that the consequences for my revoking this authorization may result in denial of further State Disability Insurance benefits.

I understand that, unless revoked by me in writing, this authorization is valid for fifteen years from the date received by EDD or the effective date of the claim, whichever is later. I understand that I may not revoke this authorization to avoid prosecution or to prevent EDD’s recovery of monies to which it is legally entitled.

I understand that I am signing this authorization voluntarily and that payment or eligibility for my benefits will be affected if I do not sign this authorization. The consequences for my refusal to sign this authorization may result in an incomplete claim form that cannot be processed for payment of State Disability Insurance benefits.

I understand I have the right to receive a copy of this authorization.

Claimant Signature (Do Not Print) |

Date Signed |

|

Sample Claimant |

M |

M D D Y Y Y Y |

|

1 2 2 5 2 0 1 5 |

|

DE 2501 Rev. 81 |

Page 7 of 13 |

SAMPLE, this page for reference only

Your disability claim can also be filed online at www.edd.ca.gov

PLEASE PRINT WITH BLACK INK.

PART A - CLAIMANT’S STATEMENT

A1. YOUR SOCIAL SECURITY NUMBER

0  0

0 0

0

0

0  0

0

0

0  0

0  0

0  0

0

A2. IF YOU HAVE PREVIOUSLY BEEN ASSIGNED AN EDD CUSTOMER ACCOUNT NUMBER, ENTER THAT NUMBER HERE

N  o

o

A3. CALIFORNIA DRIVER |

A4. GENDER |

LICENSE OR ID NUMBER |

MALE FEMALE |

Z 1 2 3 4 5 6 7 |

X |

A5. IF YOU EVER USED OTHER SOCIAL SECURITY NUMBERS, |

|

A6. STATE GOVERNMENT EMPLOYEE |

A7. YOUR DATE OF BIRTH |

|||

ENTER THOSE NUMBERS BELOW |

|

|

(IF “YES” INDICATE BARGAINING UNIT#) |

|

|

|

|

|

|

|

YES X NO UNIT# |

M |

M D D Y Y Y Y |

|

|

|

|

0 1 0 1 1 9 0 0 |

||

A8. YOUR LEGAL NAME |

(FIRST) |

(MI) |

(LAST) |

|

|

SUFFIX |

S

S  a

a  m

m  p

p  l

l  e

e

C

C  l

l  a

a  i

i  m

m  a

a  n

n  t

t

A9. OTHER NAMES, IF ANY, UNDER WHICH YOU HAVE WORKED |

|

||

(FIRST) |

(MI) |

(LAST) |

SUFFIX |

(FIRST) |

(MI) |

(LAST) |

SUFFIX |

A10. YOUR HOME AREA CODE AND TELEPHONE NUMBER

9  9

9  9

9

0

0 2

2 3

3

6

6  7

7 8

8 9

9

A11. YOUR CELL AREA CODE AND TELEPHONE NUMBER

1  1

1  1

1

0

0  0

0  2

2

0

0  0

0  4

4  7

7

A12. LANGUAGE YOU PREFER TO USE |

|

|

|

|

||

ENGLISH |

SPANISH |

CANTONESE |

VIETNAMESE |

ARMENIAN PUNJABI |

TAGALOG |

OTHER |

X |

A13. YOUR MAILING ADDRESS, PO BOX OR NUMBER/STREET/APARTMENT, SUITE, SPACE#, OR PMB# (PRIVATE MAIL BOX)

1 2

2  3

3

A

A n

n y

y

S

S t

t r

r e

e e

e t

t

CITY |

STATE |

ZIP OR POSTAL CODE |

COUNTRY (IF NOT U.S.A.) |

A  n

n  y

y  t

t  o

o  w

w  n

n

C

C  A

A

1

1  2

2  3

3  4

4  5

5

A14. YOUR RESIDENCE ADDRESS, REQUIRED IF DIFFERENT FROM YOUR MAILING ADDRESS

NUMBER/STREET/APARTMENT OR SPACE#

CITY |

STATE |

ZIP OR POSTAL CODE |

COUNTRY (IF NOT U.S.A.) |

A15. YOUR LAST OR CURRENT EMPLOYER - IF YOUR LAST OR CURRENT EMPLOYMENT WAS

SELF

R  o

o  a

a  d

d  r

r  u

u  n

n  n

n  e

e  r

r

P

P a

a s

s t

t r

r i

i e

e s

s

NUMBER/STREET/SUITE# (STATE GOVERNMENT EMPLOYEES: PLEASE PROVIDE THE ADDRESS OF YOUR PERSONNEL OFFICE)

6  4

4  7

7

A

A  r

r  m

m  i

i  s

s  t

t  i

i  c

c  e

e

W

W  a

a  y

y

CITY |

|

STATE ZIP OR POSTAL CODE |

COUNTRY (IF NOT U.S.A.) |

A n y w h e r e |

C A 6 6 2 2 2 |

|

|

EMPLOYER’S TELEPHONE NUMBER |

|

|

|

4 9 9 |

3 1 1 1 1 1 1 |

|

|

A16. AT ANY TIME DURING YOUR DISABILITY, WERE YOU IN THE CUSTODY OF LAW ENFORCEMENT

AUTHORITIES BECAUSE YOU WERE CONVICTED OF |

YES |

X NO |

VIOLATING A LAW OR ORDINANCE? |

A17. BEFORE YOUR DISABILITY BEGAN, WHAT

WAS THE LAST DAY YOU WORKED?

1M  2M

2M  0D

0D  1D

1D  2Y

2Y  0Y

0Y  1Y

1Y  5Y

5Y

A18. WHEN DID YOUR DISABILITY BEGIN?

1M  2M

2M  1D

1D  6D

6D  2Y

2Y  0Y

0Y  1Y

1Y  5Y

5Y

A20. SINCE YOUR DISABILITY BEGAN, HAVE YOU WORKED OR ARE YOU WORKING ANY FULL OR PARTIAL DAYS?

YES |

X NO |

A19. DATE YOU WANT YOUR CLAIM TO BEGIN IF DIFFERENT THAN THE DATE ENTERED IN A18

M  M

M  D

D  D

D  Y

Y  Y

Y  Y

Y  Y

Y

A21 A. IF YOU RECOVERED, ENTER DATE: |

A21 B. IF YOU RETURNED TO WORK, |

|

ENTER DATE: |

M M D D Y Y Y Y |

M M D D Y Y Y Y |

DE 2501 Rev. 81 |

Page 8 of 13 |

SAMPLE, this page for reference only

PART A - CLAIMANT’S STATEMENT - CONTINUED

A22. PLEASE |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

|

|

A23. WHAT IS YOUR REGULAR OR CUSTOMARY OCCUPATION?

P  a

a  s

s  t

t  r

r  y

y

C

C h

h e

e f

f

A24. WHY DID YOU STOP WORKING? (SELECT ONLY ONE BOX)

LAYOFF |

UNPAID LEAVE OF ABSENCE |

X ILLNESS, INJURY, OR PREGNANCY

VOLUNTARILY QUIT OR RETIRED |

TERMINATED |

OTHER REASON

A25. HOW WOULD YOU DESCRIBE OR CLASSIFY YOUR JOB?

X

Mostly sit; occasionally stand or walk; occasionally lift, carry, push, pull, or otherwise move objects that weigh 10 lbs. or less. Mostly walk/stand; occasionally lift, carry, push, pull, or otherwise move objects that weigh up to 20 lbs.

Constantly lift, carry, push, pull, or otherwise move objects that weigh up to 10 lbs.; frequently up to 20 lbs.; occasionally up to 50 lbs. Constantly lift, carry, push, pull, or otherwise move objects that weigh up to 20 lbs.; frequently up to 50 lbs.; occasionally up to 100 lbs.

Constantly lift, carry, push, pull, or otherwise move objects that weigh over 20 lbs.; frequently over 50 lbs.; occasionally over 100 lbs.

A26. IF YOUR EMPLOYER(S) CONTINUED OR WILL CONTINUE TO PAY YOU DURING YOUR DISABILITY, INDICATE

TYPE OF PAY: |

Paid Time Off |

|

|

|

|

|

|

|

|

SICK |

VACATION |

(PTO) |

ANNUAL |

OTHER (EXPLAIN) |

A27. MAY WE DISCLOSE BENEFIT PAYMENT INFORMATION TO YOUR EMPLOYER(S)?

YESNO

A28. SECOND EMPLOYER NAME (IF YOU HAVE MORE THAN ONE EMPLOYER)

C o

o s

s m

m i

i c

c

C

C o

o o

o k

k i

i e

e s

s

NUMBER/STREET/SUITE#

4  6

6  9

9

T

T  h

h  r

r  i

i  f

f  t

t y

y

W

W a

a y

y

CITY |

STATE ZIP OR POSTAL CODE |

|

|

COUNTRY (IF NOT U.S.A.) |

||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

B |

l |

u |

e |

b |

e |

l |

l |

|

|

|

|

|

|

|

|

C |

A |

|

8 |

4 |

3 |

6 |

9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

BEFORE YOUR DISABILITY BEGAN, WHAT WAS THE LAST DAY YOU WORKED FOR THIS EMPLOYER? |

|

EMPLOYER’S TELEPHONE NUMBER |

||||||||||||||||||||||||||||||||||||||

M |

M |

D |

D |

Y |

Y |

Y |

Y |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 |

2 |

1 |

6 |

2 |

0 |

1 |

5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

A29. IF YOU HAVE MORE THAN 2 EMPLOYERS CHECK HERE. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A30. IF YOU ARE A RESIDENT OF AN ALCOHOLIC RECOVERY HOME OR A

NUMBER/STREET/SUITE#

CITY |

STATE |

ZIP OR POSTAL CODE |

AREA CODE AND TELEPHONE NUMBER |

A31. HAVE YOU FILED OR DO YOU INTEND TO FILE FOR WORKERS’ COMPENSATION BENEFITS?

YES - COMPLETE ITEMS A32 THROUGH A38 |

NO - SKIP ITEMS A33 THROUGH A38 |

A32. WAS THIS DISABILITY CAUSED BY YOUR JOB?

YES |

NO |

A33. DATE(S) OF INJURY SHOWN ON YOUR WORKERS’ COMPENSATION CLAIM

M

M  M

M  D

D  D

D  Y

Y  Y

Y  Y

Y  Y

Y

M

M  M

M  D

D  D

D  Y

Y  Y

Y  Y

Y  Y

Y

M

M  M

M  D

D  D

D  Y

Y  Y

Y  Y

Y  Y

Y

M

M  M

M  D

D  D

D  Y

Y  Y

Y  Y

Y  Y

Y

A34. WORKERS’ COMPENSATION INSURANCE COMPANY NAME |

|

|

|

|

|

|

AREA CODE AND TELEPHONE NUMBER |

|

EXTENSION (IF ANY) |

|||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NUMBER/STREET/SUITE# |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CITY |

STATE |

|

ZIP CODE |

|

|

|

|

|

|

WORKERS’ COMPENSATION CLAIM NUMBER |

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DE 2501 Rev. 81 |

Page 9 of 13 |

SAMPLE, this page for reference only

PART A - CLAIMANT’S STATEMENT - CONTINUED

A35. PLEASE |

|

0 |

|

|

|

|

|

|

0 |

0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A36. WORKERS’ COMPENSATION ADJUSTER’S NAME |

|

|

|

|

|

|

|

|

AREA CODE AND TELEPHONE NUMBER |

EXTENSION (IF ANY) |

|||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A37. EMPLOYER’S NAME SHOWN ON YOUR WORKERS’ COMPENSATION CLAIM |

AREA CODE AND TELEPHONE NUMBER |

EXTENSION (IF ANY) |

|||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A38. YOUR ATTORNEY’S NAME (IF ANY) FOR YOUR WORKERS’ COMPENSATION CASE |

AREA CODE AND TELEPHONE NUMBER |

EXTENSION (IF ANY) |

|||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ATTORNEY’S ADDRESS NUMBER/STREET/SUITE# |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

WORKERS’ COMPENSATION APPEALS |

|||||||||

CITY |

|

|

STATE |

|

ZIP CODE |

|

|

|

|

|

|

|

BOARD/ADJ CASE NUMBER |

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A39. SELECT YOUR PREFERRED PAYMENT METHOD |

oEDD DEBIT CARDSM oCHECK |

|

|

|

|

|

|||||||||||||||||||||||||||||||||

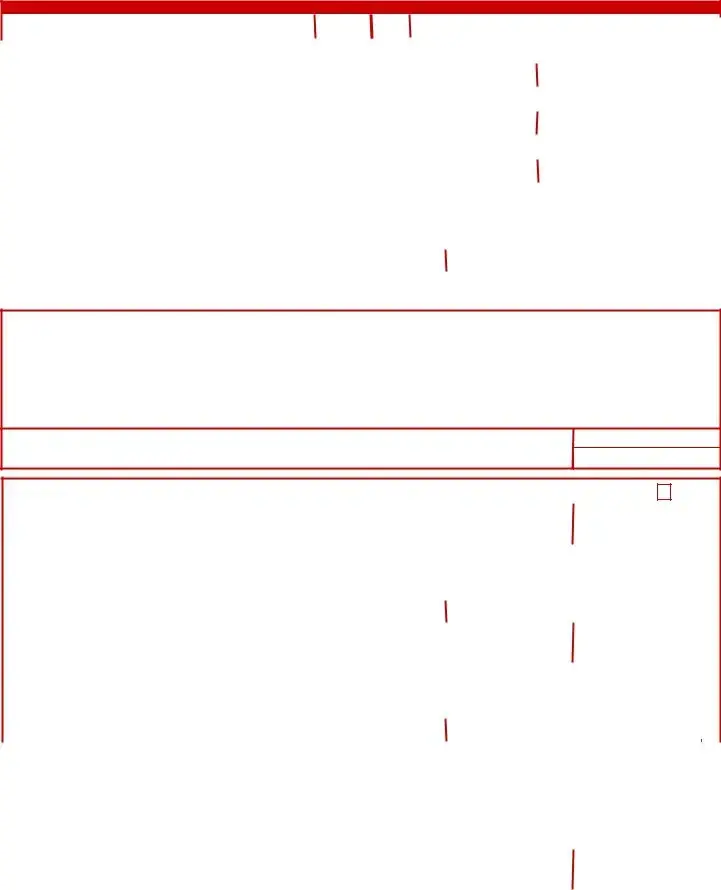

A40. Declaration and Signature. By my signature on this claim statement, I claim benefits and certify that for the period covered by this claim I was unemployed and disabled. I understand that willfully making a false statement or concealing a material fact in order to obtain payment of benefits is a violation of California law and that such violation is punishable by imprisonment or fine or both. I declare under penalty of perjury that the foregoing statement, including any accompanying statements, is to the best of my knowledge and belief true, correct, and complete. By my signature on this claim statement, I authorize the California Department of Industrial Relations and my employer to furnish and disclose to State Disability Insurance all facts concerning my disability, wages or earnings, and benefit payments that are within their knowledge. By my signature on this claim statement, I authorize release and use of information as stated in the “Information Collection and Access” portion of this form (see Informational Instructions, page D). I agree that photocopies of this authorization shall be as valid as the original, and I understand that authorizations contained in this claim statement are granted for a period of fifteen years from the date of my signature or the effective date of the claim, whichever is later.

CLAIMANT’S SIGNATURE (DO NOT PRINT) OR SIGNATURE MADE BY MARK (X)

Sample Claimant

DATE SIGNED

1M  2M

2M  1D

1D  6D

6D  2Y

2Y  0Y

0Y  1Y

1Y  5Y

5Y

A41. IF YOUR SIGNATURE IS MADE BY MARK (X), CHECK THE BOX AND IT MUST BE ATTESTED BY TWO WITNESSES WITH THEIR ADDRESSES.

|

1st WITNESS SIGNATURE (PRINT AND SIGN) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DATE SIGNED |

|

|||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

M |

M |

D |

D |

Y |

Y |

Y |

Y |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NUMBER/STREET/APARTMENT OR SPACE#, PO BOX OR PRIVATE MAIL BOX ADDRESSES NOT ACCEPTABLE. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CITY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

STATE |

|

|

ZIP CODE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2nd WITNESS SIGNATURE (PRINT AND SIGN) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DATE SIGNED |

|

|||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

M |

M |

D |

D |

Y |

Y |

Y |

Y |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NUMBER/STREET/APARTMENT OR SPACE#, PO BOX OR PRIVATE MAIL BOX ADDRESSES NOT ACCEPTABLE. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CITY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

STATE |

|

|

ZIP CODE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A42. |

|

|

|

CHECK THIS BOX IF YOU ARE THE PERSONAL REPRESENTATIVE SIGNING ON BEHALF OF CLAIMANT AND COMPLETE THE FOLLOWING: |

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

(FIRST) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(MI) |

|

(LAST) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

I, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

, REPRESENT THE CLAIMANT IN |

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||

|

THIS MATTER AS AUTHORIZED BY |

|

|

DECLARATION OF INDIVIDUAL CLAIMING DISABILITY INSURANCE BENEFITS DUE AN INCAPACITATED OR DECEASED |

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||

|

CLAIMANT, DE 2522 (SEE INSTRUCTION & INFORMATION A, UNDER HOW TO APPLY #4) |

|

|

POWER OF ATTORNEY (ATTACH COPY) |

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||

|

PERSONAL REPRESENTATIVE’S SIGNATURE (DO NOT PRINT) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DATE SIGNED |

|

|||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

M |

M |

D |

D |

Y |

Y |

Y |

Y |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DE 2501 Rev. 81 |

Page 10 of 13 |

File Specs

| Fact Name | Detail |

|---|---|

| Form Identification | EDD DE 2501 is identified as the claim form for Disability Insurance (DI) benefits in California. |

| Purpose | The form is used by individuals to file a claim for disability benefits through the California Employment Development Department (EDD). |

| Eligibility | To be eligible for DI benefits, individuals must be unable to work due to a non-work-related illness, injury, or pregnancy. |

| Filing Timeframe | Claims should be filed within 49 days after the date the claimant's disability begins to ensure they do not lose benefits. |

| Required Information | Claimants must provide personal information, details about their medical provider, and their last employer's information. |

| Submission Methods | The DE 2501 form can be submitted to the EDD through mail, fax, or, in some cases, online through the EDD's website. |

| Governing Law | The form is governed by California state law, under the administration of the California Employment Development Department. |

| Processing Time | After submission, it typically takes up to 14 days for the EDD to process the DE 2501 claim form and make a decision. |

| Benefit Duration | Eligible individuals may receive DI benefits for a maximum of 52 weeks, depending on the severity of their disability and the amount of their pre-disability wages. |

Steps to Filling Out EDD DE 2501

Filling out the EDD DE 2501 form is a pivotal step for individuals seeking to claim state disability insurance benefits in California. This process might appear daunting at first, but understanding the required steps can simplify the task. Following a concise, step-by-step guide ensures that applicants provide all necessary information accurately, which is crucial for the timely processing of their claims. Once the form is completed and submitted, the California Employment Development Department (EDD) will review the submission. Applicants should prepare for a period of waiting, during which the EDD assesses their eligibility and processes the claim. For a smooth experience, applicants are encouraged to carefully check their entries for accuracy before submission.

- Begin by downloading the latest version of the EDD DE 2501 form from the California Employment Development Department's official website.

- Read through the instructions provided on the first few pages of the form carefully to understand the type of information you are required to provide.

- Enter your full legal name, including any middle initials, in the designated space to ensure your application is matched with your identity.

- Fill in your Social Security number accurately to avoid any delays or issues with processing your claim.

- Provide detailed contact information, including your current mailing address, telephone number, and email address, to enable the EDD to reach you with updates or additional requests for information.

- Include your employment history and the last employer's information, as this will be used to verify your eligibility for disability benefits.

- Specify the date when your disability began. This date is crucial as it affects the commencement of your benefit payments.

- Describe the nature of your disability in the section provided. Be specific and provide enough detail to support your claim, including any medical diagnoses if available.

- Sign and date the form in the designated areas. A physical signature is usually required, so if you're filling the form out electronically, you may need to print it to sign it.

- Follow the instructions on the form regarding submission. This could involve mailing it to the address provided or submitting it through an online portal, depending on your preference or the options available.

Completing the EDD DE 2501 form accurately and comprehensively is the first step towards receiving disability benefits. Applicants should be diligent in following the provided instructions and double-check their information before submission. The waiting period after submission is a good time to gather any additional documents that may support the claim, and to prepare for any further communications from the California Employment Development Department.

Discover More on EDD DE 2501

What is the EDD DE 2501 form used for?

The EDD DE 2501 form, issued by the California Employment Development Department (EDD), is used to file for State Disability Insurance (SDI) benefits. These benefits offer short-term support to eligible workers who are unable to work due to a non-work-related illness, injury, or pregnancy.

How can I obtain the EDD DE 2501 form?

There are a few ways to obtain the EDD DE 2501 form. You can request it online through the EDD's website, call the EDD to have a form mailed to you, or visit a local EDD office to pick up a copy in person. Remember, the form cannot be downloaded and printed because it is printed on special paper that is required for processing.

What information is needed to complete the EDD DE 2501 form?

To complete the form, you'll need to provide personal information like your social security number, date of birth, and mailing address. You'll also need details about your employment, such as your employer's name and address, and information about your medical provider who can verify your disability. Additionally, you'll be asked to provide details about your disability, including when it began and how it affects your ability to work.

Can I submit the EDD DE 2501 form online?

No, the EDD DE 2501 form must be submitted by mail or in person at an EDD office. This requirement is due to the form being printed on special paper. However, once you have obtained and completed the form, you can use EDD’s online services to track the status of your claim.

How long does it take to process the EDD DE 2501 form?

The processing time for the EDD DE 2501 form can vary. Typically, once the EDD receives your completed form, it takes about 14 days to process. However, this timeframe can change based on the volume of applications and the completeness of your application. It's important to ensure all sections are filled out accurately to avoid delays.

What happens after I submit the form?

After you submit the form, the EDD will review your application to determine if you meet the eligibility criteria for State Disability Insurance benefits. You might be contacted for additional information or documentation. Once your application is approved, you will start receiving benefits, usually within two weeks of the approval date.

Is there a deadline to submit the EDD DE 2501 form?

Yes, there is a deadline. You must submit the EDD DE 2501 form within 49 days from the date your disability begins. Failing to meet this deadline may result in a loss of benefits, so it's crucial to apply as soon as possible after you become aware of your disability.

Can someone help me fill out the form?

Absolutely, if you need assistance completing the form, you can ask a family member, friend, or your medical provider for help. Additionally, EDD representatives are available to answer questions and provide guidance either over the phone or at local EDD offices.

What if my claim is denied?

If your claim is denied, you have the right to appeal the decision. The denial letter you receive from the EDD will outline the steps you need to take to file an appeal. This usually involves submitting a written appeal within a specified timeframe. It is important to provide additional documentation or information that supports your claim during the appeal process.

Common mistakes

Filling out the EDD DE 2501 form, required for Disability Insurance (DI) claims in the state, involves careful attention to detail. Common errors can delay the processing time or result in the denial of benefits. Recognizing and avoiding these mistakes ensures a smoother claims process.

Not checking the eligibility criteria before applying: Applicants often overlook the importance of verifying their eligibility for Disability Insurance benefits. This includes having sufficient work history and meeting the minimum earnings requirements within a specific time frame. Ignoring these criteria can lead to immediate disqualification.

Providing incomplete or inaccurate information: The form requires detailed personal information, employment history, and medical documentation. Failure to provide complete and accurate information can result in the rejection of the application. It's essential to double-check all entries and ensure that the medical documentation supports the disability claim.

Missing signatures and dates: A common mistake is overlooking the necessity to sign and date the form. Both the applicant and the certifying physician must sign the EDD DE 2501 form. Unsigned or undated forms are considered incomplete and will not be processed until corrected, causing unnecessary delays.

Omitting supplementary documents: Applicants sometimes forget to attach required supplementary documents, such as medical certification and any additional proof required to substantiate the claim. This omission can halt the processing of the form until the necessary documents are received, potentially delaying the benefits.

Not reporting other compensation: Individuals often fail to report other forms of compensation they are receiving or eligible for, such as Paid Family Leave or workers' compensation. This information is crucial for the accurate processing of the claim, and failing to disclose it can be considered fraud, leading to severe penalties.