Free Employee Advance PDF Form

In the landscape of business operations, financial transactions between employers and employees take various forms, one of which is the issuance of an advance on wages. This process, typically formalized through an Employee Advance Form, serves as a critical tool for managing financial assistance to employees before their regular payday. While the concept of wage advances is straightforward, the specifics encapsulated in the Employee Advance Form capture significant details such as the amount of the advance, repayment conditions, and any applicable interest or fees. Moreover, it outlines the agreement between the employer and the employee, ensuring clarity and mutual understanding. This form not only provides immediate financial relief to employees when needed but also helps in maintaining transparent and efficient financial dealings within an organization. Consequently, understanding the major aspects of the Employee Advance Form is essential for both employers who extend these advances and employees who receive them, as it plays a pivotal role in the broader spectrum of financial management and employee relations.

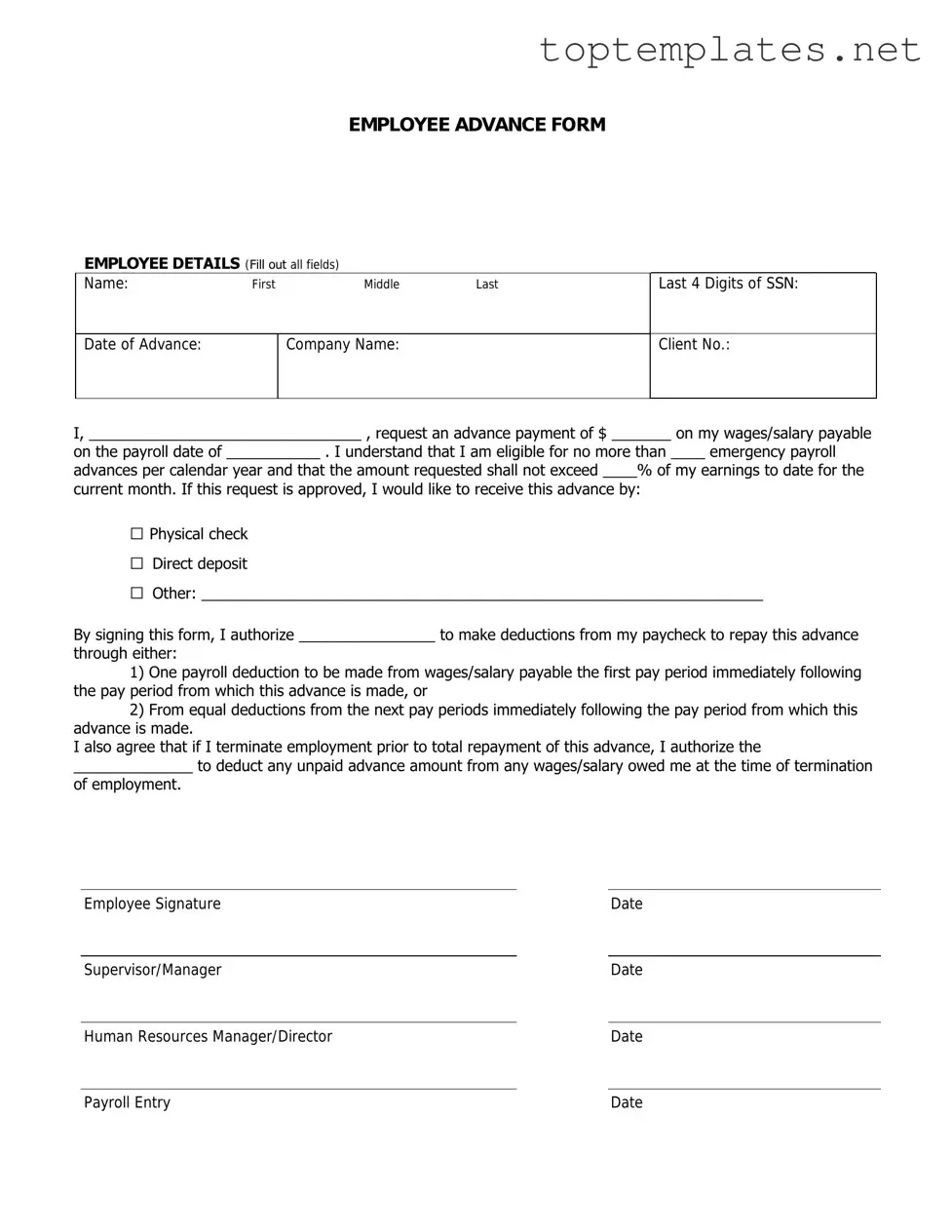

Sample - Employee Advance Form

EMPLOYEE ADVANCE FORM

EMPLOYEE DETAILS (Fill out all fields)

Name: |

First |

Middle |

Last |

|

|

|

|

Date of Advance: |

|

Company Name: |

|

|

|

|

|

Last 4 Digits of SSN:

Client No.:

I, ________________________________ , request an advance payment of $ _______ on my wages/salary payable

on the payroll date of ___________ . I understand that I am eligible for no more than ____ emergency payroll

advances per calendar year and that the amount requested shall not exceed ____% of my earnings to date for the

current month. If this request is approved, I would like to receive this advance by:

□Physical check

□Direct deposit

□Other: __________________________________________________________________

By signing this form, I authorize ________________ to make deductions from my paycheck to repay this advance

through either:

1)One payroll deduction to be made from wages/salary payable the first pay period immediately following the pay period from which this advance is made, or

2)From equal deductions from the next pay periods immediately following the pay period from which this advance is made.

I also agree that if I terminate employment prior to total repayment of this advance, I authorize the

______________ to deduct any unpaid advance amount from any wages/salary owed me at the time of termination of employment.

Employee Signature |

|

Date |

|

|

|

Supervisor/Manager |

|

Date |

|

|

|

Human Resources Manager/Director |

|

Date |

Payroll Entry |

Date |

File Specs

| Fact Number | Detail |

|---|---|

| 1 | An Employee Advance form is used when an employee requests an advance on their salary. |

| 2 | This form typically requires the employee to specify the reason for the advance request. |

| 3 | The amount requested by the employee must be clearly stated on the form. |

| 4 | Repayment terms, including the repayment schedule and any interest charged, are often outlined in the form. |

| 5 | Employers may require managerial or human resources approval before processing the advance. |

| 6 | The form may include a section for updating the employee's payroll records to reflect the advance and its repayment. |

| 7 | State-specific laws may govern the provision of salary advances, affecting the form's content and how it must be handled. |

| 8 | Some states may impose limits on the amount that can be advanced or prescribe specific repayment methods. |

| 9 | The Employee Advance form may include a clause that outlines consequences for failing to repay the advance as agreed. |

| 10 | Both the employee requesting the advance and a company representative typically must sign the form, indicating agreement to its terms. |

Steps to Filling Out Employee Advance

When an employee requires an advance on their salary, completing the Employee Advance Form is the initial step. This formal procedure ensures that the request is properly documented and processed, aligning the process with the company's financial protocols. After the form is submitted, it will undergo a review by the financial department. Following the approval, the advance amount will be processed and disbursed to the employee, usually through their next paycheck or as specified by the company's disbursement schedule.

- Start by entering your full name as indicated on your employment documents to ensure there is no confusion about your identity.

- Provide your employee identification number, which links your advance request directly to your personnel record for efficient processing.

- List your department and job title so that the request can be contextualized within the organizational structure.

- Enter the date of the advance request to help track the processing time and ensure timely disbursement.

- Specify the amount of money you are requesting. Be clear and concise to avoid any delays in approval.

- Detail the reason for the advance. Providing a straightforward explanation can support the necessity of your request.

- State the repayment plan. This is crucial as it outlines your commitment to repaying the advanced sum according to the agreed terms.

- Sign and date the form at the bottom. Your signature is essential as it indicates your acknowledgment of and agreement with the terms of the advance.

Once the Employee Advance Form has been filled out completely, it should be submitted to the designated department or individual handling such requests. It's crucial to retain a copy for personal records. The waiting period for processing may vary; however, rest assured that the company's financial team will work diligently to review and act on your request promptly. Proper communication will be maintained throughout the process to keep you informed of the status of your advance.

Discover More on Employee Advance

What is an Employee Advance form?

An Employee Advance form is a document used by an employee to request a short-term loan from their employer. This loan is typically deducted from future paychecks. The form should clearly state the amount requested, the reason for the advance, and the proposed repayment schedule.

Who can request an Employee Advance?

Generally, any full-time employee who has completed a certain period of employment, often 90 days, is eligible to request an Employee Advance. However, eligibility requirements may vary based on the employer's policies.

How does repayment work for an Employee Advance?

Repayment terms for an Employee Advance are usually defined by the employer's policies. Typically, the advanced amount is deducted from the employee's future paychecks over a specified period. The repayment schedule, including the deduction amount per paycheck, should be outlined in the Employee Advance form agreement.

Are there any interest charges on an Employee Advance?

Most employers do not charge interest on Employee Advances as they are not considered a traditional loan. However, policies can vary between different employers. It’s recommended to review the terms and conditions specified in the Employee Advance form or policy document.

What happens if an employee leaves the company before repaying the advance?

If an employee resigns or is terminated before fully repaying the Employee Advance, the remaining balance is typically due immediately. The employer may deduct the outstanding amount from the employee's final paycheck. Specific details regarding this scenario should be outlined in the terms of the Employee Advance agreement.

Common mistakes

Filling out an Employee Advance form requires careful attention to detail. Mistakes can lead to delays or even rejection of the request. Here are four common errors:

Not verifying personal information. Employees often overlook the importance of double-checking their personal details like full name, employee ID, and contact information. This can result in processing delays or misdirected funds.

Omitting the advance amount. Failing to clearly specify the amount requested for the advance is a frequent mistake. It is crucial to provide an exact figure to avoid any confusion or unnecessary back-and-forth communications.

Incomplete explanation of the reason for the advance. A detailed explanation as to why the advance is needed is often required, but not always provided. Leaving this section vague or incomplete can lead to a lack of understanding or support from the employer's side.

Forgetting to sign and date the form. This might seem obvious, but it’s a common oversight. An unsigned or undated form is typically considered incomplete and can stall the approval process.

To ensure the smooth processing of an Employee Advance form, individuals should:

Review all entered information for accuracy and completeness.

Be precise with the requested advance amount.

Provide a clear and detailed explanation for the need of the advance.

Remember to sign and date the form before submission.

By avoiding these mistakes, employees can expedite the approval process for their advance requests, ensuring timely access to the funds they need.

Documents used along the form

When managing employee advances, it’s essential to have a set of documents that support and clarify the process, ensuring both the employer and the employee are protected and fully informed. The Employee Advance Form is just the starting point. Alongside this document, several others play a critical role in the overall procedure. These documents not only help in maintaining financial accuracy but also in establishing clear communication between all parties involved.

- Repayment Agreement Form - This document outlines the terms under which the employee agrees to repay the advanced amount. It includes repayment schedules, amounts, and methods, providing a clear repayment plan.

- Loan Policy Document - It defines the company’s policies regarding advances, including eligibility criteria, maximum amount allowed, and any interest or fees. This ensures employees understand the policy before requesting an advance.

- Direct Deposit Authorization Form - If the advance is to be repaid through payroll deductions, this form authorizes the employer to deduct the agreed-upon amounts from the employee's paycheck.

- Payroll Deduction Authorization Form - Similar to the Direct Deposit Authorization Form, this document is specifically designed for the deduction from payroll for the purpose of loan repayment, ensuring mutual consent for the deduction process.

- Employee Acknowledgment Form - This form is an acknowledgement by the employee of the advance received and a confirmation of their obligation to adhere to the repayment terms, acting as a receipt of the transaction.

- Financial Statement Form - Sometimes, an employee might be required to provide a statement of their financial situation. This can help in determining the feasibility of the repayment plan and ensure that the advance does not cause undue financial strain.

Collectively, these documents create a comprehensive framework that supports the Employee Advance process. They serve not only as legal protections but also as tools for clear communication, helping to avoid any misunderstanding between employees and employers. Properly used, they ensure that advances are managed effectively, responsibly, and to the benefit of all parties involved.

Similar forms

An Employee Loan Agreement is quite similar to an Employee Advance form. Both documents are crafted to set out the terms for a financial transaction between the employer and the employee. However, an advance typically covers imminent expenses and may not be subject to interest, whereas a loan might be larger and include repayment terms over an extended period, possibly with interest.

A Payroll Deduction Authorization form also bears resemblance. This form is used when an employee agrees to have a specified amount deducted from their paycheck, which can be for various purposes, including repaying an advance. Like an Employee Advance form, it specifies amounts and timing, but it's focused on the mechanics of repayment rather than the advance of funds.

The Expense Reimbursement Form shares a functional similarity. It's utilized after an employee has spent personal funds for work-related expenses, outlining what costs will be covered by the employer. Although it serves as a claim for reimbursement rather than an upfront payment, both documents are centered on the employer compensating the employee for out-of-pocket expenses.

A Promissory Note has elements in common as well. It is a formal, legal document that outlines one party's promise to pay another a definite sum of money either on demand or at a specified future date. An Employee Advance form could be seen as a simpler, more specific type of promissory note, where the employer advances funds to the employee, who then promises to repay the advance, often through payroll deductions.

Dos and Don'ts

Filling out an Employee Advance form is a straightforward process, but it's important to approach it with attention to detail and understanding. Here are some do's and don'ts to guide you through the process:

- Do double-check the accuracy of all entered information, including personal details and the advance amount requested. Accuracy is key to ensuring the process goes smoothly.

- Do provide a clear reason for the advance request. Being transparent about why you need the advance can facilitate approval.

- Do make sure you understand the terms of repayment. Knowing when and how you need to repay the advance can prevent any misunderstandings later on.

- Do keep a copy of the submitted form for your records. It’s always good practice to have proof of your request and any related agreements.

- Don't leave any fields blank. Incomplete forms can delay processing times or result in a denied request.

- Don't exaggerate the amount you need. Request only what is necessary, as asking for more can raise questions about your financial management.

- Don't forget to sign the form. An unsigned form is often considered invalid and can be rejected outright.

- Don't hesitate to ask for help if you're unsure about how to complete the form or the process. Reaching out for clarification can save time and effort for both you and your employer.

Misconceptions

When discussing the topic of Employee Advance forms, there are several misconceptions that can lead to confusion for both employers and employees. Understanding the true aspects of these forms is essential for proper financial and policy management within a company. Here are four common misunderstandings:

Employee advances are essentially free money. A widespread misconception is that employee advances are akin to receiving free money. However, it's crucial to recognize that these advances are prepayments of future earnings. This means the amount given in advance will be deducted from subsequent paychecks. It's not additional income, but rather a reallocation of when an employee receives their pay.

There is an obligation for employers to offer advances. Many believe that employers are legally bound to provide advances if requested by an employee. This is not the case. The decision to offer an advance rests with the employer’s policies and discretion. There are no federal laws compelling an employer to grant advances, and practices vary widely among organizations.

Employee advances do not need to be documented. This assumption can lead to significant administrative and legal issues. For the protection of both the employer and the employee, it's essential that any advance payment is documented with a clear agreement. This document should detail the advance amount, the repayment schedule, and any other relevant terms. This paperwork is vital for financial clarity and to prevent misunderstandings.

Interest or fees cannot be charged on advances. Some are under the impression that it is illegal for an employer to charge interest or fees on an advance. While laws vary by state, generally, employers can impose interest or fees on advances, provided these charges are reasonable and are clearly communicated to the employee in advance. Employers should consult legal guidance to ensure their policies comply with applicable laws and that employees understand any potential fees or interest associated with an advance.

Understanding these nuances of Employee Advance forms can help ensure that both employees and employers navigate financial advances wisely and in compliance with applicable laws and policies.

Key takeaways

When it comes to handling finances in the workplace, the Employee Advance form plays a pivotal role in maintaining transparency and accountability. This form is not just a piece of paper; it's a mutual agreement between an employee and employer concerning an advance on wages. Below are eight key takeaways to ensure both parties fill out and use this form effectively and efficiently.

- Understand the Purpose: Before filling out the form, both parties should clearly understand why it’s being used. An employee advance form is primarily for situations where an employee needs a portion of their wages before their next payday.

- Complete All Sections: Ensure that every section of the form is filled out. Missing information can lead to confusion or delays. This includes personal information, the advance amount requested, and the reason for the advance.

- Clarity on Repayment Terms: The form should clearly outline how the advance will be repaid. This can be through a deduction from the next paycheck or over a series of paychecks, depending on the agreement.

- Agreement on Interest or Fees: If there are any interest rates or fees associated with the advance, these should be clearly stated and agreed upon in the form.

- Signature is a Must: Both the employee requesting the advance and their supervisor or HR representative must sign the form. This signifies that both parties agree to the terms of the advance.

- Keep a Copy: After the form is filled out and signed, it’s essential that both the employee and the employer keep a copy. This serves as a record of the agreement and can be referred back to if there are any disputes.

- Follow-Up: Ensure that there is a follow-up process in place. Once an advance is granted, there should be clear communication about when the repayment will begin and any other necessary steps the employee needs to take.

- Confidentiality: Be mindful of confidentiality. Financial matters are sensitive, and the process of requesting and granting an advance should be handled discreetly to respect the privacy of the employee.

In conclusion, the Employee Advance form is an important document that requires careful attention from both the employer and the employee. By understanding its purpose, accurately completing all sections, and ensuring clarity on terms and conditions, both parties can facilitate a process that is fair and transparent. Remember, clear communication and mutual agreement are key to a successful advance request and repayment process.

Common PDF Forms

Cg2010 Form - The endorsement includes provisions that exclude coverage for additional insureds for injuries or damages occurring post-completion of the insured's work or after any part of the work has been put to its intended use.

Baseball Evaluation Sheets - Coaches are encouraged to adjust scoring weight based on their perception of key team skills, allowing customization of the assessment process.