Free Free And Invoice Pdf PDF Form

In the world of business transactions and freelance services, the importance of a clear, concise, and professional invoice can't be overstated. The Free And Invoice PDF form serves as a crucial tool for entrepreneurs, small business owners, and freelancers who aim to streamline their billing process. This form is designed to be easily accessible, editable, and shareable, ensuring that the invoicing process doesn't become a time-consuming task. Its structure allows individuals to detail the services rendered or goods provided, alongside the agreed-upon prices, in a manner that is straightforward for both the issuer and the recipient. Not only does it facilitate prompt payment by eliminating any potential confusion, but it also contributes to building a professional image for the issuer. The versatility of a PDF format means it can be accessed across different devices, maintaining its formatting and allowing for easy printing or electronic sharing. The Free And Invoice PDF form encapsulates the essence of efficient and professional invoicing, thereby playing a pivotal role in the smooth operation of a variety of business activities.

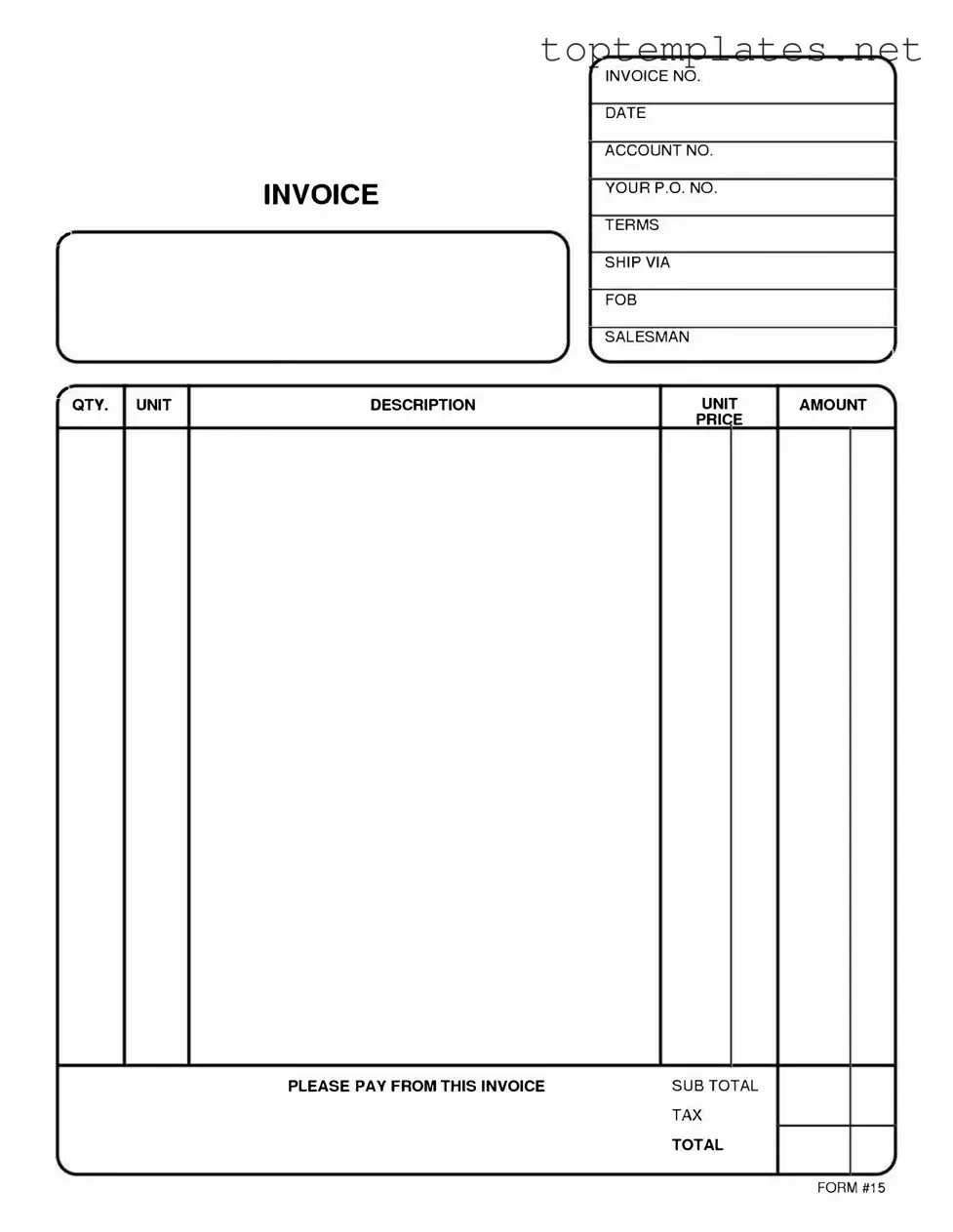

Sample - Free And Invoice Pdf Form

, INVOICENO.

|

|

DATE |

|

|

|

|

INVOICE |

A CCOUNTNO. |

|

|

|

|

|

YOUR Р.О. NO. |

r |

|

TERMS |

|

SHIPVI A |

|

|

|

|

|

|

|

|

|

FOB |

|

|

|

|

|

SALESMAN |

|

|

|

|

� |

, QTY. UNIТ |

DESCRIPTION |

UNIT |

AMOUNT |

|

|

|

PRICE |

|

|

|

|

|

|

|

PLEASE РАУ FROM THIS INVOICE |

SUBTOTAL |

|

ТАХ |

|

TOTAL |

FORM #15

File Specs

| Fact Name | Detail |

|---|---|

| Form Purpose | Allows individuals and businesses to create an invoice for services rendered or goods provided. |

| Accessibility | Available for free online, often in PDF format for easy download and printing. |

| Customization | Can be customized to include specific details such as company logo, payment instructions, and terms of service. |

| Components | Typically includes fields for date, invoice number, description of services or goods, amount charged, and payment terms. |

| State-Specific Versions | Some states may have specific requirements or formats for invoices; it's important to check local laws. |

| Governing Law | While generally governed by contract law, specific state laws and regulations can apply, thus influencing the form's content. |

| Importance of Accuracy | Ensuring accuracy in filling out the form is crucial for legal and financial records, and for dispute resolution. |

Steps to Filling Out Free And Invoice Pdf

Filling out the Free And Invoice PDF form is a straightforward process designed to help you accurately document the details of a transaction. This form is essential for keeping records of sales and services provided, ensuring both parties understand the financial aspects of the deal. Completing this form accurately is crucial for smooth financial tracking and transparency. The steps below will guide you through the process, ensuring all necessary information is captured efficiently and effectively.

- Start by downloading the Free And Invoice PDF form to your computer. Ensure you have a PDF reader or editor installed to open and fill out the form.

- Enter the date of the invoice at the top of the form, typically located in the upper right corner. Use the format MM/DD/YYYY to avoid any confusion.

- Fill in the seller's details, including name, address, phone number, and email. This information should be accurate to ensure proper communication.

- Provide the buyer's information in the designated section, mirroring the details you provided for the seller. This ensures clarity on who is involved in the transaction.

- Describe the product or service provided. Include a thorough description, quantity, and price per unit. If multiple items are involved, list each one separately to maintain clarity.

- Calculate the total cost of the products or services provided. If applicable, include any taxes, shipping charges, or discounts. This should be clearly stated to avoid any discrepancies.

- Include payment terms at the bottom of the invoice. This might detail the accepted payment methods and the due date for payment. Being explicit about the payment expectations helps prevent delays or confusion.

- Sign the invoice. If digital, a typed name may suffice, but ensure this is consistent with your usual practice. Signatures finalize the transaction, signaling agreement on the provided terms.

- Save the completed form. Consider renaming the file to include the invoice number and the date for easy retrieval.

- Send the completed invoice to the buyer. Email is typically the most efficient method, but ensure you use a reliable means of delivery.

After the form is filled out and sent, it's advisable to keep a copy for your records. This will assist in future financial tracking, resolving disputes, and during tax season. Ensure the information is stored securely, respecting privacy and confidentiality standards. Completing this form is a critical step in formalizing transactions and fostering trust between parties involved.

Discover More on Free And Invoice Pdf

What is a Free And Invoice PDF form?

A Free And Invoice PDF form is a downloadable document that businesses can use to create an invoice for goods or services provided to a client. This form is customizable, allowing for the addition of important details such as company and client information, descriptions of the services or products offered, prices, and payment terms.

How can I access the Free And Invoice PDF form?

Access to the Free And Invoice PDF form is typically provided through online platforms offering business forms. Users can download the form from websites that specialize in business resources or directly from vendors that supply software for document management.

Is there a cost associated with using the Free And Invoice PDF form?

As indicated by its name, the Free And Invoice PDF form is available at no cost. This allows businesses, particularly small enterprises and freelancers, to professionally manage their billing without incurring additional expenses.

Can the Free And Invoice PDF form be customized?

Yes, the form is designed for customization. Users can easily add their company logo, adjust the layout, and include specific information relevant to their services or products, making it a versatile tool for invoicing purposes.

What software is needed to edit the Free And Invoice PDF form?

To edit the Free And Invoice PDF form, users will need software capable of handling PDF files, such as Adobe Acrobat Reader, Foxit Reader, or other PDF editing tools. Some online platforms also offer direct editing capabilities without the need to download any software.

Can I save a filled-out Free And Invoice PDF form for future use?

Absolutely. Once the form has been filled out, it can be saved with all the entered information intact. This allows for easy reuse and adaptability for future transactions, saving time and ensuring consistency across invoicing.

Is the Free And Invoice PDF form legally binding?

When properly filled out and agreed upon by both the provider and the client, the Free And Invoice PDF form serves as a legally binding document. It can outline the agreed-upon services, prices, and payment terms, helping to protect all parties involved.

How can I ensure the security of information when using the Free And Invoice PDF form?

To protect sensitive information, users should ensure that the PDF editing software they use complies with industry-standard security measures. Additionally, when sharing the filled-out form electronically, using encrypted email or secure file-sharing services is advisable.

Can the Free And Invoice PDF form be used for international transactions?

Yes, the form can be adapted for international transactions. It can be customized to include currency exchange rates, taxes applicable in the service or product provider's and client's countries, and other relevant international trade details.

Common mistakes

Filling out the Free And Invoice PDF form correctly is crucial to ensuring that transactions are processed efficiently and accurately. However, individuals often encounter common pitfalls that can lead to delays or discrepancies in their invoicing processes. It is important to be mindful of these mistakes to avoid any unnecessary complications.

-

Not double-checking the recipient's information: One common mistake is not verifying the recipient's details, such as their full name, address, and contact information. This can lead to the invoice being sent to the wrong party or getting lost, resulting in payment delays.

-

Omitting the date or including an incorrect date: The date is crucial for tracking invoices and payments. Forgetting to add the date or using the wrong date can create confusion and affect the payment timeline.

-

Inaccurate description of goods or services provided: A detailed description is necessary for clarity and to prevent disputes. Vague or incorrect descriptions can lead to disagreements over what was agreed upon, potentially delaying payments.

-

Forgetting to include the total amount due: It is essential to clearly state the total amount owed, including any taxes or discounts. Neglecting to include this information can complicate the payment process and may require issuing a corrected invoice.

-

Not specifying payment terms: Clearly outlining the expected payment deadline and accepted payment methods helps avoid late payments. Failing to specify these terms can lead to misunderstandings regarding the payment schedule.

-

Miscalculating totals: Errors in addition or applying incorrect tax rates can result in inaccurate invoices. These mistakes not only delay the process but can also damage the trust between parties involved.

To ensure the accuracy and efficiency of your invoicing, here are additional recommendations:

Always review the completed form before sending it out.

Use a calculator or digital tools to double-check sums and tax calculations.

Maintain a copy of the sent invoice for your records.

Communicate openly with the recipient to quickly resolve any issues that may arise.

By avoiding these common mistakes and following the proposed recommendations, individuals can streamline their invoicing process, ensuring that transactions are conducted smoothly and professionally.

Documents used along the form

When it comes to managing and documenting transactions, the use of a Free And Invoice PDF form is quite common. This form typically serves as a request for payment, detailing the goods or services provided, their prices, and the total amount due. However, to ensure a comprehensive approach to transactional documentation, several other forms and documents often accompany the Free And Invoice PDF. These additional documents help in further detailing the transaction, providing legal cover, and ensuring both parties are well-informed. Let’s explore some of these commonly used forms and documents.

- Quotation Form: Before an invoice is issued, a quotation form is often used to provide potential buyers with a detailed breakdown of the costs associated with goods or services. This document helps in setting the expectations right for both parties.

- Purchase Order: This document is issued by the buyer to the seller, listing the goods or services they wish to purchase at specified prices. It serves as an official offer to buy, often leading to the creation of an invoice.

- Delivery Note: Accompanying the goods delivered, this document outlines the description, quantity, and condition of the goods, ensuring that what was ordered has indeed been supplied.

- Receipt: Acting as proof of payment, a receipt is provided by the seller to the buyer. It’s a crucial document for both accounting and legal purposes.

- Credit Note: In cases where goods are returned or an invoice needs to be adjusted, a credit note is issued to record the adjustment, ensuring the accounts reflect the correct transaction values.

- Proforma Invoice: Often used in international transactions, a proforma invoice is sent before the shipment of goods, detailing the value and description of the goods for customs, financing, or other purposes.

- Packing List: Especially important for shipments, the packing list details the contents of the shipment, including weight, box dimensions, and packing details, crucial for logistics and customs clearance.

- Contract Agreement: Though not always necessary for smaller transactions, a contract agreement delineates the terms and conditions of the service or sale, providing a legal framework and protection for both parties involved.

Integrating these documents with a Free And Invoice PDF form not only streamlines the transaction process but also enhances transparency, accountability, and compliance with legal standards. Each document serves a unique purpose, contributing to a smooth, clear, and secure transactional process. Ensuring that your business transactions are well-documented not only helps in maintaining robust records but also aids in dispute resolution, should any issues arise. By familiarizing yourself with these forms and documents, you're taking a significant step towards more professional and efficient business operations.

Similar forms

A Quotation form closely resembles a Free And Invoice PDF form because both serve the purpose of presenting potential costs to clients or customers. While quotations provide an estimate of the goods or services requested, invoices request payment for those goods or services after they are delivered. Both documents detail the nature of the transaction including the costs, quantities, and descriptions of the items or services involved.

A Sales Receipt is similar to an invoice in that it provides a record of the purchase of goods or services. However, a sales receipt is issued after payment has been made to confirm the transaction. Both documents include critical information such as the date of the transaction, a description of the goods or services sold, the amount paid, and the parties involved. The key difference lies in the timing of the document's issuance and its purpose.

The Purchase Order document shares similarities with an invoice as they both are used in the buying process. Purchase orders are sent by buyers to suppliers as a formal request for goods or services, specifying types, quantities, and agreed prices for products or services. The invoice, on the other hand, is issued by the seller to request payment for the order. While serving different stages of the transaction, both include detailed information about the order, including prices and terms.

A Proforma Invoice is closely aligned with a Free And Invoice PDF form, serving as a preliminary bill of sale sent to buyers in advance of a shipment or delivery of goods. The proforma invoice outlines the goods or services to be provided and the cost associated with them. It is used for customs purposes in international trade, where it provides a buyer the details of what is to come. Similar to a standard invoice, it describes the transaction but is not a final demand for payment as it might be subject to changes.

Dos and Don'ts

Filling out a Free And Invoice PDF form requires attention to detail and precision to ensure that the information provided is accurate and clear. Here are 10 essential do's and don'ts to guide you through the process:

- Do double-check the accuracy of all entered information, including dates, names, quantities, and prices.

- Do use a readable font if the form allows font adjustments. Fonts such as Arial or Times New Roman in a size that's easy to read are generally recommended.

- Do provide complete contact information for both the issuer and the recipient. This includes full names, addresses, phone numbers, and email addresses.

- Do specify payment terms, such as due date and acceptable payment methods, to avoid any confusion.

- Do itemize services or products provided in a clear and organized manner. This helps in understanding the bill at a glance.

- Don't leave any fields blank that are relevant to your invoice. If a particular section does not apply, consider marking it as "N/A" (not applicable) instead of leaving it empty.

- Don't forget to include an invoice number. This is crucial for tracking and referencing purposes.

- Don't underestimate the importance of including a detailed description of each item or service provided. This can help in preventing disputes.

- Don't neglect to review the tax requirements pertinent to the items or services sold and ensure that any necessary tax is correctly calculated and included in the total amount.

- Don't send the invoice without double-checking all the details. Errors are easier to correct before the document is sent out.

Adhering to these do's and don'ts when completing your Free And Invoice PDF form can streamline the invoicing process, ensuring clarity and preventing misunderstandings between the parties involved.

Misconceptions

When dealing with the Free And Invoice PDF form, various misconceptions can arise. Understanding these common misbeliefs helps in utilizing these forms effectively for your business or personal needs.

It's Only Suitable for Small Businesses: There's a common belief that Free And Invoice PDF forms are only appropriate for small businesses or startups. However, businesses of all sizes can benefit from these forms due to their flexibility, ease of customization, and capability to streamline billing processes efficiently.

They Lack Professionalism: Another misconception is that using a Free And Invoice PDF form might not project professionalism. In reality, these forms can be highly professional. Many templates are designed to be sleek, clear, and customizable, allowing businesses to incorporate their branding, such as logos and color schemes.

Security Concerns are Often Overlooked: Some users fear that Free And Invoice PDF forms are less secure, potentially exposing sensitive information. However, many free PDF forms offer features like encryption and password protection to ensure that business and client data remain secure.

Limited Features Compared to Paid Software: While it's true that some free versions may not offer all the bells and whistles of their paid counterparts, many Free And Invoice PDF forms come equipped with an impressive array of features that meet the essential invoicing needs, including templates, tax calculations, and currency conversions.

Key takeaways

Filling out and using the Free And Invoice PDF form correctly is essential for businesses and freelancers alike. It ensures that financial transactions are accurately recorded and that payment processes run smoothly. Here are eight key takeaways to remember:

- Ensure all relevant details are filled in accurately, including the date, invoice number, and contact information for both the provider and the recipient.

- Clearly describe the product or service provided, including quantities, unit prices, and total charges, to prevent any confusion.

- Utilize the customizable fields to tailor the invoice to your business needs, making sure to include any specific payment terms or conditions.

- Double-check the tax calculations if applicable, ensuring they comply with local, state, or federal tax regulations to avoid any legal complications.

- Always include payment instructions on the invoice, specifying accepted payment methods, and where to send payment, to expedite the payment process.

- Keep a copy of each invoice for your records, aiding in financial management and tax preparation by maintaining a clear paper trail.

- Consider attaching a polite and professional message with your invoice to maintain good relations with your clients and encourage prompt payment.

- Look into software or applications that can help manage and store your Free And Invoice PDFs efficiently, especially if dealing with a high volume of invoices.

By adhering to these guidelines, businesses and freelancers can ensure their invoicing process is efficient, professional, and legally compliant.

Common PDF Forms

P45 Uk - The P45 form is a critical document for employees leaving a job, detailing tax and employment information.

Shared Well Agreement Example - An organized method for multiple property owners to access and pay for the maintenance of a shared well, promoting harmonious relations.

T47 Form - It's a legal form that helps protect buyers from purchasing a property with undisclosed defects.