Free Gift Letter PDF Form

In the journey toward homeownership or making significant financial decisions, the gesture of giving or receiving a substantial monetary gift can be both a blessing and a complex matter to navigate. This is where a Gift Letter form plays a crucial role, offering clarity and legitimacy to the process. Essentially, it serves as a formal document that clearly states the money received is indeed a gift and not a loan that requires repayment. This distinction is vital for both the giver and the receiver, especially in the eyes of financial institutions and tax authorities. The form includes critical details such as the donor's name, relationship to the recipient, the exact amount of the gift, and a clear statement that no repayment is expected. By providing this information, the Gift Letter form helps to ensure transparency and peace of mind for all parties involved, facilitating a smoother transaction and compliance with legal and financial regulations. It stands as an essential tool in personal finance management, particularly in contexts like home purchasing, where gifts can significantly impact the financial equation.

Sample - Gift Letter Form

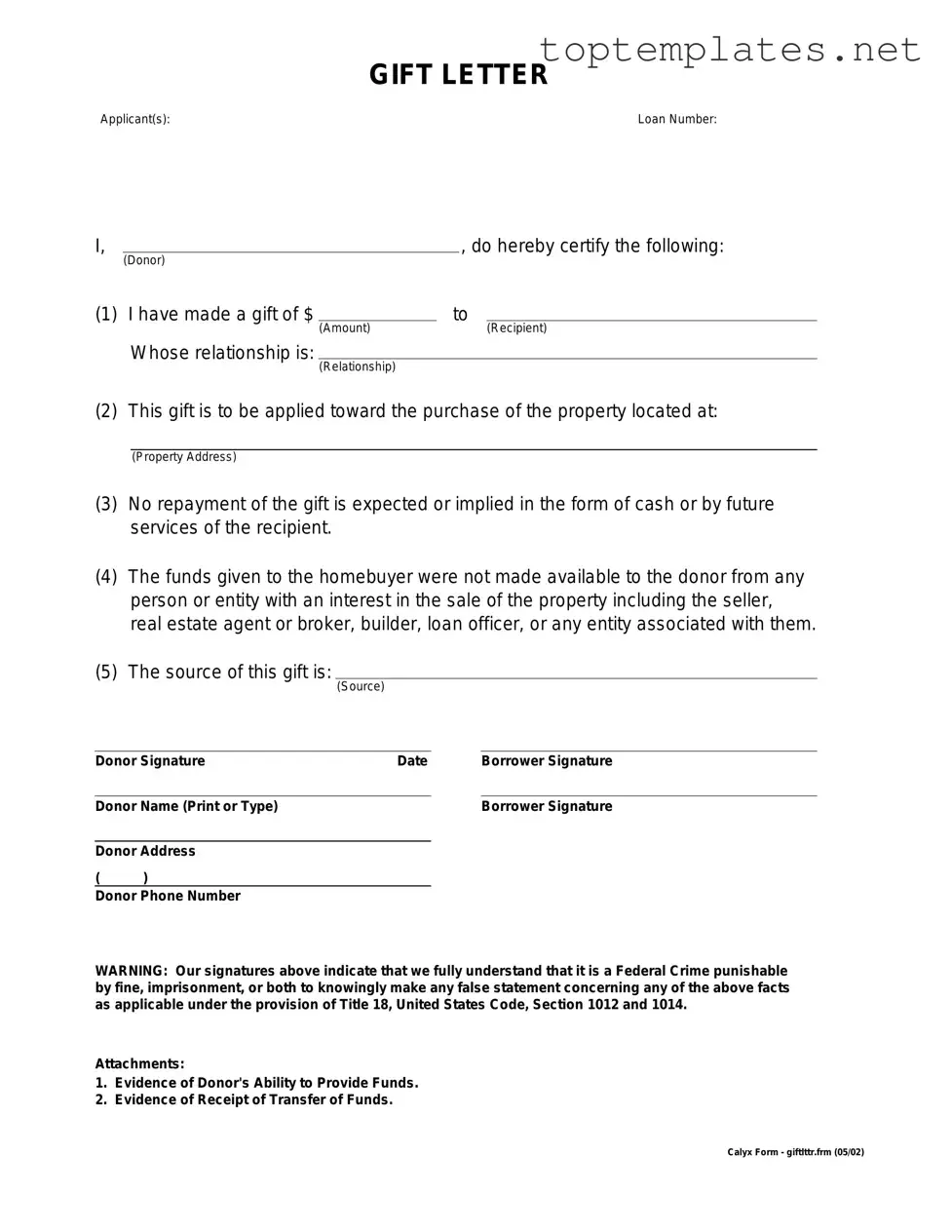

GIFT LETTER

Applicant(s): |

Loan Number: |

I, |

|

|

, do hereby certify the following: |

||

|

(Donor) |

|

|

|

|

(1) I have made a gift of $ |

|

to |

|

||

|

|

(Amount) |

|

|

(Recipient) |

|

Whose relationship is: |

|

|

|

|

|

|

(Relationship) |

|

|

|

(2) This gift is to be applied toward the purchase of the property located at:

(Property Address)

(3)No repayment of the gift is expected or implied in the form of cash or by future services of the recipient.

(4)The funds given to the homebuyer were not made available to the donor from any person or entity with an interest in the sale of the property including the seller, real estate agent or broker, builder, loan officer, or any entity associated with them.

(5)The source of this gift is:

(Source)

Donor Signature |

Date |

Borrower Signature |

||

|

|

|

|

|

Donor Name (Print or Type) |

|

|

Borrower Signature |

|

|

|

|

|

|

Donor Address |

|

|

|

|

( |

) |

|

|

|

Donor Phone Number

WARNING: Our signatures above indicate that we fully understand that it is a Federal Crime punishable by fine, imprisonment, or both to knowingly make any false statement concerning any of the above facts as applicable under the provision of Title 18, United States Code, Section 1012 and 1014.

Attachments:

1.Evidence of Donor's Ability to Provide Funds.

2.Evidence of Receipt of Transfer of Funds.

Calyx Form - giftlttr.frm (05/02)

File Specs

| Fact | Description |

|---|---|

| 1. Purpose | A Gift Letter form is used to provide proof that funds received by a homebuyer from another person are indeed a gift and not a loan that needs to be repaid. |

| 2. Tax Implications | This form is critical in ensuring that the gift does not have any tax implications for the buyer, as gifts of a certain size may be taxable under federal law. |

| 3. Lender Requirements | Mortgage lenders often require a Gift Letter form to be filled out to allow the buyer to use gift money towards their down payment or closing costs. |

| 4. Required Information | The form typically requires the donor's name, relationship to the recipient, amount of the gift, and a statement that no repayment is expected. |

| 5. State-Specific Forms | While Gift Letters are widely used across the United States, some states may have specific requirements or formats for the form, governed by state laws regarding gifts and real estate transactions. |

| 6. Date of Gift | The exact date of the gift transfer must be documented within the letter to satisfy lender requirements and for any potential tax documentation. |

| 7. Donor's Signature | For the Gift Letter to be valid, it must include the signature of the donor, attesting to the truth of the information provided in the letter. |

| 8. No Repayment Clause | One of the most crucial aspects of the letter is the clear statement that the gift does not need to be repaid, distinguishing it from a loan. |

Steps to Filling Out Gift Letter

Preparing a Gift Letter is a critical step when a loved one is offering financial assistance for a significant purchase like a home. This formal document ensures transparency and legality in the financial gift process. It clarifies the nature of the gift, ensuring it does not need to be repaid. Below, you'll find straightforward steps to complete the Gift Letter form, making this process as smooth as possible for both the giver and the recipient. After filling out the form, the next step involves getting it notarized to add a layer of legal validity, followed by submitting it to the relevant financial institution or lender.

- Start by entering the Date at the top of the Gift Letter form, ensuring it reflects the current date of completion.

- Include the Donor's Full Name, clearly printed to avoid any confusion regarding the individual offering the gift.

- Add the Recipient's Full Name under the donor’s information, specifying the individual receiving the gift.

- Specify the Relationship between the donor and the recipient to establish the connection and the reason for the gift.

- Enter the Exact Amount of the gift in dollars, ensuring clarity on the extent of financial assistance provided.

- Detail the Purpose of the gift, such as down payment for a house, indicating how the funds should be used by the recipient.

- Include the Address of the Property (if applicable), to link the gift to a specific purchase that the recipient is making.

- Ensure the Donor's Statement is clear, confirming that there’s no expectation for the gift to be repaid.

- The Donor must then sign and date the form, formally finalizing the gift declaration.

- Last, write down the Contact Information of the donor, including a phone number and address, to facilitate any necessary communication.

After these steps have been meticulously followed, the Gift Letter form is ready for notarization. Notarization acts as a security measure, verifying the identities of the parties involved and the authenticity of their signatures. Once notarized, the document should be presented to the appropriate financial institution or lender. This marks a crucial step in ensuring that the gift contributes positively toward the recipient’s financial goals without any misunderstandings or legal complications.

Discover More on Gift Letter

What is a Gift Letter form?

A Gift Letter form is a document that formally records the transfer of money or property from one individual to another without any expectation of repayment. It is often used by donors to provide to lenders to prove that the funds received by a borrower for a down payment on a home are not a loan.

When do I need to use a Gift Letter form?

You should use a Gift Letter form when giving a significant amount of money or valuable property to another person, especially if that receiver intends to use the gift as part of a transaction with a financial institution, like securing a mortgage for a home purchase. Financial institutions generally require this letter to confirm that the gifted sum does not need to be repaid.

What information must be included in a Gift Letter?

A Gift Letter must include the donor's name, address, and phone number; the recipient's name, address, and relationship to the donor; the exact amount of the gift; a statement that the gift is not a loan and there is no expectation of repayment; the date of the gift; and both the donor and recipient's signatures.

Is a Gift Letter legally binding?

Yes, a Gift Letter is considered a legally binding document. By signing it, the donor is formally declaring that the funds given are indeed a gift and not a loan. This has implications for both parties, including tax obligations for the donor and financial considerations for the recipient.

Do I need to notarize a Gift Letter?

While not always required, getting a Gift Letter notarized can add an extra layer of validity to the document. Some financial institutions may specifically request a notarized Gift Letter as part of their documentation requirements for a mortgage or loan approval.

Can a Gift Letter be used for tax purposes?

Yes, a Gift Letter can be used for tax purposes, primarily by the donor. The Internal Revenue Service (IRS) may require proof that a transfer of money or property was a gift and not a loan or transaction intended for gain. A Gift Letter helps in clarifying the nature of the transfer for tax reporting requirements.

How does a Gift Letter affect the recipient's ability to get a loan?

By providing a Gift Letter, the recipient can prove to lenders that certain funds are a gift and do not need to be repaid. This often positively affects the recipient's loan application, as it demonstrates financial support that does not add to their debt obligations, potentially making them a less risky borrower.

Is there a limit to how much can be gifted using a Gift Letter?

There's no limit to how much you can gift using a Gift Letter. However, for tax purposes, the IRS has an annual exclusion limit for gifts. Amounts above this limit may be subject to gift tax or require filing a gift tax return. It's advisable to consult with a tax professional to understand any tax obligations.

What happens if I don't use a Gift Letter for a large money gift?

Not using a Gift Letter for a large money gift can complicate matters for both the donor and recipient, especially if the money is used in transactions with financial institutions. Without a Gift Letter, the recipient may have difficulty proving that the money is not a loan, potentially affecting loan approvals. Additionally, the donor may face complications with the IRS in proving that the transfer was a gift not subject to repayment, impacting tax obligations.

Common mistakes

Filling out a Gift Letter form may seem straightforward, but there are common mistakes people often make that can lead to unnecessary complications. This document is crucial for verifying that a gift, often a substantial amount of money, is indeed a gift and not a loan to be repaid. Lenders need this to ensure that the gift does not affect your debt-to-income ratio, a key factor in determining loan eligibility. Here are four mistakes to avoid:

-

Not clearly specifying that the gift is not a loan. It's essential for the gift letter to explicitly state that the money given is a gift and does not need to be repaid. This assertion removes any ambiguity about the nature of the transfer, reassuring the lender that the borrower's financial obligations have not increased.

-

Omitting relevant details. A comprehensive gift letter should include all pertinent information: the donor's name, relationship to the recipient, the exact amount of the gift, the date the funds were transferred, and the recipient's name. Forgetting any of these details can delay the loan process as the lender verifies the gift's legitimacy.

-

Failure to sign the document. Both the donor and the recipient often need to sign the gift letter to make it legally binding. An unsigned gift letter is typically not valid in the eyes of lenders, as it lacks the formal acknowledgment of the gift's terms by both parties involved.

-

Misstating the gift amount. The gift amount on the letter should exactly match the amount that changes hands. Any discrepancy between the letter and bank statements can raise red flags for lenders, leading to potential delays or denials in the approval process.

Attention to detail is key when filling out a Gift Letter. This document ensures that financial gifts do not unduly complicate the loan approval process. Avoiding these common errors can streamline your path to securing a mortgage or loan, making the generous contribution from a family member or friend as beneficial as intended.

Documents used along the form

When a Gift Letter Form is used, typically during the process of gifting funds to assist in the purchase of a home, several other documents might be required to ensure the transaction is well-documented and meets legal and financial guidelines. The following are descriptions of such documents that are commonly utilized in conjunction with a Gift Letter Form.

- Mortgage Application Form: This form initiates the process of applying for a loan to purchase real estate. It collects detailed information about the borrower’s financial status, employment, income, debts, and assets to assess their ability to repay the loan.

- Bank Statements: These are provided to prove the donor's ability to gift the funds. Banks require these statements from the donor to verify that the money given is indeed a gift and not a loan that requires repayment.

- Proof of Transfer: This document evidences that the gift funds were successfully transferred from the donor's account to the recipient's account. It could be a bank transfer receipt, a copy of the check, or a confirmation of a wire transfer.

- Closing Disclosure: This form is given to the homebuyer at least three days before the loan closing. It includes the final terms of the loan, projected monthly payments, and a detailed breakdown of the closing costs and other fees associated with the mortgage.

- Real Estate Purchase Agreement: This is a contract between the buyer and the seller of a property that outlines the terms and conditions of the property sale. It includes the purchase price, closing date, and any contingencies that must be met before the sale is finalized.

Utilizing the Gift Letter Form with the aforementioned documents helps in making the gifting process transparent and legally compliant. These documents collectively ensure that the financial aspects of the property purchase are accurately recorded and agreed upon by all parties involved. This meticulous documentation is crucial for protecting the interests of both the gift giver and the recipient.

Similar forms

Affidavit: Just like a Gift Letter, an affidavit is a written statement made under oath, verifying that the information provided is true and accurate. Both documents serve to legally assert specific facts, with the Gift Letter focusing on the nature and purpose of a financial gift.

Loan Agreement: This is similar in structure to a Gift Letter as both define the terms of transferring money. However, a Loan Agreement outlines the repayment terms and interest, if applicable, while a Gift Letter clarifies that no repayment is expected.

Promissory Note: Like a Gift Letter, a Promissory Note details the transfer of funds. The critical difference is that a Promissory Note is a promise to pay back the money, highlighting the transaction's obligation, whereas the Gift Letter confirms there is no obligation to repay.

Declaration of Trust: This document outlines how property or money is held for the benefit of someone else. Similar to a Gift Letter, it can specify that funds are given to an individual. The Gift Letter, though, denotes the lack of repayment and interest, making it a pure gift rather than a trust arrangement.

Donor Affidavit: Specifically used in situations like organ donations, this document confirms the donor's consent. It's akin to a Gift Letter in that both express an intent to give something of value freely and without coercion.

Mortgage Gift Letter: A variant of the Gift Letter, specifically tailored for real estate purchases. It serves the same purpose—to declare that funds given are a gift and not a loan—but is used explicitly to assure mortgage lenders that the homebuyer is not incurring additional debt.

Dos and Don'ts

When completing a Gift Letter form, certain practices should be adhered to for clarity and compliance with legal requirements. This form plays a crucial role in documenting that funds received by an individual from another are indeed a gift and not a loan, which is particularly significant during the acquisition of assets like real estate. Below is a comprehensive list of dos and don'ts to consider.

Do:

- Ensure the donor's name, address, and phone number are accurately filled out to establish their identity and means of contact.

- Clearly state the relationship between the donor and the recipient to outline the nature of their connection.

- Specify the exact amount of the gift to leave no ambiguity regarding the value of the transaction.

- Indicate the date the funds were transferred or will be transferred to provide a clear timeline of the gift.

- Attach the relevant bank statement or documentation to verify the transfer of funds, enhancing the credibility of the claim.

- Include a clear statement that no repayment is expected or required, reinforcing the nature of the transaction as a true gift.

- Have the donor sign the form to authenticate their agreement and understanding of the document's terms.

- Document the recipient’s full name and relationship to the donor to establish the context of the gift within the legal documentation.

- Consult with a legal professional if there is any uncertainty about how to properly complete the form.

- Keep a copy of the completed form for personal records, ensuring both parties have evidence of the transaction.

Don't:

- Leave any sections of the form incomplete, as missing information can create confusion and potential legal challenges.

- Provide falsified or misleading information, which could result in legal penalties or the invalidation of the gift letter.

- Forget to specify the purpose of the gift, especially if it is intended for a specific use, like a down payment on a home.

- Omit the signature of the donor, as it is essential for validating the document's authenticity.

- Ignore the necessity to communicate clearly and directly when explaining the nature of the gift and the expectation (or lack thereof) of repayment.

- Assume that a verbal agreement will suffice in lieu of a properly executed gift letter, which could lead to misunderstandings or disputes.

- Delay the completion and submission of the form, as this can complicate or delay the recipient's ability to use the gift for its intended purpose.

- Underestimate the importance of retaining a copy of the form for future reference should any questions arise about the gift.

- Use informal or vague language that might obscure the intentions behind the gift or leave room for misinterpretation.

- Fail to review the form for accuracy and completeness before submission, potentially causing delays or issues in the approval process.

Misconceptions

When it comes to gifting money, especially for purposes like helping someone buy a house, a Gift Letter form is often required by lenders to ensure that the money given is truly a gift and not a loan. However, there are several misconceptions about this form and its requirements. Here are eight common misconceptions explained:

- Gift letters need to be notarized: It's a common belief that for a gift letter to be valid, it must be notarized. While some lenders may request notarization to add an extra layer of verification, most simply require the donor to sign the document, attesting that the gift is not a loan and does not need to be repaid.

- Only family members can provide gift funds: While it's true that gift funds are often given by family members, lenders do not exclusively restrict gifts to family. Friends or even entities can provide gift funds, as long as they meet the lender's requirements and can provide a legitimate gift letter.

- The recipient needs to pay taxes on gift money: Generally, in the United States, the gift recipient does not have to pay taxes on the money received. It's the donor who might need to file a gift tax return if the amount exceeds the annual exclusion limit set by the IRS, currently at $15,000 per recipient per year.

- Gift letters are only for home purchases: While commonly used in the home buying process, gift letters can also be used for other purposes, such as contributing to a college fund or buying a car. The key is that the lender or institution accepting the gift wants assurance the funds are a gift.

- There's a standard format for all gift letters: Although many lenders have preferred formats for gift letters, there is no one-size-fits-all template. Each lender may have specific requirements for what needs to be included, so it's important to use the lender's own form or follow their instructions closely.

- Gift letters can be vague about the gift amount: Precise details are crucial. A gift letter must state the exact amount being given. Vague language or unclear figures could make the lender reject the letter or delay the approval process.

- Donors can’t retract gift letters once issued: Legally, until the funds have actually been transferred, donors can decide against giving a gift. However, retracting a gift letter after the process has significantly progressed can lead to complications and potentially damage the relationship between the donor and the recipient.

- Gift letters guarantee mortgage approval: Providing a gift letter does not ensure that the mortgage application will be approved. Lenders consider a wide range of factors when assessing an application, including the recipient's credit score, employment history, and debt-to-income ratio.

Understanding these misconceptions can help donors and recipients navigate the process of gifting funds more effectively, ensuring smoother transactions and meeting lender requirements without unnecessary hurdles.

Key takeaways

Gift letters illustrate that funds received by a homebuyer from a relative or friend are indeed a gift and not a loan. When applying for a mortgage, these letters play a crucial role. Below are key takeaways for properly filling out and using a Gift Letter form:

- The donor must clearly state their name, relationship to the recipient, and contact information.

- It's vital to specify the exact amount of the gift.

- For the document to hold validity, the address of the property being purchased should be included.

- Clarity on the fact that the gift is not a loan and the donor expects no repayment is essential.

- Both the donor and the recipient must sign the Gift Letter to attest to its accuracy.

- Documentation such as bank statements may be requested to prove the donor's ability to provide the gift.

- The donor should indicate whether any part of the gift is designated for a specific use, such as down payment or closing costs.

- Mortgage lenders often have specific requirements or forms for a Gift Letter, so consulting with your lender ahead of time is advisable.

- Failure to properly document a gift can lead to delays in the mortgage process or the need for additional verification.

- Legal and tax advice might be necessary to understand any potential implications for the donor or recipient related to gift taxes.

Effectively managing paperwork like the Gift Letter is key in ensuring a smooth home buying process, especially when gifts are involved in funding the purchase.

Common PDF Forms

Florida Family Law Financial Affidavit Short Form - For individuals navigating the complexities of family law in Florida, completing the 12.902(b) form is a practical step towards achieving a fair resolution.

I-864 - Filing the I-864 form is a critical step in the process of sponsoring a relative for permanent residency in the U.S.

Prescription Bottle Label Requirements - Includes language or symbols indicating urgent warnings, such as the risk of allergic reactions or other serious health risks.