Free Goodwill donation receipt PDF Form

Donating items to Goodwill not only clears out your space but also supports goodwill in the community by helping fund job training and employment services. When you make a donation, receiving a donation receipt is a crucial step in the process, particularly for those looking to deduct the donation on their tax returns. The Goodwill donation receipt form serves this exact purpose. It acts as a record of your charitable contribution, detailing the items or cash given. Understanding how to correctly fill out and use this form can maximize the benefits of your donation, for both you and those Goodwill aims to help. This form, which may seem simple at first glance, requires careful attention to ensure that the details of your donation are accurately captured. These details include the date of the donation, a description of the donated items, and their condition, all of which are important for tax deduction purposes. So, whether you're decluttering your home or aiming to help those in need, knowing the ins and outs of the Goodwill donation receipt form can make your charitable efforts even more rewarding.

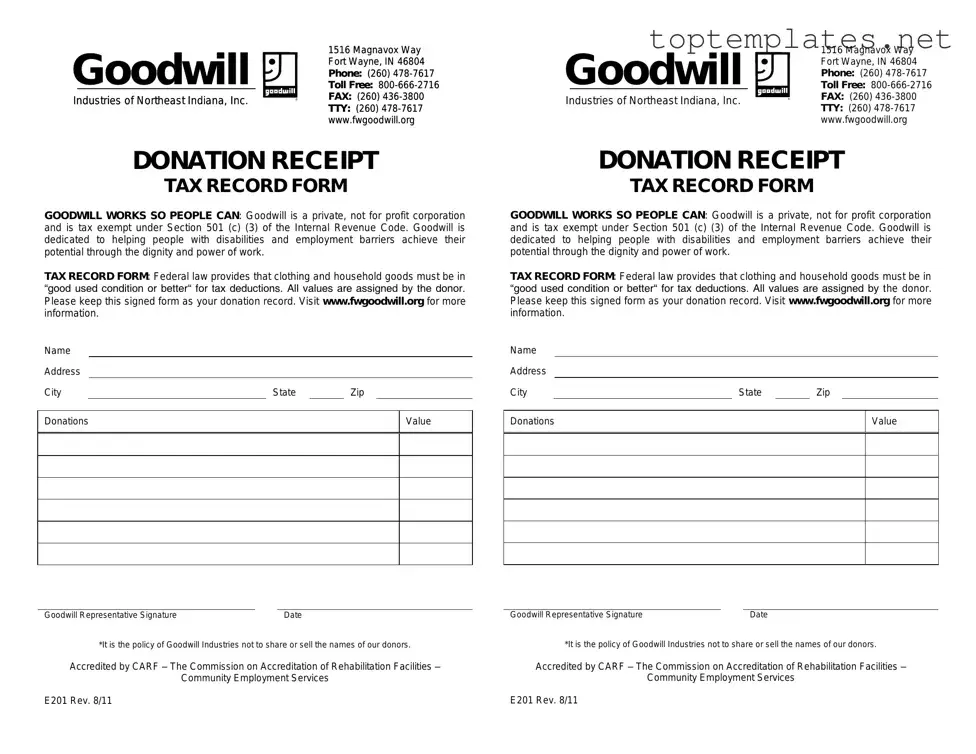

Sample - Goodwill donation receipt Form

Goodwill |

1516 Magnavox Way |

|

Toll Free: |

||

|

Fort Wayne, IN 46804 |

|

|

Phone: (260) |

|

Industries of Northeast Indiana, Inc. |

FAX: (260) |

|

TTY: (260) |

||

|

||

|

www.fwgoodwill.org |

DONATION RECEIPT

TAX RECORD FORM

GOODWILL WORKS SO PEOPLE CAN: Goodwill is a private, not for profit corporation and is tax exempt under Section 501 (c) (3) of the Internal Revenue Code. Goodwill is dedicated to helping people with disabilities and employment barriers achieve their potential through the dignity and power of work.

TAX RECORD FORM: Federal law provides that clothing and household goods must be in “good used condition or better“ for tax deductions. All values are assigned by the donor. Please keep this signed form as your donation record. Visit www.fwgoodwill.org for more information.

Name

Address

City |

|

State |

|

Zip |

|

|

|

|

|

|

|

|

|

Donations |

|

|

|

|

Value |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Goodwill Representative Signature |

|

Date |

*It is the policy of Goodwill Industries not to share or sell the names of our donors.

Accredited by CARF – The Commission on Accreditation of Rehabilitation Facilities –

Community Employment Services

E201 Rev. 8/11

Goodwill |

1516 Magnavox Way |

|

Toll Free: |

||

|

Fort Wayne, IN 46804 |

|

|

Phone: (260) |

|

Industries of Northeast Indiana, Inc. |

FAX: (260) |

|

TTY: (260) |

||

|

||

|

www.fwgoodwill.org |

DONATION RECEIPT

TAX RECORD FORM

GOODWILL WORKS SO PEOPLE CAN: Goodwill is a private, not for profit corporation and is tax exempt under Section 501 (c) (3) of the Internal Revenue Code. Goodwill is dedicated to helping people with disabilities and employment barriers achieve their potential through the dignity and power of work.

TAX RECORD FORM: Federal law provides that clothing and household goods must be in “good used condition or better“ for tax deductions. All values are assigned by the donor. Please keep this signed form as your donation record. Visit www.fwgoodwill.org for more information.

Name

Address

City |

|

State |

|

Zip |

|

|

|

|

|

|

|

|

|

Donations |

|

|

|

|

Value |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Goodwill Representative Signature |

|

Date |

*It is the policy of Goodwill Industries not to share or sell the names of our donors.

Accredited by CARF – The Commission on Accreditation of Rehabilitation Facilities –

Community Employment Services

E201 Rev. 8/11

File Specs

| Fact Name | Description |

|---|---|

| Purpose of the Form | The Goodwill donation receipt form is used by donors to document charitable contributions made to Goodwill. This form can help donors qualify for tax deductions on their annual tax returns. |

| Contents of the Form | Typically, this form includes information such as the donor's name, the description of the donated items, the date of donation, and a signature from a Goodwill representative. |

| State-Specific Variations | While the general purpose of the form is consistent, specific requirements regarding the documentation of charitable donations can vary by state, influenced by state tax laws and regulations. |

| Importance in Tax Preparation | Keeping a completed Goodwill donation receipt can be crucial for tax preparation purposes. It serves as proof of the donation in the event of an audit by the IRS or state tax authorities. |

Steps to Filling Out Goodwill donation receipt

When you donate items to Goodwill, they provide a receipt that can be used to write off the donation on your taxes. The process to fill out the Goodwill donation receipt form is straightforward, ensuring that both you and the nonprofit have a record of your contributions. This document helps in maintaining an accurate account of the items donated, potentially aiding in reducing your taxable income. Below are step-by-step instructions to guide you through filling out the form accurately.

- Gather all the items you have donated and make a detailed list. This will help you in accurately filling out the form.

- Start by entering the date of the donation in the field provided. This ensures that your donation is recorded accurately in Goodwill's records and yours.

- Write your full name and address in the sections provided. Goodwill needs this information to identify you as the donor and for any future communication.

- Detail the items you donated in the section provided. Be as specific as possible, including the condition of each item, as this can affect your tax deduction.

- If available, estimate the value of the items donated. While Goodwill cannot assign values, your estimation helps in your tax preparation and should be based on the fair market value.

- Sign and date the bottom of the receipt. This verifies that the information provided is accurate and that you indeed made the donation.

After the form is completed, keep one copy for your records and give the other to Goodwill. This receipt will be crucial for your tax records, enabling you to claim a deduction for your charitable contribution. Remember, it's important to consult with a tax professional to understand fully how your donations impact your tax situation.

Discover More on Goodwill donation receipt

What is a Goodwill donation receipt form?

A Goodwill donation receipt form is a document given to you by Goodwill after you donate items. It's necessary for keeping a record of your donation for tax deduction purposes. When you drop off your donations, Goodwill will offer this receipt, acknowledging the items you've given. However, it's your responsibility to list the items donated and determine their fair market value.

How can I get a Goodwill donation receipt form?

You can receive a Goodwill donation receipt form whenever you make a donation at a Goodwill drop-off location. Upon donating, ask the staff for a receipt, and they should provide you with one. Make sure to fill out and retain this receipt for your records. In some instances, you can also find printable versions of the donation receipt form on the official Goodwill website, allowing you to prepare it in advance.

What information do I need to include on my Goodwill donation receipt form?

On your Goodwill donation receipt form, you need to include detailed information about the items you've donated. This includes descriptions of the items, their condition (new, like new, used, etc.), and your estimate of their fair market value. Besides the details about the donated items, you should also provide your name, the donation date, and any other information required by the form. Remember, it's important to be as accurate and honest as possible when estimating the value of your donations.

Can I claim a tax deduction without a Goodwill donation receipt?

Generally speaking, to claim a tax deduction for any donation to charity, including Goodwill, you must have a written acknowledgment from the charity for any contribution of $250 or more. For donations less than $250, a bank record or a receipt from the charity showing the charity’s name, the date of the donation, and the amount of the contribution will suffice. Therefore, while it's possible to claim a deduction without the standard Goodwill donation receipt, having this receipt simplifies the process and serves as a solid piece of evidence for your donation should you need it for tax purposes.

Common mistakes

When donors contribute goods to Goodwill, a receipt is provided to acknowledge their donation. This receipt is crucial for tax deduction purposes. However, errors can occur when filling out the Goodwill donation receipt form, potentially affecting the benefits of donation and compliance with tax laws. Here are nine common mistakes:

-

Not itemizing donations accurately: Donors often list items in a general manner, such as 'bags of clothes', without detailing the contents. Precise itemization helps in assessing the value correctly for tax deductions.

-

Overvaluing items: Assigning a higher value than the fair market value to donated goods is a prevalent mistake. The IRS requires that the condition and value of used items be reasonable and reflective of their current worth.

-

Forgetting to list the date of donation: The date of donation is essential for tax records. Accurate dating ensures that the donation is credited within the correct tax year.

-

Omitting the Goodwill location: The receipt must specify the Goodwill location where the donation was made. This information is necessary for validation and in case of any queries regarding the donation.

-

Not obtaining a signature from Goodwill: A signature from a representative of Goodwill verifies the authenticity of the donation receipt. Its absence can lead to the IRS questioning the validity of the donation.

-

Failing to keep a personal copy: Donors sometimes leave without retaining a copy of the completed donation receipt for their records. This oversight can create challenges during tax filing or if the submitted documentation is questioned.

-

Incomplete donor details: Sometimes, donors neglect to fill in all required personal information such as full name, address, or contact details. Complete information is critical for processing the receipt and for donor acknowledgment.

-

Skipping the declaration of no goods or services in exchange: The receipt must state that the donor did not receive any goods or services in return for their donation, as this impacts the deductibility of the donation.

-

Ignoring the need for an independent appraisal: For donations exceeding a certain value, an independent appraisal may be required by the IRS. Not acknowledging this necessity can lead to complications in claiming a tax deduction.

To derive the maximum benefit from donations and remain compliant with tax regulations, donors are advised to avoid these common mistakes. Correctly completing the Goodwill donation receipt form ensures that contributions are accurately documented and recognized.

Documents used along the form

When individuals decide to donate items to Goodwill, they are often given a Goodwill donation receipt form. This receipt is critical for tracking donations for tax deduction purposes. However, there are other essential forms and documents that donors might use in conjunction with the Goodwill donation receipt form to ensure a smooth donation process and to maximize the benefits of their contributions. Here's a list of some of these key documents.

- Itemized Donation List: This document allows donors to keep a detailed record of all items donated. It includes specifics such as the item type, quantity, and estimated value, providing a clear overview for personal records and tax purposes.

- IRS Form 8283: For non-cash donations exceeding $500 in value, this form is necessary for tax filing. It details information about the donated items and the receiving organization, helping to properly claim the tax deduction.

- Appraisal Documents: High-value donations may require an appraisal to substantiate their worth. These documents, provided by a qualified appraiser, are crucial for donations valued over $5,000 and must accompany the tax return if a deduction for the donation is claimed.

- Non-cash Donation Tracker: A spreadsheet or software tool designed to track non-cash donations throughout the year. This helps in organizing and summarizing charitable contributions for personal finance management and tax preparation.

- Volunteer Hours Log: For individuals also donating their time, a log of volunteer hours can be valuable. Though such hours are not tax-deductible, they can be beneficial for personal records and can sometimes lead to matched contributions from employers or special awards from the charity.

- Tax Preparation Software Documentation: Documentation or electronic records from tax preparation software that can integrate the details of donations. This facilitates accurate data transfer during tax filing and can help in maximizing deductions.

- Charitable Donation Guide: A reference document provided by tax authorities or financial advisors that outlines the rules, limits, and benefits of charitable contributions. It helps donors understand how to effectively contribute and claim deductions.

In conclusion, while the Goodwill donation receipt form is a key document for donors, leveraging additional forms and documents can greatly assist in managing and benefiting from charitable contributions. Keeping these records organized and readily available can make the donation process easier and more rewarding, particularly when it comes to filing taxes and maximizing deductions.

Similar forms

Salvation Army Donation Receipt: This document bears a strong resemblance to the Goodwill donation receipt form in purpose and content. Both serve as proof of donation to a charitable organization, enabling donors to document the items they have given and potentially claim a tax deduction. Each form includes similar fields, such as the donor’s name, the date of the donation, and a detailed list or description of the items donated.

Habitat for Humanity Restore Donation Receipt: Similar to the Goodwill donation form, the Habitat for Humanity Restore receipt is provided to donors who contribute items to the organization. Both receipts are crucial for record-keeping, offering a written acknowledgment of the donation. They include the donor's information, a description of donated items, and often note the receipt does not assign value to the donated goods, leaving this responsibility to the donor for tax purposes.

Tax-Deductible Donation Receipt: The general tax-deductible donation receipt shared by many nonprofits closely mirrors the structure of the Goodwill donation receipt. It is designed to comply with IRS requirements for charitable contributions, outlining the non-cash items donated, the name of the donor, and the date of the donation. While the format may vary slightly among organizations, the core intent—to provide a record for tax deduction eligibility—remains the same.

Library Donation Receipt: When individuals donate books or other media to a library, they may receive a receipt that serves a similar function to the Goodwill donation receipt. Although the types of donated items may differ, both documents acknowledge the contribution made by the donor. Information such as the donor’s name, contact details, and a description of the donated items are typically included, which helps both the donor and the receiving organization maintain accurate records.

Dos and Don'ts

When you donate items to Goodwill, filling out the donation receipt form correctly is crucial. This document serves as a record of your charitable contribution and may be necessary for tax deduction purposes. Here is a list of do's and don'ts to help guide you through the process:

Do:

- Ensure all your personal information is accurate, including your full name, address, and contact information.

- Itemize your donated items, detailing each one separately to maintain clear records.

- Estimate the value of each item realistically and fairly according to its condition and current market value.

- Keep a copy of the filled-out form for your records, as it may be needed for tax purposes or personal reference.

- Fill out the form at the time of donation to ensure all information is fresh and accurate.

- Consult IRS guidelines or a tax advisor if you're unsure how to value your donations, especially for high-value items.

- Ask Goodwill staff for assistance if you have questions or need clarification on how to properly fill out the form.

- Sign and date the receipt to validate it.

- Be honest with the information you provide, reflecting the true extent of your donation.

- Check the Goodwill website or contact them directly for any specific instructions or updates regarding the donation receipt process.

Don't:

- Leave any required fields blank. If a section doesn't apply, write 'N/A' (not applicable) instead of leaving it empty.

- Overestimate the value of your items to boost your tax deduction. This could lead to penalties or audits from the IRS.

- Forget to specify if your donation is a single item or a group of similar items bundled together.

- Discard your copy of the donation receipt. It's important to keep this document until you've filed your taxes and received confirmation.

- Delay filling out the form until tax season. Doing so could result in inaccuracies or missing information.

- Assume the staff at Goodwill knows the value of your items. It's your responsibility to provide this information.

- Fill out the form in a rush. Take your time to ensure all details are correct and fully accounted for.

- Use vague descriptions of your donated items. Be as specific as possible to ensure a clear record.

- Ignore the IRS's limits and guidelines on charitable donations. Make sure your donation aligns with federal tax rules.

- Wait to ask for a donation receipt if you're not automatically offered one. It's your right to have a record of your contribution.

Misconceptions

Many people have misconceptions about the Goodwill donation receipt form, which can lead to confusion or missed opportunities when donating items. Let's clear up some of these misunderstandings:

All donated items qualify for a tax deduction. Not every item you donate to Goodwill is eligible for a tax deduction. The IRS has specific guidelines on what qualifies, and it's important to consult these or a tax professional to ensure your donations meet the criteria.

You can claim any value for your donated items. The value of your donated items should reflect their current market value, not their original purchase price. Overestimating the value of donated items can lead to issues with the IRS.

A Goodwill donation receipt is all you need for tax purposes. While the receipt is important, the IRS may require additional documentation for donations above a certain value, such as an appraisal for more valuable items.

Every Goodwill center can provide a receipt. While most Goodwill centers do offer donation receipts, there may be exceptions. It's a good practice to check with the specific location where you plan to donate.

Digital and paper receipts are treated differently by the IRS. The IRS accepts both digital and paper receipts as valid documentation for your donation, as long as they contain the necessary information such as the date of donation, the location of the Goodwill center, and a reasonably detailed list of the donated items.

There’s no need to itemize donations on the receipt. While you don't need to list every individual item, providing a general description and condition (e.g., "3 bags of women's clothing, good condition") can be helpful for your records and necessary to determine the value of your donation.

Understanding these key points can make the process of donating to Goodwill—and receiving the potential tax benefits—a smoother experience.

Key takeaways

Understanding how to correctly fill out and utilize the Goodwill donation receipt form is crucial for ensuring your contributions are accurately documented for tax and personal records. Here are key takeaways to help guide you through the process:

- Keep detailed records: For every donation, ensure you receive and retain a Goodwill donation receipt. This practice is essential for tax purposes and keeping track of your charitable contributions.

- Itemize donated items: List each item donated on the receipt. Specificity helps in valuing your donation accurately and satisfies IRS documentation requirements.

- Assess the value yourself: Goodwill employees cannot assign values to your donations. It's your responsibility to determine the fair market value of the items you donate.

- Understand Fair Market Value (FMV): FMV is the price an item would sell for on the open market. Consider the item's condition and age when determining FMV.

- Use official Goodwill receipts: Ensure you receive an official receipt from Goodwill. This serves as a valid proof of donation necessary for tax deductions.

- Photograph valuable items: For high-value donations, take photographs as additional documentation. This can be helpful if your tax return is ever questioned.

- Keep receipts organized: Store all donation receipts together in a safe place. Organized records simplify tax preparation and can be crucial in the event of an audit.

- Consult a tax professional: Tax laws can be complex. For donations of significant value or if you have questions about deductions, consulting with a tax professional is advisable.

By following these guidelines, donors can maximize the impact of their generosity while ensuring their donations are correctly documented for tax benefits and personal record-keeping.

Common PDF Forms

Prescription Bottle Label Requirements - Offers guidance on storage instructions, ensuring medication efficacy by advising on the proper conditions to store drugs.

Fedex Manage Delivery - Streamline your FedEx delivery process by indicating where to leave your package, backed by your signed approval.