Free Independent Contractor Pay Stub PDF Form

In today's diverse and dynamic work environment, the relationship between businesses and independent contractors has become increasingly pivotal. At the heart of this relationship is the critical yet often overlooked Independent Contractor Pay Stub form. This form serves as a comprehensive record of payment details between a business and a contractor, bridging the gap between traditional employment and freelance or contractual work. It not only ensures transparency and accountability in financial transactions but also aids contractors in managing their taxes effectively. Despite its importance, many are unaware of the specifics of this form – its components, the legal requirements surrounding its issuance, and its significant role in both financial planning for the contractor and record-keeping for the business. The Independent Contractor Pay Stub form encapsulates key aspects of the modern work arrangement, making it an essential tool in the freelancing and contracting world.

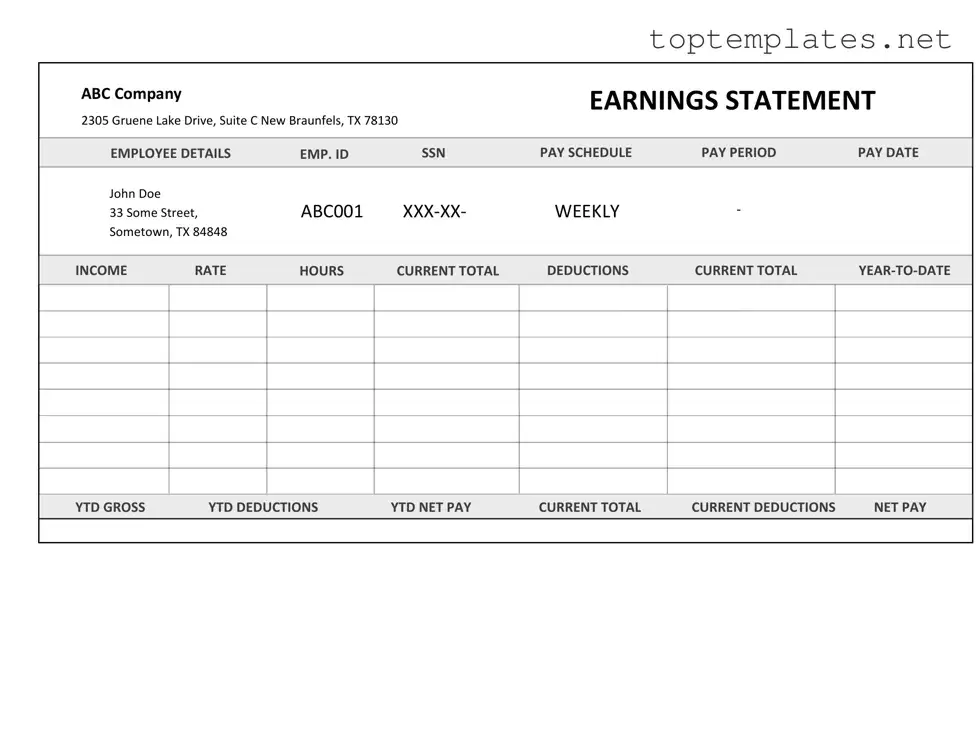

Sample - Independent Contractor Pay Stub Form

ABC Company |

|

|

|

EARNINGS STATEMENT |

||

|

|

|

|

|

|

|

2305 Gruene Lake Drive, Suite C New Braunfels, TX 78130 |

|

|

|

|||

EMPLOYEE DETAILS |

EMP. ID |

SSN |

PAY SCHEDULE |

PAY PERIOD |

PAY DATE |

|

John Doe |

|

ABC001 |

WEEKLY |

- |

|

|

33 Some Street, |

|

|||||

Sometown, TX 84848 |

|

|

|

|

|

|

INCOME |

RATE |

HOURS |

CURRENT TOTAL |

DEDUCTIONS |

CURRENT TOTAL |

|

YTD GROSS |

YTD DEDUCTIONS |

YTD NET PAY |

CURRENT TOTAL |

CURRENT DEDUCTIONS |

NET PAY |

File Specs

| Fact | Description |

|---|---|

| Definition | An Independent Contractor Pay Stub is a document that outlines the payment details from a business to an independent contractor for their services. |

| Not an Employee | Independent contractors are not employees of the business, thus they do not receive traditional pay stubs with deductions for taxes, social security, or Medicare. |

| Contents | The form typically includes information such as date of payment, amount paid, description of services provided, and any deductions or expenses. |

| Importance | It serves as a record of payment for both the business and the independent contractor and can be used for tax filing purposes. |

| Self-Employment Taxes | Independent contractors are responsible for paying their own taxes, including self-employment tax, and the pay stub can help in calculating these taxes. |

| No Standard Format | There is no standardized format for an Independent Contractor Pay Stub, as regulations vary by jurisdiction, but essential payment details should be included. |

| State-Specific Laws | In some states, there may be specific requirements or templates for independent contractor pay stubs, governed by state labor law. |

| Electronic or Physical Form | Depending on agreement or regional regulation, pay stubs can be issued in electronic or physical format. |

Steps to Filling Out Independent Contractor Pay Stub

Completing an Independent Contractor Pay Stub form is an important step in ensuring transparency and accuracy in compensation for services rendered. This document serves as a record of payment from a client to an independent contractor, detailing the amount paid for services provided. Careful completion of this form helps in maintaining clear financial records, facilitating easier reporting during tax season, and supporting any necessary documentation for financial disputes. The following steps will guide you through the process of filling out this form accurately and efficiently.

- Begin by entering the Date of the pay period end. This ensures the payment is accurately recorded against the proper time frame for both parties' records.

- Fill in the Contractor's Name, making sure to include any legal or preferred names to ensure clarity on whom the payment is issued to.

- Input the Contractor's Address, including street name and number, city, state, and ZIP code to ensure proper identification and for any necessary correspondence.

- Provide the Social Security Number (SSN) or Employer Identification Number (EIN) for tax identification purposes. This step is crucial for accurate tax reporting and compliance with tax laws.

- Enter the Payment Amount in the designated area. It's important to double-check this figure to avoid any disputes or corrections later on.

- Detail any deductions that apply. These might include taxes, insurance, or other withholdings agreed upon between the contractor and the client. Clearly list each deduction to ensure transparency.

- Calculate and note the Total Amount Paid after deductions. This figure represents the net payment made to the contractor for the services provided.

- Include any Notes relevant to the payment. This section can be used to document any additional agreements, payment terms, or clarifications about the services rendered.

- Ensure both the contractor and the client Sign the form, validating the accuracy of the information provided and the payment made. A signature is essential for the document to be considered valid and binding.

Once filled out, the Independent Contractor Pay Stub form acts as a crucial piece of documentation for both parties, serving as proof of payment for services rendered. It is recommended to keep a copy of each pay stub for record-keeping purposes and future reference. Proper documentation and transparency in the payment process can help foster trust and maintain a healthy, professional relationship between contractor and client.

Discover More on Independent Contractor Pay Stub

What is an Independent Contractor Pay Stub?

An Independent Contractor Pay Stub is a document that details the payment information between a business and an independent contractor. Unlike traditional employees, independent contractors aren't provided with a standard paycheck or pay stub through payroll systems. Instead, they often receive payments based on the invoices they submit. An Independent Contractor Pay Stub, therefore, serves to document each payment's details, such as the date, amount, and description of services provided.

Why is it important for independent contractors to have Pay Stubs?

Even though independent contractors operate differently from regular employees, having a Pay Stub is crucial for several reasons. First, it helps in maintaining clear records of payments received for services rendered, which is essential for financial management and tax preparation. Second, these pay stubs can act as proof of income, which is necessary when applying for loans, mortgages, or renting properties. Lastly, they assist in resolving any disputes over payment amounts or services provided.

Do businesses have to provide Pay Stubs to independent contractors?

Typically, businesses are not legally required to provide Pay Stubs to independent contractors as they are with traditional employees. The relationship between businesses and independent contractors is governed by the terms of the contract they agree upon. However, businesses may still choose to provide Pay Stubs to maintain transparent financial records and foster positive working relationships with their contractors.

How can an Independent Contractor Pay Stub be created?

Independent Contractor Pay Stubs can be created in several ways. Contractors can manually create a pay stub using templates available online or invest in accounting software that automates this process. The key is to ensure that the pay stub includes all necessary details such as pay period, amount paid, method of payment, and a breakdown of services provided. Some software solutions are specifically designed for contractors and freelancers, offering features that simplify the creation of pay stubs and other financial documents.

What information should be included on an Independent Contractor Pay Stub?

An effective Independent Contractor Pay Stub should include the contractor's name and contact information, the hiring business's name and contact details, the date of payment, the pay period, payment amount, method of payment, and a detailed breakdown of the services provided including any applicable taxes or deductions. This not only ensures transparency but also makes the document useful for tax and financial reporting purposes.

Can an Independent Contractor Pay Stub be used for tax purposes?

Yes, an Independent Contractor Pay Stub can and should be used for tax purposes. These pay stubs serve as a record of the income an independent contractor earns from various clients. They are crucial for accurately reporting income on tax returns and can help in calculating the appropriate amount of taxes owed. Having detailed pay stubs simplifies the tax preparation process and can provide necessary documentation in case of an IRS audit.

Common mistakes

Filling out an Independent Contractor Pay Stub form seems straightforward, but mistakes can often occur. These errors can lead to misunderstandings, delayed payments, or even legal complications. To ensure accuracy and compliance, here are ten common mistakes people make when completing this form:

Not checking for updates - Forms can be updated or changed. Always use the most current version.

Failing to double-check the identification numbers - Whether it's a Social Security number or an Employer Identification Number, incorrect information can cause significant issues.

Omitting the full legal name - Using nicknames or abbreviations instead of the full legal name can lead to confusion or payment delays.

Overlooking the contract dates - Forgetting to include the start and end dates of the contract might lead to confusion about the payment period.

Miscalculating the hours worked - This can lead to underpayment or overpayment. Always confirm the exact hours worked before submission.

Incorrectly listing expenses - Not properly detailing reimbursable expenses can result in non-compensation.

Forgetting to sign the form - An unsigned form can be considered incomplete and may not be processed.

Not keeping records - Always keep a copy of the submitted form for your records. It's crucial for tracking payments and resolving potential disputes.

Using unclear handwritten text - If the person processing the form can't read your handwriting, it can delay payment processing.

Ignoring state-specific requirements - Some states have additional requirements for independent contractors. Failing to comply can result in legal complications.

Avoiding these common pitfalls will help ensure that the process of submitting an Independent Contractor Pay Stub is seamless and error-free. Paying attention to detail and staying informed about the most current form requirements are key to a successful submission.

Documents used along the form

When dealing with work-related documentation, especially for independent contractors, it is crucial to have a comprehensive suite of forms and documents that cater to all necessary financial and legal requirements. The Independent Contractor Pay Stub form is a pivotal document that delineates the payment details between a contractor and the hiring entity. However, to ensure a thorough and legally compliant process, several other documents often supplement the Independent Contractor Pay Stub form, contributing to a seamless workflow and clear communication.

- Independent Contractor Agreement: This document outlines the terms of the working relationship, including the scope of work, payment terms, and confidentiality clauses. It serves as a contract binding both parties to agreed-upon terms.

- W-9 Form: Required by the IRS, this form is used to gather information about the contractor for tax purposes, ensuring the correct reporting of income and necessary deductions.

- Invoicing Template: Independent contractors typically use an invoicing template to request payment for services rendered, detailing the work completed, the rate charged, and the total amount due.

- Non-Disclosure Agreement (NDA): An NDA protects any confidential information shared between the contractor and the client, prohibiting the unauthorized sharing of sensitive data.

- Service Level Agreement (SLA): This document defines the level of service expected from the contractor, including timelines, deliverable quality, and milestones, thereby setting clear expectations.

- 1099-MISC Form: At the end of the fiscal year, companies must fill out this IRS form for each independent contractor they have paid more than $600, reporting the income paid to the contractor.

- Business Licenses and Permits: Depending on the nature of the work and local regulations, independent contractors might need specific licenses or permits to legally offer their services.

- Project Proposal: Before beginning work, a contractor often submits a project proposal outlining the objectives, strategies, timeline, and costs associated with the project, awaiting approval from the client.

- Work Order: Similar to a project proposal but often more concise, a work order specifies the work to be done, including any materials needed, pricing, and deadlines.

Each form and document plays a unique role in establishing a clear, legal, and efficient working relationship between an independent contractor and their client. From setting the initial terms of engagement to finalizing the specifics of a project and ensuring compliance with tax laws, these documents collectively form the backbone of professional and legal standards in contractor-client interactions. Ensuring each document is correctly utilized and filled can help mitigate potential legal issues, streamline payment processes, and foster a positive working relationship.

Similar forms

1099-NEC Form: This form is used to report income for independent contractors who have been paid $600 or more in a year by a business. It's similar to the Independent Contractor Pay Stub, as both documents are critical for tax reporting and provide a summary of the income received from a particular source. However, while the Pay Stub might be issued periodically with each payment, the 1099-NEC is an annual summary.

Invoice: Often used by independent contractors to bill for their services, invoices detail the work performed, the rate charged, and the total amount owed. Like the Independent Contractor Pay Stub, it serves as a record of the transaction between the contractor and the client. Both documents provide proof of income for the contractor, although the Pay Stub typically comes from the payer, while the invoice originates from the contractor.

Payment Receipt: This document acknowledges that payment has been made and received. It's similar to the Independent Contractor Pay Stub as both confirm the transfer of funds for services rendered. Each acts as proof of payment, but while the pay stub outlines the specifics of the payment calculation, a receipt merely confirms the payment has occurred.

Timesheet: A record of the hours worked by an employee or contractor. For independent contractors, timesheets can serve a similar purpose to Pay Stubs, as they provide a basis for the payment calculation. Both documents are essential for accurate and fair compensation, although the pay stub is more of an after-the-fact document reflecting payment, whereas a timesheet is used to determine the amount due.

Service Agreement: Though not a payment document, a service agreement outlines the terms and conditions under which an independent contractor provides services, including payment terms. It's similar to the Pay Stub in that both are key components of the financial relationship between the contractor and the client. The agreement sets the expectation, while the pay stub confirms its fulfillment.

W-2 Form: Used by employers to report employee wages, taxes withheld, and other compensation. Although designed for employees rather than contractors, it's similar to the Independent Contractor Pay Stub in functionality. Both provide important tax reporting information and summarize earnings. The primary difference lies in the employment relationship and tax obligations reflected by each.

Dos and Don'ts

When completing the Independent Contractor Pay Stub form, it's crucial to pay attention to detail and ensure the information you provide is accurate and up-to-date. Here are some guidelines to follow:

Things you should do:Verify your personal details, including your full name, address, and social security number or tax identification number, to ensure they are correct.

Double-check the period covered by the pay stub to make certain it reflects the correct dates of service.

Enter the total amount you were paid during the pay period accurately, including any additional compensation such as bonuses or commissions.

Itemize deductions if applicable, such as retirement contributions or health insurance premiums, and ensure they are correctly calculated.

Review the net pay to verify that it matches your calculations after deductions.

Make use of a calculator or software to help with calculations to minimize errors.

Keep a copy of the completed pay stub for your records.

Don't leave any required fields blank. If a section does not apply to you, write "N/A" (not applicable) rather than leaving it empty.

Avoid rounding numbers. Instead, provide exact amounts to ensure accuracy.

Never guess amounts or figures. Refer to your contract or payment records for exact numbers.

Do not use pencil or inks that can easily be erased or smudged. Fill out the form in permanent ink or type it if possible.

Misconceptions

When it comes to understanding pay stubs for independent contractors, there are several misconceptions that can create confusion. It's important to clear these up to ensure both contractors and those who hire them have a correct understanding of what is required, what is provided, and what the implications are of the financial information shared between parties. Here are six common misconceptions about the Independent Contractor Pay Stub form:

- Independent contractors don't need pay stubs. Many believe that, unlike regular employees, independent contractors aren't provided with or required to have pay stubs. While it's true that the legal requirements applying to employees' pay stubs don't necessarily apply to contractors, these documents are still very useful. They provide a detailed record of payments, deductions, and other financial information that can be crucial for tax preparation and personal record-keeping.

- There's a standard format for all Independent Contractor Pay Stub forms. This is not correct. Unlike pay stubs for employees, which might need to meet specific state requirements, there is no one-size-fits-all format for an independent contractor pay stub. The format can vary significantly depending on the preferences of the contractor or the business, as long as the essential information is included.

- The pay stub must detail taxes withheld. A common misconception is that pay stubs for independent contractors must show taxes that have been withheld. However, independent contractors are responsible for paying their own taxes, so typically, no taxes are withheld from their payments. The pay stub would not show tax withholdings, but it should detail the amount paid for the work performed.

- Only the contractor needs a copy of the pay stub. While the primary purpose of the pay stub is for the contractor’s own records, especially for managing taxes and tracking income, it's also beneficial for the hiring entity to keep copies. These records can help in verifying expenses and payments in financial statements, audits, and when preparing 1099 forms during tax season.

- Using pay stubs means an independent contractor is considered an employee. Simply providing a pay stub does not change the legal classification of a worker from an independent contractor to an employee. The classification depends on several factors outlined by the IRS and other regulatory bodies, focusing on the level of control and independence in the work relationship.

- Independent Contractor Pay Stubs aren't necessary for taxes. Finally, some might think these pay stubs aren't necessary for tax purposes, but that’s not entirely accurate. While it's true that the essential document for tax reporting is the 1099 form, which reports annual income, the pay stubs serve as valuable proof of income throughout the year. They can be particularly helpful in managing quarterly tax payments and ensuring that income is accurately reported to the IRS.

Key takeaways

Filling out and using the Independent Contractor Pay Stub form is an essential process for both businesses and independent contractors alike. This document helps track payments made for services rendered, ensuring transparency and accuracy in financial dealings. Below are six key takeaways to keep in mind when dealing with this important form:

- Accuracy is key: Ensure all information entered on the form is accurate, including personal details, payment amount, and any deductions. Mistakes can lead to misunderstandings or legal issues down the line.

- Understand tax obligations: Unlike traditional employees, independent contractors are responsible for their own taxes. The pay stub should detail any deductions made, but it's up to the contractor to manage their tax obligations accordingly.

- Keep records: Both parties should keep a copy of each pay stub for their records. These documents can be crucial for financial tracking, resolving disputes, and fulfilling tax requirements.

- Know your rights: Independent contractors have specific rights regarding payment and contract terms. Familiarize yourself with these rights to ensure you're not being taken advantage of.

- Regular updates: If any details change, such as the payment amount or contact information, a new pay stub reflecting these changes should be issued. This helps keep both parties informed and avoids confusion.

- Use as proof of income: For independent contractors, these pay stubs are often used as proof of income for loans, housing, and more. It’s important that they reflect the true earnings and are readily available when needed.

By focusing on these key takeaways, businesses and independent contractors can maintain a clear, professional, and legally sound financial relationship. Remember, the little efforts put into the management and proper use of the Independent Contractor Pay Stub form can save a lot of trouble and confusion in the long run.

Common PDF Forms

High School Transcript - A standardized form that provides a breakdown of a student’s high school academic track, including GPA and class rank, if applicable.

Child Guardianship Forms - This document temporarily delegates the authority to care for a child to another, stipulating the conditions of such care.

Joint Tenancy in California - Used to confirm the decedent’s death and establish the survivor as the sole property owner.