Free Intent To Lien Florida PDF Form

In the landscape of construction law in Florida, the Intent To Lien form embodies a crucial preliminary step for parties seeking to secure their right to payment for services rendered or materials provided on a property. This form, formally known as the Notice of Intent to File a Lien, serves as a formal warning to property owners that a lien, which is a legal claim against a property for unpaid work, may soon be placed on their property due to nonpayment. The form outlines essential details such as the property owner's full legal name and address, the general contractor's information if applicable, a description of the property, and a statement of the unpaid amount. According to Florida Statutes §713.06(2)(a), this notice must be served at least 45 days prior to the actual filing of the lien, providing a clear timeframe for property owners to respond to the allegations of nonpayment. In doing so, it acts not just as a preliminary notification, but also as a final opportunity for the property owner to settle any outstanding debts before legal action is taken, which, as mentioned in the form, could lead to foreclosure proceedings, legal fees, court costs, and other related expenses. Through its procedural requirements, the Intent To Lien form underscores the balance between protecting the rights of laborers and suppliers to be compensated for their work and materials, and providing homeowners with fair notice and an opportunity to resolve any disputes.

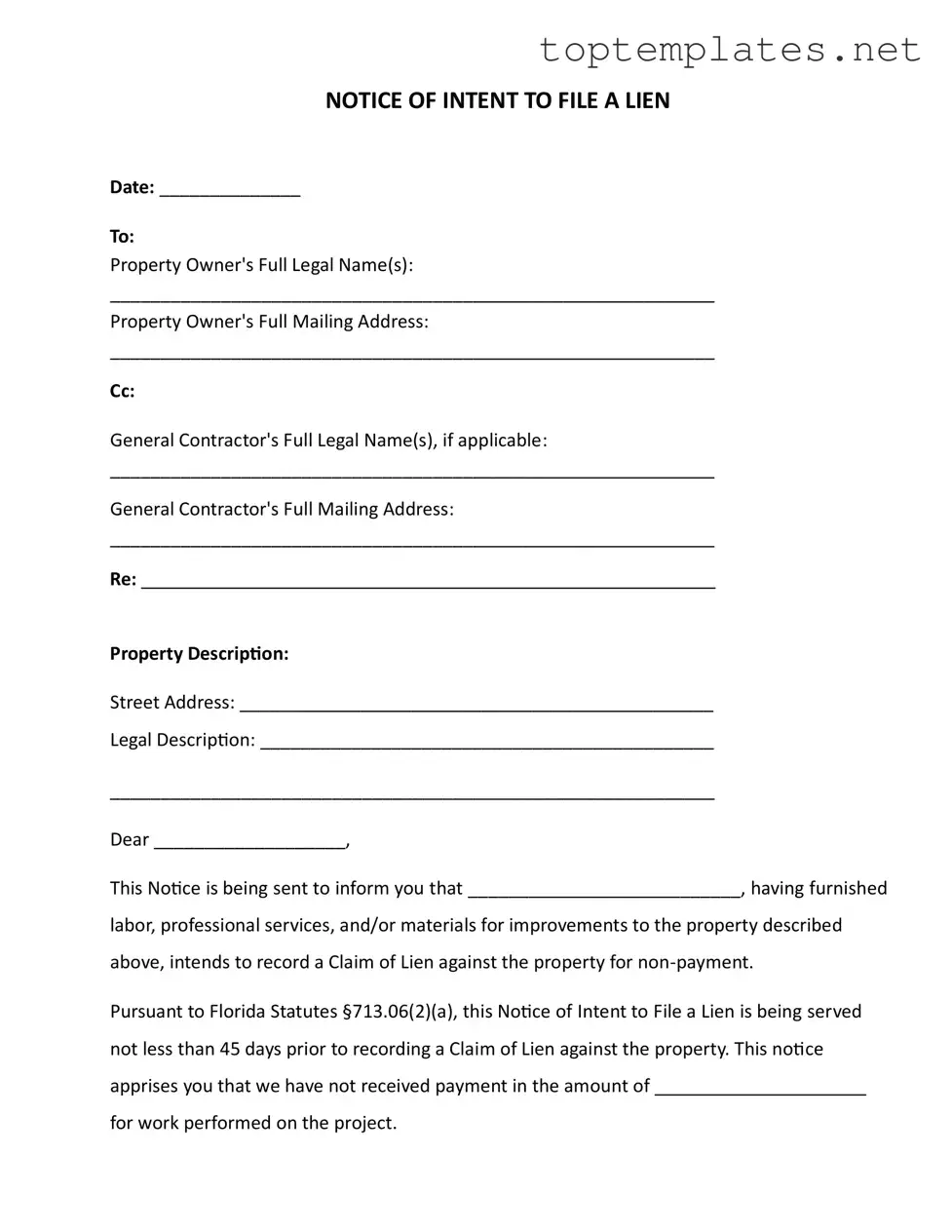

Sample - Intent To Lien Florida Form

NOTICE OF INTENT TO FILE A LIEN

Date: ______________

To:

Property Owner's Full Legal Name(s):

____________________________________________________________

Property Owner's Full Mailing Address:

____________________________________________________________

Cc:

General Contractor's Full Legal Name(s), if applicable:

____________________________________________________________

General Contractor's Full Mailing Address:

____________________________________________________________

Re: _________________________________________________________

Property Description:

Street Address: _______________________________________________

Legal Description: _____________________________________________

____________________________________________________________

Dear ___________________,

This Notice is being sent to inform you that ___________________________, having furnished

labor, professional services, and/or materials for improvements to the property described above, intends to record a Claim of Lien against the property for

Pursuant to Florida Statutes §713.06(2)(a), this Notice of Intent to File a Lien is being served not less than 45 days prior to recording a Claim of Lien against the property. This notice apprises you that we have not received payment in the amount of _____________________

for work performed on the project.

As per Florida Statutes §713.06(2)(b), failure to make payment in full or provide a satisfactory response within 30 days may result in the recording of a lien on your property. If the lien is recorded, your property could be subject to foreclosure proceedings, and you could be responsible for attorney fees, court costs, and other expenses.

No waivers or releases of lien have been received that would affect the validity of this lien claim.

We would prefer to avoid this action and request your immediate attention to this matter. Please contact us at your earliest convenience to arrange payment and avoid further action.

Thank you for your prompt attention to this matter.

Sincerely,

_________________________ [Your Name]

_________________________ [Your Title]

_________________________ [Your Phone Number]

_________________________ [Your Email Address]

CERTIFICATE OF SERVICE

I certify that a true and correct copy of the Notice of Intent to File a Lien was served on

______________ to ____________________________ at

__________________________________________ by:

□Certified Mail, Return Receipt Requested

□Registered Mail

□Hand Delivery

□Delivery by a Process Server

□Publication

____________________________ |

____________________________ |

Name |

Signature |

File Specs

| Fact Name | Description |

|---|---|

| Notification Period Requirement | This Notice of Intent must be served at least 45 days before recording a Claim of Lien, as mandated by Florida Statutes §713.06(2)(a). |

| Response Timeframe for Property Owner | Florida Statutes §713.06(2)(b) specifies that the property owner has 30 days to make full payment or provide a satisfactory response to avoid lien recording. |

| Consequences of Lien Recording | If a lien is recorded, the property may become subject to foreclosure proceedings. The property owner could also be liable for attorney fees, court costs, and other expenses related to the lien. |

| Service of Notice Validation | The Notice includes a Certificate of Service, which validates that a true and correct copy of the Notice of Intent to File a Lien has been properly served on the intended recipient. |

Steps to Filling Out Intent To Lien Florida

Completing the Intent To Lien form in Florida is a critical step towards securing your right to claim a lien for unpaid labor, services, or materials provided. Here's how to accurately fill out the form:

- Date: Fill in the current date at the top of the form.

- Property Owner's Full Legal Name(s): Enter the complete legal name(s) of the property owner(s) as it appears in public records.

- Property Owner's Full Mailing Address: Provide the full mailing address of the property owner(s), ensuring accuracy for official correspondence.

- General Contractor's Full Legal Name(s), if applicable: If a general contractor is involved, include their complete legal name(s).

- General Contractor's Full Mailing Address: Enter the full mailing address of the general contractor, if applicable.

- Re: Briefly describe the nature of the project or work involved.

- Property Description: Include both the street address and the legal description of the property. This might require two separate entries, as the legal description is more detailed and can often be found on property deeds or tax bills.

- Under the salutation "Dear," insert the property owner's name(s) to personalize the notice.

- In the blank space following "This Notice is being sent to inform you that," fill in your own name or your company's name, as the entity that provided labor, professional services, and/or materials.

- Specify the amount not received for work performed in the space provided after "This notice apprises you that we have not received payment in the amount of." Be sure to state the exact outstanding balance.

- Close the letter with your name, title, phone number, and email address to provide clear contact information should the property owner wish to resolve the payment issue.

- For the Certificate of Service, tick the appropriate method of delivery used to serve this notice on the property owner and/or the general contractor. Then, fill in the date the notice was served, print your name, and sign the form.

After completing the form, it's important to follow the chosen method of delivery correctly, as stipulated in the Certificate of Service section, to ensure the notice is legally served. Serving this notice starts a formal process and the recipients are given a clear timeframe to respond or settle the outstanding balance. Failure to respond or resolve the issue could lead to further legal action, including filing a lien against the property. Therefore, it is advisable to monitor the situation closely and be prepared to take additional steps if necessary.

Discover More on Intent To Lien Florida

What is a Notice of Intent to File a Lien in Florida?

A Notice of Intent to File a Lien is a legal document that must be served to a property owner in Florida, informing them that a lien will be placed against their property due to unpaid labor, services, or materials. This notice is a mandatory step before recording a Claim of Lien, and it serves as a final warning to the property owner to settle the outstanding payment or face a lien against their property.

When must the Notice of Intent to File a Lien be served?

Under Florida Statutes §713.06(2)(a), the Notice of Intent to File a Lien must be served to the property owner at least 45 days before recording the Claim of Lien.

What should be included in the Notice of Intent to File a Lien?

The notice must include the date, full legal names and addresses of the property owner and, if applicable, the general contractor. It also must describe the property, the nature of the work performed or materials provided, the amount unpaid, and the intention to file a lien if payment is not made. Additionally, a Certificate of Service showing how the notice was delivered must be included.

How can the Notice of Intent to File a Lien be delivered?

The notice can be delivered by certified mail, registered mail, hand delivery, delivery by a process server, or publication, as required by law, to ensure that the property owner receives it. Whichever method is chosen, it must be documented in the Certificate of Service.

What happens if the recipient does not respond to the Notice of Intent to File a Lien?

If the property owner does not respond with payment or a satisfactory resolution within 30 days as outlined by Florida Statutes §713.06(2)(b), the party that served the notice may proceed to file a lien against the property.

Can a Notice of Intent to File a Lien lead to foreclosure?

Yes, once a lien is placed on a property, if it remains unpaid, it could potentially lead to foreclosure proceedings. This is because a lien is a legal claim against the property for unpaid debt, allowing the lienholder to pursue foreclosure to recover the owed amounts.

Are there any costs associated with filing a Notice of Intent to File a Lien?

While there are minimal costs associated with serving the Notice of Intent, such as postage for certified mail, the subsequent step of recording a lien requires payment of a fee to the County Recorder's Office. Additional costs may accrue if legal assistance is sought to prepare the document.

Can a Notice of Intent to File a Lien be disputed?

Yes, a property owner may dispute a Notice of Intent to File a Lien if they believe it to be unjustified. This could be due to a disagreement over the amount owed, the quality of work done, or other reasons. Disputes are typically resolved through negotiation, mediation, or, if necessary, legal action.

What should a property owner do upon receiving a Notice of Intent to File a Lien?

Upon receiving the notice, a property owner should immediately contact the sender to discuss the matter. It is advisable to attempt to resolve the issue promptly, either by verifying and paying the outstanding amount or by negotiating a satisfactory compromise for both parties.

Does providing a Notice of Intent to File a Lien affect the validity of the eventual lien?

Serving a Notice of Intent to File a Lien does not in itself affect the validity of a lien. However, failing to serve this notice according to the statutory requirements can render a subsequently filed lien invalid. This step must be completed correctly to maintain the right to enforce the lien.

Common mistakes

Providing inaccurate information about the property owner including their full legal name and mailing address is a common mistake. This detail is crucial for ensuring the notice is served correctly and legally.

Failure to include the complete legal description of the property can significantly delay the process. The legal description is necessary for properly identifying the property involved in the lien.

Omitting the general contractor's details, if applicable, is another error. Including the general contractor's full legal name and address helps clarify the parties involved and can be essential for the notice's validity.

Incorrectly stating the amount due for work performed can lead to disputes and complications in enforcing the lien. It's important to verify the amount claimed is both accurate and owed.

Not serving the notice within the legally required time frame, at least 45 days before recording a claim of lien, can invalidate the notice. Timeliness is key to preserving the right to lien.

Failing to include a specific project description or the address where the work was performed leads to vagueness that can be challenged. Clear and concise descriptions of the work and location are necessary.

Sending the notice by an improper method of service can result in the notice being considered undelivered. It's important to follow the certificate of service requirements precisely for the notice to be legally effective.

Ignoring to sign and date the certificate of service is a crucial oversight. This certification validates that the notice has been correctly served on the property owner and, if applicable, the general contractor.

Documents used along the form

When dealing with construction projects in Florida, the Notice of Intent to File a Lien is a critical document designed to signal to property owners the intention of a contractor, subcontractor, or supplier to secure payment for services rendered by placing a lien on the property in question. This formal notification is often preceded or followed by additional legal forms and documents, each serving a distinct but complementary role in the construction lien process. These documents help to ensure that the rights and interests of all parties involved are adequately protected and communicated. Understanding these documents is essential for navigating the complexities of construction law in Florida.

- Claim of Lien: This legal document is formally filed with the county recorder's office. It details the amount owed, the services provided, and the property address. It is the actual lien against the property that arises if payment is not made after the Notice of Intent to Lien is served and the required time has elapsed.

- Conditional Waiver and Release on Progress Payment: This form is used when a payment is made but not yet confirmed cleared by the bank. It waives the claimant's rights to file a lien for the amount paid, conditional upon the payment clearing. It's a security measure for both the property owner and the claimant during ongoing projects.

- Unconditional Waiver and Release on Final Payment: Utilized once the final payment on a project clears, this document completely releases any construction lien rights the filer has on the property. It signifies the conclusion of their financial involvement and satisfaction of the agreed-upon payment.

- Notice to Owner (NTO): Florida law requires this notice be sent by subcontractors and material suppliers to the property owner to inform them of the materials or labor being provided. This document precedes a lien and is critical for subcontractors and suppliers to secure their right to file a future lien should they not receive payment for their services.

Understanding and properly using these documents in conjunction with the Intent To Lien form is key to effectively managing and resolving payment disputes in the construction industry in Florida. Each document plays a specific role in the process, ensuring that all parties are aware of their rights and responsibilities, and helping to facilitate clear communication and resolution of financial obligations. These legal tools are necessary for navigating the often complex landscape of construction projects, protecting the interests of contractors, subcontractors, suppliers, and property owners alike.

Similar forms

The Intent to Lien form used in Florida shares similarities with various other legal documents that are important in the construction and property management sectors. Below are six documents that are similar to the Intent to Lien Florida form and an explanation of how they are alike:

- Mechanic’s Lien: This document is perhaps the closest relative to the Intent to Lien. A Mechanic’s Lien is actually the next step if the Intent to Lien does not resolve in payment. It is a legal claim against property for unpaid construction work or supplies. The Mechanic’s Lien form is used to formally secure the lienor's interest in the property until payment is received.

- Notice to Owner (NTO): In Florida, this document is a prerequisite for subcontractors and material suppliers not in direct contract with the owner who wish to protect their right to file a lien. Similar to the Intent to Lien, the NTO must be sent within a specific timeframe and serves to inform the property owner about the involvement of the sender in the project and their right to lien.

- Conditional Waiver and Release on Progress Payment: This document is used when payments are being made during the course of the work. Like an Intent to Lien, it deals with the issue of payment for services or materials provided. However, it operates in reverse; it's a release of lien rights up to the point of a specific payment amount, conditionally upon the receipt of that payment.

- Unconditional Waiver and Release on Final Payment: Similar to the Conditional Waiver, this form releases all claimant’s lien rights unconditionally, but after the final payment has been made. Unlike the Intent to Lien form, which alerts the owner of a potential lien, this document confirms that no further liens can be claimed due to payment being fully settled.

- Claim of Lien: As mentioned, a Mechanic’s Lien form, or simply a Claim of Lien, is a filed document that makes the lien official. The Intent to Lien is a precursor, warning the property owner of the impending lien. Both documents are crucial in securing payment for labor, services, or materials provided.

- Notice of Commencement: Though not a direct action for securing or releasing payment, the Notice of Commencement is an important document in the Florida construction lien process. It is recorded by the property owner before construction begins and provides important information about the property, the owner, the contractor, and others involved in the work. It indirectly relates to the Intent to Lien form because it helps define the timeframe for submitting an Intent to Lien and subsequent liens.

Understanding these documents and their interactions is vital for anyone involved in Florida's construction industry or dealing with property improvements. Each document plays a crucial role in managing and securing payments, ensuring all parties are aware of their rights and responsibilities throughout the project.

Dos and Don'ts

When preparing the Intent To Lien form for Florida, here are key do's and don'ts to ensure accuracy and compliance:

- Do ensure all information provided is accurate and up to date. This includes the full legal names and addresses of the property owner and, if applicable, the general contractor.

- Do provide a thorough description of the property, incorporating both the street address and legal description to avoid any confusion.

- Do verify the deadline for serving the notice. The notice must be served at least 45 days prior to recording a Claim of Lien, as mandated by Florida Statutes §713.06(2)(a).

- Do outline the details of payment due clearly, including the amount and for what services or materials the payment is outstanding.

- Don't leave any required fields incomplete. Each section of the Intent To Lien form is important for its validity and enforceability.

- Don't neglect to serve the notice following the appropriate method as required by law. This could include certified mail, registered mail, hand delivery, delivery by a process server, or publication.

- Don't fail to include a Certificate of Service at the end of the notice. It's crucial to certify that a true and correct copy of the notice was served to the intended recipient(s).

- Don't disregard the importance of your contact information. Ensure your name, title, phone number, and email address are provided, allowing the recipient to contact you easily.

By closely following these guidelines, you can more effectively prepare the Intent To Lien form, thereby protecting your rights and interests in the property involved.

Misconceptions

Many misconceptions surround the Intent to Lien process in Florida, often causing unnecessary concern and confusion for property owners and contractors alike. Understanding what an Intent to Lien notice really means can help clarify the process and set expectations straight. Here are nine common misconceptions:

- It's too late to negotiate once an Intent to Lien is received. This notice actually serves as a warning, giving the property owner a chance to resolve the issue before an actual lien is recorded. It's designed to motivate payment, not to end negotiations.

- An Intent to Lien can be filed by anyone who has a grievance. In reality, only those who have furnished labor, professional services, materials, or other valuables directly contributing to the improvement of the property and have not been paid are eligible to file.

- Sending an Intent to Lien immediately secures a lien on the property. This notice does not place a lien on the property. It is a prerequisite step that must be taken before filing a formal lien, according to Florida Statutes §713.06.

- An Intent to Lien affects the property title immediately. Since it's not an actual lien, it doesn't immediately affect the property's title. It's a precursor to a potential lien that could impact the title if the claim progresses and a lien is recorded.

- The notice is optional before filing a lien. Under Florida law, sending a Notice of Intent to Lien is a mandatory step. It must be served not less than 45 days prior to recording a Claim of Lien against the property, providing a clear window for resolution.

- If payment is made, the Intent to Lien automatically becomes void. While making payment is a significant step towards resolution, it's essential to ensure that a proper release or waiver is obtained. This action protects against the filing of a lien even after payment has been made.

- An Intent to Lien means a lawsuit is imminent. Filing this notice is a statutory requirement meant to spur payment and does not necessarily mean a lawsuit will be filed. Many disputes are resolved once the property owner is officially notified of the unpaid claim.

- The recipient of an Intent to Lien must hire an attorney immediately. While seeking legal advice is wise to understand one's rights and options, receiving this notice does not require immediate legal representation. It's an opportunity for the parties to settle the matter without escalating to litigation.

- Only the property owner is notified. The statutory requirements stipulate that the Notice of Intent to Lien should be sent not only to the property owner but also, if applicable, to the general contractor. This ensures that all relevant parties are aware of the unpaid claim.

Understanding these aspects of the Intent to Lien process in Florida can help individuals navigate their responsibilities and options more effectively. It's a structured approach designed to ensure fairness and transparency in construction and property improvement transactions.

Key takeaways

Filling out and using the Intent to Lien form in Florida requires attention to detail and an understanding of legal requirements. Here are key takeaways to ensure the process is handled correctly:

- Ensure all information is accurate, including the full legal name and mailing address of the property owner and, if applicable, the general contractor.

- The property description must include both the street address and the legal description to accurately identify the property in question.

- This notice must be sent at least 45 days prior to recording a Claim of Lien against the property, per Florida Statutes §713.06(2)(a).

- Clearly state the amount unpaid for labor, professional services, and/or materials provided for property improvements.

- Inform the recipient that failure to make full payment or provide a satisfactory response within 30 days may lead to recording a lien on the property, as dictated by Florida Statutes §713.06(2)(b).

- Notify the recipient that if a lien is recorded, the property could be subject to foreclosure proceedings, and they could be responsible for attorney fees, court costs, and other expenses.

- Mention clearly that no waivers or releases of lien affecting the validity of this lien claim have been received.

- Express a preference to resolve the matter without further action and request immediate attention to arrange payment.

- Include a Certificate of Service at the document's end to certify that a true and correct copy of the Notice of Intent to File a Lien was served on the relevant parties through one of the specified methods.

- Ensure the person filling out the Certificate of Service signs and prints their name for validation purpose.

Handling the Intent to Lien process with diligence and thoroughness helps protect the rights of individuals and entities seeking payment for services or materials provided. Following these guidelines will aid in navigating the legal landscape effectively.

Common PDF Forms

Availability Form Template - An efficient way for teams to communicate their availability, leading to a more cohesive and flexible working environment.

Employee Advance Form - Employers use this form to track and manage advance payments, helping to maintain financial records and balance sheets.