Free IRS 941 PDF Form

Navigating the intricacies of tax forms can often feel like steering through a labyrinth, especially when tackling the obligations tied to payroll taxes. Among these, the IRS 941 form stands out as a critical document for employers throughout the United States. This quarterly form serves as a conduit for reporting income taxes, social security tax, and Medicare taxes withheld from employee's paychecks. Additionally, it accounts for the employer's portion of social security and Medicare taxes, making it a cornerstone of payroll tax compliance. Its significance extends beyond mere reporting; it directly impacts the reconciliation of payroll tax deposits made throughout the quarter, ensuring that businesses stay aligned with federal tax obligations. Understanding the major aspects of the IRS 941 form is fundamental for employers seeking to navigate the complexities of tax reporting and compliance faithfully and accurately.

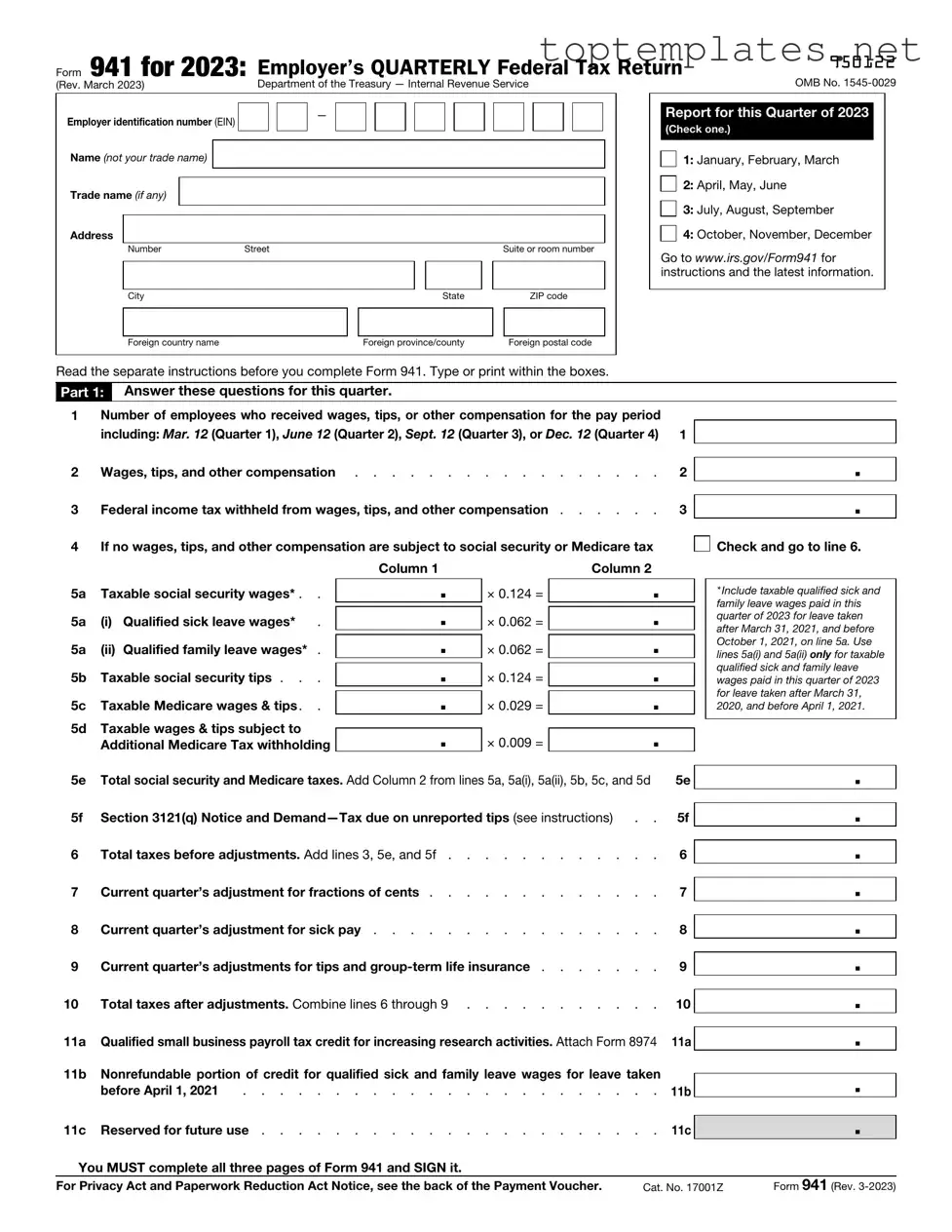

Sample - IRS 941 Form

Form 941 for 2023: |

Employer’s QUARTERLY Federal Tax Return |

950122 |

|

|

|

(Rev. March 2023) |

Department of the Treasury — Internal Revenue Service |

OMB No. |

Employer identification number (EIN) |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name (not your trade name) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Trade name (if any) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Number |

Street |

|

|

|

|

|

Suite or room number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

|

|

State |

|

|

ZIP code |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

||

Foreign country name |

|

|

Foreign province/county |

|

|

Foreign postal code |

||

Report for this Quarter of 2023

(Check one.)

1: January, February, March

2: April, May, June

3: July, August, September

4: October, November, December

Go to www.irs.gov/Form941 for instructions and the latest information.

Read the separate instructions before you complete Form 941. Type or print within the boxes.

Part 1: Answer these questions for this quarter.

1 |

Number of employees who received wages, tips, or other compensation for the pay period |

|

including: Mar. 12 (Quarter 1), June 12 (Quarter 2), Sept. 12 (Quarter 3), or Dec. 12 (Quarter 4) 1 |

2 |

Wages, tips, and other compensation |

. |

2 |

|||||

3 |

Federal income tax withheld from wages, tips, and other compensation |

. |

3 |

|||||

4 |

If no wages, tips, and other compensation are subject to social security or Medicare tax |

|

||||||

|

|

Column 1 |

|

Column 2. |

|

|||

5a |

Taxable social security wages* . . |

. |

× 0.124 = |

|

||||

|

|

|

|

|

|

. |

|

|

5a |

(i) |

Qualified sick leave wages* . |

. |

× 0.062 = |

|

|

||

|

|

|

|

|

|

. |

|

|

5a |

(ii) |

Qualified family leave wages* . |

. |

× 0.062 = |

|

|

||

|

|

|

|

|

. |

|

||

5b |

Taxable social security tips . . . |

. |

× 0.124 = |

|

|

|||

|

|

|

|

|

. |

|

||

5c |

Taxable Medicare wages & tips. . |

. |

× 0.029 = |

|

|

|||

5d |

Taxable wages & tips subject to |

|

|

|

|

|

||

. |

× 0.009 = |

|

. |

|

||||

|

Additional Medicare Tax withholding |

|

|

|||||

5e |

Total social security and Medicare taxes. Add Column 2 from lines 5a, 5a(i), 5a(ii), 5b, 5c, and 5d |

|

5e |

|||||

5f |

Section 3121(q) Notice and |

. |

5f |

|||||

6 |

Total taxes before adjustments. Add lines 3, 5e, and 5f |

. |

6 |

|||||

7 |

Current quarter’s adjustment for fractions of cents |

. |

7 |

|||||

8 |

Current quarter’s adjustment for sick pay |

. |

8 |

|||||

9 |

Current quarter’s adjustments for tips and |

. |

9 |

|||||

10 |

Total taxes after adjustments. Combine lines 6 through 9 |

. |

10 |

|||||

11a |

Qualified small business payroll tax credit for increasing research activities. Attach Form 8974 |

11a |

||||||

11b |

Nonrefundable portion of credit for qualified sick and family leave wages for leave taken |

|

||||||

|

before April 1, 2021 |

. . . . . . . . . . . . . . . . . . . . . . |

. |

11b |

||||

.

.

Check and go to line 6.

Check and go to line 6.

*Include taxable qualified sick and family leave wages paid in this quarter of 2023 for leave taken after March 31, 2021, and before October 1, 2021, on line 5a. Use lines 5a(i) and 5a(ii) only for taxable qualified sick and family leave wages paid in this quarter of 2023 for leave taken after March 31, 2020, and before April 1, 2021.

.

.

.

.

.

.

.

.

.

11c Reserved for future use . . . . . . . . . . . . . . . . . . . . . . 11c

.

You MUST complete all three pages of Form 941 and SIGN it.

For Privacy Act and Paperwork Reduction Act Notice, see the back of the Payment Voucher. |

Cat. No. 17001Z |

Form 941 (Rev. |

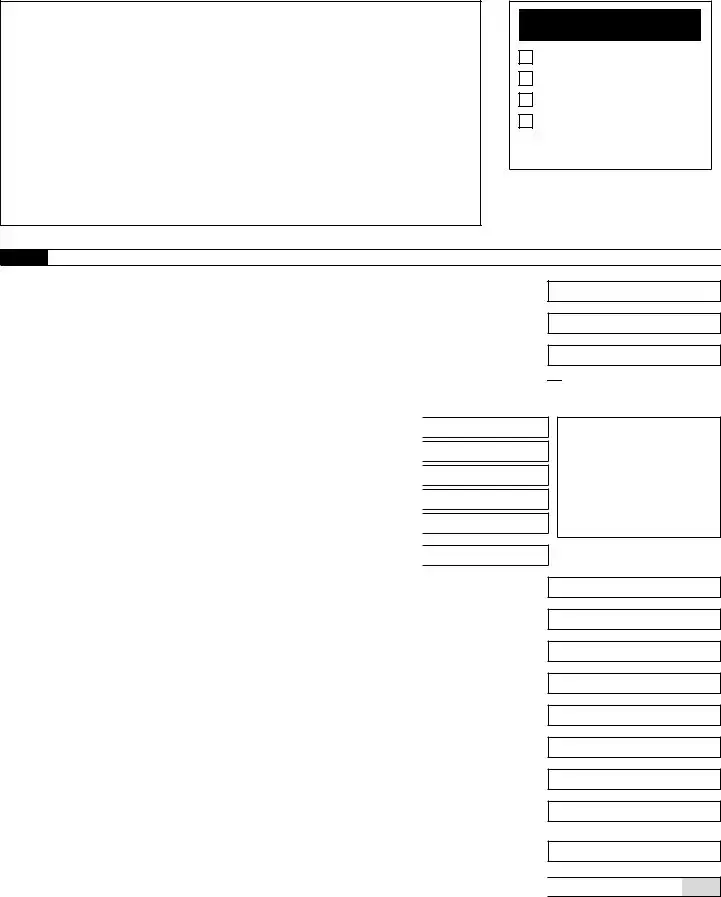

951222

Name (not your trade name) |

Employer identification number (EIN) |

|

|

|

– |

Part 1: |

Answer these questions for this quarter. (continued) |

|

11d Nonrefundable portion of credit for qualified sick and family leave wages for leave taken after March 31, 2021, and before October 1, 2021 . . . . . . . . . . . . . 11d

.

|

|

|

|

|

11e |

Reserved for future use |

. . . . . . . . . 11e |

. |

|

11f |

Reserved for future use |

|

|

|

|

|

|

||

11g |

Total nonrefundable credits. Add lines 11a, 11b, and 11d |

11g |

12 |

Total taxes after adjustments and nonrefundable credits. Subtract line 11g from line 10 . |

12 |

.

.

13a |

Total deposits for this quarter, including overpayment applied from a prior quarter and |

|

|

overpayments applied from Form |

13a |

13b |

Reserved for future use |

13b |

.

.

.

13c Refundable portion of credit for qualified sick and family leave wages for leave taken |

|

before April 1, 2021 |

13c |

13d Reserved for future use |

13d |

.

.

.

13e Refundable portion of credit for qualified sick and family leave wages for leave taken after March 31, 2021, and before October 1, 2021 . . . . . . . . . . . . . . 13e

.

13f |

Reserved for future use |

13f |

13g |

Total deposits and refundable credits. Add lines 13a, 13c, and 13e |

13g |

13h |

Reserved for future use |

13h |

13i |

Reserved for future use |

13i |

14Balance due. If line 12 is more than line 13g, enter the difference and see instructions . . . 14

|

|

|

|

15 |

Overpayment. If line 13g is more than line 12, enter the difference |

. |

Check one: |

.

.

.

.

.

.

.

.

Apply to next return. |

|

Send a refund. |

Part 2: Tell us about your deposit schedule and tax liability for this quarter.

If you’re unsure about whether you’re a monthly schedule depositor or a semiweekly schedule depositor, see section 11 of Pub. 15.

16 Check one:

Line 12 on this return is less than $2,500 or line 12 on the return for the prior quarter was less than $2,500, and you didn’t incur a $100,000

You were a monthly schedule depositor for the entire quarter. Enter your tax liability for each month and total

liability for the quarter, then go to Part 3.

|

|

|

Tax liability: Month 1 |

. |

|

|

|

|

Month 2 |

. |

|

|

|

|

Month 3 |

. |

|

|

|

|

Total liability for quarter |

. |

Total must equal line 12. |

You were a semiweekly schedule depositor for any part of this quarter. Complete Schedule B (Form 941),

Report of Tax Liability for Semiweekly Schedule Depositors, and attach it to Form 941. Go to Part 3.

You MUST complete all three pages of Form 941 and SIGN it.

Page 2 |

Form 941 (Rev. |

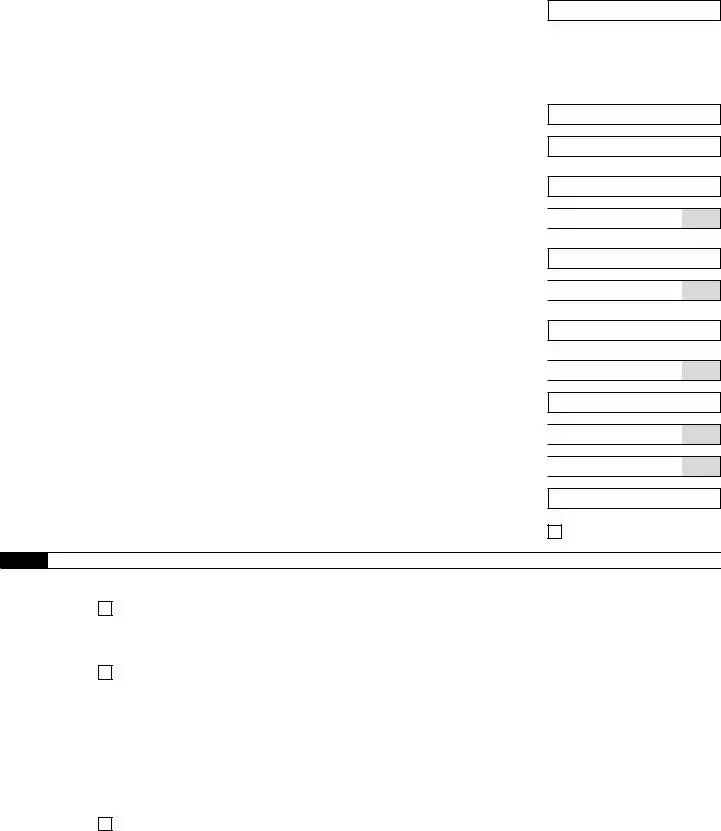

950922

Name (not your trade name)

Employer identification number (EIN)

–

Part 3: Tell us about your business. If a question does NOT apply to your business, leave it blank.

17 If your business has closed or you stopped paying wages . . . . . . . . . . . . . . .

Check here, and

enter the final date you paid wages

/ /

; also attach a statement to your return. See instructions.

18 If you’re a seasonal employer and you don’t have to file a return for every quarter of the year . . .

Check here.

19Qualified health plan expenses allocable to qualified sick leave wages for leave taken before April 1, 2021

20Qualified health plan expenses allocable to qualified family leave wages for leave taken before April 1, 2021

21 |

Reserved for future use |

22 |

Reserved for future use |

23Qualified sick leave wages for leave taken after March 31, 2021, and before October 1, 2021

24Qualified health plan expenses allocable to qualified sick leave wages reported on line 23

25Amounts under certain collectively bargained agreements allocable to qualified sick

leave wages reported on line 23 . . . . . . . . . . . . . . . . . . .

26Qualified family leave wages for leave taken after March 31, 2021, and before October 1, 2021

27Qualified health plan expenses allocable to qualified family leave wages reported on line 26

28Amounts under certain collectively bargained agreements allocable to qualified family leave wages reported on line 26 . . . . . . . . . . . . . . . . . . .

|

|

19 |

. |

|

|

20 |

. |

|

|

21 |

. |

|

|

22 |

. |

|

|

23 |

. |

|

|

24 |

. |

|

|

25 |

. |

|

|

26 |

. |

|

|

27 |

. |

|

|

28 |

. |

Part 4: May we speak with your

Do you want to allow an employee, a paid tax preparer, or another person to discuss this return with the IRS? See the instructions

for details.

Yes. Designee’s name and phone number

Yes. Designee’s name and phone number

Select a

No.

Part 5: Sign here. You MUST complete all three pages of Form 941 and SIGN it.

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief, it is true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

Sign your name here

Date

/ /

Print your name here

Print your title here

Best daytime phone

Paid Preparer Use Only

Preparer’s name

Preparer’s signature

Firm’s name (or yours if

Address

City

State

Check if you’re

PTIN |

|

|

|

|

|

|

|

Date |

/ |

/ |

|

EIN |

|

|

|

|

|

|

|

Phone |

|

|

|

|

|

|

ZIP code

Page 3 |

Form 941 (Rev. |

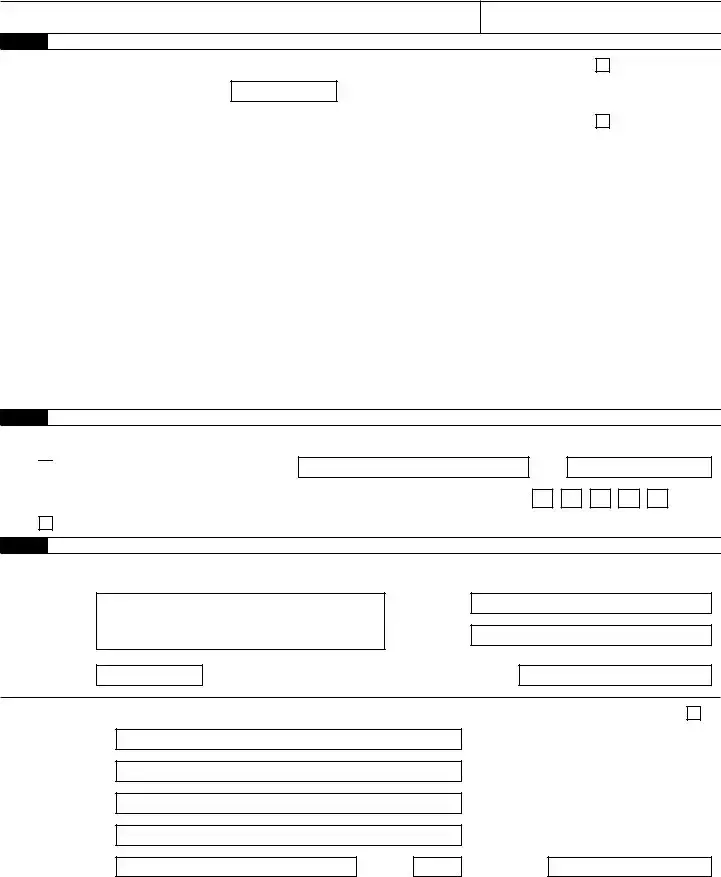

951020

This page intentionally left blank

Form

Purpose of Form

Complete Form

Making Payments With Form 941

To avoid a penalty, make your payment with Form 941 only if:

•Your total taxes after adjustments and nonrefundable credits (Form 941, line 12) for either the current quarter or the preceding quarter are less than $2,500, you didn’t incur a $100,000

•You’re a monthly schedule depositor making a payment in accordance with the Accuracy of Deposits Rule. See section 11 of Pub. 15 for details. In this case, the amount of your payment may be $2,500 or more.

Otherwise, you must make deposits by electronic funds transfer. See section 11 of Pub. 15 for deposit instructions. Don’t use Form

▲! Use Form

CAUTION Form 941 that should’ve been deposited, you may be subject to a penalty. See Deposit Penalties in section 11 of Pub. 15.

Specific Instructions

Box

Box

Box

Box

•Enclose your check or money order made payable to “United States Treasury.” Be sure to enter your

EIN, “Form 941,” and the tax period (“1st Quarter 2023,” “2nd Quarter 2023,” “3rd Quarter 2023,” or “4th Quarter 2023”) on your check or money order. Don’t send cash.

Don’t staple Form

•Detach Form

and Form 941 to the address in the Instructions for Form 941.

Note: You must also complete the entity information above Part 1 on Form 941.

Detach Here and Mail With Your Payment and Form 941.

Form |

|

|

|

|

Payment Voucher |

|

OMB No. |

||||

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

||

|

Department of the Treasury |

|

|

Don’t staple this voucher or your payment to Form 941. |

|

2023 |

|||||

|

Internal Revenue Service |

|

|

|

|||||||

|

1 Enter your employer identification |

|

2 |

|

Dollars |

|

|

Cents |

|||

|

|

number (EIN). |

|

|

Enter the amount of your payment. |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

||

|

|

– |

|

|

Make your check or money order payable to “United States Treasury.” |

|

|

|

|||

3 |

Tax Period |

|

4 Enter your business name (individual name if sole proprietor). |

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1st |

|

3rd |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

Quarter |

|

Quarter |

|

Enter your address. |

|

|

|||

|

|

|

|

|

|

|

|||||

|

|

2nd |

|

4th |

|

|

|||||

|

|

|

|

Enter your city, state, and ZIP code; or your city, foreign country name, foreign province/county, and foreign postal code. |

|||||||

|

|

Quarter |

|

Quarter |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Form 941 (Rev.

Privacy Act and Paperwork Reduction Act Notice. We ask for the information on Form 941 to carry out the Internal Revenue laws of the United States. We need it to figure and collect the right amount of tax. Subtitle C, Employment Taxes, of the Internal Revenue Code imposes employment taxes on wages and provides for income tax withholding. Form 941 is used to determine the amount of taxes that you owe. Section 6011 requires you to provide the requested information if the tax is applicable to you. Section 6109 requires you to provide your identification number. If you fail to provide this information in a timely manner, or provide false or fraudulent information, you may be subject to penalties.

You’re not required to provide the information requested on a form that is subject to the Paperwork Reduction Act unless the form displays a valid OMB control number. Books and records relating to a form or its instructions must be retained as long as their contents may become material in the administration of any Internal Revenue law.

Generally, tax returns and return information are confidential, as required by section 6103. However, section 6103 allows or requires the IRS to disclose or give the information shown on your tax return to others as described in the Code. For example, we may disclose your tax information to the Department of

Justice for civil and criminal litigation, and to cities, states, the District of Columbia, and U.S. commonwealths and possessions for use in administering their tax laws. We may also disclose this information to other countries under a tax treaty, to federal and state agencies to enforce federal nontax criminal laws, or to federal law enforcement and intelligence agencies to combat terrorism.

The time needed to complete and file Form 941 will vary depending on individual circumstances. The estimated average time is:

Recordkeeping . . . . . . . . . . 22 hr., 28 min.

Learning about the law or the form . . |

. . 53 min. |

Preparing, copying, assembling, and |

|

sending the form to the IRS |

1 hr., 18 min. |

If you have comments concerning the accuracy of these time estimates or suggestions for making Form 941 simpler, we would be happy to hear from you. You can send us comments from www.irs.gov/FormComments. Or you can send your comments to Internal Revenue Service, Tax Forms and Publications Division, 1111 Constitution Ave. NW,

File Specs

| Fact Number | Description |

|---|---|

| 1 | The IRS Form 941 is used by employers to report quarterly federal taxes. |

| 2 | This form encompasses reporting on income taxes, Social Security tax, or Medicare tax withheld from employee's paychecks. |

| 3 | It also accounts for the employer's portion of Social Security or Medicare tax. |

| 4 | The form must be filed every quarter by any business that has employees. |

| 5 | Deadlines for filing Form 941 are April 30, July 31, October 31, and January 31, for each respective quarter. |

| 6 | Failure to file on time or correctly can result in penalties and interest charges from the IRS. |

| 7 | Employers can file Form 941 online or mail a paper form to the IRS. |

| 8 | There are no state-specific versions of IRS Form 941 as it is a federal form; however, employers need to be aware of state employment tax reporting requirements. |

| 9 | Small businesses with a tax liability of less than $1,000 for the year may file Form 944 annually instead, upon IRS notification and approval. |

Steps to Filling Out IRS 941

Filling out the IRS Form 941 correctly is essential for businesses to report income taxes, social security tax, or Medicare tax withheld from employees' paychecks, and to pay the employer's portion of social security or Medicare tax. This task may seem daunting at first, but with clear instructions, it can be managed efficiently. The process outlined below aims to guide employers through each step required to complete the form accurately, ensuring compliance with tax obligations.

- Start by providing your business's Employer Identification Number (EIN), name, and address in the allocated spaces at the top of the form.

- Enter the total number of employees who received wages, tips, or other compensation during the reporting period.

- Report total wages paid, including tips and other compensation, in the corresponding section.

- Calculate the federal income tax withheld from the wages, tips, and other compensation and enter the amount.

- Fill in the taxable social security and Medicare wages in the sections provided. These amounts are based on current tax rates and wage limits.

- Document the amount of social security and Medicare taxes withheld from employees' wages.

- If applicable, enter any adjustments for fractions of cents, sick pay, tips, and group-term life insurance.

- Calculate your total taxes after adjustments and enter this amount.

- Document your deposits made for the quarter and balance due if any.

- Sign and date the form, including your title and the best contact phone number.

Once the IRS Form 941 is filled out accurately and in its entirety, it's ready for submission. Employers should ensure they retain a copy for their records. Keep in mind, timely filing of this form is crucial to avoid potential penalties. Additionally, staying current with any updates to tax rates or filing procedures will help streamline the process for future submissions.

Discover More on IRS 941

What is the IRS Form 941 used for?

The IRS Form 941, known as the Employer's Quarterly Federal Tax Return, serves a critical role for employers. It is utilized to report income taxes, social security tax, or Medicare tax withheld from employee's paychecks. Additionally, it calculates the employer’s portion of Social Security or Medicare tax. By filing this form every quarter, employers fulfill their federal tax obligations related to employee compensation.

Who needs to file the IRS Form 941?

Most employers operating a business and paying wages to employees are required to file IRS Form 941. This includes corporations, small businesses, households employing domestic workers, non-profit organizations, and government agencies. Exceptions include those hiring seasonal workers, farm employees, or household employees, for whom different reporting forms are used.

When are the deadlines for filing the IRS Form 941?

The IRS mandates that Form 941 be filed four times a year. The deadlines for each quarter are as follows: April 30 for the first quarter (January – March), July 31 for the second quarter (April – June), October 31 for the third quarter (July – September), and January 31 for the fourth quarter (October – December). To avoid penalties, it’s crucial for employers to adhere to these deadlines.

Can IRS Form 941 be filed electronically?

Yes, the IRS encourages the electronic filing of Form 941 through the e-file system. This method is faster and more secure compared to paper filing. Employers can e-file directly or through a tax professional who is an authorized IRS e-file provider. Using e-file also allows for quicker confirmation that the IRS has received the form, reducing the risk of penalties for late filing.

Common mistakes

When filling out the IRS 941 form, which is crucial for reporting quarterly federal tax returns, people frequently stumble over the same hurdles. From incorrect calculations to overlooking deadlines, these mistakes can complicate what should be a straightforward process. Understanding these errors can save both time and potential headaches, ensuring a smoother interaction with tax obligations.

Not double-checking the math: Simple arithmetic errors or incorrect tax rate application can lead to significant discrepancies in the amount owed to the IRS. Always cross-verify the calculations to avoid potential penalties.

Using outdated forms: Tax laws and forms evolve. Using an outdated version of the IRS 941 form can mean missing new requirements or reporting sections, leading to incomplete filings.

Forgetting to sign or date the form: An unsigned or undated form is like handing in a blank test; it’s incomplete. The IRS treats such forms as if they were never submitted, which could lead to penalties for failing to file.

Missing deadlines: Submitting the IRS 941 form late can result in fines and interest on the owed taxes. Mark the calendar well in advance for each quarter’s deadline: April 30, July 31, October 31, and January 31.

Omitting essential information: Every field in the IRS 941 form serves a purpose. Leaving sections unfilled can cause delays and might trigger an audit. Ensuring all relevant information is present and correctly entered is key.

Filing the form for the wrong quarter: Filling out the IRS 941 with the correct quarter’s information is crucial. A form filled out with details for the incorrect quarter can lead to under or overestimating taxes owed, thus complicating past and future filings.

Ignoring electronic filing options: For businesses over a certain size, electronic filing isn’t an option—it’s a requirement. Even for smaller businesses, e-filing can be faster and more reliable, reducing the chance of errors or lost paperwork.

Each of these mistakes can complicate your tax filing process. Approach the task with care, and remember, seeking help from a tax professional can provide guidance and peace of mind, ensuring the IRS 941 form is correctly filled out and submitted on time.

Documents used along the form

When businesses manage their federal tax responsibilities, the Internal Revenue Service (IRS) Form 941, Employer's Quarterly Federal Tax Return, often comes into play. This form is crucial for reporting income taxes, social security tax, or Medicare tax withheld from employees' paychecks, and for paying the employer's portion of social security or Medicare tax. However, Form 941 doesn't stand alone. Its completion and submission may require the use of additional forms and documents to ensure accurate and comprehensive tax reporting and compliance.

- Form W-2, Wage and Tax Statement: Each employee must receive this form annually. It details the wages paid and taxes withheld for the year, serving as a critical document for employees’ tax filings.

- Form W-3, Transmittal of Wage and Tax Statements: This form accompanies Form W-2 submissions to the Social Security Administration, summarizing employees' earnings and tax withholdings.

- Form W-4, Employee's Withholding Certificate: Employees use this form to determine the amount of federal income tax to withhold from their pay. Employers need this to correctly calculate withholding.

- Form 940, Employer's Annual Federal Unemployment (FUTA) Tax Return: This annual form reports federal unemployment taxes, separate from the withholdings reported on Form 941.

- Form 944, Employer's ANNUAL Federal Tax Return: Small businesses with annual tax liabilities of $1,000 or less use this form instead of Form 941 to report income and social security and Medicare taxes.

- Form 1099-NEC, Nonemployee Compensation: Businesses use this form to report payments made to independent contractors who earn $600 or more in a year from the business.

- Form 1099-MISC, Miscellaneous Income: Payments not reported on Form 1099-NEC, such as rent or prizes, are reported on this form.

- Form 945, Annual Return of Withheld Federal Income Tax: This form is used to report federal income tax withheld from non-payroll payments, including pension, annuity, and IRA distributions.

- Form 1023, Application for Recognition of Exemption Under Section 501(c)(3) of the Internal Revenue Code: Although not directly related to payroll, nonprofits use this form to apply for tax-exempt status, affecting their tax filings and obligations.

In summary, the IRS 941 form is a cornerstone of federal tax compliance for employers, but it’s just one part of a broader framework. From ensuring that employee withholdings are accurately reported to managing unemployment tax obligations, these additional forms and documents are essential for maintaining compliance with the IRS. Businesses should familiarize themselves with each of these documents to ensure a comprehensive approach to tax reporting and payment.

Similar forms

IRS Form 940: This form is designed for employers to report their annual Federal Unemployment Tax Act (FUTA) tax. Like the IRS Form 941, which reports quarterly federal income tax withholdings and FICA taxes (Social Security and Medicare taxes) from employees' paychecks, the Form 940 is a payroll-related tax form. Both forms require employer identification numbers (EINs) and details about the tax obligations based on payroll. While Form 941 is filed quarterly, Form 940 is submitted annually.

IRS Form W-2: The W-2 form is issued by employers to report an employee's annual wages and the amount of taxes withheld from their paychecks. It shares a similar purpose with the IRS Form 941 in that they both deal with reporting income and withholding taxes to the IRS. However, the 941 form aggregates the payroll taxes withheld and paid by the employer each quarter, whereas the W-2 focuses on the annual earnings and taxes withheld for each individual employee.

IRS Form W-3: The W-3 form, Transmittal of Wage and Tax Statements, works in tandem with Form W-2. It is a summary form that accompanies W-2 forms when they are sent to the Social Security Administration. It serves a consolidating function similar to IRS Form 941 but on an annual basis. While Form 941 provides a quarterly report of payroll taxes paid and owed to the IRS, Form W-3 offers a summary of employee earnings and tax withholdings reported via multiple W-2s to the Social Security Administration.

IRS Form 944: This form is designed for small employers whose annual liability for Social Security, Medicare, and withheld federal income taxes is $1,000 or less. Form 944 allows these small employers to report taxes annually instead of quarterly, as done with Form 941. Hence, both forms serve the purpose of reporting employment taxes, but the eligibility for filing and the frequency of reporting differ based on the employer's tax liability.

IRS Form 1099: The 1099 forms are a series of documents used to report various types of non-employment income. Similar to IRS Form 941, which reports payroll taxes withheld by employers, the 1099 forms are used for reporting other payments and withholdings not covered by regular employment. While 941 forms focus on reporting employee payroll taxes quarterly, 1099 forms deal with contractor payments, interest, dividends, and other forms of miscellaneous income, often on an annual basis.

Dos and Don'ts

Filling out the IRS 941 form is an important task for accurately reporting your business's quarterly payroll taxes. To ensure this process is completed smoothly, take note of the following dos and don'ts:

- Do ensure all information is current and accurate, including your Employer Identification Number (EIN), the quarter you are reporting for, and your business name and address.

- Do calculate your payroll taxes meticulously, ensuring the amounts for withheld federal income tax, and both employee and employer shares of social security and Medicare taxes, are correct.

- Do double-check the math. Errors in calculation can lead to discrepancies, underpayment, or overpayment, all of which can result in penalties.

- Do utilize the IRS’s electronic filing options for quicker processing and confirmation of your submission.

- Do sign and date the form; an unsigned form is considered incomplete and will not be processed.

- Don't forget to report any adjustments to social security and Medicare taxes due to tips or group-term life insurance, which are common errors.

- Don't submit the form late. Late submissions can lead to penalties. Be aware of the deadlines for each quarter to ensure timely filing.

Misconceptions

The IRS 941 form often confuses many due to widespread misconceptions about its purpose, requirements, and filing process. Understanding these misconceptions can lead to a smoother experience when handling payroll taxes for your business. Here are seven common misunderstandings cleared up for better guidance:

- It’s only for large businesses. This is not true. The IRS 941 form is required for any business that withholds income taxes, social security tax, or Medicare tax from employees' paychecks. It applies to businesses of all sizes, not just large corporations.

- You don’t need to file if your business didn’t pay wages this quarter. Even if your business didn't pay wages during a quarter, you might still be required to file the form to report zeroes, indicating to the IRS your current activity status. Always check the latest filing requirements.

- Filing late won’t really affect your business. Filing the IRS 941 form late can lead to penalties and interest charges that accumulate over time. This can affect your business financially and may also signal poor tax compliance to the IRS.

- Electronic filing is complicated. In fact, electronic filing can be straightforward and is encouraged by the IRS. It can lead to faster processing, quicker confirmations of receipt, and less likelihood of errors in comparison to paper filing.

- Corrections are not allowed or are too difficult. If you've made an error on your IRS 941 form, corrections are indeed possible and necessary to ensure compliance. Use Form 941-X, Adjusted Employer’s Quarterly Federal Tax Return or Claim for Refund, to make the correction.

- All businesses file the 941 form annually. Actually, the 941 is a quarterly form. Businesses generally must file it each quarter to report their employees' wages, and withholdings. Do not confuse it with annual reports or forms such as the 940.

- The same 941 form is used for all states. While the IRS 941 form is federal and thus the same across the United States, state reporting requirements vary. Some states require additional forms or filings related to unemployment insurance or state taxes withheld from employees.

Understanding these key points can help demystify the process of filing Form 941 and improve compliance with payroll tax obligations. Correctly managing this responsibility is crucial for the health and legality of your business.

Key takeaways

Filling out and using the IRS 941 form, which is essential for reporting quarterly federal tax returns, is something employers must get right. This form is key for reporting income taxes, social security tax, or Medicare tax withheld from employee's paychecks, and it also reports the employer's portion of social security or Medicare tax.

Understanding Form 941’s Purpose: Initially, recognize that this form plays a critical role in reporting wages paid, tips your employees have received, and the withholding of federal income taxes. Moreover, you report your share of Social Security and Medicare taxes here, ensuring contributions to these programs are accurately documented.

Filing Deadlines Are Critical: The IRS mandates that Form 941 is filed by the last day of the month following the end of a quarter. This means you have until April 30, July 31, October 31, and January 31, for the four respective quarters of the fiscal year. Late filings can result in penalties and interest charges, so it’s important to mark these deadlines on your calendar.

Gathering Necessary Information: Before you dive into filling out the form, gather all necessary payroll information. This includes total wages paid, federal income tax withheld, Social Security and Medicare taxes withheld, and your share of Social Security and Medicare taxes. Accurate record-keeping throughout the quarter will streamline this process.

Understanding Deposit Schedules: Depending on the total tax liability reported, you may be a monthly or semi-weekly depositor. This affects when you’re required to deposit the taxes you’ve withheld, including your share of FICA taxes. It’s essential to know your deposit schedule to comply with IRS regulations and avoid penalties.

Utilizing the Electronic Federal Tax Payment System (EFTPS): The IRS encourages employers to make tax deposits through EFTPS. This system is secure, efficient, and free, offering you a hassle-free way to ensure your tax payments are timely and accurately recorded.

Seek Professional Advice If Unsure: Filling out and submitting Form 941 involves several intricate details. If at any point you’re unsure about how to proceed, seeking advice from a tax professional is wise. They can help clarify doubts, ensure accuracy, and keep you compliant with federal tax laws.

Remember, keeping thorough payroll records, understanding your responsibilities, and adhering to deadlines can significantly alleviate the stress associated with filing IRS Form 941. Always stay informed of changes in tax legislation to maintain compliance and avoid unforeseen penalties.

Common PDF Forms

Doctors Note Template - Simplifies the administrative aspect of managing health-related absences, providing clear and concise information for record-keeping purposes.

How to Become a Professional Hugger - Ready to experience the therapeutic benefits of cuddling? Begin by filling out our concise application form.