Free IRS Schedule C 1040 PDF Form

Navigating the financial obligations and opportunities that come with being self-employed or owning a small business can often feel like charting through complex territory. Central to this journey is the IRS Schedule C 1040 form, a crucial document for reporting the income, expenses, and overall profit or loss from a business you operated or a profession you practiced as a sole proprietor. This form is not just a means of fulfilling your tax responsibilities; it also offers an avenue to detail the operational costs, which may reduce your overall taxable income. However, understanding and accurately completing this form requires a thorough grasp of its components, from identifying deductible expenses to accurately categorizing the cost of goods sold. Moreover, the implications of the information reported on Schedule C extend beyond immediate tax obligations, influencing potential loan qualifications and future financial planning. In essence, mastering the IRS Schedule C 1040 form is not only about compliance but also about maximizing the financial health and potential of your business.

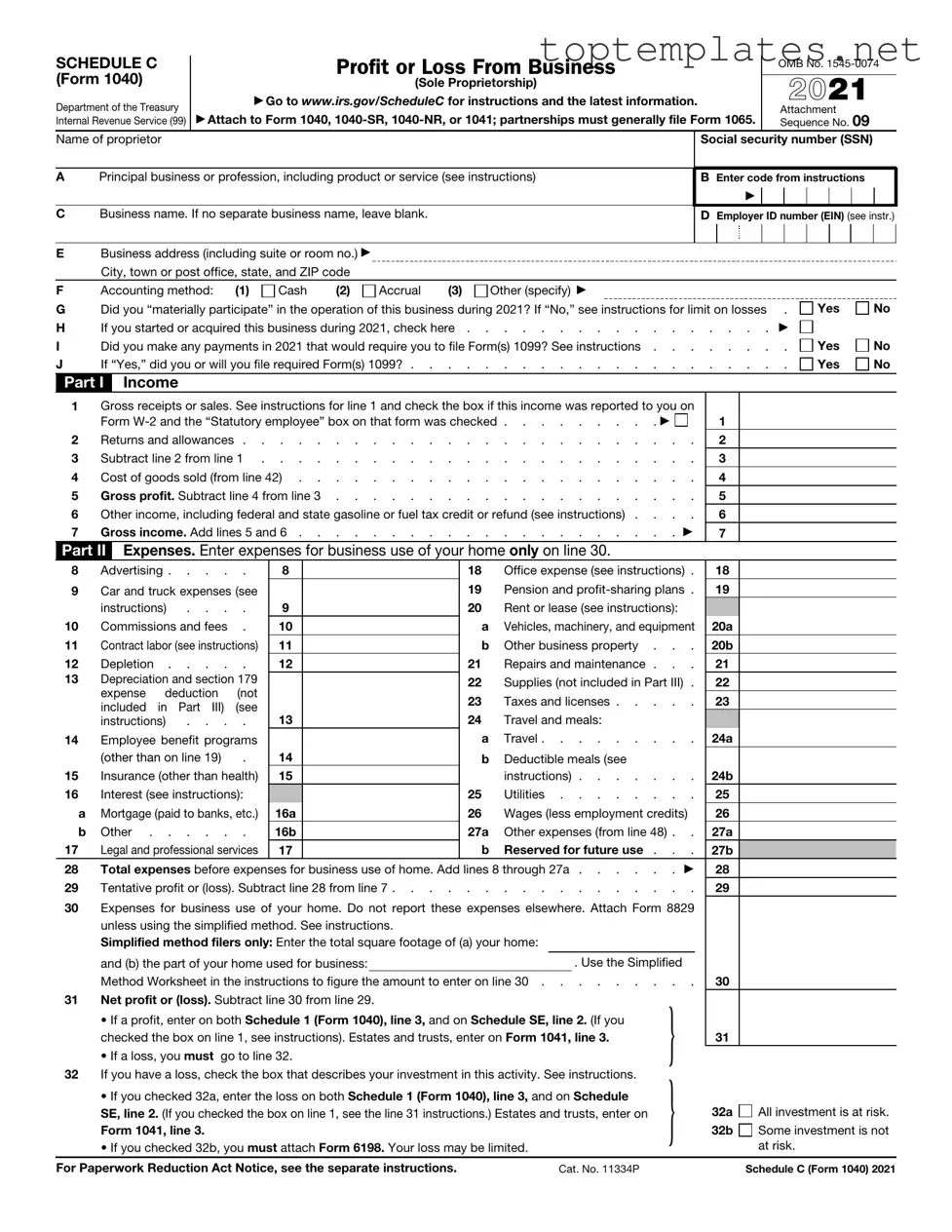

Sample - IRS Schedule C 1040 Form

SCHEDULE C (Form 1040)

Department of the Treasury Internal Revenue Service (99)

Profit or Loss From Business

(Sole Proprietorship)

▶Go to www.irs.gov/ScheduleC for instructions and the latest information.

▶Attach to Form 1040,

OMB No.

2021

Attachment Sequence No. 09

Name of proprietor

APrincipal business or profession, including product or service (see instructions)

CBusiness name. If no separate business name, leave blank.

Social security number (SSN)

BEnter code from instructions

▶

DEmployer ID number (EIN) (see instr.)

EBusiness address (including suite or room no.) ▶

City, town or post office, state, and ZIP code

F |

Accounting method: |

(1) |

Cash |

(2) |

|

Accrual |

(3) |

Other (specify) ▶ |

|

|

|

|

|

|

|

||||||

G |

Did you “materially participate” in the operation of this business during 2021? If “No,” see instructions for limit on losses |

. |

Yes |

No |

|||||||||||||||||

H |

If you started or acquired this business during 2021, check here |

. . |

. . |

▶ |

|

|

|||||||||||||||

I |

Did you make any payments in 2021 that would require you to file Form(s) 1099? See instructions . . . |

. . |

. . |

. |

Yes |

No |

|||||||||||||||

J |

If “Yes,” did you or will you file required Form(s) 1099? |

. . |

. . |

. |

Yes |

No |

|||||||||||||||

Part I |

Income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 |

Gross receipts or sales. See instructions for line 1 and check the box if this income was reported to you on |

|

|

|

|

|

|||||||||||||||

|

Form |

. . . . . . . . . ▶ |

1 |

|

|

|

|

||||||||||||||

2 |

Returns and allowances |

2 |

|

|

|

|

|||||||||||||||

3 |

Subtract line 2 from line 1 |

3 |

|

|

|

|

|||||||||||||||

4 |

Cost of goods sold (from line 42) |

4 |

|

|

|

|

|||||||||||||||

5 |

Gross profit. Subtract line 4 from line 3 |

5 |

|

|

|

|

|||||||||||||||

6 |

Other income, including federal and state gasoline or fuel tax credit or refund (see instructions) . . . . |

6 |

|

|

|

|

|||||||||||||||

7 |

Gross income. Add lines 5 and 6 |

. . . . . . . . . |

. ▶ |

7 |

|

|

|

|

|||||||||||||

Part II |

Expenses. Enter expenses for business use of your home only on line 30. |

|

|

|

|

|

|

|

|||||||||||||

8 |

Advertising |

8 |

|

|

|

|

|

|

18 |

Office expense (see instructions) . |

18 |

|

|

|

|

||||||

9 |

Car and truck expenses (see |

|

|

|

|

|

|

|

19 |

Pension and |

19 |

|

|

|

|

||||||

|

instructions) . . . . |

9 |

|

|

|

|

|

|

20 |

Rent or lease (see instructions): |

|

|

|

|

|

||||||

10 |

Commissions and fees . |

10 |

|

|

|

|

|

|

a |

Vehicles, machinery, and equipment |

20a |

|

|

|

|

||||||

11 |

Contract labor (see instructions) |

11 |

|

|

|

|

|

|

b |

Other business property . . . |

20b |

|

|

|

|

||||||

12 |

Depletion |

12 |

|

|

|

|

|

|

21 |

Repairs and maintenance . . . |

21 |

|

|

|

|

||||||

13 |

Depreciation and section 179 |

|

|

|

|

|

|

|

22 |

Supplies (not included in Part III) . |

22 |

|

|

|

|

||||||

|

expense deduction |

(not |

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

23 |

Taxes and licenses |

23 |

|

|

|

|

|||||||

|

included in Part III) (see |

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

instructions) . . . . |

13 |

|

|

|

|

|

|

24 |

Travel and meals: |

|

|

|

|

|

|

|

||||

14 |

Employee benefit programs |

|

|

|

|

|

|

|

a |

Travel |

24a |

|

|

|

|

||||||

|

(other than on line 19) |

. |

14 |

|

|

|

|

|

|

b |

Deductible meals (see |

|

|

|

|

|

|

|

|||

15 |

Insurance (other than health) |

15 |

|

|

|

|

|

|

|

instructions) |

24b |

|

|

|

|

||||||

16 |

Interest (see instructions): |

|

|

|

|

|

|

|

25 |

Utilities |

25 |

|

|

|

|

||||||

a |

Mortgage (paid to banks, etc.) |

16a |

|

|

|

|

|

|

26 |

Wages (less employment credits) |

26 |

|

|

|

|

||||||

b |

Other |

16b |

|

|

|

|

|

|

27a |

Other expenses (from line 48) . . |

27a |

|

|

|

|

||||||

17 |

Legal and professional services |

17 |

|

|

|

|

|

|

b |

Reserved for future use . . . |

27b |

|

|

|

|

||||||

28 |

Total expenses before expenses for business use of home. Add lines 8 through 27a |

. ▶ |

28 |

|

|

|

|

||||||||||||||

29 |

Tentative profit or (loss). Subtract line 28 from line 7 |

29 |

|

|

|

|

|||||||||||||||

30 |

Expenses for business use of your home. Do not report these expenses elsewhere. Attach Form 8829 |

|

|

|

|

|

|||||||||||||||

|

unless using the simplified method. See instructions. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

Simplified method filers only: Enter the total square footage of (a) your home: |

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

and (b) the part of your home used for business: |

|

|

|

|

|

|

|

. Use the Simplified |

|

|

|

|

|

|||||||

|

Method Worksheet in the instructions to figure the amount to enter on line 30 |

30 |

|

|

|

|

|||||||||||||||

31 |

Net profit or (loss). Subtract line 30 from line 29. |

|

|

|

|

|

|

|

} |

|

|

|

|

|

|

||||||

|

• If a profit, enter on both Schedule 1 (Form 1040), line 3, and on Schedule SE, line 2. (If you |

|

|

|

|

|

|

||||||||||||||

|

checked the box on line 1, see instructions). Estates and trusts, enter on Form 1041, line 3. |

|

31 |

|

|

|

|

||||||||||||||

|

• If a loss, you must go to line 32. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

32 |

If you have a loss, check the box that describes your investment in this activity. See instructions. |

} |

|

|

|

|

|

|

|||||||||||||

|

• If you checked 32a, enter the loss on both Schedule 1 (Form 1040), line 3, and on Schedule |

|

|

|

|

|

|

||||||||||||||

|

SE, line 2. (If you checked the box on line 1, see the line 31 instructions.) Estates and trusts, enter on |

|

32a |

All investment is at risk. |

|||||||||||||||||

|

Form 1041, line 3. |

|

|

|

|

|

|

|

|

|

|

|

|

|

32b |

Some investment is not |

|||||

|

• If you checked 32b, you must attach Form 6198. Your loss may be limited. |

|

|

|

at risk. |

|

|

||||||||||||||

For Paperwork Reduction Act Notice, see the separate instructions. |

|

|

Cat. No. 11334P |

|

|

|

Schedule C (Form 1040) 2021 |

||||||||||||||

Schedule C (Form 1040) 2021 |

Page 2 |

|

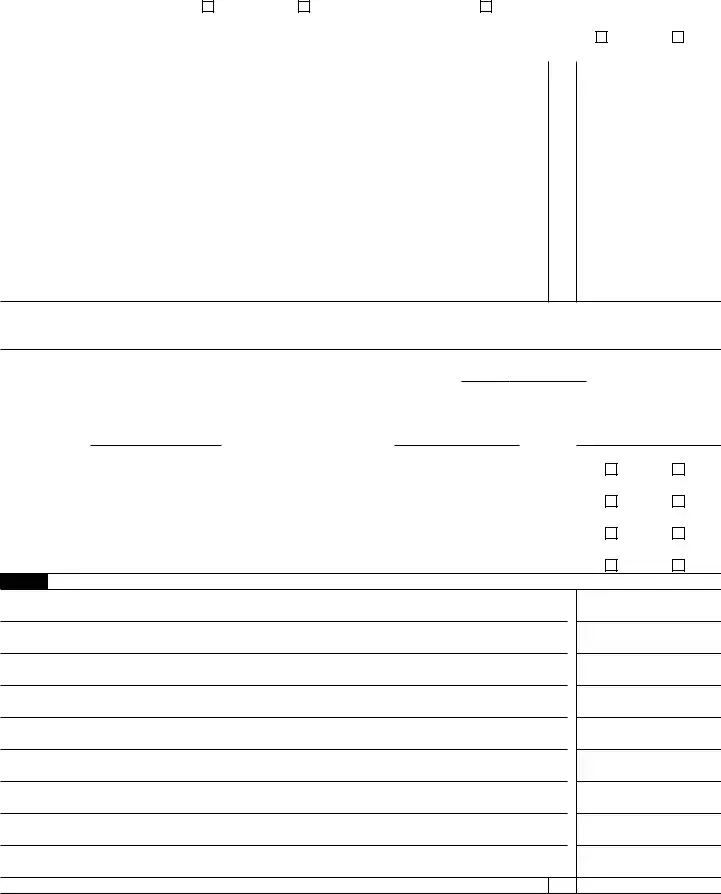

Part III |

Cost of Goods Sold (see instructions) |

|

33 |

Method(s) used to |

|

|

|

|

|

|

|

value closing inventory: |

a |

Cost |

b |

Lower of cost or market |

c |

Other (attach explanation) |

34Was there any change in determining quantities, costs, or valuations between opening and closing inventory?

If “Yes,” attach explanation |

Yes |

No

35 |

Inventory at beginning of year. If different from last year’s closing inventory, attach explanation . . . |

35 |

36 |

Purchases less cost of items withdrawn for personal use |

36 |

37 |

Cost of labor. Do not include any amounts paid to yourself |

37 |

38 |

Materials and supplies |

38 |

39 |

Other costs |

39 |

40 |

Add lines 35 through 39 |

40 |

41 |

Inventory at end of year |

41 |

42 |

Cost of goods sold. Subtract line 41 from line 40. Enter the result here and on line 4 |

42 |

Part IV Information on Your Vehicle. Complete this part only if you are claiming car or truck expenses on line 9 and are not required to file Form 4562 for this business. See the instructions for line 13 to find out if you must file Form 4562.

43 |

When did you place your vehicle in service for business purposes? (month/day/year) |

▶ |

/ |

/ |

44Of the total number of miles you drove your vehicle during 2021, enter the number of miles you used your vehicle for:

a |

Business |

b Commuting (see instructions) |

c Other |

45 |

Was your vehicle available for personal use during |

||

46 |

Do you (or your spouse) have another vehicle available for personal use? |

||

47a |

Do you have evidence to support your deduction? |

||

b |

If “Yes,” is the evidence written? |

||

Yes

Yes

Yes

Yes

No

No

No

No

Part V Other Expenses. List below business expenses not included on lines

48 |

Total other expenses. Enter here and on line 27a |

48

Schedule C (Form 1040) 2021

File Specs

| Fact Number | Fact Detail |

|---|---|

| 1 | The IRS Schedule C 1040 form is used by sole proprietors to report their business income and expenses. |

| 2 | It is part of the individual tax return and affects the taxpayer's overall tax obligations. |

| 3 | Schedule C is applicable when a business owner operates under a sole proprietorship or a single-member LLC that chooses to be taxed as a sole proprietorship. |

| 4 | Expenses such as advertising, travel, meals, and office supplies can be deducted on Schedule C. |

| 5 | Net profit or loss from the business, calculated on Schedule C, is reported on the owner's personal tax return (Form 1040). |

| 6 | If there is a net profit, this amount may be subject to self-employment taxes, which Schedule SE is used to calculate. |

| 7 | Losses reported on Schedule C can reduce the taxpayer's other taxable income, potentially lowering their overall taxes owed. |

| 8 | Keeping thorough and accurate records is essential for filling out Schedule C correctly and substantiating claimed deductions. |

| 9 | The IRS may require additional forms or schedules to be filed along with Schedule C for specific types of deductions or business activities. |

| 10 | Schedule C is governed by the federal tax code, and while this form is standardized, state-specific tax obligations may vary and require additional filings. |

Steps to Filling Out IRS Schedule C 1040

Completing the IRS Schedule C 1040 form is important for individuals who operate a sole proprietorship or single-member LLC. This form helps you report the income, expenses, and overall profit of your business to the Internal Revenue Service. Filling out this form accurately is crucial to ensure that you report your business activities correctly and take advantage of any deductions to minimize your tax liability. The process can be straightforward if approached step by step. Let's walk through these steps to ensure you provide all necessary details effectively.

- Gather your records. Before starting, ensure you have detailed records of your business income and expenses. Collect all receipts, bank statements, invoices, and any other documentation that can help support the numbers you report.

- Identify your business. In Part I of Schedule C, fill in your name and social security number as they appear on your Form 1040. Also, describe the nature of your business and enter the business code that best describes your primary business activity.

- Report your income. Enter your total gross receipts or sales for the year in Part I. If you returned or refunded any money to customers, subtract those amounts to calculate your gross income.

- List your expenses. In Part II, detail your business expenses. Categories include advertising, car and truck expenses, commissions and fees, supplies, and utilities. Be thorough and accurate, using your records to fill in each line as applicable.

- Calculate your net profit or loss. Follow the form’s instructions to subtract your total expenses from your gross income. This will give you your net profit or loss, which you'll need to report on your Form 1040.

- Examine the specifics of your business. Parts III, IV, and V focus on the cost of goods sold, information on the use of your home for business, and other expenses, respectively. Fill these sections out only if they apply to your business.

- Review and sign. Go over your completed Schedule C to verify that all information is accurate and complete. Mistakes or omissions can cause delays or issues with the IRS, so this step is crucial. Once you're satisfied, sign and date where indicated.

- Attach Schedule C to your Form 1040. After you've completed Schedule C, attach it to your Form 1040 or 1040-SR. Make sure you've also filled out any other necessary schedules or forms that relate to your tax situation.

- File your taxes. Decide whether you will file electronically or by mail. Double-check the filing deadline for the current tax year to ensure your taxes are filed on time. Late filing can result in penalties and interest on any tax owed.

Completing the IRS Schedule C 1040 form is a critical step for business owners. It's not just about meeting your tax obligations—it’s also about understanding the financial health of your business. By accurately reporting your income and expenses, you provide a clear picture of your business’s profitability, which can be invaluable for future planning and growth. If at any point you feel unsure, consider consulting a tax professional to guide you through the process and ensure everything is filed correctly.

Discover More on IRS Schedule C 1040

What is the IRS Schedule C 1040 form?

The IRS Schedule C 1040 form is a document used by sole proprietors to report the income or loss from a business they operated or a profession they practiced as a sole proprietor. It's part of the individual tax return and helps to detail the earnings and expenses associated with the business activity.

Who needs to file a Schedule C 1040 form?

Anyone who operates a business as a sole proprietor or an independent contractor, practices a profession as a sole proprietor, or earns income through a single-member LLC needs to file a Schedule C form with their 1040 tax return. This document is necessary to calculate the taxable income for the business activities.

What information do I need to complete Schedule C?

To complete Schedule C, you will need your business income records, including gross receipts or sales. Expenses related to your business, such as costs of goods sold, car and truck expenses, utilities, rent, payroll, and other operational expenses, are also required. You will need detailed records of these transactions to accurately fill out the form.

Can I file Schedule C if I have a loss?

Yes, if your business operated at a loss, you are still required to file Schedule C. Reporting a loss on Schedule C can reduce your total taxable income, potentially lowering your overall tax bill. However, it's important to accurately report your income and expenses to justify the loss.

Are there penalties for not filing Schedule C?

Failure to file Schedule C when required can result in penalties and interest on any taxes owed. The IRS can also assess penalties for underreporting income. It's crucial to file all required forms to avoid these penalties.

How does Schedule C impact my self-employment taxes?

The net income reported on Schedule C is used to calculate your self-employment taxes, which cover social security and Medicare taxes for individuals who work for themselves. Generally, self-employment tax applies if your net earnings are $400 or more.

Can I deduct home office expenses on Schedule C?

Yes, if you use part of your home exclusively and regularly for business, you may be able to deduct expenses related to the business use of your home. These deductions can include a portion of your rent or mortgage interest, utilities, real estate taxes, and maintenance. The exact calculation can be complex, and certain conditions must be met to qualify.

What happens if I make a mistake on my Schedule C?

If you discover an error on your filed Schedule C, you should amend your return using Form 1040X, Amended U.S. Individual Income Tax Return, and a corrected Schedule C. It's important to correct any mistakes to accurately report your business income and expenses, which can affect your tax liability or refund.

Where can I get help with filling out my Schedule C?

You can get help with your Schedule C from a professional tax preparer, certified public accountant (CPA), or the IRS's free resources online. There are also several tax preparation software solutions that guide individuals through the process of completing Schedule C as part of their tax return.

Common mistakes

-

Not properly reporting all income. Some individuals accidentally omit or incorrectly report their income because they forget to include all sources. This includes cash payments, online sales, and any other income related to their business. It's critical to keep meticulous records and report every dollar earned to avoid potential issues with the IRS.

-

Mixing personal and business expenses. A common mistake is failing to separate business expenses from personal ones. Everything reported on Schedule C should be solely for the business. This includes supplies, business-related vehicle expenses, office rent, and utilities. Using personal expenses as business deductions can lead to audits and penalties.

-

Incorrectly classifying employees as independent contractors. The distinction between an employee and an independent contractor is significant, affecting how taxes are handled. Misclassifying an employee as an independent contractor can lead to substantial fines and penalties.

-

Not fully understanding which deductions are legitimate. It's essential to know what can legally be deducted to maximize your return without stepping over the line. Common legitimate deductions include home office expenses, mileage for business use of a personal vehicle, and certain types of insurance. However, understanding the subtleties of these deductions is crucial to avoid claiming something incorrectly.

-

Forgetting to include carryover losses. If your business experienced losses in previous years that were not fully deductible at that time, you might be able to carry over those losses into the current year. Failing to include these can result in overpaying taxes.

-

Failing to accurately calculate the cost of goods sold. If your business involves selling physical products, accurately reporting the cost of goods sold (COGS) is vital. This includes the cost to acquire or make your products. Mistakes in calculation can significantly affect your reported business income.

When filling out IRS paperwork, making mistakes can have serious consequences, including audits, fines, and penalties. Paying attention to detail and seeking professional advice if you're unsure can save you a lot of trouble in the long run.

Documents used along the form

For entrepreneurs and self-employed individuals, filling out the IRS Schedule C 1040 form is a fundamental step in reporting business income and expenses. However, it’s crucial to understand that this form does not stand alone. Several other forms and documents often accompany it to provide a complete picture of a taxpayer's financial activities. These additional forms help substantiate various entries on the Schedule C and ensure compliance with tax laws.

- Form 1040 – The U.S. Individual Income Tax Return is the starting document where you summarize your overall income, deductions, and credits. Schedule C income feeds directly into this form.

- Schedule SE (Form 1040) – Used to calculate the self-employment tax owed on income from self-employment, including Schedule C earnings.

- Form 8829 – Expenses for Business Use of Your Home provides a format to calculate and claim the deduction for business use of one’s home, which is common for many Schedule C filers.

- Form 1099-NEC – Nonemployee Compensation is crucial for reporting any income paid to a freelancer or contractor that exceeds $600 in the tax year. It’s important both for those issuing the form and those receiving it.

- Form 4562 – Depreciation and Amortization Report is used to detail the depreciation and amortization expenses, typically for big-ticket items like vehicles or computers, over their useful life.

- Form 1099-MISC – Miscellaneous Income, although less common after the introduction of Form 1099-NEC, is still used for reporting other forms of compensation or income, such as rent or prizes.

- Form 1040-ES – Estimated Tax for Individuals helps individuals calculate and pay their quarterly estimated taxes, crucial for most Schedule C filers to avoid penalties for underpayment of tax throughout the year.

- Schedule 1 (Form 1040) – Additional Income and Adjustments to Income, where you report additional income or adjustments that aren’t entered directly on Form 1040. It may include gains or losses relevant to the business that don’t fall neatly into Schedule C.

- Form 8949 – Sales and Other Dispositions of Capital Assets is used to list all capital asset transactions not reported directly on Schedule D. It's essential for those selling business assets during the tax year.

Familiarity with these supporting documents enhances understanding of the broader tax filing process, ensuring that taxpayers meet their obligations and maximize potential deductions. It's a symbiotic relationship: each form complements the others, providing a thorough narrative of a taxpayer’s financial landscape. For those navigating self-employment or small business ownership, a mastery of these forms is not just recommended; it’s indispensable for adhering to tax laws and optimizing financial outcomes.

Similar forms

Schedule SE (Form 1040): The Schedule SE is closely related to the Schedule C as it is used to calculate the self-employment tax owed by individuals who have net earnings from self-employment, as detailed on Schedule C. Both forms work hand-in-hand, with Schedule C computing the profit or loss from a business which then serves as a base for the Schedule SE to calculate self-employment taxes due.

Form 8829 (Expenses for Business Use of Your Home): This form is utilized by individuals who use part of their home for business purposes, a scenario often reported on Schedule C. Form 8829 allows for the deduction of expenses related to the home business use, such as mortgage interest, insurance, utilities, repairs, and depreciation. This deduction directly affects the net profit or loss reported on Schedule C by reducing the taxable income from the business.

Schedule E (Form 1040): Schedule E is used to report income and expenses from rental real estate, royalties, partnerships, S corporations, estates, trusts, and residual interests in REMICs. While targeting different sources of income, it is similar to Schedule C in terms of reporting income and calculating net earnings. Both forms assess the profitability of specific activities and affect the individual's overall taxable income.

Schedule F (Form 1040): Schedule F shares a purpose with Schedule C but is tailored for individuals in the farming business. It is used to report income and expenses related to farming activities. Like Schedule C, it calculates the net profit or loss from operations, which contributes to the taxpayer's total income or loss as reported on the Form 1040. Both forms play crucial roles for self-employed individuals, calculating the profitability of their endeavors and influencing their tax responsibilities.

Form 1099-MISC and Form 1099-NEC: These forms are integral to the process surrounding Schedule C as they report income from various sources such as freelance, independent contracting, and other non-employee compensation. Form 1099-NEC, in particular, reports payments of $600 or more made to non-employee service providers. This income must then be reported on Schedule C, making these forms essential for accurately calculating taxable business income and determining the correct amounts to be paid in taxes and potential deductions.

Dos and Don'ts

Filling out the IRS Schedule C 1040 form is a critical process for individuals who operate a business as a sole proprietor or as a single-member LLC. It's used to report income or loss from a business you operated or a profession you practiced as a sole proprietor. Attention to detail is crucial in ensuring that the information provided is both accurate and complete. Here are some do's and don'ts to keep in mind when completing this form.

Do's

Ensure you have all your financial records organized before you start filling out the form. This includes receipts, bank statements, invoices, and any other documents related to your business income and expenses.

Accurately report all income, including cash, checks, and credit card payments. Underreporting income can lead to penalties and interest.

Take advantage of all legitimate business expense deductions. This can include costs related to the home office, vehicle expenses, supplies, and equipment necessary for your business.

Review the IRS guidelines for the Schedule C form to ensure you understand which expenses are deductible. The IRS provides resources and publications that outline acceptable deductions and how they should be reported.

Utilize IRS-approved software or a tax professional to help fill out the form if you're unsure about any requirements or calculations.

Double-check your figures and the entire form for accuracy before submitting. Mistakes can delay processing and may trigger an audit.

Don'ts

Don't overlook reporting any part of your income. Remember to include all forms of payment received from your business activities.

Don't guess on numbers. Use your actual financial records to report income and expenses. Estimations can lead to errors and potential issues with the IRS.

Don't claim personal expenses as business deductions. Only expenses that are directly related to the operation of your business and are ordinary and necessary should be claimed.

Don't forget to sign and date the form. An unsigned form is considered incomplete and will not be processed by the IRS.

Don't file late. Be aware of IRS deadlines to avoid late filing penalties and interest charges. If you need more time, you can request an extension.

Don't ignore IRS notices or letters. If you receive communication from the IRS, respond promptly and provide any requested information to resolve issues quickly.

Misconceptions

Filing taxes can often be confusing, and the IRS Schedule C 1040 form is no exception. Several misconceptions surround this form, which is crucial for small business owners and self-employed individuals. Let’s clear up some of these misunderstandings.

Schedule C is only for "big" businesses: This is not true. Schedule C is intended for the self-employed, freelancers, and any individual who operates a sole proprietorship, regardless of their business size. It's about reporting profit or loss from a business you operated or a profession you practiced as a sole proprietor.

You must have a separate business bank account to file a Schedule C: While having a separate bank account for your business transactions is advisable for organizational and tracking purposes, it's not a requirement for filing Schedule C. However, maintaining clear records of your business expenses and income is essential.

If you don’t make a profit, you don’t have to file Schedule C: Even if your business didn’t turn a profit, you're still required to file Schedule C if you meet the IRS filing requirements. Reporting your losses may reduce your tax liability by offsetting other income.

Filing Schedule C increases your chance of an IRS audit: There's a common belief that filing Schedule C puts you at a higher risk of being audited. However, what triggers an audit are usually errors, omissions, or discrepancies in your tax return, not the mere fact of filing a Schedule C.

You can only deduct home office expenses if you itemize deductions: This is incorrect. If you use part of your home regularly and exclusively for business, you may qualify to deduct expenses for the business use of your home on Schedule C, regardless of whether you itemize your other deductions.

Personal expenses can be deducted if there’s some business use: It's vital to differentiate between business and personal expenses. Only the business portion of an expense can be deducted on Schedule C. Mixing personal expenses with business ones can lead to complications and inaccuracies in your tax return.

Everything earned from side gigs is “extra” and not reported: All income, including what you earn from side gigs, must be reported. The IRS requires reporting of any income from services you provide, goods you sell, or freelancing, regardless if it's a side job or your primary source of income.

Understanding the intricacies of Schedule C can help ensure you're filing your taxes correctly and taking advantage of all eligible deductions, thus saving money and avoiding potential issues with the IRS. Always keep accurate records and consult with a tax professional if you're unsure about your specific situation.

Key takeaways

Filling out and accurately submitting the IRS Schedule C 1040 form is crucial for individuals who operate a business as a sole proprietor or have received income as an independent contractor. Here are several key takeaways to ensure the process is handled efficiently and accurately:

- Understand Eligibility: Before diving into the Schedule C form, confirm that you're eligible to use it. It's designed for sole proprietors and single-member LLCs that have business income.

- Gather Necessary Documents: Collect all relevant financial records related to your business income, expenses, and possibly home office deductions. Accurate record-keeping throughout the year simplifies this step.

- Report All Income: Ensure all business income, including cash, checks, and credit card transactions, is reported. Don't overlook smaller transactions, as they can add up and impact your tax responsibilities.

- Deductible Expenses: Familiarize yourself with deductible business expenses. This can range from advertising, supplies, and utilities to more substantial costs like business travel or vehicle expenses. Proper documentation is essential to justify these deductions if questioned.

- Utilize the Home Office Deduction When Applicable: If you use part of your home exclusively for business, you may be able to claim a deduction for that space. Understanding the requirements and correctly calculating this deduction can save a significant amount of money.

- Self-Employment Tax: Completion of Schedule C also plays a role in determining the amount of self-employment tax owed. Income reported on Schedule C is subject to self-employment tax, covering Social Security and Medicare taxes for those who work for themselves.

- Seek Professional Help if Needed: The complexity of your business finances might make it necessary to seek out a tax professional or accountant. They can provide personalized advice and ensure that the form is filled out correctly, maximizing your deductions and minimizing errors.

By paying close attention to these aspects, individuals can navigate the intricacies of the IRS Schedule C 1040 form more effectively, leading to accurate reporting of business income and expenditures. This not only helps in staying compliant with tax laws but also in optimizing financial outcomes for your business.

Common PDF Forms

Faa Aircraft Bill of Sale - Ensuring the form is filled out legibly and in its entirety is important for the accuracy of the aircraft's official records.

What Is the Normal Range of Hiv Test - Facilitates the monitoring and documentation of testing conditions, such as room temperature, to support accurate and reliable HIV testing.