Valid Investment Letter of Intent Template

When individuals or corporations set out to make an investment, clarity and commitment are key elements that guide their decisions and actions. At the confluence of these elements is the Investment Letter of Intent (LOI), a form that plays a pivotal role in the investment process. This form serves as a provisional agreement between the investor and the party seeking investment, outlining the basic terms and conditions of the proposed deal. The LOI doesn't just signify the investor's serious intent to follow through with the investment; it also sketches a broad framework for the negotiations to come, setting the stage for more detailed, binding agreements. Importantly, this form allows both parties to identify and possibly address any deal-breakers early in the negotiation process, reducing the risk of surprises that could derail the investment. Furthermore, the LOI might also include provisions for confidentiality, ensuring that sensitive information disclosed during negotiations is protected. While not a binding agreement in itself, an LOI represents the first step towards a formal investment agreement, acting as a foundational tool in bridging initial interest and final commitment.

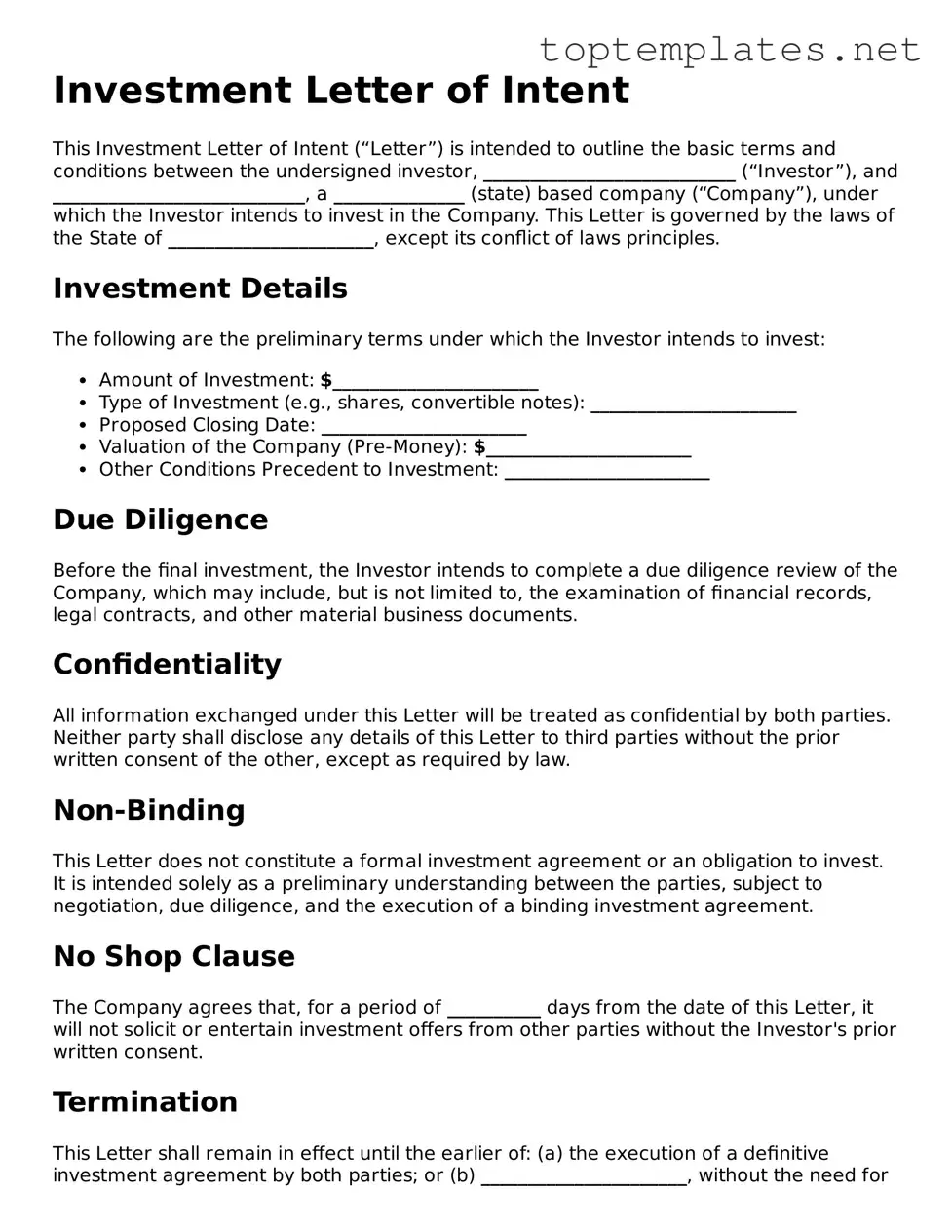

Sample - Investment Letter of Intent Form

Investment Letter of Intent

This Investment Letter of Intent (“Letter”) is intended to outline the basic terms and conditions between the undersigned investor, ___________________________ (“Investor”), and ___________________________, a ______________ (state) based company (“Company”), under which the Investor intends to invest in the Company. This Letter is governed by the laws of the State of ______________________, except its conflict of laws principles.

Investment Details

The following are the preliminary terms under which the Investor intends to invest:

- Amount of Investment: $______________________

- Type of Investment (e.g., shares, convertible notes): ______________________

- Proposed Closing Date: ______________________

- Valuation of the Company (Pre-Money): $______________________

- Other Conditions Precedent to Investment: ______________________

Due Diligence

Before the final investment, the Investor intends to complete a due diligence review of the Company, which may include, but is not limited to, the examination of financial records, legal contracts, and other material business documents.

Confidentiality

All information exchanged under this Letter will be treated as confidential by both parties. Neither party shall disclose any details of this Letter to third parties without the prior written consent of the other, except as required by law.

Non-Binding

This Letter does not constitute a formal investment agreement or an obligation to invest. It is intended solely as a preliminary understanding between the parties, subject to negotiation, due diligence, and the execution of a binding investment agreement.

No Shop Clause

The Company agrees that, for a period of __________ days from the date of this Letter, it will not solicit or entertain investment offers from other parties without the Investor's prior written consent.

Termination

This Letter shall remain in effect until the earlier of: (a) the execution of a definitive investment agreement by both parties; or (b) ______________________, without the need for any formal notice.

Signatures

By signing below, the parties indicate their intention to proceed with the investment subject to the terms outlined in this Letter.

Investor:

Name: ___________________________________

Title: __________________________________

Date: ___________________________________

Company:

Name: ___________________________________

Title: __________________________________

Date: ___________________________________

File Breakdown

| Fact Name | Description |

|---|---|

| Purpose | The Investment Letter of Intent form is used to outline the preliminary terms and conditions of an investment agreement before the final document is drafted. |

| Non-Binding Nature | Typically, this form is non-binding, meaning neither party is legally obligated to complete the investment transaction based on this document alone. |

| Key Components | Includes details such as amount to be invested, the structure of the investment, anticipated closing date, and confidentiality clauses. |

| Confidentiality | Often contains confidentiality clauses to protect sensitive information shared between the parties during negotiation. |

| Governing Law | State-specific forms are governed by the laws of the state in which the investment transaction is to be completed. |

| Due Diligence Clause | May include a clause that allows the investor to conduct due diligence before finalizing the investment. |

Steps to Filling Out Investment Letter of Intent

Filling out an Investment Letter of Intent may initially seem like a daunting task, but it's a crucial step in the investment process. This document essentially serves as a preliminary agreement between you and another party, indicating your intent to engage in a transaction concerning investment. It lays the groundwork for formal negotiations and can help facilitate a smoother investment process. By following these step-by-step instructions, you can ensure that your Letter of Intent encapsulates all the necessary information and reflects your intentions accurately.

- Identify the Parties: Start by clearly identifying the name and contact information of both the potential investor and the recipient (individual or entity) of the investment. This establishes who is involved in the potential transaction.

- State the Purpose: Briefly describe the purpose of the investment and the nature of the business relationship you are seeking to establish. This helps set the context for the entire document.

- Outline the Terms: Provide a detailed account of the proposed investment terms. This could include the total investment amount, the currency involved, investment structure, and any specific conditions or milestones that need to be met. It's crucial to be as specific as possible to avoid ambiguity.

- Specify the Time Frame: Clearly state the effective date of the letter and the period during which the offer will remain valid. This helps in creating a sense of urgency and compels the other party to act within a specified timeframe.

- Confidentiality Clause: If applicable, include a clause that outlines the agreement's confidentiality. This is particularly important if sensitive information will be exchanged during the negotiation process.

- Non-Binding Clause: It’s important to specify that the Letter of Intent is non-binding, meaning it does not legally compel either party to complete the transaction. This clause safeguards both parties until a formal agreement is reached and signed.

- Signature: End the letter with a closing note, thanking the recipient for considering the investment, followed by the signature of the person sending the letter. Ensure that there is also space for the recipient to sign, acknowledging receipt and acceptance of the letter’s terms, albeit in a non-binding manner.

Once you've accurately filled out the Investment Letter of Intent, the next step involves careful review and possible revision to ensure that all details accurately reflect your intentions and terms. It's advisable to have a legal professional review the document to ensure its integrity and compliance with relevant laws. Upon mutual satisfaction with the terms outlined in the Letter of Intent, both parties can proceed towards drafting and negotiating a binding agreement based on the foundations laid out by this initial document. Remember, the Letter of Intent is a crucial step in building understanding and agreement between parties, setting the stage for successful investment negotiations.

Discover More on Investment Letter of Intent

What is an Investment Letter of Intent?

An Investment Letter of Intent (LOI) is a document where an investor outlines their intentions to invest in a business or project. It serves as a preliminary agreement between the investor and the company seeking funding, detailing the terms and conditions of the future investment. Though not always legally binding in all its parts, this document can establish a framework for future negotiations and sometimes includes binding provisions such as confidentiality or exclusivity clauses.

Why is an Investment Letter of Intent important?

This document is crucial because it signifies a serious interest from the investor to move forward with the investment. It can help both the investor and the company seeking investment to outline the specifics of the potential deal, such as the investment amount, the structure of the investment, and any conditions that must be met before finalizing the agreement. In many cases, an LOI can facilitate smoother negotiations by clarifying the expectations and intentions of both parties upfront.

What are the key elements to include in an Investment Letter of Intent?

A comprehensive Investment Letter of Intent should include several key elements: the names and contact information of the parties involved, the proposed investment amount, the structure of the investment (e.g., stock purchase, asset purchase), conditions precedent to the investment, confidentiality obligations, exclusivity arrangements if any, and a clause stating whether parts of the LOI are legally binding. It's also common to include a timeline for due diligence and a projected date for closing the investment. These elements ensure that the LOI reflects the intentions of both parties accurately and provides a clear path forward.

Is an Investment Letter of Intent legally binding?

The binding nature of an Investment Letter of Intent can vary. Typically, the document itself states which parts, if any, are legally binding. Common binding provisions include confidentiality and exclusivity agreements, which protect the interests of both parties during negotiations. However, the sections detailing the investment itself, such as the amount and structure, are usually not binding. This allows both the investor and the business the flexibility to negotiate the final terms in a subsequent, more detailed agreement. Always consult with a legal professional to understand the binding aspects of any LOI.

Common mistakes

Filling out an Investment Letter of Intent form is a crucial step for investors keen on making their intentions clear when approaching investment opportunities. Unfortunately, mistakes can happen, which may affect the process negatively. Understanding these common errors can play a significant part in ensuring your investment journey begins on the right foot.

Not Reading Instructions Carefully: The form comes with specific instructions, and overlooking these can lead to filling it out incorrectly. Each section is designed to gather precise information, and assumptions can result in errors.

Omitting Essential Details: Sometimes, individuals skip over fields that they consider irrelevant or too personal. However, every piece of requested information serves a purpose. Missing data can delay the process or lead to misinterpretation of intentions.

Misunderstanding Terminology: Investment terms can be complex. Misinterpreting these terms might lead to providing incorrect information. It’s important to research or ask for clarification on any terms that are not clear.

Forgetting to Sign and Date the Form: It might seem like an obvious step, but the excitement or rush to submit the form can lead to oversight. An unsigned form is typically considered invalid.

Ignoring the Need for Witness or Notarization: Depending on the nature of the investment or jurisdiction, some forms require either a witness or notarization. Not complying with this requirement can make the document legally void.

Using Incorrect Identification Details: This might occur due to simple typos or outdated information. It’s crucial to double-check the identification details provided, such as social security numbers or addresses, for accuracy.

To avoid these common mistakes:

Take the time to thoroughly read through the entire form and its instructions before starting.

Do not leave any fields blank. If uncertain about what to include, seek clarification.

Verify all personal and investment details for accuracy.

Make sure the form is correctly signed, dated, and notarized (if required).

Retain a copy of the completed form for your records.

Approaching the Investment Letter of Intent form with diligence and care ensures that your investment intentions are clearly communicated, paving the way for a smoother investment process.

Documents used along the form

When negotiating investment agreements, several key forms and documents oftentimes accompany the Investment Letter of Intent (LOI). These documents play crucial roles in outlining the terms, conducting due diligence, and finalizing agreements between parties. They vary in function and purpose, emphasizing the importance of a comprehensive understanding to facilitate smooth transactions and protect the interests of all involved.

- Confidentiality Agreement: This document ensures that sensitive information disclosed during negotiations remains confidential, protecting both parties' proprietary and financial data.

- Term Sheet: A non-binding agreement outlining the basic terms and conditions under which an investment will be made. It serves as a blueprint for future agreements.

- Due Diligence Checklist: This list details the documents and information required from the company seeking investment, used to assess the viability and risks of the proposed deal.

- Subscription Agreement: A promise by the company to sell a certain number of shares to the investor at a specified price, detailing the investment terms and investor's rights.

- Shareholders Agreement: Outlines the rights and obligations of the shareholders, including how the company is run, the management of shares, and how decisions are made.

- Memorandum of Understanding (MoU): A formal agreement between two or more parties indicating an intended common line of action, often used in the early stages of negotiations.

- Corporate Resolutions: Documents that record decisions or actions taken by a company's board of directors or shareholders, authorizing specific actions related to the investment.

- Investment Agreement: A comprehensive document that finalizes all terms and conditions of the investment, including representations, warranties, covenants, and conditions precedent to the investment.

Having these documents in order complements the Investment Letter of Intent, ensuring a clear, legal foundation for investment transactions. Each document addresses specific aspects of the investment process, working together to facilitate understanding, ensure legality, and protect the interests of all parties involved.

Similar forms

Term Sheet: Much like an Investment Letter of Intent, a Term Sheet provides an overview of the main terms and conditions proposed for an investment deal. It is often used in the early stages of negotiation between investors and companies, specifying key financial terms and other important aspects of the investment, such as valuation, capital structure, and governance. Both documents serve as a preliminary agreement before the finalization of the deal, offering a roadmap for the detailed legal documents that will follow.

Memorandum of Understanding (MOU): An MOU shares similarities with an Investment Letter of Intent in that both establish preliminary agreements between two or more parties before embarking on a formal contract. MOUs are used across various sectors to outline the intention of mutual cooperation and the framework for specific projects, including investment initiatives. They are non-binding and express a convergence of will between the parties, suggesting a serious intention to move forward toward a formal agreement.

Non-Disclosure Agreement (NDA): While distinct in purpose, NDAs and Investment Letters of Intent often intersect in the investment process. An NDA is specifically designed to protect confidential information. When negotiating an investment, parties might sign an NDA to safeguard sensitive business information shared during the process. An Investment Letter of Intent, meanwhile, might reference confidentiality clauses, integrating aspects of NDAs to ensure that negotiations and disclosed information remain protected.

Heads of Agreement: This document is closely related to an Investment Letter of Intent as it outlines the key terms of a deal before the execution of a full contract. Common in the UK and Commonwealth countries, Heads of Agreement serve the same purpose as a Term Sheet or MOU by recording the initial terms agreed upon by parties. They are typically non-binding, except for specific provisions such as exclusivity or confidentiality, mirroring the conditional commitments found in an Investment Letter of Intent.

Shareholders’ Agreement: Although a Shareholders’ Agreement comes later in the investment process, its foundation is often laid out in the Investment Letter of Intent. This agreement regulates the rights and obligations of the shareholders, the management of the company, ownership of shares, and the protection of investors. The Investment Letter of Intent frequently outlines the intention to draft such an agreement, highlighting key terms that will be detailed in the final Shareholders’ Agreement. It's a bridge between preliminary understanding and the binding agreements that govern investor relations.

Partnership Agreement: Similar to an Investment Letter of Intent, a Partnership Agreement sets out the terms of a partnership between two or more parties. While a Partnership Agreement is a full contracts that details the nature of the business, roles, and responsibilities of each partner, profit and loss distribution, and the procedure for resolving disputes, an Investment Letter of Intent might set the stage for such an agreement by outlining the intention to form a partnership, especially in cases where the investment leads to joint ventures or close collaborations.

Dos and Don'ts

When preparing an Investment Letter of Intent, it's important to proceed with careful consideration and accuracy. Below are critical do's and don'ts that should guide you through the process:

- Do ensure all the information you provide is accurate and current. Making sure that dates, names, investment details, and financial figures are correct is crucial.

- Do review the form instructions carefully before beginning. Each section often has specific requirements that must be followed for valid completion.

- Do use black ink or type the information if the form allows it, to improve readability and prevent misunderstandings.

- Do keep a copy of the completed form for your own records. Having your own documentation is important for future reference and any necessary follow-up.

- Don't leave sections blank. If a section does not apply, it's better to indicate this with a "N/A" (not applicable) rather than leaving it empty.

- Don't rush through the form without verifying each entry. Errors or omissions can lead to delays or complications in the investment process.

- Don't hesitate to ask for help if you're unsure about any part of the form. It's better to seek clarification than to fill out sections incorrectly.

- Don't sign the form without reviewing it completely. Your signature verifies that all the information provided is true and accurate to the best of your knowledge.

- Don't use correction fluid or tape. Mistakes should be neatly crossed out with a single line, and the correct information should be clearly written above or beside it.

Misconceptions

When it comes to navigating the world of investment, the Investment Letter of Intent (LOI) is a crucial document that often gets misunderstood. Here are five common misconceptions about the Investment LOI:

It's legally binding. Many people think that an Investment LOI is a legally binding agreement. While it does show a serious intent to go forward with an investment, most of its terms are not enforceable. Typically, only provisions related to confidentiality and exclusivity are legally binding.

It's just a formality. This couldn't be further from the truth. An LOI serves as a foundation for the investment process, outlining the basic terms and conditions of the investment. It's a crucial step in negotiations, signaling that both parties are serious about proceeding but need to work out further details.

It has a standard format. While there are common elements found in most Investment LOIs, such as the investment amount and structure, each LOI is tailored to the specific agreement between the investor and the company. Therefore, it's essential to customize the LOI to reflect the unique aspects of each investment opportunity.

It guarantees the investment will proceed. An LOI is not a guarantee that the investment will go forward. It's a step in the negotiation process, and either party can decide not to proceed with the deal. Unforeseen issues during due diligence or changes in market conditions can lead to a deal falling through even after an LOI is signed.

It's unnecessary if you trust the other party. Even if there's a strong trust between the investor and the company, an LOI is still critical. It ensures that both parties have a clear understanding of the key terms and intentions of the investment. This clarity can prevent misunderstandings and conflicts down the line.

Key takeaways

An Investment Letter of Intent (LOI) is a critical document that signifies a preliminary agreement between two parties, typically the investor and the entity seeking investment, before finalizing a formal agreement. This document, while not a legally binding contract in its entirety, outlines the basic terms of the investment agreement. Understanding how to accurately fill out and use this form can significantly impact the negotiation phase and ensure both parties clearly understand the investment's terms. Below are ten key takeaways for effectively handling an Investment Letter of Intent.

- Understanding the Purpose: Recognize that the LOI serves as a foundation for negotiations, indicating serious intent to invest under specified conditions, but it is not an absolute commitment.

- Clarify Terms: Ensure all key terms such as investment amount, structure, valuation of the company, rights, and obligations of each party are clearly detailed to prevent misunderstandings.

- Confidentiality Clause: It’s advisable to include a confidentiality clause to protect sensitive information shared during negotiations.

- Exclusivity Agreement: An exclusivity clause can be added to restrict the company from seeking other investors for a specified period, allowing the potential investor to conduct due diligence.

- Non-Binding Agreement: Clarify which parts of the LOI are non-binding, except typically for confidentiality and exclusivity clauses, to maintain flexibility.

- Due Diligence Process: The LOI should outline the due diligence process, including timelines and the type of information and access required by the investor.

- Legal Review: Before signing, have a legal professional review the LOI to ensure it aligns with your interests and doesn’t impose unintended obligations.

- Termination Clause: Include a clause stating under what conditions either party can terminate the LOI, which is critical for risk management.

- Binding Provisions: Clearly identify any provisions that will remain binding if the investment does not proceed, such as dispute resolution methods.

- Use Clear Language: Avoid legal jargon and ensure that the LOI is written in clear, accessible language to prevent misinterpretations and foster mutual understanding.

Filling out an Investment Letter of Intent with precision and care is foundational in setting the stage for a successful partnership between an investor and a company. By emphasizing clarity, mutual understanding, and safeguarding interests through specific clauses, parties can navigate through the initial stages of investment with confidence. Remember, consulting with legal professionals to review and advise on the LOI can prevent potential legal challenges and ensure that the investment process proceeds smoothly.

Find Other Types of Investment Letter of Intent Documents

Letter of Intent to Lease Commercial Property Pdf - Serves as an entry to formal lease discussions, highlighting a potential tenant's terms and interest in a commercial lease agreement.

How to Create Letter of Intent - It’s an opportunity to showcase your organization's capabilities, the significance of your project, and how financial backing would benefit your cause, aiming to persuade funders to invite a full application.