Valid Letter of Intent to Lease Commercial Property Template

Finding the ideal commercial property to lease is a critical step for any business, big or small. However, before keys change hands, a crucial document comes into play: the Letter of Intent to Lease Commercial Property. This form serves not just as a precursor to a binding agreement, but as a detailed expression of the prospective tenant's intentions. It allows both parties – the tenant and the landlord – to outline and negotiate terms such as rent, lease duration, and any other specifics before drafting the official lease agreement. The form acts as a safeguard, ensuring that both parties are on the same page about the commercial property's use and its financial responsibilities. Its utility extends beyond clarification, providing a structured path to follow, which helps in preventing potential disputes during the leasing process. Thus, the Letter of Intent is an indispensable tool in the world of commercial leasing, setting the stage for a successful landlord-tenant relationship.

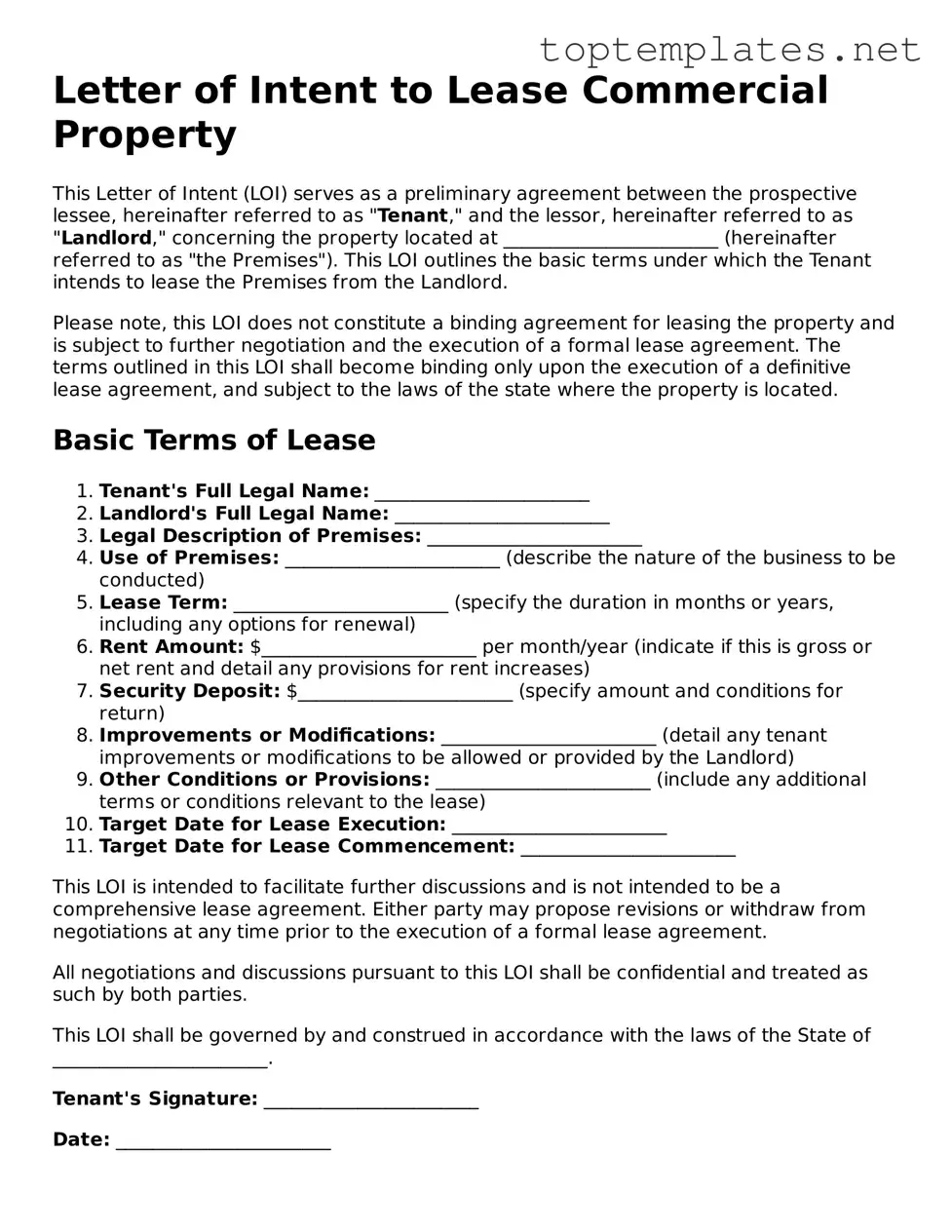

Sample - Letter of Intent to Lease Commercial Property Form

Letter of Intent to Lease Commercial Property

This Letter of Intent (LOI) serves as a preliminary agreement between the prospective lessee, hereinafter referred to as "Tenant," and the lessor, hereinafter referred to as "Landlord," concerning the property located at _______________________ (hereinafter referred to as "the Premises"). This LOI outlines the basic terms under which the Tenant intends to lease the Premises from the Landlord.

Please note, this LOI does not constitute a binding agreement for leasing the property and is subject to further negotiation and the execution of a formal lease agreement. The terms outlined in this LOI shall become binding only upon the execution of a definitive lease agreement, and subject to the laws of the state where the property is located.

Basic Terms of Lease

- Tenant's Full Legal Name: _______________________

- Landlord's Full Legal Name: _______________________

- Legal Description of Premises: _______________________

- Use of Premises: _______________________ (describe the nature of the business to be conducted)

- Lease Term: _______________________ (specify the duration in months or years, including any options for renewal)

- Rent Amount: $_______________________ per month/year (indicate if this is gross or net rent and detail any provisions for rent increases)

- Security Deposit: $_______________________ (specify amount and conditions for return)

- Improvements or Modifications: _______________________ (detail any tenant improvements or modifications to be allowed or provided by the Landlord)

- Other Conditions or Provisions: _______________________ (include any additional terms or conditions relevant to the lease)

- Target Date for Lease Execution: _______________________

- Target Date for Lease Commencement: _______________________

This LOI is intended to facilitate further discussions and is not intended to be a comprehensive lease agreement. Either party may propose revisions or withdraw from negotiations at any time prior to the execution of a formal lease agreement.

All negotiations and discussions pursuant to this LOI shall be confidential and treated as such by both parties.

This LOI shall be governed by and construed in accordance with the laws of the State of _______________________.

Tenant's Signature: _______________________

Date: _______________________

Landlord's Signature: _______________________

Date: _______________________

By signing below, both the Tenant and the Landlord acknowledge that they have read, understood, and agree to the terms outlined in this Letter of Intent to Lease Commercial Property.

File Breakdown

| Fact Number | Description |

|---|---|

| 1 | A Letter of Intent to Lease Commercial Property is a preliminary agreement between a potential tenant and a landlord, outlining the main terms of a future lease. |

| 2 | It typically includes terms such as the lease duration, rent amount, property description, and proposed use of the property. |

| 3 | This document is not legally binding in terms of enforcing the lease but may contain provisions that are, such as confidentiality and exclusivity clauses. |

| 4 | The purpose of the Letter of Intent is to establish a mutual understanding of the lease terms before drafting the formal lease agreement. |

| 5 | Landlords may require a Letter of Intent as a sign of good faith that the potential tenant is serious about leasing the property. |

| 6 | Negotiating and agreeing on the terms in the Letter of Intent can save both parties time and reduce potential misunderstandings in the formal lease agreement. |

| 7 | Once both parties sign the Letter of Intent, they may proceed to negotiate and draft the official lease agreement, which will be legally binding. |

| 8 | The governing laws for the Letter of Intent and the subsequent lease agreement depend on the state where the property is located. |

| 9 | It's advisable for both landlords and potential tenants to consult with legal professionals before signing a Letter of Intent to ensure understanding and agreement on its terms. |

Steps to Filling Out Letter of Intent to Lease Commercial Property

After deciding to pursue a commercial property for lease, the next critical step involves signaling your intention to the property's owner or management. This is where a Letter of Intent to Lease Commercial Property plays a crucial role. It serves as a preliminary agreement, paving the way for formal lease negotiations. While it may not be legally binding in terms of the lease agreement itself, it clearly outlines the terms under which you wish to negotiate. Understanding and completing this document carefully is vital to ensure both parties are on the same page before proceeding to the binding lease agreement.

To fill out the Letter of Intent to Lease Commercial Property, follow these steps:

- Begin by inserting the date at the top left corner of the document.

- Address the letter to the property owner or the representing management company, providing their full name and address.

- In the first paragraph, introduce yourself or your company and express your interest in leasing the commercial property. Be specific about the property by including its address or description.

- Detail the proposed terms of the lease in the following sections, including:

- The specific premises you wish to lease within the property.

- The intended use of the leased premises.

- The desired term of the lease and any options for renewal.

- Proposed lease payments, including any details on how they might be adjusted over time.

- Information about any deposits or fees required upfront.

- Include a section on the expectations regarding the maintenance and condition of the property. Specify who will be responsible for what aspects of the property's upkeep.

- Discuss the conditions under which the lease may be terminated early by either party.

- State that the letter is non-binding except in terms of confidentiality or exclusivity, if applicable.

- Request a response by a specific date, indicating your desire to move forward promptly.

- Close the letter by thanking the owner or management for considering your proposal.

- Sign the letter with your full name and title, if relevant. Include contact information for follow-up.

After submitting the Letter of Intent, the next steps will involve waiting for a response from the property owner or management. If they find the proposed terms acceptable, or wish to negotiate them further, they will reach out to you. This is the start of the negotiation process, which will ideally end in a mutually agreeable lease agreement. Remember, the Letter of Intent is not a lease agreement, but a necessary precursor to detailed lease negotiations. It sets the stage for a successful leasing relationship by clearly communicating your intentions and desired terms.

Discover More on Letter of Intent to Lease Commercial Property

What is a Letter of Intent to Lease Commercial Property?

A Letter of Intent to Lease Commercial Property is a written document that expresses a party's preliminary agreement towards leasing commercial property. This letter outlines the basic terms and conditions under which the lessee is willing to lease the property from the lessor and serves as a foundation for negotiating the formal lease agreement.

Why is sending a Letter of Intent important?

Sending a Letter of Intent is important because it formally initiates the negotiation process between the prospective tenant and the property owner. It demonstrates the tenant's serious interest in the property and sets the stage for discussing lease terms in more detail. This step can help clarify expectations and reduce misunderstandings early in the leasing process.

What key elements should be included in a Letter of Intent?

A comprehensive Letter of Intent should include elements such as the proposed lease term, lease rate or rental amount, description of the property, intended use of the property, any requirements for modifications or improvements, responsibilities for repairs and maintenance, options to renew the lease, and any conditions or contingencies that the agreement is subject to.

Is the Letter of Intent legally binding?

Generally, a Letter of Intent itself is not legally binding with respect to the lease obligations. However, it may contain provisions that are binding, such as confidentiality agreements or exclusivity clauses. It's essential to clearly state which parts, if any, are intended to be legally binding.

Can negotiations continue after a Letter of Intent has been sent?

Yes, negotiations can and often do continue after a Letter of Intent has been sent. The Letter of Intent serves as a starting point for negotiations, not the final agreement. Both parties can discuss and modify the terms until a formal lease agreement is signed.

What happens if the landlord and tenant cannot agree on terms after a Letter of Intent is issued?

If the landlord and tenant cannot agree on the terms following a Letter of Intent, either party can choose to walk away from the negotiations. Since the Letter of Intent is generally not binding regarding the lease agreement, it does not compel either party to finalize the lease if terms cannot be agreed upon.

How does a Letter of Intent differ from a lease agreement?

A Letter of Intent is a preliminary document that outlines the basic terms and conditions for a potential lease agreement and expresses an interest to enter into a lease. A lease agreement, on the other hand, is a legally binding contract that formalizes the leasing arrangement, specifying in detail the rights and obligations of each party.

Can a tenant withdraw a Letter of Intent?

Yes, a tenant can generally withdraw a Letter of Intent before a formal lease agreement is signed, especially if it is stated within the Letter that it is not legally binding. However, it is crucial to communicate such a decision promptly and professionally to the landlord to maintain goodwill.

Should a Letter of Intent be drafted by a legal professional?

While it's not mandatory to have a legal professional draft a Letter of Intent, it is advisable. A lawyer can ensure that the letter clearly communicates the tenant's intentions, includes all necessary components, and identifies any binding provisions, thus avoiding potential legal issues.

Is a Letter of Intent necessary for every commercial lease negotiation?

While not every commercial lease negotiation requires a Letter of Intent, it is beneficial in many situations. It can help clarify the terms and conditions from the outset, making the lease negotiation process more efficient and reducing the risk of misunderstandings. However, the necessity may vary depending on the complexity of the lease and the preferences of the parties involved.

Common mistakes

Filling out a Letter of Intent to Lease Commercial Property is an essential step in the leasing process, designed to outline the preliminary agreements between a potential tenant and the property owner. However, mistakes in this document can lead to misunderstandings, delays, or even financial losses. Here are five common errors to avoid:

-

Not specifying the lease term accurately. Some applicants do not provide clear details about the lease duration. This oversight can lead to confusion regarding the expected start date and the length of the lease, impacting contract negotiations.

-

Omitting details about the intended use of the property. Failing to clearly define the business activities can result in legal challenges or issues with zoning regulations. Property owners need to ensure that the tenant's planned use complies with local laws and the property's zoning designations.

-

Ignoring the condition of the premises. Tenants often assume the property will be delivered in a certain condition without explicitly stating this in the Letter of Intent. This assumption can lead to disputes if the tenant expects improvements or specific conditions that the landlord did not agree to accommodate.

-

Forgetting to detail renewal options. Many tenants overlook the importance of specifying terms regarding lease renewal. This omission can cause problems at the end of the lease term, especially if the tenant wishes to extend the lease under favorable conditions.

-

Neglecting to outline the process for amendments. The Letter of Intent should include a clause on how the agreement can be amended, to allow for flexibility and adaptation to unforeseen circumstances. Without this provision, modifying the agreement could become a contentious and complicated process.

By avoiding these mistakes, parties can ensure that their Letter of Intent to Lease Commercial Property accurately reflects their preliminary agreement and serves as a strong foundation for the formal lease agreement.

Documents used along the form

When looking to lease commercial property, the journey often starts with a Letter of Intent to Lease. This document is crucial as it sets the stage for negotiations and signals serious interest from a potential tenant. However, it’s just one piece of the puzzle. Several other documents play vital roles in ensuring a smooth leasing process. Each document serves a unique purpose, together building a comprehensive pathway from expressing initial interest to officially securing a lease.

- Personal Financial Statement: This document provides a snapshot of the potential tenant's financial health. It includes assets, liabilities, income, and expenses. Landlords require this to assess the financial stability and capability of the tenant to fulfill lease obligations.

- Business Plan: Especially relevant for new businesses, this outlines the company’s goals, strategies, market analysis, and financial projections. Landlords look for a solid business plan to ensure the long-term viability of the tenant’s business on their property.

- Commercial Lease Application: Similar to a rental application for residential property, this application gathers detailed information about the business and its owners. This includes business background, references, and financial information, helping the landlord decide if they’re a good fit for the property.

- Credit Authorization Form: With this form, the tenant gives the landlord or the property management company permission to check their credit history. It’s an essential step for landlords to verify the financial reliability of the potential tenant.

- Lease Agreement: The final and most crucial document, the Lease Agreement, outlines the terms and conditions of the lease, including rent, lease duration, responsibilities of each party, and any other conditions agreed upon. This legally binding document is what officially secures the commercial space for the tenant.

These documents, when used in conjunction with each other, help ensure a thorough understanding and agreement between the landlord and the tenant. Starting with a Letter of Intent to Lease, and moving through financial verification, detailed plans, and official applications, the process culminates in the signing of the Lease Agreement. This thorough approach not only protects both parties but also sets the foundation for a successful business relationship in the leased space.

Similar forms

Commercial Lease Agreement: This document is like a Letter of Intent (LOI) because it is used in the leasing process of commercial properties. However, it goes further than the LOI by being the binding agreement that stipulates the terms and conditions of the lease, such as the rental amount, lease duration, and responsibilities of each party. The LOI serves as the foundation for this agreement, detailing preliminary agreements before the actual lease is drafted.

Residential Lease Agreement: Similar to the Commercial Lease Agreement, this document outlines the terms under which a residential property will be rented. Though it focuses on residential rather than commercial properties, the structure and preliminary function align with the LOI in setting the stage for finalizing the rental agreement.

Letter of Intent to Purchase Real Estate: Like the LOI to Lease Commercial Property, this document is a preliminary agreement but for purchasing rather than leasing. It outlines the buyer's intent to purchase property, including proposed purchase terms, and starts the negotiation process before a formal purchase agreement is signed.

Offer to Lease: This document is very similar to the LOI in that it signifies the intention of one party to lease property from another, specifying terms such as lease duration and rent. It often precedes a more detailed lease agreement and serves as the initial proposal from the potential lessee to the landlord.

Business Plan: While not a legal document, a business plan shares similarities with an LOI because it outlines intentions—this time, regarding how a business intends to operate and achieve its goals. When leasing commercial property, a strong business plan can be crucial in convincing a landlord of the tenant's viability and financial stability.

Memorandum of Understanding (MOU): An MOU is a formal agreement between two or more parties that establishes a common line of action. Like an LOI, it is often non-binding and used early in negotiations to outline the intentions of all parties before entering into a binding contract.

Option Agreement: Particularly relevant in real estate transactions, this document grants one party the option to take a specified action (e.g., to purchase or lease property) within a set period. Although it's a preliminary agreement like the LOI, an option agreement can be binding, offering the holder the right but not the obligation to proceed.

Dos and Don'ts

When preparing to sign a lease for commercial property, drafting a Letter of Intent (LOI) is a crucial preliminary step. This document outlines the prospective tenant's desire to lease a particular commercial space, serving as a foundation for negotiations. Here are essential dos and don'ts to ensure the LOI accurately represents your intentions and safeguards your interests.

- Do ensure accuracy in all details. This includes the property address, space description, proposed lease term, and any specific conditions or requirements. Precise information prevents misunderstandings and clarifies your expectations.

- Do be specific about lease terms. Highlight your desired lease duration, renewal options, and rent amount, including any escalations. Clarity here sets the stage for a lease agreement that matches your business needs.

- Do mention your intent regarding improvements or modifications to the property. Whether you expect the landlord to undertake these at their expense or you plan to handle them directly, outlining these intentions upfront avoids future disputes.

- Do include conditions for backing out. Circumstances change, and having contingencies for termination or withdrawal without severe penalties is crucial for flexibility.

- Do seek legal advice. Before finalizing the LOI, consulting with a legal professional ensures your interests are adequately protected and that you understand all implications.

- Don't forget about exclusivity and confidentiality. If necessary for your negotiations, request an exclusivity clause to prevent the landlord from leasing the space to another tenant during negotiations. Additionally, a confidentiality clause can protect sensitive business information shared during the process.

- Don't rush through the process. Take your time to thoroughly review and understand every aspect of the LOI. Prematurely agreeing to terms without proper consideration can lead to unfavorable conditions in the final lease.

- Don't overlook the lease's impact on future business operations. Consider how the property and the lease terms will accommodate your business as it grows or changes. This foresight can save significant headaches and expenses later on.

- Don't underestimate the importance of negotiation. The LOI is a starting point, not the final agreement. Be prepared to negotiate terms to better suit your needs, and understand that it's a standard part of the leasing process.

Misconceptions

When it comes to leasing commercial property, a Letter of Intent (LOI) often precedes the formal lease agreement. However, there are widespread misconceptions about its function and legal standing. A clear understanding is key for both landlords and tenants to navigate this initial stage effectively. Here are six common misconceptions about the Letter of Intent to Lease Commercial Property:

- The LOI is legally binding. Many people mistakenly believe that once a Letter of Intent is signed, both parties are legally bound to proceed with the lease on the terms outlined within it. In reality, the LOI is typically a non-binding document that outlines the terms for a future lease agreement. It serves as a foundation for negotiations, not a final commitment.

- There's a standard LOI format. While many Letters of Intent follow a similar structure, there's no one-size-fits-all template that applies to every lease situation. Terms may vary considerably depending on the property type, location, and the parties' specific needs. It's critical to tailor each LOI to the particular transaction.

- All terms in the LOI will be in the lease. Not necessarily. The LOI outlines intended terms, but it’s important to recognize that negotiations can still lead to changes or omissions in the final lease agreement. Viewing the LOI as a rigid set of terms can lead to misunderstandings and unmet expectations.

- Negotiations can't continue after the LOI is signed. This myth can pressure parties into believing they must finalize all terms before signing the LOI. In practice, the LOI kick-starts negotiations by establishing a preliminary understanding, with room for further discussion and refinement of terms before the lease is finalized.

- Every LOI must address all potential lease issues. While comprehensive detail in an LOI is beneficial, it doesn't need to cover every possible aspect of the lease agreement. The focus should be on major points such as lease duration, rent amount, property description, and any condition-specific clauses. Over-detailing in the LOI phase can lead to premature conflicts or bog down negotiations.

- A verbal agreement is as good as an LOI. While informal agreements or verbal understandings may guide preliminary discussions, they lack the structure and clarity of a written LOI. A well-drafted LOI provides a documented reference point that can reduce misunderstandings and provide a framework for formal lease negotiations.

Understanding these misconceptions helps clarify the nature and purpose of a Letter of Intent to Lease Commercial Property. By fostering a more informed approach to these initial agreements, both landlords and tenants can navigate the leasing process more effectively and with clearer expectations.

Key takeaways

When embarking on the journey of leasing commercial property, one of the pivotal steps involved is the preparation and understanding of the Letter of Intent (LOI) to Lease Commercial Property. This document acts as a precursor to the actual lease agreement, outlining the preliminary terms agreed upon by both parties. Below are key takeaways to consider when filling out and utilizing this form:

- Clarify Negotiation Intentions: The LOI should explicitly state that it's a non-binding document, except for specific clauses such as confidentiality. This clarity ensures that both parties are on the same footing, understanding that the LOI is a basis for future negotiations.

- Outline Key Terms: Essential terms of the lease should be clearly outlined, including lease duration, rental rate, property description, use restrictions, and options for renewals. This framework will serve as a guide for drafting the formal lease agreement.

- Address Financial Responsibilities: Clearly detail all financial obligations, including rent, security deposits, maintenance costs, and other associated fees. This transparency helps avoid future disputes over financial responsibilities.

- Specify Condition of the Property: The LOI should mention the condition of the commercial property at the time of lease commencement and any improvements or modifications required by either party.

- Include Contingency Plans: It's prudent to incorporate contingencies for critical issues, such as zoning approvals or building inspections, to ensure the property meets the lessee's needs and compliance requirements.

- Detail the Process for Formal Agreement: The LOI should outline the steps and timeline for transitioning from the LOI to signing the official lease agreement, keeping both parties on a clear path towards finalizing the deal.

- Consider Exclusivity: Including an exclusivity clause can be beneficial, preventing the lessor from negotiating with other potential lessees for a specified period, giving both parties a clear window to finalize the lease.

- Legal Review: Before signing the LOI, it's crucial to have it reviewed by legal counsel. This ensures that your interests are protected and that you fully understand the implications of the terms proposed.

Think Long-Term: Consider how the lease terms fit with your long-term business goals. The flexibility of the lease, possibilities for expansion, and sublease options should align with your business's growth trajectory. - Maintain Professionalism: Always approach the negotiation and documentation process with professionalism. Remember, the LOI sets the tone for your relationship with the lessor and can impact negotiations and terms.

While the path to securing commercial property may seem fraught with complexities, a well-crafted Letter of Intent serves as a valuable tool to navigate this process, paving the way for a successful leasing arrangement. Acknowledging these key points ensures that your business interests are safeguarded and lays a solid foundation for your commercial lease.

Find Other Types of Letter of Intent to Lease Commercial Property Documents

How to Write Letter of Intent for Job - This document can streamline the hiring process, giving candidates clear insights into their potential employment conditions.