Valid Letter of Intent to Purchase Business Template

Entering into business negotiations marks a pivotal step for both buyers and sellers, with the Letter of Intent to Purchase Business representing a critical milestone in this process. This document, crucial for laying the groundwork for a successful transfer of business ownership, signifies the serious intent of a buyer to proceed with the purchase, subject to due diligence, negotiation, and final agreement. It encompasses several crucial components, including the proposed purchase price, payment terms, confidentiality clauses, and conditions precedent to the sale, which safeguard both parties’ interests during the negotiation phase. Serving both as a roadmap and a safeguard, the Letter of Intent (LOI) helps in streamlining the transaction, setting clear expectations, and minimizing misunderstandings. It's designed to ensure that both parties are aligned on the terms of the deal before incurring significant legal or financial obligations. Addressing key aspects such as exclusivity and due diligence timelines, the LOI acts as a binding agreement in some respects, yet it also allows for flexibility, given its typically non-binding nature on the transaction itself. This delicate balance makes understanding and crafting a Letter of Intent a fundamental step for entrepreneurs, business owners, and legal professionals navigating the complexities of buying or selling a business.

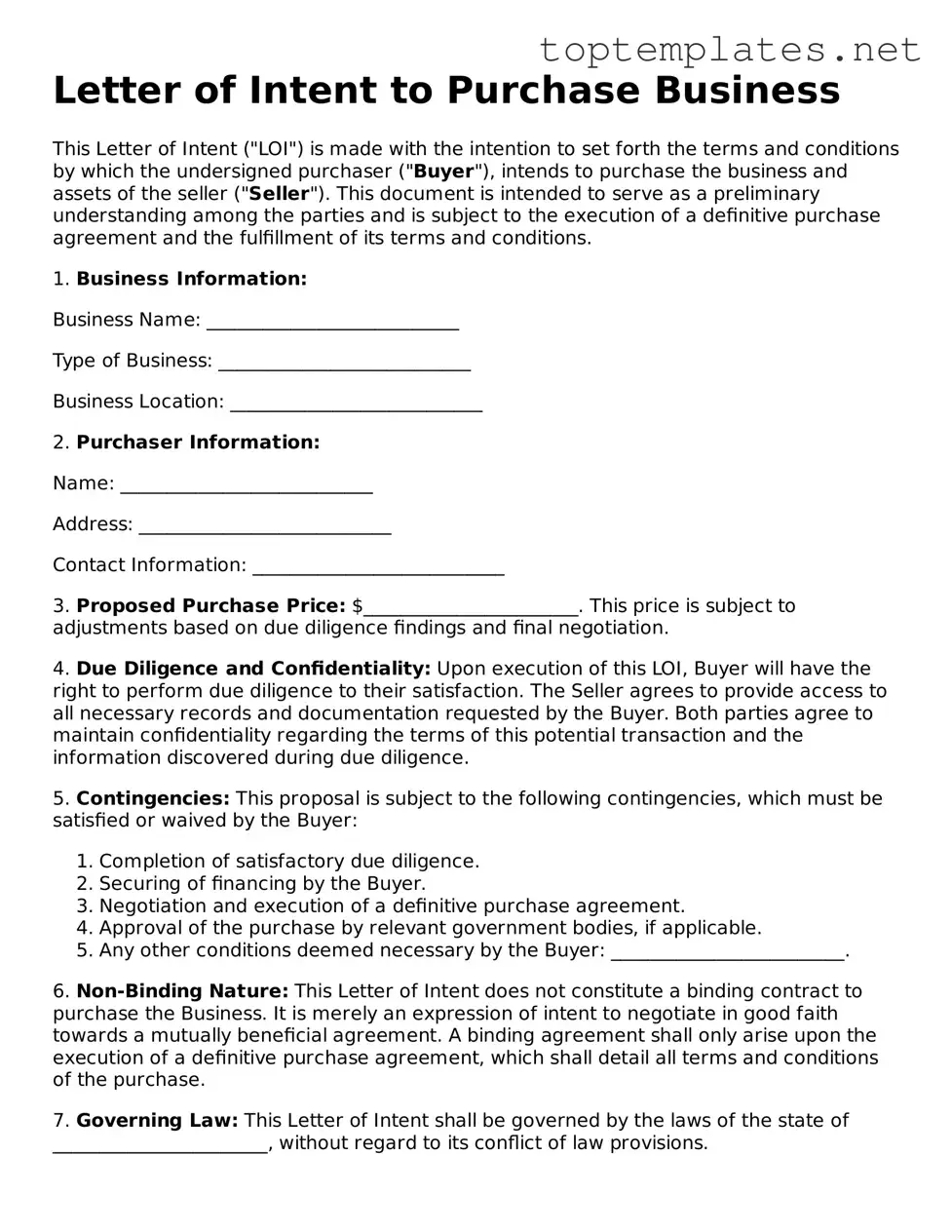

Sample - Letter of Intent to Purchase Business Form

Letter of Intent to Purchase Business

This Letter of Intent ("LOI") is made with the intention to set forth the terms and conditions by which the undersigned purchaser ("Buyer"), intends to purchase the business and assets of the seller ("Seller"). This document is intended to serve as a preliminary understanding among the parties and is subject to the execution of a definitive purchase agreement and the fulfillment of its terms and conditions.

1. Business Information:

Business Name: ___________________________

Type of Business: ___________________________

Business Location: ___________________________

2. Purchaser Information:

Name: ___________________________

Address: ___________________________

Contact Information: ___________________________

3. Proposed Purchase Price: $_______________________. This price is subject to adjustments based on due diligence findings and final negotiation.

4. Due Diligence and Confidentiality: Upon execution of this LOI, Buyer will have the right to perform due diligence to their satisfaction. The Seller agrees to provide access to all necessary records and documentation requested by the Buyer. Both parties agree to maintain confidentiality regarding the terms of this potential transaction and the information discovered during due diligence.

5. Contingencies: This proposal is subject to the following contingencies, which must be satisfied or waived by the Buyer:

- Completion of satisfactory due diligence.

- Securing of financing by the Buyer.

- Negotiation and execution of a definitive purchase agreement.

- Approval of the purchase by relevant government bodies, if applicable.

- Any other conditions deemed necessary by the Buyer: _________________________.

6. Non-Binding Nature: This Letter of Intent does not constitute a binding contract to purchase the Business. It is merely an expression of intent to negotiate in good faith towards a mutually beneficial agreement. A binding agreement shall only arise upon the execution of a definitive purchase agreement, which shall detail all terms and conditions of the purchase.

7. Governing Law: This Letter of Intent shall be governed by the laws of the state of _______________________, without regard to its conflict of law provisions.

8. Acceptance: If the above terms are acceptable to you, please signify your acceptance by signing and returning a copy of this LOI by ___________________ (date). This offer shall expire unless accepted by the above date.

Sincerely,

_________________________________

(Buyer's Signature)

_________________________________

(Print Name)

Date: ___________________________

Accepted by:

_________________________________

(Seller's Signature)

_________________________________

(Print Name)

Date: ___________________________

File Breakdown

| Fact Name | Description |

|---|---|

| Definition | A Letter of Intent to Purchase Business is a document expressing a party's intention to buy a business, outlining the preliminary terms and conditions of the purchase. |

| Purpose | It sets the stage for negotiations between the buyer and seller, providing a framework for the final agreement and helping to prevent misunderstandings. |

| Non-Binding Nature | Most provisions in the letter are non-binding, except for certain clauses such as confidentiality, exclusivity, and governing law. |

| Key Elements | Includes details such as purchase price, payment terms, due diligence period, and conditions precedent to closing. |

| Governing Law | The letter is generally governed by the laws of the state in which the business is located, making it crucial to be aware of state-specific legal nuances. |

| Preparation and Execution | Legal professionals often prepare or review the letter to ensure clarity, accuracy, and the protection of both parties' interests. |

Steps to Filling Out Letter of Intent to Purchase Business

Filling out a Letter of Intent (LOI) to Purchase Business is a critical first step in the process of acquiring a business. This document sets the stage for negotiations, outlining the interest of the potential buyer in purchasing the business and the terms under which they would like to proceed. The writing of this letter should be done with careful consideration, as it can greatly influence the seller's reception to your offer and the future discussions between both parties. Following a clear, step-by-step guide can simplify this process, ensuring that all necessary details are properly addressed.

- Begin by inserting the date at the top of the document, aligned to the right side.

- Below the date, write the recipient's name, title (if applicable), and the business's address, aligning this information to the left.

- Start the letter with a formal salutation, such as "Dear [Recipient's Name]," making sure to use the appropriate title and last name.

- In the first paragraph, clearly state your intention to purchase the business, including the name of the business and its location.

- Proceed to outline the proposed terms of purchase in the next section. This includes the purchase price, payment method, and any other conditions or contingencies, such as due diligence periods and confidentiality requirements.

- Include a paragraph stating that the letter is a non-binding agreement, except for specific provisions that will be explicitly described as binding, like confidentiality and exclusivity clauses.

- Express your anticipation for a positive response and the opportunity to move forward with the transaction in a concluding paragraph.

- Close the letter with a formal closing, such as "Sincerely," followed by your printed name, signature, title (if applicable), and contact information.

After the Letter of Intent has been completed and sent, the next stage involves waiting for the seller's response. They might accept your initial terms, provide counteroffers, or request further discussion on certain points. It's pivotal at this juncture to remain flexible and open to negotiations, keeping in mind the ultimate goal of successfully purchasing the business. Advisory input from legal, financial, and business professionals can be invaluable in navigating the ensuing steps, helping to analyze the seller's responses, structuring counteroffers, and moving towards a formal purchase agreement.

Discover More on Letter of Intent to Purchase Business

What is a Letter of Intent to Purchase Business?

A Letter of Intent to Purchase Business is a formal document where an individual or entity expresses their interest in buying a specific business. It serves as a preliminary agreement between the buyer and the seller, outlining the terms and conditions of the sale before the final purchase agreement is drafted.

Why is a Letter of Intent important?

The Letter of Intent is important because it lays the foundation for the negotiation process. It shows the seller that the buyer is serious about the purchase and provides a framework for discussions. Additionally, this document can help streamline the purchasing process by identifying the terms that both parties agree on from the start.

What information should be included in a Letter of Intent to Purchase Business?

The Letter should include key information such as the identity of the buyer and seller, description of the business being sold, purchase price, payment terms, due diligence period, confidentiality agreement, and any conditions precedent to the sale. It may also specify the expected date for the final sale agreement to be signed.

Is a Letter of Intent legally binding?

Generally, a Letter of Intent is not a legally binding contract for the sale or purchase of a business. However, certain provisions within the letter, such as confidentiality agreements and exclusivity clauses, can be binding. It is crucial to clearly state which parts, if any, are intended to be legally binding.

Can either party back out after signing a Letter of Intent?

Since the Letter of Intent is typically non-binding regarding the sale itself, both the buyer and the seller can usually back out of the deal. However, if there are binding clauses, such as confidentiality and exclusivity, the parties must adhere to those specific terms.

How is a Letter of Intent different from a Purchase Agreement?

A Letter of Intent is an initial document that outlines the basic terms of the purchase and shows the intent to enter into a sale. A Purchase Agreement is a detailed, legally binding contract that finalizes the sale of the business, including comprehensive terms and conditions. The Purchase Agreement is drafted after the Letter of Intent once terms are further negotiated and due diligence is completed.

Is it necessary to have a lawyer review the Letter of Intent?

Yes, it is advisable to have a lawyer review the Letter of Intent before it is signed. A lawyer can help ensure that the letter accurately reflects the buyer's intentions and identify any terms that might inadvertently bind you legally. They can also advise on any potential risks or issues.

How long is the due diligence period usually?

The due diligence period can vary significantly based on the complexity of the business and the agreement between the parties. It typically ranges from a few weeks to several months. The exact timeframe should be clearly stated in the Letter of Intent.

What happens after the Letter of Intent is signed?

After the Letter of Intent is signed, the buyer usually conducts a detailed investigation of the business, known as due diligence, to verify the business's financials, legal compliance, and other critical factors. During this period, negotiations continue, and if both parties agree to proceed, a Purchase Agreement is drafted based on the terms outlined in the Letter of Intent.

Can the terms outlined in the Letter of Intent be changed later?

Yes, the terms in the Letter of Intent are not final. They serve as a basis for negotiation. As the buyer learns more about the business during the due diligence period, either party can propose changes to the terms. Any changes must be mutually agreed upon and will be reflected in the final Purchase Agreement.

Common mistakes

-

Not Including All Relevant Parties: A common mistake is failing to include every party that has a legal interest in the business. This oversight can lead to issues later on, as each relevant party needs to be aware of and in agreement with the terms discussed.

-

Being Vague in Descriptions of What Is Being Purchased: Sometimes, individuals may use broad or vague language to describe the assets or shares being purchased. It's essential to be specific to prevent misunderstandings or disputes over what exactly is included in the sale.

-

Skipping Over the Non-Compete Clause: Not including a non-compete clause, or failing to detail its terms clearly, can result in the seller starting a competing business. This clause is crucial for protecting the buyer's investment.

-

Omitting the Date of Possession: Failing to stipulate when the buyer will take possession of the business can create confusion. Precise dates ensure that both parties have a clear understanding of the timeline.

-

Ignoring the Need for Confidentiality: When individuals neglect to include a confidentiality clause, sensitive information about the business can be inadvertently disclosed, potentially harming the business’s interests.

-

Forgetting to Clarify Terms of Financing: Another oversight is not specifying the terms of financing. This detail is critical in outlining how the purchase will be funded and ensures that both parties are on the same page.

-

Missing Deadline Dates: Excluding or being unclear about deadline dates for due diligence, financing approval, and closing can lead to delays. These deadlines help to keep the transaction moving forward promptly.

-

Legal and Regulatory Compliance: Sometimes, purchasers fail to address legal and regulatory compliance issues that may arise with the sale. It’s important to acknowledge and plan for any necessary approvals or inspections.

When filling out a Letter of Intent to Purchase Business form, considerable attention to detail is crucial. Each of these common mistakes can potentially hinder the progress or validity of the transaction. Therefore, it's advisable for parties involved to be thorough and precise, to ensure a smooth transition and to protect the interests of all parties involved.

Documents used along the form

When navigating through the process of purchasing a business, the Letter of Intent (LOI) to Purchase Business form is a significant first step. However, it rarely stands alone in the journey to a successful acquisition. Several other forms and documents are often used in conjunction with the LOI to ensure a thorough understanding and to facilitate a smooth transition from intent to actual purchase. These documents help to protect both the buyer and the seller, providing a clear framework for the transaction and highlighting any details that need further scrutiny.

- Non-Disclosure Agreement (NDA): This legal contract between at least two parties outlines confidential material, knowledge, or information that the parties wish to share with one another for certain purposes but wish to restrict access to or by third parties. An NDA ensures that sensitive information doesn't get leaked to competitors or the public.

- Due Diligence Checklist: This document is essential for the buyer to systematically verify the assets, liabilities, and operational viability of the business in question. It includes areas such as financials, legal compliance, employee contracts, and any liabilities.

- Asset Purchase Agreement: Used when buying or selling a business's assets, this agreement specifies the items to be purchased or sold, including but not limited to physical assets, intellectual property, and inventory. It provides specifics on what is included in the transaction.

- Stock Purchase Agreement: Relevant when the transaction involves the purchase of the company's stock rather than its assets, this agreement details the number of shares to be purchased, the price per share, and any representations or warranties.

- Bill of Sale: This document serves as the official record of the transaction and transfer of ownership of the assets or business from the seller to the buyer. It is a critical document that finalizes the sale.

- Employment Agreement: In cases where the buyer plans to retain the current employees or the seller (in a smaller business context), this agreement outlines the terms of employment, including roles, responsibilities, salary, and any confidentiality clauses.

- Lease Agreement: If the business operates out of a leased space, this agreement between the buyer and the landlord is crucial. It ensures that the buyer can continue to use the premises under the terms agreed upon with the seller or negotiate new terms.

- Franchise Agreement: When purchasing a franchised business, this agreement is necessary to understand the franchisor's terms, the relationship, and ongoing obligations such as fees, marketing requirements, and product sourcing.

Each of these documents plays a vital role in the complex process of acquiring a business. They provide a roadmap, ensuring due diligence, legality, and clarity at every step of the transaction. Working closely with a legal professional can help simplify this process, ensuring that each document is properly executed and serves its intended purpose without undermining the buyer's or seller's position.

Similar forms

-

Memorandum of Understanding (MOU): Much like the Letter of Intent to Purchase Business, a Memorandum of Understanding acts as a preliminary agreement between two parties. It outlines the basic terms and conditions under which the parties agree to proceed. Although not always legally binding in all of its parts, an MOU signifies a mutual intention to move forward. Both documents serve as foundational steps towards a more formal agreement, providing a structure for the negotiations that follow.

-

Term Sheet: A Term Sheet shares similarities with the Letter of Intent in that it summarizes the key financial and other terms of a proposed investment or business sale. It is commonly used in venture capital transactions or major business deals to outline the terms of an investment or acquisition before drafting full legal documents. Both the Term Sheet and the Letter of Intent serve to identify and agree on the basic terms of a deal, acting as a precursor to binding agreements.

-

Non-Binding Offer: This document, like the Letter of Intent to Purchase Business, is typically used in the early stages of a negotiation to indicate a willing buyer's price and terms under which they would be interested in proceeding with a transaction. It outlines the structure of the deal and the intention of the parties without creating a legal obligation to complete the deal. The key similarity lies in its non-binding nature, intended to facilitate further negotiation and agreement on finer details.

-

Heads of Agreement: Often used in international transactions, the Heads of Agreement document outlines the initial understanding and principles of a deal, similar to a Letter of Intent. It sets out the framework within which the parties agree to negotiate the final terms of a deal. While it can be legally binding if specified, it generally serves the same purpose as a Letter of Intent, which is to signal the intent of the parties to continue negotiations in good faith based on agreed-upon principles.

Dos and Don'ts

When approaching the completion of the Letter of Intent to Purchase Business form, adhering to both dos and don'ts ensures clarity, legitimacy, and forward momentum in the business acquisition process. Below is a compilation of critical best practices and pitfalls to avoid.

- Do ensure all provided information is accurate and current to prevent legal and financial discrepancies.

- Do include comprehensive contact details for all involved parties to facilitate straightforward communication.

- Do specify the terms of payment clearly, including any intended timelines, to preempt misunderstandings and disputes.

- Do use professional language that reflects the seriousness of the intent and fosters mutual respect among parties.

- Don't leave any required fields blank; incomplete forms can delay or derail the intended purchase.

- Don't guess on details or figures. If uncertain, verify the information before including it on the form.

- Don't overlook the necessity of reviewing the entire document for errors or omissions before submission.

- Don't hesitate to seek legal advice for any clauses or terms that are unclear or seem unfavorable.

- Don't use informal or vague language that could lead to misinterpretations or legal vulnerabilities.

Misconceptions

When considering the pursuit of acquiring a business, potential buyers often turn to the Letter of Intent (LOI) to Purchase Business as a starting point. However, several misconceptions surround this crucial document, affecting both parties' understanding and expectations. Here, we aim to clarify some common misunderstandings to enhance the transaction process's effectiveness and transparency.

- Misconception: The LOI is legally binding in all its parts.

This is a common misunderstanding. Typically, the LOI serves as a framework for the negotiations and outlines the transaction's terms and conditions. However, it is not entirely binding except for specific provisions such as confidentiality and exclusivity, which are clearly stated to be binding.

- Misconception: An LOI is unnecessary if the buyer and seller have an agreement in principle.

Even when both parties have an informal agreement, an LOI plays a critical role by documenting the agreed-upon terms, setting the transaction's foundation, and guiding the due diligence and formal agreement drafting process. It brings structure to the negotiation, helping avoid misunderstandings later on.

- Misconception: A Letter of Intent gives the buyer the right to purchase the business.

An LOI does not grant the buyer an inherent right to purchase the business. It signals the intent to enter into negotiations under specified terms. The actual purchase is contingent upon agreement on a final contract after due diligence and negotiation.

- Misconception: The terms outlined in the LOI cannot be changed.

The terms within an LOI are not set in stone. They represent the initial understanding and expectations of both parties. As the due diligence process unfolds, findings may necessitate adjustments to the initial terms before reaching a definitive purchase agreement.

- Misconception: Submitting an LOI forces one to complete the transaction.

Submitting an LOI does not obligate either party to finalize the deal. It is a step towards negotiation, where either party can walk away if the transaction does not meet their criteria or if they fail to reach a final agreement.

- Misconception: An LOI is just a formality and holds little importance.

Contrary to this belief, an LOI holds significant importance as it lays the groundwork for the negotiation process, outlines the deal's structure, and provides a roadmap for due diligence. It signals a serious intent to pursue the transaction, guiding both parties towards a formal agreement.

- Misconception: There's no need for legal review of an LOI since it's not a final agreement.

Given that certain sections of the LOI can be legally binding, such as confidentiality and non-disclosure agreements, a legal review is crucial to protect all parties' interests and to clarify the binding and non-binding aspects of the document.

- Misconception: The LOI should cover every detail of the transaction.

While it's important for the LOI to outline the transaction's key terms and conditions, it is not meant to cover every detail. The definitive agreements will contain the comprehensive and final terms. The LOi's role is to establish the basic structure and agreement to proceed.

- Misconception: Any party can draft an LOI without professional advice.

Although it's possible for either party to draft an LOI, professional guidance is advisable to ensure that the document meets legal standards and adequately protects all parties' interests. Without professional input, parties might inadvertently commit to terms that are not in their best interest or overlook critical aspects of the transaction.

Understanding the nuances of a Letter of Intent to Purchase Business can pave the way for smoother negotiations and a more structured transaction process. By dispelling these common misconceptions, parties can approach the LOI with the seriousness and attention it deserves, leading to a more informed and effective negotiation.

Key takeaways

When you're ready to take the significant step of expressing your intent to purchase a business, utilizing a Letter of Intent (LOI) to Purchase Business form is an initial stride toward negotiating the terms of the acquisition. Here are five key takeaways to keep in mind as you embark on filling out and using this essential document:

- Clarify Intentions Clearly: The LOI serves as a preliminary agreement between you and the seller, outlining the basic terms and conditions of the sale. It's crucial to be as clear and detailed as possible about your intentions and the aspects of the deal. This clarity helps prevent misunderstandings and sets the foundation for a smoother negotiation process.

- Non-Binding Agreement: Typically, an LOI is not a legally binding contract to purchase the business, but certain components, such as confidentiality provisions, can be binding. Understanding what parts of your LOI are legally enforceable is essential to protect your interests during the negotiation phase.

- Due Diligence Period: The LOI should specify a due diligence period, granting you time to thoroughly examine the business's financials, operations, and legal standings. This period is crucial for making an informed decision and should be negotiated to allow adequate time for a comprehensive review.

- Exclusivity: Including an exclusivity clause in your LOI can be beneficial, as it restricts the seller from negotiating with other potential buyers for a specified period. This can ensure that your investment in due diligence and negotiation efforts is not undermined by other offers.

- Professional Guidance is Key: While an LOI might seem straightforward, having a professional, such as a lawyer, review or draft your document can safeguard your interests. Legal professionals can help identify any potential issues and ensure that the LOI accurately reflects your intentions and the nuances of the deal.

A Letter of Intent to Purchase Business form is a critical start to the process of acquiring a business, serving as a blueprint for the subsequent negotiations. Taking these key takeaways into account will help facilitate a smoother transaction and pave the way for successful business ownership.

Find Other Types of Letter of Intent to Purchase Business Documents

How to Create Letter of Intent - By submitting this form, you're taking the first step in the journey of securing funding, making a preliminary case for your project's financial needs and its potential to create meaningful change.