Valid LLC Share Purchase Agreement Template

Entering the world of business transactions, particularly those involving the intricate structure of a Limited Liability Company (LLC), requires a keen understanding and meticulous attention to detail. At the heart of these transactions often lies the LLC Share Purchase Agreement, a critical document that facilitates the seamless transfer of ownership interests in an LLC. This agreement encompasses several key aspects, including the terms and conditions of the sale, the identification of the parties involved, the representations and warranties of both the buyer and the seller, and any conditions precedent to the closing of the transaction. Additionally, it addresses the obligations and rights of all parties post-transaction, providing a comprehensive framework for both the transfer process and the implications thereafter. Understanding each component of the LLC Share Purchase Agreement is essential for stakeholders to ensure that their interests are adequately protected and that the transaction adheres to the relevant legal and regulatory standards.

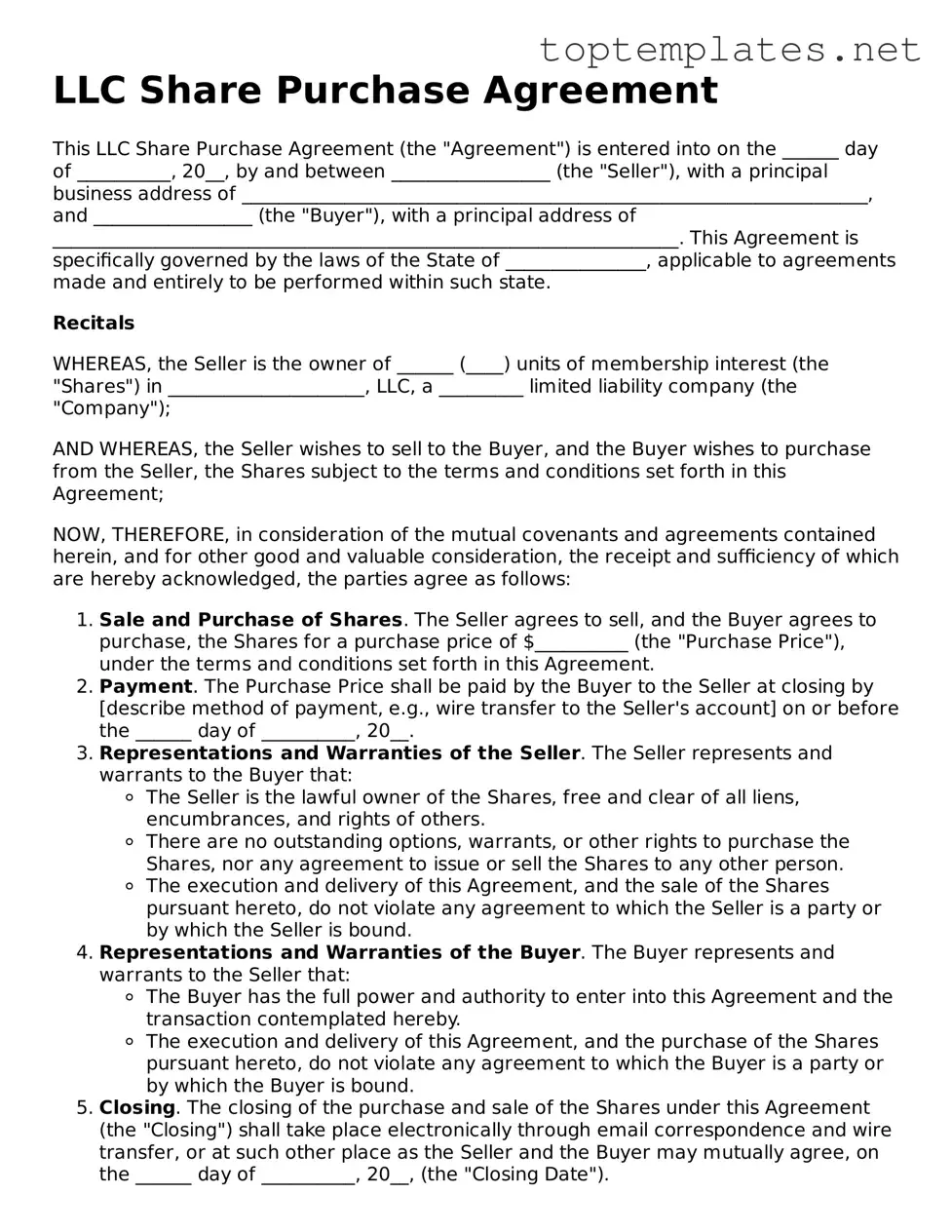

Sample - LLC Share Purchase Agreement Form

LLC Share Purchase Agreement

This LLC Share Purchase Agreement (the "Agreement") is entered into on the ______ day of __________, 20__, by and between _________________ (the "Seller"), with a principal business address of ___________________________________________________________________, and _________________ (the "Buyer"), with a principal address of ___________________________________________________________________. This Agreement is specifically governed by the laws of the State of _______________, applicable to agreements made and entirely to be performed within such state.

Recitals

WHEREAS, the Seller is the owner of ______ (____) units of membership interest (the "Shares") in _____________________, LLC, a _________ limited liability company (the "Company");

AND WHEREAS, the Seller wishes to sell to the Buyer, and the Buyer wishes to purchase from the Seller, the Shares subject to the terms and conditions set forth in this Agreement;

NOW, THEREFORE, in consideration of the mutual covenants and agreements contained herein, and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties agree as follows:

- Sale and Purchase of Shares. The Seller agrees to sell, and the Buyer agrees to purchase, the Shares for a purchase price of $__________ (the "Purchase Price"), under the terms and conditions set forth in this Agreement.

- Payment. The Purchase Price shall be paid by the Buyer to the Seller at closing by [describe method of payment, e.g., wire transfer to the Seller's account] on or before the ______ day of __________, 20__.

- Representations and Warranties of the Seller. The Seller represents and warrants to the Buyer that:

- The Seller is the lawful owner of the Shares, free and clear of all liens, encumbrances, and rights of others.

- There are no outstanding options, warrants, or other rights to purchase the Shares, nor any agreement to issue or sell the Shares to any other person.

- The execution and delivery of this Agreement, and the sale of the Shares pursuant hereto, do not violate any agreement to which the Seller is a party or by which the Seller is bound.

- Representations and Warranties of the Buyer. The Buyer represents and warrants to the Seller that:

- The Buyer has the full power and authority to enter into this Agreement and the transaction contemplated hereby.

- The execution and delivery of this Agreement, and the purchase of the Shares pursuant hereto, do not violate any agreement to which the Buyer is a party or by which the Buyer is bound.

- Closing. The closing of the purchase and sale of the Shares under this Agreement (the "Closing") shall take place electronically through email correspondence and wire transfer, or at such other place as the Seller and the Buyer may mutually agree, on the ______ day of __________, 20__, (the "Closing Date").

- Governing Law. This Agreement shall be governed by and construed in accordance with the laws of the State of _______________ without regard to its conflict of laws principles.

- Entire Agreement. This Agreement constitutes the entire agreement between the parties relating to the subject matter hereof and supersedes all prior agreements, understandings, negotiations, and discussions, whether oral or written, of the parties.

- Amendment. This Agreement may only be amended or modified by a written instrument executed by both the Seller and the Buyer.

- Notices. All notices, requests, demands, and other communications under this Agreement shall be in writing and shall be deemed to have been duly given on the date of service if served personally on the party to whom notice is to be given, or on the third day after mailing if mailed to the party to whom notice is to be given, by first-class mail, registered or certified, postage prepaid, and properly addressed as follows:

- For the Seller: ____________________________________________________

- For the Buyer: _____________________________________________________

IN WITNESS WHEREOF, the parties have executed this Agreement as of the date first above written.

SELLER:

__________________________________

Date: ____________________

BUYER:

__________________________________

Date: ____________________

File Breakdown

| Fact Name | Description |

|---|---|

| Purpose | The LLC Share Purchase Agreement form is used when an individual or entity agrees to buy shares from an LLC, transferring ownership of those shares under specified terms and conditions. |

| Legally Binding | This agreement, once signed by all parties, becomes a legally binding document that enforces the terms of the sale and purchase of shares. |

| Contents | It typically includes details such as the identification of parties, number of shares being sold, purchase price, representations and warranties, and conditions precedent to closing. |

| Governing Laws | The agreement is governed by the state laws in which the LLC is registered. Each state may have unique requirements affecting the agreement. |

| Confidentiality | Often contains clauses that ensure the transaction and its terms remain confidential, safeguarding the interests of both the buyer and seller. |

| Dispute Resolution | Includes provisions on how disputes related to the agreement will be resolved, potentially including arbitration or court jurisdiction preferences. |

| Importance of Legal Review | Hiring a legal expert to review or draft the agreement is crucial to ensure that interests are protected and obligations are clearly outlined, minimizing future disputes. |

Steps to Filling Out LLC Share Purchase Agreement

Completing an LLC Share Purchase Agreement is a crucial step in the process of buying or selling ownership stakes in a limited liability company (LLC). This formal document outlines the specifics of the transaction, including the purchase price, payment terms, and any representations and warranties. To ensure the process progresses smoothly, it’s important to fill out the agreement accurately and thoroughly. Follow these steps to complete the form correctly.

- Begin with the date of the agreement at the top of the document.

- Enter the full legal names and addresses of both the buyer and the seller in the designated sections.

- Specify the name of the LLC whose shares are being bought and sold, including the state in which it is registered.

- Detail the number of shares being purchased and the price per share. This section should also include the total purchase price.

- Outline any payment terms agreed upon, such as a deposit or installment payments, and include specific dates if relevant.

- Include any representations and warranties from the seller regarding the condition and the legal standing of the shares being sold.

- If applicable, list any conditions precedent that must be fulfilled before the transaction can be completed.

- Provide details on how any disputes related to the agreement will be resolved, such as through arbitration or in a specific court jurisdiction.

- Specify any additional terms or conditions that were agreed upon by both parties that are pertinent to the share purchase agreement.

- Ensure both parties have their signatures witnessed and dated at the end of the document. This may require a neutral third party or a notary, depending on state laws and the specifics of the agreement.

Once the LLC Share Purchase Agreement is fully completed and signed by both parties, the next steps include fulfilling any conditions precedent outlined in the agreement, making the agreed-upon payments, and transferring the shares. It's important to retain copies of the completed agreement for both parties' records and to proceed with the necessary filings or notifications as required by state law and the LLC's operating agreement.

Discover More on LLC Share Purchase Agreement

What is an LLC Share Purchase Agreement?

An LLC Share Purchase Agreement is a legally binding contract that outlines the terms and conditions under which shares of a Limited Liability Company (LLC) are sold and purchased between a seller and a buyer. This document specifies the number of shares being sold, the price per share, and any conditions or warranties associated with the sale.

Why is an LLC Share Purchase Agreement important?

This agreement is vital as it ensures that both the buyer and the seller have a clear understanding of the terms of the transaction, thereby preventing future disputes. It also provides a legal framework that protects the interests of both parties and ensures that the share transfer is conducted smoothly and in compliance with applicable laws.

What are some key elements that should be included in an LLC Share Purchase Agreement?

Key elements include the identity of the buyer and seller, a description of the shares being sold, the purchase price and payment terms, representations and warranties of both parties, confidentiality obligations, dispute resolution mechanisms, and conditions precedent to the closing of the transaction.

How does an LLC Share Purchase Agreement differ from a Stock Purchase Agreement?

While both agreements are used for buying and selling ownership interests, an LLC Share Purchase Agreement is specifically designed for transactions involving limited liability companies, which are governed by different laws and regulations than corporations. In contrast, a Stock Purchase Agreement is used for transactions involving corporations and deals with the purchase of stock.

What happens if either party breaches the LLC Share Purchase Agreement?

In the event of a breach, the non-breaching party may seek remedies specified in the agreement, which often include damages, specific performance, or termination of the agreement. The exact recourse depends on the nature of the breach and the terms outlined in the agreement.

Do I need a lawyer to draft an LLC Share Purchase Agreement?

While it's possible to draft an agreement on your own, engaging a lawyer is highly recommended. A lawyer can ensure that the agreement complies with applicable laws and fully protects your rights and interests. They can also help negotiate terms and identify potential issues before they become problematic.

Can an LLC Share Purchase Agreement be modified after it has been signed?

Yes, an LLC Share Purchase Agreement can be modified after it has been signed, but any changes must be made in writing and agreed upon by all involved parties. This ensures that the modifications are legally binding and reflects the mutual consent of both the buyer and seller to the updated terms.

Common mistakes

When individuals are filling out an LLC Share Purchase Agreement, mistakes can often occur due to oversights or misunderstandings of the form's requirements. These errors can potentially lead to legal complications or delays in the transaction. Below are five common mistakes:

-

Not thoroughly verifying the identity and authority of the parties involved. Sometimes, individuals fill out these agreements without confirming if the other party is legally authorized to sell shares of the LLC. This includes ensuring that sellers have the right to sell the shares and that buyers are legally capable of purchasing them.

-

Omitting necessary attachments and supporting documents. The Share Purchase Agreement often requires attachments, such as the LLC's operating agreement, proof of ownership, and financial statements. Failure to attach these documents can lead to incomplete understanding of what is being purchased and the terms of the LLC's operation.

-

Ignoring state-specific regulations. Each state has its own rules regarding LLCs and the buying and selling of shares. Neglecting to align the agreement with state-specific laws can invalidate the agreement or cause future legal disputes.

-

Misunderstanding the terms and conditions. It is not uncommon for individuals to skim over the agreement without fully comprehending the terms, including payment schedules, dispute resolution procedures, and the rights and obligations of each party. This misunderstanding can lead to disagreements and breaches of contract.

-

Incorrectly describing the shares or ownership interest being purchased. Failing to accurately specify the number of shares, the class of shares (if applicable), and any limitations or rights associated with those shares can lead to significant misunderstandings and complications with ownership transition.

Addressing these mistakes requires careful review and, often, the advice of a legal professional. Doing so ensures that the Share Purchase Agreement accurately reflects the intentions of all parties and complies with relevant laws.

Documents used along the form

When finalizing an agreement for buying shares in a Limited Liability Company (LLC), the LLC Share Purchase Agreement form is central to the transaction. However, this document does not stand alone. Various other forms and documents are commonly utilized alongside the LLC Share Purchase Agreement to ensure a clear, comprehensive, and legally sound transaction. These additional documents help in detailing the terms, understanding the implications of the purchase, and fulfilling legal requirements.

- Due Diligence Checklist: This document outlines all necessary information and records that the buyer must review before purchasing the shares. It typically includes financial statements, contracts, and legal documents of the LLC.

- Bill of Sale: This provides written evidence of the sale and transfer of ownership of the LLC's assets from the seller to the buyer. It's a complementary document to the Share Purchase Agreement.

- Non-Compete Agreement: Often, the seller is required to sign this agreement, which restricts their ability to start or engage in a similar business within a certain geographic area and time frame after selling their shares.

- Disclosure Schedules: These schedules attached to the Share Purchase Agreement list any exceptions to the representations and warranties made by the seller, such as pending litigations or debts.

- Escrow Agreement: This agreement is used when part of the purchase price is held in escrow post-closing to secure indemnification obligations or to ensure certain conditions are met after the sale.

- Minutes of the Meeting of the Board of Directors: This document records the approval of the transaction by the LLC’s Board of Directors or Managers, exhibiting the company's consent for the sale.

Together, these documents provide a comprehensive framework for transferring ownership of LLC shares. Each serves a specific purpose, from detailing the transaction, providing legal protections, to ensuring both parties fulfill their agreed-upon obligations. Having a thorough understanding and proper execution of these accompanying documents is just as crucial as the LLC Share Purchase Agreement itself for a successful and legally compliant share transaction.

Similar forms

An Asset Purchase Agreement is akin to an LLC Share Purchase Agreement in that both are fundamental in business transactions involving the transfer of ownership. However, while the LLC Share Purchase Agreement focuses on the exchange of membership interests or shares in a company, an Asset Purchase Agreement covers the sale and purchase of the company’s assets. This may include tangible properties like equipment and real estate, as well as intangible assets such as trademarks and customer lists.

A Stock Purchase Agreement shares similarities with an LLC Share Purchase Agreement, as both pertain to the transfer of ownership interests. The key difference lies in the type of entity these agreements involve; a Stock Purchase Agreement is used for corporations. Despite this distinction, the essence of both documents is to detail the terms, conditions, and provisions under which shares (or stock) of an entity are sold and purchased by parties.

Mergers and Acquisitions Agreements (M&A) encompass a broad range of transactions, including those similar to the LLC Share Purchase Agreement when a company is being absorbed or combined with another. These agreements could involve the acquisition of shares, similar to a Share Purchase Agreement, or assets, depending on the structure of the deal. They set out the terms of how one company will be merged into another or how an entity will acquire another entity in its entirety.

Membership Interest Purchase Agreements are quite similar to LLC Share Purchase Agreements as they directly pertain to entities structured as limited liability companies (LLCs). These documents are used explicitly for the transaction of membership interests in an LLC, detailing the transfer of a member’s ownership stake to another party. The core function aligns with that of a Share Purchase Agreement, focusing on the change in ownership of interests within the company, but it is specifically tailored to the unique structure of LLCs, incorporating terms and provisions relevant to LLC governance and operation.

Dos and Don'ts

When you're ready to fill out an LLC Share Purchase Agreement, it's important to proceed carefully to ensure all aspects of the agreement are properly addressed and accurately reflected. Here's a list of dos and don'ts to help guide you through the process:

Do:Read the entire form before starting to fill it out to understand all the requirements and provisions.

Ensure that all parties involved in the transaction have agreed to the terms before any information is filled out on the form.

Use clear and precise language to avoid any ambiguity, especially when describing the amount and price of shares being transferred.

Verify the accuracy of all names, addresses, and other personal information of the parties involved.

Include detailed information about the payment terms, such as the amount, payment method, and any payment schedule agreed upon.

Consult with a legal advisor or attorney who specializes in business law if there are any doubts or unfamiliar terms.

Check if additional documents or steps are required by your state or local jurisdiction to complete the share purchase successfully.

Sign and date the form in front of a notary public, if required, to validate the agreement’s authenticity.

Make copies of the signed agreement for all parties involved for record-keeping and future reference.

Follow up on any post-agreement actions, such as filing the necessary documents with state agencies or updating the LLC operating agreement.

Rush through filling out the form without ensuring all information is complete and correct.

Ignore the specific legal requirements or formalities your state may have regarding LLC share transactions.

Forget to specify any conditions or contingencies that must be met before the transaction is finalized.

Overlook any restrictive covenants or clauses that could affect the sale or transfer of shares, such as right of first refusal.

Leave blanks on the form; if a section does not apply, indicate with “N/A” (not applicable) to show it was not overlooked.

Use vague or informal language that could lead to misinterpretation of the agreement’s terms.

Sign the agreement without ensuring that all parties fully understand and agree to its terms.

Assume verbal agreements will be enforceable; all important terms should be included in the written agreement.

Fail to keep a secure, easily accessible record of the signed agreement.

Dismiss the possibility of consulting with a legal professional for advice or review of the agreement.

Misconceptions

Understanding an LLC Share Purchase Agreement can sometimes be challenging, particularly if you're encountering misinformation or unfounded beliefs. It's essential to dispel these misconceptions to approach these agreements with a clearer perspective. Here are four common misconceptions:

Anyone Can Easily Fill Out and Understand the Agreement: While templates are available, crafting an effective LLC Share Purchase Agreement requires a deep understanding of your business, the laws of your state, and the specifics of the transaction. It's not merely filling in blanks; each section needs to represent accurately the agreement between the parties involved.

It's Only About Transferring Shares: Beyond the exchange of shares, these agreements often cover various critical elements such as representations and warranties, conditions precedent to the closing, covenants, indemnification, and possibly the future relationship between the parties. Each of these aspects is crucial for the protection and clarity of the agreement.

Legal Assistance Isn't Necessary: Given the complexity and the legal ramifications involved, seeking legal advice is not just recommended; it's prudent. A legal professional can help navigate the complexities of the agreement, ensuring that your rights are protected and that you fully understand the terms and implications of the transaction.

All LLC Share Purchase Agreements Are the Same: While many agreements follow a general format, the details and provisions can vary significantly based on the nature of the business, the state laws, and the specific terms negotiated by the parties. Customizing the agreement to align with your specific needs and situation is crucial.

Addressing these misconceptions can help ensure that you are better prepared and informed when dealing with an LLC Share Purchase Agreement. Remember, understanding the nuances and seeking appropriate guidance is key to protecting your interests in any business transaction.

Key takeaways

Filling out and using the LLC Share Purchase Agreement form is a crucial step in transferring ownership of shares within a limited liability company (LLC). This document not only outlines the sale details but also legally binds both parties to the terms. Here are key takeaways to ensure the process is handled correctly and efficiently:

- Accuracy is Critical: Every detail in the agreement must be accurate and reflect the true intentions of the parties involved. This includes the names of the buyer and seller, the number of shares being transferred, and the price per share. Inaccuracies can lead to disputes or even nullification of the agreement.

- Understand All Terms: Both parties should carefully review and understand every term and condition listed in the agreement. This includes payment schedules, representations and warranties of the seller, and any conditions precedent to the sale. Misunderstandings could affect the rights and obligations of either party.

- Compliance with Laws: The agreement must comply with all relevant state laws governing LLCs and share sales. This ensures the sale is legally valid and enforceable. It's often advisable to consult with a legal professional to ensure full compliance.

- Confidentiality: The agreement may contain confidentiality clauses to protect sensitive information about the LLC and the transaction. Parties should be aware of these provisions and their implications for disclosing information about the deal.

- Execution and Witnesses: Proper execution of the agreement is essential for it to be legally binding. This typically means that both parties need to sign the document in the presence of witnesses or a notary. Ensuring the agreement is correctly executed helps safeguard against future legal challenges.

By focusing on these key takeaways, parties can better navigate the complexities of completing an LLC Share Purchase Agreement. It's a vital step in ensuring that the share transfer process proceeds smoothly and without legal complications.

Consider Other Documents

Rental Application Form Template - A foundational document in the rental process, paving the way for a detailed evaluation of potential renters.

Texas Temporary Tag - Supports the Texas DMV process by offering a provisional registration solution.

Form 6059B Customs Declaration - Non-compliance with the requirements of the CBP 6059B can result in confiscation of goods or monetary penalties.