Valid Loan Agreement Template

When entering into a financial transaction as significant as a loan, whether you're the lender or the borrower, it's vital to lay out the terms clearly and protect both parties involved. This is where a Loan Agreement form plays a crucial role. It not only details the loan amount and repayment plan but also encompasses interest rates, collateral requirements (if any), and the consequences of defaulting on the loan. This document serves as a legal record of the loan, providing a clear roadmap for repayment and offering security and peace of mind to everyone involved. Additionally, the Loan Agreement form addresses any pertinent legalities specific to the jurisdiction in which the loan is made, ensuring compliance with local laws and regulations. By covering these major aspects, the Loan Agreement form stands as a cornerstone in formalizing the lending process, safeguarding interests, and setting the stage for a successful financial partnership.

Loan Agreement Form Categories

Sample - Loan Agreement Form

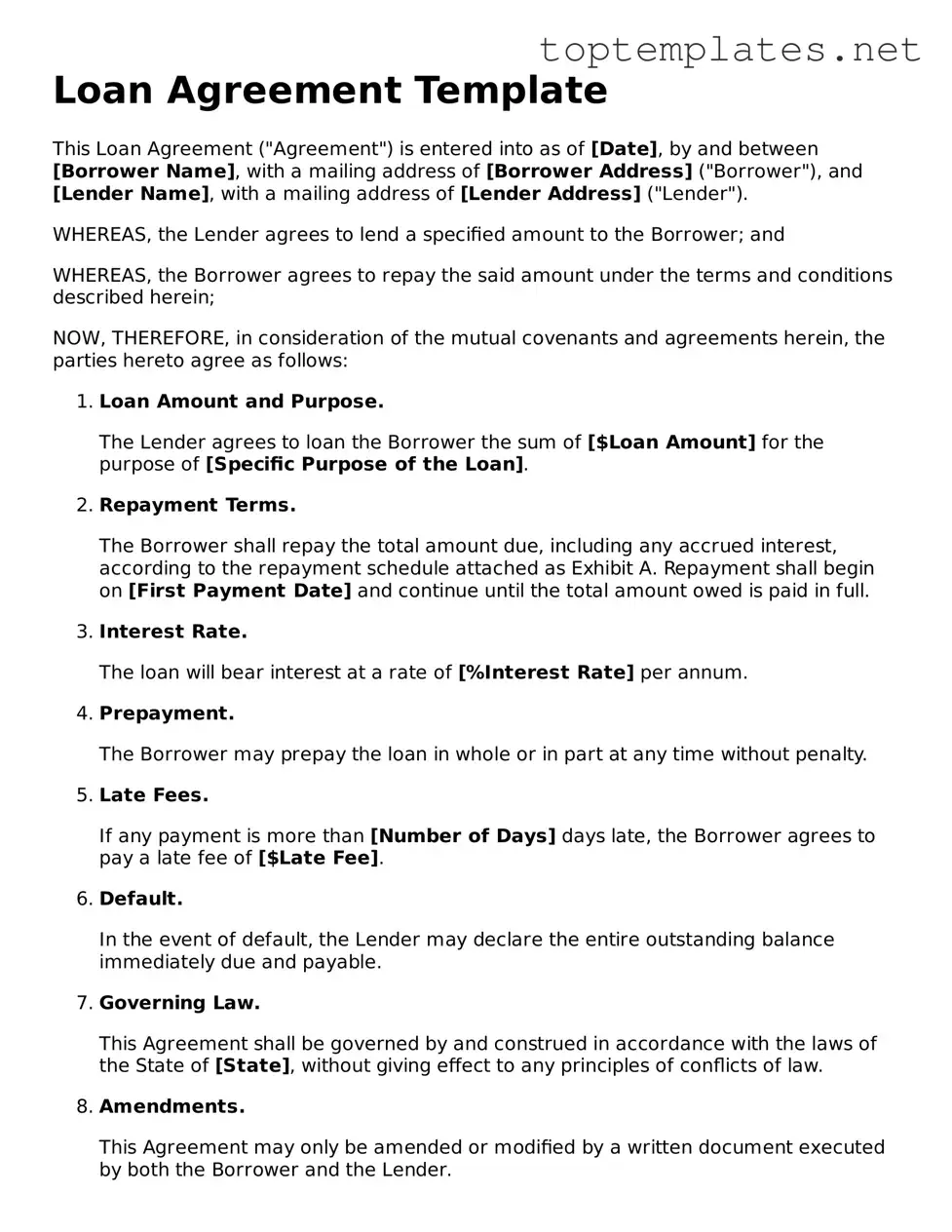

Loan Agreement Template

This Loan Agreement ("Agreement") is entered into as of [Date], by and between [Borrower Name], with a mailing address of [Borrower Address] ("Borrower"), and [Lender Name], with a mailing address of [Lender Address] ("Lender").

WHEREAS, the Lender agrees to lend a specified amount to the Borrower; and

WHEREAS, the Borrower agrees to repay the said amount under the terms and conditions described herein;

NOW, THEREFORE, in consideration of the mutual covenants and agreements herein, the parties hereto agree as follows:

- Loan Amount and Purpose.

The Lender agrees to loan the Borrower the sum of [$Loan Amount] for the purpose of [Specific Purpose of the Loan].

- Repayment Terms.

The Borrower shall repay the total amount due, including any accrued interest, according to the repayment schedule attached as Exhibit A. Repayment shall begin on [First Payment Date] and continue until the total amount owed is paid in full.

- Interest Rate.

The loan will bear interest at a rate of [%Interest Rate] per annum.

- Prepayment.

The Borrower may prepay the loan in whole or in part at any time without penalty.

- Late Fees.

If any payment is more than [Number of Days] days late, the Borrower agrees to pay a late fee of [$Late Fee].

- Default.

In the event of default, the Lender may declare the entire outstanding balance immediately due and payable.

- Governing Law.

This Agreement shall be governed by and construed in accordance with the laws of the State of [State], without giving effect to any principles of conflicts of law.

- Amendments.

This Agreement may only be amended or modified by a written document executed by both the Borrower and the Lender.

- Notices.

All notices under this Agreement shall be sent to the addresses provided at the beginning of this Agreement, or to such other address as either party may, from time to time, provide to the other party.

- Severability.

If any provision of this Agreement is determined to be unlawful or unenforceable, the remaining provisions of the Agreement will continue in effect.

- Entire Agreement.

This Agreement constitutes the entire agreement between the parties concerning the subject matter herein and supersedes all previous agreements and understandings, whether oral or written.

- Signature.

IN WITNESS WHEREOF, the parties have executed this Agreement as of the first date above written.

Borrower Signature: ___________________________

Lender Signature: _____________________________

File Breakdown

| Fact Number | Description |

|---|---|

| 1 | Loan agreements outline the terms under which a lender provides a loan to a borrower. |

| 2 | They specify the loan amount, interest rate, repayment schedule, and any collateral securing the loan. |

| 3 | The agreements serve to protect both the lender's and borrower's interests. |

| 4 | Interest rates can be fixed or variable, impacting the repayment amount. |

| 5 | Default provisions are included, detailing consequences for failing to meet the agreement's terms. |

| 6 | Governing laws are specified, which determine the legal jurisdiction in the event of a dispute. |

| 7 | For state-specific forms, local laws and regulations can greatly affect the terms and enforceability of the agreement. |

| 8 | Prepayment terms may allow the borrower to pay off the loan early, potentially reducing interest paid over time. |

| 9 | Loan agreements must be signed by all parties involved to be legally binding. |

Steps to Filling Out Loan Agreement

Completing a Loan Agreement form is a critical step in formalizing the terms of a financial arrangement between a lender and a borrower. It outlines the obligations of each party and provides legal protection in case of a dispute. Whether you're a first-time borrower/lender or have engaged in loan transactions before, following these steps carefully will help ensure the agreement reflects your intentions and complies with applicable laws.

- Gather necessary information including the full legal names and contact details of both the lender and the borrower. Additionally, ascertain the loan amount, interest rate, repayment schedule, and any collateral involved.

- Begin by filling out the date on which the Loan Agreement is being entered into. This date is crucial as it marks the official commencement of your agreement's terms and conditions.

- Enter the full legal names and addresses of the lender and borrower in their respective fields to identify the parties involved.

- Specify the loan amount in words and numbers to avoid any confusion. This clarity ensures both parties understand the magnitude of the financial obligation.

- Detail the loan's interest rate. If it's a fixed rate, indicate the percentage; if it's variable, describe how it will be calculated. This rate affects the total amount to be repaid and must be agreed upon by both parties.

- Outline the repayment terms, including the start date, the frequency of payments (monthly, quarterly, etc.), and the duration of the repayment period. This schedule provides a clear roadmap for the borrower to fulfill their obligation.

- If collateral secures the loan, describe the asset in detail to ensure both parties understand what is at stake. Clarifying this can prevent misunderstandings and legal issues in the future.

- Include any additional clauses or conditions both parties have agreed upon. These might cover scenarios such as early repayment penalties or what happens in the event of a default.

- Both the lender and borrower must sign and date the Loan Agreement. Witnesses or notarization may also be required, depending on the legal requirements in your jurisdiction. Verify these details to ensure your agreement is legally binding.

- Keep a copy of the signed agreement for your records and provide one to the other party. This ensures both the lender and borrower have a reference for the loan’s terms and conditions.

After completing these steps, your Loan Agreement will be ready to serve as a formal record of the financial arrangement. Remember, this document not only outlines the loan's specifics but also protects both parties' interests. It's always a wise choice to review the agreement one more time before signing to ensure all details are correct and mutually agreeable. If necessary, consider consulting with a legal professional to clarify any aspects of the agreement. This careful approach can help prevent future disputes and ensure a smooth lending and borrowing process.

Discover More on Loan Agreement

What is a Loan Agreement?

A Loan Agreement is a formal contract between a borrower and a lender that outlines the terms and conditions of a loan. The agreement details the loan amount, interest rate, repayment schedule, and the obligations and rights of both parties involved.

Why do I need a Loan Agreement?

Having a Loan Agreement is crucial as it legally binds the lender and the borrower to the terms set forth in the agreement. It protects both parties if there are disagreements or the borrower fails to repay the loan as agreed. It clearly specifies the recourse available to the lender and ensures there is a legal framework for repayment.

What should be included in a Loan Agreement?

A comprehensive Loan Agreement should include the following information: the loan amount, interest rate, repayment schedule, collateral details (if any), late fees, provisions for loan prepayment, and legal recourse in case of default. Additionally, it should detail the obligations and rights of both the borrower and the lender.

Can I write my own Loan Agreement?

Yes, you can draft your own Loan Agreement. However, it's essential to ensure that the agreement complies with state and federal laws and includes all necessary legal provisions to protect your interests. Seeking advice or review by a legal professional can help ensure your agreement is valid and enforceable.

How do I make my Loan Agreement legally binding?

To make a Loan Agreement legally binding, both the borrower and the lender must sign the document. Often, it is also recommended to have the signatures notarized to further authenticate the agreement and protect against disputes. Following state-specific requirements for such agreements can also ensure their enforceability.

Do I need to register my Loan Agreement with any government authorities?

Most personal Loan Agreements do not need to be registered with government authorities. However, depending on your jurisdiction and if the loan involves collateral, you might need to register the agreement or a related statement to protect the collateral. It's advisable to check local laws to confirm registration requirements.

What happens if the borrower defaults on the loan?

If the borrower defaults on the loan, the recourse actions outlined in the Loan Agreement can be pursued. This might include imposing late fees, seizing collateral, or taking legal action to recover the loan amount. The specific steps will depend on the terms of the Loan Agreement and applicable state and federal laws.

Can a Loan Agreement be modified?

Yes, a Loan Agreement can be modified if both the borrower and the lender agree to the changes. The modifications should be made in writing and signed by both parties, similar to the original agreement, to ensure the changes are legally binding.

What is the difference between a Loan Agreement and a Promissory Note?

While both documents are similar in that they outline a promise to pay a debt, a Loan Agreement is more detailed and includes comprehensive terms and conditions of the loan, such as repayment schedule, interest rate, and legal recourse. A Promissory Note, on the other hand, is typically simpler and outlines the basic details of the promise to pay a sum of money. A Loan Agreement provides more protection and clarity for both parties involved.

Common mistakes

When filling out a Loan Agreement form, it's crucial to approach the task with precision and understanding. Often, people make mistakes that can lead to misunderstandings, disputes, or even legal complications down the line. Here, we explore four common mistakes to be aware of and avoid.

-

Not Specifying the Loan Terms Clearly: One of the most critical aspects of a Loan Agreement is the detailed specification of the loan terms. This includes the loan amount, interest rate, repayment schedule, and any collateral. A common mistake is not defining these terms clearly or precisely enough, leading to ambiguity and potential disagreements. It’s essential to outline all these elements in unambiguous language to ensure both parties have a clear understanding of their obligations and rights.

-

Omitting Late Fees and Consequences of Default: Often underestimated, the sections detailing the late fees and the consequences of a default are sometimes overlooked or not specified with enough detail. This omission can render it difficult to enforce penalties or take action if the borrower fails to make payments according to the agreed schedule. By clearly outlining the repercussions of late payments and defaults, both parties are better protected and understand the seriousness of these issues.

-

Failing to Include a Governing Law Clause: Every Loan Agreement should specify the governing law, i.e., the state laws that will interpret and enforce the agreement. This mistake is especially common when agreements are made without legal assistance. The governing law clause ensures that, in the case of a dispute, both parties know which state's laws will apply, providing a clear path for legal recourse. Without this, there may be unnecessary confusion and conflict over jurisdiction in the event of legal action.

-

Not Having the Agreement Properly Witnessed or Notarized: Though not always a legal requirement, having a loan agreement witnessed or notarized adds a level of verification and formality to the document. Skipping this step might lead to questions about the authenticity of the agreement or the signatures involved, especially if the matter goes to court. Proper witnessing or notarization helps solidify the document's validity and can protect against claims of forgery or coercion.

Avoiding these mistakes can significantly increase the effectiveness and enforceability of a Loan Agreement. Both the lender and the borrower should take the time to review the document carefully, ensuring it is comprehensive, clear, and legally robust. This not only minimizes potential misunderstandings but also provides a strong foundation for the financial transaction and relationship.

Documents used along the form

When finalizing a loan agreement, several additional documents are typically required to ensure that all aspects of the loan process are covered comprehensively. These documents vary based on the nature of the loan, the parties involved, and regulatory requirements. Here is a list of documents that are frequently used in conjunction with a Loan Agreement form to secure the interests of both the lender and the borrower, and to adhere to legal standards.

- Promissory Note: This is a written promise by the borrower to pay back the borrowed amount to the lender. It includes details like the loan amount, interest rate, and repayment schedule.

- Amortization Schedule: This document outlines the payment schedule of the loan, showing the principal and interest breakdown of each payment over the life of the loan.

- Personal Guarantee: Required for business loans, this document makes an individual (usually a business owner) personally liable for the loan if the business fails to repay it.

- Mortgage or Deed of Trust: For real estate loans, this document secures the loan against the property being purchased, allowing the lender to foreclose if the borrower defaults.

- Security Agreement: This agreement provides the lender with a security interest in a specific asset or property (collateral) of the borrower in case of default.

- Disclosure Statement: A document that outlines the important terms and conditions of the loan, including the APR (Annual Percentage Rate), loan charges, and payment terms.

- Prepayment Penalty Disclosure: This document outlines any penalties the borrower would face if they choose to pay off the loan early.

- Compliance Agreement: It ensures that all parties agree to comply with relevant federal and state laws pertaining to the loan transaction.

- Insurance Documents: For certain types of loans, especially auto and home loans, insurance documents are required to prove that the collateral is insured against damage or loss.

- Government Monitoring Information: In compliance with fair lending laws, this form collects demographic information voluntarily provided by the borrower to prevent discrimination.

Together with the Loan Agreement, these documents play critical roles in clarifying the terms of the loan, protecting the interests of involved parties, and ensuring legal compliance. They form a comprehensive package that addresses various aspects of the borrowing and lending process, from repayment schedules and legal obligations to collateral and insurance requirements. As such, they are indispensable to the structuring of a transparent, fair, and legally sound loan agreement.

Similar forms

A Promissory Note shares similarities with a Loan Agreement as both outline the amount of money borrowed, the interest rate, and the repayment schedule. However, a promissory note is typically more straightforward and may not include as detailed provisions about the obligations of the parties.

A Mortgage Agreement is similar because it also involves a loan for a specific purpose, such as purchasing property, and includes terms for repayment. Plus, it grants the lender a security interest in the property until the loan is fully repaid.

An Employment Contract might not seem similar at first glance, but it shares the characteristic of setting out terms agreed upon by two parties. In this case, the terms are about employment rather than a loan, including responsibilities, benefits, and duration of employment.

A Lease Agreement is comparable because it involves one party agreeing to pay the other for use of an asset, similar to a loan’s structure of payments over time. However, it specifically relates to rental rather than lending money.

Lines of Credit Agreements are closely related to Loan Agreements as they both provide for borrowing terms. A line of credit agreement, though, offers access to funds up to a certain limit without a need to reapply for a new loan.

The Bill of Sale document, while more a receipt than a contract, is similar in documenting an agreement between two parties for the sale of items, detailing payment, just as a Loan Agreement details payment terms for money borrowed.

Lastly, a Service Agreement can resemble a Loan Agreement in that it outlines the terms of a service to be provided, including compensation, scope of work, and time frame. This stands parallel to how a Loan Agreement specifies the loan’s terms, including its repayment.

Dos and Don'ts

When filling out a Loan Agreement form, it's crucial to approach the process with care and attention to detail. This document outlines the terms and conditions of a loan between two parties and serves as a legal record. Below are both the steps you should follow and the mistakes you should avoid to ensure a smooth and disputable process.

Things You Should Do:

- Read the entire form carefully before you start filling it out to understand all the requirements and provisions.

- Ensure all the information you provide is accurate and true to the best of your knowledge.

- Include complete contact information for both the lender and the borrower to facilitate easy communication.

- Clearly specify the loan amount in words and numbers to prevent any confusion.

- Detail the repayment schedule, including the dates and amounts of payments, to establish clear expectations.

- Agree on the interest rate, if any, and state it clearly in the agreement.

- Specify the collateral for the loan, if applicable, to secure the agreement.

- Include a clause about late fees or penalties for missed payments to enforce timeliness.

- Have a section dedicated to any legal actions that will be taken in case of default.

- Sign the document in front of a witness or notary public, if required, to add an extra layer of legal protection.

Things You Shouldn't Do:

- Don't leave any fields blank. If a section doesn't apply, write "N/A" (not applicable) to indicate that.

- Don't rush through reading the agreement. Missing a critical detail could lead to misunderstandings or legal issues later.

- Don't use vague language. Be as specific as possible to avoid ambiguity.

- Don't forget to review the agreement for typos or errors, as these mistakes could affect the terms of the loan.

- Don't neglect to get a copy of the signed agreement for your records.

- Don't sign the agreement without understanding every term and condition it contains.

- Don't agree to terms that are unfair or unfavorable to you without attempting to negotiate better conditions.

- Don't omit the dates for payment deadlines, as specificity is key in legal documents.

- Don't exclude any agreed-upon terms from the written agreement. Oral agreements should be documented as well.

- Don't underestimate the importance of having a witness or notary public present during the signing to authenticate the document.

Misconceptions

A Loan Agreement form is a crucial document that outlines the terms and conditions between a borrower and a lender. Misunderstandings about this form can lead to confusion or disputes. Here are seven common misconceptions about Loan Agreement forms:

- All loan agreements are the same. This isn't true. While many loan agreements share common elements, such as interest rates and repayment schedules, they can vary significantly depending on the nature of the loan, the parties involved, and the jurisdiction. Customization is often necessary to address specific needs and legal requirements.

- You don’t need a loan agreement for personal loans between family or friends. Even when loaning money to known acquaintances, a loan agreement is crucial. It clarifies the terms and conditions of the loan, helping to prevent misunderstandings and preserve relationships. It also provides a legal framework for recourse if disagreements arise.

- The terms of a loan agreement are not negotiable. Before signing, both the borrower and lender can negotiate the terms of a loan agreement. This negotiation can help customize the agreement to better align with both parties' interests, including interest rates, repayment plans, and collateral requirements.

- Loan agreements only benefit the lender. While it might seem that loan agreements are designed to favor the lender, they also protect the borrower by defining the scope of the loan, the expectations for repayment, and any applicable interest. They ensure that the borrower knows exactly what they're agreeing to, which helps avoid potential disputes.

- A verbal agreement is enough for a loan. Relying on a verbal agreement is risky for both parties. Without a written loan agreement, the terms of the loan can be difficult to enforce or prove in a dispute. A written agreement serves as a tangible record of the commitments made by both the lender and the borrower.

- Loan agreements are too complex to understand without legal help. While loan agreements can be complex, they do not always require legal assistance to understand. Many templates provide clear explanations of the terms and conditions. However, for large or unusual loans, consulting with a legal professional can be beneficial to ensure that the agreement meets all legal requirements and adequately protects your interests.

- If you sign a loan agreement, you cannot renegotiate its terms. While it's true that a signed loan agreement is legally binding, parties can renegotiate its terms if both agree to the changes. Any amendments should be documented in writing and signed by both parties, just like the original agreement.

Key takeaways

When it comes to documenting a loan between two parties, a Loan Agreement form is an essential tool to ensure clarity and legal protection for both the lender and the borrower. Here are eight key takeaways to guide you in filling out and using a Loan Agreement effectively:

Accuracy is key: Ensure all parties’ details are accurate, including the legal names, addresses, and contact information. Mistakes here can lead to disputes or legal challenges later on.

Specify loan details: Clearly outline the loan amount, repayment schedule, interest rate, and any collateral. This specificity prevents misunderstandings.

Understand the interest rate: The interest rate should be agreed upon by both parties. It’s important to know whether it’s fixed or variable as this impacts the repayment amount.

Set clear repayment terms: Define how and when payments will be made (e.g., monthly on the first). Include what happens in case of late payments or default.

Include a clause on prepayment: Decide if the borrower can pay off the loan early and under what conditions. Sometimes, a prepayment penalty is applied.

Governing law: Specify which state's law will govern the agreement. Laws vary by state, and this will dictate how the agreement is interpreted and enforced.

Signatures are crucial: A Loan Agreement is not legally binding until it is signed by both parties. Ensure the document is signed and dated.

Keep records: Both the lender and the borrower should keep a copy of the signed agreement. This is essential for record-keeping and protects both parties if any issues arise.

Filling out and using a Loan Agreement with care can make the lending process smoother and safeguard the interests of both the borrower and the lender. Remember, it’s not just about the loan itself but about maintaining a good relationship throughout its duration.

Consider Other Documents

Work Incident Report Template - A necessary tool for maintaining compliance with workplace health and safety regulations and documenting due diligence.

Return to Work Note From Doctor - This form serves as an agreement between the employer, the correctional facility, and the inmate to ensure work conditions and schedules are met.

Miscarriage Symptoms - An invaluable tool for healthcare facilities, ensuring miscarrying women are informed about their miscarriage confirmation and fetal death certificate rights.