Valid Employee Loan Agreement Template

When employers offer financial assistance to their employees in the form of loans, the foundation of this assistance is often formalized through an Employee Loan Agreement form. This critical document serves not only as a testament to the employers' support but also as a legally binding contract that outlines the specific terms and conditions of the loan. Major aspects covered include the loan amount, repayment schedule, interest rates, and any consequences of late or missed payments. Additionally, it details any provisions for loan forgiveness under particular circumstances, ensuring clarity and mutual understanding between the employer and the employee. By meticulously outlining these key elements, the Employee Loan Agreement protects the interests of both parties and sets the stage for a transparent and accountable financial transaction. It’s a tool designed to prevent misunderstandings and foster trust, making it an essential document for businesses that opt to support their employees in this manner.

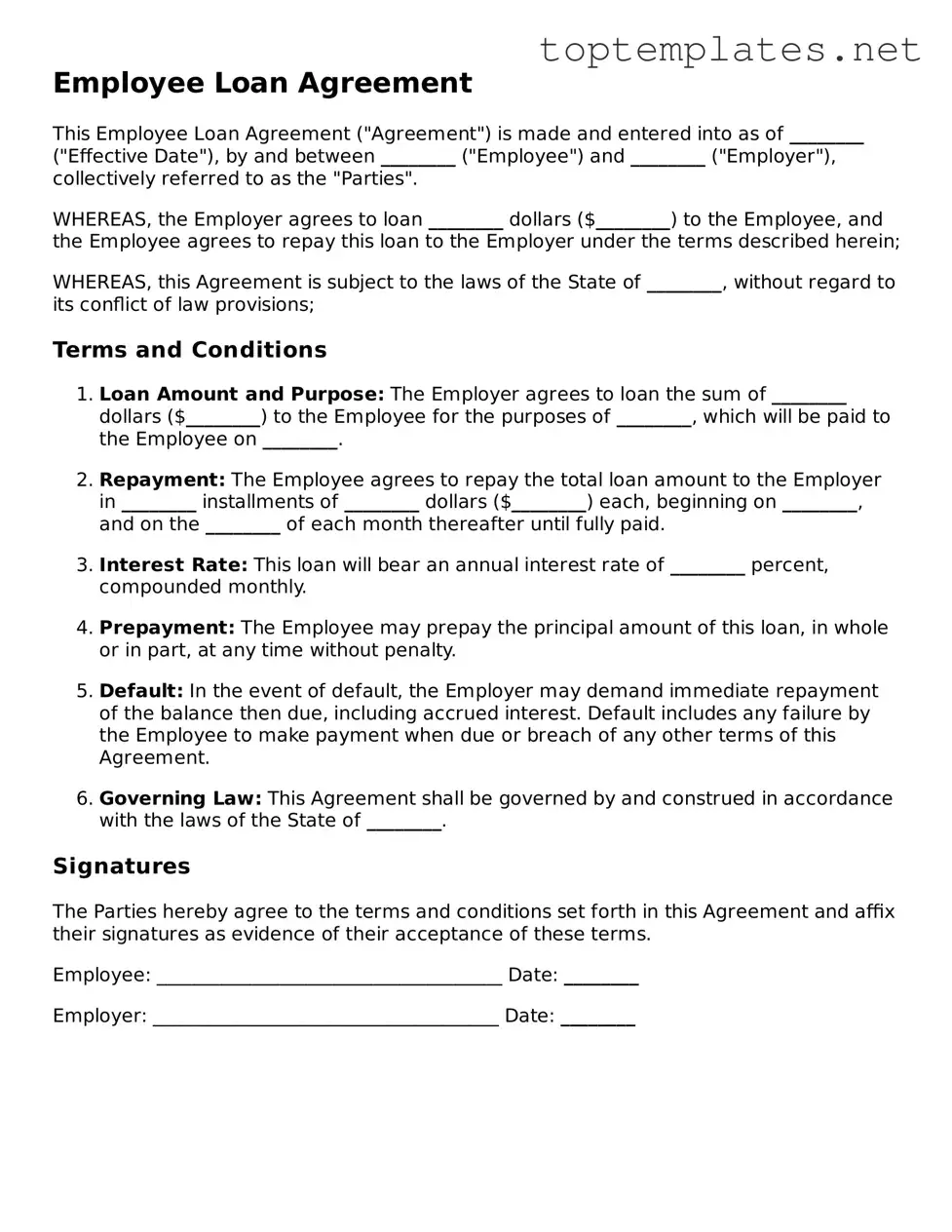

Sample - Employee Loan Agreement Form

Employee Loan Agreement

This Employee Loan Agreement ("Agreement") is made and entered into as of ________ ("Effective Date"), by and between ________ ("Employee") and ________ ("Employer"), collectively referred to as the "Parties".

WHEREAS, the Employer agrees to loan ________ dollars ($________) to the Employee, and the Employee agrees to repay this loan to the Employer under the terms described herein;

WHEREAS, this Agreement is subject to the laws of the State of ________, without regard to its conflict of law provisions;

Terms and Conditions

Loan Amount and Purpose: The Employer agrees to loan the sum of ________ dollars ($________) to the Employee for the purposes of ________, which will be paid to the Employee on ________.

Repayment: The Employee agrees to repay the total loan amount to the Employer in ________ installments of ________ dollars ($________) each, beginning on ________, and on the ________ of each month thereafter until fully paid.

Interest Rate: This loan will bear an annual interest rate of ________ percent, compounded monthly.

Prepayment: The Employee may prepay the principal amount of this loan, in whole or in part, at any time without penalty.

Default: In the event of default, the Employer may demand immediate repayment of the balance then due, including accrued interest. Default includes any failure by the Employee to make payment when due or breach of any other terms of this Agreement.

Governing Law: This Agreement shall be governed by and construed in accordance with the laws of the State of ________.

Signatures

The Parties hereby agree to the terms and conditions set forth in this Agreement and affix their signatures as evidence of their acceptance of these terms.

Employee: _____________________________________ Date: ________

Employer: _____________________________________ Date: ________

File Breakdown

| Fact Number | Detail |

|---|---|

| 1 | The Employee Loan Agreement form is a legally binding contract between an employer and an employee, outlining the terms for a loan provided by the employer to the employee. |

| 2 | It specifies the loan amount, repayment schedule, interest rate (if applicable), and any collateral involved. |

| 3 | Interest rates must be considered carefully to avoid creating a taxable benefit or running afoul of applicable usury laws, which vary by state. |

| 4 | Repayment can be structured in various ways, such as payroll deductions, lump sum payments, or regular bank transfers, as agreed upon in the form. |

| 5 | The form should include provisions regarding what happens if the employee leaves the company before the loan is fully repaid, including any acceleration of repayment. |

| 6 | State-specific forms may require adherence to specific governing laws, including but not limited to, the Truth in Lending Act (TILA) and state usury laws. |

| 7 | This agreement ensures that both parties have clear expectations regarding the loan, protecting both the employer’s financial interests and the employee's rights. |

Steps to Filling Out Employee Loan Agreement

Filling out an Employee Loan Agreement form marks a significant step in the process of obtaining a loan from your employer. This document outlines the terms and conditions of the loan, including repayment schedule, interest rates, and any other obligations. It's crucial that the information provided is accurate and comprehensive to ensure a smooth agreement process. Following these steps will guide you in completing the form correctly and efficiently.

- Start by entering the date at the top of the form. This should be the date on which the agreement is being filled out.

- Proceed to fill in the Employee Information section. Here, you will need to provide your full legal name, address, and contact details, including your email address and phone number.

- In the Loan Details section, specify the amount being borrowed. Ensure that the amount is written in both words and figures for clarity.

- Next, detail the purpose of the loan. Being specific is important, as this justifies the reason for the loan request.

- Under the Repayment Terms section, indicate the loan repayment period, the installment amount, and the interest rate, if applicable. Here, it’s essential to agree with the terms set forth by your employer and verify the accuracy of the numbers.

- Examine the General Provisions section carefully. This part includes crucial clauses about the agreement, such as confidentiality, breach of agreement, and other legal considerations.

- Both the employee and a company representative must sign the form. Ensure that the Employee’s Signature section is completed with your signature, printed name, and the date of signing.

- Similarly, complete the Employer’s Signature section. A designated company representative should provide their signature, printed name, and the date. This step formalizes the agreement and its commencement.

Upon completing these steps, the form will need to be submitted according to your employer's submission guidelines, which may include handing it in personally, via email, or through an internal company portal. Following submission, it's advisable to keep a copy of the signed agreement for your records. The next stage often involves the loan disbursement process, as detailed by your employer, along with any further documentation or steps required to finalize the loan transaction.

Discover More on Employee Loan Agreement

What is an Employee Loan Agreement?

An Employee Loan Agreement is a formal document that outlines the terms and conditions under which an employer lends money to an employee. This agreement covers the loan amount, repayment schedule, interest rate (if applicable), and consequences of non-repayment. It serves to protect both parties' interests and ensures clarity regarding the loan.

Why is it important to have a written Employee Loan Agreement?

Having a written agreement is crucial as it formally records the loan's terms, preventing misunderstandings between the employee and employer. It ensures both parties have a clear understanding of their obligations. Additionally, in case of a dispute, a written agreement provides a solid reference point that can help in resolving issues amicably or in legal proceedings.

What details should be included in an Employee Loan Agreement?

An effective Employee Loan Agreement should include the full names and contact information of both the employer and the employee, the loan amount, the purpose of the loan, repayment schedule, interest rate if any, consequences of late payments or non-repayment, and any collateral involved. It should also be signed and dated by both parties to signify their agreement to the terms.

Are interest rates required in Employee Loan Agreements?

Interest rates are not mandatory in Employee Loan Agreements. Whether to charge interest is at the discretion of the employer. However, if an interest rate is applied, it should be reasonable and clearly stated in the agreement to avoid any potential legal issues related to usury laws.

How can one enforce an Employee Loan Agreement?

If an employee fails to repay the loan as agreed, the employer has the right to take legal action based on the terms outlined in the Employee Loan Agreement. Before proceeding to legal action, it's often advisable to attempt resolving the situation through direct communication. If that fails, small claims court or civil court are potential avenues for enforcing the agreement, depending on the loan amount.

Can an Employee Loan Agreement be modified?

Yes, an Employee Loan Agreement can be modified, but any modifications must be agreed upon by both the employer and the employee. It is important to document these changes formally through a written amendment to the original agreement and to have both parties sign it to avoid future disputes.

What happens if an employee leaves the company with an outstanding loan?

If an employee leaves the company before repaying the loan in full, the repayment terms outlined in the Employee Loan Agreement still apply. The agreement may specify procedures for such situations, including immediate repayment or continued repayment as per the original schedule. Employers may also have the legal right to deduct the remaining loan amount from the employee's final paycheck, subject to state laws.

Common mistakes

Filling out an Employee Loan Agreement form requires careful attention to detail. Common mistakes can lead to misunderstandings, conflicts, and sometimes legal complications between the employee and the employer. Here are seven errors individuals frequently make when completing this document:

-

Not specifying the loan amount clearly. It's crucial to write down the exact loan amount in numbers and words. This helps prevent any confusion about how much money is being lent.

-

Omitting the repayment schedule. Many people forget to clearly define the repayment terms. This includes specifying the start date, frequency of payments (monthly, biweekly, etc.), and the end date or duration of the loan.

-

Ignoring the interest rate. If the loan carries interest, failing to mention the rate and how it's calculated can lead to disputes. This is particularly important if the interest rate is not fixed and may require clarity on how fluctuations are handled.

-

Failing to outline the consequences of default. The agreement should clearly state what constitutes a default and the actions that the lender can take if the borrower fails to make timely payments.

-

Leaving out the purpose of the loan. Although not always required, detailing the purpose of the loan can provide context and safeguard the lender by ensuring that the loan is used as intended.

-

Not documenting the agreement with signatures. A common oversight is not having the loan agreement signed and dated by both parties. This is crucial for the enforceability of the document.

-

Forgetting to mention the governing law. It's important to state which state's law will govern the agreement. This can be vital if any legal issues arise, as laws concerning loans and interest rates can vary significantly from one jurisdiction to another.

In addition to these mistakes, people often overlook the necessity of keeping a copy for their records or fail to involve a witness or notary during the signing, though not strictly required, these steps add another layer of veracity to the agreement. Handling the Employee Loan Agreement with thoroughness and precision ensures both parties are well-informed and protected throughout the duration of the loan.

Documents used along the form

When the topic is financial transactions between employers and employees, especially in the context of loan agreements, it's critical to approach the process with a collection of complementary documents. These documents serve to clarify terms, ensure repayment, and safeguard both parties' interests. Here's a concise list of other vital forms and documents often used alongside an Employee Loan Agreement form.

- Promissory Note: Outlines the borrower's promise to repay the loan under the agreed terms and conditions. It specifies the loan amount, interest rate, repayment schedule, and consequences of default.

- Loan Repayment Schedule: Provides a detailed timetable for repaying the loan, including the amount of each payment, due dates, and the breakdown of principal and interest.

- Amendment Agreement: Used to make any changes to the original Employee Loan Agreement, ensuring both parties agree to and document any modifications.

- Security Agreement: If the loan is secured with collateral, this document describes the collateral and outlines the conditions under which the lender can take possession if the loan is not repaid.

- Guaranty: A third party agrees to be responsible for the loan payment if the original borrower fails to repay, providing an additional layer of security for the lender.

- Release of Loan Agreement: Documents the fulfillment of all repayment obligations by the employee, officially concluding the loan agreement.

- Confidentiality Agreement: Protects sensitive financial and personal information discussed during the loan negotiation and execution process.

Together, these documents form a robust framework around the Employee Loan Agreement, ensuring clarity and protection for all involved parties. It's always recommended to review these documents carefully and consider legal advice to navigate the complexities and implications effectively.

Similar forms

Promissory Note: Like an Employee Loan Agreement, a Promissory Note is also a written promise to pay back a specified sum of money to another party by a certain date. It sets out the terms of repayment, similar to the detailed repayment schedule often found in loan agreements with employees.

Personal Loan Agreement: This document is quite like an Employee Loan Agreement in that it also outlines the terms under which money is lent to an individual. The key components, such as the loan amount, interest rate, repayment schedule, and consequences of default, are present in both types of agreements.

Employment Contract: While focusing on job specifics rather than a loan, an Employment Contract shares similarities with an Employee Loan Agreement in terms of being a legally binding agreement. It contains terms agreed upon by an employer and employee, including compensation and job responsibilities, much like how loan agreements outline loan terms and responsibilities.

Confidentiality Agreement: Although focused on the non-disclosure of information, a Confidentiality Agreement shares its legally binding nature with an Employee Loan Agreement. Both contracts involve agreements on specific behaviors between the two parties involved.

Mortgage Agreement: Similar to an Employee Loan Agreement, a Mortgage Agreement involves a loan but is specifically tied to the purchase of real estate. Both documents set forth the terms under which the loan will be repaid and outline the consequences of failing to make timely payments.

Car Loan Agreement: This agreement is similar to an Employee Loan Agreement in that it is a loan specifically used for purchasing a vehicle. Both documents detail the amount loaned, repayment schedule, interest rate, and the actions lenders can take in case of default.

Student Loan Agreement: Like an Employee Loan Agreement, a Student Loan Agreement outlines the terms and conditions of a loan provided to assist with education-related expenses. Key aspects like repayment terms, interest rates, and the borrower's obligations are clearly detailed in both types of agreements.

Business Loan Agreement: This type of agreement is very similar to an Employee Loan Agreement as both specify the terms of a loan. In a Business Loan Agreement, the focus is on funding business operations, including specifics on repayment, interest, and collateral, mirroring the structure seen in employee loans.

Lease Agreement: Although generally related to the rental of property rather than a loan, a Lease Agreement shares similarities with an Employee Loan Agreement in its specification of terms, conditions, and obligations of both parties, as well as in the provision of a legal framework should disputes arise.

Dos and Don'ts

When filling out the Employee Loan Agreement form, it is crucial to ensure the accuracy and clarity of all provided information. The following list outlines essential dos and don'ts to consider during this process:

- Do thoroughly read the entire form before beginning to fill it out. Understanding the requirements and details in advance can help prevent mistakes.

- Do use a black or blue pen if the form is being filled out by hand, as these colors are generally considered more formal and are easier to read.

- Do print legibly to prevent any misunderstandings or delays related to hard-to-read handwriting.

- Do verify all personal information, including your full legal name, address, and contact details, for accuracy.

- Do double-check figures and calculations related to loan amounts, interest rates, and repayment schedules to ensure they are correct.

- Don't leave any fields blank. If a particular section does not apply, write "N/A" (not applicable) to indicate this. This shows you did not overlook the section.

- Don't use correction fluid or tape. Mistakes should be neatly crossed out with a single line, and the correction should be initialed and written nearby.

- Don't forget to sign and date the form. An unsigned agreement is often considered invalid and can lead to unnecessary delays.

- Don't hesitate to ask for clarification if any part of the form is confusing. It's better to seek assistance than to fill out the form incorrectly.

Misconceptions

When discussing Employee Loan Agreements, it's crucial to address some of the common misconceptions that often arise. Understanding these misconceptions is important for both employers and employees as they navigate the complexities of such agreements.

One-size-fits-all: Many people believe that an Employee Loan Agreement form can be a standard, one-size-fits-all document. This isn't the case, as the specifics of the loan such as the amount, interest rate, repayment schedule, and consequences of non-repayment, should be tailored to each individual situation. A carefully crafted agreement can help prevent misunderstandings and legal issues down the line.

No need for witnesses or notarization: Another misconception is that these agreements don't need to be witnessed or notarized. While not all states require these formalities, having the agreement witnessed or notarized can add a layer of authenticity and can be crucial in cases where the agreement is disputed.

Verbal agreements are sufficient: Some employers and employees believe that a verbal agreement is good enough for an employee loan. This is risky. Verbal agreements are difficult to prove and enforce. For the sake of clarity and legal protection, it's always recommended to have a written agreement.

Only benefits the employer: It's a common belief that Employee Loan Agreements primarily benefit the employer. However, these agreements can also provide clear benefits to the employee by setting out the terms of the loan in a straightforward manner, thereby avoiding any potential misunderstandings over expectations or terms.

By understanding and addressing these misconceptions, both employers and employees can create a more transparent and equitable working relationship when it comes to the handling of employee loans.

Key takeaways

When businesses choose to extend loans to their employees, it's crucial that both parties understand their obligations and rights. An Employee Loan Agreement form serves as a formal document that outlines the terms and conditions of the loan provided by the employer to the employee. Below are key takeaways to consider when filling out and using the Employee Loan Agreement form:

- It is essential to provide complete and accurate information about both the employer and the employee. This includes full names, addresses, and contact information, ensuring that the agreement is legally binding.

- The loan amount and disbursement method should be clearly stated. Details on how and when the loan will be disbursed to the employee are fundamental to avoid any misunderstandings.

- Terms regarding the repayment schedule must be specific. Include the start date, the amount of each installment, and the frequency of repayments to help both parties manage their financial responsibilities effectively.

- The interest rate, if applicable, needs to be outlined in the agreement. Specifying whether the interest rate is fixed or variable is crucial for transparency and fairness.

- Consequences of late payments should be clearly defined. Detailing any fees or penalties for late payments upfront will encourage timely repayment and maintain a good employer-employee relationship.

- In situations where the employee leaves the company, the agreement should specify the impact on the loan repayment. Whether the loan becomes due immediately or continues per the original terms, it must be clearly defined.

- The document should include a clause about prepayment. If the employee wishes to repay the loan earlier than scheduled, terms regarding prepayment penalties or allowances need to be explicitly stated.

- Both the employer and the employee should review and sign the agreement. Having witnesses or a notary public can also lend additional legal validity to the document.

Utilizing the Employee Loan Agreement form with a comprehensive understanding and careful consideration of its components can prevent potential conflicts, ensuring a smooth financial transaction that benefits both the employer and the employee.