Free Louisiana act of donation PDF Form

In the legal landscape of Louisiana, the act of donation form serves as a pivotal document for the transfer of ownership of property from one individual to another, without the exchange of payment. This unique facet of Louisiana law, influenced by the state’s civil law traditions, sets it apart from the more common law-oriented procedures found in other U.S. states. It is fundamental for both parties involved in the donation to understand the specifics of this form, as it outlines the terms and conditions of the donation, including the description of the property being donated, and any conditions attached to the donation. Furthermore, the form entails specific legal requirements to ensure its validity, such as the necessity for notarization and the presence of witnesses during the signing. This document not only facilitates a smooth transfer but also secures legal protection for both the donor and the donee, underlining its significance in property transactions where a generous gift replaces a financial exchange. In examining the Louisiana act of donation form, one delves into the broader principles of property transfer within the state, offering insight into a process that underscores the importance of clarity, legality, and the fulfillment of specified conditions to effectuate a successful property donation.

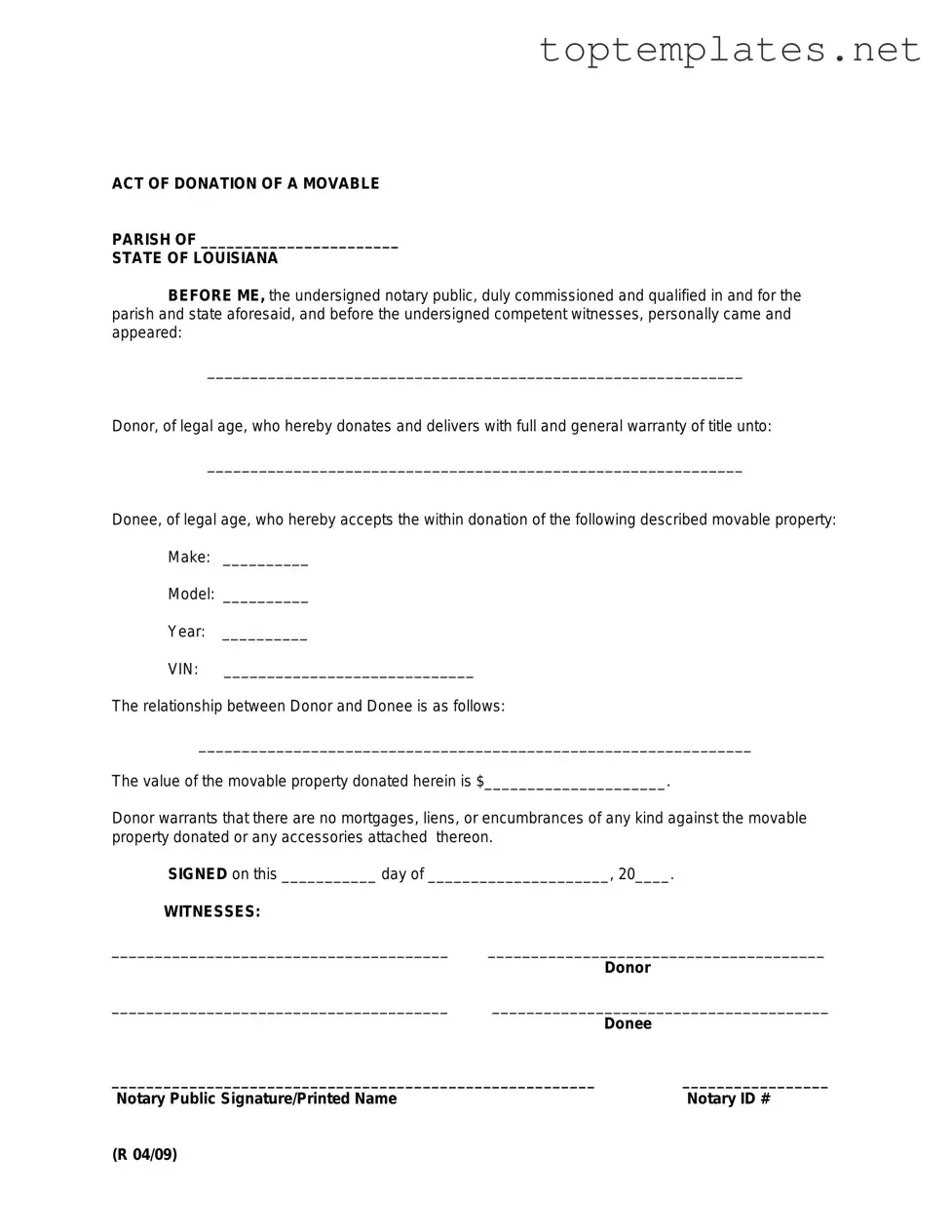

Sample - Louisiana act of donation Form

ACT OF DONATION OF A MOVABLE

PARISH OF _______________________

STATE OF LOUISIANA

BEFORE ME, the undersigned notary public, duly commissioned and qualified in and for the parish and state aforesaid, and before the undersigned competent witnesses, personally came and appeared:

______________________________________________________________

Donor, of legal age, who hereby donates and delivers with full and general warranty of title unto:

______________________________________________________________

Donee, of legal age, who hereby accepts the within donation of the following described movable property:

Make: __________

Model: __________

Year: __________

VIN: _____________________________

The relationship between Donor and Donee is as follows:

________________________________________________________________

The value of the movable property donated herein is $_____________________.

Donor warrants that there are no mortgages, liens, or encumbrances of any kind against the movable property donated or any accessories attached thereon.

SIGNED on this ___________ day of _____________________, 20____. |

|

|

WITNESSES: |

|

|

_______________________________________ |

_______________________________________ |

|

|

Donor |

|

_______________________________________ |

_______________________________________ |

|

|

Donee |

|

________________________________________________________ |

_________________ |

|

Notary Public Signature/Printed Name |

|

Notary ID # |

(R 04/09)

File Specs

| Fact Name | Description |

|---|---|

| Purpose | The Louisiana Act of Donation form is used to legally transfer ownership of property or goods from one person to another without any exchange of money. |

| Governing Laws | This form is governed by the Louisiana Civil Code, particularly articles concerning donations and transfers. |

| Requirements for Validity | The donation must be made in writing, signed by the donor and the donee, and notarized to be valid in Louisiana. |

| Type of Property | It can be used for the transfer of both movable and immovable property, including real estate, vehicles, or other tangible items. |

| Revocability | Depending on the conditions set forth at the time of the donation, the act may allow for donations to be revocable under specific circumstances. |

Steps to Filling Out Louisiana act of donation

In Louisiana, transferring the ownership of property as a gift is a legal process that involves completing an Act of Donation form. This document officially records the intention of the donor to give and the donee to receive. Whether you're passing on a cherished family home or a valued piece of personal property, it's critical to accurately fill out this form to ensure the transfer is legally recognized. The process is straightforward but requires attention to detail to ensure all legal requirements are met.

- Gather all necessary information about the property being donated, including a legal description of the property and any associated titles or deeds.

- Identify the donor(s) and donee(s) involved in the transaction. Collect full legal names and contact information for all parties.

- Access a copy of the Louisiana Act of Donation form. This can typically be found online through Louisiana's Department of Revenue website or at a local legal stationery store.

- Fill in the date of the donation at the top of the form.

- Enter the donor's full legal name, address, and contact information in the designated section.

- Insert the donee's full legal name, address, and contact information in the corresponding section.

- Describe the donated property in detail in the space provided. Be sure to include any identifying numbers, such as serial numbers for vehicles or parcel numbers for real estate, along with a thorough description that clearly identifies the property.

- For real estate transactions, attach a copy of the legal description of the property. This can typically be found on the deed.

- Read through the declarations and conditions section carefully. This part of the form outlines the agreement terms, including any conditions placed on the donation.

- Both the donor and donee must sign and date the form in the presence of a notary public. Ensure that the notary public also signs and seals the form, making it legally binding.

- Keep a copy of the completed form for your records. It's also advisable to file a copy with the local parish where the property is located, especially for real estate donations, to ensure the transfer is recorded in public records.

After filling out the Act of Donation form, the next steps involve ensuring the document is properly recognized and recorded. Specific actions might vary depending on the type of property being donated and local parish requirements. Generally, you will need to officially file or record the completed form with relevant local or state authorities. This step is crucial for real estate donations, as it updates the official ownership records. It's always a good idea to consult with a legal professional to ensure all aspects of the donation process are handled correctly.

Discover More on Louisiana act of donation

What is the Louisiana Act of Donation Form?

The Louisiana Act of Donation Form is a legal document used to officially transfer ownership of property from one person to another without any payment. This form is commonly utilized for the gift of immovable property, such as land or a house, but can also apply to movable properties like vehicles or other personal items.

Who can donate property using this form?

Anyone who legally owns property in the state of Louisiana can donate it using this form. Donors must have the legal capacity to enter into a contract and must do so without coercion or duress. The recipient, or donee, must be legally capable of owning property in Louisiana.

Are there any specific requirements for the Louisiana Act of Donation Form to be valid?

Yes, certain requirements must be met for the donation to be considered valid. The form must be in writing, clearly describe the property being donated, and be signed by both the donor and the donee. Additionally, Louisiana law requires that the act of donation for immovable property be notarized and recorded with the parish where the property is located. Two witnesses must also sign the document.

Can the donation be revoked?

Under Louisiana law, donations that are properly executed and meet all legal requirements are generally irrevocable. However, there are exceptions where donations can be revoked, such as if the donee fails to fulfill conditions set by the donor or in cases of ingratitude, which involve the donee committing certain serious offenses against the donor.

What types of property can be donated with this form?

Both movable and immovable properties can be donated using the Louisiana Act of Donation Form. Immovable property includes land and anything attached to it, like a building or house. Movable property refers to items that are not fixed to a particular location, such as vehicles, furniture, or jewelry.

Is there a cost to donate property using the Louisiana Act of Donation Form?

While there is no fee for the act of donation itself, there may be costs associated with the process, such as notary fees, recording fees, and possibly legal advice or assistance in preparing the documentation to ensure it meets all legal requirements.

What happens if the donor or donee dies after the donation has been made but before it's recorded?

If the donor dies after signing the donation but before it has been recorded, the donation can still be valid if it meets all legal requirements, including proper execution and witness. The responsibility of recording the document to complete the transfer legally then falls to the estate of the donor or the donee, depending on the case. It's important to record the donation as soon as possible to avoid complications in the property transfer process.

Common mistakes

Filling out the Louisiana Act of Donation form requires attention to detail and an understanding of certain legal requirements. Many individuals make errors during this process, which can lead to complications or the invalidation of the document. Below are nine common mistakes to avoid when completing this form:

Not Including All Necessary Parties - Sometimes, not all individuals required by law to be party to the donation, such as all co-owners, are included in the form, leading to its potential invalidity.

Omitting Essential Information - Leaving out important details about the property being donated or the parties involved, such as complete legal descriptions, addresses, or identification numbers, can result in processing delays or rejection.

Failure to Specify Donation Terms - If the donation is conditional, failing to clearly state these conditions can create legal ambiguities.

Incorrect Legal Descriptions - Providing vague or incorrect legal descriptions of the property makes it difficult to effectively transfer ownership.

Not Using Witnessed Signatures - Louisiana law requires certain documents to be signed in the presence of a notary and witnesses. Missing these requirements can void the document.

Forgetting to File With the Parish Recorder - After completion, the act must be filed with the appropriate parish office to be effective. Neglecting this step means the donation might not be legally recognized.

Confusing Donation with Sale - Mixing up terms or treating the donation as a sale can introduce tax implications and other unintended consequences.

Not Consulting a Legal Professional - Many individuals try to complete the process without legal advice, leading to errors that could have been avoided with professional guidance.

Lack of Clarity on Retained Rights - If the donor intends to retain certain rights over the property, failing to clearly outline these rights can cause confusion and legal disputes down the line.

By addressing these common mistakes, individuals can ensure that their donation process is smooth and legally sound. When in doubt, consulting with a legal professional experienced in Louisiana property law is advisable to navigate the complexities of the Act of Donation form.

Documents used along the form

When you're planning to transfer property in Louisiana, the Act of Donation form is a key document. However, it's just one of several documents that might be necessary to complete the process smoothly and legally. The following list covers additional forms and documents often used alongside the Act of Donation form, each playing its own role in ensuring the transaction adheres to Louisiana's specific legal requirements.

- Title Certificate: This document verifies the legal ownership of the property being donated. It's essential to ensure that the donor actually has the legal right to donate the property.

- Notarized Witness Declaration: Louisiana law requires donations of immovable property to be made in the presence of a notary and two witnesses. This document affirms that this requirement was met.

- Property Appraisal Report: Though not always required, an appraisal can be necessary to determine the fair market value of the donated property, which is important for tax purposes.

- Property Tax Statements: Recent property tax statements may need to be presented to confirm that all dues are cleared at the time of donation.

- Mortgage Release Statement: If there was a mortgage on the property, this statement confirms that it has been fully paid off and the property can be legally transferred.

- Proof of Insurance: Providing evidence of any existing property insurance can be necessary, especially if the property is to remain insured after the donation.

- Municipal Clearance Certificate: This certificate proves that the property complies with local zoning and building codes, which is especially crucial for commercial property donations.

- Succession Certificate: In cases where the property was inherited, this certificate verifies the legal transfer of property to the donor before they donate it to someone else.

Together with the Louisiana Act of Donation form, these documents facilitate a transparent and legal transfer of property. Ensuring you have the right paperwork in order can prevent future legal complications, making the generosity of donation a smoother experience for everyone involved. Be sure to consult with a legal professional to understand the specifics of your situation and gather all the necessary documents before proceeding.

Similar forms

Deed of Gift: This document closely resembles the Louisiana act of donation form in that it represents a voluntary transfer of property from one party to another without any payment. Both are utilized to legally document the gift of tangible or intangible property, ensuring the transfer is recognized formally by authorities. The core similarity lies in their function to record a transfer of ownership freely and willingly, aiming to prevent future disputes regarding the property's transfer.

Quitclaim Deed: A Quitclaim Deed, much like the act of donation, is used to transfer interest in a property. However, it does not guarantee that the title is clear. Both documents serve the purpose of changing the ownership of property, but the act of donation is specifically designed for gifts, whereas a Quitclaim Deed could be used for various types of transfers, not necessarily involving a sale. The primary parallel is their application in conveying property rights from one party to another without guarantees on the title's validity.

Warranty Deed: Although mainly used in sales, a Warranty Deed shares similarities with the Louisiana act of donation form by transferring property ownership. Unlike the act of donation, which is a gift, the Warranty Deed comes with guarantees from the seller to the buyer about the title's clear status and the property's freedom from encumbrances. Both documents formalize the transfer of property, but the Warranty Deed offers more protection to the recipient.

Gift Affidavit: A gift affidavit is a sworn statement that documents a gift's transfer from one individual to another and asserts there is no expected compensation. Similarly, the Louisiana act of donation form is utilized for gifts of property but is more formal and legally binding in property transfer matters. Both are used to prove the intention of gifting, helping to distinguish gifts from sales or loans in legal and tax contexts.

Transfer-on-Death Deed (TOD): This document permits property owners to name a beneficiary who will inherit their property upon the owner’s death, bypassing the probate process. Like the act of donation, it aims to ensure the smooth transfer of property to another person. However, the TOD deed takes effect after the giver's death, contrasting with the immediate effect of a Louisiana donation act. Both serve to prevent disputes over property transfer but operate under different conditions regarding the timing of the transfer.

Dos and Don'ts

Filling out the Louisiana Act of Donation form is an important process that requires attention to detail and an understanding of the legal implications. This document is used to transfer ownership of property from one person to another without any exchange of money. To ensure that this transaction is legally binding and recognized, there are several do's and don'ts to keep in mind:

Do's:- Thoroughly read the entire form before beginning to fill it out. It's important to understand every section to ensure that all relevant information is provided accurately.

- Provide accurate information about both the donor (the person giving the property) and the donee (the person receiving the property). This includes full legal names, addresses, and identification details.

- Specify the property being donated with as much detail as possible. If it's real estate, include the legal description of the property. If it's a movable property, describe it clearly to avoid any ambiguity.

- Have the document notarized. In Louisiana, an Act of Donation must be notarized and, in the case of real estate, also witnessed by two people and filed with the parish recorder to be legally effective.

- Don't leave blanks on the form. If a section does not apply to your situation, fill it with "N/A" (not applicable) instead of leaving it empty. This helps to confirm that you did not overlook any part of the form.

- Don't use informal language or nicknames. Use the full legal names and terms to ensure the document retains its formal and legal validity.

- Don't forget to check for any parish-specific requirements. Some parishes in Louisiana may have additional requirements or steps for the Act of Donation to be recognized. It's essential to check with the local clerk of court.

- Don't try to use the form for complex donations without consulting a lawyer. If the donation involves conditions, or if you're unsure about tax implications, it's wise to seek legal advice to ensure everything is in order.

Misconceptions

The Louisiana Act of Donation form is crucial for transferring property as a gift in Louisiana. However, several misconceptions surround its use and requirements. Understanding these can help in executing this legal document correctly and ensuring the transfer complies with Louisiana law.

It Only Requires the Donor's Signature: A common misconception is that the donation form only needs to be signed by the person giving the property (donor). In reality, Louisiana law requires notarization of the act of donation. This means it must be signed by the donor, the recipient (donee), and a notary public to be legally binding.

Any Type of Property Can Be Transferred Without Restrictions: While the act of donation is a flexible tool for transferring ownership, certain types of property, like homestead property, may have specific restrictions or require additional steps. It's critical to consult with a legal professional to ensure compliance with state laws and regulations.

Verbal Agreements Are Sufficient: Another misunderstanding is the belief that verbal agreements of donation are as binding as written ones. Louisiana law mandates that donation agreements, especially for immovable property, must be in writing and meet specific formalities to be enforceable.

No Need for Witnesses: While the focus is often on the notary, overlooking the requirement for witnesses is a mistake. In addition to notarization, Louisiana's act of donation form generally needs to be signed in the presence of two competent witnesses to ensure its validity.

Filing with a Government Office Isn't Necessary: Finally, there's a belief that once signed, no further action is required. However, for the donation to be fully effective, particularly with immovable property, the act must be filed with the parish clerk’s office where the property is located. Ensuring public record of the donation is crucial for the donee's legal recognition as the new owner.

Clearing up these misconceptions is vital for anyone involved in the act of donating property in Louisiana. Proper adherence to the legal requirements ensures the process is smooth and legally sound. Consulting with a legal professional familiar with Louisiana's property laws can provide further guidance and peace of mind during this process.

Key takeaways

Filling out and using the Louisiana Act of Donation form requires attention to detail and an understanding of the legal implications of gifting property. Here are key takeaways to consider:

- The form must be completed accurately, providing clear details about the donor (the person giving the property) and the donee (the person receiving the property).

- It is essential to properly describe the property being donated to ensure there is no ambiguity regarding what is being given.

- All involved parties must sign the form in the presence of a notary public and two witnesses to make the donation legally binding.

- Donations of immovable property, such as real estate, require the act of donation to be recorded with the parish clerk of court to finalize the transfer of ownership.

- The donor must have the legal capacity to make the donation, and the donee must accept the donation, either explicitly in the document or through their actions, for it to be valid.

- It's important to consider the tax implications of making a donation and to seek advice from a tax professional.

- For the donation to be effective, the act must comply with Louisiana state laws, including any specific requirements for the type of property being donated.

Common PDF Forms

Form I-983 - Adequate completion of the I-983 form is instrumental in preventing issues with immigration status, underscoring its role in compliance with DHS requirements.

Printable Editable Blank Utility Bill Template - The layout and clarity of the Utility Bill form make it easy for users to understand their charges at a glance.