Free Membership Ledger PDF Form

In the world of business organization and member tracking, the Membership Ledger form plays a pivotal role, acting as a crucial document for companies, especially those structured as limited liability companies (LLCs) or similar entities where membership interests or units are a key aspect of ownership. This comprehensive document meticulously records the issuance and transfer of membership interests, embodying the financial and operational backbone of the entity in question. The ledger requires fundamental information to be entered, including the company's name, details about certificates issued, and specifics about the transfer of membership interests or units—such as the date of issuance or transfer, the parties from whom and to whom interest was transferred, the amount paid for such membership interests, and the residence of the member. It also captures the issuance of original certificates of membership and keeps a running tally of the number of units or interests held by each member after every transaction. The Membership Ledger form not only functions as an authoritative record for internal use but also serves as an essential tool for regulatory compliance, ensuring a transparent and traceable lineage of ownership and transactions within the company.

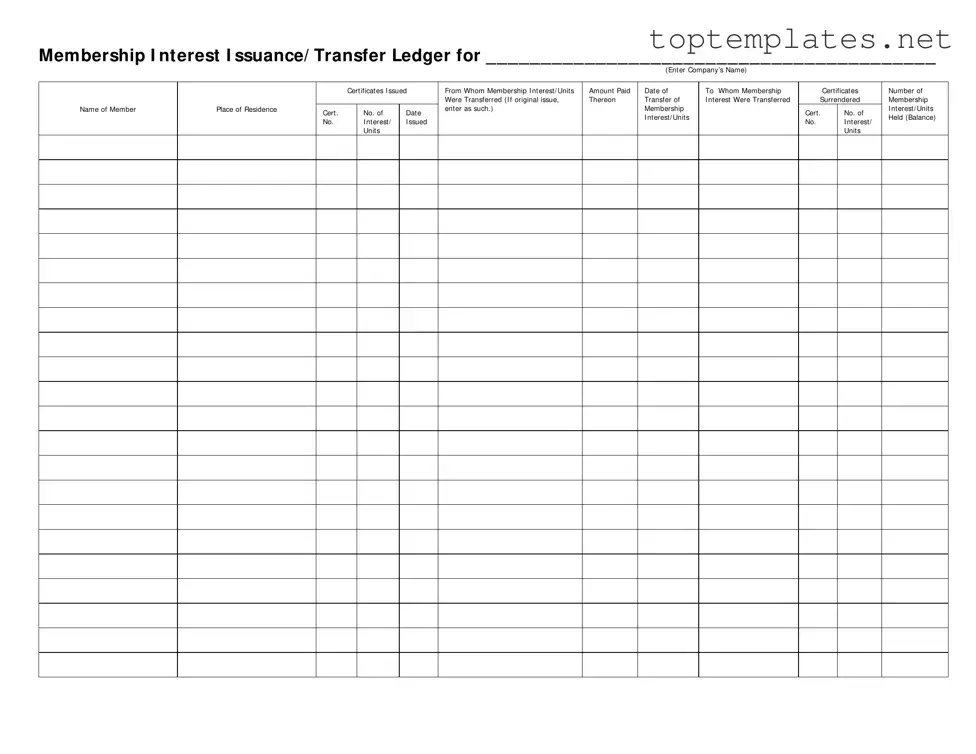

Sample - Membership Ledger Form

Membership I nt erest I ssuance/ Transfer Ledger for _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

(Enter Company’s Name)

|

|

|

Certificates I ssued |

From Whom Membership I nterest/ Units |

Amount Paid |

Date of |

To Whom Membership |

||

|

|

|

|

|

|

Were Transferred (I f original issue, |

Thereon |

Transfer of |

I nterest Were Transferred |

Name of Member |

Place of Residence |

Cert . |

|

No. of |

Date |

enter as such.) |

|

Membership |

|

|

|

|

|

|

I nterest/ Units |

|

|||

|

|

No. |

|

I nterest/ |

I ssued |

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

Units |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Certificates

Surrendered

Cert . |

No. of |

No. |

I nterest/ |

|

Units |

|

|

Number of Membership

I nterest/ Units Held (Balance)

File Specs

| Fact Name | Description |

|---|---|

| Form Purpose | The Membership Interest Issuance/Transfer Ledger is designed to document all issuances and transfers of membership interests or units within a company. |

| Company Name Requirement | This form requires the input of the company's name, ensuring that the ledger is specifically tailored to a particular entity. |

| Tracking Certificates | It helps in tracking both the issuance and surrender of certificate numbers associated with membership interests or units. |

| Membership Transfers | Details regarding from whom and to whom membership interests or units were transferred, including the date and amount paid, are meticulously recorded. |

| Member Information | The ledger includes columns for entering the name and place of residence of members, facilitating a clear record of who holds interests in the company. |

| Governing Law | While not state-specific in its basic form, the application and relevance of the Membership Ledger may vary based on the governing state laws that dictate the management and transfer of company membership interests. |

Steps to Filling Out Membership Ledger

Understanding how to correctly complete a Membership Interest Issuance/Transfer Ledger is crucial for accurately documenting the issuance and transfer of membership interests within a company. This ledger serves as a formal record, tracking who owns membership units at any given time, changes in ownership, and the financial transactions associated with these changes. It's a tool both for internal governance and legal compliance. Below are detailed steps to properly fill out this essential document.

- At the top of the form, where it says "Enter Company’s Name," fill in the full legal name of the company whose membership interests are being documented.

- In the "Certificates Issued" section, for each issuance or transfer of membership interests, start by entering the name of the individual or entity from whom the membership interests were transferred. If the membership interests are being issued for the first time, specify this by writing "Original Issue."

- Next, in the column labeled "To Whom Membership Interests Were Transferred," include the full name of the new member receiving the interests.

- Under "Place of Residence," input the full address of the new member. This helps in identifying members and can be essential for official notices.

- In the column for "Date of Transfer of Interest," specify when the membership interests were officially transferred to the new member.

- Following that, in the "Amount Paid Thereon" section, write down the monetary value paid for the membership interests, if applicable. This is crucial for financial records and member equity calculations.

- If a certificate was issued to represent the membership interest, note the certificate number in the "Cert. No. of Membership Interest/Units Issued" field. If not applicable, leave this blank.

- In the scenario where membership interests were transferred rather than newly issued, and a certificate was surrendered, enter the surrendered certificate number in the appropriate column.

- Lastly, in the "Number of Membership Interest/Units Held (Balance)" column, update the total number of membership units the member now holds. This column reflects the member's current stake in the company after the transaction.

By following these steps, the Membership Interest Issuance/Transfer Ledger will be filled out thoroughly and accurately. This document, now containing detailed records of membership changes, serves as an important part of the company's legal and financial documentation. It ensures transparency among members and aids in the management and tracking of ownership interests over time.

Discover More on Membership Ledger

What is a Membership Ledger form?

A Membership Ledger form is a document used by companies, particularly those structured as limited liability companies (LLCs), to keep track of the issuance and transfer of membership interests or units. This form records important details such as the names of members who have been issued or have transferred their interests, the amount paid for these interests, certificate numbers, dates of transactions, and the balance of interests held by each member.

Why is it important to maintain a Membership Ledger?

Maintaining a Membership Ledger is crucial for several reasons. It ensures accurate record-keeping of all transactions related to membership interests, helps in the management of the company’s capital structure, and facilitates the resolution of disputes among members regarding ownership. Additionally, it is a legal requirement for LLCs in many jurisdictions to keep updated records of membership interests for regulatory compliance and tax purposes.

Who should have access to the Membership Ledger?

Access to the Membership Ledger should be limited to authorized personnel only, such as members of the LLC, the company’s legal counsel, and accountants. It contains sensitive and potentially confidential information about the company’s members and their financial contributions. Proper access control ensures the protection of member privacy and secures the company’s financial information.

How often should the Membership Ledger be updated?

The Membership Ledger should be updated promptly after every transaction that affects membership interests or units. This includes issuances of new interests, transfers of existing interests among members, and any changes in the amount paid or in the balance of interests held. Regular updates ensure that the ledger accurately reflects the current ownership structure of the company.

Can membership interests be transferred between members?

Yes, membership interests can be transferred between members, subject to the terms outlined in the company’s operating agreement and applicable laws. The Membership Ledger form includes sections for documenting such transfers, including information about the transferring and receiving parties, the number of units transferred, and the related certificate numbers. It is important to update this document to reflect these changes accurately.

What happens if there are discrepancies in the Membership Ledger?

If discrepancies are found in the Membership Ledger, it is important to investigate and resolve them promptly. Discrepancies might include errors in the number of units issued, incorrect member information, or outdated records of transfers. Resolving these issues may require reviewing transaction documents, amending the ledger to correct inaccuracies, and possibly consulting legal counsel to ensure compliance with regulatory requirements and to protect the company's and its members' interests.

Is digital record-keeping of the Membership Ledger acceptable?

Yes, digital record-keeping of the Membership Ledger is generally acceptable and, in many cases, preferred due to its efficiency, ease of updating and accessing information, and reduced risk of physical damage or loss. However, it's vital to ensure that digital records are securely stored, regularly backed up, and accessible only to authorized personnel to protect against unauthorized access or data breaches.

Common mistakes

Not entering the company's name at the beginning is a common mistake. This field sets the stage, identifying whose ledger is being updated. Without this information, the ledger lacks context, leading to potential confusion and misidentification.

Overlooking the "From Whom Membership Interest/Units Were Transferred" section. If a transfer of membership interest occurs, this detail is crucial. It records the origin of the transfer, ensuring a traceable history of ownership transfers within the company.

Leaving the "Amount Paid Thereon" field blank. This omission can create complications in understanding the financial transactions associated with the transfer of membership interests, such as the cost of acquiring those interests or any associated liabilities.

Forgetting to specify whether the interest was an original issue in the appropriate field. This detail distinguishes between newly issued interests and secondary market transactions, affecting the interpretation of company's equity structure.

Misidentifying the "Place of Residence" of the member. Accurate information here is essential for legal and communication purposes. It serves as a means to contact the member and may have legal implications regarding jurisdiction and taxes.

Ignoring the certificates numbers in both "Certificates Issued" and "Certificates Surrendered" sections. These numbers are vital for tracking the issuance and transfer of membership interests, acting as a unique identifier for transactions.

Inaccurately reporting the "Number of Membership Interest/Units Held (Balance)." This error can misrepresent a member's stake in the company, affecting voting rights, dividend allocations, and other membership benefits.

When filling out a Membership Ledger form, attention to detail is imperative for maintaining accurate and legal records of membership interest transactions. Each entry serves as a legal record of the changes in ownership and financial status within the company, underscoring the necessity of diligence and precision in filling out this form.

Documents used along the form

When managing a business or an organization, especially one structured as a limited liability company (LLC) or a similar entity, the Membership Ledger form is an essential document. It meticulously records the issuance and transfer of membership interests or units, providing a clear trail of ownership. However, to ensure comprehensive and effective documentation and legal compliance, several other forms and documents often accompany the Membership Ledger. Here's a closer look at some of these critical documents.

- Operating Agreement: This foundational document outlines the LLC's operational and managerial structures and processes. It complements the Membership Ledger by detailing members' rights, responsibilities, and profit distribution, thereby providing context to the ledger entries.

- Member Resolutions: These documents record decisions made collectively by the members or by specific resolutions passed concerning the company. Member Resolutions often relate to changes that affect the Membership Ledger, such as the admission of new members or the transfer of membership units.

- Membership Certificates: Serving as proof of membership interest ownership, these certificates complement the Membership Ledger's data by providing a formal, tangible record for members, should they require it for legal purposes or validation.

- Capital Contribution Statements: These statements detail the financial or asset contributions made by members to the LLC. They support the Membership Ledger's data by providing evidence of the contributions that correspond to members' interest units.

- Buy-Sell Agreement: Also known as a buyout agreement, this document outlines the process and terms under which a member's interest can be bought out or sold, typically in events like death, divorce, or voluntary departure. It interacts with the Membership Ledger by guiding the transfer and reallocation of membership units.

Collectively, these documents not only support the Membership Ledger but also strengthen the governance and operational clarity of an LLC. They aid in documenting significant decisions, member contributions, and the transfer of interests, ensuring all members are aligned and informed. Managing these forms diligently not only aids in legal compliance but also facilitates smoother operations and transitions within the organization.

Similar forms

A Stock Transfer Ledger is similar to the Membership Ledger because both track the issuance and transfer of ownership interests. The main difference is that the Stock Transfer Ledger focuses on stocks in corporations, whereas the Membership Ledger focuses on membership interests in companies like LLCs.

The Share Register closely resembles the Membership Ledger as it records details about the issued shares of a company, the shareholders, and any changes in ownership. Both documents serve as evidence of ownership and are crucial for maintaining accurate company records.

A Cap Table (Capitalization Table) shares similarities with the Membership Ledger form by outlining the ownership structure of a company. It details who owns what in terms of equity shares, options, warrants, etc., while the Membership Ledger focuses more specifically on membership interest transactions.

The Asset Register parallels the Membership Ledger in that it tracks assets owned by a company. However, the Membership Ledger specifically tracks membership interests as the “asset” of the members, documenting transfers and issuances of these interests.

A Unit Ledger is very similar to the Membership Ledger in ventures like cooperatives or non-stock corporations where ownership units instead of shares are issued. It records ownership and transactions of units, analogous to how the Membership Ledger tracks membership interests.

An Investor Register is akin to the Membership Ledger, as both log details about the entity's investors and their respective stakes. While the Investor Register is broader and can be used in various entities, the Membership Ledger is tailored for memberships in LLCs or similar setups.

Real Estate Ownership Registers bear resemblance to the Membership Ledger by documenting the transaction history and current ownership of real estate properties. The key difference is the asset type; real estate registers cover physical properties, whereas Membership Ledgers cover intangible membership interests.

The Partnership Record Book is comparable because it details the contributions, distributions, and ownership percentage changes among partners in a partnership. Like the Membership Ledger, it's essential for tracking the ownership dynamics within the entity.

A Securities Log has similarities with a Membership Ledger, focusing on transactions related to securities such as bonds and stocks. Both are maintained to provide a historical account of ownership and transfers, though the assets they cover can differ significantly.

Dos and Don'ts

Filling out a Membership Ledger form is a critical process that requires attention to detail and accuracy. The information provided impacts the official records and rights of members within a company. To ensure the process is handled correctly, consider the following guidelines on what to do and what to avoid.

Things You Should Do

- Double-check the company’s name for accuracy before entering it. This is crucial for maintaining legal consistency across all documents.

- Provide clear and precise information for each entry, including the full legal names of individuals, exact dates, and accurate amounts. Ambiguity could lead to disputes or confusion.

- Ensure that all amounts paid and membership interest units are accurately noted. Correct financial reporting is essential for both the company’s records and legal compliance.

- Maintain confidentiality and security of the information. This document contains sensitive information that could be misused if it falls into the wrong hands.

Things You Shouldn't Do

- Avoid leaving blank spaces. If certain information is not applicable, indicate this clearly to prevent misunderstandings or the impression of incomplete documentation.

- Do not use abbreviations or nicknames when listing member names. Always use full legal names to avoid any ambiguity about member identity.

- Resist the temptation to make unofficial changes or notes on the ledger. All entries should be official and should follow the proper procedure for amendments.

- Never discard old ledgers or records without ensuring that the information has been correctly transferred and is fully accessible in the new documentation. Historical records are important for legal and operational reasons.

Adhering to these guidelines will help maintain the integrity of the Membership Ledger and ensure that a company's records are accurate, verifiable, and legally binding. It’s about safeguarding the rights of its members and ensuring the smooth operation of the entity in a legally compliant manner.

Misconceptions

When it comes to managing and recording the ownership details of members in a company, especially those structured as LLCs or similar entities, the Membership Ledger form is indispensable. However, there are several misconceptions about this document that can confuse or mislead those tasked with its maintenance. Let's address four common misunderstandings:

- It's Only Necessary for Large Companies: Many assume that the Membership Ledger is only a requirement for large corporations with numerous members. This is incorrect. No matter the size, companies that issue membership interests need to keep an accurate record of these transactions to ensure legal compliance and transparent ownership tracking.

- It's Equivalent to a Member List: While the Membership Ledger does contain names of members, it serves a broader purpose than a simple member list. Beyond listing owners, it details the issuance and transfer of membership interests, including the amount paid and the balance of interests held. This provides a comprehensive view of the company's ownership structure over time, not just a snapshot.

- Digital Records Are Unacceptable: With the advancement of technology, digital record-keeping has become both acceptable and preferable in many jurisdictions. While maintaining a physical Membership Ledger may be traditional, digital ledgers are legally valid and offer easier access and update capabilities, provided they are kept secure and backed up.

- It Doesn't Require Regular Updates: There’s a misconception that once filled, the Membership Ledger need not be updated regularly. However, it is crucial to update this document anytime there's a change in membership or interests therein. This includes new issuances, transfers, or the surrender of membership interests. Regular updates ensure the ledger accurately reflects the current state of ownership.

Understanding these aspects of the Membership Ledger form is vital for proper company governance and compliance. It plays a crucial role in tracking the ownership structure and ensuring the legal standing of the company's members. Keeping these misconceptions in mind can help in managing this important document effectively and accurately.

Key takeaways

Filling out and using the Membership Ledger form correctly is a critical administrative task for companies. This document ensures accurate recording and tracking of membership interests, a key aspect of managing a company's equity structure and member ownership details. Below are eight key takeaways to consider when dealing with the Membership Ledger form:

- Accuracy is paramount: Every entry regarding the issuance, transfer, and balance of membership interests must be recorded accurately to maintain the correctness of company records and to reflect the true ownership structure at any given time.

- Record complete details: For each transaction, whether it is an issuance or a transfer of membership interests, complete details including from whom and to whom the interests were transferred, the amount paid for them (if applicable), and the date of the transaction must be recorded meticulously.

- Certificate numbers are key: Each membership interest issuance or transfer must be associated with a specific certificate number. This number is crucial for tracking purposes and for verifying the ownership of the membership interests.

- Update the balance: Each transaction must include an updated balance of the membership interests held by each member. This reflects the current state of a member's interest in the company and aids in the overall management of membership records.

- Original issuances: Distinguishing between original issuances and transfers is vital. Original issuances should be clearly marked as such to differentiate them from secondary market transactions.

- Member information is essential: Details such as the name of the member and their place of residence should be recorded accurately. This information is crucial for communication, legal, and administrative purposes.

- Document retention: Keeping the Membership Ledger up-to-date and securely storing it is not just a best practice; it is often a legal requirement. This document serves as a formal record of the company's membership interests and might be required for audits, legal processes, or other administrative reviews.

- Review and verification: Regular reviews of the Membership Ledger are necessary to ensure that it accurately reflects the current membership interests and to verify that all transactions have been recorded properly. Mistakes or omissions should be corrected promptly to maintain the integrity of the company’s records.

Adhering to these guidelines when filling out and using the Membership Ledger form will help in ensuring that a company's membership interest records are precise, up-to-date, and legally compliant. This diligence supports sound corporate governance and contributes to the transparent and effective management of the company’s ownership structure.

Common PDF Forms

Printable Direction of Payment Form - An authorization document that enables direct financial transactions between an insurance company and a repair facility for covered repairs.

Dd 2870 Army Pubs - The DD 2870 form empowers patients to have a say in their healthcare by deciding who can view their medical records.

Blank Timesheet Template - Utilized by workers to report their daily work start and end times for payroll accuracy.