Free Mortgage Statement PDF Form

Understanding the intricacies of a Mortgage Statement form is crucial for homeowners to manage their mortgage effectively. This comprehensive document serves multiple purposes, acting as a communication tool between the mortgage servicer and the borrower. It details various components such as the borrower's name and address, statement date, and the account number, ensuring clarity and personalization of information. Crucially, it outlines the payment due date and the total amount due, including any late fees applicable if the payment is not made in time. The statement breaks down the payment into principal, interest, escrow for taxes and insurance, and any fees charged, providing a clear picture of where the borrower's money is going. It also provides a transaction activity section, highlighting recent payments, fees charged, and any partial payments held in a suspense account, offering a snapshot of the account's activity over a specific period. Additionally, the form contains a delinquency notice if the account is in arrears, sternly reminding the borrower of the consequences of non-payment. It offers guidance for those experiencing financial difficulties, directing them towards necessary assistance or counseling. Overall, the Mortgage Statement form is an essential document that aids in keeping track of mortgage payments, understanding the financial aspects of the loan, and taking action if financial troubles arise.

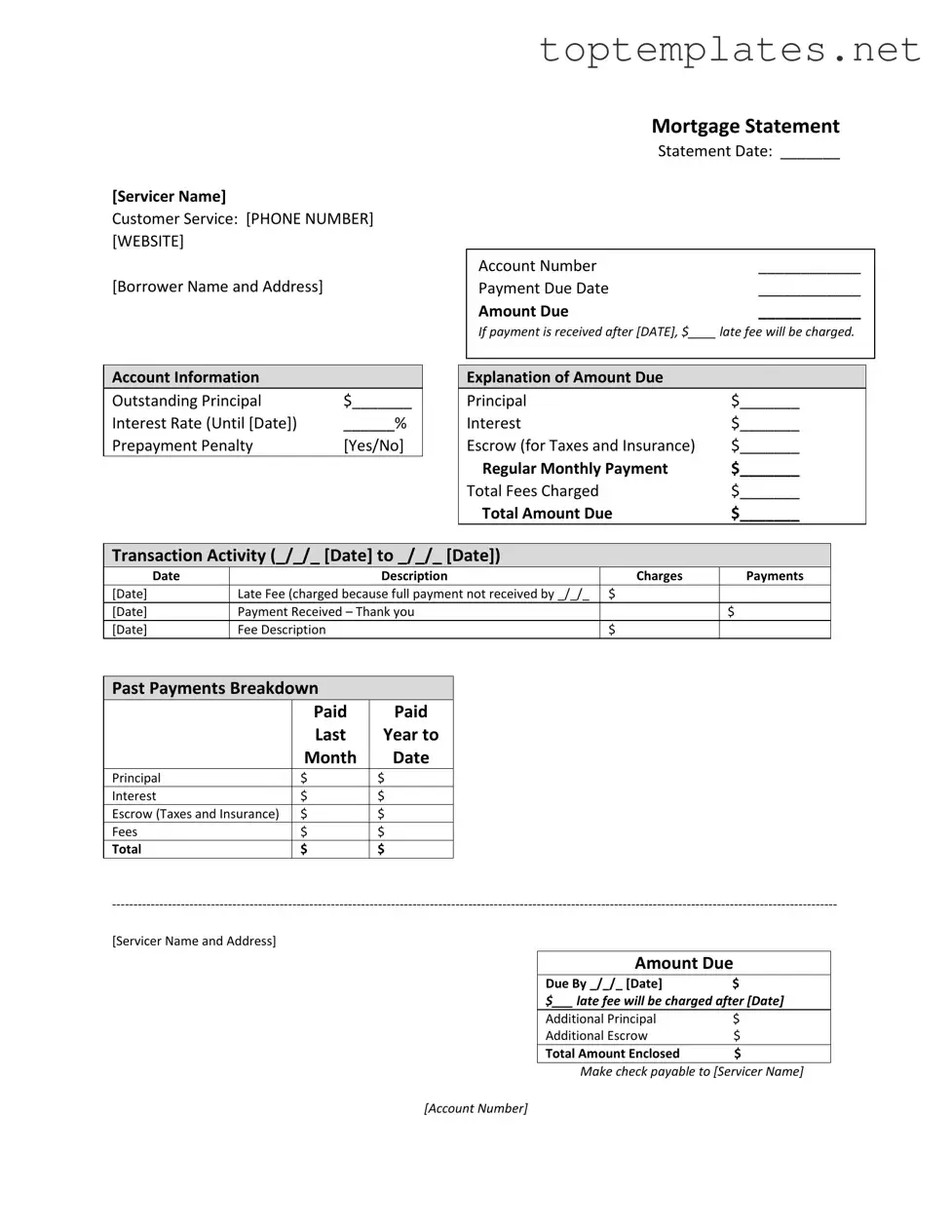

Sample - Mortgage Statement Form

[Servicer Name]

Customer Service: [PHONE NUMBER] [WEBSITE]

[Borrower Name and Address]

Mortgage Statement

Statement Date: _______

Account Number |

____________ |

Payment Due Date |

____________ |

Amount Due |

____________ |

If payment is received after [DATE], $____ late fee will be charged.

Account Information

Outstanding Principal |

$_______ |

Interest Rate (Until [Date]) |

______% |

Prepayment Penalty |

[Yes/No] |

Explanation of Amount Due

Principal |

$_______ |

Interest |

$_______ |

Escrow (for Taxes and Insurance) |

$_______ |

Regular Monthly Payment |

$_______ |

Total Fees Charged |

$_______ |

Total Amount Due |

$_______ |

Transaction Activity (_/_/_ [Date] to _/_/_ [Date])

Date |

Description |

Charges |

Payments |

[Date] |

Late Fee (charged because full payment not received by _/_/_ |

$ |

|

[Date] |

Payment Received – Thank you |

|

$ |

[Date] |

Fee Description |

$ |

|

Past Payments Breakdown

|

Paid |

Paid |

|

Last |

Year to |

|

Month |

Date |

Principal |

$ |

$ |

Interest |

$ |

$ |

Escrow (Taxes and Insurance) |

$ |

$ |

Fees |

$ |

$ |

Total |

$ |

$ |

[Servicer Name and Address]

Amount Due

Due By _/_/_ [Date]$

$___ late fee will be charged after [Date]

Additional Principal |

$ |

Additional Escrow |

$ |

Total Amount Enclosed |

$ |

Make check payable to [Servicer Name]

[Account Number]

[Additional tables to be translated]

Important Messages

*Partial Payments: Any partial payments that you make are not applied to your mortgage, but instead are held in a separate suspense account. If you pay the balance of a partial payment, the funds will then be applied to your mortgage.

**Delinquency Notice**

You are late on your mortgage payments. Failure to bring your loan current may result in fees and foreclosure – the loss of your home. As of [Date], you are __ days delinquent on your mortgage loan.

Recent Account History

·Payment due [Date]: Fully paid on time

·Payment due [Date]: Fully paid on [Date]

·Payment due [Date]: Unpaid balance of $________

·Current payment due [Date]: $_______

·Total: $_______ due. You must pay this amount to bring your loan current.

If you are Experiencing Financial Difficulty: See back for information about mortgage counseling or assistance.

File Specs

| Fact Name | Description |

|---|---|

| Structure of the Statement | The mortgage statement includes information such as the servicer's name and contact details, borrower's name and address, statement date, account number, payment due date, amount due, and details on the outstanding principal, interest rate, and if there's a prepayment penalty. |

| Breakdown of Amount Due | It meticulously outlines the components constituting the total amount due, including principal, interest, escrow (for taxes and insurance) if applicable, regular monthly payment, total fees charged, thereby providing a clear explanation of the total amount due. |

| Transaction Activity | This section records all the transaction activity within a specified period, listing dates, descriptions of each transaction, charges, payments, along with any late fee charges because full payment was not received by a specified due date. |

| Past Payments Breakdown | It displays a history of past payments, breaking them down into principal, interest, escrow (for taxes and insurance), and fees paid in the current and previous year, offering a comprehensive view of payment history. |

| Governing Laws | Although not explicitly stated in the form, mortgage statements in the United States are generally governed by federal laws like the Real Estate Settlement Procedures Act (RESPA), specifically under Regulation X, which mandates servicers to provide periodic statements to borrowers. State-specific laws can further stipulate requirements based on local regulations. |

Steps to Filling Out Mortgage Statement

Filling out a Mortgage Statement form is a crucial step in managing your home loan effectively. This document typically outlines your payment history, current balance, and other essential details about your mortgage. Handling this form accurately ensures that you and the servicer are on the same page regarding your loan's status. Here is a straightforward guide on how to fill out the Mortgage Statement form.

- Start by entering the Servicer Name, located at the top of the form. This should be the company managing your mortgage.

- Fill in the Customer Service section with the provided PHONE NUMBER and WEBSITE details of your mortgage servicer.

- Insert the Borrower Name and Address in the designated space. This information should match the details the mortgage servicer has on file for you.

- Write the Statement Date, which is when the mortgage statement was issued.

- Input your Account Number to identify your specific mortgage account.

- Enter the Payment Due Date to indicate when your next payment should be made.

- Specify the Amount Due for the upcoming payment. This includes the total of principal, interest, and any escrow obligations you have.

- Note the Late Fee information, filling in the date after which the late fee applies and the amount of the late fee.

- In the Account Information section, list the Outstanding Principal, current Interest Rate (including the date until which it applies), and state whether there is a Prepayment Penalty by marking Yes/No.

- Under Explanation of Amount Due, break down the amounts for Principal, Interest, Escrow, Regular Monthly Payment, Total Fees Charged, and the Total Amount Due.

- Log any Transaction Activity, including dates, descriptions, charges, and payments made within the specified period.

- For the Past Payments Breakdown, input the amounts paid last year to date for Principal, Interest, Escrow (Taxes and Insurance), Fees, and the overall Total.

- At the bottom of the form, enter any relevant Important Messages, such as information on partial payments, delinquency notices, and account history detailing payments and outstanding balances.

- If you're making an additional payment towards Principal or Escrow, specify these amounts in the Additional Principal and Additional Escrow sections respectively.

- Finally, indicate the Total Amount Enclosed with your payment and ensure the check is made payable to the Servicer Name, including your Account Number for reference.

After filling out the Mortgage Statement form, review all entered information for accuracy. Ensure that all sections are completed and reflect your current mortgage situation correctly. Once verified, send the form to your mortgage servicer's address, usually found at the top or bottom of the form. Taking the time to fill out this form diligently helps maintain a transparent and up-to-date record of your mortgage payments and obligations.

Discover More on Mortgage Statement

What information can I find on my Mortgage Statement?

Your Mortgage Statement provides a detailed overview of your loan activity. It includes the servicer's name, contact details, your name, and address. Key details such as the statement date, account number, payment due date, and amount due are highlighted at the beginning. The statement also outlines the outstanding principal, interest rate, whether there's a prepayment penalty, and a breakdown of the amount due including principal, interest, and escrow. Late fees, transaction activity, and a past payments breakdown are also provided to offer a complete picture of your mortgage account status.

What happens if my payment is received after the due date?

If your payment is received after the due date specified on your mortgage statement, a late fee will be charged to your account. The exact amount of the late fee and the cut-off date for late payments are clearly stated on the statement, allowing you to understand the potential additional cost should your payment be delayed.

How is a partial payment handled?

Partial payments are not immediately applied to your mortgage. Instead, they are held in a separate suspense account. Once you pay the balance of a partial payment, the combined funds will then be applied to your mortgage loan. This policy ensures clarity in accounting and helps you keep track of how much more you need to contribute to meet the full payment required.

What does it mean if I receive a Delinquency Notice?

A Delinquency Notice on your mortgage statement indicates that you are late on your mortgage payments. It details how many days you've been delinquent and warns of potential fees and the risk of foreclosure—losing your home. This notice serves as a critical reminder to address any missed payments immediately to avoid further penalties.

Is there information on financial assistance if I’m struggling with payments?

Yes. If you're experiencing financial difficulties, your mortgage statement includes information and resources about mortgage counseling or assistance. It’s encouraged to look into these resources promptly to understand the options available for managing your mortgage payments and avoid falling further behind.

Can I make additional principal or escrow payments?

You have the option to make additional payments towards your principal or escrow as indicated on your mortgage statement. Additional payments can help reduce your loan balance faster or adjust your escrow to ensure enough funds are available for taxes and insurance. The specifics on how to make these additional payments are outlined, including how to include them with your total payment amount.

Common mistakes

Not accurately providing the servicer name and contact information can lead to miscommunication. This includes not filling out the customer service phone number and website correctly, where available. This information is crucial for ensuring that any queries or concerns regarding the mortgage can be directed correctly and promptly addressed.

Incorrectly filling out the payment details, such as the amount due, the payment due date, and especially noting if the payment is received after a certain date which incurs a late fee, can lead to financial discrepancies. This mistake could result in the borrower being unaware of the correct amount to be paid or when it is due, potentially leading to unnecessary late fees.

Failing to accurately report the account information, including the outstanding principal, interest rate, and whether there is a prepayment penalty, can cause significant misunderstandings regarding the loan's terms and conditions. Borrowers might be unaware of critical details about how much they owe, changes to interest rates, or penalties for early repayment.

Omitting or inaccurately detailing the 'Important Messages' section, such as notes on partial payments and delinquency notices, may lead to borrowers being uninformed about the consequences of their payment actions. Not understanding that partial payments are placed into a suspense account rather than applied directly to the mortgage could significantly affect the loan's status. Similarly, not being aware of the implications of delinquency on their loan could lead to borrowers not taking timely action to address late payments, thereby risking additional fees or even foreclosure.

It is imperative for individuals filling out a mortgage statement form to do so with great care and attention to detail, ensuring that all information provided is accurate and complete. Mistakes in this document can lead to financial consequences, miscommunication, and a misunderstanding of the loan's terms and conditions, ultimately affecting the borrower's ability to maintain good standing on their mortgage. Individuals unsure about how to correctly fill out this form should seek advice or clarification from their mortgage servicer or a financial advisor to avoid such potential pitfalls.

Documents used along the form

Maintaining a clear understanding of one's mortgage responsibilities is crucial for any homeowner. A mortgage statement plays a vital role by providing a snapshot of the current loan balance, interest rate, and any amounts due, including late fees if applicable. However, to fully grasp one's financial obligations and to take advantage of potential benefits, certain other documents are often used alongside a Mortgage Statement. Here is an overview of four such documents that are key to managing a mortgage effectively.

- Truth in Lending Disclosure Statement: This document outlines the costs of your mortgage, including the annual percentage rate (APR), finance charges, amount financed, and the total of payments. It's essential for comparing loans and understanding the full cost over the life of your mortgage.

- Good Faith Estimate (GFE): Before finalizing a mortgage, borrowers receive a GFE. This estimate provides a detailed preview of expected closing costs and loan terms. It's a critical tool for budgeting and for comparing offers from different lenders.

- Escrow Statement: This annual statement reviews the past year's escrow account activity and projects the upcoming year's expenses. It lists the amount collected for taxes and insurance and any adjustments needed to ensure sufficient funds for these payments.

- Loan Amortization Schedule: This document breaks down each mortgage payment by the amount going toward the principal versus interest. It shows how the loan balance decreases over time and can be a helpful planning tool for those looking to pay off their mortgage early.

Understanding and actively managing these documents can empower homeowners to make informed decisions throughout the life of their mortgage. Keeping abreast of your financial situation not only helps avoid surprises but also positions you to take proactive steps in your financial journey—protecting your home and your peace of mind. Whether you're reviewing your monthly Mortgage Statement or planning for the future with your Amortization Schedule, each document plays a part in the broader picture of home ownership. Adequate attention to these details can significantly impact your financial well-being and the path to owning your home outright.

Similar forms

A Loan Amortization Schedule is similar to a Mortgage Statement as it breaks down the payment schedule of a loan into individual amounts applied toward principal and interest, allowing borrowers to see how their loan decreases over time.

A Credit Card Statement shares similarities because it provides a detailed summary of the account activity within a billing cycle, including charges, payments, fees, and the total amount due.

An Auto Loan Statement is closely related as it outlines the payments due on a car loan, including the principal balance, interest rate, and information on late fees, mirroring the structure of a mortgage statement.

A Student Loan Statement resembles a Mortgage Statement by detailing the outstanding balance, interest rate, payment due dates, and any fees incurred for late payments.

The Utility Bill is somewhat similar because it itemizes charges such as water, electricity, and gas usage over a period, along with payment deadline and penalties for late payment, which is akin to how mortgage statements operate.

An Insurance Premium Statement parallels mortgage statements through its detailed reporting of the amount due for insurance coverage over a period, the due date, and penalties for late payment.

A Property Tax Bill outlines the taxes due on a property, providing a breakdown of charges, due dates, and consequences for late payments, which follows a similar format to that of a mortgage statement.

Finally, an Investment Account Statement is related in the way it details transaction activities, including deposits and withdrawals, over a period, as well as total balances, akin to the transaction activity and balance information found in mortgage statements.

Dos and Don'ts

Filling out a Mortgage Statement form accurately is crucial for maintaining the health of your loan and avoiding unnecessary fees. Here are key dos and don'ts to keep in mind:

- Do verify the servicer's name, customer service contact information, and your own borrower name and address for accuracy. Errors here could lead to communication issues.

- Do not overlook the statement date and payment due date. These dates are critical for making timely payments and avoiding late fees.

- Do double-check the account number and ensure it matches your records. This helps in preventing payments from being applied to the wrong account.

- Do not ignore the total amount due, including the principal, interest, escrow, and any fees. Understanding each component is important for managing your mortgage effectively.

- Do pay attention to transaction activity and past payments breakdown. This section provides a history of your payments, fees, and any additional charges or credits to your account.

- Do not forget to read and understand the "Important Messages" section. It contains information on partial payments, delinquency notices, and what to do if you're experiencing financial difficulties.

- Do confirm the interest rate, especially if it's set to change. Knowing your current rate and any future adjustments helps in planning your finances.

- Do not send your payment without including the additional principal or escrow amount if you intend to make such payments. This ensures that your extra funds are allocated as you wish.

By adhering to these guidelines, borrowers can ensure their mortgage statements are correctly filled out and submitted, thereby avoiding potential issues such as late fees or misapplied payments.

Misconceptions

Understanding mortgage statements can sometimes be complex, leading to various misconceptions. Here are five common misconceptions about mortgage statements and the truths behind them:

- Misconception 1: The Interest Rate Is Fixed for the Life of the Loan. Many people believe that the interest rate listed on their mortgage statement will remain the same throughout the life of their loan. However, this is not always the case, particularly for borrowers with adjustable-rate mortgages (ARMs). The interest rate may change depending on market conditions after the initial fixed-rate period.

- Misconception 2: The Statement Shows the Current Loan Balance. While the mortgage statement does include an outstanding principal amount, this figure may not reflect the loan balance in real-time. Payments made or additional fees assessed after the statement date are not shown, which can lead to confusion about the exact amount owed at any given moment.

- Misconception 3: Late Fees Are Negotiable. Some borrowers might think that the late fee indicated on a mortgage statement can be waived or negotiated. Generally, late fees are part of the loan agreement and are imposed as stated in the mortgage contract. Borrowers should pay close attention to the grace period and due dates to avoid these fees.

- Misconception 4: All Payments Go Toward Reducing the Loan Principal. It's a common misunderstanding that each payment made decreases the loan's principal. In reality, a mortgage payment is divided among several costs, including the principal, interest, taxes, and insurance (if held in escrow), and possibly other fees. Early in the loan term, a larger portion of the monthly payment is allocated to interest rather than reducing the principal amount.

- Misconception 5: Partial Payments Immediately Affect the Loan Balance. Borrowers might assume that any payment, partial or otherwise, will immediately be applied to their mortgage balance. However, partial payments are typically held in a separate account until the full payment amount is received, at which point they are applied to the loan. This policy prevents partial payments from immediately impacting the loan's principal and interest structure.

Clarifying these misconceptions is crucial for homeowners to understand their mortgage statements fully, manage their financial obligations effectively, and make informed decisions regarding their home financing.

Key takeaways

Understanding your mortgage statement is crucial for managing your home loan effectively. Here are four key takeaways to ensure you're fully informed:

- Payment Details: Your mortgage statement outlines the amount due and the due date. Take special note of the late fee applied if the payment is received after the specified date. It's vital to pay by the due date to avoid these extra charges.

- Breakdown of Amount Due: The statement provides a detailed breakdown of how your payment is applied, including principal, interest, escrow for taxes and insurance, and any fees. Understanding each component helps you see where your money goes each month.

- Transaction Activity: This section records all transactions that have occurred within the statement period, including payments made and any fees charged. Regularly reviewing this section can aid in spotting any discrepancies or unexpected fees quickly.

- Notices and Important Messages: Pay attention to any highlighted notices or messages in your statement. Whether it's information about the handling of partial payments, delinquency notices, or details on getting mortgage counseling or assistance, these notes are imperative for maintaining good standing on your loan or getting help if you're facing financial difficulties.

Always remember, if you have questions about your mortgage statement, contacting your loan servicer directly can provide clarity and help you stay on top of your mortgage responsibilities.

Common PDF Forms

Dekalb County Water Application Online - The form requests the preferred start date for service, helping to coordinate activation with moving or business operation schedules.

Puppy Health Record - Essential for pet travel, this form verifies a dog’s vaccination status, ensuring they meet the health requirements of airlines and destinations.