Free Netspend Dispute PDF Form

When cardholders face unauthorized credit or debit transactions, the Netspend Dispute Notification Form serves as an essential tool to contest these charges. This document must be filled out and submitted promptly, ideally immediately upon noticing the dubious transaction but no later than sixty days after the transaction date, to initiate the dispute process. The form acts as a first step towards potentially reversing unauthorized charges, specifying that once received, Netspend has a period of up to ten business days to make a decision on whether the disputed funds will be returned to the cardholder's account. Importantly, the submission of supporting evidence alongside the form could substantially aid in the resolution of the dispute in favor of the cardholder. However, the form also highlights a crucial cautionary note regarding liability - if the card was lost, stolen, or used without the owner's permission, the cardholder might be held accountable for any unauthorized transactions that occurred prior to reporting the card as compromised. Notably, cardholders are urged to declare if their card was lost or stolen on the form itself, to change their PIN, and to file a police report as additional protective measures. With spaces provided to detail up to five disputed transactions, including information on the merchant involved and prior communication attempts, the form is designed to gather comprehensive information to assist Netspend in the investigation and eventual resolution of the dispute.

Sample - Netspend Dispute Form

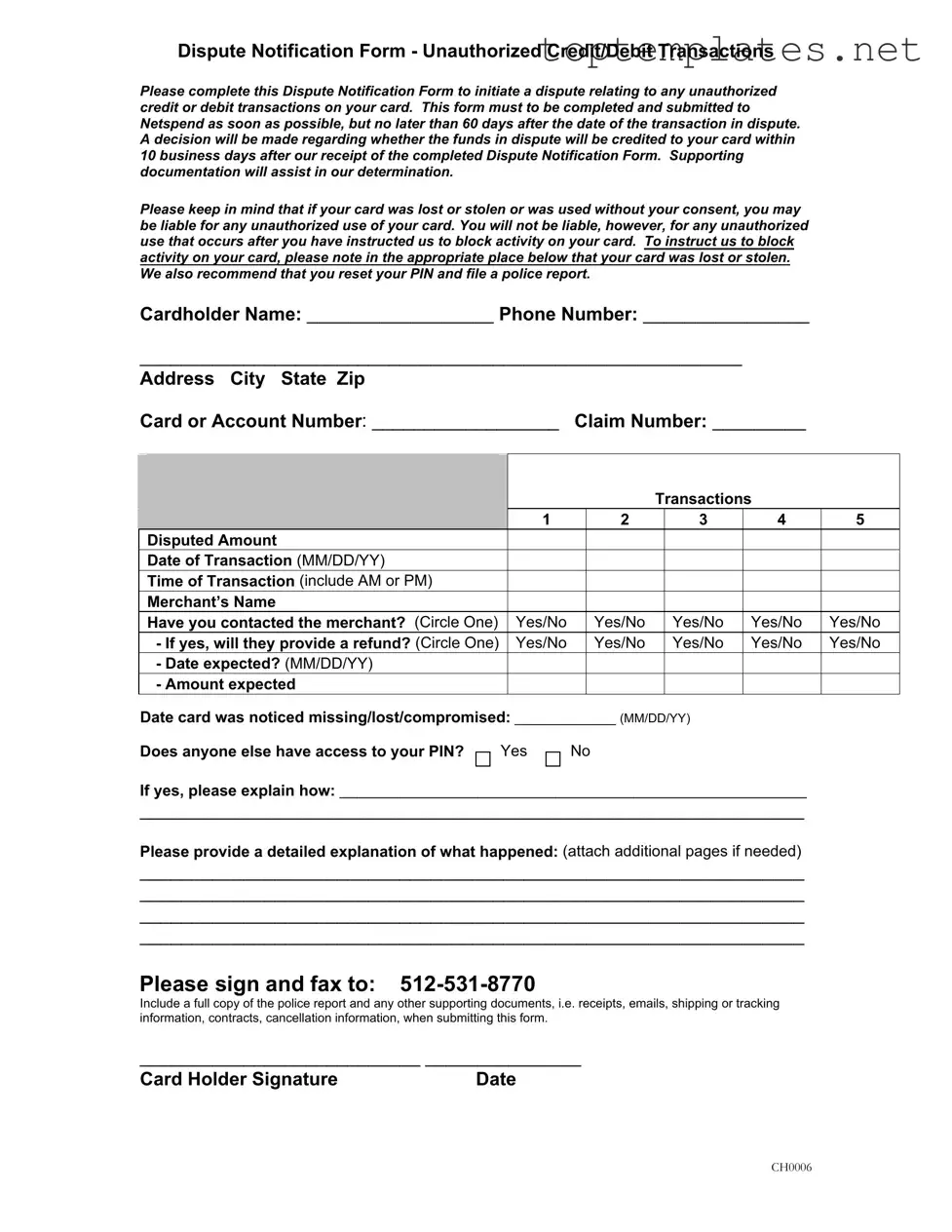

Dispute Notification Form - Unauthorized Credit/Debit Transactions

Please complete this Dispute Notification Form to initiate a dispute relating to any unauthorized credit or debit transactions on your card. This form must to be completed and submitted to Netspend as soon as possible, but no later than 60 days after the date of the transaction in dispute. A decision will be made regarding whether the funds in dispute will be credited to your card within 10 business days after our receipt of the completed Dispute Notification Form. Supporting documentation will assist in our determination.

Please keep in mind that if your card was lost or stolen or was used without your consent, you may be liable for any unauthorized use of your card. You will not be liable, however, for any unauthorized use that occurs after you have instructed us to block activity on your card. To instruct us to block activity on your card, please note in the appropriate place below that your card was lost or stolen. We also recommend that you reset your PIN and file a police report.

Cardholder Name: __________________ Phone Number: ________________ |

|

||||||||

__________________________________________________________ |

|

|

|||||||

Address City State Zip |

|

|

|

|

|

|

|

||

Card or Account Number: __________________ |

Claim Number: _________ |

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

Please provide information for each |

|

|

|

|

|

|

|

|

|

transaction you are disputing (submit up to 5 |

|

|

|

|

|

|

|

|

|

on one form) |

|

|

|

|

Transactions |

|

||

|

|

|

1 |

|

2 |

|

3 |

4 |

5 |

Disputed Amount |

|

|

|

|

|

|

|

||

Date of Transaction (MM/DD/YY) |

|

|

|

|

|

|

|

||

Time of Transaction (include AM or PM) |

|

|

|

|

|

|

|

||

Merchant’s Name |

|

|

|

|

|

|

|

||

Have you contacted the merchant? (Circle One) |

Yes/No |

|

Yes/No |

|

Yes/No |

Yes/No |

Yes/No |

||

|

- If yes, will they provide a refund? (Circle One) |

Yes/No |

|

Yes/No |

|

Yes/No |

Yes/No |

Yes/No |

|

|

- Date expected? (MM/DD/YY) |

|

|

|

|

|

|

|

|

|

- Amount expected |

|

|

|

|

|

|

|

|

Date card was noticed missing/lost/compromised: _____________ (MM/DD/YY)

Does anyone else have access to your PIN?

Yes

No

If yes, please explain how: ______________________________________________________

________________________________________________________________

Please provide a detailed explanation of what happened: (attach additional pages if needed)

________________________________________________________________

________________________________________________________________

________________________________________________________________

________________________________________________________________

Please sign and fax to:

Include a full copy of the police report and any other supporting documents, i.e. receipts, emails, shipping or tracking information, contracts, cancellation information, when submitting this form.

___________________________ _______________

Card Holder Signature |

Date |

CH0006

File Specs

| Fact Name | Description |

|---|---|

| Form Purpose | This form is specifically designed for initiating a dispute related to unauthorized credit or debit transactions on a Netspend card. |

| Submission Deadline | The form must be completed and submitted to Netspend no later than 60 days after the transaction date in dispute. |

| Decision Timeline | A decision regarding the disputed funds being credited back to the cardholder's account will be made within 10 business days after Netspend receives the completed Dispute Notification Form. |

| Supporting Documentation | Submitting supporting documentation along with the dispute form can assist in the determination of the dispute. |

| Liability for Unauthorized Use | Cardholders may be liable for unauthorized use of the card if it was lost, stolen, or used without consent, but not for unauthorized use occurring after the cardholder has instructed Netspend to block activity on their card. |

| Instructions for Lost/Stolen Cards | Cardholders are advised to report their card as lost or stolen, reset their PIN, and file a police report to prevent unauthorized use and support their dispute. |

Steps to Filling Out Netspend Dispute

Once you've discovered unauthorized transactions on your Netspend card, taking prompt action is crucial. The Netspend Dispute form is designed for such situations, allowing you to formally report these transactions to attempt a resolution. It's important to fill out and submit this form within 60 days from the date of the disputed transaction. After submission, expect a decision about the disputed funds within 10 business days. Providing supporting documents can be helpful in resolving your dispute. Remember, proactive steps like informing Netspend if your card was lost or stolen and changing your PIN can also be necessary.

Steps to Fill Out the Netspend Dispute Form:

- Write your full name as it appears on the card in the 'Cardholder Name' section.

- Enter your best contact phone number.

- Add your full address, including city, state, and zip code, in the provided spaces.

- Fill in your card or account number and claim number if available.

- Under 'Transactions', list each disputed transaction separately. You can dispute up to 5 transactions per form. For each transaction, provide:

- The disputed amount.

- The date of the transaction (MM/DD/YY format).

- The time of the transaction, indicating AM or PM.

- The merchant's name.

- Circle 'Yes' or 'No' to indicate whether you have contacted the merchant and if they've agreed to a refund. Note the expected refund date and amount if applicable.

- Indicate the date your card was noticed missing, lost, or compromised.

- Answer whether anyone else has access to your PIN. If 'Yes', provide an explanation.

- In the space provided, give a detailed explanation of what happened. Attach additional pages if necessary.

- Sign and date the form at the bottom.

- Fax the completed form to 512-531-8770, along with a full copy of the police report and any other supporting documents, such as receipts, emails, shipping or tracking information, contracts, cancellation information, etc.

Completing the Netspend Dispute form carefully and providing as much detail and evidence as possible will aid in the resolution process. Don't forget to follow up if necessary and keep copies of all documents for your records.

Discover More on Netspend Dispute

What is a Netspend Dispute Form?

A Netspend Dispute Form is a document provided by Netspend that customers must fill out and submit to dispute any unauthorized credit or debit transactions on their card. It is a critical step in notifying Netspend of disputed transactions for investigation and potential reimbursement.

How soon after noticing an unauthorized transaction should I submit the Dispute Notification Form?

You should submit the Dispute Notification Form as soon as possible, but no later than 60 days after the date of the transaction you are disputing. Prompt submission ensures your dispute is addressed swiftly.

What happens after I submit the Dispute Notification Form?

Once you submit the Dispute Notification Form, Netspend will review the information provided and make a decision about whether the disputed funds will be credited to your card. This decision is usually made within 10 business days after receiving the completed form. Providing supporting documentation can assist in the determination process.

Am I liable for unauthorized transactions made with my card?

If your card was lost, stolen, or used without your consent, you may be liable for the unauthorized transactions. However, you will not be liable for any unauthorized use that occurs after you have informed Netspend to block activity on your card. Informing Netspend as soon as you notice any unauthorized activity is crucial.

Should I contact the merchant involved in the unauthorized transaction?

Yes, you should contact the merchant involved in the unauthorized transaction. If the merchant agrees to provide a refund, this information could support your dispute with Netspend. Documenting your communication with the merchant and any confirmation of a refund can be helpful.

What should I do if my card was lost or stolen?

If your card was lost or stolen, notify Netspend immediately to block activity on your card. You should also reset your PIN and consider filing a police report. Including a full copy of the police report with your Dispute Notification Form can strengthen your case.

Can I submit more than one disputed transaction on one form?

Yes, you can list up to five disputed transactions on one Dispute Notification Form. For each transaction, you will need to provide specific details such as the date, time of the transaction, merchant’s name, and whether you have contacted the merchant about a refund. If you have more than five transactions to dispute, you may need to submit additional forms.

Common mistakes

When filling out the Netspend Dispute Form, it's crucial to avoid common mistakes to ensure your dispute is processed efficiently. Here are nine common errors:

- Not reporting the dispute in time: Failing to submit the Dispute Notification Form within 60 days of the transaction date.

- Omitting transaction details: Leaving out essential information such as the disputed amount, transaction date, or merchant’s name can delay the dispute resolution process.

- Forgetting to indicate merchant contact: Not specifying whether the merchant has been contacted or if they agreed to a refund can weaken your case.

- Ignoring the requirement for additional explanation: Not providing a detailed explanation of the incident or attaching necessary additional pages.

- Failure to include supporting documentation: Neglecting to fax or attach relevant documents like receipts, emails, or police reports that support your claim.

- Not signing the form: The dispute form is considered incomplete without the cardholder’s signature and the submission date.

- Inaccurate information: Entering incorrect details about the card or account number, which can lead to the rejection of the dispute.

- Skipping the lost or stolen card section: Not noting if the card was lost, stolen, or compromised can affect the liability and handling of your dispute.

- Failure to notify of PIN access: Not disclosing whether someone else has access to your PIN and explaining the circumstances.

- This mistake can impact the investigation and outcome of the dispute, as unauthorized use liability changes based on cardholder actions.

Avoiding these mistakes can help streamline the dispute process with Netspend, potentially leading to a quicker resolution in your favor.

Documents used along the form

When dealing with unauthorized credit or debit transactions, particularly with a Netspend card, the Dispute Notification Form is your first step in contesting charges you did not authorize. However, the success of your dispute often hinges on the supporting documentation you can provide alongside this form. To strengthen your case, consider including the following commonly used documents:

- Police Report: If your card was lost or stolen, or if you believe a crime has been committed, filing a police report and including a copy with your dispute form is crucial. This document adds a level of seriousness and validates your claim of unauthorized use.

- Bank Statements: Providing copies of your bank statements that highlight the disputed transactions can help clarify the issue. It allows the reviewing party to quickly identify the transactions in question amidst your regular card activity.

- Communication Records: If you've contacted the merchant involved in the unauthorized transaction, any records of this communication (emails, letters, or even phone call logs) can support your dispute. They show your attempts to resolve the matter directly, a step that’s often appreciated and sometimes required.

- Receipts or Contracts: If the dispute involves an item or service you did not receive, any receipts, contracts, or related documents originally involved in the transaction can be instrumental. They provide a baseline for what was expected and what was not delivered.

Compiling these documents may seem tedious, but they are integral to substantiating your claim. Each piece of evidence you gather and submit alongside your Netspend Dispute Notification Form helps build a comprehensive picture of the dispute. This enables the reviewing party to make a more informed decision, potentially leading to a faster resolution in your favor. Remember, while the Dispute Notification Form initiates your dispute, it’s the quality and clarity of your supporting documents that often determine the outcome.

Similar forms

The Credit Card Fraud Dispute Form is similar because it also allows cardholders to report unauthorized transactions. Like the Netspend Dispute form, this document is used to inform the credit card company about charges that were made without the cardholder's consent. The process often includes detailing the disputed transactions and may require the submission of additional documents to support the dispute.

The Bank Account Fraud Claim Form mirrors the Netspend form's purpose by providing customers a way to dispute unauthorized debits or fraudulent activities noticed on their bank accounts. Customers must describe the unauthorized transactions in detail and submit the form within a given timeframe, similar to the 60-day requirement for the Netspend Dispute form.

The Identity Theft Report Form has similarities in terms of dealing with the aftermath of unauthorized use of personal information. Although broader than disputing specific transactions, this form often initiates the process for disputing fraudulent accounts or transactions made in the victim's name. As with the Netspend form, documentation and detailed descriptions of the unauthorized activity are crucial.

Insurance Claim Forms for unauthorized use or theft are similar because they allow individuals to claim for reimbursement or coverage of losses due to fraud or theft. Users must provide specific information about the incident and submit within a strict deadline, akin to the Netspend Dispute form's submission requirements.

The Mobile Phone Insurance Claim Form also shares similarities, especially when reporting unauthorized use or transactions made through mobile banking apps tied to the phone. Such forms typically require detailed incident descriptions, timely submission, and sometimes a police report, much like the steps suggested by the Netspend Dispute form.

Merchandise Return Form can seem quite different at first glance, but it also revolves around disputing transactions, albeit in a more direct vendor-to-customer context. If a product is unauthorized, not as described, or faulty, completing this form with detailed explanations and seeking a refund or exchange mirrors the action of filling out the Netspend form to dispute unauthorized charges with the hope of financial restitution.

Dos and Don'ts

When filling out the Netspend Dispute form, it is crucial to follow specific dos and don'ts to ensure your dispute is processed efficiently and effectively. Below is a list of recommendations:

- Do complete the Dispute Notification Form promptly after recognizing an unauthorized transaction to ensure it is submitted within the 60-day time frame.

- Don't wait until the last moment to submit your form. Processing times and deadlines are strict, and delays can affect the resolution of your dispute.

- Do provide a detailed explanation of what happened regarding the unauthorized transaction, including any relevant dates, times, and the circumstances surrounding the discovery of the unauthorized use.

- Don't leave any sections of the form blank. If a question does not apply, mark it as "N/A" to indicate this to the processor.

- Do include all supporting documentation when submitting the form, such as a full copy of the police report, receipts, emails, contracts, and any shipping or tracking information that may support your dispute.

- Don't forget to sign and date the form. An unsigned form may delay processing or be returned unprocessed.

- Do immediately instruct Netspend to block activity on your card if it was lost, stolen, or used without your consent and reset your PIN.

- Don't disclose your PIN to others, and if someone else had access, be prepared to explain the circumstances on the form.

- Do contact the merchant involved to seek a refund before submitting the dispute form, as this may resolve the issue more quickly. Be sure to document your communication and outcome as it may be required.

By adhering to these guidelines, you increase the likelihood of a favorable outcome in the dispute process while ensuring compliance with Netspend's procedures.

Misconceptions

When handling financial matters, especially those concerning disputes over unauthorized transactions, it's crucial to navigate the process with accurate information. Unfortunately, there are several misconceptions about the Netspend Dispute Form that need to be clarified. Understanding these misconceptions can greatly improve the chances of a successful resolution to your dispute.

Submitting the form guarantees a refund. It’s important to understand that completing and submitting the Netspend Dispute Form does not automatically ensure that you will receive a refund for disputed transactions. The form initiates the investigation process, during which Netspend reviews the circumstances of the dispute before making a decision.

There's no time limit for submitting a dispute. Many cardholders mistakenly believe that they can submit a dispute at any time. However, the form must be completed and submitted to Netspend no later than 60 days after the date of the transaction in dispute. Failing to adhere to this deadline could result in the forfeiture of your right to dispute the charge.

Supporting documentation is optional. While it might seem that explaining your situation on the form is sufficient, providing supporting documentation can significantly assist in the determination process. Such documents might include receipts, emails, shipping or tracking information, contracts, cancellation information, and a police report if applicable.

All disputes are resolved within 10 business days. Netspend aims to make a decision on the dispute within 10 business days after receiving the completed form. However, this is not a guarantee, and some cases may take longer to resolve, depending on their complexity and the specifics involved.

You will not be held liable for any unauthorized use. While Netspend provides protections against unauthorized use, if your card was lost or stolen and used without your consent, there may be circumstances under which you could be held liable. It’s crucial to report any loss or unauthorized use immediately to limit your potential liability.

Filing a police report is always required. In the instructions, it is recommended to include a full copy of the police report if applicable. However, this may not be necessary for all types of disputes. Assessing the nature of your dispute will help determine if a police report is required to support your case.

You can dispute transactions for any reason. While you may feel justified in disputing a transaction, only those categorized as unauthorized are typically valid for a dispute through this process. If you have a different issue with a transaction, such as dissatisfaction with a purchase, other resolution processes may be more appropriate.

A dispute can include an unlimited number of transactions. The form has space to list up to five transactions. If you need to dispute more than five transactions, you may need to submit additional forms. This limitation is in place to ensure that each disputed transaction is given the appropriate level of attention and detail.

Contacting the merchant is unnecessary. One of the sections on the form asks whether you have contacted the merchant and if they will provide a refund. Engaging with the merchant can sometimes result in a faster resolution than proceeding directly to a dispute with Netspend, especially for cases where the issue can be resolved amicably.

Anyone can submit a dispute on behalf of the cardholder. For security reasons, only the cardholder or someone with legal authority to act on behalf of the cardholder should complete and submit the dispute form. Unauthorized submissions can complicate the dispute process and may lead to delays.

Correcting these misconceptions plays a critical role in the dispute process, empowering cardholders with the knowledge to effectively manage their finances and protect their rights. If you're considering filing a dispute with Netspend, it’s advisable to review all instructions and guidelines carefully to ensure that your submission is both timely and well-supported.

Key takeaways

Filling out the Netspend Dispute Form accurately and comprehensively is essential for cardholders who face unauthorized transactions on their accounts. Here are nine key takeaways to ensure the process is handled efficiently:

- Initiate the dispute process immediately upon discovering any unauthorized credit or debit transactions to ensure timely submission.

- The Dispute Notification Form must be submitted within 60 days following the transaction date to be eligible for investigation.

- Expect a decision regarding the disputed funds within 10 business days after Netspend receives the completed form, highlighting the importance of prompt action.

- Providing supporting documentation can significantly aid in the determination process.

- Clearly indicate if the card was lost or stolen or used without consent, directly impacting liability concerns.

- Immediately instruct Netspend to block activity on the card to mitigate further unauthorized use and reduce potential liability.

- Reset your PIN and consider filing a police report as recommended actions to strengthen your dispute case.

- Complete the dispute form with specific transaction details for up to five disputed transactions, including dates, amounts, and merchant information.

- Fax the signed form alongside a full copy of the police report and any other relevant supporting documents such as receipts or emails to Netspend at 512-531-8770.

Adhering to these guidelines when filling out and submitting the Netspend Dispute Form can help secure a favorable resolution to the dispute process, offering peace of mind and potentially preventing financial loss due to unauthorized transactions.

Common PDF Forms

Security Guard Report - The requirement for security officers to immediately notify their supervisor in the event of significant incidents underscores the importance of a rapid response and escalation process.

How to Calculate Load in Kw - Facilitates a smoother project execution phase, with fewer electrical system modifications required during construction.

D1 Application Form - Understanding the legal ramifications of false declarations or omissions is emphasized as a deterrent against misrepresentation.