Valid Operating Agreement Template

An Operating Agreement is a fundamental document for any business structured as a Limited Liability Company (LLC). It plays a pivotal role in defining the company's financial and functional decisions, including rules, regulations, and provisions. The document is crafted to outline the governance of the business, dictating the terms under which it operates, and providing clarity and structure to its legal framework. This agreement serves not only to establish the operating procedures for the company but also to protect the rights and responsibilities of its members, delineating their duties, investment percentages, profit splits, and procedures for handling the addition or loss of members. Additionally, while not required in every state, having an Operating Agreement can significantly assist in preserving the limited liability status of the company by reinforcing the separation between the business and its owners. It acts as a critical internal document that can help resolve any future disputes between members by referring back to the agreed-upon guidelines outlined within. Empowering businesses with the ability to customize their operating rules, this agreement affords a level of flexibility and security to the LLC, aiding in the smooth operation and management of the company.

Operating Agreement Form Categories

Sample - Operating Agreement Form

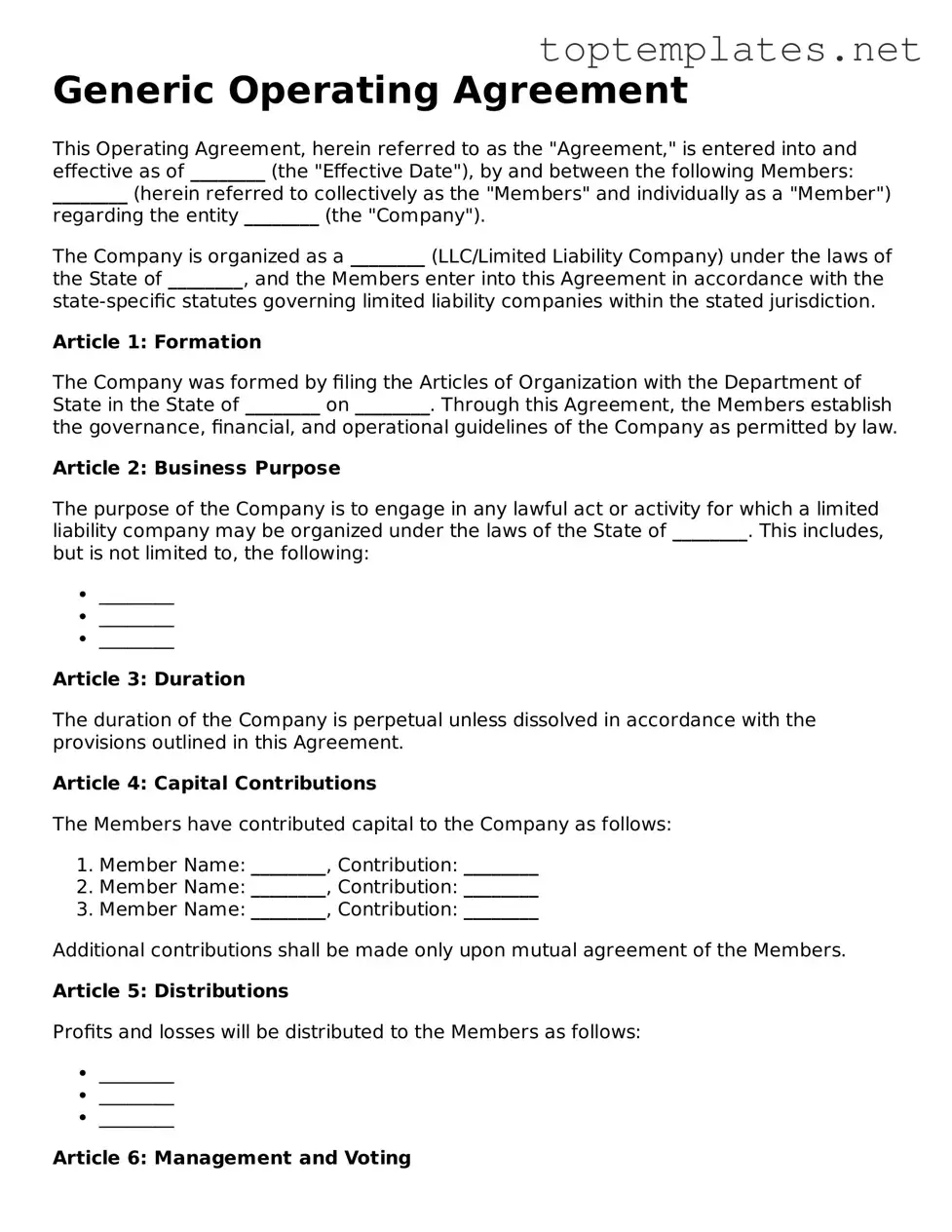

Generic Operating Agreement

This Operating Agreement, herein referred to as the "Agreement," is entered into and effective as of ________ (the "Effective Date"), by and between the following Members: ________ (herein referred to collectively as the "Members" and individually as a "Member") regarding the entity ________ (the "Company").

The Company is organized as a ________ (LLC/Limited Liability Company) under the laws of the State of ________, and the Members enter into this Agreement in accordance with the state-specific statutes governing limited liability companies within the stated jurisdiction.

Article 1: Formation

The Company was formed by filing the Articles of Organization with the Department of State in the State of ________ on ________. Through this Agreement, the Members establish the governance, financial, and operational guidelines of the Company as permitted by law.

Article 2: Business Purpose

The purpose of the Company is to engage in any lawful act or activity for which a limited liability company may be organized under the laws of the State of ________. This includes, but is not limited to, the following:

- ________

- ________

- ________

Article 3: Duration

The duration of the Company is perpetual unless dissolved in accordance with the provisions outlined in this Agreement.

Article 4: Capital Contributions

The Members have contributed capital to the Company as follows:

- Member Name: ________, Contribution: ________

- Member Name: ________, Contribution: ________

- Member Name: ________, Contribution: ________

Additional contributions shall be made only upon mutual agreement of the Members.

Article 5: Distributions

Profits and losses will be distributed to the Members as follows:

- ________

- ________

- ________

Article 6: Management and Voting

The Company shall be managed by its Members. Each Member shall have voting rights in proportion to their percentage of ownership in the Company. Decisions shall require a majority vote unless otherwise specified herein.

Article 7: Amendments

This Agreement can only be amended through written consent of all the Members.

Article 8: Dissolution

The Company may be dissolved upon the decision reached by a unanimous vote of all Members. Upon dissolution, the Company's assets will be distributed first to satisfy any liabilities and then to the Members based on their proportionate shares.

In witness whereof, the Members have executed this Agreement as of the Effective Date first above written.

Member Signature: ________ Date: ________

Member Signature: ________ Date: ________

File Breakdown

| Fact | Description |

|---|---|

| Definition | An Operating Agreement is a document that outlines the governance and operational guidelines, rights, and responsibilities of the members of a Limited Liability Company (LLC). |

| Flexibility | It allows LLC members to structure their financial and working relationships in a way that suits their business. This includes provisions for distribution of profits and losses, allocation of management duties, and procedures for adding or removing members. |

| State Regulation | The requirement for an Operating Agreement and its contents vary by state. Certain states mandate having an Operating Agreement, while others do not. Regardless, it is considered a best practice for LLCs to adopt one. |

| Key Clauses | Typical clauses include the LLC's name and address, its duration, the names of the members, the management structure, the capital contributions of the members, how profits and losses will be shared, and how the LLC can be dissolved. |

Steps to Filling Out Operating Agreement

Filling out an Operating Agreement is a crucial step in formalizing the structure and operational guidelines of a Limited Liability Company (LLC). This document lays out key aspects of the business, such as management, ownership percentages, and profit sharing, helping to ensure that all members are on the same page and reducing the potential for future disputes. Below, you'll find step-by-step instructions designed to guide you through the process of completing this important form.

- Begin by gathering all necessary information, including the LLC's official name, primary place of business, and the names and addresses of all members.

- Next, specify the duration of the LLC if it is not intended to be perpetual. Some LLCs are created for a specific length of time, so this should be clearly stated.

- Outline the contributions of each member, including cash, property, or services, and note the ownership percentage each contribution represents.

- Detail the allocation of profits and losses among members. This could be based on the percentage of ownership or another agreement among members.

- Describe the management structure of the LLC. Indicate whether it will be member-managed or manager-managed, and identify the manager(s) if applicable.

- Set forth the voting rights of members, including how votes are allocated, the process for conducting votes, and any matters that require a higher or unanimous vote.

- Include any provisions for meetings, such as how often they will occur, how members will be notified, and the quorum requirements for making decisions.

- Explain the process for admitting new members, including any approval needed from existing members and how the new member's ownership interest will be determined.

- Outline the circumstances under which the LLC may be dissolved and the process for winding up its affairs, including distributing assets to members.

- Finally, ensure that all members sign and date the agreement. It might also be beneficial to have the signatures notarized to authenticate the document further.

After completing the Operating Agreement, it's important to store it in a safe place and distribute copies to all members of the LLC. While not always legally required, filing this document can help protect the members' personal assets and provide clear guidelines for the operation of the business. Remember, the Operating Agreement can be amended as the business grows and changes, so consider it a living document that reflects the current understanding and agreements between LLC members.

Discover More on Operating Agreement

What is an Operating Agreement?

An Operating Agreement is a crucial document used by LLCs (Limited Liability Companies) to outline the business's financial and functional decisions including rules, regulations, and provisions. The purpose of this agreement is to govern the internal operations of the business in a way that suits the specific needs of the business owners. It lays down the blueprint for how the owners interact on a business and legal level.

Who needs an Operating Agreement?

All LLCs should create an Operating Agreement, regardless of the state in which they operate. While not all states require LLCs to have an Operating Agreement, it is highly recommended. This document is beneficial not only for meeting state legal requirements but also for ensuring all business owners are on the same page regarding the operation of the LLC, thus preventing conflicts in the future.

What happens if an LLC does not have an Operating Agreement?

Without an Operating Agreement, an LLC is governed by the default state laws that may not be to the advantage of the LLC or its members. This could lead to misunderstandings and conflicts among members about financial and management decisions. It can also make your business seem less credible to banks and potential investors.

Can the Operating Agreement be changed?

Yes, the Operating Agreement can be amended as the needs of the LLC and its members change. However, the process for making amendments should be included within the original Operating Agreement to ensure that any changes are made systematically and agreed upon by all members.

What are the key elements of an Operating Agreement?

Key elements often include the percentage of members' ownership, the voting rights and responsibilities of members, the powers and duties of managers, distribution of profits and losses, how meetings are conducted, and how the business is managed on a day-to-day basis. It should also outline the procedures for adding new members, exiting members, and dissolving the business if necessary.

Does an Operating Agreement need to be filed with the state?

Most states do not require the Operating Agreement to be filed with the state. This document is internal and is kept by the members of the LLC. However, having an Operating Agreement can be crucial when opening a bank account in the business’s name or when dealing with legal matters. It's also important to refer to your specific state's requirements as a few states do have filing requirements.

Common mistakes

When business owners or partners set out to fill out an Operating Agreement form, which governs the operations of a Limited Liability Company (LLC), they often overlook or mishandle certain aspects. This document is crucial as it outlines the ownership and member duties, helping to prevent conflicts in the future. Below are six common mistakes to avoid:

-

Not Customizing the Agreement to Fit the Business: Many people use a one-size-fits-all approach, relying on generic templates. Each business is unique, and the Operating Agreement should reflect its specific needs, including management structure and profit distribution.

-

Omitting Important Details: It's essential not to overlook critical elements such as the process for adding or removing members, dispute resolution methods, and specific duties of each member. These details can save a lot of headaches down the line.

-

Ignoring State Laws: Each state has its own set of rules governing LLCs. Failing to align the Operating Agreement with state laws can lead to legal issues or the document being partly or wholly unenforceable.

-

Lack of Clarity in Financial Provisions: The sections dealing with financial distributions, contributions, and decision-making processes should be clear and precise to avoid future disputes among members.

-

Forgetting to Include the Buy-Sell Agreement: This is a critical mistake. A Buy-Sell Agreement outlines what happens when a member wants out, dies, or becomes incapacitated. Without this, transferring ownership can become a major problem.

-

Not Keeping the Document Updated: As businesses evolve, so should their Operating Agreements. Failing to update the document to reflect changes in management, membership, or the business model can lead to operational and legal challenges.

In preparing an Operating Agreement, attention to detail and foresight can prevent these common pitfalls. Taking the time to customize and regularly update this document can safeguard the business's future, ensuring smooth operations and minimizing internal disputes.

Documents used along the form

When forming a business, particularly a Limited Liability Company (LLC), the Operating Agreement is a critical document that outlines the operational procedures and financial arrangements between the members of the company. However, this important document is often accompanied by several other forms and documents that are vital for the proper establishment and maintenance of the business entity. These documents not only help in ensuring compliance with local and federal regulations but also in safeguarding the interests of all parties involved.

- Articles of Organization: This document is essential for officially forming the LLC in the state. It contains basic information about the LLC, such as the name of the LLC, its address, and the names of its members. Filing the Articles of Organization with the state agency is a prerequisite for the legal existence of the LLC.

- Employer Identification Number (EIN) Application: An EIN, also known as a Federal Tax Identification Number, is required for an LLC to open a bank account and conduct business. It is obtained by applying to the IRS, either online or by mail, and is necessary for hiring employees and handling taxes.

- Membership Certificates: Similar to stock certificates in a corporation, Membership Certificates are issued to the owners (members) of the LLC. These certificates serve as evidence of ownership in the company and specify the percentage of the company owned by each member.

- Operating Agreement Amendment: As businesses evolve, the original Operating Agreement might need amendments. This document helps in officially recording any changes agreed upon by the members regarding the operation or ownership of the LLC.

- Minutes of Meeting: Keeping a record of the decisions made during meetings is crucial for an LLC. Minutes of Meeting documents help in maintaining a formal record of what was discussed and decided upon during member or managerial meetings, ensuring transparency and accountability.

Together with the Operating Agreement, these documents form the backbone of a well-structured and compliant LLC. They provide a clear framework for operation, protect the legal rights of all members, and ensure that the business meets all necessary regulatory requirements. Proper attention to these documents can significantly reduce legal risks and help maintain a smooth operational flow within the company.

Similar forms

Partnership Agreement: Much like the Operating Agreement, a Partnership Agreement outlines the terms of the partnership between two or more business partners. It covers profit-sharing, decision-making processes, and dispute resolution, ensuring that all partners are aligned on the business's operation and expectations.

Bylaws for Corporations: Serving a similar purpose for corporations, Bylaws establish the internal rules governing the management of a corporation. Like an Operating Agreement for LLCs, Bylaws set forth procedures for holding meetings, electing officers and directors, and handling other corporate formalities.

Shareholder Agreement: This document is akin to an Operating Agreement but for corporations with shareholders. It delineates shareholders' rights, responsibilities, and procedural rules, focusing on ownership, valuation, and transfer of shares.

Buy-Sell Agreement: Closely related, a Buy-Sell Agreement outlines what happens to a partner's share of the business if they choose to leave, die, or become incapacitated. Operating Agreements often include similar provisions to handle such events within an LLC.

Co-Founder Agreement: Startups frequently use a Co-Founder Agreement, which parallels an Operating Agreement, to clarify the roles, responsibilities, and equity division among founders to prevent conflicts as the business grows.

Employment Agreement: Though focused on the employer-employee relationship, Employment Agreements share commonalities with Operating Agreements by detailing the terms of employment, roles, responsibilities, and conditions for termination, aiming to protect both parties’ interests.

Independent Contractor Agreement: Similar to Employment Agreements but for freelance or consultancy roles, these agreements define the scope of work, payment terms, and confidentiality requirements, preserving the non-employee status while ensuring clear expectations are set.

Member-Managed LLC Agreement: Specifically for LLCs that choose not to appoint a manager and instead opt for all members to collectively manage, this form of Operating Agreement specifies the decision-making processes and distribution of duties among members.

Franchise Agreement: Operating Agreements and Franchise Agreements both specify operational practices and standards. However, Franchise Agreements are between a franchisor and franchisee, detailing the terms under which the franchisee operates the franchised business.

Joint Venture Agreement: This document establishes a partnership for a limited period or project, similar to how an Operating Agreement may apply to projects undertaken by an LLC. It covers each party's contributions, profit sharing, and operational control.

Dos and Don'ts

Filling out the Operating Agreement for your business is a crucial step in ensuring its smooth operation and legal compliance. Here are eight dos and don'ts to consider during this important process:

- Do ensure that all members agree on the terms before filling out the form. It’s important to have a clear and mutual understanding to prevent future conflicts.

- Do review the form thoroughly to ensure it covers all aspects of your business operation, including management structure, member roles, and financial arrangements.

- Do consult with a legal professional if there are any clauses or terms that are unclear. Getting expert advice can help safeguard your business and its members.

- Do use clear and precise language to avoid ambiguity. This will help prevent misunderstandings and provide clarity on the agreement’s terms.

- Don't rush through the process. Take the time needed to consider all aspects of the business and how they should be addressed in the agreement.

- Don't overlook any state-specific requirements that may be applicable to your Operating Agreement. Each state has its own rules, and failing to comply can result in legal complications.

- Don't use a one-size-fits-all template without making necessary adjustments. While templates can be a great starting point, customize the agreement to fit the unique needs of your business.

- Don't forget to update the agreement as your business grows or changes. What works for your business now may not be sufficient in the future, so periodically review and amend the agreement as needed.

Misconceptions

An Operating Agreement is a vital document for any LLC, setting out the rules and provisions for its operation. However, there are many misconceptions about this legal form that can lead to misunderstandings and mismanagement. Let’s clear up some of the most common myths surrounding Operating Agreements.

All LLCs are legally required to have an Operating Agreement. This is not true in every state. While it's highly recommended for every LLC to have an Operating Agreement to outline the structure and operating procedures of the business, not all states mandate it. However, without one, your LLC will be governed by the default state laws, which may not be to your benefit.

Operating Agreements are only necessary for multi-member LLCs. Even if you're a sole proprietorship operating as an LLC, having an Operating Agreement is beneficial. It adds credibility to your business, can be required by lenders, and helps ensure your limited liability status is respected by the courts.

A standardized form downloaded from the internet will suffice. While a template might be a good starting point, every business is unique. A form operating agreement may not cover all aspects of your business or meet the specific legal requirements of your state. Customizing your agreement is crucial.

Once signed, the Operating Agreement cannot be changed. An Operating Agreement can be amended as your LLC grows and changes. It's important to review and potentially update it periodically, especially after significant events like the addition or departure of a member.

Operating Agreements are not important for day-to-day operations. While it's true that Operating Agreements are more about the overall structure and governance of the LLC, they often include vital information for daily operations, such as dispute resolution procedures, duties of members, and financial management policies.

The only purpose of an Operating Agreement is to satisfy state requirements. Beyond compliance, Operating Agreements protect members' interests, prevent misunderstandings by setting clear expectations, and provide a clear path for resolving disputes. They are a key document for both legal protection and effective management.

Operating Agreements are publicly registered documents. Unlike your Articles of Organization, Operating Agreements are internal documents. They are not typically filed with the state (except in a few states) and are not made public, offering a level of privacy to the business operations.

You can wait until there's a dispute or issue to create an Operating Agreement. At that point, it might be too late. An Operating Agreement should be in place to prevent disputes by outlining governance and procedures upfront. Waiting until a problem arises defeats one of the primary purposes of having one.

Operating Agreements don't need to be in writing. While some states allow for oral agreements, having your Operating Agreement in writing is crucial. It reduces misunderstandings and will likely be required to resolve any disputes among members or with third parties.

Understanding these misconceptions about Operating Agreements can help ensure that your LLC is properly protected and operates smoothly. While it may seem like just another formality, an Operating Agreement is a powerful tool that can safeguard your business against future problems and conflicts.

Key takeaways

An Operating Agreement form is a crucial document for any LLC (Limited Liability Company), serving as a guideline for the business's operations and providing protection to its members. Here are key takeaways you should consider when filling out and using this document:

- Customization is key: Tailor the Operating Agreement to fit the specific needs of your LLC. Though templates are available, customization ensures that the agreement reflects the unique aspects of your business.

- Define the ownership structure clearly: The agreement should distinctly outline the ownership percentages of each member, based on their contributions or any other agreed-upon measures.

- Outline the distribution of profits and losses: Clarify how the LLC will distribute profits and handle losses among members. This is crucial for financial planning and prevents disputes.

- Establish member roles and responsibilities: Assigning clear roles and responsibilities to each member helps in the smooth operation of the business and makes accountability easier.

- Voting rights and decision-making processes: The Operating Agreement should specify voting rights for each member and the processes for making significant business decisions, ensuring fairness and transparency.

- Plan for changes in membership: Including provisions for adding or removing members helps prepare the LLC for future changes in its membership structure without causing disruption.

- Detail the process for dissolving the LLC: Although it may seem pessimistic to plan for the end of the business, having a clear dissolution process in place protects everyone involved.

- Dispute resolution: Outline a procedure for resolving disputes among members or between members and the LLC to avoid costly litigation.

- Signatures are essential: To be effective, all members must sign the Operating Agreement. This formalizes the document's validity and the members' commitment to it.

- Keep the document accessible: Once completed and signed, keep the Operating Agreement in a safe, easily accessible place. All members should have copies, and it should be reviewed regularly or when the business undergoes significant changes.

Remember, the Operating Agreement is not just a formality but a pivotal document that can safeguard the stability and continuity of the LLC. Seeking legal counsel to assist in drafting or reviewing the Operating Agreement can ensure that it comprehensively covers all necessary legal bases.

Consider Other Documents

Employee Change of Status Form - Facilitates a transparent and traceable process for acknowledging significant changes in an employee's career path or employment status.

Dd 2870 Army Pubs - For veterans, the DD 2870 is helpful in facilitating healthcare services and benefits.

Shared Well Agreement Example - Guidelines and rules governing the shared use of a well, including how expenses for maintenance and operation are split.