Valid Single-Member Operating Agreement Template

For entrepreneurs embarking on a solo venture, clarity in operation and protection of personal assets becomes paramount. The Single-Member Operating Agreement plays a crucial role in achieving these objectives, outlining the architecture of your business operations. This essential document serves as a blueprint, providing detailed descriptions of the owner's financial and managerial rights and responsibilities. Beyond its functional benefits, it stands as a testament to the seriousness and professionalism of the business owner, reinforcing credibility with financial institutions and potential partners. While it may initially seem like a daunting task, crafting this agreement ensures that both the legal structure and the operational framework of the business are well-defined, paving the way for smooth business operations and providing a solid foundation for future growth and success.

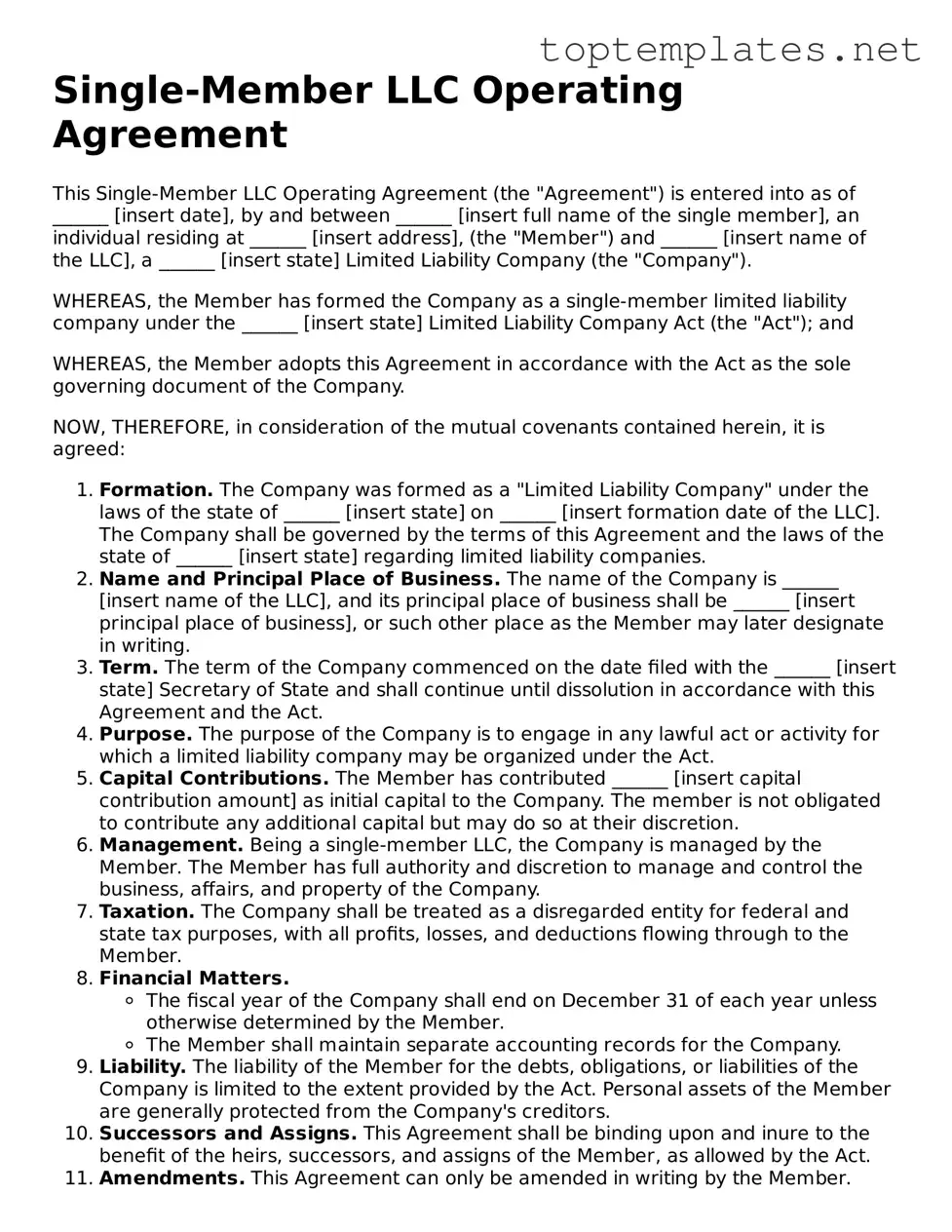

Sample - Single-Member Operating Agreement Form

Single-Member LLC Operating Agreement

This Single-Member LLC Operating Agreement (the "Agreement") is entered into as of ______ [insert date], by and between ______ [insert full name of the single member], an individual residing at ______ [insert address], (the "Member") and ______ [insert name of the LLC], a ______ [insert state] Limited Liability Company (the "Company").

WHEREAS, the Member has formed the Company as a single-member limited liability company under the ______ [insert state] Limited Liability Company Act (the "Act"); and

WHEREAS, the Member adopts this Agreement in accordance with the Act as the sole governing document of the Company.

NOW, THEREFORE, in consideration of the mutual covenants contained herein, it is agreed:

- Formation. The Company was formed as a "Limited Liability Company" under the laws of the state of ______ [insert state] on ______ [insert formation date of the LLC]. The Company shall be governed by the terms of this Agreement and the laws of the state of ______ [insert state] regarding limited liability companies.

- Name and Principal Place of Business. The name of the Company is ______ [insert name of the LLC], and its principal place of business shall be ______ [insert principal place of business], or such other place as the Member may later designate in writing.

- Term. The term of the Company commenced on the date filed with the ______ [insert state] Secretary of State and shall continue until dissolution in accordance with this Agreement and the Act.

- Purpose. The purpose of the Company is to engage in any lawful act or activity for which a limited liability company may be organized under the Act.

- Capital Contributions. The Member has contributed ______ [insert capital contribution amount] as initial capital to the Company. The member is not obligated to contribute any additional capital but may do so at their discretion.

- Management. Being a single-member LLC, the Company is managed by the Member. The Member has full authority and discretion to manage and control the business, affairs, and property of the Company.

- Taxation. The Company shall be treated as a disregarded entity for federal and state tax purposes, with all profits, losses, and deductions flowing through to the Member.

- Financial Matters.

- The fiscal year of the Company shall end on December 31 of each year unless otherwise determined by the Member.

- The Member shall maintain separate accounting records for the Company.

- Liability. The liability of the Member for the debts, obligations, or liabilities of the Company is limited to the extent provided by the Act. Personal assets of the Member are generally protected from the Company's creditors.

- Successors and Assigns. This Agreement shall be binding upon and inure to the benefit of the heirs, successors, and assigns of the Member, as allowed by the Act.

- Amendments. This Agreement can only be amended in writing by the Member.

- Governing Law. This Agreement and the rights of the Member hereunder shall be governed by and construed in accordance with the laws of the state of ______ [insert state], excluding any conflict of laws rules that may direct the application of the laws of another jurisdiction.

- Entire Agreement. This Agreement constitutes the entire agreement between the parties regarding the organization and operation of the Company and supersedes all prior discussions, agreements, or understandings of any kind.

IN WITNESS WHEREOF, the undersigned has executed this Single-Member LLC Operating Agreement as of the date first above written.

Member:

___________________________________

[Insert member's name]

Date: _______________________________

File Breakdown

| Fact Name | Description |

|---|---|

| Purpose | An operating agreement for a single-member LLC outlines the business's financial and functional decisions including rules, regulations, and provisions. The purpose is to govern the internal operations of the business in a way that suits the needs of the single owner. |

| Legally Required? | While not required by every state, having an operating agreement is strongly recommended. It helps to establish the separate legal status of the business, which can be crucial for personal asset protection. |

| State Specific | Several states have specific requirements and provisions that should be included in the agreement. Always refer to the state's governing laws where the LLC is registered to ensure compliance. |

| Governing Law | The operating agreement is governed by the state law where the LLC is formed. Each state can have different statutes that affect how the agreement should be formed and what it should contain. |

Steps to Filling Out Single-Member Operating Agreement

After deciding to establish a limited liability company (LLC), a Single-Member Operating Agreement is vital for outlining the operation of your business and establishing its separate legal existence. This agreement is your entity's internal document, and therefore, it's not submitted to any state agency but kept for your records and possibly those of your financial institutions. Let's ensure this document captures all necessary details accurately by following these steps:

- Begin by entering the date the agreement is being executed.

- Next, fill in the full legal name of the LLC as registered with the state.

- Specify the state where your LLC is organized and the date of formation.

- State the purpose of the LLC, ensuring the description is broad enough to encompass your business activities without being too generic.

- Identify the registered agent's name and registered office address, which is essential for receiving legal correspondence. This should be in the state where your LLC is formed.

- Provide the principal place of business, which is where your LLC officially conducts its operations.

- Document the name of the sole member and detail their capital contribution to the LLC. This clarifies the member's investment and ownership stake.

- Outline the management structure of the LLC and specify that the sole member will manage the LLC's affairs, making all business decisions.

- Delineate the powers and duties of the member in operating the LLC, providing a clear framework for business operations.

- Include clauses on how changes to the agreement can be made, ensuring there’s a process for future amendments.

- Clarify the dissolution process of the LLC, addressing how the business can be wound up should the need arise.

- Finally, the sole member must sign and date the document, making it official. Witness or notarization may not be obligatory but consider it for added formality.

With your Single-Member Operating Agreement competently filled out, you're taking a significant step towards fortifying the operational foundation and legal integrity of your LLC. This document serves as a critical reference for managing your business's operations and underscores your commitment to professional governance. Keep this document secure, and readily accessible, as it's a pivotal piece of your business's organizational documentation.

Discover More on Single-Member Operating Agreement

What is a Single-Member Operating Agreement?

A Single-Member Operating Agreement is a legal document that outlines the structure, operations, and guidelines of a Limited Liability Company (LLC) that has only one owner. It serves as a fundamental framework for how the business will be managed, detailing every aspect from financial decisions to daily operations, despite the company being owned by a solitary individual. This agreement not only solidifies operational procedures but also reinforces the owner's limited liability status, distinguishing the owner's personal assets from the business's liabilities.

Why is having a Single-Member Operating Agreement important?

Although not always legally required, having a Single-Member Operating Agreement is crucial for several reasons. First, it provides official documentation that strengthens the separation between the owner's personal and business assets, which is essential for maintaining limited liability protection. Additionally, in the event of legal disputes or if the business is sold, this agreement serves as a clear outline of the owner’s intentions and the business's operating procedures, ensuring the continuity and stability of the LLC. It also clarifies operational matters for banks, lenders, and other entities requiring detailed insight into the business's structure.

What should be included in a Single-Member Operating Agreement?

This agreement should comprehensively address several key areas, including the LLC's name and principal place of business; the nature of the business; the name and address of the LLC's registered agent; the LLC’s term of duration; how the LLC will be taxed; the owner's contributions to the LLC; how profits, losses, and distributions will be handled; the process for amending the agreement; and the procedures for dissolving the LLC. Detailed provisions regarding the management of the LLC and the owner’s powers and duties also form an essential part of the agreement.

Can the Single-Member Operating Agreement be amended?

Yes, the Single-Member Operating Agreement can be amended. Since business circumstances and personal goals may change over time, the agreement allows for modifications. Generally, the initial agreement should outline the procedure for making amendments. Typically, any changes to the agreement must be in writing and signed by the LLC's sole member, ensuring that the document remains current and relevant to the business’s needs.

Is it mandatory to file the Single-Member Operating Agreement with state authorities?

No, it is not generally required to file the Single-Member Operating Agreement with state authorities. Most states do not ask for this document during the LLC formation process or as part of annual reporting requirements. Instead, the agreement should be kept with the business’s important records, readily accessible for reference, and provided when needed to financial institutions, potential buyers of the business, or in legal situations as proof of the LLC’s operational structure.

How does a Single-Member Operating Agreement protect the owner's assets?

The Single-Member Operating Agreement plays a significant role in maintaining the liability shield between the owner's personal assets and business debts or liabilities. By clearly documenting the business as a separate legal entity, it helps in asserting the owner's limited liability protection, especially in legal disputes. This distinction is vital for preventing personal assets from being targeted to satisfy business debts or judgments against the LLC.

What happens to the Single-Member Operating Agreement if the business is sold?

Should the business be sold, the Single-Member Operating Agreement can either be transferred to the new owner—who may opt to amend it—or be dissolved along with the sale. The sale process typically includes terms that address the transfer or termination of the operating agreement, ensuring that all parties are aware of their rights and obligations concerning the business’s operational procedures and structure.

Can a Single-Member Operating Agreement prevent disputes in business?

While a Single-Member Operating Agreement is designed for an LLC with only one owner and may not directly deal with disputes between multiple owners, it can still help prevent disputes related to the business operations from external parties. By outlining clear procedures for managing the LLC, including financial management, dispute resolution processes, and operational controls, the agreement provides a clear roadmap that may help in avoiding misunderstandings or conflicts with vendors, employees, and other parties.

How often should the Single-Member Operating Agreement be reviewed?

It is wise to review the Single-Member Operating Agreement annually or whenever major changes occur in the business or its operations. This ensures that the agreement remains aligned with the current state of the business and the owner’s objectives. Regular reviews can also help in identifying any provisions that may need updating due to changes in laws or the business environment, maintaining the document’s effectiveness and relevance.

Common mistakes

When completing the Single-Member Operating Agreement form, individuals often make a variety of mistakes that can have significant implications for their business. Recognizing and avoiding these errors can ensure the document accurately reflects the owner's intentions and complies with legal standards. The following list outlines common mistakes made during this process:

Not customizing the agreement to fit the business: Many individuals use a generic template without making necessary adjustments to address the specific needs and operations of their business. This oversight can lead to issues that affect the company's governance and operation.

Failing to fully understand the terms: It's crucial to comprehend all terms and conditions outlined in the agreement. Misunderstanding these terms can lead to conflicts and legal issues regarding the business's operations.

Omitting important clauses: Essential clauses such as those detailing the dissolution process, ownership of intellectual property, and dispute resolution mechanisms are sometimes overlooked. The absence of these clauses can result in ambiguities and vulnerabilities.

Not updating the agreement: As a business evolves, its operating agreement should reflect these changes. Failing to regularly update the agreement as the business grows and changes can lead to discrepancies and legal complications.

Skipping legal review: While it may seem cost-effective to bypass professional legal advice, not having the agreement reviewed by a legal expert can result in compliance issues and oversights that could have been avoided.

Avoiding these mistakes requires attention to detail, a deep understanding of the business, and, often, consultation with legal professionals. Ensuring the Single-Member Operating Agreement is thoroughly and correctly completed is fundamental to the legal and operational foundation of any business.

Documents used along the form

When setting up a single-member LLC, the Single-Member Operating Agreement is a key document that outlines the company's structure and the member's rights and responsibilities. However, this agreement does not exist in isolation. To fully establish and operate a single-member LLC, several other forms and documents are often used in conjunction. These documents complement the Operating Agreement by covering areas not directly addressed within it, enhancing the company's legal and operational framework.

- Articles of Organization: This is the primary document filed with the state to officially form the LLC. It includes basic information such as the LLC's name, principal address, and the registered agent for service of process.

- Employer Identification Number (EIN) Registration: An EIN, obtained from the IRS, is necessary for tax purposes, opening a business bank account, and hiring employees. It serves as the LLC's federal taxpayer identification number.

- Operating Agreement Amendment Form: If changes need to be made to the original Operating Agreement, this form documents those amendments, ensuring the agreement stays current and relevant.

- Annual Report: Most states require LLCs to file an annual (or biennial) report updating the company's information, such as current business activities, addresses, and the registered agent.

- Business License Application: Depending on the nature of the business and its location, various licenses and permits may be required to legally operate.

- Bank Resolution: This document authorizes the opening of a business bank account in the LLC's name and specifies who can sign checks, access bank account information, or make financial decisions on behalf of the LLC.

- Membership Certificate: Although not always legally required, this certificate serves as physical proof of ownership in the LLC, similar to a stock certificate in a corporation.

While the Single-Member Operating Agreement lays the groundwork for the operations and management of the LLC, these additional documents are crucial for compliance, financial management, and legal protection. Together, they create a comprehensive framework that supports the LLC's successful operation and growth. Keeping accurate and updated records of all these documents is vital for legal compliance and managing the company's affairs efficiently.

Similar forms

A Partnership Agreement is similar in function to a Single-Member Operating Agreement because both outline the operational and financial strategies of a business. While a Single-Member Operating Agreement is for solo entrepreneurs, a Partnership Agreement is for businesses owned by two or more individuals, detailing each partner's rights, responsibilities, and share in the profits.

A Bylaws Document for Corporations serves a similar purpose as it outlines the internal management structure and operating procedures of a corporation. Just as the Single-Member Operating Agreement organizes the operations for a limited liability company (LLC), Bylaws do the same for corporations, detailing how decisions are made and the roles of directors and officers.

The Shareholder Agreement is related because it governs the relationship among the shareholders of a company and with the company itself, similar to how a Single-Member Operating Agreement sets out the operation and management of an LLC. It includes aspects like share ownership, distribution of profits, and decision-making processes.

A Business Plan is akin to a Single-Member Operating Agreement in that it provides a roadmap for the company. However, it focuses more on the strategic aspect of the business, including market analysis, organizational structure, and financial projections, guiding the business's growth and securing financing.

An Employment Contract outlines the terms of employment between a business and its employees, similar to how a Single-Member Operating Agreement outlines the structure and functioning of an LLC. This contract details the roles, responsibilities, and rights of the employee and employer, including compensation, job duties, and confidentiality obligations.

A Freelancer Contract is developed for the purpose of setting terms between a freelancer and their clients, detailing project scopes, timelines, payment schedules, and intellectual property rights. This mirrors the way a Single-Member Operating Agreement sets the framework for the operation of a solo entrepreneur’s business venture.

Dos and Don'ts

When filling out a Single-Member Operating Agreement form, it's essential to approach the task with diligence and attention to detail. This document outlines the structure, operations, and financial decisions of your limited liability company (LLC). Here are some guidelines on what to do and what not to do during the process:

- Do clarify how decisions are made: Make sure you specify the process for making significant business decisions, such as entering contracts or taking on debt.

- Do outline the distribution of profits: Detail how and when profits will be distributed from the LLC to you as the sole member.

- Do plan for the future: Consider including clauses that address how changes in membership or dissolution of the company would be handled. This is crucial for your business's longevity.

- Do regularly update the agreement: As your business grows and evolves, so should your Single-Member Operating Agreement. Make revisions as necessary to reflect current operations and goals.

- Don't overlook dispute resolution: Specify a method for resolving disputes, whether through mediation, arbitration, or court action, to help prevent misunderstandings and legal issues down the line.

- Don't forget to specify the role of the member: Even as a single-member LLC, it's important to formalize your role and duties within the company in the agreement.

- Don't use vague language: Be as clear and precise as possible in your wording to avoid ambiguity. This includes defining terms, roles, and processes within the agreement.

- Don't neglect to sign and date the agreement: An unsigned agreement is often considered invalid, so ensure you sign and date the document to formalize its validity.

Misconceptions

When it comes to the Single-Member Operating Agreement form, several misconceptions often lead individuals astray. These misunderstandings can impact the solidity of one's legal and financial framework. By addressing these inaccuracies, we aim to clarify the essential nature of this document.

Only Multi-Member LLCs Need an Operating Agreement: A common fallacy is the belief that Single-Member LLCs do not require an Operating Agreement. However, even for a single owner, this document is crucial for establishing the financial and management structure, helping to reinforce personal liability protection.

It’s Legally Required in Every State: While important, not every state mandates the existence of an Operating Agreement for Single-Member LLCs. Despite this, having one is beneficial for defining your business operations and is considered a best practice.

It Must Be Filed with State Authorities: Another misconception is that the Operating Agreement needs to be filed like the Articles of Organization. In reality, it is an internal document that should be kept with your business records, not filed with the state.

Templates Found Online Are Always Sufficient: Many believe that a standard template pulled from the internet is adequate for their business needs. However, each business is unique, and the Operating Agreement should reflect your specific circumstances and requirements.

Once Signed, It Cannot Be Changed: Operating Agreements are not set in stone. They can be amended as your business evolves, ensuring they continually meet your needs and state regulations.

It’s Only Necessary If You Have Significant Assets: This document is critical regardless of the size of your business assets. It establishes key operational processes and helps to protect your personal assets from your business liabilities.

It Doesn’t Affect Taxes: While it's true that the Operating Agreement itself doesn’t dictate tax rates, it outlines the financial organization of your LLC, which can influence how you prepare your taxes. It is particularly important in delineating the business from personal finances for tax purposes.

There’s No Need If You Plan to Work Alone: Even sole proprietors can benefit from an Operating Agreement as it provides a structured framework for business operations, enhances the legitimacy of your enterprise, and offers an extra layer of protection for the business owner.

Understanding and demystifying these misconceptions about the Single-Member Operating Agreement can significantly impact how effectively you establish and manage your LLC. It’s not just about adhering to legal formality; it's about safeguarding the business you are building and ensuring its operations align with your vision and the law.

Key takeaways

A Single-Member Operating Agreement form stands as a crucial document for individuals who own 100% of a limited liability company (LLC). This agreement holds value not just in its provision of a clear structure for the business's operations, but also in the legal protections and flexibilities it affords the owner. Below are key takeaways regarding the filling out and utilization of the Single-Member Operating Agreement form.

- The purpose of a Single-Member Operating Agreement is to legally separate the business entity from the individual, which helps in protecting personal assets from business liabilities. This distinction is critically important in ensuring that, should the business incur debt or face lawsuits, the owner's personal assets remain safeguarded.

- Despite not being mandatory in all states, filling out a Single-Member Operating Agreement is highly advised. Its completion adds a layer of credibility to the LLC, asserting that the business operates with a clear set of rules and procedures, which can be pivotal during legal or financial scrutiny.

- Detailing the business's operating procedures, the agreement should cover areas such as the nature of the business activities, how decisions are made, and the process for changing ownership. This clarity ensures that there is a documented path to follow for major business decisions, even though there is only one member.

- The agreement grants the owner the flexibility to manage the business according to their vision while setting a formalized structure for its operation. This balance between structure and flexibility is one of the key benefits of an LLC.

- In the eventuality of the owner's death, the Single-Member Operating Agreement can play a pivotal role in the business's succession plans. By specifying the manner in which the business should be transferred or dissolved, it provides a clear directive, thereby minimizing disputes among potential heirs or other interested parties.

- Considering the ever-evolving nature of businesses, the Single-Member Operating Agreement should be seen as a living document. It is advisable to review and update it regularly to reflect significant changes in the business or the regulatory environment.

- Finally, while templates and online resources can serve as helpful starting points, consulting with legal professionals specialized in business law can ensure that the agreement not only meets all legal requirements but also aligns with the specific needs and goals of the business and its owner.

By comprehensively addressing the operational, legal, and financial aspects of running an LLC, the Single-Member Operating Agreement form serves as an essential tool for solo entrepreneurs. Its proper completion and application can significantly contribute to the smooth operation and long-term success of the business.