Free Payroll Check PDF Form

In the realm of employment and financial transactions, the payroll check form stands as a pivotal document, integral to ensuring the timely and accurate compensation of employees for their services. This essential piece of paperwork bridges the gap between employers and employees, serving as a physical or digital record of payment while also fulfilling legal and regulatory requirements. It encompasses a variety of crucial details, such as the amount of money to be paid to the employee, deductions for taxes and benefits, and the net payment received after such deductions. Moreover, the payroll check form functions not only as a proof of income for the employee but also as a key record for both the employer's payroll accounting and for future reference in case of any discrepancies or disputes regarding payment. Despite its commonality and core role in the employment process, the nuances and specifics encapsulated within the payroll check form demand a deeper understanding to fully appreciate its significance and ensure its correct application within the framework of employment law and financial management.

Sample - Payroll Check Form

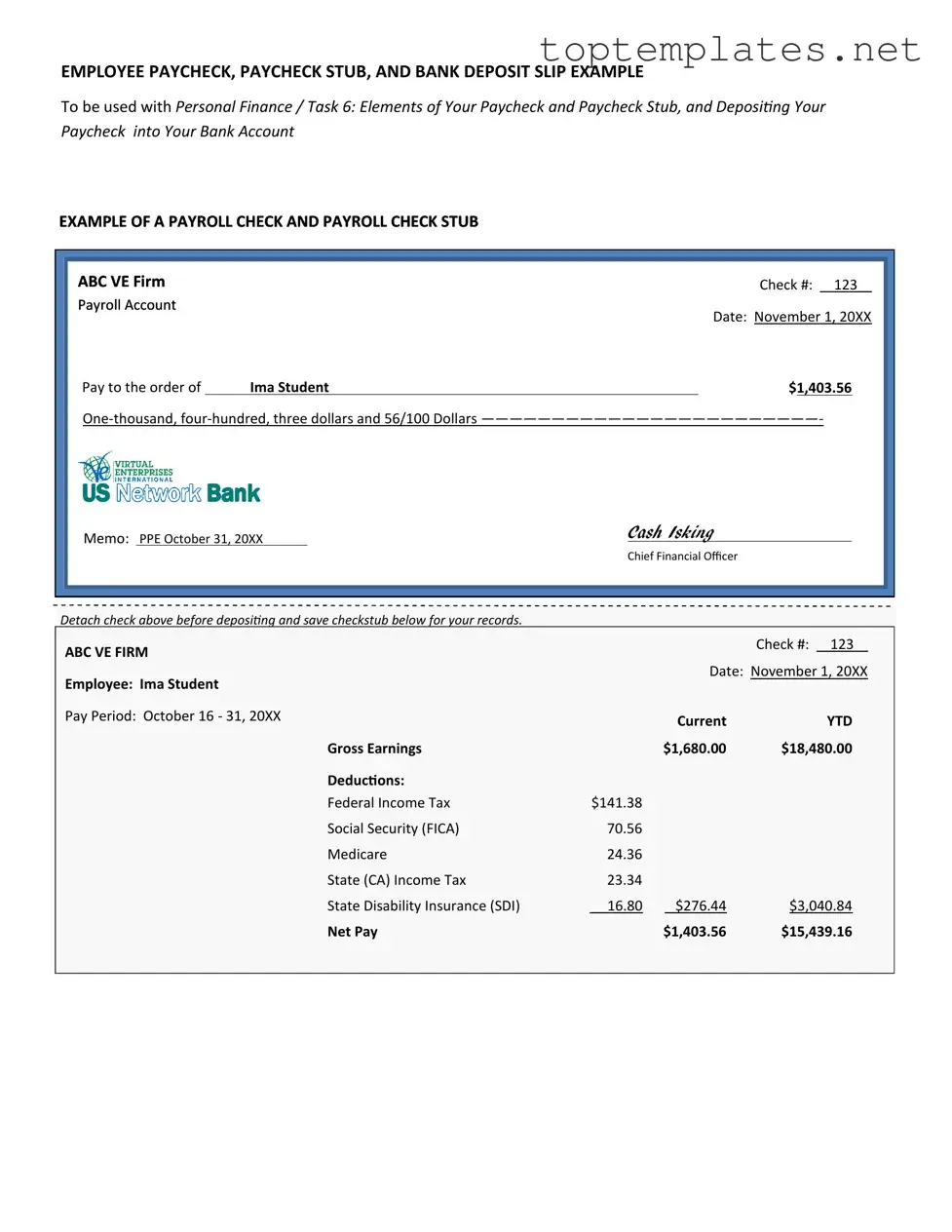

EMPLOYEE PAYCHECK, PAYCHECK STUB, AND BANK DEPOSIT SLIP EXAMPLE

To be used with Personal Finance / Task 6: Elements of Your Paycheck and Paycheck Stub, and Depositing Your Paycheck into Your Bank Account

EXAMPLE OF A PAYROLL CHECK AND PAYROLL CHECK STUB

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ABC VE Firm |

|

|

|

|

|

|

|

|

Check #: |

|

123 |

|

|

|

||||

|

Payroll Account |

|

|

|

|

|

|

Date: November 1, 20XX |

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

Pay to the order of |

|

Ima Student |

|

|

|

|

|

|

$1,403.56 |

|

|

|

||||||

|

|

|

|

|

|

||||||||||||||

|

Memo: PPE October 31, 20XX |

|

Cash Isking |

|

|

|

|

|

|

|

|

||||||||

|

|

Chief Financial Officer |

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

Detach check above before depositing and save checkstub below for your records. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

ABC VE FIRM |

|

|

|

|

|

|

|

|

Check #: |

|

123 |

|

|

|

||||

|

|

|

|

|

|

|

Date: November 1, 20XX |

||||||||||||

|

Employee: Ima Student |

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Pay Period: October 16 - 31, 20XX |

|

|

|

Current |

|

|

|

YTD |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

Gross Earnings |

|

|

$1,680.00 |

|

$18,480.00 |

|

|

|

||||||

|

|

|

|

|

Deductions: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Federal Income Tax |

$141.38 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Social Security (FICA) |

70.56 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Medicare |

24.36 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

State (CA) Income Tax |

23.34 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

State Disability Insurance (SDI) |

16.80 |

|

$276.44 |

|

$3,040.84 |

|

|

|

||||||

|

|

|

|

|

Net Pay |

|

|

$1,403.56 |

|

$15,439.16 |

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BACK OF PAYCHECK |

|

|

|

|

|

ENDORSE HERE |

|

Recipient’s signature |

|

|

|

DO NOT WRITE, STAMP OR SIGN BELOW THIS LINE |

|

|

|

|

|

|

|

|

List amount of each item that |

||

|

|

|

is being depositing. Checks |

||

|

|

BANK DEPOSIT SLIP |

are entered separately; do |

||

|

|

not combine. |

|

||

|

|

|

|

||

|

Customer’s name |

|

|

|

|

|

|

DEPOSIT SLIP |

|

|

|

|

|

|

dollars |

cents |

|

Customer’s account # |

NAME |

CASH |

|

. |

|

|

|

|

|||

Current date |

ACCOUNT # |

CHECKS |

|

. |

|

|

|

|

|

|

|

|

DATE |

|

|

. |

|

|

|

|

|

|

|

Customer’s Signature |

|

|

|

. |

|

|

|

|

|

|

|

|

SIGNATURE: |

|

|

. |

Sum of items to |

|

|

Subtotal |

|

. |

be deposited |

|

|

|

|

||

Less Cash |

. |

Cash that you |

|

|

|

want back |

|

TOTAL |

. |

||

|

Total amount being deposited into your account

File Specs

| Fact Name | Description |

|---|---|

| Definition | A Payroll Check form is used by employers to pay employees for their services. It details the amount of pay the employee is receiving for a specific pay period. |

| Components | The form typically includes the employee’s gross pay, deductions, net pay, and sometimes the hours worked and pay rate. |

| Frequency of Issuance | Employers issue payroll checks on a regular schedule, which could be weekly, bi-weekly, semi-monthly, or monthly, depending on the company policy or state law requirements. |

| Digital vs. Physical Forms | While traditionally provided as a physical check, many employers now offer direct deposit options, where the Payroll Check form may be provided electronically. |

| State-Specific Requirements | Some states have specific laws governing the details that must be included on a Payroll Check form, as well as the delivery method and timing. |

| Record Keeping Requirements | Employers are required to keep records of all payroll checks issued for a minimum period as specified by federal and state laws. |

| Legal Disputes | Incorrect or late payment through payroll checks can lead to legal disputes between an employer and an employee, which are governed by federal and state labor laws. |

Steps to Filling Out Payroll Check

Filling out a Payroll Check form is a crucial step in ensuring employees are paid accurately and on time. This process might appear complex initially, but by following a series of straightforward steps, you can complete it efficiently. Precise completion of this form is essential for maintaining accurate payroll records and ensuring compliance with financial regulations. Let's walk through the necessary steps to fill out the Payroll Check form correctly.

- Gather necessary information including the employee's full name, social security number, and the pay period ending date.

- Calculate the total number of hours worked. This includes regular hours, overtime hours, and any additional compensable time.

- Determine the gross pay by multiplying the hours worked by the employee's hourly rate. Add any overtime pay or bonuses to calculate the total gross pay.

- Subtract any pre-tax deductions such as retirement plan contributions, health insurance premiums, or other allowed deductions to find the taxable income.

- Calculate federal, state, and local taxes based on the employee's withholding status and the taxable income.

- Subtract the calculated taxes along with any post-tax deductions from the gross pay to arrive at the net pay. Post-tax deductions could include garnishments or after-tax retirement contributions.

- Fill in the check date, which is the date the employee will receive the payment.

- Enter the employee's name and address in the designated area on the form.

- List the net pay both in numerical and written form to ensure clarity.

- Sign the check or obtain the necessary authorization signature to validate it.

- Record the payment details in your payroll system for accounting purposes and future reference.

After completing these steps, you will have a filled-out Payroll Check ready for distribution. This methodical approach ensures each employee's pay is calculated accurately, reflecting their earnings and deductions correctly. Whether you're a new business owner or an experienced payroll professional, mastering this form is vital for streamlining your payroll process and maintaining compliance with financial and legal standards.

Discover More on Payroll Check

What information is required to complete the Payroll Check form?

To ensure accurate and timely processing, the Payroll Check form requires several key pieces of information. Employees must provide their full legal name, social security number, and address to confirm their identity and for tax purposes. Additionally, details about the pay period, gross earnings, deductions (such as taxes, benefits, and retirement contributions), and the net pay amount must be accurately filled in. Failure to provide complete or accurate information may result in processing delays or errors in paycheck amounts.

How can I submit my Payroll Check form securely?

Considering the sensitive nature of the information on the Payroll Check form, it's crucial to submit it through secure channels. Many employers offer digital platforms for submitting such forms securely, protected by encryption and login safeguards. If a physical form must be submitted, it is advised to do so in person or through a trusted, tracked mailing service to ensure it does not fall into the wrong hands. Always avoid sending sensitive information via email unless it is encrypted or through a secure file transfer service recommended by your employer.

When is the deadline for submitting the Payroll Check form?

Deadlines for submitting the Payroll Check form can vary significantly depending on the employer's pay cycle (weekly, bi-weekly, monthly) and their internal payroll processing timelines. Typically, employers require the form to be submitted a certain number of days prior to the next pay period to ensure sufficient processing time. It's essential to check with your specific employer or HR department for the exact deadline relevant to your situation, as late submissions may delay your paycheck.

What should I do if I notice an error on my Payroll Check after submission?

If you discover an error on your Payroll Check form after submission, it's important to act quickly. Contact your HR department or payroll administrator as soon as possible to notify them of the mistake. Provide clear details about the error and any necessary corrections. Depending on the payroll processing timeline, there may be a chance to correct the error before the next pay cycle. However, if the check has already been processed, arrangements will typically be made to correct the error in the following payroll period.

Common mistakes

Payroll processes can be troublesome, especially when errors are made on the Payroll Check form. Mistakes here can lead to confusion, delays, and sometimes even financial losses. Let's dive into four common mistakes to watch out for:

-

Incorrect Employee Information: A surprisingly common error is the submission of incorrect employee information. This includes misspelled names, wrong Social Security numbers, or incorrect bank account details for direct deposit. Such errors can cause significant delays in payment processing or even result in funds being deposited into the wrong account.

-

Failure to Update Employee Data: Changes in employee status, such as salary increments, promotions, or changes in tax exemptions, require timely updates in the payroll system. Neglecting to make these updates can lead to incorrect payroll calculations and unhappy employees.

-

Misclassification of Employees: Misclassifying workers either as independent contractors when they are in fact employees, or vice versa, can result in incorrect withholding of taxes and improper benefit allocations. This error not only affects payroll accuracy but can also lead to legal consequences.

-

Incorrect Hours Worked: For hourly employees especially, incorrect logging of hours worked is a frequent issue. This may stem from manual errors in data entry or failure to include overtime hours worked. It's essential to cross-check payroll entries against time records to ensure employees are compensated correctly for their time.

Avoiding these mistakes requires diligence and a good understanding of payroll procedures. Regular reviews and audits of payroll records, along with clear communication lines between payroll staff and other departments, can help mitigate these risks. Always double-check data for accuracy before submitting the payroll check form to ensure a smooth and error-free payroll process.

Documents used along the form

When managing payroll for a business, it's important to understand that the Payroll Check form is just one piece of the broader financial and legal documentation landscape. Alongside the physical or electronic paycheck, there are several critical documents and forms that play crucial roles in ensuring accurate and compliant payroll processing. These include tax forms, time-tracking records, and various reporting documents. Each serves a distinct purpose, helping employers maintain proper records and comply with legal requirements.

- W-4 Form: This is a tax form used by employers to determine the amount of federal income tax to withhold from an employee's paycheck. The employee fills out this form, which includes personal information, dependency status, and any additional allowances.

- I-9 Form: Employers use this form to verify an employee's identity and to establish that the worker is eligible to accept employment in the United States. It requires documentation that shows the employee's eligibility to work.

- Time Sheets: These documents record the number of hours an employee has worked during a specific payroll period. Time sheets can be in paper form or digital and are essential for calculating the correct wages, especially for hourly employees.

- Payroll Register: This comprehensive document records each employee's pay history for a specific period. It includes wages, deductions, hours worked, and net and gross pay. The payroll register is a crucial document for accounting and audits.

- Direct Deposit Authorization Form: Employees use this form to give their employer permission to deposit their wages directly into their bank accounts. It typically requires the employee's bank account information.

- Year-End Tax Documents: These include forms like the W-2, which employers must provide to employees and the IRS at the end of each tax year. The document reports the employee’s annual wages and the amount of taxes withheld from their paycheck.

Together, these forms and documents create a framework that supports the Payroll Check form in the payroll process. They ensure that employees are paid accurately and on time, while also helping employers stay compliant with federal and state regulations. Understanding and properly managing these documents is crucial for any business's payroll operations.

Similar forms

-

Direct Deposit Authorization Forms: Both documents are vital in the process of managing employee payments. While a Payroll Check form facilitates the issuance of a physical check, Direct Deposit Authorization Forms capture employee details for electronic fund transfers directly into their bank accounts. Both require employee information like bank details and amounts to be processed, ensuring employees receive their earnings in their preferred manner.

-

W-4 Forms: The similarity with W-4 forms lies in their role in determining the financial aspects of an employee's paycheck. While W-4 forms are used to determine the amount of federal income tax to withhold from an employee's wages, Payroll Check forms detail the net pay after such deductions. Both documents are integral in accurately calculating and disbursing employee pay.

-

Timesheets: Timesheets and Payroll Check forms are closely linked in the payroll process. Timesheets record the hours worked by an employee, which are essential for calculating the gross pay, especially for hourly employees. The Payroll Check form then itemizes deductions, taxes, and the final net pay. Both are essential for ensuring employees are paid accurately for their time worked.

-

Payroll Deduction Authorization Forms: These forms, like Payroll Check forms, deal with specifics regarding an employee's salary. Payroll Deduction Authorization Forms are used to document an employee's consent for deductions other than standard taxes—such as retirement plan contributions or health insurance premiums. This parallels the Payroll Check form's role in itemizing these deductions to demonstrate how the final paycheck amount is calculated.

-

Year-End Tax Documents (e.g., W-2 Forms): The connection with Year-End Tax Documents, like W-2 forms, is found in their use for reporting purposes. A Payroll Check form provides a detailed breakdown of each paycheck an employee receives, including taxable earnings and withholdings. Similarly, a W-2 form summarizes these figures annually, demonstrating how each paycheck contributes to the year's total income and deductions. Both are fundamental to both the employee's and the employer's financial records and tax reporting.

Dos and Don'ts

When handling a Payroll Check form, accuracy and attention to detail are key. Below are essential dos and don'ts to consider:

Do double-check the employee's information, such as name, address, and social security number, for accuracy.

Do ensure the pay period and date are correctly filled in.

Do calculate the gross pay based on the correct number of hours worked and any applicable overtime.

Do deduct the right amounts for taxes, benefits, and any other withholdings.

Don't rush through filling out the form, as mistakes can lead to payroll discrepancies.

Don't leave any fields blank. If a section does not apply, mark it as "N/A" (Not Applicable).

Don't forget to update the payroll records once the check is processed to maintain accurate financial records.

Don't hesitate to verify any information you are unsure about, either with the employee or your payroll department.

Misconceptions

When it comes to understanding payroll checks, several misconceptions can lead to confusion. Addressing these myths helps clarify important aspects of payroll processing and ensures both employers and employees have a correct understanding of what a payroll check form entails.

Myth: A payroll check is just a standard check with an employee’s wages. While a payroll check does indeed enable an employee to receive their wages, it contains much more information. Details such as the pay period, gross earnings, deductions, taxes, and net pay are also included, making it distinct from a regular check.

Myth: Digital payments have made payroll checks obsolete. Despite the rise in digital payment methods, payroll checks remain a preferred or necessary option for many employees who may not have bank accounts or prefer a physical record of their earnings.

Myth: Employers choose the payroll check form design for aesthetic reasons only. Although the design of a payroll check can reflect a company's brand, the primary reason for its design is to ensure clarity, security features, and compliance with legal requirements, not aesthetics alone.

Myth: All the deductions on a payroll check are taxes. Not all deductions from a paycheck are tax-related. Besides federal and state taxes, deductions can include retirement plan contributions, health insurance premiums, and other voluntary deductions an employee might have opted into.

Myth: The amount on the payroll check is what the employee actually earns. The amount on a payroll check represents the net pay, which is the employee's earnings after all deductions, not their gross earnings.

Myth: If there’s an error on a payroll check, it’s always the employer's fault. Mistakes can occur due to a variety of reasons, including incorrect information provided by employees or misinterpretation of hours worked. It’s crucial for both parties to review their payroll checks for accuracy.

Understanding these facets of payroll checks can help demystify the process and ensure that both employers and employees are better informed about the intricacies of payroll processing.

Key takeaways

Filling out and using a Payroll Check form correctly is essential for ensuring employees are paid accurately and on time. Here are five key takeaways to consider:

- Accuracy is paramount when completing payroll checks. Errors can lead to discrepancies in an employee's pay that could affect their trust in the payroll process and potentially incur legal complications.

- Every field on the Payroll Check form must be filled out comprehensively. This includes the employee's full name, pay period, gross pay, deductions, and net pay. Incomplete forms can delay processing and payment.

- Understanding the deductions that need to be made from an employee's gross pay, such as federal and state taxes, Social Security, Medicare, and any other withholdings, is crucial. Misunderstanding or miscalculating these deductions could lead to under or overpayment and subsequent adjustments.

- Prior to issuing a Payroll Check, double-checking the details for accuracy ensures that mistakes are caught early. This verification process should include reviewing the arithmetic, ensuring that all mandated deductions have been applied, and confirming that the net pay aligns with hours worked and applicable rates.

- Finally, maintaining a record of all Payroll Checks issued is vital for both internal auditing and compliance with state and federal record-keeping requirements. Document retention ensures that any disputes or queries regarding payroll can be swiftly and effectively resolved.

Properly handling the Payroll Check form not only streamlines the payroll process but also upholds the integrity of the compensation system within a company, ensuring a stable and transparent relationship with employees.

Common PDF Forms

6 Team Single Elimination Bracket With Consolation - Offers a visual representation of the consolation tournament’s structure, making it easier for both organizers and teams to navigate through the competition.

Free Gift Certificate Maker - Often non-refundable and must be used within a specific time frame to encourage timely use of the gift.

Employee Change of Status Form - A procedural document that ensures all modifications to an employee’s professional engagement—be it in duties, location, or teams—are formally acknowledged.