Valid Power of Attorney Template

Entrusting someone with the authority to make decisions on your behalf is a significant step, requiring a legal instrument that is both powerful and nuanced. This is where the Power of Attorney (POA) form comes into play, serving as a crucial document in legally appointing another individual, known as an agent or attorney-in-fact, to manage affairs ranging from financial transactions to medical decisions. The form varies widely in its applications, tailored to specific needs; whether for a one-time transaction or enduring through health crises under a durable power, the document ensures that an individual's wishes are honored even when they cannot personally oversee their affairs. Crafting a POA requires thoughtful consideration of the powers granted, the agent selected, and the conditions under which the document takes effect, reflecting a careful balance between granting necessary authority and protecting the principal's interests. Understanding the legalities, including state-specific requirements and potential future scenarios, is essential for anyone considering the creation of such a form. The complexity of this legal tool underscores its importance as a foundational element of personal and financial planning.

Power of Attorney Form Categories

Sample - Power of Attorney Form

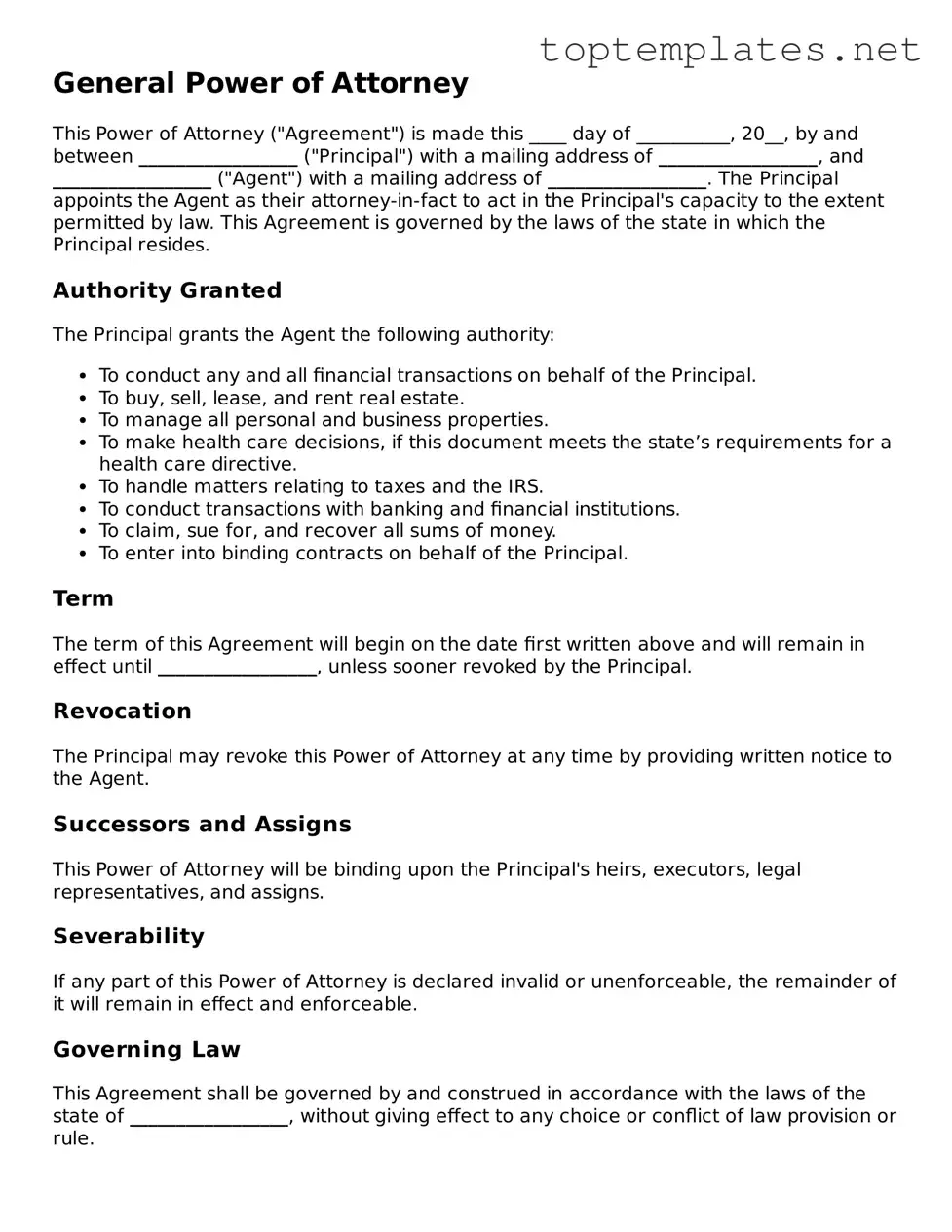

General Power of Attorney

This Power of Attorney ("Agreement") is made this ____ day of __________, 20__, by and between _________________ ("Principal") with a mailing address of _________________, and _________________ ("Agent") with a mailing address of _________________. The Principal appoints the Agent as their attorney-in-fact to act in the Principal's capacity to the extent permitted by law. This Agreement is governed by the laws of the state in which the Principal resides.

Authority Granted

The Principal grants the Agent the following authority:

- To conduct any and all financial transactions on behalf of the Principal.

- To buy, sell, lease, and rent real estate.

- To manage all personal and business properties.

- To make health care decisions, if this document meets the state’s requirements for a health care directive.

- To handle matters relating to taxes and the IRS.

- To conduct transactions with banking and financial institutions.

- To claim, sue for, and recover all sums of money.

- To enter into binding contracts on behalf of the Principal.

Term

The term of this Agreement will begin on the date first written above and will remain in effect until _________________, unless sooner revoked by the Principal.

Revocation

The Principal may revoke this Power of Attorney at any time by providing written notice to the Agent.

Successors and Assigns

This Power of Attorney will be binding upon the Principal's heirs, executors, legal representatives, and assigns.

Severability

If any part of this Power of Attorney is declared invalid or unenforceable, the remainder of it will remain in effect and enforceable.

Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the state of _________________, without giving effect to any choice or conflict of law provision or rule.

Signatures

IN WITNESS WHEREOF, the Parties have executed this Power of Attorney on the day and year first above written.

Principal's Signature: ___________________

Date: ___________________

Agent's Signature: ___________________

Date: ___________________

State of _________________

County of _________________

On this ____ day of __________, 20__, before me, a notary public, personally appeared _________________, known to me (or satisfactorily proven) to be the person whose name is subscribed to the within instrument and acknowledged that they executed the same for the purposes therein contained.

IN WITNESS WHEREOF, I hereunto set my hand.

Notary Public: ___________________

My Commission Expires: _____________

File Breakdown

| Fact Number | Fact Detail |

|---|---|

| 1 | Power of Attorney (POA) allows a person (the "principal") to appoint someone else (the "agent" or "attorney-in-fact") to make decisions on their behalf. |

| 2 | There are different types of POA, including General, Durable, Medical, and Limited, each serving different purposes and granting different levels of authority. |

| 3 | A Durable Power of Attorney remains in effect even if the principal becomes incapacitated, unlike a General POA which terminates under such conditions. |

| 4 | To be valid, most POAs must be signed by the principal, notarized, and sometimes witnessed, depending on state laws. |

| 5 | State-specific laws govern the creation and use of POAs, meaning requirements can significantly vary from one state to another. |

| 6 | An agent under a POA has a fiduciary duty to act in the principal's best interest, meaning they must make decisions with the principal's welfare in mind. |

| 7 | A principal can revoke a POA at any time as long as they are mentally competent, through a written document specifying the revocation and informing the agent and any third parties who were relying on the POA. |

Steps to Filling Out Power of Attorney

Filling out a Power of Attorney (POA) form is a significant step in managing your affairs, medical decisions, or financial matters, enabling someone else to make decisions on your behalf. It's important to do this carefully and correctly to ensure that your wishes are respected and that the person you designate has the authority they need. Let's go through the steps needed to fill out the form correctly.

- Begin by reading the form thoroughly to understand the scope and implications of granting someone else this level of authority over your affairs.

- Identify the type of Power of Attorney you need, whether it's a General Power of Attorney, Durable Power of Attorney, Special or Limited Power of Attorney, or a Medical Power of Attorney. This decision will largely be based on what decisions you want the designated person to make on your behalf.

- Enter your full legal name and address in the section designated for the principal’s information. Ensure this information is accurate to avoid any potential issues with the POA’s legality or enforceability.

- Fill in the full legal name and address of the person you are designating as your agent (also referred to as the attorney-in-fact). Double-check their name for any spelling errors or inaccuracies.

- Specify the powers you are granting to your agent in the space provided. Be as clear and detailed as possible to avoid ambiguity and ensure they have the authority needed to act on your behalf.

- If the form allows, include any special instructions or limitations to the powers granted. For example, you may wish to limit the duration of the Power of Attorney or restrict the agent’s power to certain geographic areas.

- Review any state-specific requirements or provisions that may need to be included in the form. These can vary significantly, so it's crucial to ensure your POA complies with local laws.

- Sign and date the form in the presence of a notary public, if required. Many states require notarization for the POA to be legally valid.

- Have the designated agent also sign the form, if required by your state laws.

- Store the original signed document in a safe place, and provide copies to the agent and any institutions or individuals that may need to acknowledge the POA, such as banks, hospitals, or other entities.

Once you've completed these steps, you've successfully created a Power of Attorney. However, this is only the beginning of making sure your wishes are carried out as you hope. It's crucial to communicate openly with the person you've designated as your agent, ensuring they understand your wishes and the extent of the powers you've granted them. Additionally, it's advisable to review your POA periodically and after any major life changes to ensure it still reflects your wishes.

Discover More on Power of Attorney

What is a Power of Attorney?

A Power of Attorney (POA) is a legal document that grants one person, known as the agent or attorney-in-fact, the authority to make decisions or take actions on behalf of another person, called the principal. These actions can include managing finances, selling property, and making healthcare decisions, depending on the type of POA.

Are there different types of Power of Attorney?

Yes, there are several types. The most common include a General Power of Attorney, which gives broad powers to the agent; a Durable Power of Attorney, which remains in effect even if the principal becomes incapacitated; a Limited or Special Power of Attorney, which grants authority for a specific task or for a limited time; and a Health Care Power of Attorney, which allows the agent to make health care decisions for the principal.

How do I choose an agent for my Power of Attorney?

Choosing an agent is a significant decision. You should select someone you trust implicitly, as they will potentially be making critical decisions for you. Consider their ability to handle financial matters, their understanding of your wishes, and their willingness to act on your behalf. It's also wise to discuss your expectations with them in advance to ensure they're willing and able to take on the role.

Does a Power of Attorney need to be notarized or witnessed?

The requirements can vary by state. However, most states require that a POA be notarized, some may also require witnesses, and others may have additional stipulations. Notarization and witnessing add layers of protection by verifying the identity of the principal and ensuring the document is signed voluntarily.

When does a Power of Attorney become effective?

The effectiveness of a POA can depend on its type and the specific terms it contains. Some POAs become effective immediately upon signing, while others, known as "springing" POAs, become effective only upon the occurrence of a specific event, usually the principal's incapacitation. The POA document should clearly state when it becomes effective.

Can a Power of Attorney be revoked?

Absolutely. A principal can revoke a POA at any time as long as they are mentally competent. Revocation should be done in writing, and all parties who were given copies of the POA, including the agent, should be notified. Additionally, if the document was recorded in any public office, the revocation should be recorded as well.

What happens if there's no Power of Attorney and I become incapacitated?

If someone becomes incapacitated without a POA in place, a court may need to appoint a guardian or conservator. This process can be time-consuming, costly, and stressful for family members. The court-appointed guardian may not be someone you would have chosen. Establishing a POA avoids this situation and ensures your affairs are managed according to your wishes.

Is a Power of Attorney valid in other states?

Generally, a POA executed according to the laws of one state will be recognized in another. However, there can be exceptions, and some states may have specific requirements for acceptance of an out-of-state POA. If you spend significant time in more than one state or are planning to move, it's wise to review the POA requirements in all relevant states.

Common mistakes

Not specifying the powers granted clearly. People often assume that a Power of Attorney form covers all decisions. It's crucial to detail the specific powers you're giving, whether they're for managing finances, healthcare decisions, or both. Without clear instructions, unnecessary confusion and legal issues might arise.

Choosing the wrong agent. The agent's role is significant, and they should be someone trustworthy and capable of handling responsibilities effectively. Sometimes, without much thought, individuals select someone close to them without evaluating their ability to act wisely in tough situations.

Failing to appoint a backup agent. Life's unpredictable nature means the first choice for an agent might not always be available. Not naming an alternate can lead to complications if the primary agent can no longer serve.

Ignoring the need for witnesses or notarization. Depending on the state, having witnesses or a notarized form is crucial for the document to be legally binding. Skipping this step can render the document useless when it's most needed.

Using a generic form without state-specific considerations. State laws vary widely regarding Powers of Attorney. Utilizing a "one-size-fits-all" approach can result in a document that does not comply with state requirements, possibly making it invalid.

Not discussing wishes with the chosen agent. A crucial step often overlooked is the conversation with the agent about one's preferences and expectations. This talk ensures that the agent understands their responsibilities and your wishes, reducing the chances of misinterpretation.

Omitting the expiration date. If there's a specific timeframe for the Power of Attorney, it must be mentioned. Otherwise, it could remain in effect longer than the person intended, potentially leading to issues down the line.

Lack of understanding of the different types of Power of Attorney. There are various forms, including durable, springing, and healthcare. Each serves different purposes. Not knowing the differences can result in selecting the wrong type for your needs, causing problems when the document needs to be used.

Documents used along the form

When handling affairs that involve a Power of Attorney (POA), it's often necessary to be familiar with additional forms and documents that complement or are used in conjunction with the POA. These documents can help ensure that the principal’s wishes are respected and that the agent has the necessary tools to act on the principal’s behalf. Below is a list of four such documents, each serving a critical role in various circumstances.

- Living Will: This document outlines a person's wishes regarding medical treatment in situations where they are unable to communicate due to illness or incapacity. It acts as a guide for healthcare providers and family members, making it an important companion to a Health Care Power of Attorney.

- Advanced Healthcare Directive: Similar to a Living Will, this consists of two parts: a Living Will and a Durable Power of Attorney for Health Care. It specifies what kinds of medical treatment are desired or not desired and appoints a healthcare agent to make decisions if the person is unable to do so themselves.

- Last Will and Testament: This document spells out how a person’s estate should be distributed after their death. While a POA gives an agent authority to act while the principal is alive, a Last Will and Testament takes over after the principal’s death, ensuring that assets are allocated according to the deceased's wishes.

- Revocation of Power of Attorney: Essential for situations where the principal decides to terminate the authority granted to the agent. This legal document officially ends the powers granted under a previously executed POA, and it's crucial that it be completed correctly to prevent the former agent from continuing to act.

In the realm of legal and personal planning, understanding how these documents interact and support each other can significantly impact an individual's preparations for the future. They work in concert to provide a comprehensive plan that covers a wide array of potential needs and circumstances. Whether planning for healthcare decisions, financial management, or posthumous arrangements, incorporating these documents with a Power of Attorney can provide peace of mind and clear guidance for all parties involved.

Similar forms

Living Will: Both the Power of Attorney (POA) and a Living Will are advance directives used in planning for future healthcare and financial decisions. While a POA designates an agent to make decisions on someone's behalf, a Living Will outlines specific medical care preferences in the event one becomes unable to communicate these wishes themselves.

Healthcare Surrogate Designation: This document, like a POA, allows an individual to appoint someone to make healthcare decisions on their behalf should they become incapacitated. The main difference lies in the scope; a Healthcare Surrogate Designation is specifically for health decisions, whereas a POA can cover a broader range of responsibilities.

Durable Power of Attorney: A specific form of POA, a Durable Power of Attorney remains effective even if the person who created it becomes incapacitated. Both serve the purpose of authorizing a trusted person to act in the creator's stead, though the Durable POA provides continuous authority despite changes in the individual's mental state.

Will: While fundamentally different in purpose—a Will takes effect after one's death and a POA is for while they are alive—both documents are preparatory, ensuring that an individual's wishes are respected and acted upon in situations where they cannot express those wishes directly.

Revocable Living Trust: Like a POA, a Revocable Living Trust involves designating someone to manage one's affairs. The Trust specifically deals with the management and disposal of assets in the trust, both during the individual's lifetime and after. Trustees may have powers similar to an agent under a POA but within the confines of the trust's terms.

Advance Directive: An umbrella term that includes both Living Wills and durable powers of attorney for healthcare, Advance Directives guide choices for doctors and caregivers if one is incapacitated. While an Advance Directive can include elements of a POA, it specifically addresses healthcare decisions.

Conservatorship/Guardianship Documents: These legal mechanisms are court-ordered and, like a POA, allow an individual or organization to make decisions for another. The difference lies in the process and permanency; Conservatorships/Guardianships are generally more structured, involve a court process, and are used when someone is deemed incapable of making their own decisions.

Business Power of Attorney: Specific to the business realm, this variant empowers someone to make business-related decisions on the creator’s behalf. It is akin to a standard POA but tailored for business owners, allowing them to ensure continuous operation during their absence or incapacity.

Financial Power of Attorney: This type specifically grants an agent the authority to manage the financial affairs of the principal. Similar to other forms of POA, it ensures that the individual's financial matters are handled according to their preferences if they are unable to do so themselves.

Special or Limited Power of Attorney: Unlike a general POA that grants broad powers, a Special or Limited Power of Attorney allows the principal to specify exactly what powers the agent has. This could be as limited as selling a particular property on their behalf or handling specific financial transactions.

Dos and Don'ts

Filling out a Power of Attorney (POA) form is an important step in managing your or someone else's affairs. It should be done with care and attention to detail. Below, find guidelines to help ensure the process is completed accurately and effectively.

Things You Should Do:

- Read the entire form thoroughly before beginning to understand all the requirements and instructions.

- Ensure all parties understand the powers being granted and the responsibilities that come with them. Communication is key.

- Use clear, precise language to avoid any ambiguity about the extent of the authority being given.

- Include specific start and end dates if the POA is not meant to be permanent. A clear timeframe can prevent confusion.

- Have the document notarized, if required by your state, to confirm the identity of the person signing and add a layer of legal validity.

- Provide detailed information on any special instructions or limitations to the powers granted to avoid misuse or overreach.

- Store the completed form in a safe, secure location and make sure that the relevant parties know where it is and can access it if necessary.

Things You Shouldn't Do:

- Don't leave any sections incomplete. An incomplete form may be considered invalid or lead to misunderstandings or misuse.

- Don't use vague terms or language that could be open to interpretation. Specificity is crucial in a legal document.

- Don't forget to check the document for errors before finalizing. Even small mistakes can lead to big problems.

- Don't ignore state-specific requirements or forms. Each state can have different rules and forms for POA documents.

- Don't choose an agent without considerable thought. The appointed person should be trustworthy and capable.

- Don't forget to update the POA as necessary. Life changes may dictate changes to the document.

- Don't fail to consult with a legal professional if you have questions or concerns. Professional guidance can ensure the form is completed correctly.

Taking the time to carefully prepare your Power of Attorney form can spare you and your loved ones from potential difficulties later on. By following these guidelines, you can help ensure that your interests are protected and your wishes are clearly communicated.

Misconceptions

Many people have misconceptions about the Power of Attorney (POA) form, which can lead to a lack of proper planning and unexpected legal challenges. Understanding what a POA is—and what it is not—is crucial for anyone considering creating one. Here are ten common misconceptions about the Power of Attorney form:

- A Power of Attorney grants unlimited control. This belief is widespread but incorrect. A POA can be as broad or as limited as the person creating it (known as the principal) decides. It can grant authority over all financial decisions or be restricted to specific actions, such as selling a house.

- The Power of Attorney remains valid after death. This is not true. A POA ceases to be effective upon the death of the principal. After death, the executor of the will or appointed administrator of the estate takes over.

- Only a lawyer can draft a Power of Attorney. While it's wise to consult a lawyer to ensure that a POA meets all legal requirements and accurately reflects the principal's wishes, it’s not mandatory to have a lawyer draft the document. Various templates and software can help create a POA, but the key is to make sure it is valid in your state.

- A Power of Attorney is irrevocable. Many believe once a POA is created, it cannot be changed. However, a principal can revoke or amend their POA as long as they are mentally competent.

- A Power of Attorney grants the agent the right to make healthcare decisions. This misunderstanding can lead to serious issues, as a standard POA typically does not cover healthcare decisions unless it explicitly says so. A separate document, known as a Medical Power of Attorney or Healthcare Proxy, is needed for health-related matters.

- You can only name one person as your agent. It’s possible to appoint multiple agents either to act together (jointly) or separately (severally), or even to appoint a successor agent in the event the primary agent can’t or won’t act.

- Creating a Power of Attorney means losing control over your finances. Many people are hesitant to create a POA because they fear it means giving up their autonomy. In reality, a well-drafted POA can specify the exact powers granted and can include safeguards, such as requiring the agent to provide regular accounting to another trusted individual.

- The best time to set up a Power of Attorney is when health starts to decline. Waiting until a health crisis or mental incapacity can make it too late to draft a POA, as the principal must be mentally competent to sign the document. It’s wise to set up a POA as part of broader estate planning while the principal is in good health.

- Any type of Power of Attorney will work in any situation. There are different types of POA (general, durable, springing), and each serves different purposes. It's essential to choose the right kind of POA for your needs and to make sure it complies with your state's laws.

- Once a Power of Attorney is signed, it must be registered with a government agency to be valid. While some states require certain types of POA to be filed with a court or government office, this is not a universal requirement for a POA to be effective. However, recording a POA can be beneficial in some cases, such as real estate transactions.

Understanding these misconceptions and the realities behind the Power of Attorney can help individuals make informed decisions about their estate planning and ensure their wishes are carried out effectively.

Key takeaways

When considering the use of a Power of Attorney (POA) form, it is essential to understand its purpose and implications. A POA allows you to grant another person, often referred to as your agent or attorney-in-fact, the authority to make decisions on your behalf should you become unable to do so yourself. This document can cover a range of activities, including managing your finances, selling property, or making medical decisions. Here are four key takeaways to keep in mind:

- Choose Your Agent Wisely: The person you appoint as your agent holds significant power. It's crucial to select someone who is not only trustworthy but also capable of making decisions that align with your wishes. This person should have a clear understanding of their responsibilities and be willing to act in your best interest.

- Understand the Different Types of POAs: There are several types of Power of Attorney forms, including general, durable, and healthcare POAs. Each serves a different purpose. For instance, a durable POA remains in effect if you become incapacitated, while a general POA may not. It's important to select the type that best fits your needs.

- Be Specific About the Powers Granted: POA forms can be tailored to grant either broad or limited authority to your agent. When filling out the form, clearly define the powers you are transferring. This could range from the ability to make everyday financial decisions to making specific health care directives.

- Follow Legal Requirements: Each state has its own laws regarding the execution of a Power of Attorney. These often include requirements for witnessing, notarization, and even the way the form must be worded. Ensuring your POA form complies with state laws is crucial for it to be valid.

Consider Other Documents

Dmv Notice of Transfer - Used to avoid complications arising from the vehicle's condition or legal status once it's no longer in the seller’s possession.

Homeschool Letter of Intent Template - Prepares the groundwork for a customized education plan, with this form being the first step in crafting a tailored learning experience for the child.

Free Lady Bird Deed Form - Can be an essential part of a comprehensive estate plan, working in harmony with wills and trusts.