Valid Prenuptial Agreement Template

When two people decide to marry, it's often with the hope that their love will last a lifetime. Yet, the reality of modern relationships acknowledges that not every union stands the test of time. In this context, the Prenuptial Agreement form emerges as a practical tool, designed to establish clear agreements between partners regarding their finances and assets before tying the knot. This document, though sometimes viewed through a lens of skepticism, serves to protect both parties' interests, allowing for a transparent discussion on potentially sensitive issues such as division of property, debt responsibility, and alimony in the event of divorce or separation. By setting these terms prior to marriage, couples can enter into their union with a sense of security and mutual understanding, making the Prenuptial Agreement form an essential component of modern marital planning.

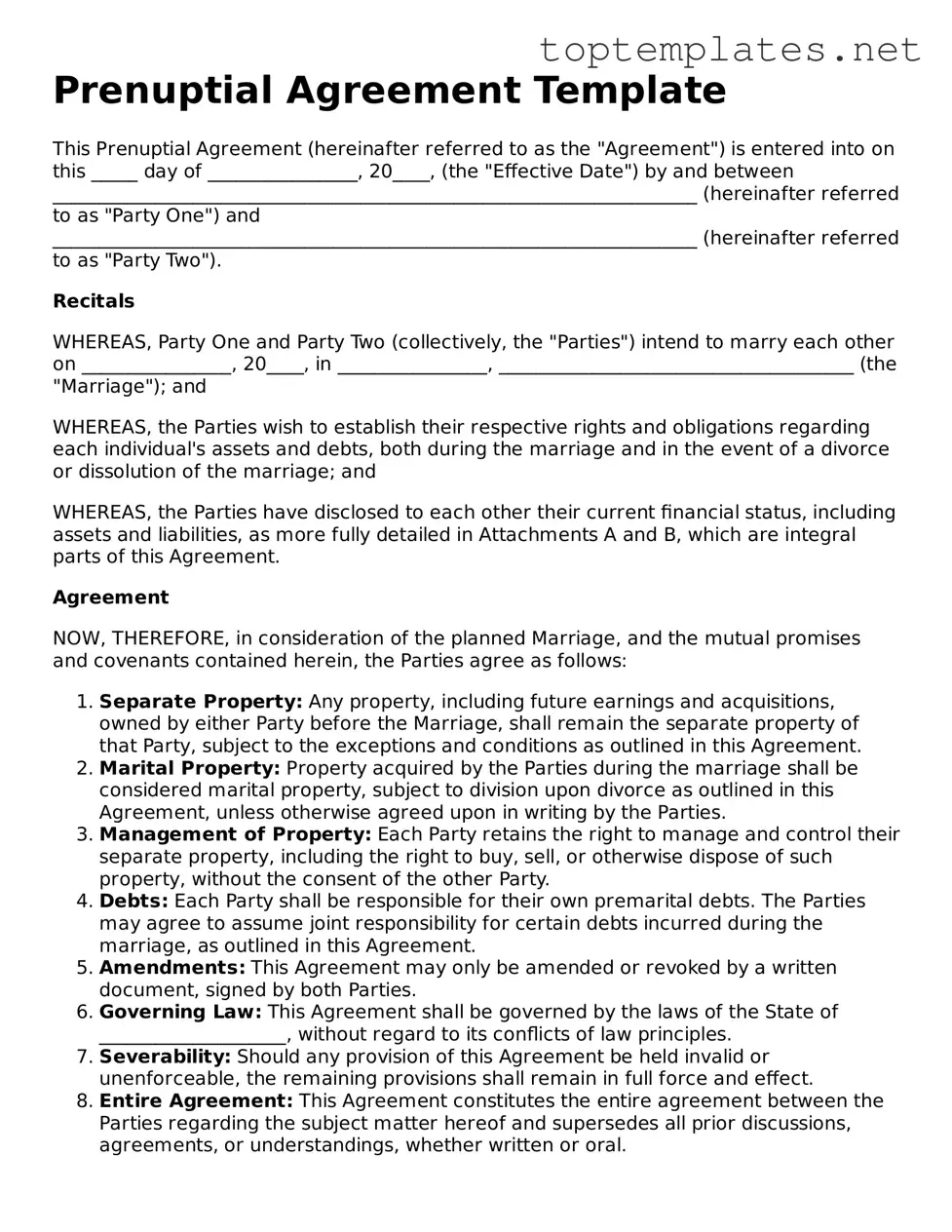

Sample - Prenuptial Agreement Form

Prenuptial Agreement Template

This Prenuptial Agreement (hereinafter referred to as the "Agreement") is entered into on this _____ day of ________________, 20____, (the "Effective Date") by and between _____________________________________________________________________ (hereinafter referred to as "Party One") and _____________________________________________________________________ (hereinafter referred to as "Party Two").

Recitals

WHEREAS, Party One and Party Two (collectively, the "Parties") intend to marry each other on ________________, 20____, in ________________, ______________________________________ (the "Marriage"); and

WHEREAS, the Parties wish to establish their respective rights and obligations regarding each individual's assets and debts, both during the marriage and in the event of a divorce or dissolution of the marriage; and

WHEREAS, the Parties have disclosed to each other their current financial status, including assets and liabilities, as more fully detailed in Attachments A and B, which are integral parts of this Agreement.

Agreement

NOW, THEREFORE, in consideration of the planned Marriage, and the mutual promises and covenants contained herein, the Parties agree as follows:

- Separate Property: Any property, including future earnings and acquisitions, owned by either Party before the Marriage, shall remain the separate property of that Party, subject to the exceptions and conditions as outlined in this Agreement.

- Marital Property: Property acquired by the Parties during the marriage shall be considered marital property, subject to division upon divorce as outlined in this Agreement, unless otherwise agreed upon in writing by the Parties.

- Management of Property: Each Party retains the right to manage and control their separate property, including the right to buy, sell, or otherwise dispose of such property, without the consent of the other Party.

- Debts: Each Party shall be responsible for their own premarital debts. The Parties may agree to assume joint responsibility for certain debts incurred during the marriage, as outlined in this Agreement.

- Amendments: This Agreement may only be amended or revoked by a written document, signed by both Parties.

- Governing Law: This Agreement shall be governed by the laws of the State of ____________________, without regard to its conflicts of law principles.

- Severability: Should any provision of this Agreement be held invalid or unenforceable, the remaining provisions shall remain in full force and effect.

- Entire Agreement: This Agreement constitutes the entire agreement between the Parties regarding the subject matter hereof and supersedes all prior discussions, agreements, or understandings, whether written or oral.

IN WITNESS WHEREOF, the Parties have executed this Agreement as of the Effective Date first above written.

Party One: ___________________________________________

Party Two: ___________________________________________

Date: _______________________________________________

Notary Acknowledgment

State of ____________________

County of ___________________

On this _____ day of ________________, 20____, before me, the undersigned notary public, personally appeared _____________________________________ and ______________________________________, known to me (or satisfactorily proven) to be the persons whose names are subscribed to the within instrument and acknowledged that they executed the same for the purposes therein contained.

In witness whereof, I hereunto set my hand and official seal.

Notary Public: ________________________________________

My Commission Expires: ________________________________

File Breakdown

| Fact Number | Description |

|---|---|

| 1 | Prenuptial agreements are contracts signed by couples before they get married to outline the division of assets and debts in the event of divorce. |

| 2 | These agreements can also include provisions for spousal support and the rights to manage property during the marriage. |

| 3 | In order for a prenuptial agreement to be enforceable, it must be in writing and signed by both parties. |

| 4 | Full and fair disclosure of all assets and liabilities by both parties is required for the agreement to be valid. |

| 5 | Each party must have the opportunity to consult with independent legal counsel before signing the agreement. |

| 6 | The agreement cannot be executed under duress, fraud, or undue influence. |

| 7 | Provisions in the prenuptial agreement that dictate child custody or support terms are generally not enforceable. |

| 8 | The enforceability of prenuptial agreements varies by state, with each state having its own laws and requirements. |

| 9 | For example, in California, prenuptial agreements are governed by the Uniform Premarital Agreement Act (UPAA), which requires the agreement to be fair at the time of enforcement. |

| 10 | Prenuptial agreements must not contain any illegal provisions or go against public policy. |

Steps to Filling Out Prenuptial Agreement

Embarking on the path of marriage often involves weaving together not just two lives but also two financial estates. To ensure clarity and peace of mind, many couples opt to outline the ownership and distribution of their financial assets and responsibilities through a Prenuptial Agreement. This legal document, when crafted with thoughtfulness and care, can serve as a robust foundation for the financial aspect of a marriage, guarding against unforeseen circumstances and providing a clear road map for the future. The process of filling out a Prenuptial Agreement requires careful attention to detail and a thorough understanding of both parties' assets and debts. Here are the steps to guide you through filling out this important document.

- Gather all necessary financial documents for both parties, including bank statements, investment accounts, property deeds, and debt records.

- Read through the Prenuptial Agreement form carefully to gain a thorough understanding of each section’s requirements.

- Begin by filling in the personal details of each party, including full legal names, addresses, and dates of birth.

- Delineate all premarital assets. List each asset along with its current value and specify which party it belongs to.

- Outline any premarital debts in a similar fashion, specifying the amount and to whom it belongs.

- Detail how marital assets will be handled. This includes assets acquired during the marriage, explaining how they will be divided or managed in different scenarios.

- Clarify any agreements regarding spousal support, including conditions under which it would be payable.

- If applicable, include terms concerning the division of estate assets in the event of one party's death.

- Review all sections of the Prenuptial Agreement form together, ensuring both parties fully understand and agree to each provision.

- Seek independent legal advice. Each party should consult with their own lawyer to ensure that the agreement is fair, valid, and enforceable.

- Sign and date the document in the presence of a notary to formalize the agreement. Ensure a notary public is present to witness and authenticate.

- Keep original signed copies in a safe but accessible place, and consider providing copies to your respective lawyers.

Filling out a Prenuptial Agreement is a significant step that requires transparency, honesty, and mutual respect. By carefully following these steps, couples can create a document that reflects their wishes and provides a secure foundation for their future together. Remember, the main goal is to protect both parties and ensure that both approach the marriage with a clear understanding of the financial implications and commitments. While it might seem challenging at first, taking the time to fill out this form carefully can prevent misunderstandings and conflicts in the future, allowing the couple to focus on building a life together.

Discover More on Prenuptial Agreement

What exactly is a Prenuptial Agreement?

A Prenuptial Agreement, often known as a "prenup," is a legal document entered into by a couple before they get married. This agreement outlines how assets and debts will be divided between the spouses in the event of a divorce, separation, or death. It can also specify financial responsibilities during the marriage. The intention behind a prenuptial agreement is to protect each party's pre-marriage assets and to ensure a fair and agreed-upon division of property and financial responsibilities, should the marriage end.

Who should consider having a Prenuptial Agreement?

While commonly associated with individuals who have substantial assets prior to marriage, prenuptial agreements can benefit a wide range of couples. Those with business interests, children from previous relationships, potential inheritances, or specific financial goals may especially benefit from a prenuptial agreement. It offers a clear, agreed-upon plan that can protect both parties and simplify legal processes in the event of a marriage breakdown.

Can a Prenuptial Agreement be modified or revoked after it is signed?

Yes, a Prenuptial Agreement can be modified or revoked after it is signed, but this action must be agreed upon by both parties in writing. Changes to the agreement, often called "amendments," must also be in writing and signed by both spouses. Similarly, if the couple decides that they no longer want the agreement to apply, they can jointly decide to revoke it entirely, also through a written and signed document.

Are Prenuptial Agreements enforceable in court?

Prenuptial Agreements are generally enforceable in court, provided they meet specific legal requirements. These requirements can include full and fair disclosure of assets by both parties, voluntary execution of the agreement without duress or undue influence, and the agreement cannot be unconscionably unfair at the time of signing. Courts scrutinize prenuptial agreements closely to ensure that they were agreed upon fairly and do not violate public policy or statutory laws.

What happens if we do not sign a Prenuptial Agreement?

If a couple does not sign a Prenuptial Agreement, state laws will determine the division of assets and debts in the event of a divorce or death. Without a prenuptial agreement, the couple may have less control over how their property is divided, and the process could become more complicated and contentious. Laws vary by state, but typically, property acquired during the marriage is considered marital property and may be divided equitably between the spouses. Any decisions about financial support or division of assets will be made according to state law, rather than the couple's personal wishes or agreements made prior to marriage.

Common mistakes

When filling out a Prenuptial Agreement form, attention to detail is crucial. However, several common mistakes can occur. Understanding these missteps can help you avoid them and ensure your agreement is strong and clear.

Not consulting a lawyer: Individuals often think they can handle the process alone, without professional advice. However, a lawyer can provide crucial insight and ensure the agreement is legally sound.

Incomplete financial disclosure: Both parties must fully disclose their financial situation. Failure to do so can later invalidate the agreement.

Rushing through the process: Taking enough time to consider all aspects of the agreement is essential. A rushed agreement may not fully protect your interests.

Ignoring state laws: Each state has its own laws regarding prenuptial agreements. Not aligning your agreement with state laws can lead to parts of it being unenforceable.

Lack of clarity: Vague terms and conditions can lead to disputes. Specificity is key in drafting an effective agreement.

Not considering future changes: Circumstances such as inheritance, changes in wealth, or children from the marriage might affect the agreement's relevance. Including clauses for future adjustments is wise.

Pressuring the other party: An agreement signed under pressure or duress can be challenged and possibly invalidated.

Failing to update the agreement: Relationships and financial situations evolve. Regularly reviewing and updating your prenuptial agreement is necessary.

Using ambiguous language: Terms must be clear and concise. Ambiguity can make the agreement difficult to enforce.

By avoiding these common mistakes, you can create a prenuptial agreement that serves both parties fairly and is more likely to be upheld in court. Remember, the goal is to provide security and clarity for the future, not to create contention. Therefore, open and honest communication, alongside professional guidance, is key to a valid and effective prenuptial agreement.

Documents used along the form

Embarking on the journey of marriage is not just a romantic endeavor but also a financial and legal partnership. A prenuptial agreement often serves as the cornerstone for couples seeking to clarify their financial rights and responsibilities before tying the knot. However, this pivotal document doesn't operate in isolation. To fully scaffold your marital legal architecture, utilizing additional forms and documents can be equally important. These complementary documents ensure a comprehensive approach to financial clarity and legal security, engaging aspects of property management, estate planning, and personal rights among others. Let’s explore some of these essential forms and documents that often accompany a prenuptial agreement.

- Will: Establishing a will is crucial for anyone, but it becomes particularly poignant for those entering a marriage with specific prenuptial agreements. A will can ensure that assets are distributed according to your wishes, dovetailing with the stipulations of the prenuptial agreement.

- Living Trust: A living trust complements a prenuptial agreement by allowing you to manage your assets during your lifetime and dictate their distribution upon your death. This document can help avoid probate and simplify the implementation of both your prenuptial agreement and will.

- Financial Power of Attorney: This document appoints someone to make financial decisions on your behalf, should you become unable to do so. It can specify exactly which powers your agent will have, aligning with your prenuptial agreement's directives.

- Health Care Directive: Also known as a living will, this document outlines your preferences for medical treatment if you’re unable to communicate your wishes. It’s an essential element of comprehensive legal planning for couples.

- Marriage Certificate: While not a form you fill out like the others, your marriage certificate is a crucial document that officially records your marriage. It may be required when you need to prove your marital status for insurance, property, and estate planning purposes.

- Postnuptial Agreement: Some couples decide to draft a postnuptial agreement after getting married to address changes in their financial situation, assets, or for other reasons. This document can modify or reinforce the original prenuptial agreement.

- Property Deeds: For couples owning real estate, property deeds are essential. They demonstrate ownership and can be structured to reflect the intentions of a prenuptial agreement, holding property separately or together.

- Beneficiary Designations: Updating beneficiary designations on life insurance policies, retirement accounts, and other financial instruments is vital to ensure they align with your prenuptial agreement's stipulations.

- Separation Agreement: Although no one wants to think about the possibility of separation or divorce, having a separation agreement in place can make a challenging situation more manageable. This document outlines the terms of a separation and can draw upon the pre-existing terms of the prenuptial agreement.

These documents serve as building blocks for a sturdy legal foundation in a marriage. They enable couples to address a broad spectrum of personal, financial, and legal matters, offering security and peace of mind. Combining a prenuptial agreement with these additional forms ensures that you’re not just planning for your wedding day but also for all the days that follow. Remember, while navigating these legal waters can seem daunting, the effort you put into this planning can provide protection and clarity for your future together.

Similar forms

Postnuptial Agreement: This document is akin to a Prenuptial Agreement, with the primary distinction being its execution after the parties are married. Both set forth the terms for asset division and financial responsibilities, thereby providing a clear roadmap for managing finances during the marriage or in the event of divorce.

Living Trust: Similar to a Prenuptial Agreement, a Living Trust outlines directives for managing an individual's assets. While a Living Trust is effective during one's lifetime and after death, it also helps in avoiding probate, similar to how a Prenuptial Agreement can avoid lengthy divorce proceedings by specifying asset distribution in advance.

Will: A Will, like a Prenuptial Agreement, specifies the distribution of an individual's assets upon their death. Both documents provide a mechanism for individuals to outline their wishes regarding asset distribution, although a Will takes effect after death, unlike a Prenuptial Agreement which concerns the arrangement while both parties are alive and possibly after one passes.

Buy-Sell Agreement: Often used in business partnerships, a Buy-Sell Agreement outlines what happens to a partner's share of the business in the event of an unforeseen circumstance, similar to how Prenuptial Agreements manage asset division upon divorce or death, ensuring the continuity of business operations.

Separation Agreement: This document is comparable to a Prenuptial Agreement in its outline of terms for separation, including financial arrangements and asset division. However, it is made at the time of separation instead of prior to marriage, serving as a blueprint for the division of marital assets and responsibilities.

Co-habitation Agreement: For couples who are living together but not married, a Co-habitation Agreement plays a role similar to a Prenuptial Agreement. It outlines how assets and finances are to be handled during the relationship and in the event of its dissolution, offering a form of legal protection similar to that enjoyed by married couples through prenuptial agreements.

Property Settlement Agreement: This document is used in the context of a divorce and is similar to a Prenuptial Agreement as it outlines the division of property and financial assets between parties. While a Prenuptial Agreement is drafted before marriage with anticipated agreements, a Property Settlement Agreement is crafted as part of divorce proceedings to distribute assets as agreed upon or as ordered by the court.

Dos and Don'ts

When it comes to entering into a prenuptial agreement, proceeding with caution and thoroughness is key. A prenuptial agreement, or prenup for short, is a legal document that couples sign before getting married, detailing how assets will be managed during the marriage and how they will be divided if the marriage ends. To ensure this process is handled correctly, here are six essential dos and don'ts to keep in mind when filling out a prenuptial agreement form.

Do:- Discuss the agreement well in advance: Avoid any rush by bringing up the topic early. This allows both parties ample time to consider their options, seek legal advice, and discuss any issues or concerns.

- Be completely transparent: Full disclosure of all assets and liabilities is a must. This openness ensures the agreement is fair and enforceable.

- Seek independent legal advice: Both parties should have their own lawyers. This help safeguard their interests and ensures that they fully understand the agreement's terms and implications.

- Hide any financial information: Withholding details about your finances can lead to the agreement being voided. Honesty is the best policy.

- Sign under pressure: Both parties must enter into the prenuptial agreement voluntarily. Any sign of coercion or duress could make the agreement invalid.

- Forget to update the agreement: Life changes, such as the birth of children, significant changes in wealth, or moving to a different state, can affect the validity and fairness of a prenup. Revisit and revise the agreement as needed.

Misconceptions

Prenuptial agreements, often simplified as 'prenups', are surrounded by a myriad of misconceptions that can skew the public's understanding of their purpose and utility. These agreements are not just legal documents; they represent a careful consideration of future financial matters in a partnership. Exploring these misconceptions helps to illuminate the true nature of prenuptial agreements.

- Misconception 1: Only wealthy people need prenuptial agreements.

One common misconception is that prenuptial agreements are solely for the affluent. However, these agreements serve individuals from various financial backgrounds by safeguarding future earnings, inheritance, or even personal business interests. It’s about protecting assets and defining financial rights and responsibilities, regardless of current wealth.

- Misconception 2: Prenuptial agreements indicate a lack of trust.

Many view the idea of a prenup as preparing for divorce, fostering a suspicion that there’s a lack of trust between partners. On the contrary, discussing and drafting a prenuptial agreement can strengthen a relationship by ensuring transparency and mutual understanding regarding financial matters, setting a solid foundation for trust.

- Misconception 3: Prenuptial agreements are only about protecting assets.

While asset protection is a significant part of prenuptial agreements, they also address debt allocation, spousal support, and other financial responsibilities. They can provide clarity and fairness for both parties, not just shield one party's assets from the other.

- Misconception 4: Prenuptial agreements are set in stone.

Another misconception is the belief that once a prenuptial agreement is signed, it cannot be modified. In reality, with consent from both parties, modifications are possible to reflect changes in financial situations, preferences, or the law itself.

- Misconception 5: Obtaining a prenuptial agreement is a complicated process.

While drafting a prenuptial agreement involves careful legal consideration, it does not have to be an overly complicated process. With the guidance of competent legal counsel, couples can navigate the process efficiently, ensuring the agreement is valid and reflective of both parties' interests.

- Misconception 6: Prenuptial agreements favor one party.

The perception that prenuptial agreements inherently favor one party over the other is widespread. However, for a prenuptial agreement to be enforceable, it must be fair, entered into voluntarily by both parties, and full financial disclosure must be made. An agreement that severely disadvantages one party is likely to face scrutiny and potential invalidation by a court.

- Misconception 7: You can include child support and custody arrangements in a prenuptial agreement.

It’s important to understand that prenuptial agreements cannot legally dictate child support or custody arrangements. These matters are determined based on the child’s best interests at the time of the divorce or separation, and no agreement can predetermine or restrict the court’s discretion in these areas.

- Misconception 8: Prenuptial agreements are expensive.

The cost associated with drafting a prenuptial agreement can vary widely but considering the potential financial and emotional cost of a contentious divorce, investing in a prenuptial agreement can be economically prudent in the long run. Moreover, the cost can be manageable and is often seen as a valuable investment in the future security of both partners.

- Misconception 9: If you didn’t get a prenuptial agreement before marriage, it’s too late.

This statement is not entirely accurate. While it’s true the ideal time for a prenuptial agreement is before marriage, couples who did not draft one beforehand have the option of entering into a postnuptial agreement. This document serves a similar purpose to a prenuptial agreement but is made after the marriage has taken place.

Key takeaways

A prenuptial agreement, often shortened to "prenup," is a legal document created before marriage, detailing how assets will be divided in the event of divorce or death. Understanding its use and implications is crucial for both parties involved. Here are seven key takeaways for filling out and using a prenuptial agreement form.

- Complete Transparency is Required: Both parties must fully disclose their financial assets and liabilities. This includes income, property, debts, and investments. Failure to do so can result in the agreement being invalidated.

- Seek Independent Legal Advice: Each party should hire their own lawyer to ensure that their interests are protected and the agreement is fair. This step can also help prevent claims of duress or coercion.

- Consider Future Changes: Life circumstances change, so it’s wise to include provisions for future adjustments, such as inheritance or changes in income.

- Understand It’s Not Just About Divorce: Prenups also outline what happens to assets upon the death of one spouse, impacting estate planning and inheritance.

- Not Everything Can Be Included: Child custody and child support issues cannot be predetermined in a prenuptial agreement. The court will always decide these matters based on the child's best interests at the time of the divorce.

- It Must Be Voluntary: Both parties must enter into the agreement voluntarily without pressure or duress. Evidence of coercion can render the document void.

- Proper Legal Procedures Must Be Followed: The agreement needs to be in writing, signed by both parties, and executed with the formalities required for enforceable contracts in your jurisdiction. Witnessing and notarization requirements vary by state.

Filling out a prenuptial agreement form with diligence and attention to detail can protect both parties' interests, providing peace of mind as they enter into marriage. Remember, the goal of a prenup is not to anticipate divorce, but rather to establish clear guidelines for financial matters, ensuring that both partners feel secure and protected.

Consider Other Documents

Irs Transcript Request - Reflects individual financial transactions, tax deductions, and credits for a specific tax year.

Dl 44 Form for Minors - Key document for California residents to manage their driver's licensing and state identification card needs through the DMV.

Bill of Sale for a Horse - It's especially crucial for valuable or pedigreed horses, where proof of sale and ownership is key.