Free Profit And Loss PDF Form

For businesses, the understanding of financial health is paramount, and this is where the significance of the Profit and Loss (P&L) form emerges. By meticulously tracking revenues, costs, and expenses over a specific period, this financial statement offers a clear overview of a company’s operational performance. It serves not just as a reflection of past activities but also as a guiding light for future strategic planning. With categories that range from sales and services to various types of expenses, the P&L form is a comprehensive record that helps stakeholders grasp the company's financial dynamics. It's a critical tool for decision-making, allowing for adjustments in strategy to enhance profitability. Moreover, it plays a fundamental role in tax preparation, furnishing essential data that ensures compliance and accurate reporting. The form's accessibility and interpretability make it crucial for business owners, investors, and financial analysts alike, offering a distilled view of financial success and areas requiring attention.

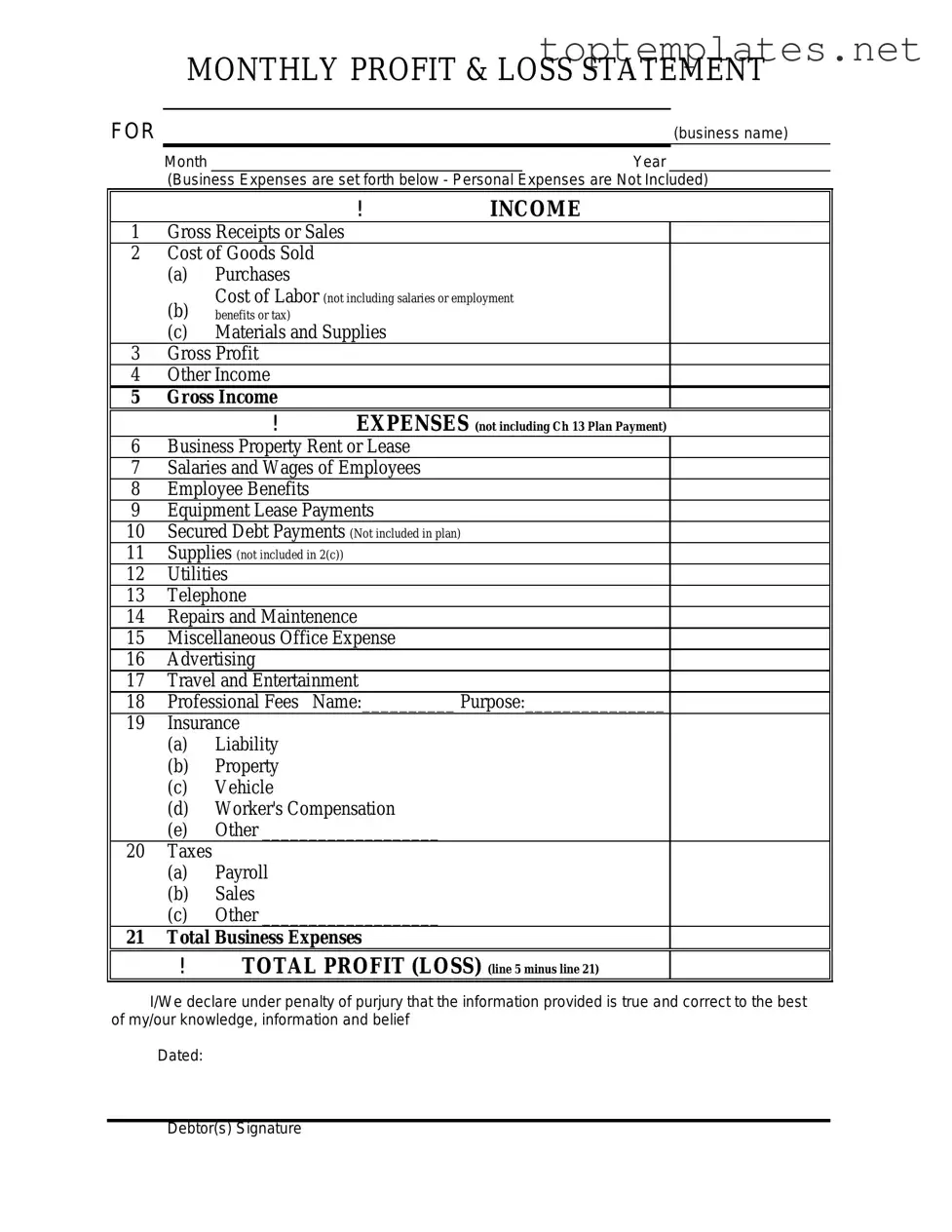

Sample - Profit And Loss Form

MONTHLY PROFIT & LOSS STATEMENT

FOR |

(business name) |

Month |

Year |

(Business Expenses are set forth below - Personal Expenses are Not Included)

|

|

|

! |

INCOME |

1 |

Gross Receipts or Sales |

|

||

2 |

Cost of Goods Sold |

|

||

|

(a) |

Purchases |

|

|

|

(b) |

Cost of Labor (not including salaries or employment |

||

|

benefits or tax) |

|

|

|

|

(c) |

Materials and Supplies |

|

|

3 |

Gross Profit |

|

|

|

4 |

Other Income |

|

|

|

5 |

Gross Income |

EXPENSES (not including Ch 13 Plan Payment) |

||

|

|

! |

||

6 |

Business Property Rent or Lease |

|

||

7 |

Salaries and Wages of Employees |

|

||

8 |

Employee Benefits |

|

|

|

9 |

Equipment Lease Payments |

|

||

10 |

Secured Debt Payments (Not included in plan) |

|

||

11 |

Supplies (not included in 2(c)) |

|

||

12 |

Utilities |

|

|

|

13 |

Telephone |

|

|

|

14 |

Repairs and Maintenence |

|

||

15 |

Miscellaneous Office Expense |

|

||

16 |

Advertising |

|

|

|

17 |

Travel and Entertainment |

|

||

18 |

Professional Fees |

Name:__________ Purpose:_______________ |

||

19 |

Insurance |

|

|

|

|

(a) |

Liability |

|

|

|

(b) |

Property |

|

|

|

(c) |

Vehicle |

|

|

|

(d) |

Worker's Compensation |

|

|

|

(e) |

Other ___________________ |

|

|

20 |

Taxes |

|

|

|

|

(a) |

Payroll |

|

|

|

(b) |

Sales |

|

|

|

(c) |

Other ___________________ |

|

|

21 |

Total Business Expenses |

|

||

|

! |

TOTAL PROFIT (LOSS) (line 5 minus line 21) |

||

I/We declare under penalty of purjury that the information provided is true and correct to the best of my/our knowledge, information and belief

Dated:

Debtor(s) Signature

File Specs

| Fact Name | Description |

|---|---|

| Purpose | The Profit and Loss (P&L) form is used by businesses to summarize their revenues, costs, and expenses during a specific period, showing the net profit or loss. |

| Frequency of Use | Typically, the P&L form is prepared quarterly and annually, but it can be generated monthly for internal use. |

| Key Components | Key components include gross revenue, cost of goods sold (COGS), gross profit, operating expenses, and net income. |

| User Base | The form is utilized by business owners, accountants, and financial analysts to assess the financial health of an entity. |

| Governing Law(s) | In the United States, the preparation and presentation of a P&L form follow Generally Accepted Accounting Principles (GAAP). |

| Importance of Accuracy | Accurate preparation is crucial for compliance, decision-making, and portraying a true and fair view of a company's financial performance. |

Steps to Filling Out Profit And Loss

Filling out a Profit and Loss (P&L) form is a critical step for businesses to assess their financial health over a specific time period. This form records revenues, costs, and expenses to determine a company's profit or loss. Careful and accurate completion of this document is essential for financial analysis, planning, and tax purposes. The following steps will guide you through the process of filling out a P&L form, ensuring that you capture all the necessary information to reflect your business's financial activity accurately.

- Gather all financial documents, including sales records, receipts, and expense reports, for the period you are reporting.

- Locate the revenue section of the form. Enter the total amount of money generated from business activities, excluding any costs or expenses. This is often referred to as gross revenue or sales.

- Identify the cost of goods sold (COGS) section. Calculate and enter the direct costs associated with the production of goods or services your business sells. This includes materials and labor costs.

- Subtract the COGS from your gross revenue to calculate the gross profit. Enter this amount in the gross profit section.

- Proceed to the expenses section. List and total all operating expenses, including rent, utilities, salaries, and marketing costs. Be thorough to ensure all expenses are accounted for.

- Deduct the total operating expenses from the gross profit to determine the operating profit. Enter this figure in the operating profit section.

- If your business has any other income sources (e.g., investments, interest on loans) or expenses (e.g., loan interest payments, legal fees), include these in the other income or expenses section.

- Calculate the net profit or loss by adding any additional income to the operating profit and then subtracting any additional expenses. Enter the final amount in the net profit (or loss) section.

- Review the entire form to ensure accuracy. Mistakes in calculations or omitted entries can significantly affect the portrayal of your business's financial health.

- Once satisfied with the accuracy of the information, sign and date the form. If applicable, submit the form to the designated department or agency as required.

By following these steps, businesses can accurately complete their Profit and Loss form, offering valuable insights into their financial performance. This document serves not only as a reflection of past and present financial health but also as a roadmap for future financial planning and decision-making. It's a cornerstone of financial management that supports growth and sustainability.

Discover More on Profit And Loss

What is a Profit and Loss (P&L) form?

A Profit and Loss (P&L) form, also known as an income statement, is a financial document that summarizes the revenues, costs, and expenses incurred during a specific period, usually a fiscal quarter or year. By providing a snapshot of a company's financial performance, the P&L statement helps stakeholders understand how much profit the business has made or how much loss it has suffered over the period.

Why is the Profit and Loss form important?

This form is critical because it provides invaluable insight into the financial health and operational efficiency of a business. For business owners, it's an essential tool for making informed decisions, such as cutting costs or identifying areas for expansion. For investors and lenders, the P&L statement offers a clear picture of a company’s profitability and potential risks, informing their investment or lending decisions.

What are the key components of a Profit and Loss form?

The key components include revenue, cost of goods sold (COGS), gross profit, operating expenses, operating profit, other expenses or incomes, and net profit before and after tax. Revenue represents the income received from normal business operations. COGS are the direct costs attributable to the production of the goods sold by the company. Gross profit is calculated by subtracting COGS from revenue. Operating expenses include salaries, rent, and utilities. Operating profit, or earnings before interest and taxes (EBIT), is the profit earned from regular business operations. Other expenses or incomes could include interest received or paid, profits from investments, or exceptional costs. Net profit, the bottom line, shows the actual profit after all expenses and taxes.

How often should a business prepare a Profit and Loss statement?

It is advisable for businesses to prepare a P&L statement at least on a quarterly basis. However, preparing it monthly can provide a more timely insight into financial performance, allowing for quicker adjustments in strategy if necessary. An annual P&L statement is also needed for a comprehensive overview of the year’s financial activity, which is useful for tax preparation, reporting to stakeholders, and strategic planning for the next year.

Common mistakes

Not separating personal and business expenses: One common mistake is mixing personal expenses with business ones. This can distort the true financial picture of the business. It's crucial to keep these separate to ensure the P&L form reflects only the business's operations.

Forgetting to include all sources of income: Another oversight is not accounting for all income streams. Whether it is sales, services, or miscellaneous income, every penny coming into the business must be recorded. This ensures that the revenue is accurately represented.

Overlooking small expenses: Similarly, all expenses, no matter how small, should be recorded. These can add up over time and significantly impact the business’s profit margins. Skipping them can give a skewed view of profitability.

Misclassifying expenses: Misunderstanding expense categories leads to misclassification. For example, categorizing a one-time purchase as an ongoing expense can inflate operational costs. Proper classification aids in precise expense tracking and management.

Inaccurate recording of inventory: For businesses that handle inventory, incorrect inventory levels can lead to incorrect cost of goods sold (COGS) calculations. This, in turn, affects gross profit estimation, making it essential to maintain accurate inventory records.

Omitting depreciation: Lastly, failing to account for depreciation can result in overstating assets and profits. Depreciation reflects the wear and tear on long-term assets and must be included to provide a complete financial picture.

Avoiding these mistakes can make a significant difference in the accuracy of a Profit and Loss statement. By paying close attention to detail and ensuring all financial information is accurately captured, businesses can better understand their financial performance and make more informed decisions.

Documents used along the form

When business owners and managers review their company's financial health, the Profit and Loss (P&L) form is undeniably central. However, it does not stand alone in providing a comprehensive view of financial status. Several other forms and documents work hand-in-hand with the P&L statement to offer a fuller picture of financial performance and position. Below are four of these key documents, each serving a specific role in business financial analysis.

- Balance Sheet: This document complements the P&L statement by providing a snapshot of the company's assets, liabilities, and equity at a specific point in time. It helps stakeholders understand what the company owns and owes, giving insights into its financial stability and liquidity.

- Cash Flow Statement: Essential for understanding the inflow and outflow of cash, this statement breaks down financial activities into operating, investing, and financing activities. It's crucial for determining the short-term viability of a company, particularly its ability to pay bills and finance its operations.

- Statement of Changes in Equity: Often used alongside the P&L statement, this document provides details on the movement in equity over the reporting period. It includes information on retained earnings, dividends paid, and changes from equity issuances or buybacks, offering insight into how profits are used or distributed.

- Notes to Financial Statements: These accompany the financial statements, providing additional details and clarifications that enhance the reader's understanding of a company's financial activities and policies. They can include information on accounting methods, potential liabilities, and other factors affecting financial results.

Together with the P&L statement, these documents provide a multi-dimensional view of a company's financial health. By analyzing these documents in conjunction, business owners, investors, and other stakeholders can make more informed decisions, grounded in a deeper understanding of the company's financial strengths, weaknesses, and overall performance.

Similar forms

Balance Sheet: Just like the Profit and Loss (P&L) statement, a balance sheet provides a snapshot of a company's financial health, but from a different perspective. While the P&L form focuses on income and expenses over a period, the balance sheet captures a company’s assets, liabilities, and shareholders' equity at a specific point in time. Both documents are crucial for assessing the financial position and performance of a business.

Cash Flow Statement: This financial statement is akin to the P&L form because it details the cash inflows and outflows of a business. However, the key difference lies in its focus on cash transactions, offering insights into a company's liquidity. The P&L statement and the cash flow statement together give a comprehensive view of a company's financial health, indicating not just profitability but also cash management.

Budget Report: Budget reports are similar to Profit and Loss statements as they both track financial performance. The primary difference is that a budget report compares actual financial results against the projected or budgeted figures, providing an analysis of variances. Both documents are essential for managing finances effectively and planning future operations.

Income Statement: Often considered synonymous with the P&L statement, the income statement is indeed its exact counterpart. It lists revenue, expenses, and net income over a period. The terminology might differ, with some industries preferring one term over the other, but the purpose and the structure of the documents are fundamentally the same.

Statement of Retained Earnings: This statement is related to the P&L form as it deals with the portion of net income which is retained by the company rather than distributed to shareholders as dividends. It effectively bridges the gap between the P&L statement and the balance sheet by showing how the profits are used to increase shareholders' equity.

Statement of Comprehensive Income: This document expands on the information presented in the P&L statement by including items not recognized in the main financial statements, such as unrealized gains and losses on financial instruments. It gives a fuller picture of a company's financial performance and overall health.

Statement of Operations: Similarly focused on the company's financial performance, this document is akin to the P&L statement. It details the company's operational and non-operational income and expenses, providing insights into the efficiency and profitability of its core activities. The statement of operations and the P&L statement are often used interchangeably, depending on the company's preference or the industry standard.

Dos and Don'ts

When preparing a Profit and Loss (P&L) form, it is crucial to approach this task with diligence and attention to detail. The P&L statement is a financial document that summarizes the revenues, costs, and expenses incurred during a specific period, often a fiscal quarter or year. To ensure accuracy and compliance, several dos and don'ts should be followed:

- Do gather all relevant financial documents before you begin. This preparation includes bank statements, receipts, invoices, and any records of expenses and income.

- Do ensure accuracy by double-checking all figures entered into the form. Mistakes can lead to a misrepresentation of the financial health of the business.

- Do categorize income and expenses properly. This classification helps in understanding where the money is coming from and where it is going, facilitating better financial decisions.

- Do use accounting software if possible. It can automate many aspects of preparing a P&L statement, reducing the risk of errors.

- Don't forget to include all sources of income. Omitting even small amounts can result in an inaccurate portrayal of the business's profitability.

- Don't overlook any expenses. Similar to income, even minor expenses can add up and significantly impact the bottom line.

- Don't estimate numbers. Use actual figures from your financial documents to ensure the precision of the P&L statement.

- Don't delay in filling out the P&L form. Regular maintenance of financial records helps in keeping track of the business’s financial health and assists in making informed decisions.

Misconceptions

When it comes to understanding a Profit and Loss (P&L) form, many people have misconceptions that can lead to confusion. Below, we outline and explain seven common misconceptions about the P&L form:

It's only for big businesses: Many believe that P&L forms are exclusively for large corporations. In reality, businesses of all sizes can and should use them. They are crucial for tracking financial performance over time, no matter the size of the company.

Revenue equals profit: A common mistake is to confuse revenue with profit. Revenue is the money a company earns from its business activities, whereas profit is what remains after all expenses have been subtracted from the total revenue.

It's too complicated to understand: While financial documents can seem daunting, the P&L form is designed to provide clear information about a business’s financial health. With a basic understanding of its components, most people can learn to read and understand P&L statements effectively.

Only accountants need to worry about it: It's a common belief that P&L forms are solely the accountant's responsibility. However, understanding these forms can provide valuable insights for various stakeholders, including business owners, investors, and managers, helping them make informed decisions.

Profit and Loss statements are the same as cash flow statements: Although both provide important financial information, they serve different purposes. A P&L statement shows how profitable the company is by detailing income and expenses. In contrast, a cash flow statement provides information about the cash flowing in and out of a business, which helps in understanding its liquidity.

A positive profit means the business is healthy: While a positive profit is a good sign, it doesn’t always mean the business is financially healthy. It’s important to consider other factors, like cash flow and liabilities, to get a complete picture of financial health.

It’s all about historical data: Some believe P&L statements are backward-looking and don’t provide insights into future performance. However, analyzing trends in these statements can help predict future financial performance, making them a powerful tool for planning.

Key takeaways

When dealing with a Profit and Loss (P&L) form, it's crucial to understand not only how to fill it out but also its significance in assessing a business’s financial health. Here, we offer key takeaways to guide individuals in correctly using and interpreting the P&L form.

Accuracy is Key: Ensure that all financial information entered in the P&L form is accurate. This includes revenues, expenses, cost of goods sold, and any other financial transactions. Accuracy forms the foundation of a reliable P&L statement, which is essential for making informed business decisions.

Regular Updates: Regularly update the P&L form to reflect the current financial situation. This is not a one-time activity but an ongoing process that helps track financial progress over time, identifying trends and areas of improvement.

Comprehensible Categories: Organize revenues and expenses into clear categories. This organization makes it easier to understand where money is coming from and going, facilitating better financial analysis and strategy planning.

Comparative Analysis: Use the P&L form for comparative analysis. By comparing P&L statements from different periods, you can identify patterns, evaluate performance, and make projections about future financial health. This comparison is crucial for strategic planning and growth.

Legal and Tax Implications: Be aware of the legal and tax implications of the information on the P&L form. The profit or loss reported can affect tax liabilities and compliance with financial regulations. It's essential to consider these aspects to avoid legal issues or unexpected tax bills.

By keeping these key points in mind, users can ensure they are leveraging the P&L form effectively, leading to more accurate financial analysis and strategic business decisions.

Common PDF Forms

Cancel Melaleuca Membership Online - Alerts customers that suspension requests made after the 25th will be processed the next month, managing expectations.

Letter Authorizing Child to Travel - By signing this form, guardians authorize the cruise line to act in the minor's best interest in lieu of direct parental presence.