Valid Promissory Note Template

When entering into a lending agreement, clarity and commitment are paramount. That's where a Promissory Note comes into play, serving as a vital document that outlines the promise by one party to pay back a sum of money to another party under agreed upon conditions. This form becomes the bedrock of trust between the lender and the borrower, ensuring that all the details regarding the payment terms, interest rates, maturity date, and any collateral involved are laid out in black and white. Not only does it facilitate a smoother financial transaction, but it also serves as a legally binding document that can be enforced in a court of law, should any disputes arise. Whether you're lending a significant sum to a friend to help them purchase a home, or you're borrowing from a financial institution, understanding the nuances and critical importance of a Promissory Note cannot be overstated. It safeguards the interests of both parties, making clear the obligations and expectations involved in the lending process.

Promissory Note Form Categories

Sample - Promissory Note Form

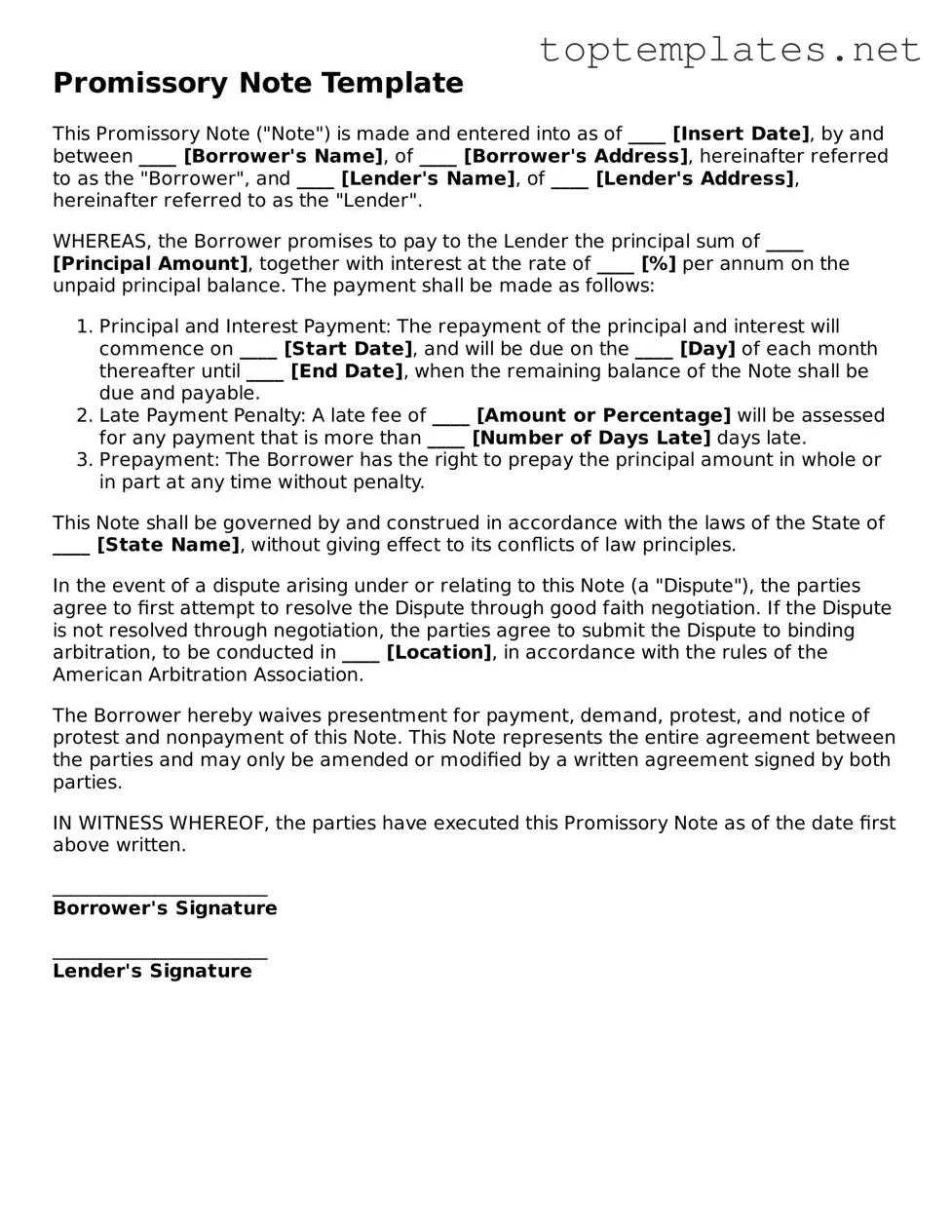

Promissory Note Template

This Promissory Note ("Note") is made and entered into as of ____ [Insert Date], by and between ____ [Borrower's Name], of ____ [Borrower's Address], hereinafter referred to as the "Borrower", and ____ [Lender's Name], of ____ [Lender's Address], hereinafter referred to as the "Lender".

WHEREAS, the Borrower promises to pay to the Lender the principal sum of ____ [Principal Amount], together with interest at the rate of ____ [%] per annum on the unpaid principal balance. The payment shall be made as follows:

- Principal and Interest Payment: The repayment of the principal and interest will commence on ____ [Start Date], and will be due on the ____ [Day] of each month thereafter until ____ [End Date], when the remaining balance of the Note shall be due and payable.

- Late Payment Penalty: A late fee of ____ [Amount or Percentage] will be assessed for any payment that is more than ____ [Number of Days Late] days late.

- Prepayment: The Borrower has the right to prepay the principal amount in whole or in part at any time without penalty.

This Note shall be governed by and construed in accordance with the laws of the State of ____ [State Name], without giving effect to its conflicts of law principles.

In the event of a dispute arising under or relating to this Note (a "Dispute"), the parties agree to first attempt to resolve the Dispute through good faith negotiation. If the Dispute is not resolved through negotiation, the parties agree to submit the Dispute to binding arbitration, to be conducted in ____ [Location], in accordance with the rules of the American Arbitration Association.

The Borrower hereby waives presentment for payment, demand, protest, and notice of protest and nonpayment of this Note. This Note represents the entire agreement between the parties and may only be amended or modified by a written agreement signed by both parties.

IN WITNESS WHEREOF, the parties have executed this Promissory Note as of the date first above written.

_______________________

Borrower's Signature

_______________________

Lender's Signature

File Breakdown

| Fact Name | Description |

|---|---|

| Definition | A promissory note is a written, legally binding promise made by one party to pay a certain amount of money to another party under specific terms. |

| Key Components | Principal amount, interest rate, maturity date, and the signatures of the involved parties are the key components of a promissory note. |

| Types | There are secured and unsecured promissory notes, differentiated by the presence or absence of collateral. |

| Usage | Commonly used for personal loans, business loans, and real estate transactions. |

| Governing Law | While the principles are generally consistent, specific terms and legality can vary by state in the U.S. |

| State-Specific Variations | Certain states might have unique requirements or provisions for interest rates, enforcement, or prepayment penalties. |

| Legal Enforcement | If the borrower fails to comply with the terms, the lender may pursue legal action to enforce the note and recover the owed amount. |

| Modification | Any modifications to the note must be agreed upon by all parties and documented in writing to remain enforceable. |

| Termination | The promissory note is terminated when the debt is fully paid or if legally discharged through other means. |

Steps to Filling Out Promissory Note

After deciding to lend money, either to someone you know or perhaps in a more formal business arrangement, the next practical step is creating a promissory note. This document serves as a written promise from the borrower that they will repay the sum under the conditions outlined in the note. While the thought of drafting legal documents might seem daunting, completing a promissory note is quite straightforward when you break it down into simple steps. Filling out this form correctly ensures clarity for both parties involved about the repayment terms, interest rates, and any collateral involved. Let's walk through each step to ensure you have a complete and enforceable promissory note by the end.

- Start by inserting the date at the top of the document. This is the date from which the terms of the promissory note become effective.

- Enter the full legal name of the borrower and the lender. Beside each name, include the complete address to clarify the parties involved.

- Specify the principal amount of money being lent. This is the initial sum without any interest or fees added.

- Detail the interest rate. This is the annual percentage rate (APR) that will be applied to the principal amount. If the note will not carry any interest, state this clearly.

- Outline the repayment plan. Describe how the borrower is expected to repay the loan (e.g., in installments, a lump sum) and specify the due dates or time frame for repayment.

- If there are any prepayment terms, such as a penalty or lack thereof for early repayment, include those terms clearly.

- Add any collateral that secures the loan, if applicable. Collateral is a borrower's asset that they agree to forfeit should they default on the loan.

- Include a clause about what will happen if the borrower fails to make payments. This can cover late fees, acceleration of the debt, and other measures.

- State the governing law, which indicates the state law that applies to the interpretation and enforcement of the promissory note.

- The borrower and lender must sign and date the form. Depending on your state's requirements, you may also need to have the document witnessed or notarized.

Completing a promissory note is a significant step in formalizing a loan agreement. It offers a clear guide for repayment and serves as a legal record of the loan. By following these steps, you can create a comprehensive document that protects the interests of both the lender and the borrower, fostering transparency and trust in the arrangement. Remember, it's important to review your promissory note carefully before signing to ensure all terms are correct and fully understood by all parties.

Discover More on Promissory Note

What is a Promissory Note and why is it important?

A Promissory Note is a financial document in which one party promises in writing to pay a determinate sum of money to the other, either at a fixed or determinable future time or on demand of the payee, under specific terms. It's a crucial instrument in lending transactions, providing a legal framework that formalizes the loan process. It ensures that there is a clear record of the loan amount, interest rate, repayment schedule, and any other terms agreed upon. This clarity helps prevent disputes and misunderstandings between the parties involved.

What are the key elements that should be included in a Promissory Note?

A comprehensive Promissory Note should encompass several key elements to be considered valid and enforceable. These include the amount borrowed, interest rate (if applicable), repayment schedule, late payment penalties, and provisions for default. Additionally, it should clearly identify the parties involved, the date of agreement, and any collateral securing the loan. Explicitly stating these elements within the document protects both parties by setting forth their rights and obligations in detail.

How legally binding is a Promissory Note?

A Promissory Note is a legally binding document as long as it contains the essential elements required for a contract: offer, acceptance, consideration, and the mutual intent to be bound by the document. Once both parties have signed the note, it becomes a legal obligation that the borrower must repay the specified sum under the agreed terms. Failure to meet these conditions can lead to legal implications, such as lawsuits or actions to enforce the note through other legal mechanisms, emphasizing the importance of understanding and fulfilling the obligations spelled out in the note.

Can a Promissory Note be modified?

Yes, a Promissory Note can be modified, but any modifications must be agreed upon by all parties involved and put in writing. The process typically involves creating and signing an amendment to the original note or drafting a new document that both parties agree on, reflecting the changes. It is critical that all changes are documented properly to maintain the legal integrity of the note and ensure that it remains enforceable under the new terms. This makes sure that the agreement continues to reflect the current understanding and agreement between the parties.

Common mistakes

When it comes to filling out a Promissory Note form, it's essential to pay careful attention to detail and follow all required procedures accurately. People often overlook crucial aspects or make errors that could potentially invalidate the agreement or create legal challenges down the road. Here are eight common mistakes:

-

Not specifying the loan amount precisely: It's vital to state the exact amount of money being loaned. Failing to do so can lead to disputes over how much should be repaid.

-

Leaving out repayment terms: A Promissory Note must include clear repayment terms, such as the repayment schedule, interest rates (if applicable), and the due date for the final payment. Unclear terms can cause confusion and disagreements.

-

Omitting the interest rate: If the loan carries an interest rate, this must be clearly stated. Forgetting to include the interest rate can complicate calculating the total amount owed.

-

Forgetting to include the date: The date of the agreement is crucial. It marks when the terms were agreed upon and can affect the repayment schedule.

-

Not defining the parties correctly: Clearly identifying the borrower and lender, including full legal names and addresses, is necessary. This helps prevent any confusion about who is obligated to repay the loan.

-

Failing to get it witnessed or notarized: While not always required, having the note witnessed or notarized can lend it additional legal validity, especially in cases of dispute.

-

Ignoring state-specific requirements: Some states have specific laws regarding Promissory Notes, such as requiring specific disclosures or terms to be included. Not adhering to these requirements can affect the enforceability of the note.

-

Neglecting to keep a copy: Both the lender and the borrower should keep a copy of the signed Promissory Note. Losing the only copy can lead to significant problems if the terms are contested or need to be verified.

In summary, filling out a Promissory Note form requires attention to detail and an understanding of the legal obligations it entails. By avoiding these common mistakes, parties can help ensure their agreement is valid, clear, and enforceable.

Documents used along the form

In the world of legal documents, especially those pertaining to financial agreements, the Promissory Note stands as a critical instrument. It serves as a formal commitment by one party to pay a specified sum of money to another under agreed terms and conditions. However, to bolster the legal framework around monetary transactions and ensure clarity of terms for both parties, other forms and documents are frequently used in conjunction with a Promissory Note. The following is an exploration of such documents, each pivotal in its own right.

- Security Agreement: This document is essential when the promissory note is secured with collateral. It outlines the specifics of the asset(s) pledged as security by the borrower to the lender. Should the borrower default, this agreement provides the legal framework for the lender to seize the collateral.

- Loan Agreement: Often accompanying a promissory note, this comprehensive document details the full scope of the loan's terms and conditions. It covers interest rates, repayment schedule, consequences of default, and can consolidate multiple promissory notes under a single agreement, providing a broader legal context.

- Guaranty: To further protect the interests of the lender, a guaranty may be required. This document ensures that if the primary borrower fails to meet the repayment obligation, a third party (the guarantor) is responsible for fulfilling those obligations, providing an additional layer of security for the lender.

- Amortization Schedule: While not always a stand-alone legal document, this schedule is crucial for both borrower and lender, detailing the precise breakdown of payments over the loan’s term. It shows how each payment is divided into interest and principal, providing transparency and helping manage expectations.

- Personal Financial Statement: Particularly in cases where the loan is extended based on personal credit or trust, this document provides a snapshot of the borrower’s financial health. Assets, liabilities, income, and expenditures are all laid out, offering the lender insight into the borrower’s capacity to repay.

Each of these documents plays a vital role in ensuring the safety, clarity, and fairness of financial transactions that involve a Promissory Note. Whether providing additional security for the lender, outlining the specifics of the agreement, or clarifying the repayment plan, they work together to create a comprehensive legal framework that supports the interests of all parties involved.

Similar forms

Loan Agreement: Similar to a promissory note, a loan agreement is a comprehensive document that outlines the terms of a loan between two parties. It covers interest rates, repayment schedule, collateral, and the consequences of default in more detail than a promissory note, offering more extensive legal protections.

Mortgage Agreement: This document is specific to loans used to purchase real estate. Like a promissory note, it details the borrower's obligation to repay the loan but also secures the loan with the property itself. In essence, if the borrower fails to repay, the lender can foreclose on the property.

IOU (I Owe You): An IOU is a simple acknowledgment of debt, much like a promissory note. However, it is less formal and usually doesn't detail repayment terms such as payment dates or interest rates, making it a less binding document.

Bill of Sale: Though primarily used to record the transfer of ownership of goods or property from a seller to a buyer, a bill of sale can resemble a promissory note if it includes terms of payment made over time, including any interest charged and payment deadlines.

Personal Guarantee: A personal guarantee is a pledge by an individual to repay a loan if the primary borrower defaults. It is similar to a promissory note in enforcing a commitment to pay. However, it involves a third party and provides additional security to the lender.

Credit Agreement: Credit agreements are more comprehensive than promissory notes, outlining the terms and conditions under which credit is extended from a lender to a borrower. It includes details similar to those found in a promissory note but is typically used for revolving credit arrangements like credit cards or lines of credit.

Student Loan Agreement: Specifically designed for educational loans, this document shares similarities with promissory notes through its detailing of the borrower’s promise to repay the borrowed amount. It additionally outlines the terms specific to student loans, such as deferment options and grace periods.

Deed of Trust: Used in certain states in place of a mortgage agreement, a deed of trust involves three parties: the borrower, the lender, and a trustee. The borrower conveys the property title to the trustee as security for the loan described in the accompanying promissory note. This document parallels the promissory note in its function of detailing the borrower's obligation but also includes the role of the trustee in foreclosure proceedings.

Dos and Don'ts

When it comes to filling out a Promissory Note form, precision and clarity are key. This document is a serious commitment—it outlines your promise to pay someone a sum of money under agreed terms. Whether you're lending or borrowing, here are some dos and don'ts that can help you navigate the process with confidence.

What You Should Do:

- Review the Entire Form First: Understand all the sections before you start filling them out. This will help you gather all the necessary information beforehand and ensure you don’t miss any details.

- Use Clear and Precise Language: Avoid any ambiguity. State the loan amount, repayment schedule, interest rate, and any collateral clearly. Precision here can prevent misunderstandings later.

- Verify the Borrower's and Lender's Information: Double-check the names, addresses, and other contact information of all parties involved. This might seem like a small detail, but inaccuracies here could lead to big issues down the line.

- Specify the Payment Terms: Clearly outline how and when the loan will be repaid. Include specific dates and amounts for each payment. This clarity benefits both the lender and the borrower.

- Sign and Date the Form: Ensure that all parties sign and date the form. This step is crucial as it indicates that everyone agrees to the terms laid out in the document.

What You Shouldn't Do:

- Leave Blank Spaces: Don’t leave any sections blank. If a section doesn’t apply, write “N/A” (not applicable) to indicate this. Blank spaces can lead to unauthorized additions or alterations.

- Rush the Process: Taking your time is important. This isn’t a document to rush through. Misunderstandings or mistakes in a Promissory Note can lead to disputes or legal issues down the line.

- Ignore State Laws: Each state can have different laws regarding loans and interest rates. Ensure you’re in compliance with these laws to prevent the note from being unenforceable.

- Forget to Include Consequences of Default: Being optimistic about repayment is natural, but it’s crucial to outline the consequences if the borrower fails to make payments as agreed.

- Use Complicated Jargon: Keep the language simple and straightforward. Avoid legal or financial jargon that might confuse any party involved. Everyone should fully understand the agreement they're entering into.

Handling a Promissory Note with care can pave the way for a smooth financial transaction and relationship between the lender and borrower. Following these guidelines ensures that your agreement is both clear and legally binding. Remember, when in doubt, consulting with a legal expert can help navigate any complexities or state-specific requirements.

Misconceptions

When it comes to promissory notes, several misconceptions can lead to confusion or misunderstandings. It's crucial to dispel these myths to ensure that all parties involved have a clear understanding of what a promissory note is and how it functions.

A promissory note is just a casual promise to pay. One common misconception is that promissory notes are informal agreements that don't hold much legal weight. In reality, promissory notes are legally binding documents. They outline how and when a debt will be repaid and can be enforced in court if necessary.

All promissory notes need to be notarized to be valid. While having a promissory note notarized can add an extra layer of validity, not all states require notarization for the note to be enforceable. The crucial elements are the details of the agreement, including the amount borrowed and the repayment terms.

Promissory notes and loan agreements are the same. Though they both relate to borrowing and lending, promissory notes and loan agreements are not identical. A promissory note is a simple agreement that specifies the amount owed and the repayment plan. In contrast, a loan agreement is more complex, containing detailed provisions about collateral, legal recourse, and defaults.

There is a standard, one-size-fits-all template for promissory notes. Though templates can provide a good starting point, there's no single promissory note format that fits every situation. The terms of a promissory note can and should be tailored to the specific details of the loan, including the interest rate, repayment schedule, and any collateral involved.

You can't modify a promissory note once it's signed. It's a common belief that once a promissory note is signed, its terms are set in stone. However, if all involved parties agree, the terms of the note can be modified. Such amendments should be documented in writing to maintain clarity and legal standing.

Promissory notes are only for business loans. While promissory notes are often used in business contexts, they're not limited to commercial loans. They can also be used for personal loans between friends or family members. In these cases, a promissory note helps to formalize the loan and clearly define the repayment expectations.

If the borrower defaults, there's nothing the lender can do. This myth could not be further from the truth. If a borrower fails to meet the terms of a promissory note, the lender has several legal options to pursue repayment. The specific actions will depend on the terms of the note and the laws of the state in which it was issued.

Understanding these misconceptions about promissory notes can clear up much of the confusion surrounding these documents. Whether you're lending or borrowing, it's essential to recognize the legal significance of a promissory note and ensure that its terms are clear and tailored to the specific agreement.

Key takeaways

A Promissory Note form is a vital legal document creating a binding agreement between two parties: a borrower and a lender. It's a promise from the borrower to pay back a specified sum of money to the lender under agreed terms. Understanding the crucial aspects of filling out and using a Promissory Note form can make the borrowing process smoother and protect both the borrower's and the lender's rights. Below are key takeaways to consider.

- Details Matter: It’s important to include complete and accurate information about the borrower and lender, such as full names, addresses, and contact information. This ensures there’s no ambiguity about who the agreement binds.

- Loan Amount and Terms: Clearly state the loan amount and be explicit about the repayment terms, including the interest rate, repayment schedule (monthly, quarterly, annually), and the loan term (when the loan should be fully repaid). Precise terms prevent misunderstandings.

- Interest Rate Clarity: The interest rate should be clearly mentioned and should comply with the state’s usury laws to ensure it's legal. Avoid excessively high rates that could render the promissory note unenforceable.

- Security or Unsecured: Specify whether the loan is secured (backed by collateral) or unsecured. If collateral is being used, detail what the collateral is. This affects the lender’s recourse in case of default.

- Repayment Plan: Outline a clear repayment plan, including the exact dates payments are due and any grace period allowed. This sets clear expectations for repayment and can help in avoiding disputes.

- Default Terms: Spell out what constitutes a default and the consequences, including any late fees or accelerations of payment. Knowing the repercussions of default encourages timely repayment.

- Governing Law: Indicate which state’s laws will govern the promissory note. Since laws vary by state, identifying this helps in resolving any legal disputes by applying the relevant legal framework.

- Signatures: Ensure that both parties sign the promissory note. A witness or notary public may also sign if required by state law. Signatures legally bind the parties to the terms of the agreement.

Filling out a Promissory Note with comprehensive and precise details minimizes risks and protects both the lender and the borrower. It’s more than just a formality; it’s a foundation for financial transactions that demand clarity and understanding from all involved parties. By adhering to these key takeaways, individuals can navigate the complexities of lending and borrowing with greater confidence and security.

Consider Other Documents

Ucc 1 308 - Highlights the right of individuals to refuse acceptance of benefits from contracts they did not enter knowingly and willingly.

U.S. Corporation Income Tax Return - Consulting with a tax professional can help corporations navigate the complexities of the IRS 1120 form and avoid common pitfalls.