Valid Promissory Note for a Car Template

When venturing into the realm of buying or selling a car through private sale, navigating the financial transaction can seem daunting without a roadmap to guide both parties securely to their destination. The cornerstone of this journey often lies in the utilization of a Promissory Note for a Car form, a document that, at its core, embodies the promise from one individual to another regarding payment for the vehicle. Thoughtfully crafted, this legal instrument goes beyond mere acknowledgment of debt. It intricately details the who, what, when, and how of repayment, encapsulating aspects such as the total amount owed, agreed-upon payment schedule, interest rates if applicable, and consequences of late payments or default. For buyers, it offers a structured path to ownership outside traditional financing methods, instilling a sense of accountability and clarity. Sellers, on the other hand, are afforded an added layer of security, ensuring that the agreement is not merely based on verbal assurances but on a legally binding commitment. Thus, the Promissory Note for a Car not only marks a financial agreement but also fosters trust and transparency between parties, paving the way for a smoother transaction and transfer of vehicle ownership.

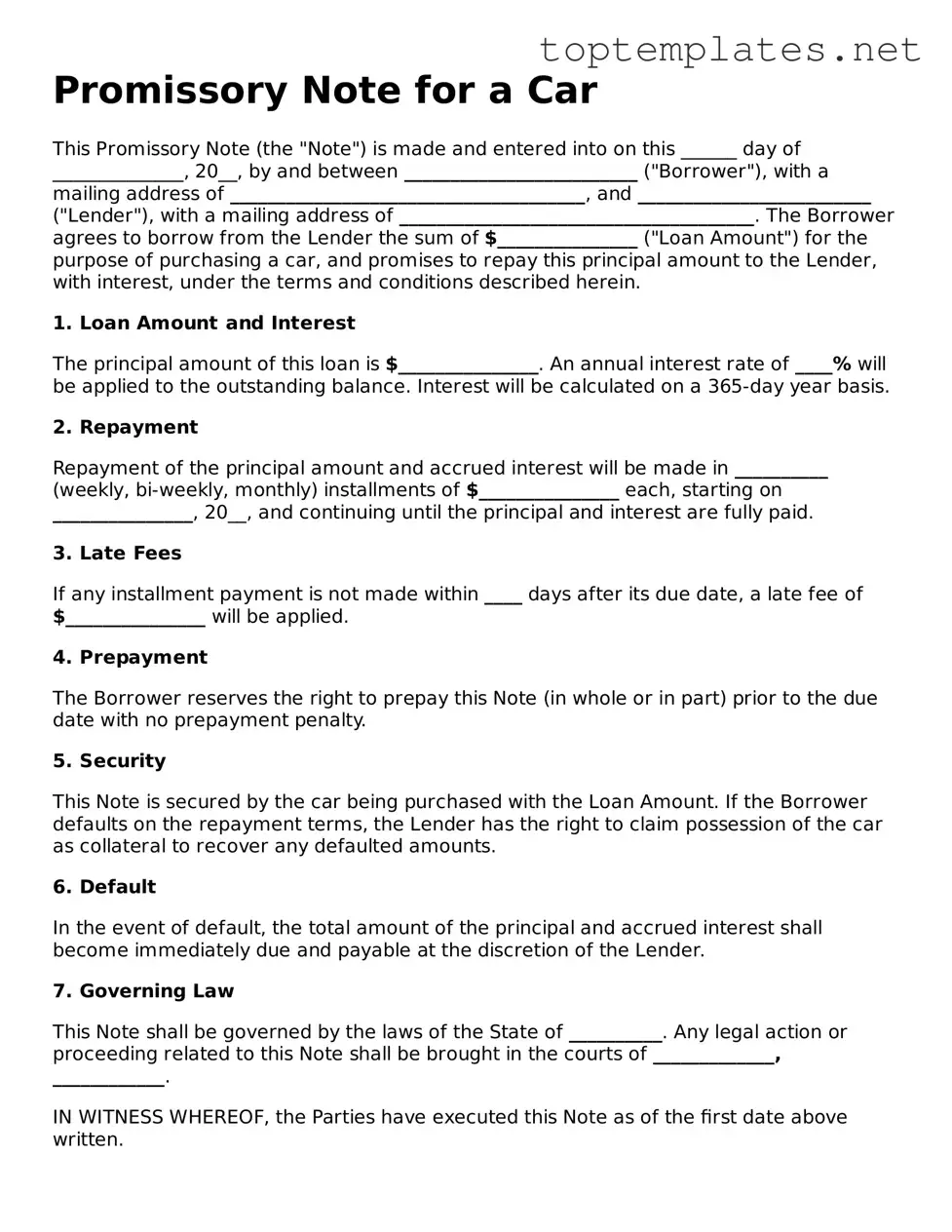

Sample - Promissory Note for a Car Form

Promissory Note for a Car

This Promissory Note (the "Note") is made and entered into on this ______ day of ______________, 20__, by and between _________________________ ("Borrower"), with a mailing address of ______________________________________, and _________________________ ("Lender"), with a mailing address of ______________________________________. The Borrower agrees to borrow from the Lender the sum of $_______________ ("Loan Amount") for the purpose of purchasing a car, and promises to repay this principal amount to the Lender, with interest, under the terms and conditions described herein.

1. Loan Amount and Interest

The principal amount of this loan is $_______________. An annual interest rate of ____% will be applied to the outstanding balance. Interest will be calculated on a 365-day year basis.

2. Repayment

Repayment of the principal amount and accrued interest will be made in __________ (weekly, bi-weekly, monthly) installments of $_______________ each, starting on _______________, 20__, and continuing until the principal and interest are fully paid.

3. Late Fees

If any installment payment is not made within ____ days after its due date, a late fee of $_______________ will be applied.

4. Prepayment

The Borrower reserves the right to prepay this Note (in whole or in part) prior to the due date with no prepayment penalty.

5. Security

This Note is secured by the car being purchased with the Loan Amount. If the Borrower defaults on the repayment terms, the Lender has the right to claim possession of the car as collateral to recover any defaulted amounts.

6. Default

In the event of default, the total amount of the principal and accrued interest shall become immediately due and payable at the discretion of the Lender.

7. Governing Law

This Note shall be governed by the laws of the State of __________. Any legal action or proceeding related to this Note shall be brought in the courts of _____________, ____________.

IN WITNESS WHEREOF, the Parties have executed this Note as of the first date above written.

Borrower’s Signature: _______________________________________ Date: _________________

Lender’s Signature: _______________________________________ Date: _________________

File Breakdown

| Fact | Detail |

|---|---|

| Definition | A promissory note for a car is a written agreement where the borrower promises to repay the lender a certain amount of money that was borrowed to purchase the vehicle. |

| Key Components | The note typically includes the amount borrowed, interest rate, repayment schedule, and any penalties for late payment. |

| Governing Law | These notes are governed by the state laws where the agreement is made. Specific terms and legal requirements can vary from one state to another. |

| Security | The vehicle itself often serves as collateral for the loan. If the borrower fails to make payments, the lender may have the right to repossess the car. |

| Importance | Having a written note provides a clear record of the loan's terms and protects both the lender and the borrower legally. |

| Enforceability | If signed by both parties, the note is a legally binding document that can be enforced in a court of law to ensure repayment of the loan. |

Steps to Filling Out Promissory Note for a Car

Once you've decided to formalize the terms for a car loan between two parties, filling out a Promissory Note for a Car form is essential. This document ensures that the terms of the loan are clearly outlined and agreed upon by both the lender and the borrower. The process of completing this form is straightforward if you follow the steps provided. Remember, having all the necessary information at hand before you begin will make the process smoother.

- Start by entering the date on which the promissory note is being created at the top of the form.

- Write the full legal name of the borrower and the lender in the designated areas, ensuring accuracy to avoid any confusion regarding the identities of the parties involved.

- Specify the loan amount in words and then in numbers to clarify the total amount being borrowed for the car purchase.

- Detail the interest rate agreed upon by the borrower and the lender. Ensure that it complies with the state's legal maximum, if applicable.

- Outline the repayment schedule including the start date, the frequency of payments (monthly, weekly, etc.), and the amount of each payment. Don’t forget to note the final payment date.

- Include any agreed-upon late payment fees and under what circumstances they will be applied. This ensures both parties understand the consequences of late payments.

- Specify the collateral for the loan, which, in this case, is the car being purchased. Describe the car in detail: make, model, year, color, and VIN (Vehicle Identification Number).

- Both the borrower and the lender must sign the form. Including the date next to each signature is crucial for legal validity.

- If applicable, have the form notarized to provide an additional layer of authenticity. Not all states require this, but it may be advisable depending on your circumstances.

After completing the Promissory Note for a Car form, make sure both parties retain a copy for their records. This acts as a contractual agreement regarding the terms of the car loan and serves as a reference document if any issues arise during the repayment period. The next step usually involves the lender providing the loan amount to the borrower so they can proceed with purchasing the car, followed by the borrower making regular payments according to the schedule until the loan is fully repaid.

Discover More on Promissory Note for a Car

What is a Promissory Note for a Car?

A Promissory Note for a Car is a legal document that outlines an agreement between a buyer and a seller regarding the financing of a car purchase. It details the amount borrowed, the repayment schedule, interest rate, and any other conditions related to the loan of the car purchase.

Why do I need a Promissory Note when buying a car?

Having a Promissory Note when buying a car ensures that there's a legally binding agreement regarding the payment terms. It protects both the seller and the buyer by clearly outlining the responsibilities of each party. This helps avoid misunderstandings and disputes over the terms of the car purchase and payment.

What details should be included in a Promissory Note for a Car?

A comprehensive Promissory Note for a Car should include the full names and contact information of both the buyer and the seller, the loan amount, interest rate, repayment schedule, late payment penalties, and any other terms related to the sale of the car. It's essential to also describe the car (make, model, year, and VIN) to ensure the document is clearly linked to the specific vehicle in question.

Is a Promissory Note legally binding?

Yes, a Promissory Note is a legally binding document once it is signed by both the buyer and the seller. It can be used in court to enforce payment and terms agreed upon by both parties. For added legal protection, it's advisable to have the document notarized.

Can I modify the terms of a Promissory Note after it has been signed?

Modifying the terms of a Promissory Note after it has been signed requires the agreement of both the buyer and the seller. Any changes should be made in writing, and both parties should initial and date the amendments to the original document to ensure that these modifications are legally binding.

What happens if the buyer fails to make payments as agreed?

If the buyer fails to make payments as outlined in the Promissory Note, the seller has the right to take legal action to enforce the agreement. This may include reclaiming the vehicle or seeking the remaining balance through court proceedings. The specific consequences should be clearly stated in the Promissory Note under the "default" section.

Do I need an attorney to create a Promissory Note for a Car?

While it's not strictly necessary to have an attorney create a Promissory Note for a Car, consulting one can be helpful to ensure that the document is legally sound and enforceable in your state. An attorney can also provide advice on your rights and responsibilities under the agreement.

Common mistakes

Filling out a Promissory Note for a car involves a detailed process that requires attention to avoid errors. Common mistakes often undermine the document's legality and enforceability. Here’s a closer examination of frequent oversights:

Not specifying the exact loan amount: A crucial detail is the precise amount being lent, as it forms the basis of the agreement.

Ignoring the interest rate: Failing to include the interest rate or inaccurately calculating it can lead to disagreements and legal issues.

Omitting the repayment schedule: Clearly stating when payments are due and their frequency ensures both parties understand the expectations.

Forgetting late fees or penalties: Not articulating the consequences of late payments can complicate enforcing the agreement should delays occur.

Misidentifying the parties involved: Accurate identification of both the lender and the borrower is essential for the note’s legal standing.

Excluding the car’s details: The make, model, year, and VIN of the car must be clearly listed to specify what the loan is being secured against.

Lacking signatures and dates: An unsigned or undated promissory note can be challenged in court and may be deemed unenforceable.

Not acknowledging the lien on the car: If the car is collateral, the note should state this, making it clear that the lender may take possession of the car if the borrower defaults.

Failure to state the governing law: Specifying the state laws that apply helps in resolving any legal disputes that may arise.

Ignoring notarization requirements: While not always mandatory, getting the note notarized can add a layer of verification and authenticity.

Avoiding these mistakes ensures that a Promissory Note for a car is comprehensively drafted, reflecting all necessary details for a smooth lending process. While not exhaustive, this list acts as a solid foundation to prevent common errors.

Documents used along the form

When buying or selling a car with the aid of financing, a Promissory Note for a Car is a common and crucial document. However, this note is typically not the only document involved in the transaction. To ensure a smooth and legally secure process, several other forms and documents often accompany the Promissory Note. Each serves its unique function, creating a comprehensive legal framework for the transaction.

- Bill of Sale: This document is a proof of the transaction between the buyer and seller. It outlines the details of the sale, including the purchase price, vehicle description, and the transaction date. The Bill of Sale is vital for transferring the ownership of the car and is often required for registration and taxation purposes.

- Loan Agreement: If the purchase involves a loan from a third party, like a bank or finance company, a Loan Agreement might also be necessary. This agreement details the loan’s terms, including the interest rate, repayment schedule, and consequences of default. It provides a formal understanding of the loan conditions between the borrower and the lender.

- Vehicle Title: The Vehicle Title shows who owns the car. When a car is sold, the title needs to be transferred to the new owner. This document is critical for establishing legal ownership and is required for registration at the local Department of Motor Vehicles (DMV).

- As-Is Sales Agreement: If the car is being sold "as-is," without any warranty regarding its condition, an As-Is Sales Agreement might be used. This document clarifies that the buyer accepts the vehicle in its current state, acknowledging any faults or issues may not be the seller's responsibility after the sale.

Together, these documents form a protective legal framework around the sale and purchase of a car. They not only define the responsibilities and rights of each party involved but also ensure that the transaction adheres to state laws and regulations. Having a complete set of these documents can significantly reduce future disputes, making the car buying or selling process more secure and transparent for everyone involved.

Similar forms

A Mortgage Agreement shares similarities with a Promissory Note for a Car in that both outline a loan's terms for a big purchase. However, a Mortgage Agreement specifically secures real estate as collateral, whereas a Promissory Note for a Car, secures a vehicle. Both documents serve as a promise to pay back the borrowed money, detailing payment amounts, schedule, and interest.

A Personal Loan Agreement is quite similar to a Promissory Note for a Car, as it's a legal contract between two parties agreeing on the terms of a loan. The key difference lies in the purpose and specificity; a Personal Loan Agreement can be used for various personal reasons and is not limited to securing a vehicle, making it more general in terms of use.

A Student Loan Agreement parallels the Promissory Note for a Car by being an official document in which the borrower agrees to repay the loan under specified terms. Both documents outline repayment schedules, interest rates, and the consequences of non-payment. The main difference is the purpose of the loan; a Student Loan Agreement is specifically intended for educational expenses.

The Lease Agreement is similar to a Promissory Note for a Car since both establish a legally binding agreement between two parties. In a Lease Agreement, one party agrees to rent property (real estate, vehicle, etc.) to another under specific terms, which include payments and length of lease term. Though the Lease Agreement deals with renting over borrowing money to purchase, both documents specify payment details and obligations of both parties.

Dos and Don'ts

When you're taking the step to formalize the purchase of a car through a promissory note, it's crucial to ensure that everything is completed accurately and thoughtfully. This document not only outlines the repayment plan but also serves as a legally binding agreement between the buyer and the seller. Here's a list of dos and don'ts to guide you through filling out the Promissory Note for a Car form effectively.

Do:- Verify all the details: Before you commit anything to paper, double-check the car's make, model, VIN, and any other identifying information. Any mistakes here could lead to big problems down the line.

- Outline clear repayment terms: Be crystal clear about the repayment schedule, interest rates (if applicable), and the final due date for the loan's repayment. Ambiguity can lead to misunderstandings or disputes.

- Specify the consequences of default: Clearly state what will happen if the buyer fails to meet the agreed-upon repayment plan. This might include late fees or repossession of the vehicle.

- Get it signed by all parties: A promissory note is not legally binding unless it's signed by everyone involved. Ensure that all signatures are on the document before proceeding.

- Keep a copy for your records: Once the promissory note is completed and signed, make sure both the buyer and seller keep a copy. This is essential for both parties' records and peace of mind.

- Consider notarization: While not always required, getting the note notarized can add an extra layer of legal protection and credibility should any issues arise.

- Leave blanks in the document: If a section does not apply, clearly mark it as "N/A" rather than leaving it blank. Unfilled sections can lead to unauthorized alterations.

- Rush through the process: Taking your time to review every section and ensure all the information is accurate and complete can save you from potential legal headaches in the future.

- Ignore local laws: Some states have specific requirements for promissory notes tied to vehicle sales. Be sure to research and comply with any local regulations.

- Forget to update if terms change: If the repayment terms or any other significant details change after the initial agreement, make sure to update the promissory note to reflect these changes. Both parties should then sign the updated document.

- Skimp on details: When it comes to the repayment plan, interest rates, or penalties for late payments, more detail is always better. This helps prevent any future disputes.

- Assume good faith is enough: While trust between the buyer and seller is important, a promissory note serves as a crucial legal document. Relying solely on good faith without a comprehensive and clear agreement could lead to issues down the line.

Misconceptions

The promissory note for a car serves as a fundamental document, outlining the borrower's promise to pay back a loan under specific terms to the lender, usually for purchasing a vehicle. Several misunderstandings surround its nature and implications, affecting how parties engage in these agreements. Addressing these misconceptions is essential for both lenders and borrowers to ensure clear expectations and responsibilities.

Misconception 1: It's Just an Informal Agreement - Many believe that a promissory note for a car is a casual, informal agreement without legal enforceability. However, it is a legally binding document, holding both parties to the terms outlined within.

Misconception 2: Only the Borrower Needs to Understand It - There's a tendency to think that only the borrower needs to grasp the full content of the promissory note. In reality, both the lender and the borrower should thoroughly understand the terms to ensure mutual agreement and expectations.

Misconception 3: A Verbal Agreement Is Just as Good - While oral contracts can be enforceable, the specificity and proof of terms in a written promissory note offer much stronger legal standing and clarity, significantly reducing the potential for disputes.

Misconception 4: It's Only About Repayment Terms - Many assume the promissory note only details the repayment schedule. In truth, it includes various important clauses such as interest rates, what happens in the event of default, and prepayment terms, among others.

Misconception 5: There's No Need for Witnesses or Notarization - People often think these formalities are unnecessary. While not always legally required, having the document witnessed or notarized can add a layer of verification and legality, especially in disputes.

Misconception 6: It Cannot Be Modified - The belief that once a promissory note has been signed it is immutable is incorrect. Amendments can be made if both parties agree and endorse any changes, adapting the agreement to new circumstances.

Misconception 7: It Covers Insurance and Maintenance Costs - A common misunderstanding is that the promissory note includes responsibilities such as insurance and maintenance of the car. Typically, this document solely outlines loan repayment terms, with other responsibilities addressed separately.

Misconception 8: Defaulting Leads Instantly to Vehicle Repossession - Many fear that failing to meet a single payment will result in immediate repossession of the car. While default consequences are serious, most agreements provide a grace period or options for renegotiation before such drastic measures are considered.

Demystifying these misconceptions requires diligence and open dialogue between the borrower and the lender. By understanding the legal and practical implications of the promissory note for a car, parties can foster more transparent and amicable transactions, ensuring agreements are respected and upheld.

Key takeaways

When preparing to use a Promissory Note for purchasing a car, it's important to understand its purpose and the essentials for completing it accurately. This legal document not only outlines the agreement between the buyer and the seller regarding the loan for the vehicle but also ensures that all parties are clear about the terms of repayment. Here are seven key takeaways to keep in mind:

- Clearly identify both parties: Make sure to include the full legal names and contact information of both the borrower (buyer) and the lender (seller or financial institution). This clarity helps prevent any misunderstandings.

- Describe the vehicle: Detail the car's make, model, year, VIN (Vehicle Identification Number), and any other information to specifically identify the vehicle being purchased. This information ties the loan to the specific asset.

- State the loan amount clearly: The principal amount being borrowed should be prominently displayed. This is the price of the car minus any down payment made by the borrower.

- Include the interest rate: The interest rate on the loan amount must be specified. This rate determines how much extra the borrower will pay back on top of the principal amount.

- Repayment terms: Outline how and when the loan will be paid back. This includes the schedule of payments, the number of payments, and their frequency (monthly, quarterly, etc.), as well as the due date for final payment.

- Specify late fees and penalties: Clearly define the consequences of late payments or failure to pay. This usually includes late fees and may also outline conditions under which the lender can repossess the vehicle.

- Signatures: For the promissory note to be legally binding, it must be signed by both the borrower and the lender. It’s also a good practice to have the signatures witnessed or notarized for additional legal standing.

This document plays a crucial role in the buying process, serving as a legal promise to pay back the amount borrowed to purchase the car. Taking the time to fill it out carefully and completely ensures that both parties have a clear understanding of their obligations. Additionally, in the event of a disagreement, the promissory note can provide critical evidence to resolve disputes. Always consult with a legal expert or financial advisor to ensure that your promissory note meets all legal requirements and adequately protects your interests.

Find Other Types of Promissory Note for a Car Documents

Satisfaction and Release Form - It's an essential tool in financial management, helping both parties to efficiently conclude their business.