Valid Release of Promissory Note Template

When a borrower has fulfilled the obligations under a promissory note, a crucial step in formally closing the chapter on that agreement is the execution of a Release of Promissory Note form. This document serves as a legally binding acknowledgment that the debtor has paid the creditor the amount due in full, thus releasing them from further payment obligations under the note. It's an essential piece of the financial puzzle for both parties, safeguarding the borrower from future claims and providing the lender with a clear record that the debt has been settled. The form not only signifies the end of the promissory note's lifecycle but also protects both parties' interests and helps maintain a detailed and accurate financial history. Understanding the nuances of the Release of Promissory Note form is vital for anyone involved in lending or borrowing, as it formally concludes the financial transaction in a manner that's recognized by law.

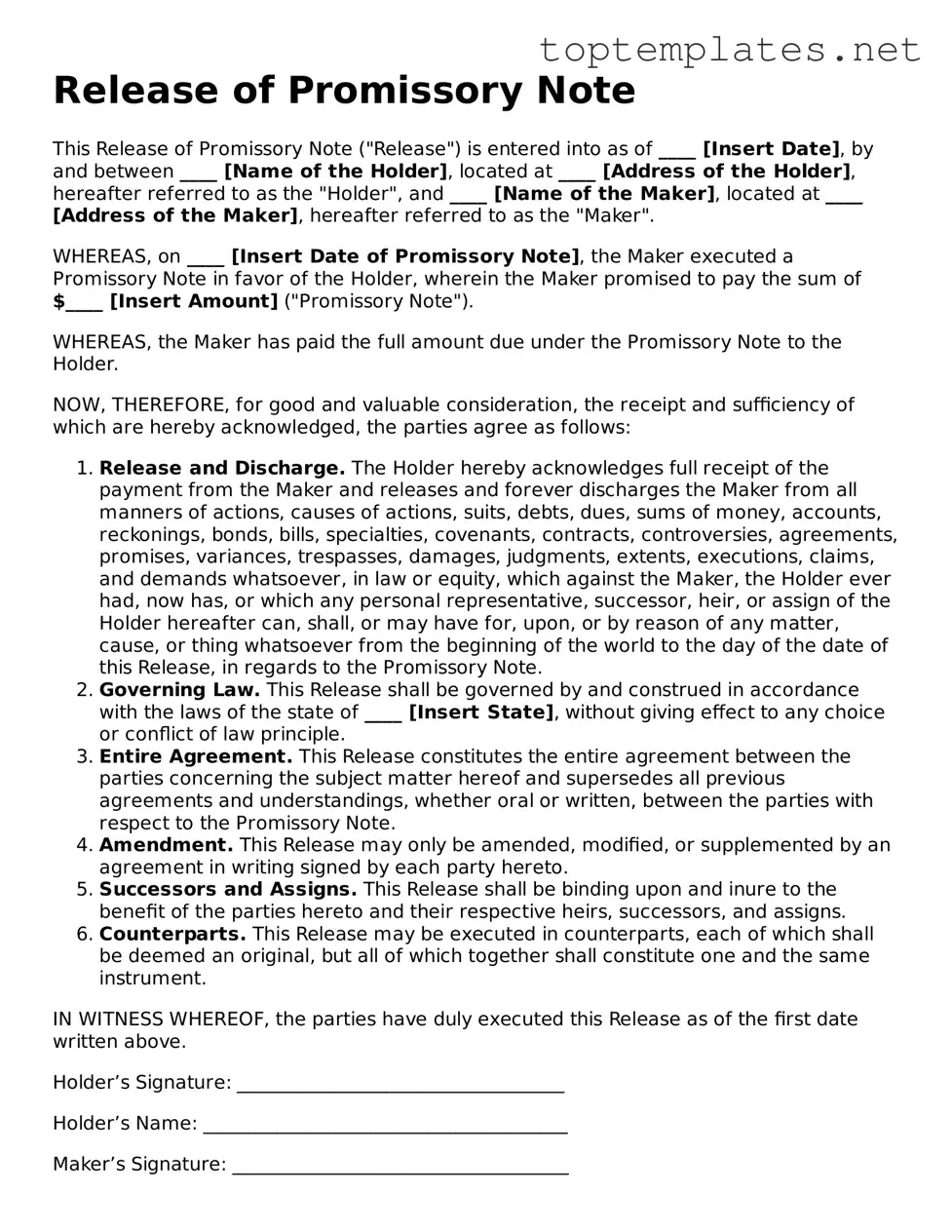

Sample - Release of Promissory Note Form

Release of Promissory Note

This Release of Promissory Note ("Release") is entered into as of ____ [Insert Date], by and between ____ [Name of the Holder], located at ____ [Address of the Holder], hereafter referred to as the "Holder", and ____ [Name of the Maker], located at ____ [Address of the Maker], hereafter referred to as the "Maker".

WHEREAS, on ____ [Insert Date of Promissory Note], the Maker executed a Promissory Note in favor of the Holder, wherein the Maker promised to pay the sum of $____ [Insert Amount] ("Promissory Note").

WHEREAS, the Maker has paid the full amount due under the Promissory Note to the Holder.

NOW, THEREFORE, for good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties agree as follows:

- Release and Discharge. The Holder hereby acknowledges full receipt of the payment from the Maker and releases and forever discharges the Maker from all manners of actions, causes of actions, suits, debts, dues, sums of money, accounts, reckonings, bonds, bills, specialties, covenants, contracts, controversies, agreements, promises, variances, trespasses, damages, judgments, extents, executions, claims, and demands whatsoever, in law or equity, which against the Maker, the Holder ever had, now has, or which any personal representative, successor, heir, or assign of the Holder hereafter can, shall, or may have for, upon, or by reason of any matter, cause, or thing whatsoever from the beginning of the world to the day of the date of this Release, in regards to the Promissory Note.

- Governing Law. This Release shall be governed by and construed in accordance with the laws of the state of ____ [Insert State], without giving effect to any choice or conflict of law principle.

- Entire Agreement. This Release constitutes the entire agreement between the parties concerning the subject matter hereof and supersedes all previous agreements and understandings, whether oral or written, between the parties with respect to the Promissory Note.

- Amendment. This Release may only be amended, modified, or supplemented by an agreement in writing signed by each party hereto.

- Successors and Assigns. This Release shall be binding upon and inure to the benefit of the parties hereto and their respective heirs, successors, and assigns.

- Counterparts. This Release may be executed in counterparts, each of which shall be deemed an original, but all of which together shall constitute one and the same instrument.

IN WITNESS WHEREOF, the parties have duly executed this Release as of the first date written above.

Holder’s Signature: ___________________________________

Holder’s Name: _______________________________________

Maker’s Signature: ____________________________________

Maker’s Name: ________________________________________

File Breakdown

| Fact Name | Description |

|---|---|

| Purpose of the Form | Used to officially confirm that a debt outlined in a promissory note has been fully paid and the lender releases the borrower from any further obligations. |

| Key Components | Includes details such as the date of the promissory note, the amount owed, information about the lender and borrower, and the release statement. |

| Governing Law | Regulated by the state law where the original promissory note was issued or where the borrower resides, as this can influence specific requirements for release. |

| Significance | Protects the borrower by providing a legal document proving the debt has been settled, preventing future claims on the same debt. |

Steps to Filling Out Release of Promissory Note

Once the terms of a promissory note have been fulfilled, such as the completion of payments from the borrower to the lender, the next essential step is to document this completion through a Release of Promissory Note form. This form serves as legal documentation that the borrower has successfully met the obligations of the note, freeing them from further payments. Filling out this form accurately is crucial to ensure that all parties have a clear understanding of the note's resolution. The steps below guide you through the process of completing this form correctly.

- Begin by entering the date the form is being filled out at the top of the document. Ensure this date is accurate, as it marks the formal release of the note's obligations.

- Write the full name of the borrower as it appears on the promissory note, ensuring it matches the original documentation to avoid any discrepancies.

- Enter the full name of the lender, consistent with the name on the promissory note, to clearly identify the party releasing the borrower from their obligation.

- Provide the original date of the promissory note to reference the agreement that is being concluded.

- Include the full amount that was loaned as per the promissory note. This figure should be exact to reflect the sum that has been repaid by the borrower.

- Detail any other identifying information related to the promissory note, such as a file number or account number, to clearly link the release to the specific agreement.

- Signatures are necessary to finalize the document. The borrower and lender must both sign the form, along with their printed names and the date of signing. If a witness or notary is required by your state, ensure their signature and seal are included as well.

After completing the Release of Promissory Note form, the involved parties should distribute copies accordingly. The borrower should retain a copy for their records, and the lender should file a copy with any other related financial documents. This release confirms that the debt obligation is fully satisfied, protecting both parties in any future disputes over the debt.

Discover More on Release of Promissory Note

What is a Release of Promissory Note form?

A Release of Promissory Note form is a legal document indicating that a borrower has fulfilled the terms of a promissory note. This document is evidence that the debt specified in the promissory note has been paid in full, releasing the borrower from any further obligation to the lender.

When should a Release of Promissory Note form be used?

This form should be used as soon as the borrower has finished paying off the debt under the terms of the promissory note. It serves as an official receipt and closing of the financial agreement between the lender and the borrower, protecting both parties from future disputes over the debt.

Who prepares the Release of Promissory Note form?

Typically, the lender or an authorized agent of the lender prepares the Release of Promissory Note form. However, the borrower can also prepare the document for the lender's signature to ensure the release is officially documented.

Is the Release of Promissory Note form legally binding?

Yes, when duly signed by the lender (and notarized, depending on state requirements), the Release of Promissory Note form becomes a legally binding document. It officially terminates the obligations of the borrower under the promissory note, thereby preventing the lender from making any future claims regarding that debt.

Do both parties need to sign the Release of Promissory Note form?

Typically, only the lender needs to sign the Release of Promissory Note form to confirm that the debt has been paid in full. However, the borrower may also sign the document, especially in cases where a mutual release is desired, acknowledging that both parties have fulfilled their obligations under the original agreement.

What happens if I don't get a Release of Promissory Note?

Without a Release of Promissory Note, the borrower may face challenges in proving that the debt has been fulfilled, which could lead to potential legal disputes. The absence of this document leaves room for the lender to mistakenly or fraudulently claim that the debt is outstanding, posing risks to the borrower's financial status and creditworthiness.

Is a notary required for a Release of Promissory Note?

The requirement for notarization varies by state. While not always necessary, having the Release of Promissory Note notarized adds an extra layer of legal protection, authenticating the identity of the signer and potentially deterring fraud. It's advisable to check local laws or consult with a legal expert to determine if notarization is needed in your case.

How should a completed Release of Promissory Note form be stored?

Both the borrower and the lender should retain copies of the completed Release of Promissory Note form. It is recommended to keep it alongside the original promissory note and any other relevant financial documents, in a secure location where it is protected from damage or loss. Digital copies can also be stored securely online for easy accessibility and added security.

Common mistakes

Filling out a Release of Promissory Note form is a critical step in formally acknowledging that a debt outlined by a promissory note has been paid in full. This document is key to ensuring that both parties have a clear record of the debt's settlement. However, errors can occur in the process, potentially leading to misunderstandings or legal complications down the line. Below are common mistakes people often make when completing this form.

- Not reviewing the original promissory note: Before filling out the release form, it's essential to refer back to the original promissory note to ensure all the details match up. This includes the loan amount, terms of repayment, and the parties involved.

- Omitting important details: Every section of the form should be completed in full. This includes the names of the lender and borrower, the date the loan was fully repaid, and any other identifying information requested on the form.

- Forgetting to include the date: The release should clearly state the date on which the borrower's obligation to repay the loan was fulfilled. This is crucial for legal and financial records.

- Failing to have the document signed: Both parties should sign the release form. Sometimes, individuals forget to have one or both signatures, which can invalidate the release.

- Not verifying the borrower's identity: It’s important to ensure that the person signing the release as the borrower is indeed the individual who took out the loan. Verification can prevent potential fraud.

- Skipping the witness or notarization step: Depending on the jurisdiction, having the form witnessed or notarized may be necessary for the document to be legally binding. Skipping this step can lead to the form’s validity being questioned.

- Ignoring state-specific requirements: Some states may have unique requirements for the release of a promissory note. It's important to research and comply with these regulations to ensure the form is properly executed.

- Not keeping a copy: After the form is filled out and signed, both the lender and the borrower should keep a copy for their records. Losing the only copy of the release can lead to unnecessary complications.

- Using an incorrect form: Ensure that the document being used is the correct form for releasing a promissory note. Using a general release form or another unrelated document can invalidate the release.

By avoiding these common mistakes, both lenders and borrowers can ensure that the release of a promissory note is completed correctly and efficiently, providing peace of mind and legal clarity for both parties involved.

Documents used along the form

In the context of resolving or concluding financial transactions, the Release of Promissory Note form stands out as a critical document, signaling the fulfillment of a borrower's obligations under a promissory note. However, its effectiveness is often amplified when used in conjunction with other legal forms and documents that address different facets of a transaction's resolution. These documents collectively ensure that all aspects of the agreement are conclusively settled, providing a comprehensive legal framework for both parties involved.

- Lien Release Form: This document is vital in transactions where property or assets were used as collateral. It officially removes the lender's interest in the collateral, clearing the title for the borrower. This step is crucial in ensuring that the borrower regains full ownership and control over their property or assets once the loan is paid off.

- Loan Amortization Schedule: Often accompanying a promissory note, this document outlines the breakdown of each payment over the course of the loan period. It details the amounts applied to the principal and interest, providing a transparent roadmap of the loan's progress. This schedule not only helps in tracking payments but also in confirming the balance owed at any point in time.

- Debt Settlement Agreement: This document comes into play if the terms of the original promissory note were renegotiated. It outlines the agreed-upon terms under which the borrower will settle the outstanding debt, which may involve paying a lump sum that is less than the original amount owed. This agreement serves as a legal confirmation of the new terms and the finality of the debt settlement process.

- Final Payment Letter: Serving as a receipt, this letter from the lender acknowledges the receipt of the borrower's final payment under the promissory note. It provides both parties with written confirmation that the debt has been paid in full, closing the transaction. Including a final payment letter with the release document offers an additional layer of closure for both parties.

Together, these documents form a cohesive suite of legal instruments that effectively manage and conclude financial obligations. By ensuring the proper use and application of each, parties can navigate the complexities of loan agreements with clearer direction and mutual understanding. As each document addresses specific concerns and stages of the loan life cycle, their collective employment marks a comprehensive approach to finalizing financial transactions in a manner that is both legally sound and equitable.

Similar forms

When a debt is paid off, documenting the event is just as crucial as the payment itself. A Release of Promissory Note form is a critical document in this process, signifying that the borrower has fulfilled their payment obligations, and the lender releases them from further responsibility. This form shares similarities with several other legal documents, each serving to formalize various types of agreements and releases. Understanding these similarities can provide a broader perspective on the importance of formal documentation in legal and financial interactions.

- Mortgage Satisfaction Piece: Just like a Release of Promissory Note, this document is vital when a mortgage is paid off. It serves as proof that the borrower has repaid their debt in full, leading the lender to relinquish any claim over the property. Both documents confirm the settlement of debt, but while one deals with personal loans, the other focuses on property loans.

- Lien Release: Similar to how a Release of Promissory Note removes the lender's right to claim repayment, a Lien Release removes a claim or hold against property that was used as collateral. It's given once a debt (normally related to the property) is fully paid, ensuring the debtor can assume clear ownership.

- Deed of Reconveyance: Common in states with trust deed laws, this document is similar to a Release of Promissory Note in that it signifies the borrower's debt, secured by real property, has been paid off, leading the trustee to transfer the property title back to the borrower. It's especially relevant in real estate transactions involving a deed of trust.

- Loan Satisfaction Letter: This document is issued by the lender and confirms that the borrower has fulfilled their loan obligations. Just like a Release of Promissory Note, it serves as a formal acknowledgment of the debt being fully repaid, but it can be used for a wider variety of loan types beyond just promissory notes.

- Release of Judgment: After a judgment debt is paid, this documents the debtor's release from the obligation imposed by the court's decision. It's akin to a Release of Promissory Note in that it demonstrates fulfillment of a financial obligation, but it originates from a court judgment rather than a mutual agreement.

- Cancellation of Debt (COD) Letter: Issued by a creditor, it declares that a debt has been forgiven and the debtor is no longer obligated to make payments. Like a Release of Promissory Note, it indicates that an obligation has been extinguished, but it differs in that the debtor is released without having to pay off the entire debt.

Each of these documents plays a unique role in the landscape of debt repayment and property rights. However, at their core, they share the principle of formalizing the conclusion of an obligation, providing peace of mind and legal clarity to all parties involved.

Dos and Don'ts

When it comes to filling out the Release of Promissory Note form, there are certain dos and don'ts you should keep in mind. This form plays a critical role in documenting that a debt has been fully paid and that the borrower is released from their obligations under the promissory note. Following the right steps can ensure the process goes smoothly and legally.

Here's what you should and shouldn't do:

Do:- Verify all the relevant details before you start, including the names of the borrower and lender, and the original promissory note date.

- Ensure that the full payment has been received and cleared in your account before filling out the form. This confirmation prevents any disputes over whether the debt has been fully settled.

- Include the date when the release of the promissory note is being executed. This date should be clearly mentioned for record-keeping purposes.

- Keep the language simple and clear. Legal documents don't need to be overly complicated to be effective.

- Sign the form in the presence of a notary public. Notarization provides an additional level of authentication, verifying the identity of the person signing the form.

- Provide a copy of the fully signed and notarized release to the borrower, and keep a copy for your records.

- Fill out the form in haste without checking the specific details of the promissory note and the payment status.

- Forget to include critical information such as the promissory note number or the date it was issued. This information links the release directly to the original agreement.

- Use ambiguous language that could lead to misinterpretation. Be as specific as possible to avoid any future disagreements or legal challenges.

- Overlook the requirement for notarization, if applicable. While not all states require a Release of Promissory Note to be notarized, doing so can add a layer of security.

- Leave out your contact information. It's important to include a way for the borrower to reach you if they have any questions or if there's an issue with the document.

- Delay sending the completed form to the borrower. Once the debt is paid, promptly issue the release to help close out the transaction fully.

By following these simple guidelines, you can ensure that the process of releasing a promissory note is done correctly, providing peace of mind to all parties involved.

Misconceptions

When dealing with the Release of Promissory Note form, several misconceptions often arise. Understanding these can help ensure that the process of releasing a promissory note is handled smoothly and correctly. Here’s a breakdown of common misunderstandings:

It cancels the debt immediately: A Release of Promissory Note does not cancel the debt but signifies that the debt has been fully paid or settled under the terms agreed upon by the parties involved.

It's only for real estate transactions: While often used in real estate transactions, a Release of Promissory Note can apply to any debt obligation, whether personal or business-related, once the debt is fully paid.

No legal documentation is required: A formal, written document is necessary to legally release both the borrower and the lender from their obligations under the original promissory note.

It must be notarized to be valid: Notarization is not always required; however, having the document notarized can add a layer of authenticity and may be required by some institutions or recommended for certain transactions.

Any party can draft it: While technically any party can draft a Release of Promissory Note, it’s advisable to have it prepared by someone with knowledge of the legal requirements in the jurisdiction where it will be used to ensure its validity.

It provides proof of payment: While it indicates the debt has been fulfilled, a Release of Promissory Note itself is not proof of payment. Receipts or bank statements should be kept as proof of payment.

Once signed, it cannot be disputed: If there are discrepancies or if the release was signed under duress or with incomplete knowledge, the document can be disputed or challenged in court.

It's a public document: A Release of Promissory Note is a private agreement between the borrower and the lender. Although it may be notarized or recorded as part of a property transaction, the document itself is not public.

It releases all parties from future claims: While it releases the parties from the obligations under the note, it may not protect them from future claims not directly related to the note but arising from the same transaction or agreement.

There’s a universal format: There is no one-size-fits-all template for a Release of Promissory Note. The format and content can vary based on state laws and the specifics of the debt or agreement.

Clearing up these misconceptions ensures that when a Release of Promissory Note is executed, all parties are fully aware of its implications and the process adheres to legal standards. Always consider consulting with a professional to guide you through the specifics of your situation.

Key takeaways

When it comes to managing a promissory note, the Release of Promissory Note form plays a pivotal role once the borrower has fulfilled their part of the agreement by repaying the borrowed amount in full. Below are key takeaways that will help ensure the process is handled smoothly and effectively:

Understanding the Purpose: The Release of Promissory Note form officially acknowledges that the borrower has repaid their debt in full, freeing them from their financial obligation. It's a crucial document that clears the borrower's liability.

Gathering Information: Before filling out the form, gather all relevant documents, including the original promissory note, payment records, and any communication between the borrower and lender. This will ensure all information entered is accurate.

Completing the Form Accurately: Fill out the form with precise information, including the names of the borrower and lender, the original amount borrowed, and the date of release. Double-check all entries for errors to avoid any future disputes.

Signing the Form: Both the lender and the borrower should sign the Release of Promissory Note form. Depending on the jurisdiction, you may also require a witness or notarization to affirm the document's legality.

Keeping Records: Once signed, both parties should keep a copy of the release form. This document serves as a legal receipt, indicating that the debt is fully paid and no further obligations exist between the lender and the borrower.

Communication with Relevant Parties: If a third party, such as a collection agency or legal representative, was involved in managing the promissory note, inform them of the debt's release. This is important to ensure they cease any collection efforts.

Reporting to Credit Bureaus: The lender should report the debt's repayment to credit bureaus, ensuring it is reflected in the borrower's credit report. This step is vital for maintaining or improving the borrower's credit score.

Filling out and using a Release of Promissory Note form is a straightforward but significant process that formally concludes a loan agreement. It's important to execute this process meticulously to ensure both parties are legally protected and the borrower's credit standing is accurately updated.

Find Other Types of Release of Promissory Note Documents

Create a Promissory Note - The form is legally binding, ensuring that the agreement is enforceable in a court of law if necessary.