Valid Real Estate Purchase Agreement Template

Embarking on the journey to buy or sell a property is a significant milestone, and the cornerstone of this process is the Real Estate Purchase Agreement. This critical document outlines the terms and conditions of the transaction, serving as a blueprint that ensures all parties are on the same page. It covers a vast array of components, from the detailed identification of the property and agreed-upon purchase price to the allocation of closing costs and contingencies that protect both the buyer and seller. Contingencies might include financial clauses, inspection requirements, and any conditions that must be met for the transaction to proceed. Moreover, this agreement specifies the dates by which certain actions must be taken, such as the deadline for securing financing and the expected closing date. By setting forth the obligations and rights of each party, the Real Estate Purchase Agreement lays the groundwork for a legally binding contract, guiding the transaction towards a successful and amicable conclusion.

Real Estate Purchase Agreement Form Categories

Sample - Real Estate Purchase Agreement Form

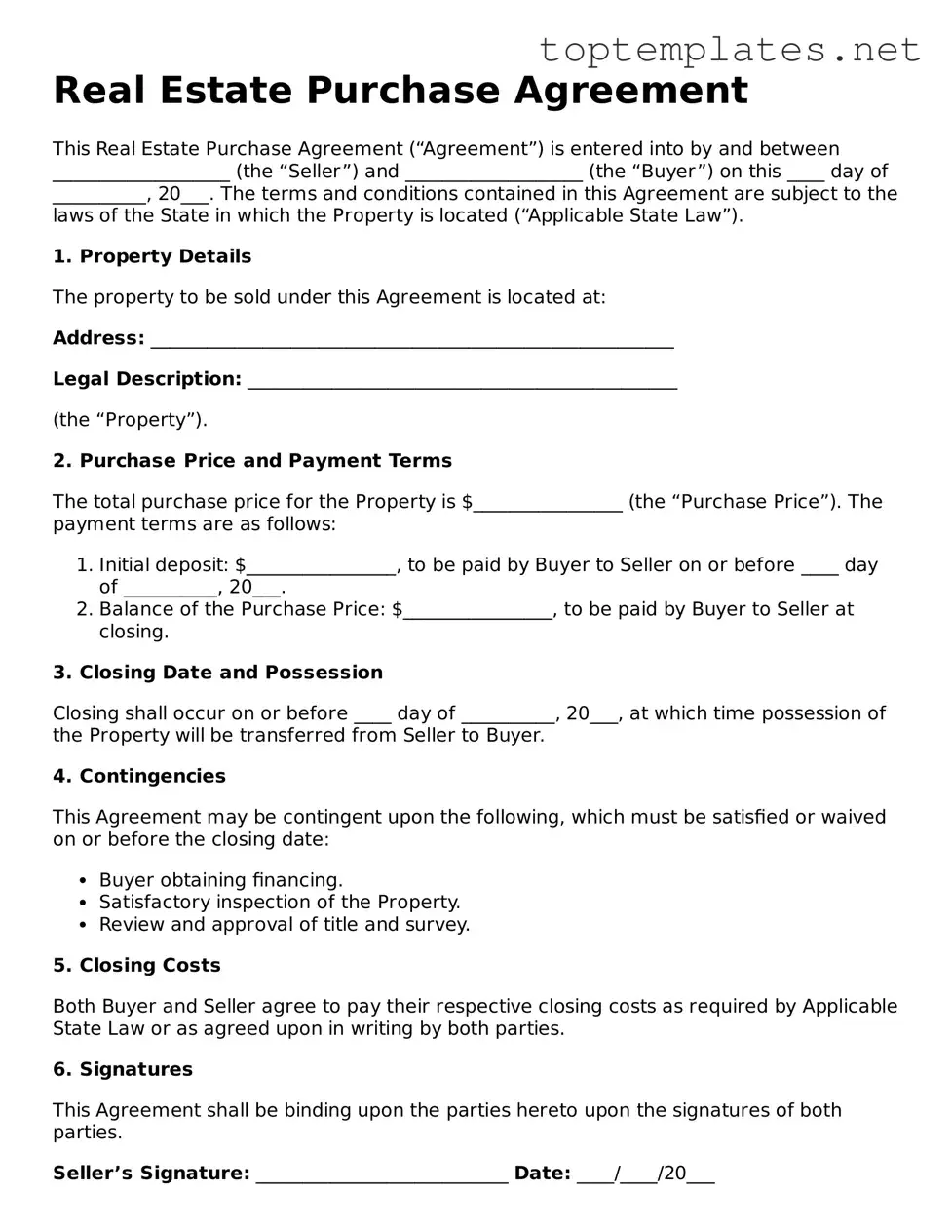

Real Estate Purchase Agreement

This Real Estate Purchase Agreement (“Agreement”) is entered into by and between ___________________ (the “Seller”) and ___________________ (the “Buyer”) on this ____ day of __________, 20___. The terms and conditions contained in this Agreement are subject to the laws of the State in which the Property is located (“Applicable State Law”).

1. Property DetailsThe property to be sold under this Agreement is located at:

Address: ________________________________________________________

Legal Description: ______________________________________________

(the “Property”).

2. Purchase Price and Payment TermsThe total purchase price for the Property is $________________ (the “Purchase Price”). The payment terms are as follows:

- Initial deposit: $________________, to be paid by Buyer to Seller on or before ____ day of __________, 20___.

- Balance of the Purchase Price: $________________, to be paid by Buyer to Seller at closing.

Closing shall occur on or before ____ day of __________, 20___, at which time possession of the Property will be transferred from Seller to Buyer.

4. ContingenciesThis Agreement may be contingent upon the following, which must be satisfied or waived on or before the closing date:

- Buyer obtaining financing.

- Satisfactory inspection of the Property.

- Review and approval of title and survey.

Both Buyer and Seller agree to pay their respective closing costs as required by Applicable State Law or as agreed upon in writing by both parties.

6. SignaturesThis Agreement shall be binding upon the parties hereto upon the signatures of both parties.

Seller’s Signature: ___________________________ Date: ____/____/20___

Buyer’s Signature: ___________________________ Date: ____/____/20___

File Breakdown

| Fact Name | Description |

|---|---|

| Definition | A Real Estate Purchase Agreement is a legally binding document between a buyer and seller for the purchase and sale of real estate. |

| Components | It typically includes terms such as the purchase price, closing date, contingencies, and other conditions both parties agree upon. |

| State-Specific Forms | Each state has its own required form and governing laws that may dictate specific clauses and disclosures. |

| Significance of Accuracy | Ensuring accuracy and completeness of the agreement is crucial, as any omissions or errors can lead to legal disputes or the nullification of the agreement. |

Steps to Filling Out Real Estate Purchase Agreement

After finding the perfect home and reaching a verbal agreement with the seller, the next step is to formalize the agreement. This is where the Real Estate Purchase Agreement form comes into play. It's a crucial document that outlines the terms and conditions of the property sale, including the purchase price, closing date, and any contingencies that must be met before the deal can close. Properly filling out this form is vital to ensure a smooth transaction. The following steps are designed to guide you through the process of completing the Real Estate Purchase Agreement form accurately.

- Begin by entering the full legal names of both the buyer(s) and seller(s) at the top of the form.

- Specify the property address, including any identifying unit or lot numbers, city, state, and zip code.

- List the offered purchase price in dollars, ensuring it matches the agreed amount between the buyer and seller.

- Detail the terms of the deposit, including the amount and the institution holding the deposit.

- Identify any items or fixtures that are explicitly included or excluded from the sale, such as appliances, lighting fixtures, or garden plants.

- Outline the closing date, which is when the final sale will be completed and the property will officially change hands.

- Specify any contingencies that must be met before the sale can proceed, such as home inspections, financing approval, or the sale of another property.

- Detail who is responsible for paying closing costs, which can include taxes, attorney fees, and title insurance.

- Clarify how property taxes, utility bills, and homeowner association fees, if applicable, will be prorated between the buyer and seller.

- Include any additional terms or conditions that are part of the agreement, such as repairs to be made by the seller.

- Ensure both the buyer(s) and seller(s) sign and date the form. Include the date the agreement is made.

- Consult with a real estate attorney or professional to review the form before final submission to ensure all legal requirements are met and the document accurately reflects the agreement.

Completing the Real Estate Purchase Agreement is a major step towards finalizing the purchase of your new home. It’s essential to take your time, review all entries, and make sure every detail is correct and agreed upon. This form not only outlines the specifics of your agreement but also serves as a legal record of the transaction. Once it's filled out and signed by all parties, the process moves on to fulfilling any contingencies and eventually, the closing. Ensuring accuracy and clarity in this document can help avoid misunderstandings and delays, leading to a smoother property transaction.

Discover More on Real Estate Purchase Agreement

What is a Real Estate Purchase Agreement?

A Real Estate Purchase Agreement is a legally binding document between a buyer and a seller outlining the terms and conditions of the sale of a property. This comprehensive document covers every aspect of the sale, including the purchase price, property description, closing details, and any contingencies that must be met before the transaction can be completed.

Why is a Real Estate Purchase Agreement important?

This agreement serves as a roadmap for the transaction, providing a clear framework for the expectations and obligations of both parties. It not only details what is being sold and for how much but also protects the interests of both the buyer and the seller, reducing the likelihood of misunderstandings and disputes. Furthermore, it ensures that the transfer of property is conducted legally and thoroughly.

What should be included in a Real Estate Purchase Agreement?

A comprehensive Real Estate Purchase Agreement should include the names of the parties involved, a detailed description of the property, the purchase price, the closing date, any contingencies such as financing or inspections, earnest money deposits, and details of who pays for what costs. It should also cover any special requirements or rights, such as seller concessions or the buyer’s right to terminate the agreement under certain conditions.

How does a contingency clause in a Real Estate Purchase Agreement work?

A contingency clause in a Real Estate Purchase Agreement sets conditions that must be met for the transaction to proceed. Common contingencies include the buyer obtaining sufficient financing, the sale of the buyer’s current home, and satisfactory property inspections. If any condition is not met, the buyer typically has the right to back out of the agreement and may recover their earnest money deposit.

Can I negotiate the terms of the Real Estate Purchase Agreement?

Absolutely. The Real Estate Purchase Agreement is not a one-size-fits-all document. Before signing, both the buyer and the seller have the right to negotiate the terms to better suit their needs and protect their interests. This negotiation phase is crucial and can cover aspects such as price, closing costs, closing date, and contingencies.

What happens if either party breaches the Real Estate Purchase Agreement?

If either party fails to comply with the terms outlined in the Real Estate Purchase Agreement, they are considered in breach of the contract. Depending on the specifics of the agreement, the non-breaching party may have various remedies, including forcing the sale (specific performance), seeking damages, or terminating the agreement and retaining or reclaiming the earnest money deposit.

How is the purchase price determined in a Real Estate Purchase Agreement?

The purchase price in a Real Estate Purchase Agreement is negotiated between the buyer and the seller. It is influenced by various factors including market conditions, the property’s condition, and comparables (recent sales of similar properties in the area). Once agreed upon, the purchase price is fixed and detailed in the agreement.

Is an earnest money deposit always required in a Real Estate Purchase Agreement?

While not always legally required, an earnest money deposit is a standard practice in real estate transactions. It serves as a good faith deposit from the buyer to show their seriousness about proceeding with the purchase. The amount is typically negotiable and is held in an escrow account until closing, at which point it is applied towards the purchase price.

What is the closing process in a Real Estate Transaction?

The closing process, which concludes the real estate transaction, involves finalizing the transfer of property ownership from the seller to the buyer. This process includes the execution of the final paperwork, payment of closing costs, and the transfer of the property title and keys. A Real Estate Purchase Agreement outlines the date by when the closing must occur and details any actions required by both parties to complete the transaction.

Can either party back out of a Real Estate Purchase Agreement?

Typically, parties can only back out of a Real Estate Purchase Agreement without penalty if certain contingencies outlined in the agreement aren’t met. Examples include failure to secure financing, or significant issues revealed during the property inspection. Outside these contingencies, backing out could constitute breach of contract, possibly resulting in financial penalties or loss of the earnest money deposit.

Common mistakes

When filling out a Real Estate Purchase Agreement form, careful attention to detail is crucial to avoid common errors. These mistakes can range from simple oversights to significant legal issues, potentially jeopardizing the entire transaction. Below are five common mistakes people often make:

Not Checking the Details: One of the most common mistakes is not thoroughly reviewing all the personal and property details listed in the agreement. This can include misspellings of names, incorrect property addresses, or inaccurate legal descriptions. Such errors can lead to disputes or complications in the property transfer process.

Omitting Key Terms and Conditions: Failing to include or clearly articulate important terms and conditions is another significant mistake. This may involve payment terms, contingencies (like financing or inspection requirements), or specific obligations of the buyer and seller. Vague or missing terms can result in misunderstandings or legal challenges.

Overlooking Contingency Clauses: Contingency clauses protect both the buyer and seller by allowing either party to back out of the agreement under certain conditions. Not specifying these conditions, such as the buyer securing financing or the outcomes of a home inspection, can lead to one party being legally bound to an unfavorable agreement.

Incorrect Financial Information: Mistakes in outlining the financial aspects of the deal, including the purchase price, deposit amounts, and details regarding the escrow, can cause significant delays or disputes. Ensuring that all financial information is accurate and agreed upon by both parties is crucial.

Failing to Specify Closing Costs and Who Bears Them: The agreement needs to be clear on which party is responsible for covering closing costs and other associated fees. Ambiguity regarding these costs can lead to unexpected expenses or conflicts at the closing stage.

Avoiding these common errors by being diligent, double-checking all entered information, and understanding the legal implications of the terms and conditions outlined in the Real Estate Purchase Agreement will contribute to a smoother transaction for all parties involved.

Documents used along the form

When buying or selling property, a Real Estate Purchase Agreement is crucial, serving as the official contract between buyer and seller. However, this agreement doesn't stand alone. To ensure a smooth and legally sound transaction, various other documents are often required. These documents can help clarify terms, provide necessary disclosures, and protect both parties' interests throughout the process. Here's a glimpse into some of these important documents.

- Addendum to Purchase Agreement: This document includes additional terms or details not covered in the original purchase agreement, allowing for amendments or additions to be made legally binding.

- Property Disclosure Form: Sellers use this form to disclose any known issues or defects with the property. It covers a wide array of potential problems, from structural issues to pests.

- Title Insurance Policy: This policy provides protection against future claims or legal fees that might arise from disputes over property ownership.

- Home Inspection Report: After a professional inspector examines the property, this report outlines any issues or repairs that might be needed. It's crucial for assessing the property's condition.

- Mortgage Pre-approval Letter: Buyers often include this letter with their purchase offer to show they have the backing of a lender to buy the property at the proposed price.

- Closing Disclosure: This form outlines the final closing costs and the detailed financial transactions involved in the real estate transaction. It's provided to the buyer at least three days before closing.

- Escrow Agreement: This agreement involves a third party, an escrow agent, who holds funds or documents on behalf of the buyer and seller, releasing them only when specific conditions are met.

- Lead-Based Paint Disclosure: For homes built before 1978, this disclosure is required by federal law, informing buyers about the presence of lead-based paint and its hazards.

These documents are not only standard in many real estate transactions but also serve as essential tools for due diligence, compliance, and protection for both parties involved. Each plays a unique role in ensuring the transaction is transparent, fair, and adheres to local, state, and federal laws. Understanding each document's significance can vastly improve the buying or selling experience, offering peace of mind in what is often the most significant financial decision of one's life.

Similar forms

Lease Agreement: Similar to a Real Estate Purchase Agreement, a Lease Agreement outlines the terms under which one party agrees to rent property from another party. Both documents specify the parties involved, the property in question, and the terms of the agreement, such as duration and payment. While a Lease Agreement pertains to renting, a Real Estate Purchase Agreement culminates in the transfer of ownership.

Bill of Sale: This document, used in the sale of personal property, shares similarities with a Real Estate Purchase Agreement in that it outlines the details of a transaction between a buyer and a seller, including the parties' details, description of the sale item, and agreed-upon price. Unlike the Real Estate Purchase Agreement, a Bill of Sale is primarily used for movable items, not real estate.

Mortgage Agreement: A Mortgage Agreement is secured against the real estate being purchased, much like the property is described and encumbered in a Real Estate Purchase Agreement. Both detail the property involved and include terms such as payment. However, the Mortgage Agreement specifically outlines the loan details for purchasing the property, not the sale's terms.

Land Contract: A Land Contract allows a buyer to purchase real estate directly from the seller in installments. Like a Real Estate Purchase Agreement, it identifies the buyer, seller, property, and sale terms. However, ownership transfers only after all payments are made under a Land Contract, unlike the immediate transfer in a traditional sale procedure.

Option Agreement: This agreement grants one party the option to purchase real estate in the future. It shares with the Real Estate Purchase Agreement the specification of the property and the potential for an eventual sale. Yet, it differs because it does not commit the holder to purchase but rather secures the right to do so under agreed-upon conditions.

Property Management Agreement: This document outlines an agreement between a property owner and a manager who will oversee the operation of the property. Both this and the Real Estate Purchase Agreement deal with real estate terms and conditions. The key difference lies in their purpose: management versus sale/purchase of the property.

Quitclaim Deed: Often used to transfer property among family members or to clear up title issues, a Quitclaim Deed, like a Real Estate Purchase Agreement, involves the transfer of real estate interest from one party to another. The main distinction is that a Quitclaim Deed does not guarantee the seller holds clear title to the property; it merely transfers whatever interest the grantor has.

Dos and Don'ts

When it comes to navigating the complexities of filling out a Real Estate Purchase Agreement form, knowing what you should and shouldn't do is key to a smooth transaction. Let's walk through some crucial dos and don'ts.

- Do: Review the entire form carefully before you start filling it out. Missing information can lead to issues down the road.

- Do: Ensure all parties' names are spelled correctly. Any errors here can cause significant headaches later.

- Do: Clearly state the purchase price and any conditions related to it. This clarity helps prevent disputes.

- Do: Include specifics about the closing date and possession date. These details are often critical parts of negotiation.

- Do: Verify all included legal descriptions and addresses. Accuracy is paramount in legal documents.

- Don't: Rush through the process. Taking your time now can save a lot of trouble later.

- Don't: Leave blanks. If a section doesn't apply, mark it as "N/A" (not applicable) instead of leaving it empty.

- Don't: Hesitate to ask for professional help. A real estate lawyer or realtor can offer invaluable advice.

- Don't: Forget to include any agreed-upon fixtures or non-fixtures. Being explicit can prevent future disputes.

Completing a Real Estate Purchase Agreement form with attention to detail not only ensures legality but also sets the foundation for a seamless transaction. Keeping these dos and don'ts in mind will guide you through a more informed and effective process.

Misconceptions

Many individuals stepping into the realm of real estate transactions hold misconceptions about the Real Estate Purchase Agreement form. These misunderstandings can lead to unnecessary complications, making it crucial to clarify them. Notably:

One Size Fits All: A common fallacy is presuming that the Real Estate Purchase Agreement is a generic, one-size-fits-all document. In reality, these agreements should be tailored to fit the specific needs and conditions of the property and sale. States may have varying laws and requirements that need to be accounted for, and unique provisions might be necessary to cover different scenarios.

Legally Binding Without Signatures: Another misunderstanding is believing that the agreement is binding upon verbal agreement or with an incomplete set of signatures. The reality is that for a Real Estate Purchase Agreement to be legally enforceable, it must be fully executed, meaning all parties involved have to sign the document. Until then, it is not considered binding.

Attorney Review is Optional: Some parties involved in a real estate transaction might think that having an attorney review the agreement is optional or unnecessary. While not always legally required, it is highly advised. An attorney can identify potential issues, ensure the contract's provisions are legal and in your best interest, and help navigate any state-specific requirements.

No Room for Negotiation Post-Agreement: The belief that once a Real Estate Purchase Agreement is signed, the terms are set in stone, is inaccurate. While it is true that the agreement outlines the terms of the sale, negotiations can still occur if issues are identified during processes like the home inspection. In such cases, amendments to the agreement can be made, provided all parties agree.

Understanding these misconceptions can empower buyers, sellers, and professionals in real estate transactions to navigate the process more effectively and avoid common pitfalls.

Key takeaways

When it comes to navigating the complexities of buying or selling property, a Real Estate Purchase Agreement form plays a pivotal role. This document outlines the terms and conditions between the buyer and seller, ensuring a clear, enforceable agreement. Here are ten key takeaways to consider when filling out and using this important form:

- Accuracy is paramount. Ensure all information is accurate and complete. Mistakes or omissions can lead to disputes or legal complications.

- Clearly define the property. The legal description of the property, including its address and any relevant details, should be unmistakably outlined to avoid any confusion.

- Agree on the price. The purchase price should be clearly stated, along with the terms of the payment, to prevent any misunderstanding.

- Understand the contingencies. Common contingencies include financing, inspections, and appraisals. Both parties should fully understand these conditions before agreeing.

- Inspect closing costs. Closing costs can vary greatly and should be clearly addressed in the agreement, indicating who is responsible for each cost.

- Review the closing date. The expected closing date sets a timeline for completing the transaction, affecting moving plans and financial arrangements.

- Know the legal requirements. Legal requirements for Real Estate Purchase Agreements can vary by location. Ensure the agreement complies with local laws.

- Disclosures are crucial. Sellers are often required to disclose certain information about the property's condition. These disclosures need to be detailed in the agreement.

- Consider future disputes. The agreement should have provisions on how to handle disagreements, such as arbitration or mediation.

- Professional advice is invaluable. Consulting with a real estate attorney or a professional experienced in real estate transactions can provide crucial guidance and peace of mind.

Filling out and using a Real Estate Purchase Agreement requires careful attention to detail and a deep understanding of the transaction's terms. By focusing on these key takeaways, parties can move forward with confidence, knowing their interests are protected and their transaction is on solid ground.

Consider Other Documents

Change of Rater Ncoer - Its focus on both performance and potential ensures that the Army identifies and develops NCOs who are capable of meeting today's challenges and tomorrow's opportunities.

How to Create Promissory Note - It benefits the borrower by potentially offering more favorable terms than those available from commercial lenders.